Polygon Chain Special Report: 60% of MATIC Converted to POL, Stablecoin Peg Doubles in 10 Months

TechFlow Selected TechFlow Selected

Polygon Chain Special Report: 60% of MATIC Converted to POL, Stablecoin Peg Doubles in 10 Months

Since launching on mainnet in 2017, the Polygon protocol has gone through three market cycles, evolved significantly, and remains a technological pioneer in the space.

Author: OurNetwork

Translation: TechFlow

Background Introduction

Welcome to the latest installment of our in-depth ecosystem series. In this edition, we use data-driven on-chain analysis to explore the overall health and growth of an emerging ecosystem.

Today, we focus on Polygon—a network well-known in the crypto space—where on-chain data offers deeper insights. Since launching on mainnet in 2017, the Polygon protocol has weathered three market cycles and evolved significantly, remaining a technological pioneer in the field. Polygon's tech stack consists of multiple layers, supporting mature decentralized finance (DeFi), gaming, decentralized physical infrastructure networks (DePIN), and mainstream consumer ecosystems, while incorporating key technologies designed to address deep fragmentation in web3.

-

Polygon PoS: An EVM-compatible proof-of-stake Layer 2, serving as the primary platform for dApp developers and users within the Polygon ecosystem.

-

Polygon zkEVM: An EVM-compatible zero-knowledge Layer 2 aimed at achieving lower costs, higher throughput, and enhanced transaction security.

-

Polygon CDK: The Chain Development Kit (CDK) empowers developers to build custom zero-knowledge-powered Layer 2s.

-

AggLayer: Addresses blockchain fragmentation by enabling any sovereign L1/L2 to connect to the network and securely share liquidity, users, and state.

Now, let’s dive into the on-chain data to uncover the story behind Polygon and its ecosystem!

User Trend Analysis

spaceharpoon | Website | Dashboard

Polygon’s Sustained Growth: Two-Thirds of MATIC Upgraded to POL, Stablecoin Market Cap Increases by $389 Million

-

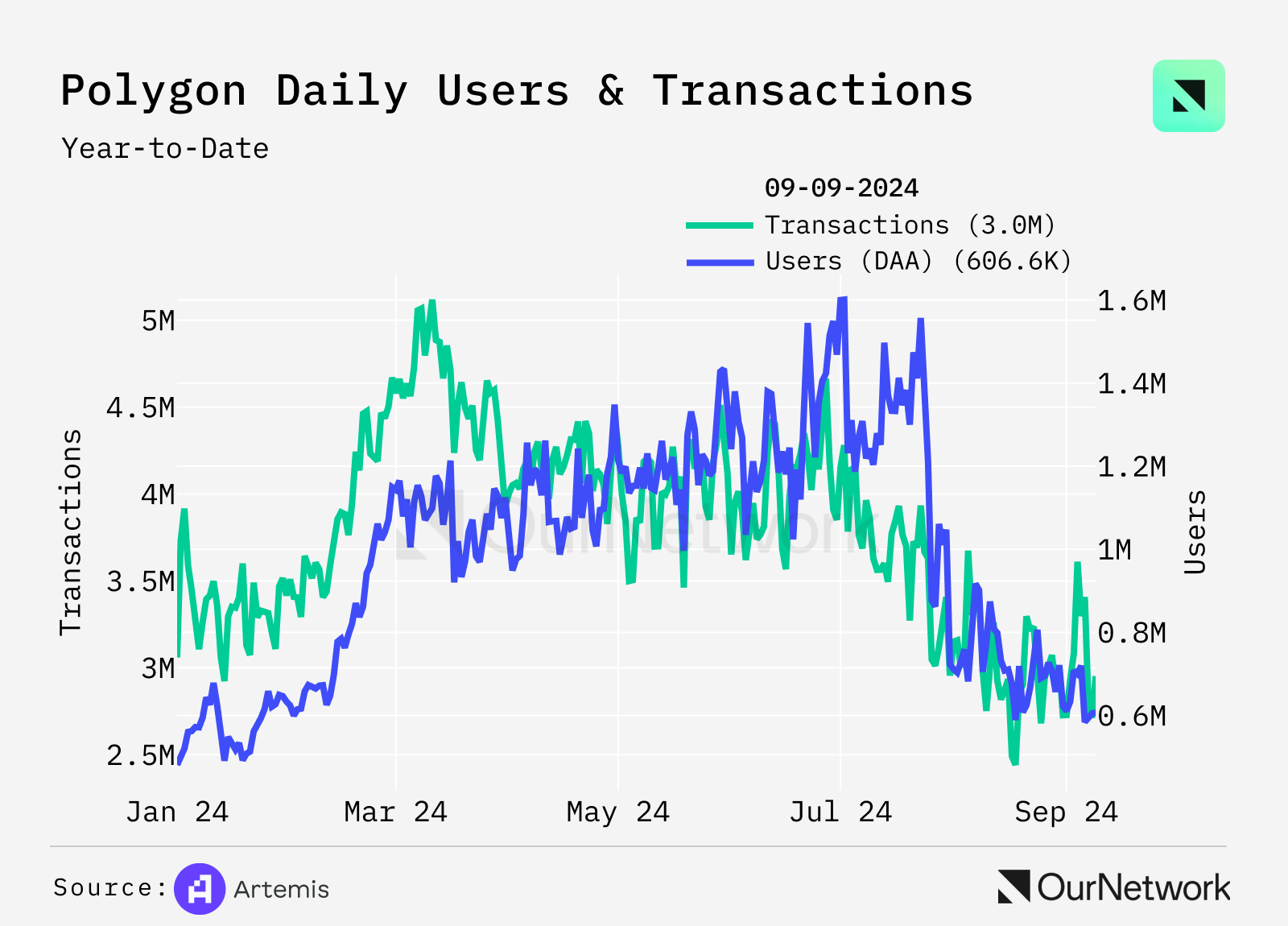

In the first 10 days of September, Polygon averaged 660,000 daily active addresses (DAA) and 3 million daily transactions. On September 4, the migration from MATIC to POL began—within six days, users upgraded over 66% of MATIC to POL. As a successor to MATIC, POL introduces the concept of a "hyper-productive token," capable of providing valuable services across any chain within the Polygon network, including AggLayer itself.

-

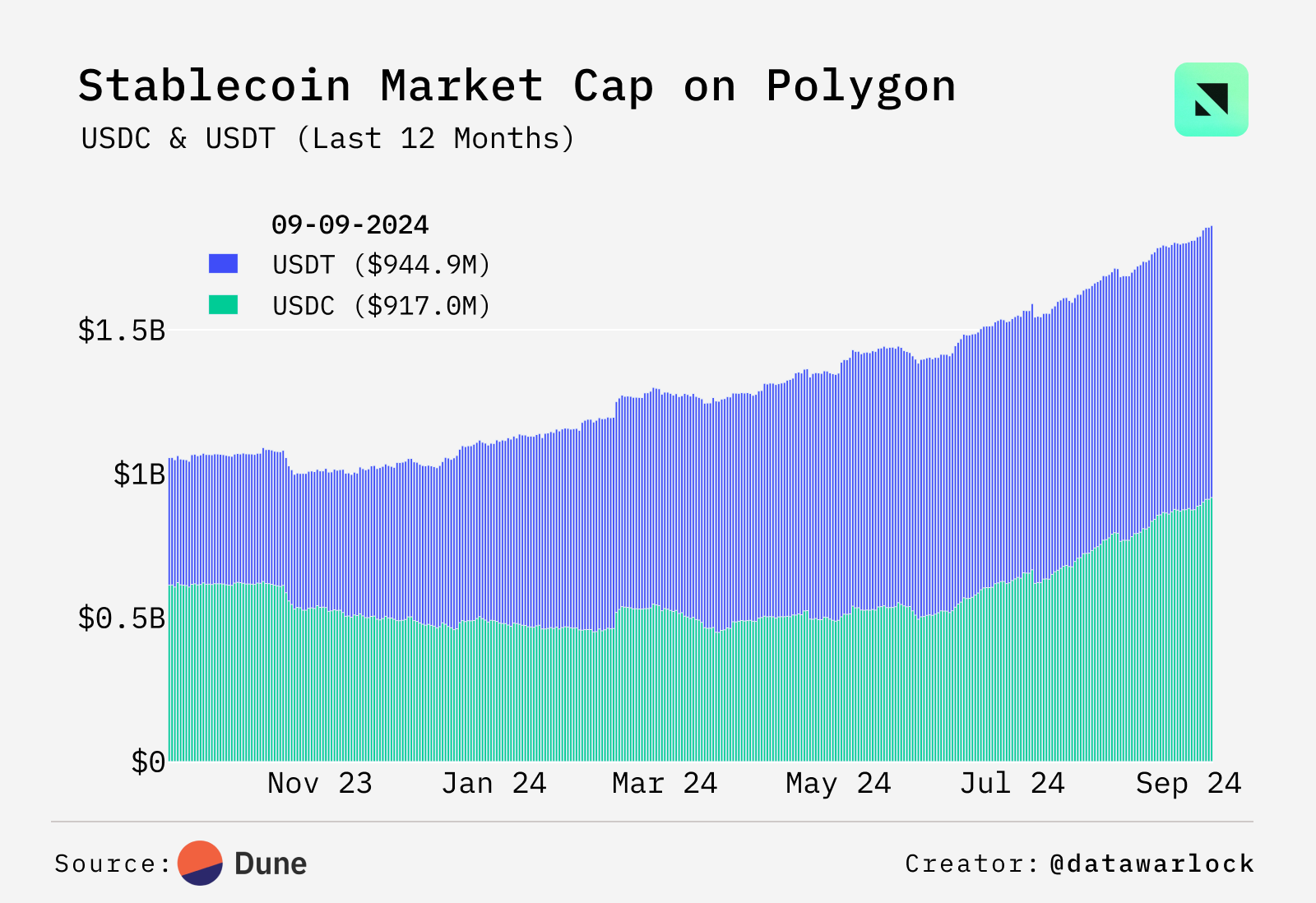

Over the past 10 months, Polygon’s stablecoin market cap has nearly doubled—from $1.1 billion to $2.1 billion. This growth is primarily driven by increases in USDC and USDT market caps. Notably, Polygon’s USDT market cap rose from $473 million to $945 million during this period, doubling in size.

-

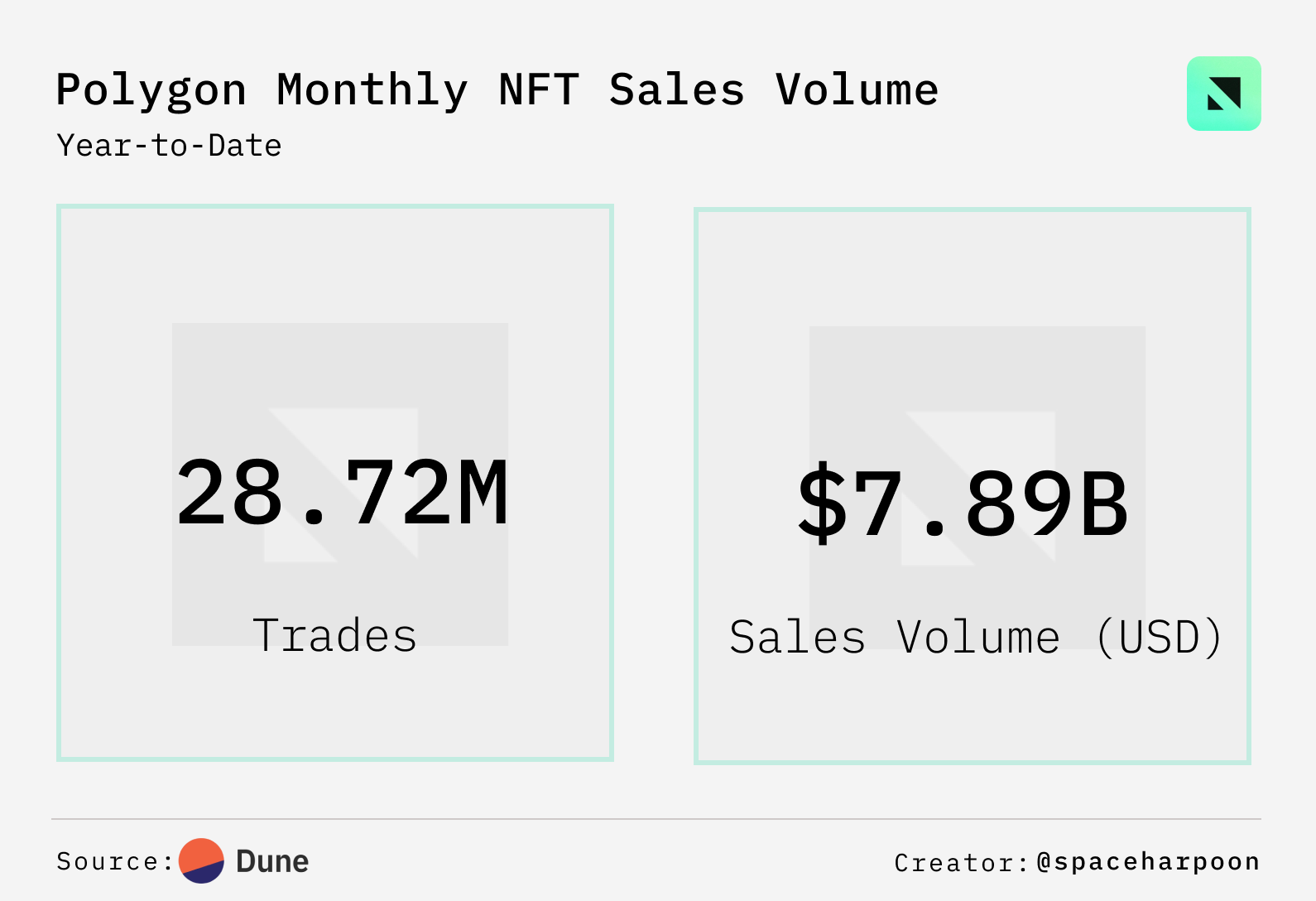

Polygon has achieved over $7.8 billion in NFT sales volume through 28 million transactions. In 2024, July and August saw NFT sales volumes reach $1.3 billion and $1.2 billion respectively—the highest monthly figures of the year.

-

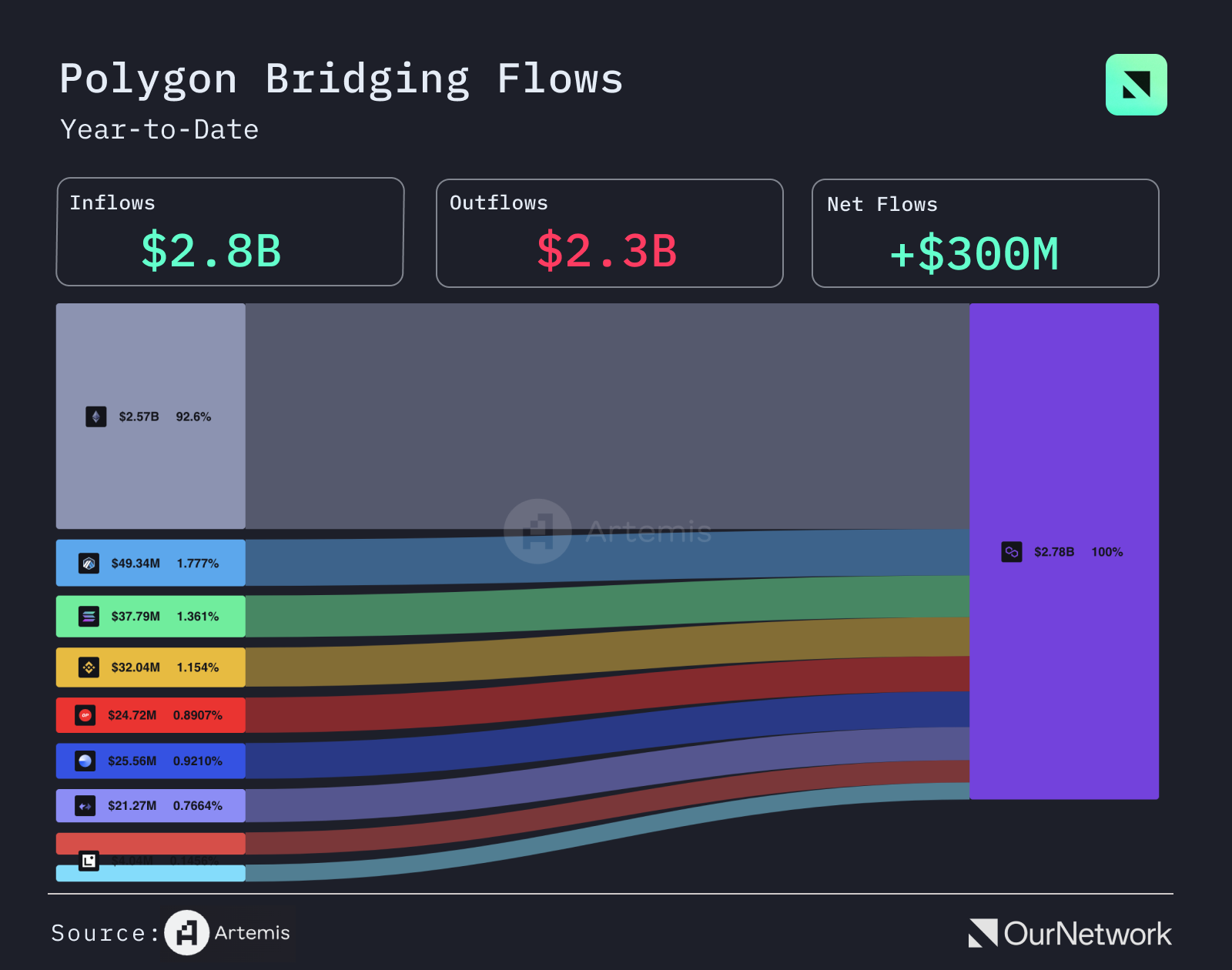

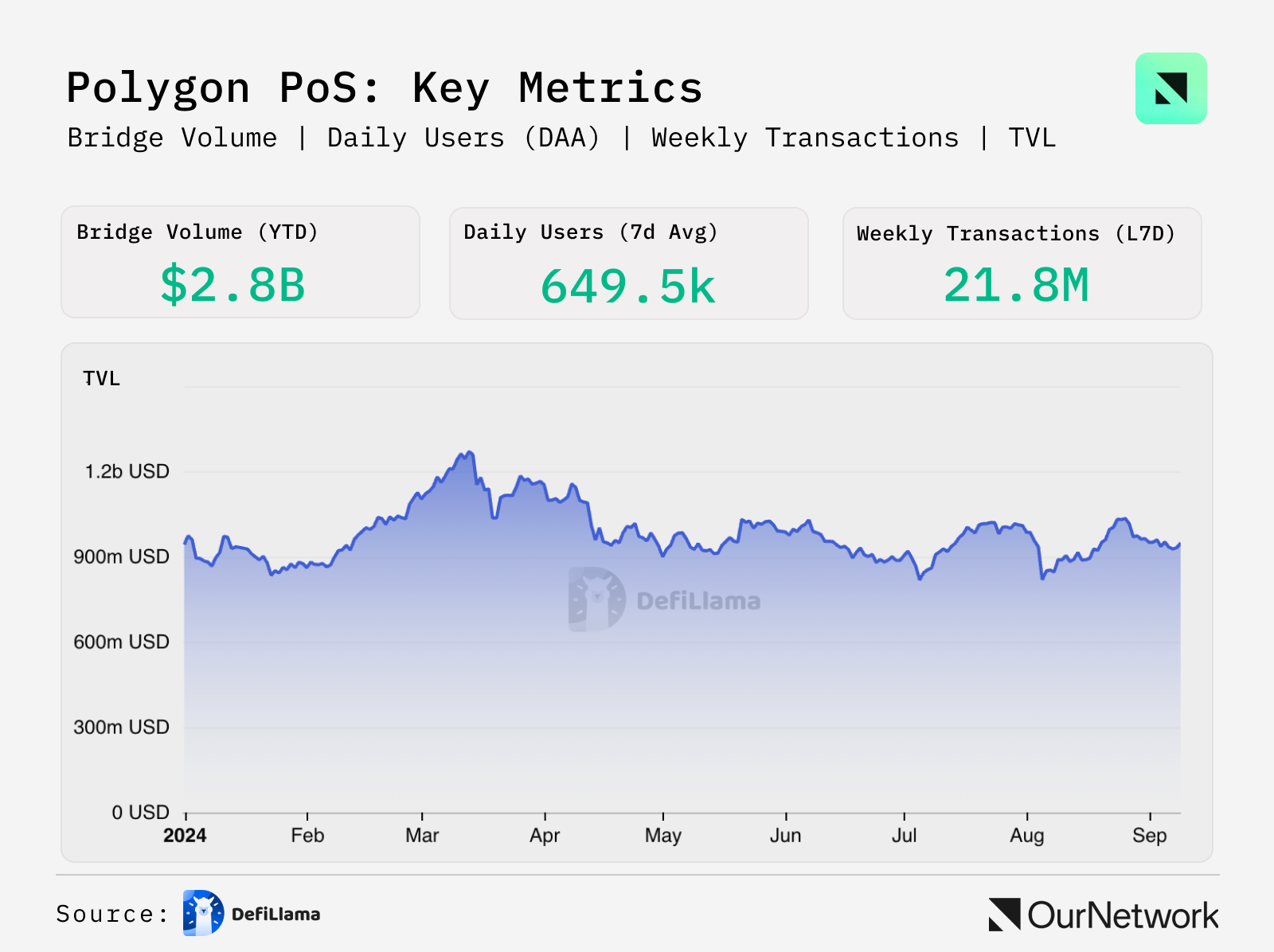

To date this year, Polygon has attracted $2.8 billion in capital inflows—of which 92% ($2.57 billion) originated from Ethereum mainnet, 1.77% ($49.34 million) from Arbitrum, and 1.36% ($37.79 million) from Solana. Meanwhile, Polygon experienced $2.5 billion in outflows, resulting in a net inflow of $300 million for the year. This sustained positive net inflow strongly indicates real demand for Polygon’s ecosystem services.

Infrastructure

spaceharpoon | Website | Dashboard

Polygon Infrastructure Supports 22 DePIN Projects, Including Fox (With Over 600K Content Items) and Immutable zkEVM (Processing Over 74M Transactions)

-

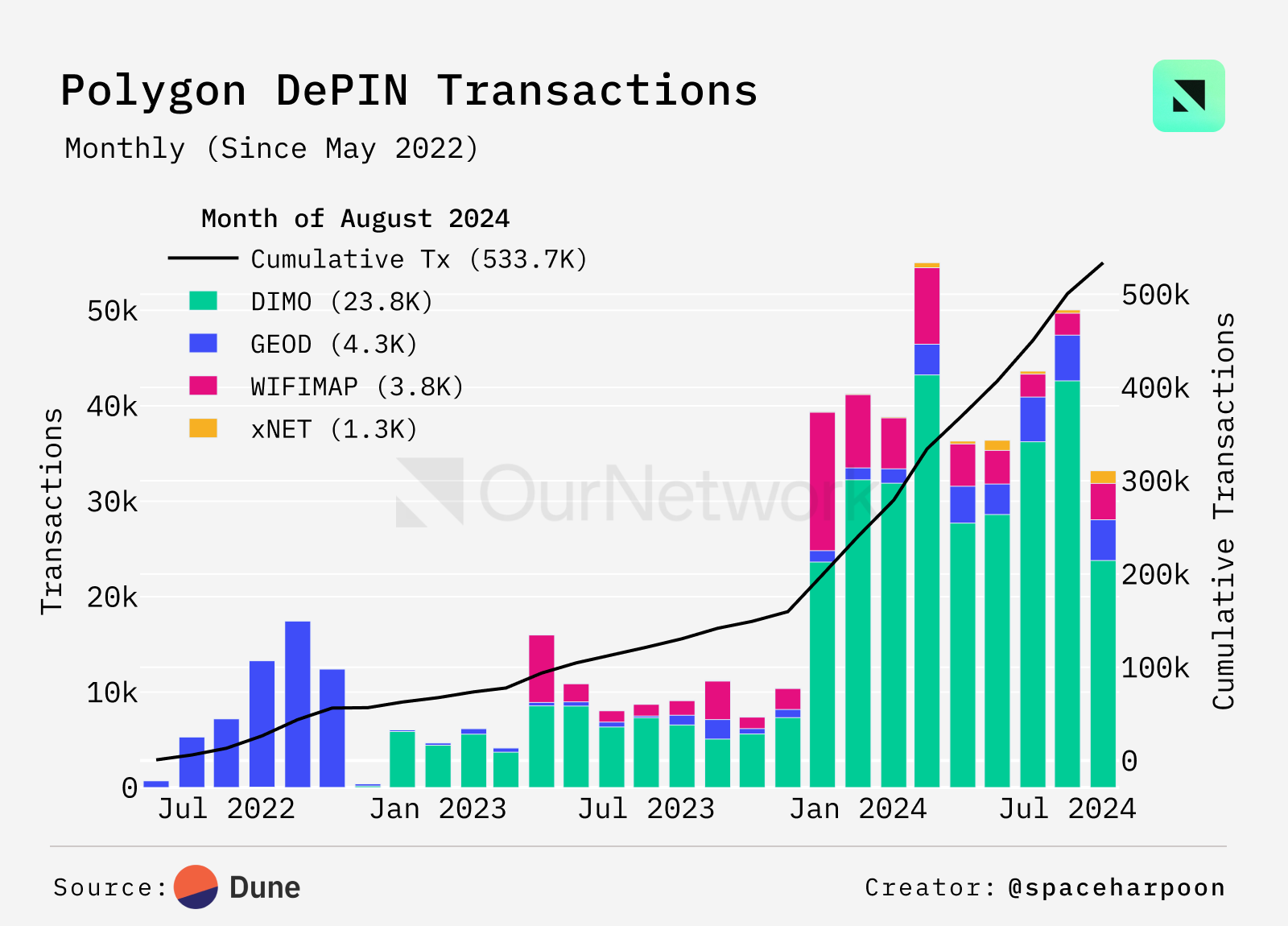

Polygon has become a leading platform for infrastructure projects such as DePIN and AI. Its DePIN ecosystem spans 19 different categories, with a total market cap of $432 million. The diversity of DePIN projects on Polygon includes seven in sensors, three in wireless, and three in energy. From May 2023 to May 2024, DePIN transaction volume increased by over 500%.

-

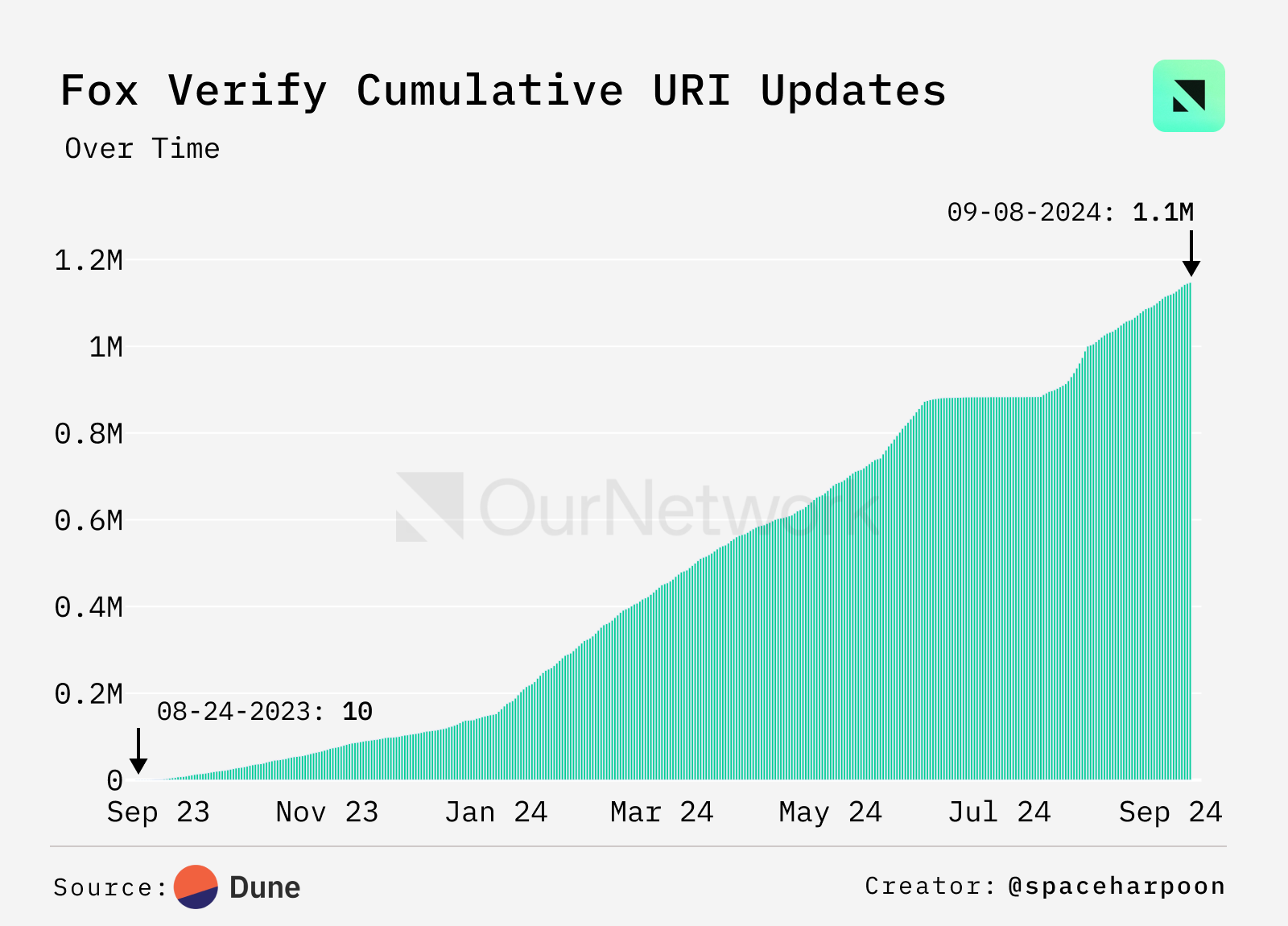

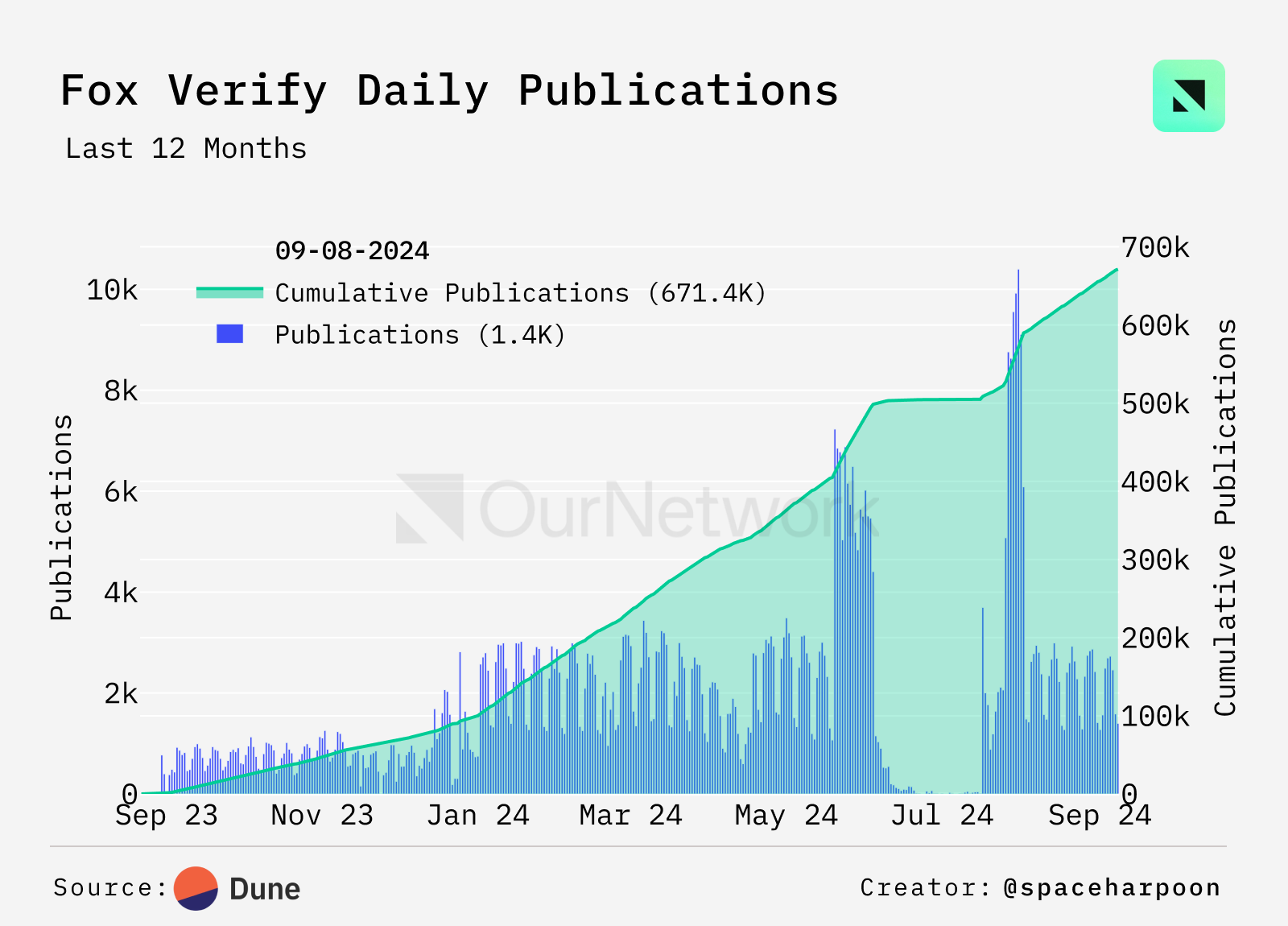

A key infrastructure project on Polygon PoS is Fox Verify—an ownership verification search engine for online content. Fox currently stores over 670,000 content items in its protocol and has completed over 1.1 million URI updates.

-

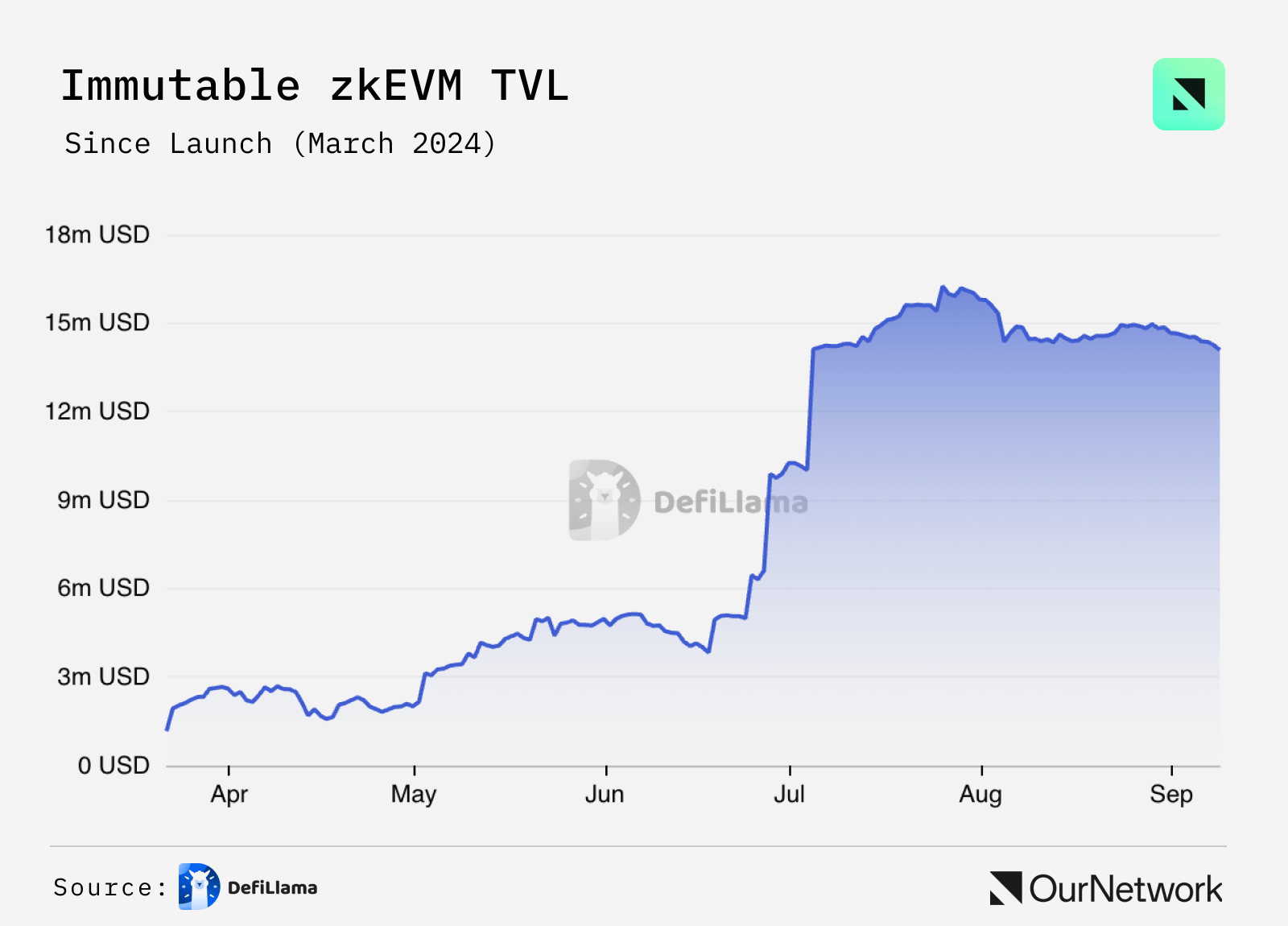

Immutable zkEVM, powered by Polygon technology, is a dedicated game-focused blockchain and a critical piece of infrastructure in the Web3 gaming ecosystem. Since launch, it has attracted 6.8 million active wallets and processed 73 million transactions. Its total value locked (TVL) has grown to $14.3 million, up 178% over the past 90 days.

Polygon PoS Overview

Polygon PoS (Proof-of-Stake) remains the preferred platform for developers and users within the Polygon ecosystem, boasting over 2 million weekly active addresses, 20 million weekly transactions, and $887 million in total value locked (TVL).

Polygon PoS hosts many of the most widely used applications across industries, including DePIN (DIMO), gaming (Anichess), entertainment (Fox Verify, Courtyard), and prediction markets (Polymarket, Azuro)—some of the few mainstream breakthrough use cases in the industry this year, which we’ll explore further below.

Last week, the native token of Polygon PoS began migrating from MATIC to POL. As of September 4, over 66.8% of MATIC had been migrated.

Polymarket

spaceharpoon | Website | Dashboard

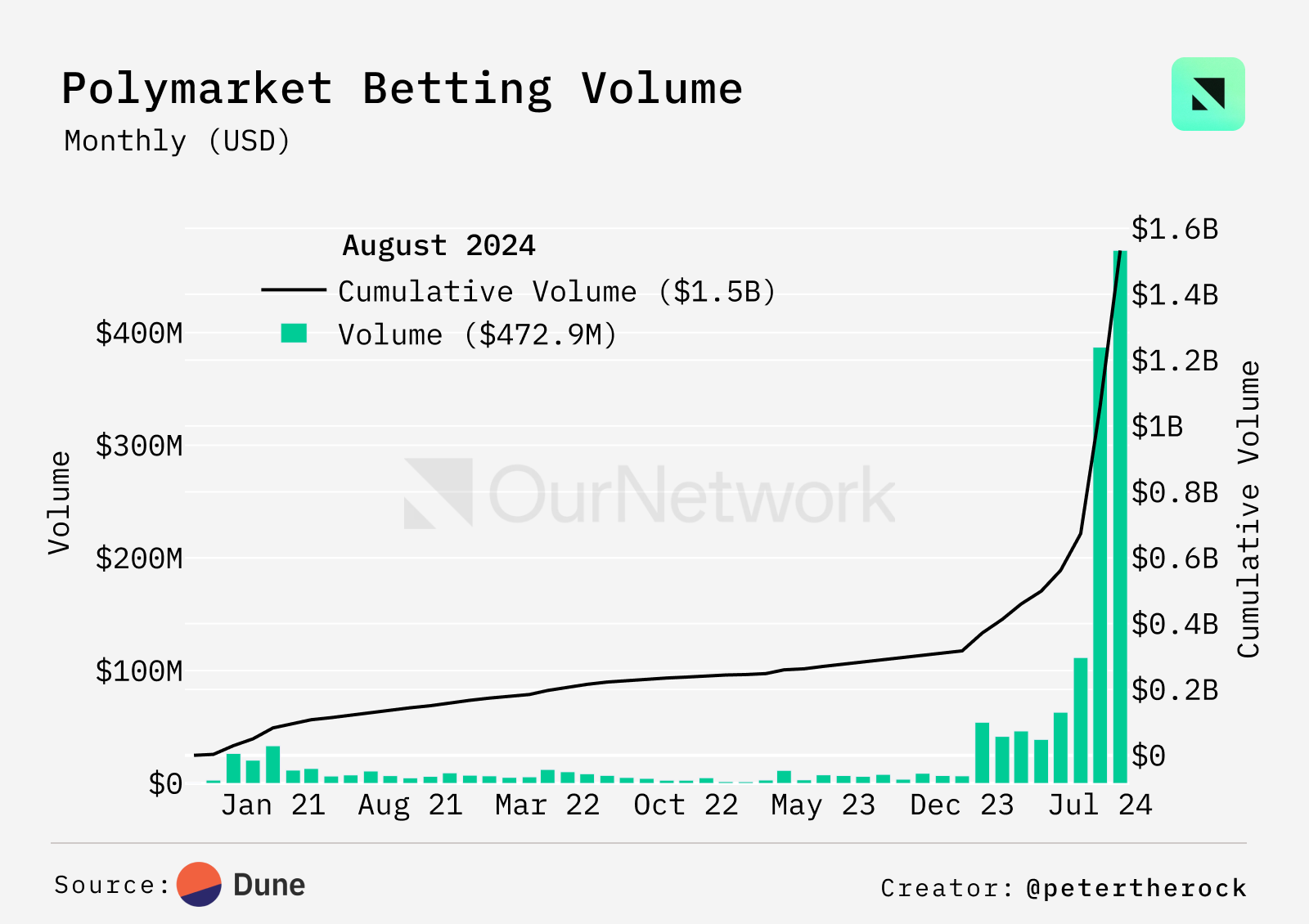

Polymarket Explosion: Trading Volume Hits $859 Million in July and August 2024, TVL Surpasses $100 Million in August

-

Polymarket, a decentralized platform on Polygon focused on real-world event betting, saw trading volume surge to $859 million in July and August—44 times higher than its average before 2024. Amid rising political tensions and key moments approaching in crypto, users flocked to this betting platform. In August, Polymarket’s total value locked (TVL) surpassed $100 million, reaching $103.9 million on August 22—up $32 million in just 12 days. Polymarket now accounts for 83% of the entire prediction market’s TVL.

-

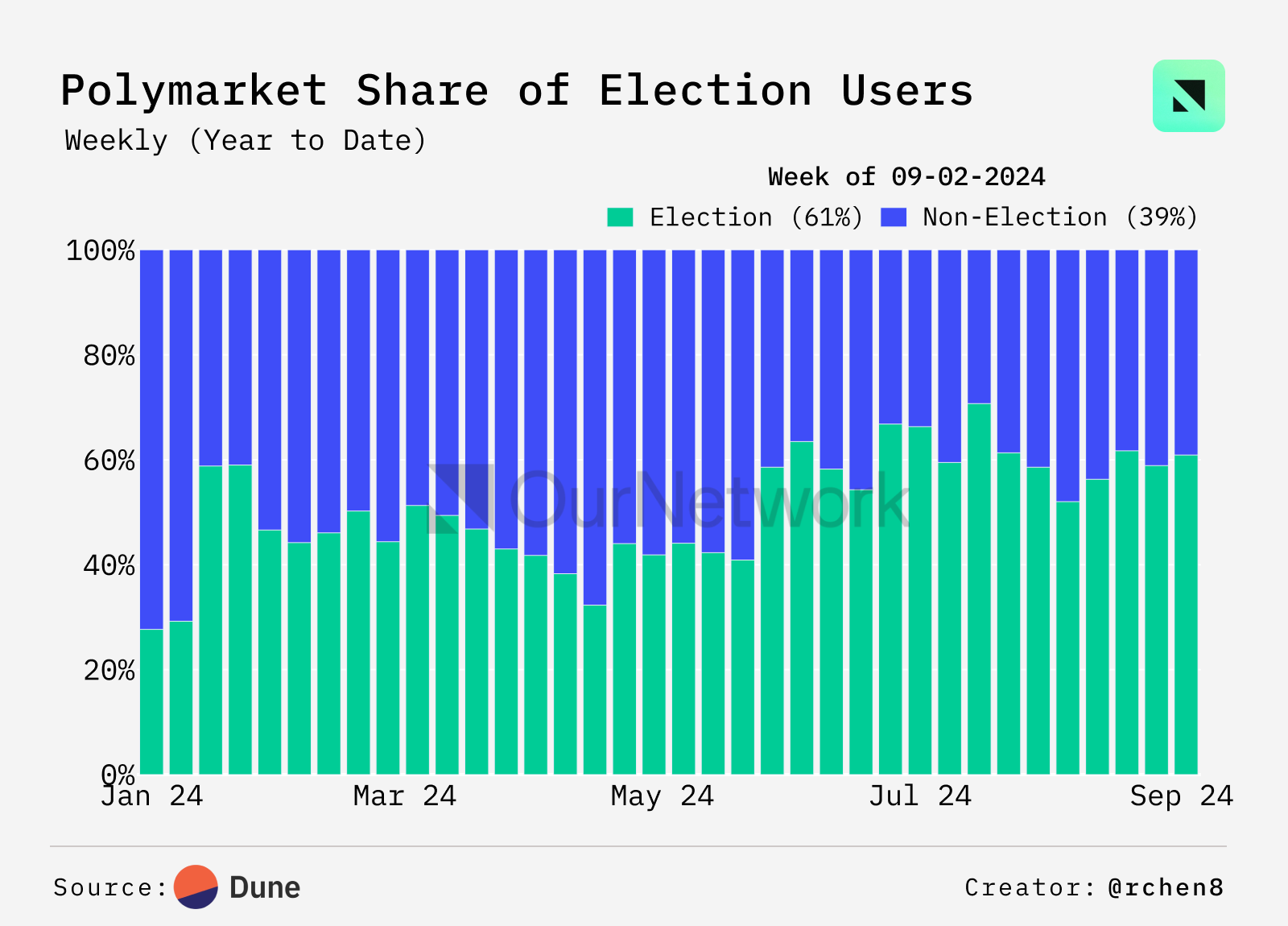

The “Winner of the 2024 Presidential Election” market dominated prediction markets, attracting $84.1 million in wagers in August alone, with a total betting volume of $606.1 million. Clearly, politics dominates the 2024 prediction markets, with both short-term and long-term data showing strong popularity among bettors.

-

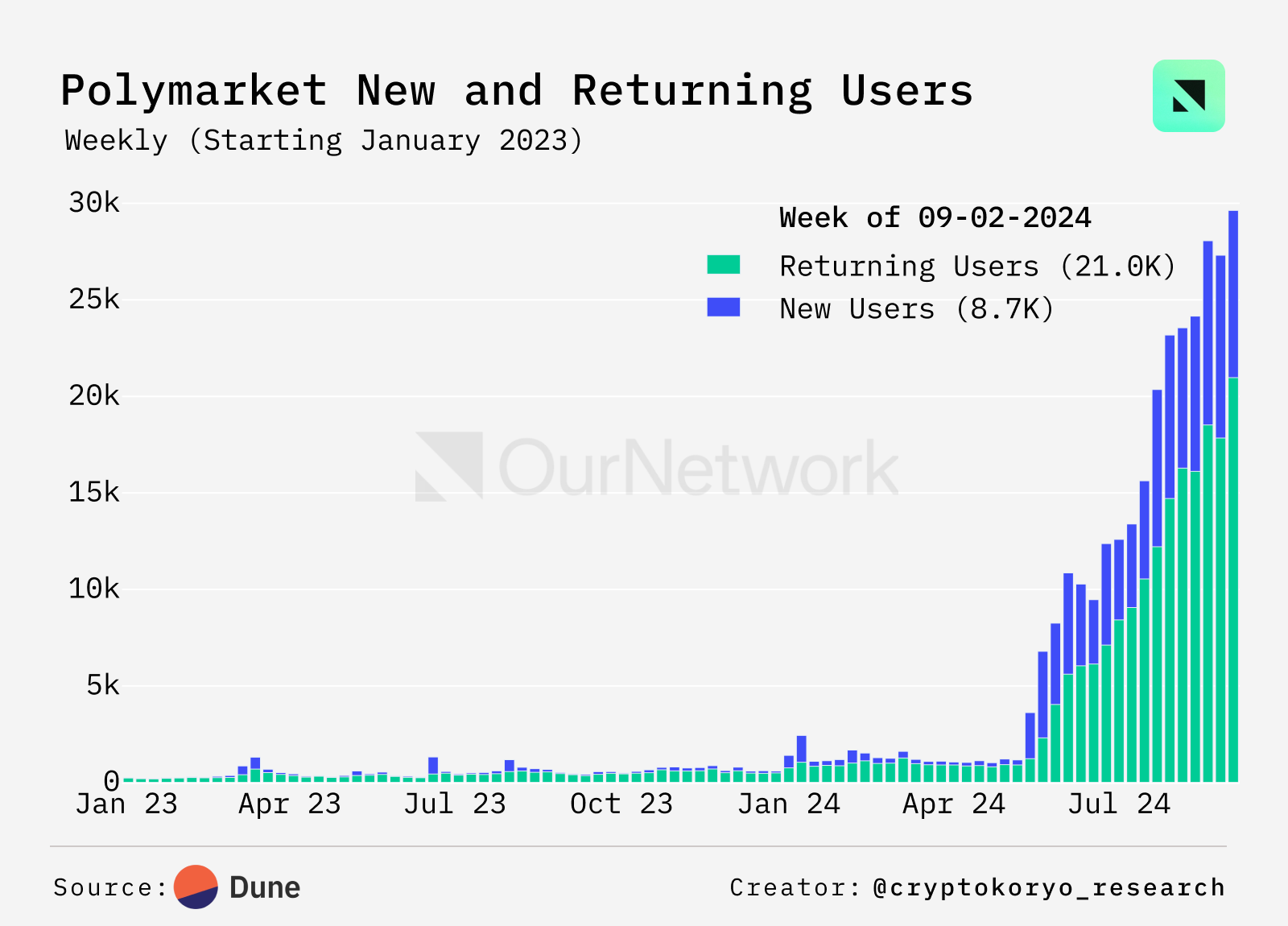

In 2024, Polymarket experienced explosive user growth. New weekly users surged from 646 in early January to 5,200 in mid-August. Total users grew from 42,445 to 128,393 in just over seven months—an increase of 202%. While Polymarket is one of the most popular platforms, it is just one of several emerging prediction markets running on Polygon PoS.

-

Transaction Highlight: The largest single bet on Polymarket reached $1.44 million, placed on the question “Will RFK Jr. drop out by Friday?” The bettor correctly predicted the outcome and received $1.78 million in winnings—earning a net profit of $340,000. Conditional tokens used in these trades demonstrate how prediction markets determine outcomes and distribute funds to the correct wallets.

Courtyard

spaceharpoon | Website | Dashboard

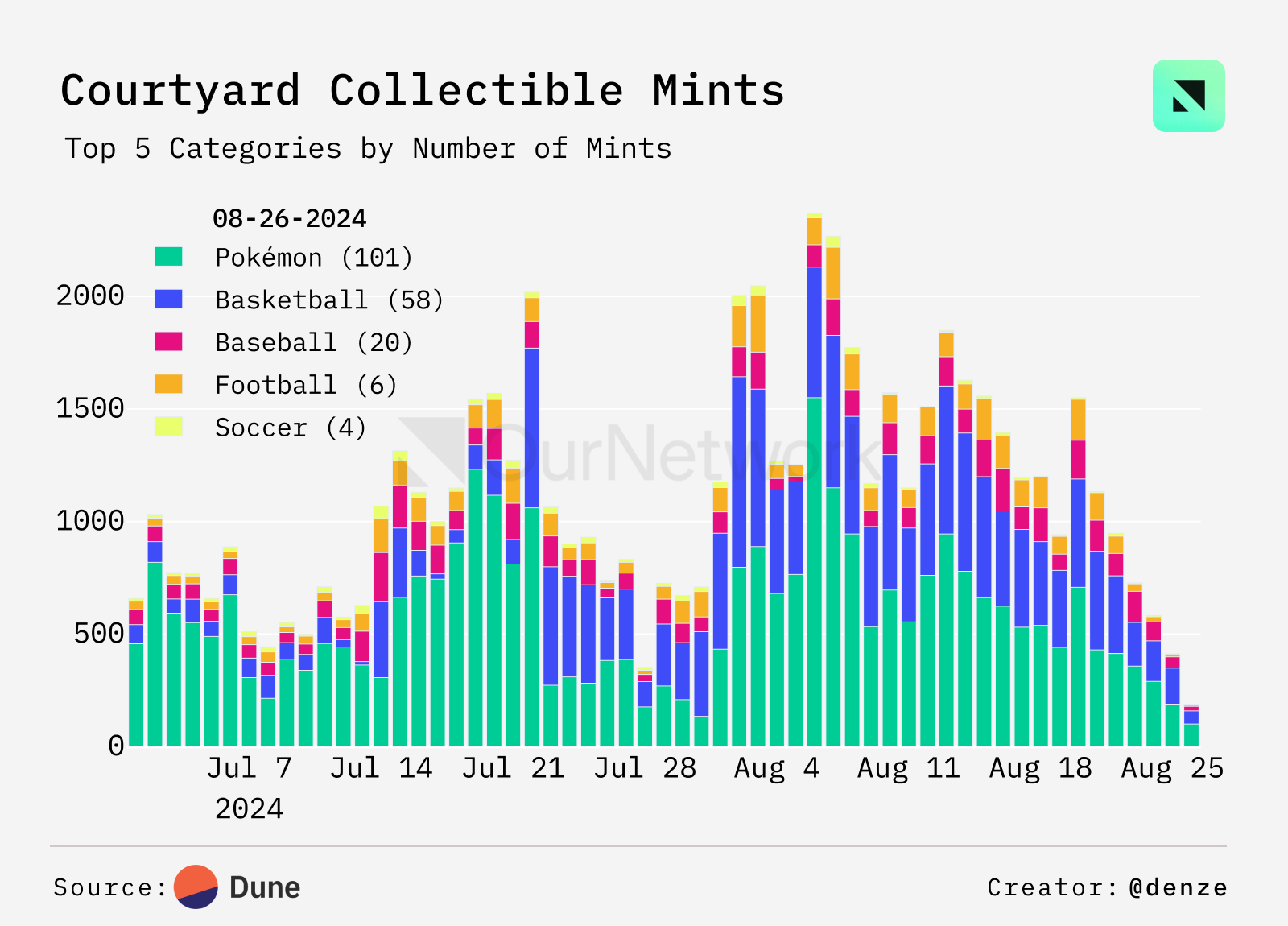

Courtyard NFT Surge: Daily Trading Volume Soars, 116,000 NFTs Minted in August 2024

-

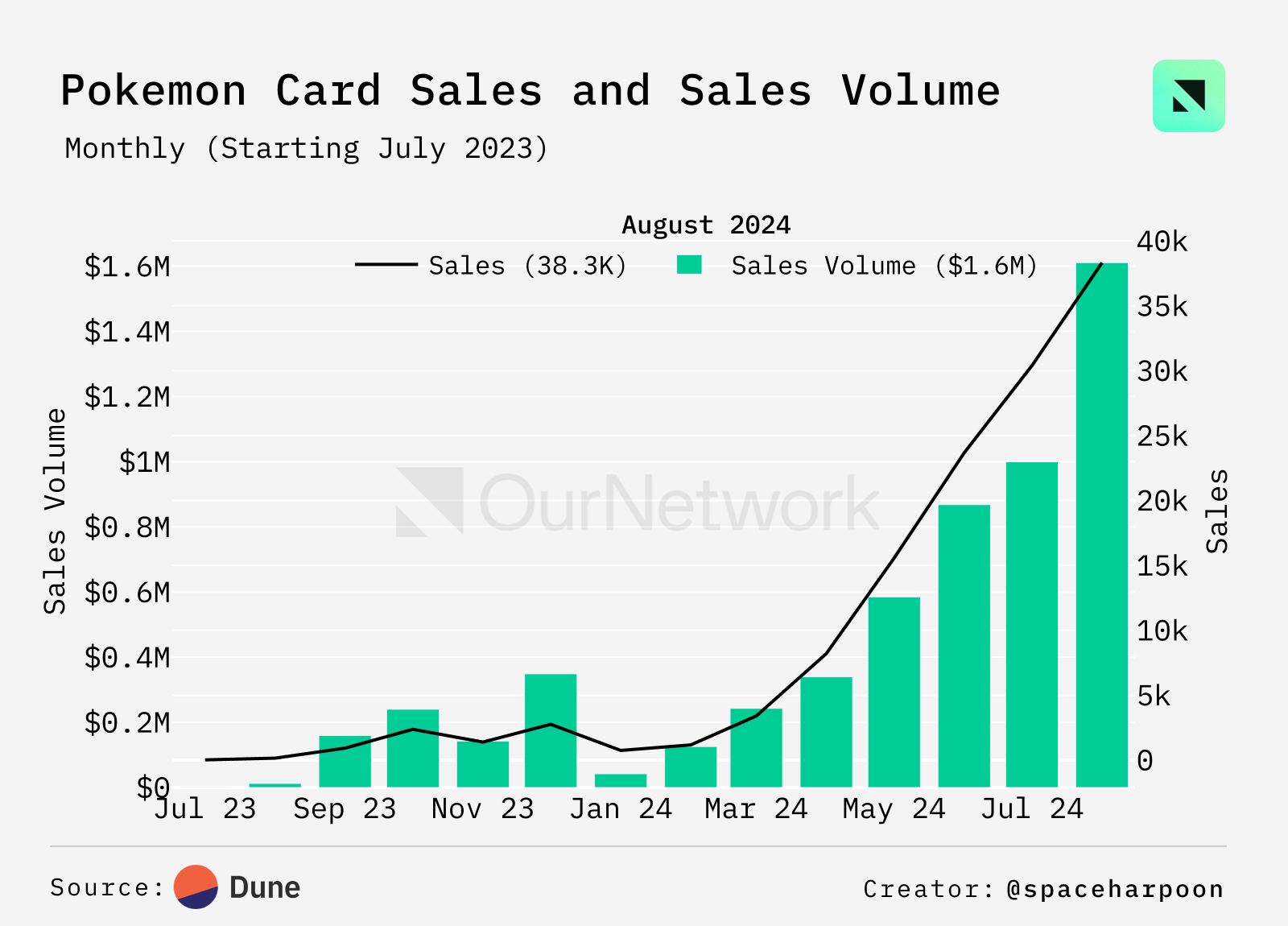

Courtyard is an on-chain collectibles trading platform. By mid-2024, daily transaction volume surged to over 3,000, peaking at 9,509 on August 7. Exponential growth began in December 2023, with monthly NFT mints increasing from around 2,700 to over 30,000 in July. Pokémon cards dominate trading activity, completing 33,000 transactions worth $1.6 million in August alone, pushing cumulative Pokémon card sales past $6.1 million.

-

Courtyard’s cumulative user count now exceeds 6,200. More notably, the platform has attracted 14,601 unique minter (creator) addresses to date. This significant growth in both users and content creators highlights Courtyard’s strong appeal to collectors and artists alike.

-

Pokémon cards account for 71% of traded assets, dominating Courtyard’s marketplace. While Pokémon cards are the primary trade item, other sports collectibles like basketball cards are also available. Secondary market activity reached $80,000 in trading volume on peak days, indicating growing market liquidity.

-

Transaction Highlight: A Pokémon card sold for a record $17,800. This transaction utilized account abstraction, where the platform paid the gas fee instead of the buyer or seller, eliminating gas cost burdens for users. This sale highlights Courtyard’s progress in bridging traditional collectibles, particularly appealing to fans of Pokémon and sports memorabilia beyond just crypto enthusiasts.

Anichess

spaceharpoon | Website | Dashboard

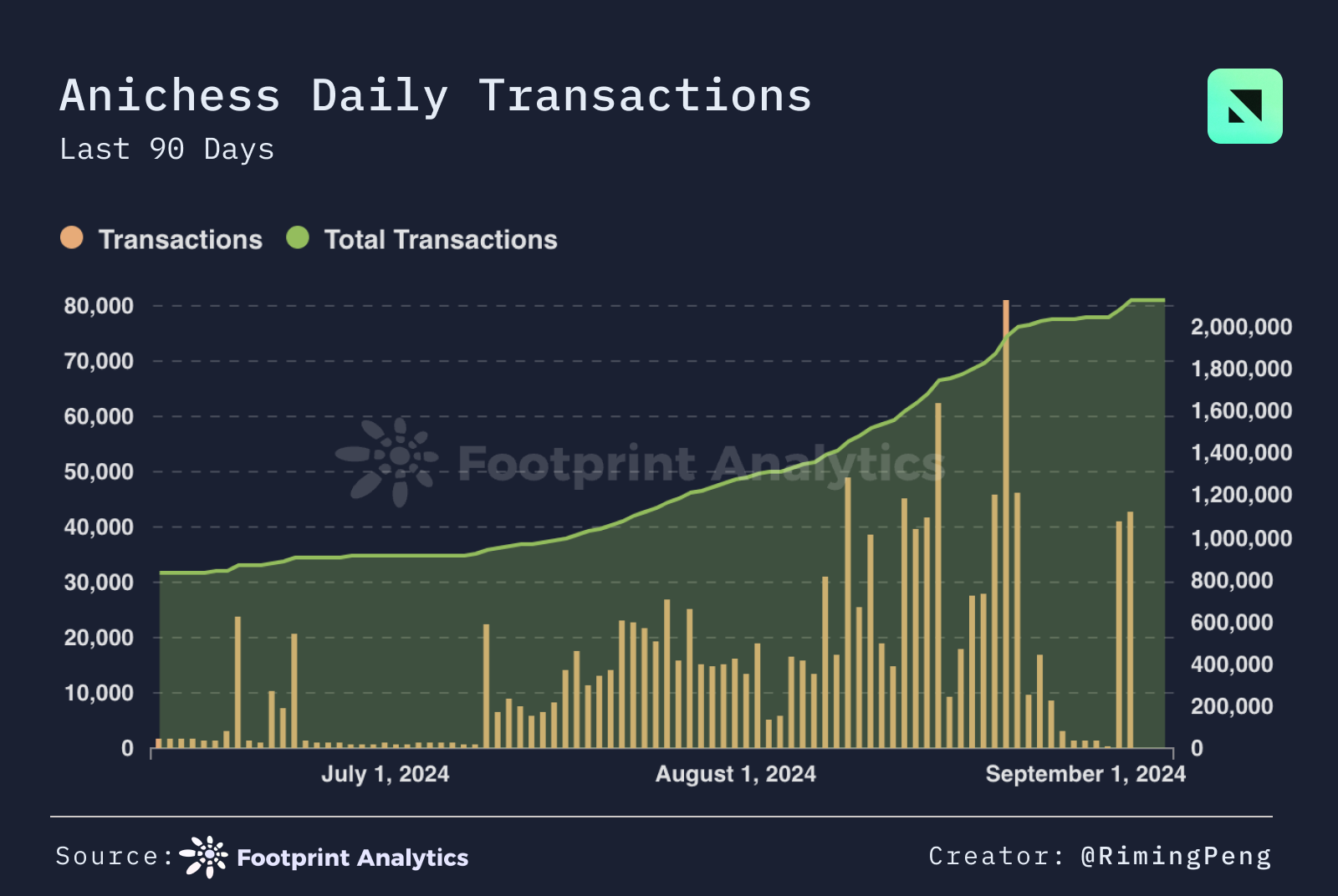

Anichess User Base Surpasses 283,800, With Significant Growth in Q3

-

Anichess is a strategy game blending traditional chess mechanics with magical elements. It now has a total user base of 283,800 and exhibits cyclical growth patterns. Weekly active wallet counts surged 700% in Q3 2024, exceeding 120,000, with new user adoption at 5.6% and daily active users at 3.2%. Transaction volume also spiked 5–8 times. Daily transaction values jumped from $50 to $1,400—a 28-fold increase—highlighting the powerful role of game design in driving periodic user engagement.

-

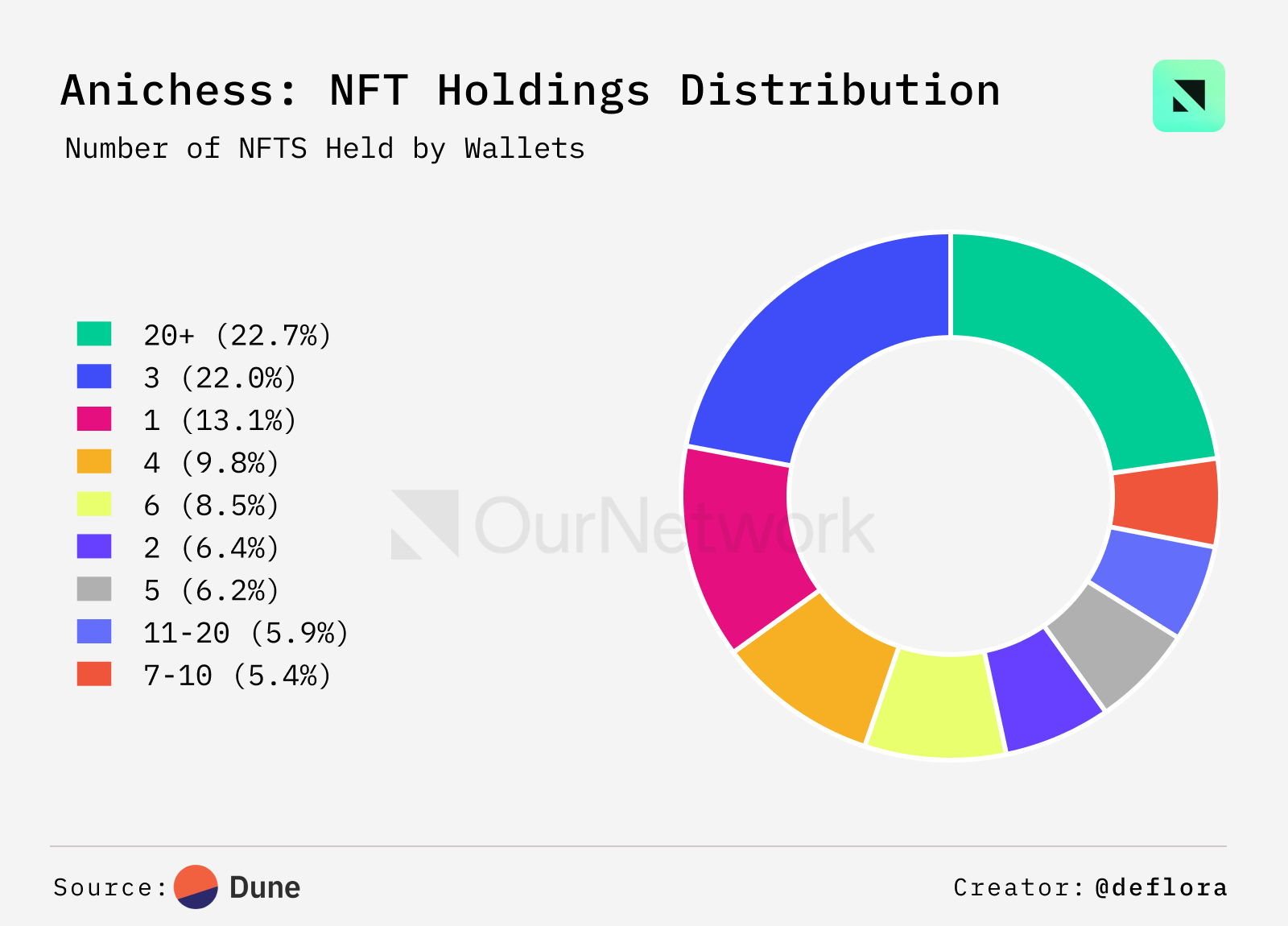

Anichess boasts a diverse and highly engaged user base: Among 484,000 unique holders, 22.7% of wallets hold more than 20 NFTs, 5.9% hold 11–20, and 5.4% hold 7–10. Notably, 22% of holders own exactly three Anichess NFTs. This distribution reflects both power users and newcomers, with cyclical factors driving large-scale participation.

-

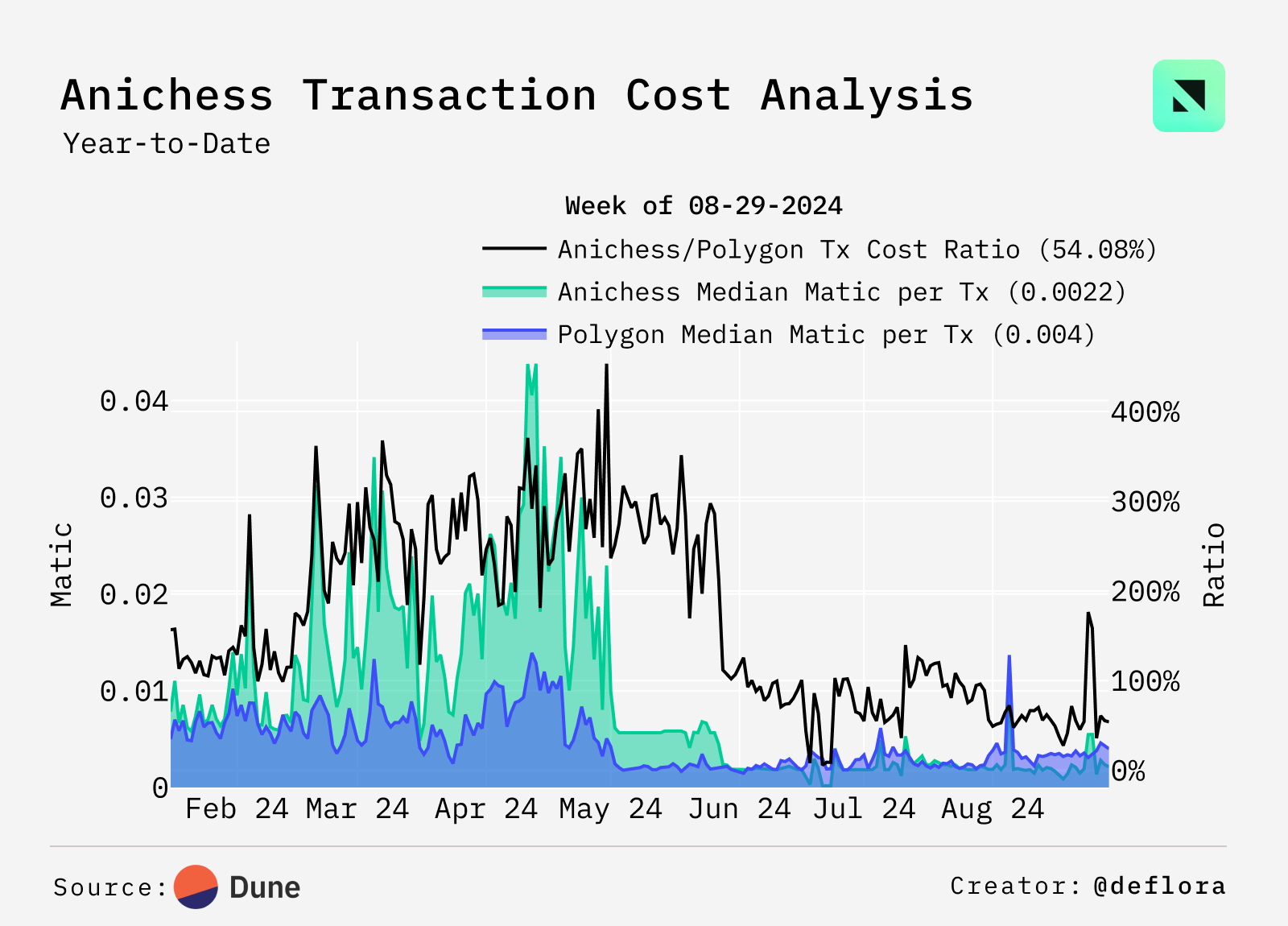

Despite fluctuating fees, Anichess continues to grow: Despite spikes in network costs, the platform’s total user count has risen to 283,800, with new user adoption at 5.59% and daily active users at 3.189%. This suggests its value proposition outweighs network costs, likely due to its unique gameplay mechanics.

-

Transaction Highlight: This transaction involved the minting and claiming of an ORB token (NFT) tied to in-game achievements (0 XP, nonce 16), costing 0.0023553 MATIC in gas on Polygon. It demonstrates how the platform builds a gamified ecosystem using NFT rewards and progression systems to drive user engagement.

DIMO

spaceharpoon | Website | Dashboard

DIMO Connects 107,000 Vehicles: Tesla Leads with 20.2% Market Share

-

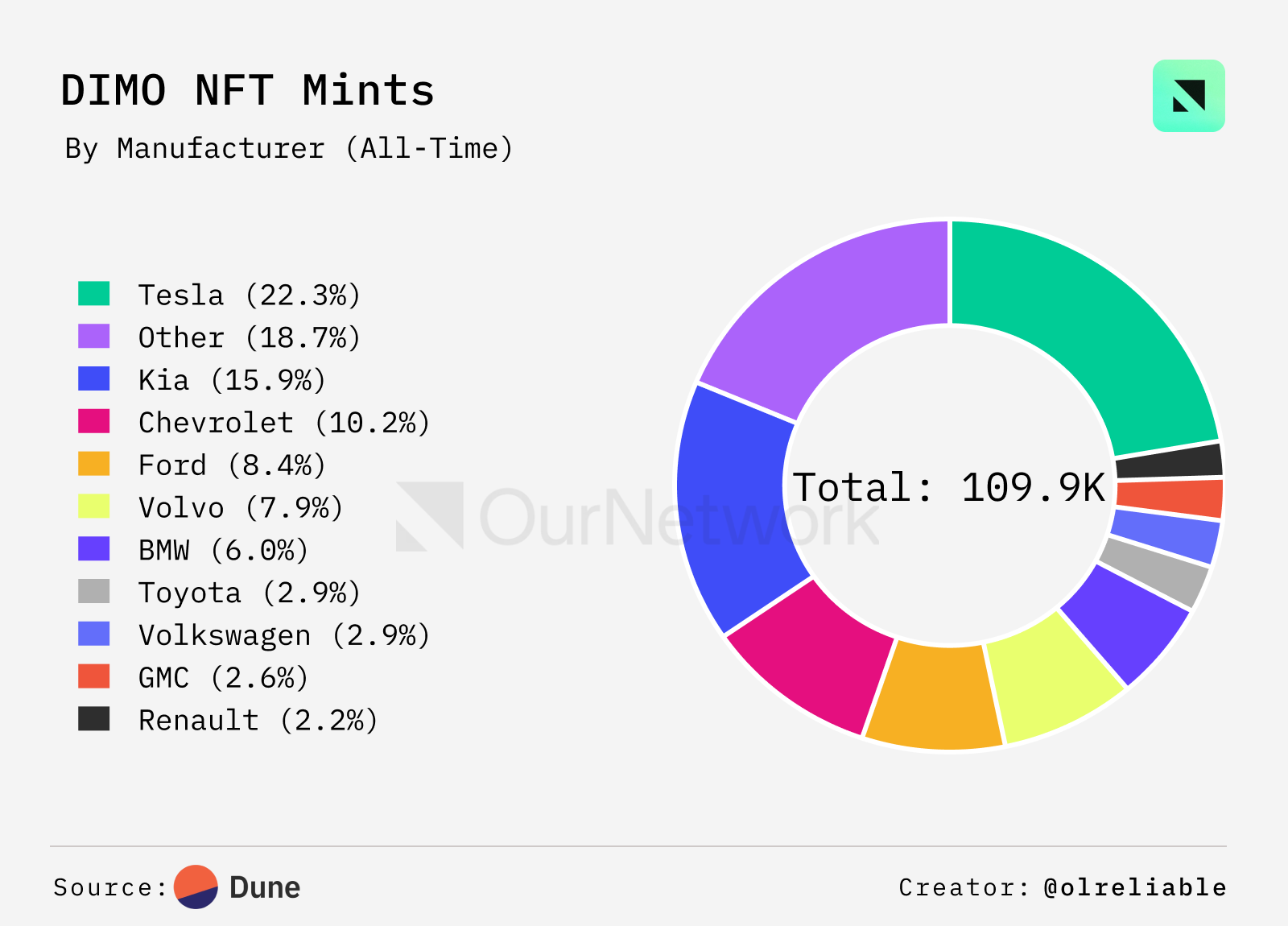

DIMO is an open connected vehicle platform that empowers drivers through data and supports over 20 car brands. Tesla leads with a 20.2% market share, becoming the first automaker to formally support DIMO with direct integration. Kia follows at 15.6%, Chevrolet at 10.0%, and Ford at 9.7%. DIMO’s broad appeal across automotive segments highlights its potential for widespread adoption and cross-brand data aggregation.

-

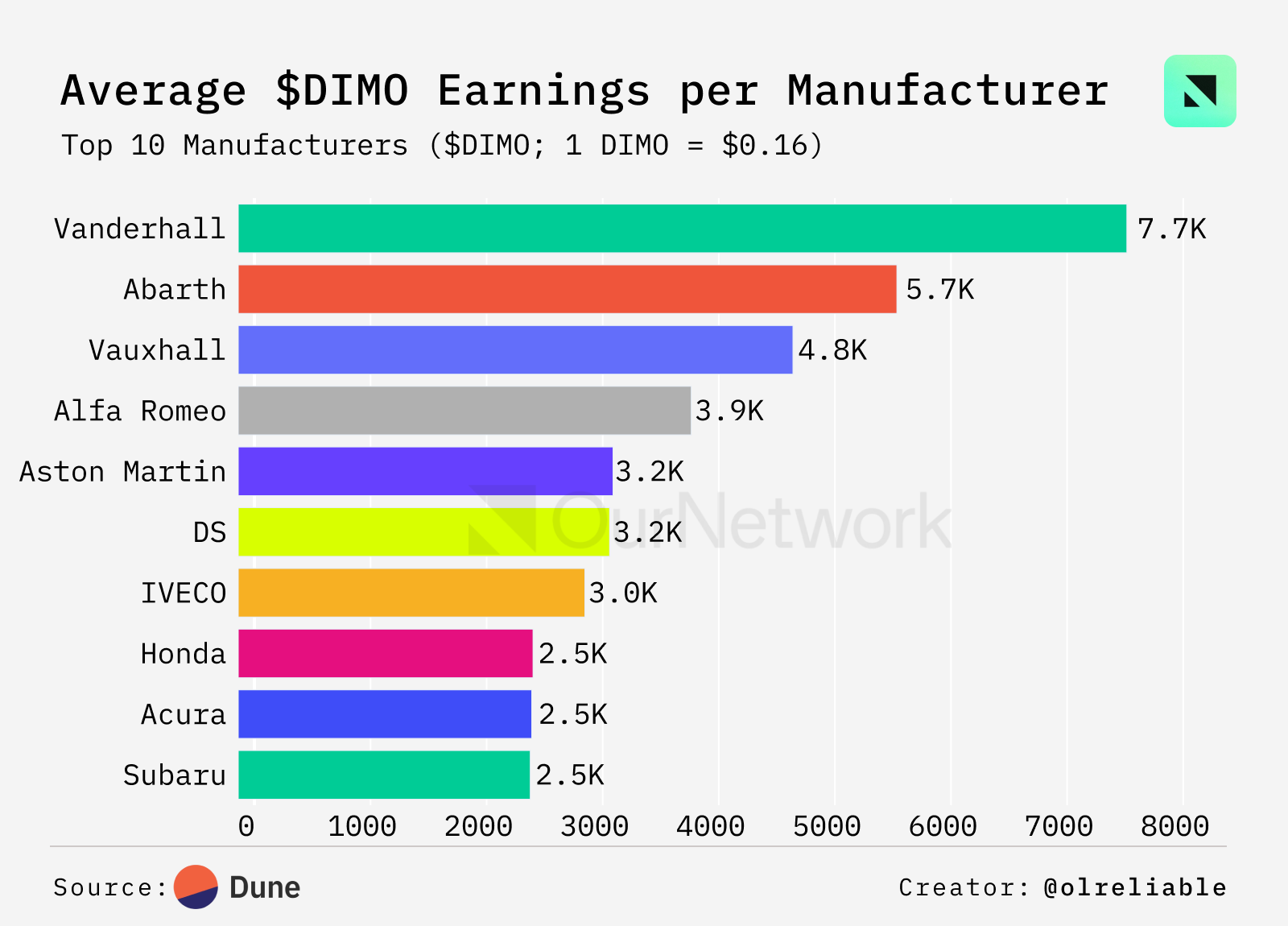

Revenue per manufacturer varies significantly. Tesla leads in EVs with 22,700 vehicles and $17.6 million in revenue. Luxury brands like Porsche generate high revenue per vehicle ($2,100/unit) despite lower volumes, while mass-market brands like Kia prioritize volume over per-unit profit (17,500 units, $115/unit).

-

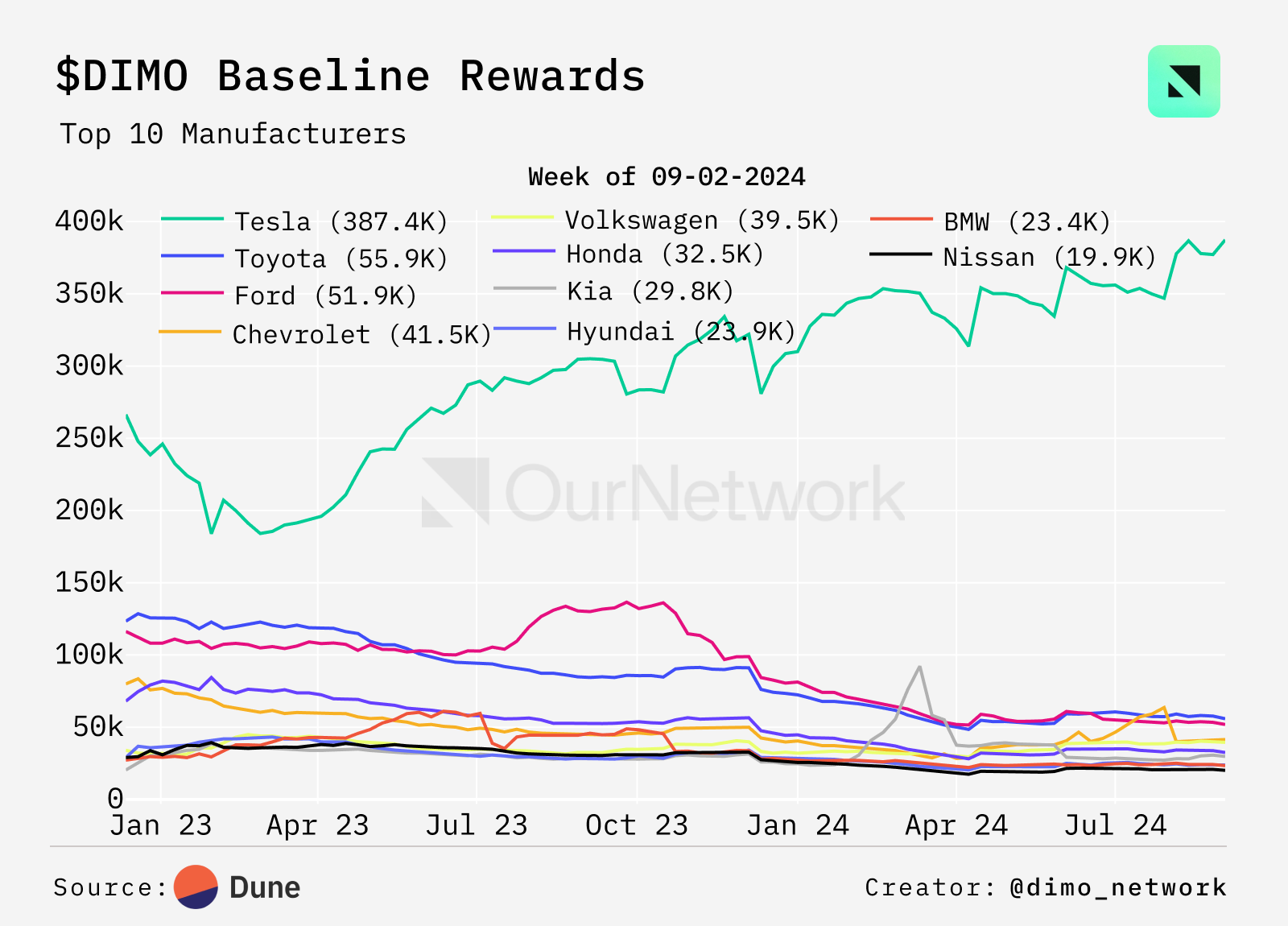

DIMO’s reward mechanism underscores Tesla’s dominance: Up to 353,000 tokens are distributed weekly to around 4,100 users. Economical brands like Kia and Chevrolet perform well, while niche and luxury brands maintain steady participation. This trend indicates ongoing development of the platform’s ecosystem across multiple vehicle segments.

-

Transaction Highlight: This transaction showcases DIMO’s innovative reward distribution mechanism. Through this bulk transfer, the platform demonstrates how weekly token distributions incentivize data sharing. Rewards are personalized based on individual contributions, possibly factoring in data quality and consistency. This approach not only encourages sustained user engagement but also ensures fair compensation for valuable vehicle data—aligning with DIMO’s mission to empower vehicle owners in the connected car ecosystem.

Polygon RWAs

spaceharpoon | Website | Dashboard

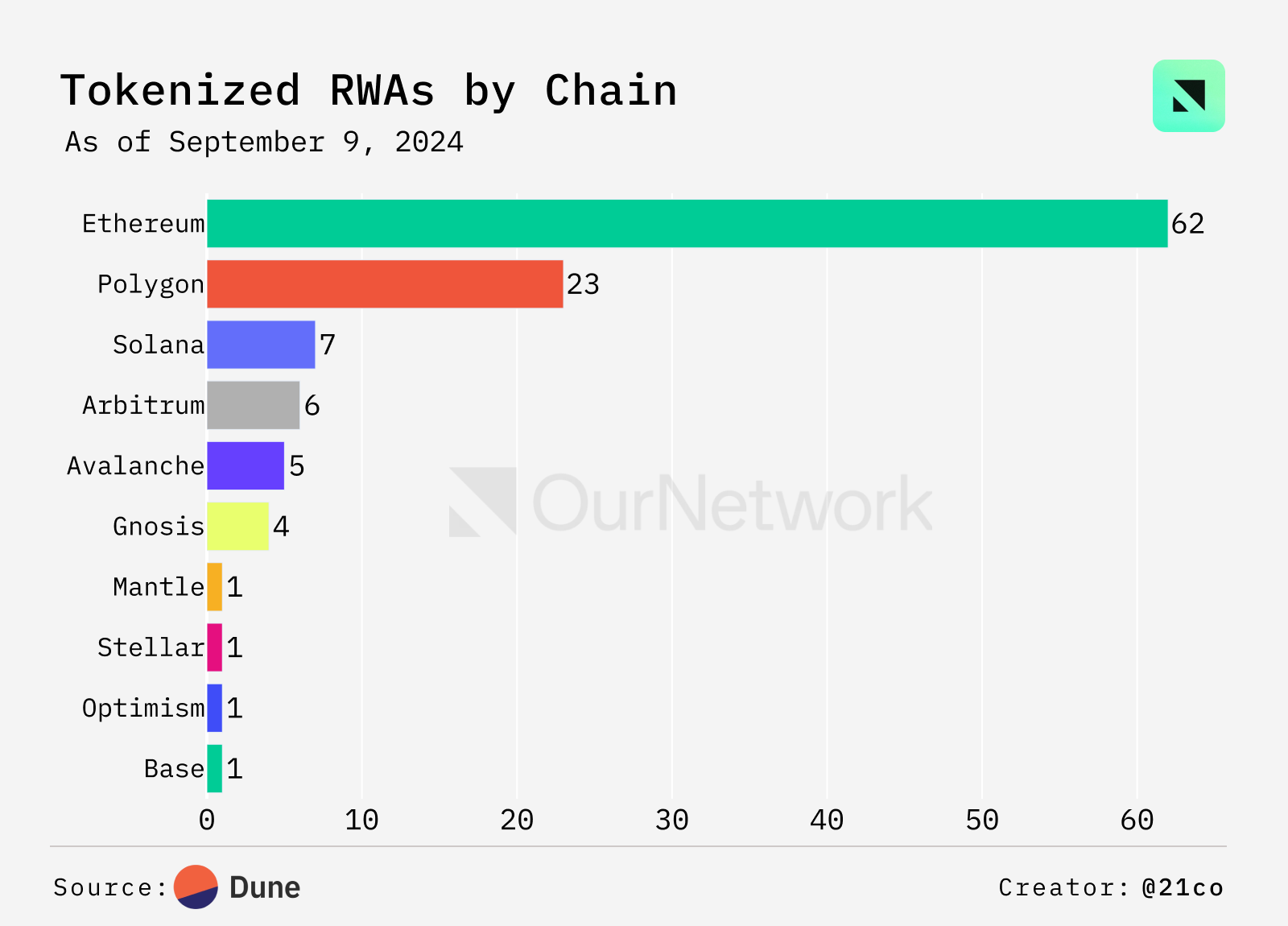

Polygon PoS Ranks Second in Tokenized Assets, 23 Real-World Assets (RWA) Valued at $531.58 Million

-

Polygon has emerged as the second-largest blockchain for tokenized real-world assets, hosting 23 assets—second only to Ethereum’s 62. This positions Polygon as a major player in the space, with a total RWA market cap of $531.58 million on its platform.

-

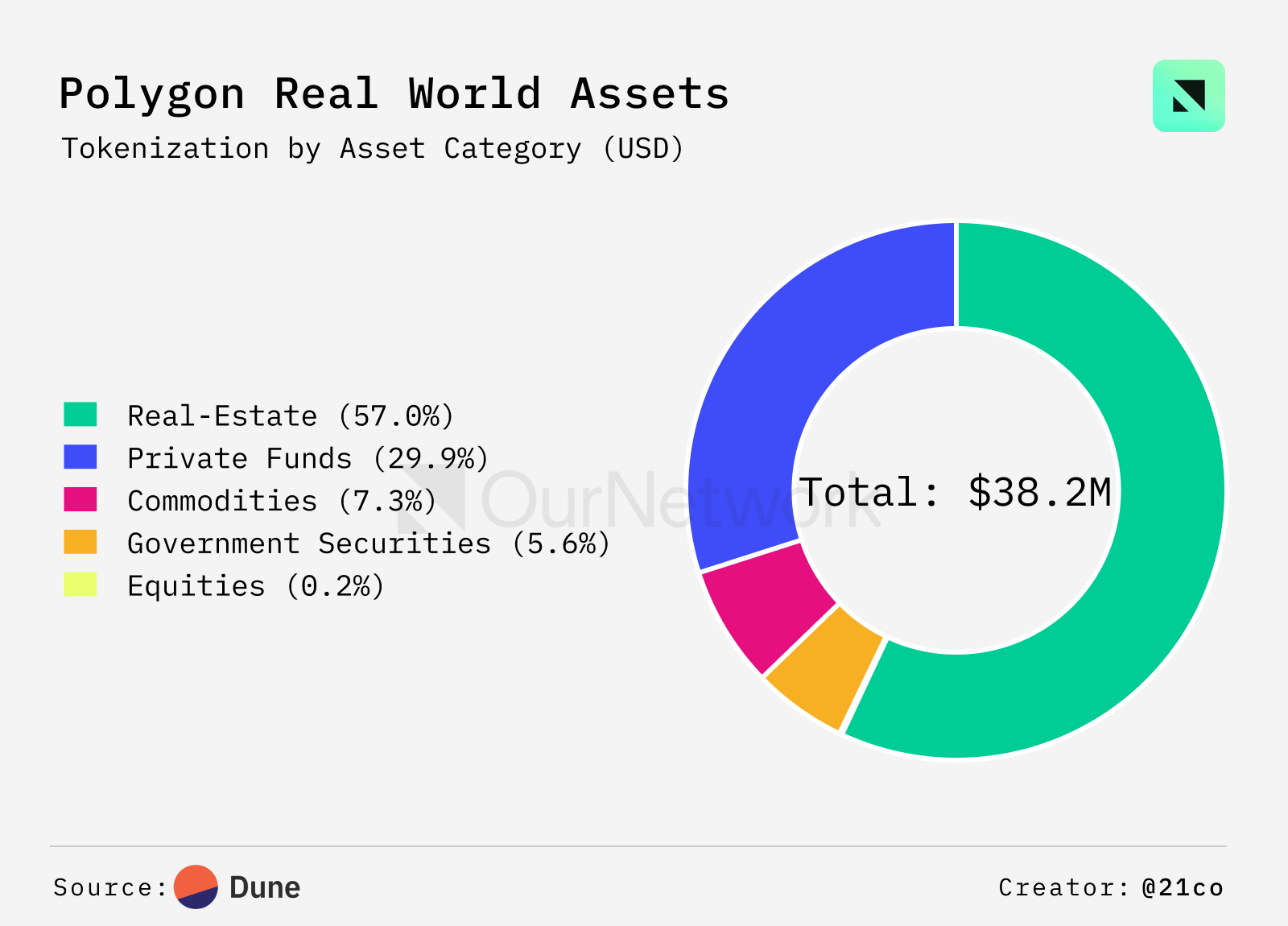

Within the real-world asset (RWA) ecosystem, sector preferences are clear: Real estate accounts for 56.9% of tokenized value, followed by private equity (30%), commodities (7.3%), and government securities (5.7%). Notable tokens include HLEOVUS in private equity (valued at $6 million) and BENJI in government securities (valued at $2.14 million).

-

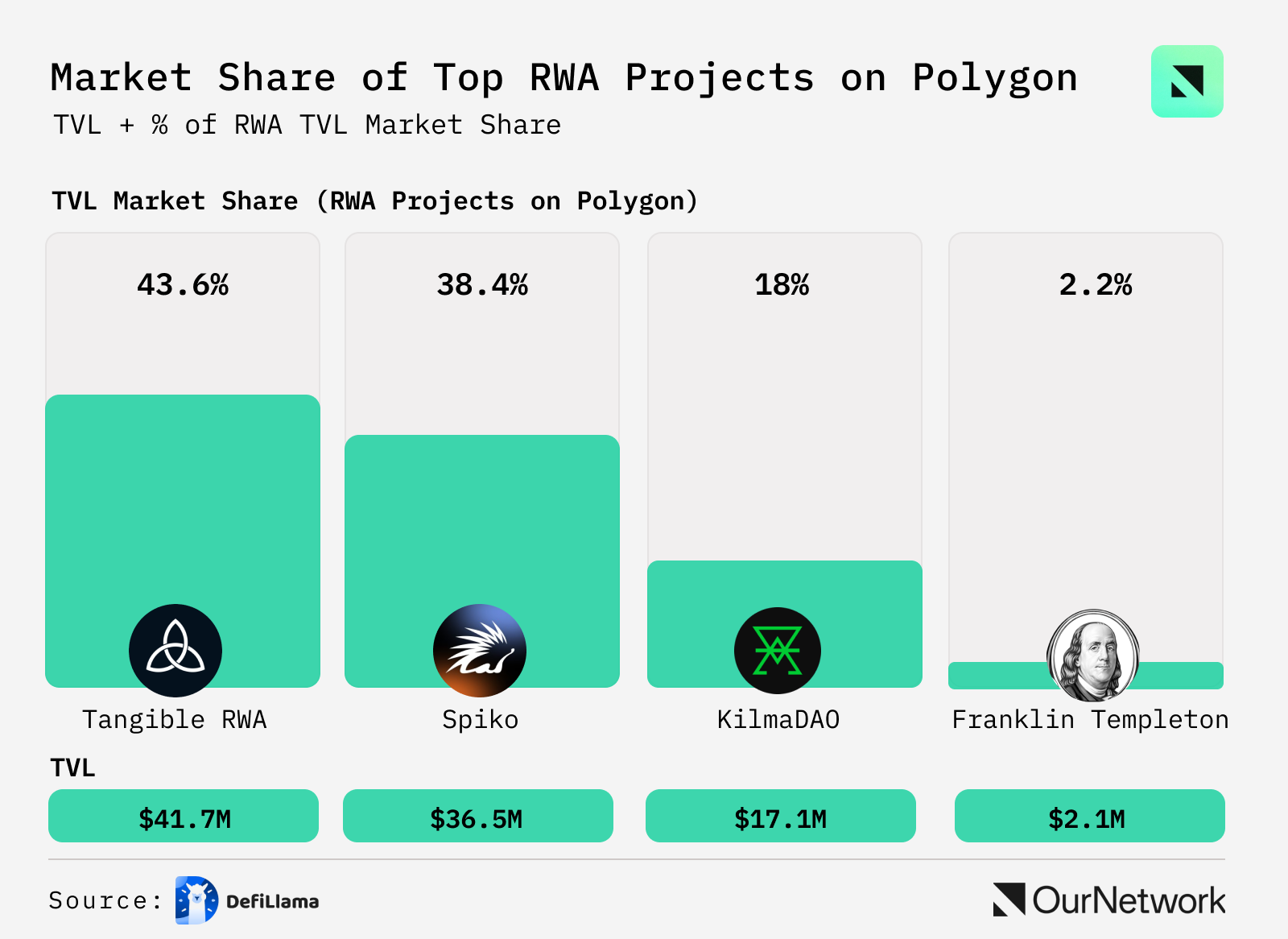

At the protocol level, Tangible RWA holds significant influence with $41 million in TVL and 218 tokenized properties, accounting for 43% of Polygon’s total RWA value. Close behind are Spiko at $36 million and Klima DAO at $10 million, further showcasing the diversified ecosystem developing on Polygon.

AggLayer Overview

Polygon is evolving into an aggregated blockchain network via AggLayer. AggLayer is an interoperability solution that connects independent blockchains into a unified network of shared liquidity and state. Designed to link multiple blockchains via zero-knowledge security, it enables more scalable cross-chain interoperability. This includes Polygon’s PoS chain, expected to integrate with AggLayer so its total value locked (TVL) and users can directly interoperate with other connected chains.

Currently in development, a recent cross-chain demo showcased inter-chain communication capabilities, signaling plans by Polygon Labs and core contributors to accelerate progress in the coming months.

Teams across the industry—including Espresso Systems, OKX, Irreducible, Gateway, Succinct Labs, Nodekit, Movement Labs, and Union—are collaborating to build a win-win chain network.

Next, we’ll examine data behind some popular blockchains being built on Polygon’s AggLayer.

Ronin

Bailey Tan | Website | Dashboard

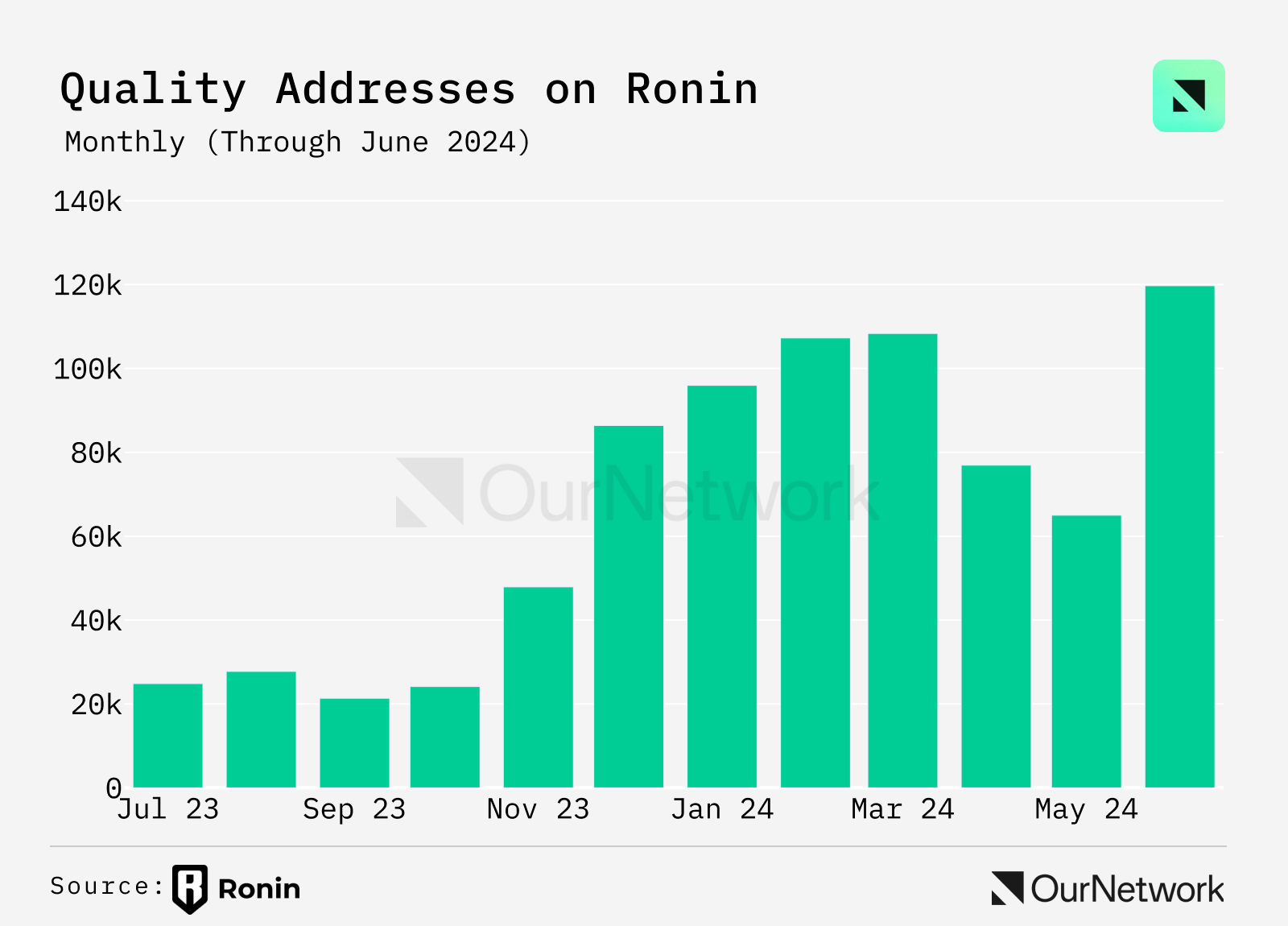

Ronin Reaches 2.3 Million Daily Active Addresses, a 100x Increase Year-on-Year

-

Ronin is an EVM-compatible L1 blockchain focused on gaming, leveraging Polygon CDK to build a zkEVM L2 that will connect to AggLayer—details here. As a blockchain purpose-built for games, Ronin aims to be the best platform for building, growing, and monetizing web3 games. Among L1s, Ronin consistently ranks in the top five for daily active users, with its market share growing from 0.6% to 22%, thanks to innovative on-chain mechanisms like daily login rewards. Ronin focuses on high-quality, on-chain spending user addresses. Although we’ve observed 2–3x growth since 2023, off-chain spending isn’t fully captured—according to Pixels’ report, over 100,000 active VIP users spend $10 monthly.

Ronin (internal)

-

Mavis Market, Ronin’s leading NFT marketplace, supports primary sales and secondary peer-to-peer trading. Transaction volume grew 16x, rising from a monthly peak of $368,000 in 2023 to $6.15 million in 2024. Its NFT Launchpad has seen five near-instant sellouts, raising over 3 million $RON.

Ronin (internal)

-

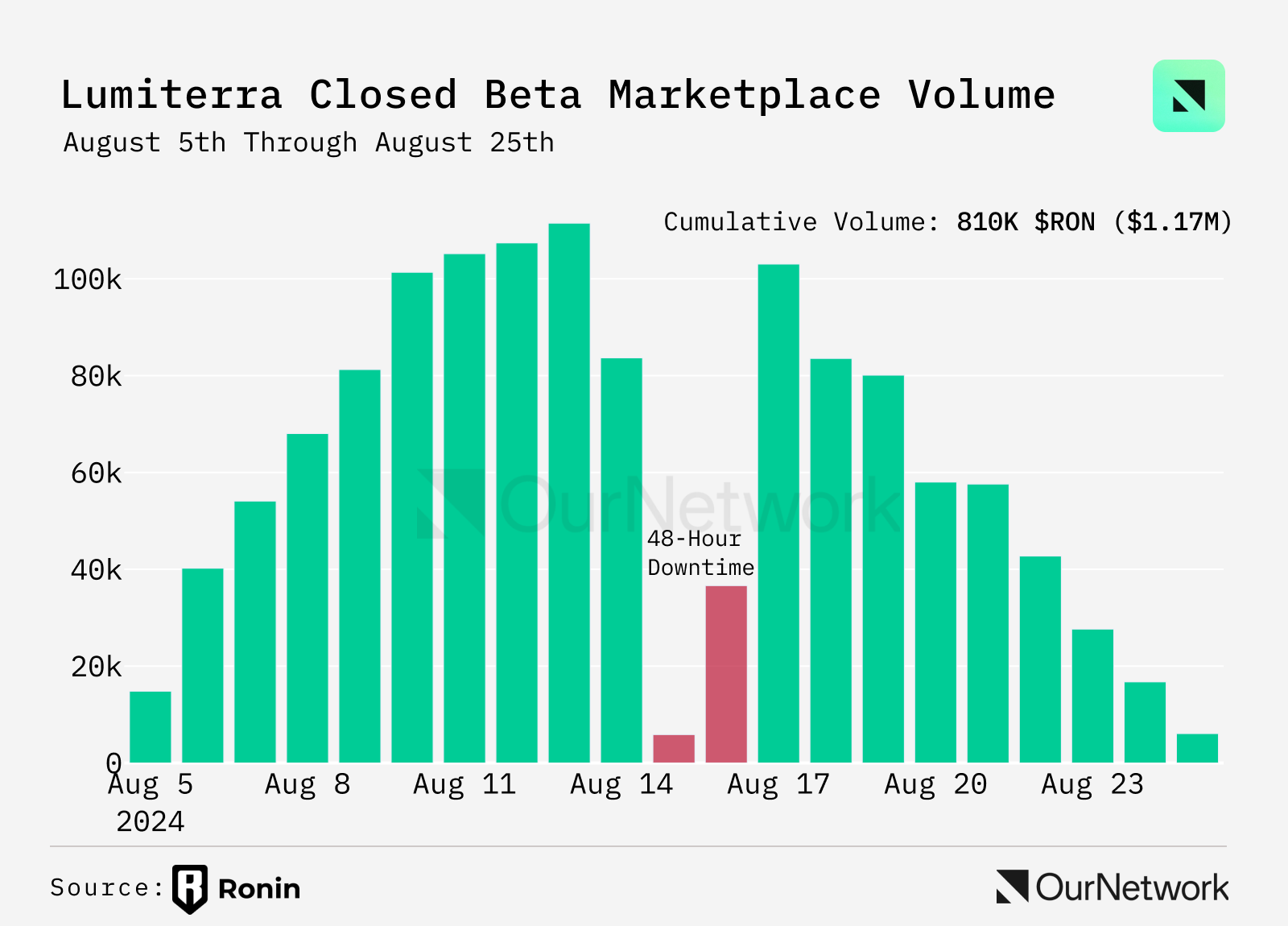

Lumiterra, a multiplayer open-world survival crafting game, generated 810,000 $RON in marketplace volume during its 20-day closed test, driven by trades of items critical to player progression. Lumiterra is the latest example of the “Ronin effect”—Ronin’s curation and promotion of high-quality games have proven effective in driving large-scale growth.

Ronin (internal)

-

Transaction Focus:

On August 29, a rare Mystic Axie—#9, one of the rarest IDs—sold for 6.26 ETH (approximately $16,100), 84% above reserve price. Mystic Axies possess the rarest Mystic body parts, with only 1,376 existing globally. Since 2018, holders have enjoyed numerous benefits from Axie Infinity, including in-game items and rewards, as well as perks from Ronin such as NFT whitelist access and priority game access. This purchase was made by a first-time owner of a Mystic Axie, highlighting the appeal of collectible Axies and suggesting continued confidence in Axie’s intellectual property among whales.

Movement Labs

Pratham Prasoon | Website | Dashboard

Movement Labs Processes Over 100 Million Transactions in Its Incentivized Testnet Program

-

Movement is developing a parallelized Move-EVM Layer 2 solution set to integrate with Polygon’s AggLayer. Specifically, this integration will bring MoveVM rollups into the AggLayer ecosystem, expanding its functionality and reach.

Movement (internal data)

-

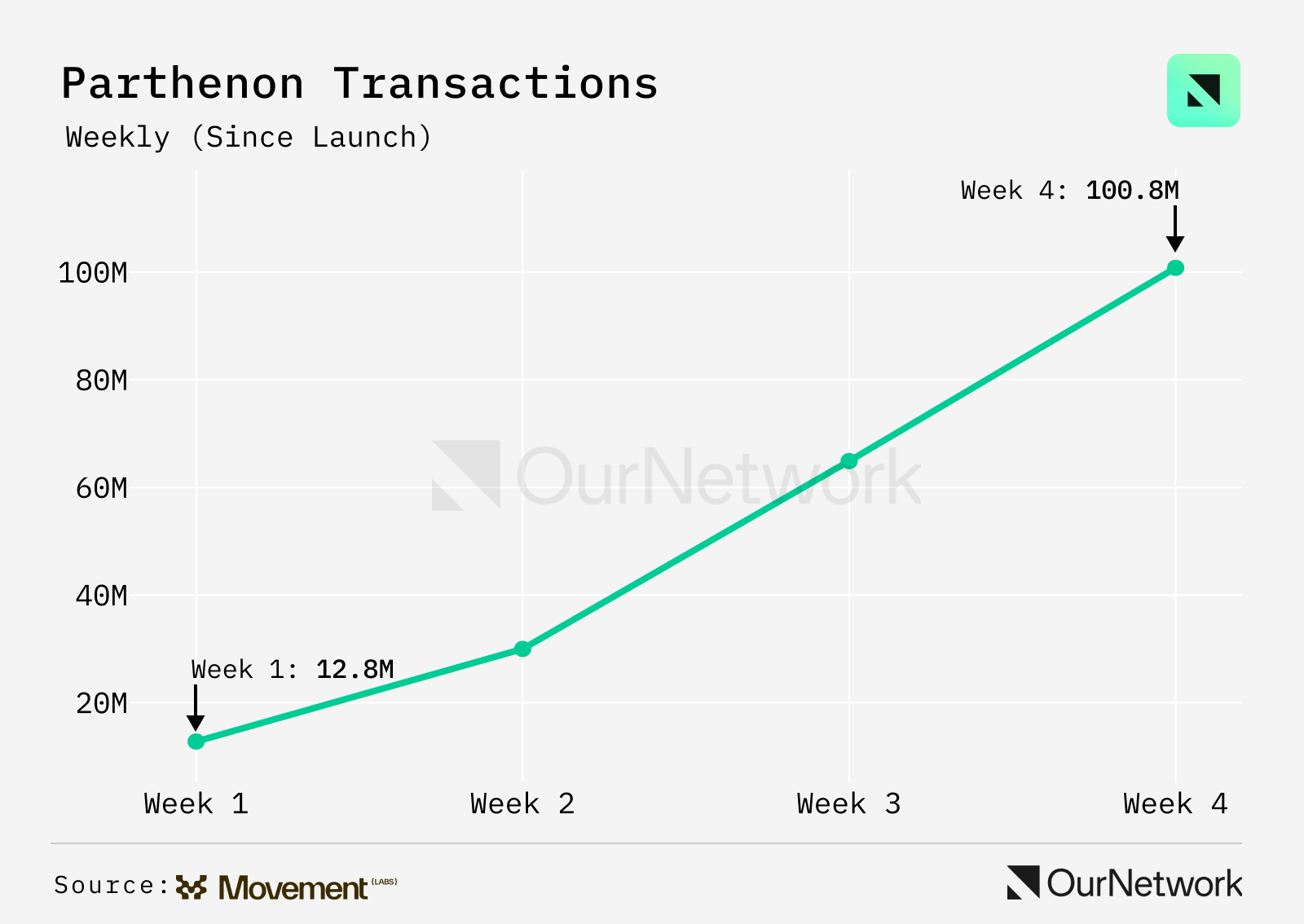

Within four weeks of Parthenon, Movement Labs’ incentivized testnet program enabled the network to process over 100 million transactions, with wallet counts growing to 3.5 million—demonstrating its scalability and effective community engagement.

Movement (internal data)

-

Movement’s flagship projects—including Echelon, Meridian, and Routex—are also growing steadily. Echelon sees 943,900 weekly transactions and 923,000 deposits; Meridian facilitates 869,000 swaps; Routex achieves 12,000 weekly transactions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News