Polygon's Ecosystem in Crisis: AAVE and Lido Exit En Masse, Sparked by "Borrowing Chickens to Hatch Eggs" Proposal

TechFlow Selected TechFlow Selected

Polygon's Ecosystem in Crisis: AAVE and Lido Exit En Masse, Sparked by "Borrowing Chickens to Hatch Eggs" Proposal

Polygon is back in social media discussions once again—but not due to any major update, rather because of exits by ecosystem partners such as AAVE and Lido.

Author: Frank, PANews

As a key driver of multi-chain interoperability, zero-knowledge proof applications, and the DeFi and NFT ecosystems, Polygon stood out during the last bull cycle. However, over the past year, many public chain projects including Polygon have failed to achieve new breakthroughs, gradually being overshadowed by emerging competitors such as Solana, Sui, or Base. When Polygon returned to social media discussions recently, it wasn’t due to major upgrades—but because of ecosystem partners like Aave and Lido exiting.

"Borrowing Chickens to Lay Eggs" Proposal Sparks Concerns

On December 16, the Aave contributor team, Aave Chan, released a proposal in the community to withdraw its lending services from Polygon's Proof-of-Stake (PoS) chain. Written by Aave Chan founder Marc Zeller, the proposal aims to gradually phase out Aave’s lending protocol on Polygon to mitigate potential future security risks. Aave is the largest decentralized application on Polygon, with over $466 million deposited on the PoS chain.

Similarly, on the same day, liquid staking protocol Lido announced it would officially deprecate its service on the Polygon network over the coming months. The Lido community cited a strategic refocus on Ethereum and the lack of scalability on Polygon PoS as reasons for discontinuing operations on Polygon.

Losing two major ecosystem applications within a single day dealt a severe blow to Polygon. The primary cause traces back to December 13, when the Polygon community published a Pre-PIP improvement proposal titled "Polygon PoS Cross-Chain Liquidity Program." This proposal suggested generating yield from more than $1 billion in stablecoin reserves held on the PoS bridge.

The Polygon PoS bridge holds approximately $1.3 billion in stablecoin reserves. The community proposed deploying these idle funds into carefully selected liquidity pools to generate returns and support the growth of the Polygon ecosystem. Based on current lending rates, this could yield around $70 million annually.

The proposal recommends gradually allocating these funds into vaults compliant with the ERC-4626 standard. Specific strategies include:

DAI: Deposit into Maker’s sUSDS, the official yield-bearing token within the Maker ecosystem.

USDC and USDT: Use Morpho Vaults as the primary source of yield, with Allez Labs managing risk. Initial markets include Superstate’s USTB, Maker’s sUSDS, and Angle’s stUSD.

In addition, Yearn will manage a new ecosystem incentive program, using the generated yields to drive activity across Polygon PoS and the broader AggLayer ecosystem.

Notably, the proposal was co-signed by Allez Labs, Morpho Association, and Yearn. According to Defillama data from December 17, Polygon’s total TVL stood at $1.23 billion, with Aave accounting for about $465 million—roughly 37.8%. In contrast, Yearn Finance ranked 26th in the ecosystem with a TVL of approximately $3.69 million. This disparity may explain why Aave raised security concerns and proposed withdrawal from Polygon.

Clearly, from Aave’s perspective, the proposal involves taking funds that are primarily deposited via Aave and reallocating them to other lending protocols for yield generation. As the largest user of cross-chain bridged funds on Polygon PoS, Aave stands to gain nothing from this initiative while bearing increased security risks.

However, Lido’s departure might not be directly related to this proposal, as Lido’s own governance process for re-evaluating its presence on Polygon began over a month earlier—the timing simply coincided.

A Desperate Move Amid Stagnant Ecosystem Growth

If Aave’s withdrawal proposal passes, Polygon’s TVL would drop to $765 million, falling short of the $1 billion reserve target outlined in the Pre-PIP proposal. Uniswap, the second-largest protocol in the ecosystem, has a TVL of about $390 million. If Uniswap follows suit with a similar move, Polygon’s overall TVL could plummet to around $370 million. Not only would the goal of generating $70 million in annual yield become unattainable, but every aspect of the ecosystem—including governance token prices and active users—would suffer significantly, potentially resulting in losses far exceeding $70 million.

Given this outcome, the proposal appears ill-advised. Why then did the Polygon community propose such a plan? What has been the state of Polygon’s ecosystem over the past year?

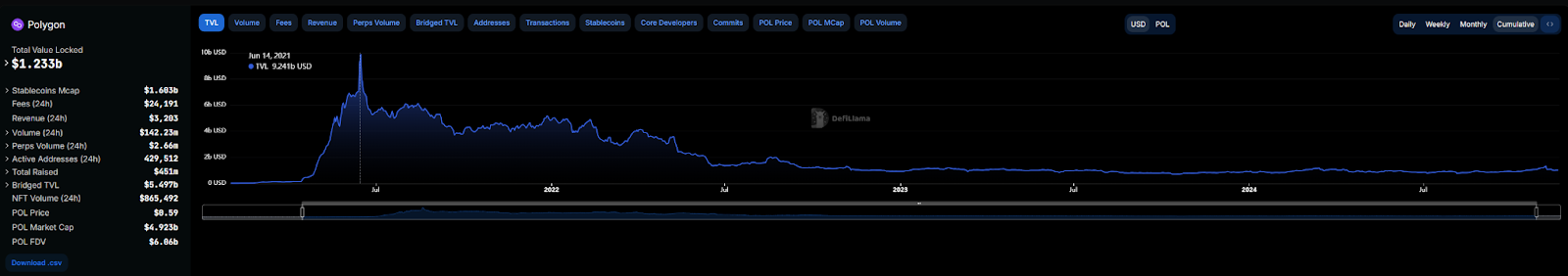

Polygon’s peak was in June 2021, when its TVL reached $9.24 billion—more than 7.5 times today’s level. Since then, the TVL curve has steadily declined. From June 2022 onward, it stabilized around $1.3 billion with little fluctuation. In 2023, it even dipped to roughly $600 million. Although market conditions improved in 2024, Polygon’s TVL mostly remained below $1 billion until finally climbing back above that threshold starting in October.

In terms of active addresses, Polygon PoS had approximately 439,000 active addresses on October 29—comparable to levels seen a year ago. Although active addresses surged between March and August this year, reaching up to 1.65 million, they sharply declined again despite favorable market conditions.

Token performance has also been lackluster. From March to November 2024, the POL token failed to follow the broader market rally led by Bitcoin, instead declining from an early-year high of $1.3 to a low of $0.28—a drop of over 77%. Only in the past one to two months has the price begun to recover, recently rebounding to around $0.6. Still, it remains far from its all-time high near $3, requiring roughly a fivefold increase to catch up.

Innovation + Rebranding Can't Match Cash Incentives

Despite stagnant ecosystem growth, Polygon hasn’t abandoned technological development, frequently announcing product updates and technical innovations over the past year. The most notable success has been the rise of prediction market platform Polymarket. Additionally, in October, Polygon launched AggLayer—a new unified blockchain ecosystem. According to official descriptions, AggLayer = Unified Chain (L1, L2, L∞), though the concept proved difficult to grasp, prompting the team to publish a dedicated explanatory article in November.

Moreover, Polygon’s ZK proof toolkit, Plonky3, became the fastest zero-knowledge proof system available. Vitalik even acknowledged this on Twitter, commenting, “You won this race.”

Beyond technology, many established public chains have attempted brand revamps through rebranding or token swaps this year. Polygon previously rebranded from Matic to Polygon. Yet in today’s market environment, non-disruptive technological innovation alone no longer provides a compelling narrative advantage—an unfortunate reality for projects like Polygon that continue focusing on technical advancement or brand consolidation.

What truly attracts and retains user attention are often reward distributions or incentive programs—as exemplified by rising platforms like Hyperliquid. For Polygon, options for reform in this area are limited. On-chain fees on Polygon amount to only tens of thousands of dollars per day, insufficient to attract meaningful interest. Hence emerged the aforementioned "borrowing chickens to lay eggs" proposal.

But clearly, the owners of the "chickens" disagree with the arrangement—and Polygon may end up losing even more as a result. Overall, the root cause of Polygon’s stagnation lies in its lack of sufficient user incentives and compelling new narratives. Facing intensifying competition, Polygon must look beyond technical innovation and develop more attractive market strategies. This challenge, however, reflects a shared dilemma among most legacy public chains today.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News