TIA Operation Guide: Stake during the bull market to farm airdrops, sell when the crowd is loudest

TechFlow Selected TechFlow Selected

TIA Operation Guide: Stake during the bull market to farm airdrops, sell when the crowd is loudest

This article discusses the latest developments of Celestia and its token $TIA.

Author: Humble Farmer Army Newsletter

Translation: TechFlow

Recently, Celestia's token TIA has performed exceptionally well, briefly reaching new highs.

Beyond its technical strengths, another reason for market optimism around TIA is the potential to earn airdrops by staking the token.

However, these gains won't last forever, and there is a lock-up period for unstaking. How can one optimally manage their TIA holdings to maximize returns?

This article explores the latest developments surrounding Celestia and its $TIA token. The author emphasizes that while Celestia differs from traditional Ponzi schemes, its technological progress and supply-demand dynamics are worth attention. Additionally, the author analyzes in detail how the $TIA token resembles OHM’s (3,3) model and discusses Celestia’s future market performance and exit strategies.

Introduction

Before you get upset with me, let me clarify—I’m not saying Celestia is a Ponzi scheme. In fact, I believe it represents one of the most significant technological advancements we’ve seen in a long time. This article focuses solely on the supply and demand dynamics of the $TIA token and explains why I think it shares similarities with the OHM (3,3) narrative that attracted so many consumers during the 2021 bubble.

The article is divided into several parts:

-

What is Celestia?

-

What is the narrative behind the $TIA token?

-

How is $TIA similar to $OHM and the (3,3) model?

-

So what’s the plan?

What is Celestia?

If I were to fully explain Celestia here, this article would become too long—so please click here for a detailed explanation. In short, Celestia decouples the blockchain stack and focuses specifically on the data availability (DA) layer. This makes it easier and cheaper for new projects to deploy rollups and blockchains. For example, Manta Network reduced costs by 99.8% by using Celestia instead of Ethereum as its DA layer!!!

What is the narrative behind $TIA?

I believe Celestia offers the purest play on the airdrop narrative. Built using the Cosmos SDK, Celestia conducted an airdrop in November 2023 to OSMO and ATOM holders. We've already seen two major airdrops—Dymension and Saga.

Celestia makes it easier for new rollups to launch. These rollups are expected to airdrop portions of their tokens to $TIA holders.

L1/L2 tokens carry a premium in the market. So the story goes: “The price of TIA doesn’t matter because the airdrops you receive from holding TIA will more than cover your purchase cost.”

Now, this claim could be either true or false. Through my TIA staking strategy, my DYM airdrop has already covered my initial cost basis for buying TIA. So assuming I sold my DYM airdrop at launch, I essentially got my TIA position for free. Now, I don’t actually intend to do that because I believe DYM also has a strong narrative—but that’s a separate discussion.

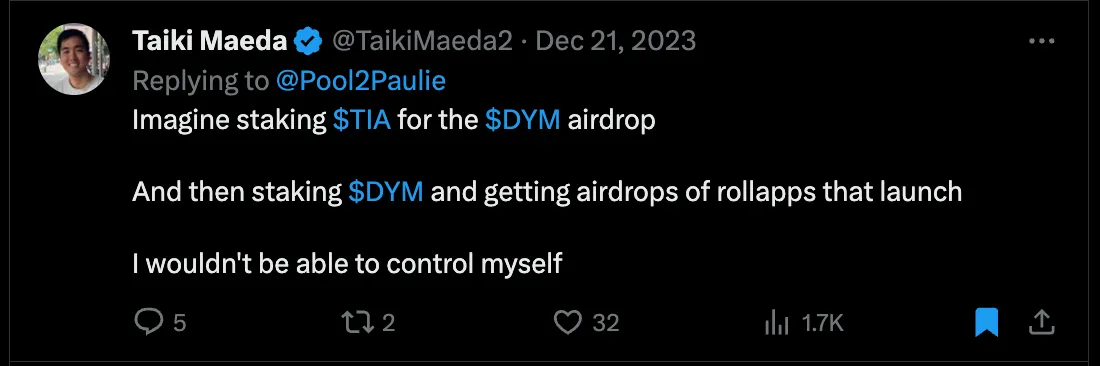

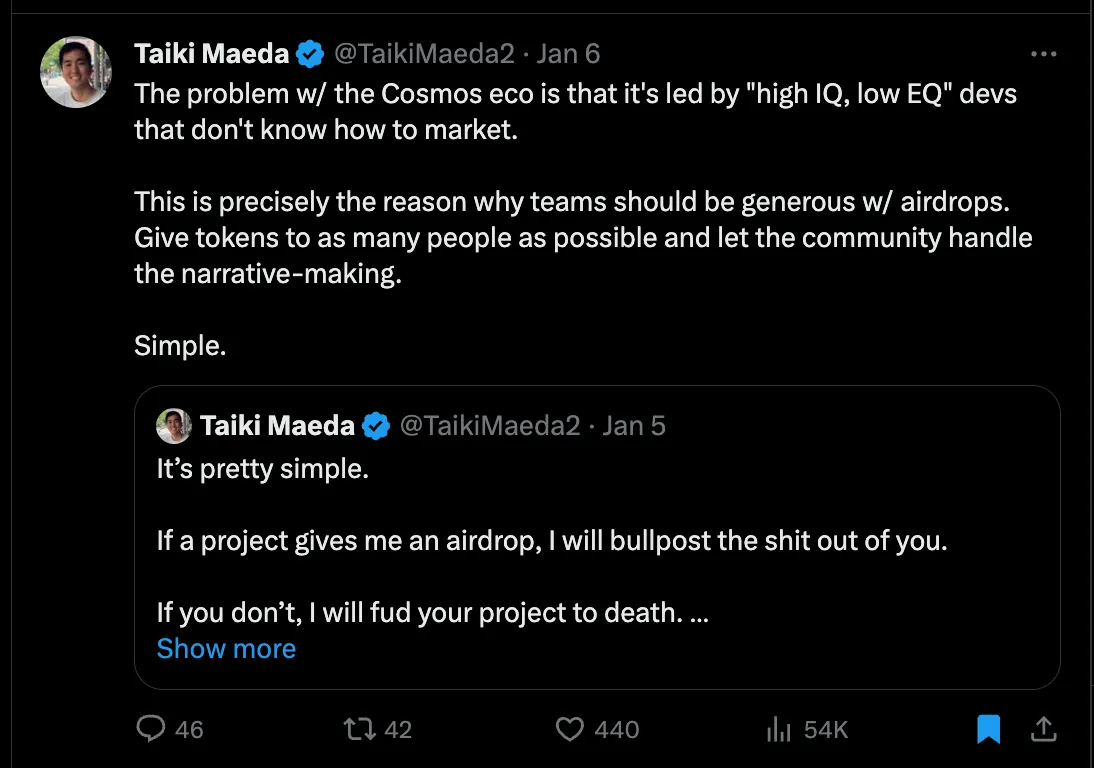

This is actually a reflexive cycle. One of my criticisms of the Cosmos community is that they’re poor at communicating their value proposition to the broader crypto and mainstream audience. They remain trapped within their own bubble, which negatively impacts both token prices and community growth.

Ironically, airdrops solve this problem. Developers can conduct generous airdrops, allowing the entire community of holders to discover and spread the token’s narrative. It benefits everyone—developers can focus on building while the community handles promotion. That’s why small airdrops by teams are bearish signals.

The above tweet is somewhat tongue-in-cheek but also serious. The SAGA team and VCs made the airdrop as hard to obtain as possible—for example, taking a snapshot of TIA holders on December 1 with a minimum staking amount of 23. Airdrops are meant to reward communities. Did they really expect a Celestia community to have formed within a month of TIA’s launch? The Celestia community is only just beginning to form, so future projects should stop conducting airdrops based on extremely early snapshots. SAGA’s airdrop was widely viewed by teams and VCs as mediocre at best.

In contrast, DYM executed an equitable airdrop with a snapshot taken on December 19 and a minimum staking requirement of just 1 TIA. This means you could stake $20 worth of TIA and receive an airdrop valued at approximately $1,000. They also distributed tokens to Pudgy Penguin and Solana NFT communities. Just search “$DYM” on Twitter/X and you’ll see a vibrant community, even before the token launch! Click here to read a discussion about what DYM should be worth.

I am extremely bearish on SAGA and extremely bullish on DYM.

Why Celestia Is the New (3,3)

Editor’s note: In OlympusDAO’s mechanism, participants support the network by bonding or staking their tokens, known as “staking.” (3,3) represents the ideal outcome where every participant chooses to stake, maximizing benefits for both the network and individuals. This concept has been widely adopted in the crypto community to describe a win-win cooperative state.

You may realize this creates a reflexive narrative. The stronger the Celestia community becomes, the greater the incentive for project teams to airdrop to the $TIA community. After all, isn’t that the spirit of the Cosmos ecosystem? The higher the market expectation for airdrops, the less sensitive buyers become to price. If holding TIA qualifies you for airdrops, why would anyone sell?

Therefore, consider this framework for valuing TIA:

Price(TIA) = Value accrual from the data availability layer + Monetary premium of TIA as “modular money” + Value of all future airdrops

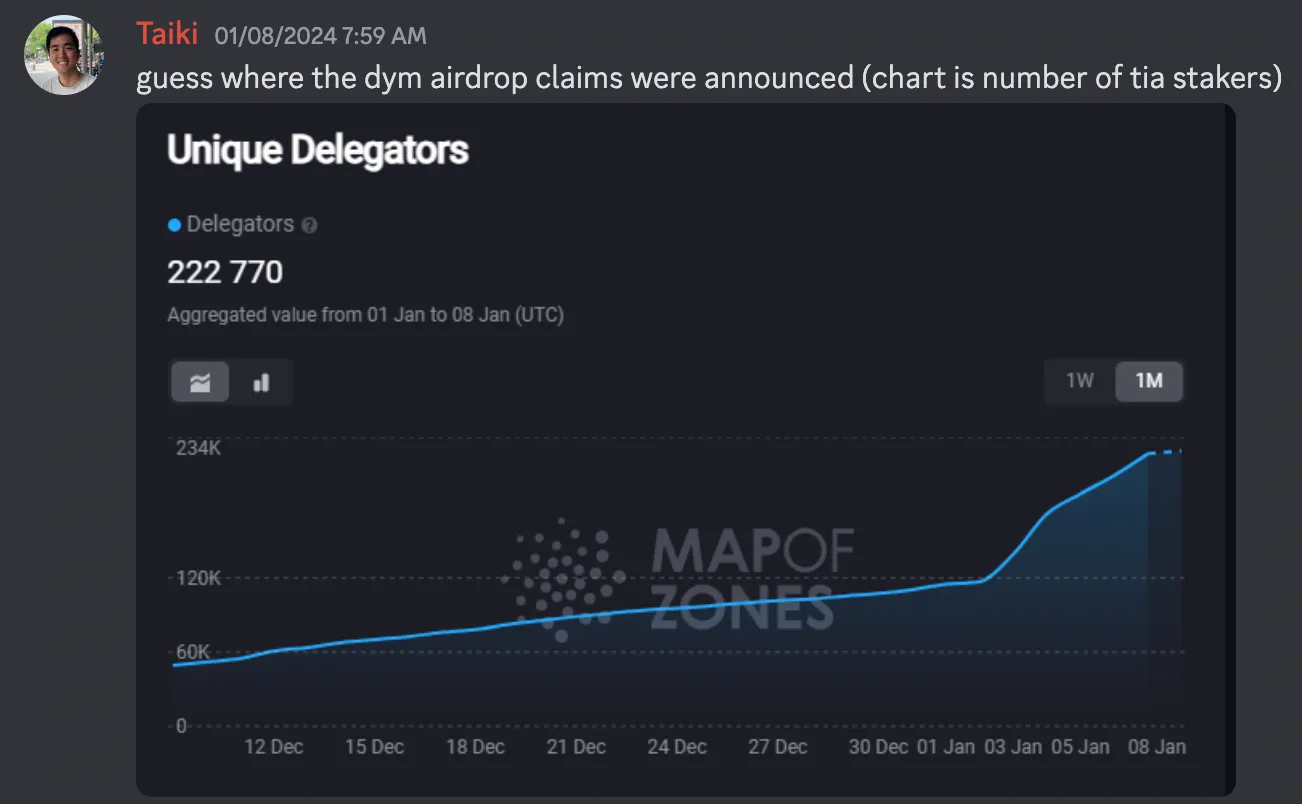

Now, no one knows how to precisely calculate value accrual or monetary premium since the network has just launched. As a result, people naturally gravitate toward justifying $TIA ownership based on expected airdrop value. The DYM airdrop was massive partly because initial expectations were low. But as more airdrops are announced, people will buy and stake TIA (remember, unstaking TIA has a 21-day unbonding period).

Clearly, over time, airdrops will become diluted. However, Celestia only launched two months ago, so I suspect we're still in the early stages of the airdrop narrative. The reality is that most cryptocurrency users remain on centralized exchanges (CEXs) and don’t even know how to stake Celestia—so feel free to ignore them. There will eventually come a time when unstaking TIA makes sense, but I don’t believe that time is now.

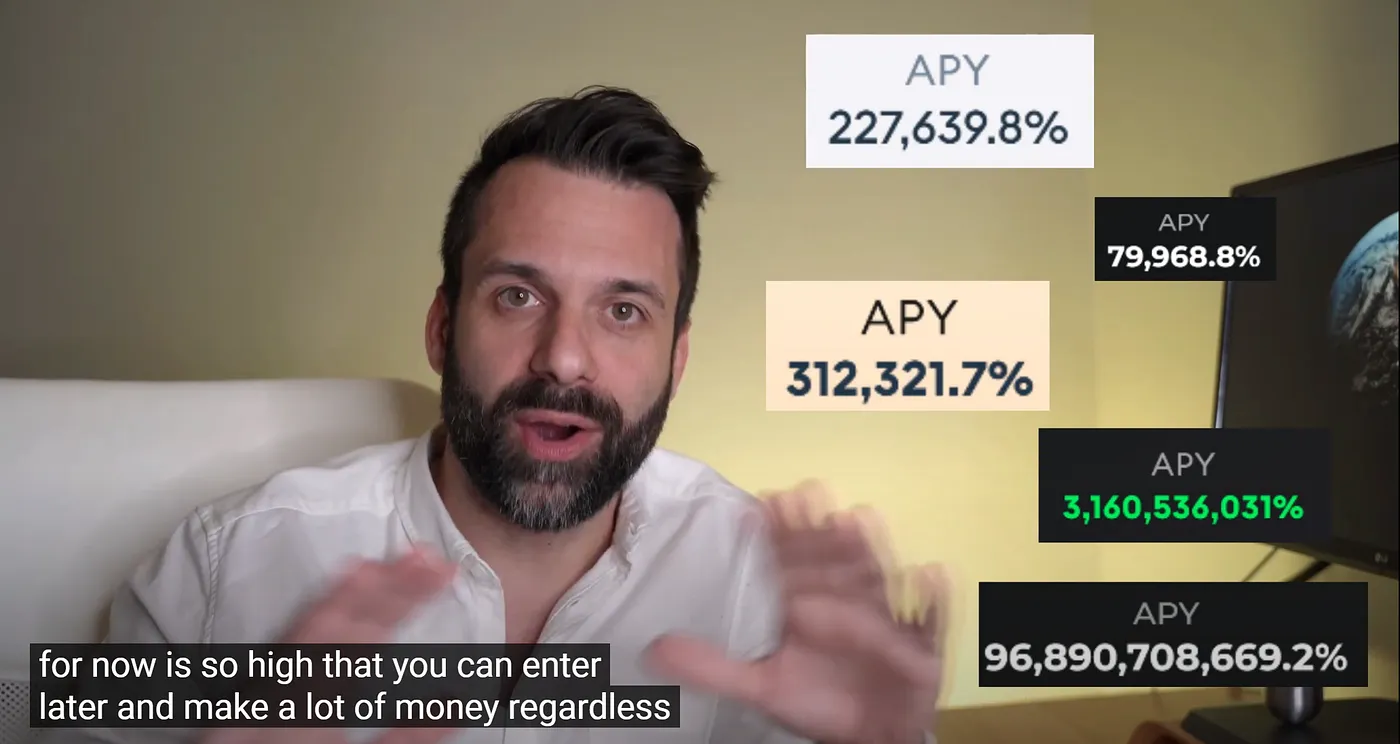

The truth is, retail investors love the airdrop narrative. Why wouldn’t they? Getting promised $100,000 for staking $100 seems like the future of finance. Look at the massive view counts on those videos in my chart above! These viewers and investors will buy and stake TIA. As TIA continues to generate airdrops and its price rises, we’ll undoubtedly see a new wave of YouTubers and TikTokers repeating the same mistakes they made with OHM:

-

“OHM can drop 99% in price because the APY will make up for it.”

-

“TIA’s price doesn’t matter because airdrops will compensate.”

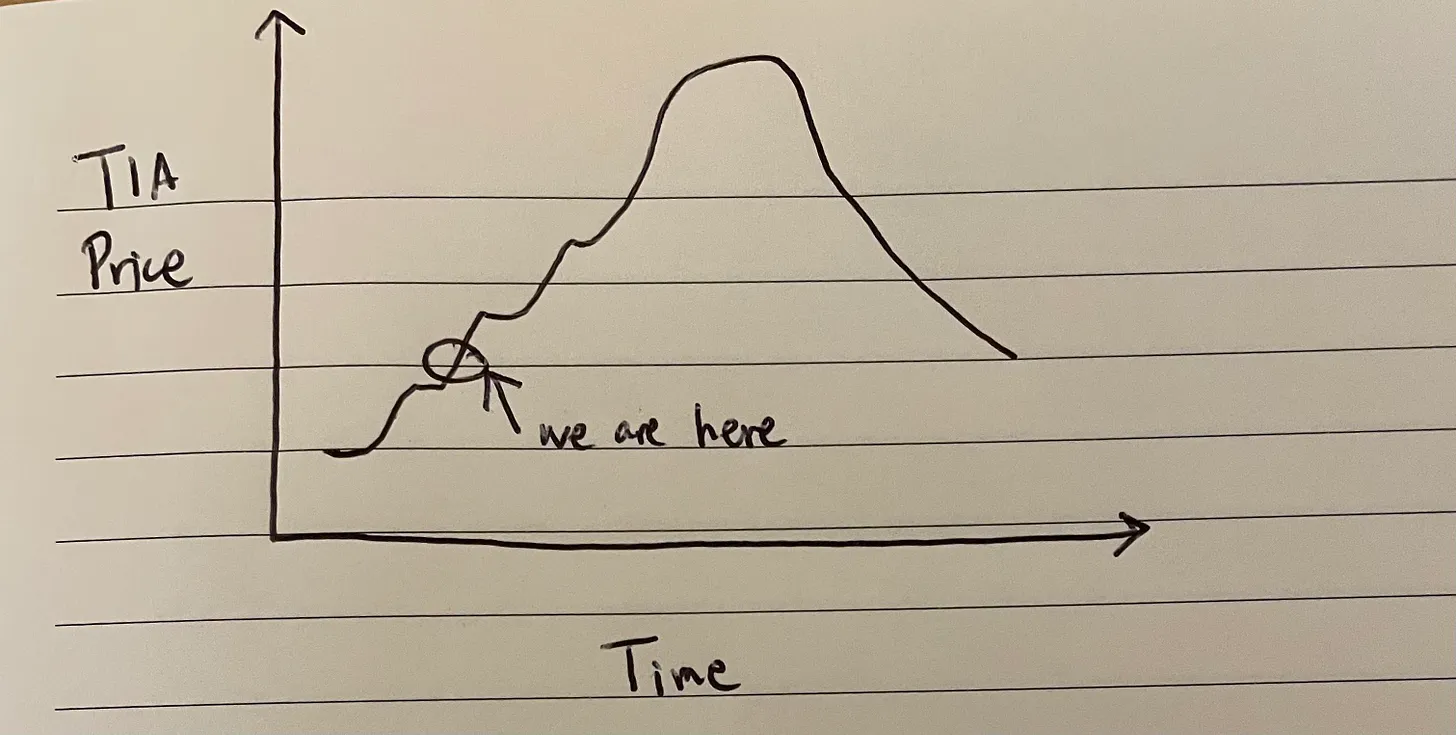

I firmly believe TIA is one of the most important innovations of this cycle, but that doesn’t mean its price will rise forever. I predict this scenario will unfold again because human greed is predictable, and KOLs promoting this idea to their audiences is inevitable. Of course, you could say I’m contributing to it too. But I also believe that staking TIA early in the bull market will be highly profitable. I’m simply warning you about what might happen so you can prepare. I’m also writing this to remind myself in 12 months’ time that even when a narrative feels unbreakable, humility and profit-taking are essential. Below is my projected TIA price trajectory for the next cycle:

I sketched the chart above in 30 seconds. Of course, there will be pullbacks, and I could be wrong. I believe holding TIA during the bull market will yield substantial returns, whereas holding through the bear market could lead to heavy losses—as soon as people realize valuations are unjustified, selling will begin. The 21-day unbonding period will only make this reality harsher.

So what’s the plan?

I am staking TIA for the upcoming cycle. I will hold some of my airdropped tokens and sell others. I expect this strategy to be profitable. But when will I sell? Honestly, I don’t know. My current plan is to start exiting my TIA position once Coinbase becomes the top app in Apple’s App Store or when major cryptocurrencies approach their all-time highs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News