Will TIA's upcoming massive unlock trigger market panic?

TechFlow Selected TechFlow Selected

Will TIA's upcoming massive unlock trigger market panic?

Negative headwinds may have already been absorbed.

Written by: 1912212.eth, Foresight News

Large token unlocks always trigger significant market concerns.

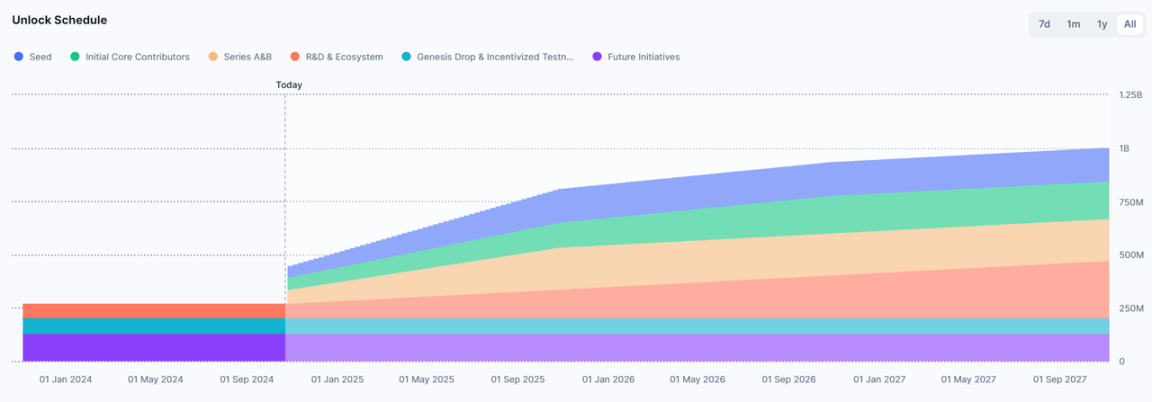

Celestia (TIA), the leading modular blockchain, is set to unlock 175.74 million tokens on October 31. At a price of $6 per token, this equates to over $1 billion in value. This unlocked amount represents 16.3% of its total supply and a staggering 80.07% of the current circulating supply. As of publication time, TIA’s price has recovered above $6, currently trading at $6.16 with a daily gain of approximately 3%.

Of this unlocked portion, seed round, Series A, and Series B investors collectively hold 117.38 million tokens—an exceptionally large allocation.

Given the scale of this unlock, the market is closely watching whether VCs will dump their holdings immediately or if a sharp price correction will follow—key questions on everyone's mind.

Celestia’s Recent Progress

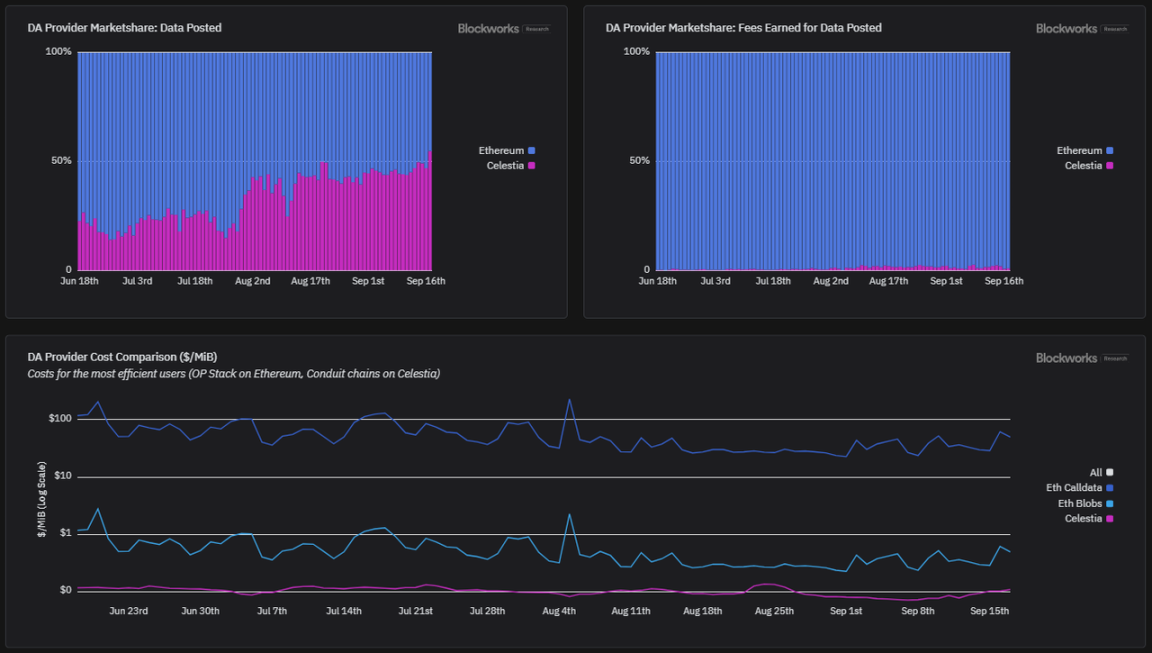

Since pioneering the modular blockchain narrative, Celestia has drawn widespread attention. Designed specifically as modular infrastructure for data availability (DA), Celestia reduces data costs by 99.9% compared to Ethereum—the dominant DA layer in the industry today.

According to Blockwork Research, by mid-September, Celestia had already achieved a data publishing ratio of 57%, generating only $243 in fees—just 1% of Ethereum mainnet’s cost. Since mainnet launch, Celestia has supported the deployment of over 20 rollups.

As of October this year, Celestia’s peak throughput stands at 2MB every 12 seconds (0.167MB/s). In response, Celestia’s core development team recently unveiled a roadmap aiming to increase data throughput capacity to 1GB.

Premature Funding Announcement

It's common practice for projects to announce funding rounds or roadmaps ahead of major token unlocks to help stabilize token prices.

Celestia’s early fundraising efforts were challenging, facing multiple rejections from investors in 2019. However, after establishing credibility within the modular narrative, it raised $55 million in October 2022. Then in September 2024, the Celestia Foundation secured another $100 million in funding, backed by several marquee institutions. Following the announcement, TIA surged 24% intraday, briefly surpassing $6.5.

However, investor Sisyphus later revealed that this funding was actually an OTC deal finalized months earlier between the foundation and multiple institutions at a $3.5 billion valuation, with these tokens scheduled to unlock in October. Sisyphus added that institutional investors would need to sell their entire unlocked position at $7.5 to break even.

The short-lived rally soon faded.

Negative Impact May Already Be Priced In

Boosted by the modular blockchain trend and broader market momentum, TIA rose from around $2 at the end of last year to over $21. It then entered a prolonged downtrend, dropping below $4 before rebounding to its current level near $6.

Typically, large token unlocks—especially when significant portions go to teams and investors—have negative implications. Amid anti-VC sentiment, community members often assume that once unlocked, VCs will immediately dump their tokens without hesitation.

News of major unlocks tends to circulate about a month in advance, giving the market two to three weeks to prepare. Hesitant capital often adjusts positions in the weeks leading up to the unlock to avoid volatility.

Messari noted in a research report that unlocks exceeding 5% of circulating supply significantly impact token performance, with weaker price action observed within seven days before and after the event.

So what might happen with this TIA unlock?

Chris Burniske, partner at bullish firm Placeholder, recently analyzed TIA on X (formerly Twitter), suggesting some investors may regret not buying below $5 when the price rises again. Burniske gained fame for his accurate calls during previous cycles, notably purchasing large amounts of SOL when it dropped below $10 in late 2022.

In a detailed thread, Chris argued that the negative sentiment surrounding TIA’s large unlock is greatly exaggerated:

-

Celestia’s ecosystem continues to grow, driven by passionate, ideologically committed, and diverse developers—reminiscent of early Bitcoin, Ethereum, and Solana.

-

The so-called "evil VCs" receiving unlocked tokens are unlikely to exit entirely in October, as they recognize the expanding ecosystem and understand that many of TIA’s strongest supporters are not short-term profit-driven.

-

When the unlock occurs, the market may realize selling pressure is far less than anticipated; if bulls haven’t been liquidated beforehand, bears could face margin calls instead.

-

Buyers who have been sidelined or hesitant due to unlock fears may enter positions once positive price action reduces uncertainty.

Chris also referenced historical precedent: SOL underwent an 80% supply unlock back in December 2020. While it experienced a pullback afterward, SOL went on to surge more than 100x in 2021. Still, skepticism remains—David Hoffman, founder of Blankless, commented: “Not sure if comparing to one of the best-performing assets of 2021 is truly appropriate.”

Whether TIA can replicate SOL’s trajectory remains debatable. However, if the price avoids a sharp decline post-unlock and stabilizes within a range, it would undoubtedly be a positive signal for future performance.

TIA Staking Rewards Could Ease Selling Pressure

Currently, staking yields on major exchanges are attractive: Binance offers 14.36% APY on TIA flexible savings, Bybit provides 11%, while OKX hovers around 20%.

On-chain options are also competitive. For example, Stride offers 9.45% APY, while Keplr Wallet reaches 10.61%. With high yields combined with broad market expectations that a new bull cycle is beginning, some holders may choose to stake rather than sell.

Notably, many past modular blockchain projects have issued airdrops to TIA stakers. If history repeats itself, this could further incentivize staking activity.

Recent Performance After Major Token Unlocks

When uncertain about outcomes, reviewing past events can offer valuable insights.

Sui (SUI), a popular Layer 1, unlocked approximately 64.19 million tokens worth ~$120 million on October 1. Investors alone received 39.16 million tokens—over half of the total unlocked amount.

Despite this, SUI saw minimal impact: it dipped slightly from $1.93 to $1.65—a drop of just 0.97%. Although there was some follow-up correction, price action remained strong. Just one week later, on October 13, SUI hit a new all-time high of $2.368.

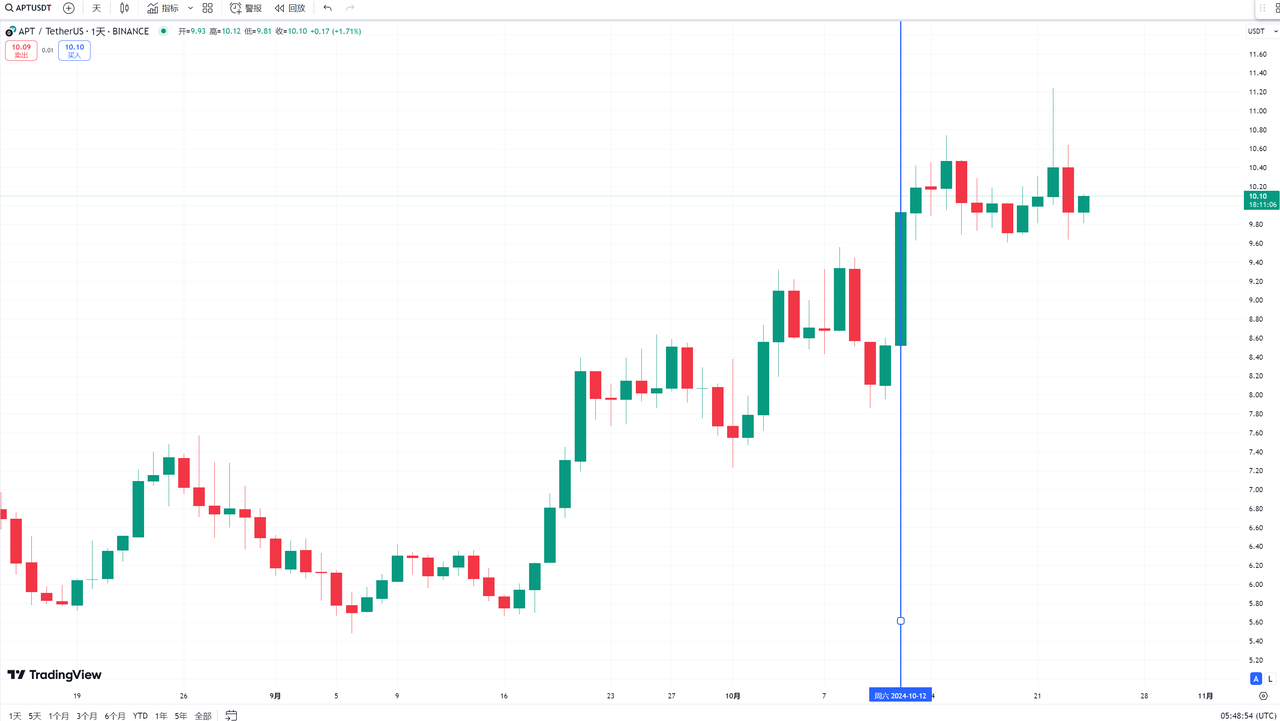

Another Move-based chain, Aptos (APT), unlocked 11.31 million tokens (~$100 million) on October 12, including 2.81 million for investors.

Rather than falling, APT surged 16.55% on the day, briefly approaching $10. By October 22, APT climbed above $11, marking its highest level since May 2024.

Even ARB, a Layer 2 token that had long underperformed, saw only a mild dip post-unlock instead of a crash. On October 16, ARB unlocked 92.65 million tokens valued at ~$49.4 million.

On the day of and the day after the unlock, ARB declined about 3.7%, falling from $0.58 to $0.54. However, it quickly rebounded with three consecutive green candles, rising above $0.6 shortly thereafter.

Conclusion

The post-unlock performance of tokens depends on multiple factors—including sector trends, unlock size, ecosystem growth, project progress, and community sentiment. Equally important is the overall market direction: bear markets typically feature weak demand, making large unlocks more likely to cause downward pressure. Conversely, in bull markets, it's not uncommon for tokens to surge despite major unlocks. Investors must conduct comprehensive analysis to accurately assess risks and opportunities in such scenarios.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News