How high can TIA go with the "Golden Shovel" attribute boost?

TechFlow Selected TechFlow Selected

How high can TIA go with the "Golden Shovel" attribute boost?

19 dollars, buy a dream.

Author: Azuma, Odaily Planet Daily

The bullish momentum for Celestia (TIA) continues.

According to OKX market data, at the time of writing, TIA is trading at 19.23 USDT, maintaining strong performance despite a generally declining market.

While the modular narrative may underpin Celestia’s fundamental value, the recent surge in investment sentiment around TIA likely stems from its "pickaxe" attribute—meaning that for many buying TIA, they are not just acquiring the token itself, but also potential future airdrop rewards targeted at TIA stakers.

TIA Staking Frenzy

Over the past period, multiple Cosmos ecosystem projects—including Dymension and Saga—have publicly announced governance proposals to include TIA stakers in their planned airdrops. Beyond these confirmed distributions, projects outside the Cosmos ecosystem such as Manta, Movement, and U Protocol, which have adopted Celestia's data availability (DA) solution, are rumored (some officially confirmed) to also consider airdropping to TIA stakers.

To gauge the potential value of these airdrops, we can look at Dymension, whose pre-launch contracts are already trading on Aevo.

Dymension's airdrop rules offer 205 DYM tokens for every 1 TIA staked. With DYM currently priced around $4 on Aevo, this means that by staking one TIA—costing roughly a dozen dollars—users could earn several hundred dollars worth of DYM in airdrop rewards from Dymension alone. The term "at least" is emphasized here because Dymension has announced it will reallocate unclaimed airdrop shares to eligible claimants, with special consideration given to large TIA and ATOM stakers. Thus, actual returns for TIA stakers post-airdrop are expected to be even higher.

Odaily Planet Daily note: Pre-launch contracts on Aevo are highly volatile and have low trading volume; they offer some reference value but cannot fully represent actual market prices after TGE.

Given such attractive return expectations, a growing number of users are rushing to buy and stake TIA.

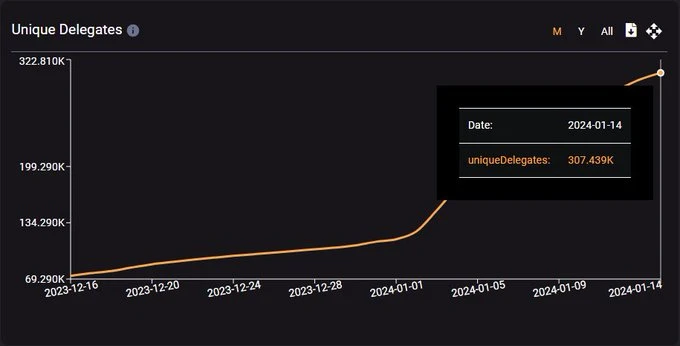

Data from Smart Stake shows that TIA’s current network-wide staking ratio has reached 48%. Considering TIA’s genesis was only a little over two months ago, this figure is impressive—even surpassing long-established PoS networks like Polygon (35%) and Harmony (34%). Meanwhile, the number of unique addresses staking TIA is rapidly increasing, having surpassed 300,000 by January 14. These figures clearly reflect the intense enthusiasm among TIA holders to stake.

Some TIA holders, aiming to maximize potential airdrop gains, have even begun splitting stakes across multiple addresses. While this strategy has benefits—potentially qualifying for more “basic income” airdrops—it also carries risks, as smaller individual stakes might fall below minimum thresholds and be excluded as overall staking scales up.

As for whether it's still worthwhile to buy TIA now, we cannot predict secondary market movements. However, considering typical staking rates of major Cosmos ecosystem tokens—SEI at 68%, ATOM at 64.9%, OSMO at 55.3%—there appears to be room for further growth in TIA’s staking rate.

The Collective Pickaxification of the Cosmos Ecosystem

Beyond TIA, in fact, most leading project tokens within the Cosmos ecosystem have recently exhibited similar "pickaxe" dynamics. However, compared to Celestia, whose DA solution extends its reach across broader ecosystems (e.g., other ecosystem rollups using Celestia DA), the potential yield from other project tokens remains largely confined to upcoming projects within the Cosmos ecosystem.

Among major Cosmos ecosystem tokens, ATOM—the native token of Cosmos itself—and OSMO, the token of liquidity hub Osmosis—currently exhibit the strongest "pickaxe" characteristics. Despite ongoing criticism about weak value capture, ATOM remains the most widely accepted token within the ecosystem. OSMO, meanwhile, serves as the primary initial liquidity pool for new tokens launched in the ecosystem. Therefore, it’s logical for newly launching Cosmos projects to target ATOM and OSMO stakers as core community members.

In just the past few months, Celestia, Namada, Dymension, and Saga have all announced airdrops targeting ATOM and/or OSMO stakers. With a wave of high-profile projects including Berachain, Nibiru, and Penumbra set to launch in the coming months, the Cosmos ecosystem may soon experience a full-blown airdrop boom.

The allure of wealth creation is undeniable. While airdrop strategies may seem simplistic, they might just be the key to unlocking a new chapter for the Cosmos ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News