TVL, trading volume, open interest — how to use DeFi data to find the next breakout project?

TechFlow Selected TechFlow Selected

TVL, trading volume, open interest — how to use DeFi data to find the next breakout project?

On-chain data is not merely a breakthrough in evaluating crypto assets, but also a revolution across the entire financial data landscape.

Author: Patrick Scott | Dynamo DeFi

Translation: TechFlow

In the past, crypto asset analysis revolved largely around charts, hype cycles, and narratives. However, as the industry matures, actual performance matters more than empty promises. You need a filter to extract meaningful signals from the noise.

Luckily, such a filter already exists—it’s called onchain fundamentals.

Onchain fundamentals give decentralized finance (DeFi) a structural advantage over traditional finance (TradFi). This isn’t just one of many reasons why "DeFi will win," but a core concept every investor in this space must understand.

Over the past four years, I’ve immersed myself in researching DeFi data metrics—first as an independent analyst, then as part of the DefiLlama team. This article summarizes some of the most useful analytical frameworks I've learned along the way, aiming to help you start using these tools effectively.

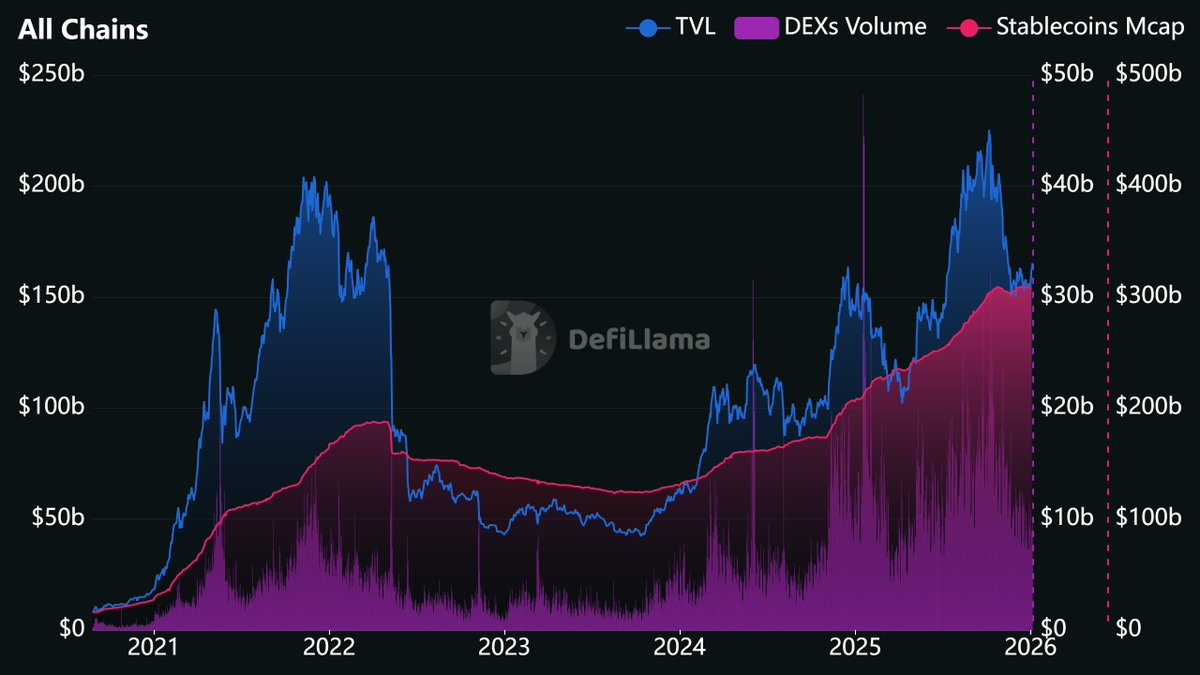

Source: https://defillama.com/?stablecoinsMcap=true&dexsVolume=true

Why Are DeFi Metrics Important?

Onchain data isn't just a breakthrough for evaluating crypto assets—it's a revolution across the entire financial data landscape.

Consider how traditional investors evaluate companies: they wait for quarterly earnings reports. In fact, there are even proposals to reduce reporting frequency from quarterly to semi-annual.

In contrast, DeFi protocols offer real-time financial data. Platforms like DefiLlama update key metrics daily—or even hourly. If you want to track revenue by the minute, you can query blockchain data directly (though excessive granularity may not be meaningful, the option exists).

This represents a revolutionary leap in transparency. When buying shares in a public company, you rely on financial statements released by management, audited by accountants, often delayed by weeks or months. But when assessing a DeFi protocol, you're reading transaction records directly from an immutable ledger—live and unfiltered.

Of course, not every crypto project has meaningful fundamental data worth tracking. For instance, memecoins or vaporware projects with only a whitepaper and a Telegram group don’t lend themselves well to fundamental analysis (though other indicators like holder count might offer limited insight).

But for protocols that generate fees, accumulate deposits, and distribute value to token holders, their operations leave behind traceable data—data that can be tracked and analyzed, often well before market narratives emerge.

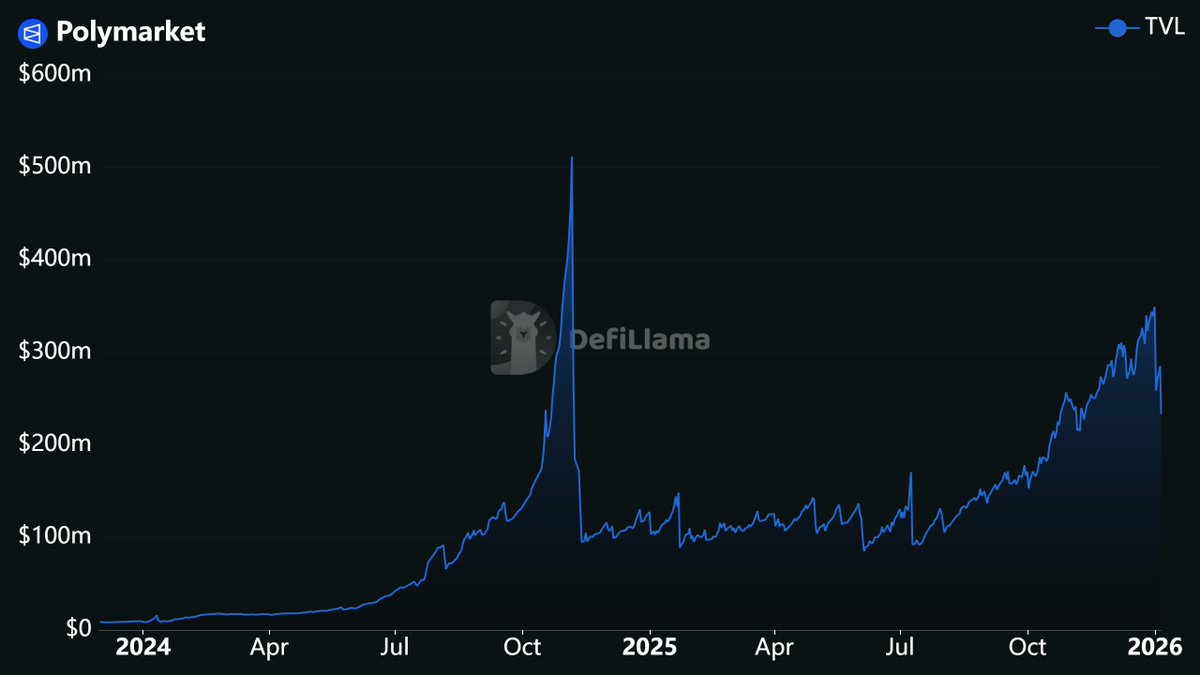

Take Polymarket, for example. Its liquidity has been growing steadily for years—a trend visible long before prediction markets became a mainstream topic.

Source: https://defillama.com/protocol/polymarket

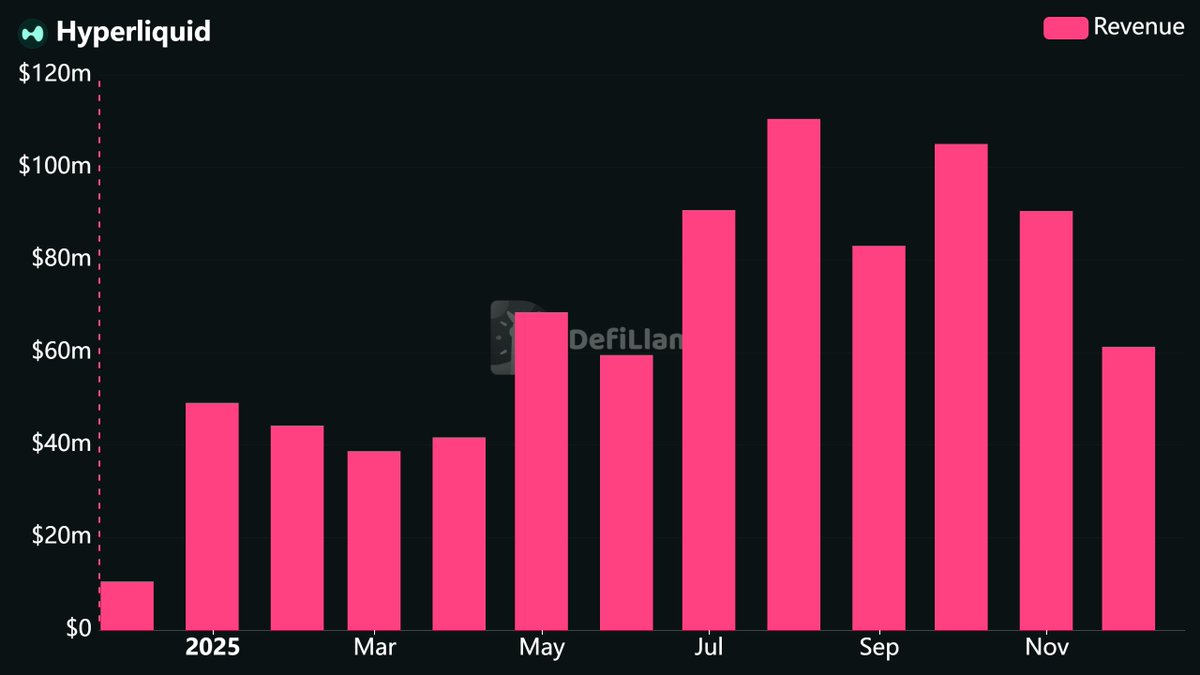

The explosive price surge of HYPE tokens last summer was rooted in sustained high revenue generation.

Source: https://defillama.com/protocol/hyperliquid?tvl=false&revenue=true&fees=false&groupBy=monthly

These metrics foreshadowed future developments—you just needed to know where to look.

Understanding Core Metrics

Let’s begin with the essential metrics every DeFi investor should understand.

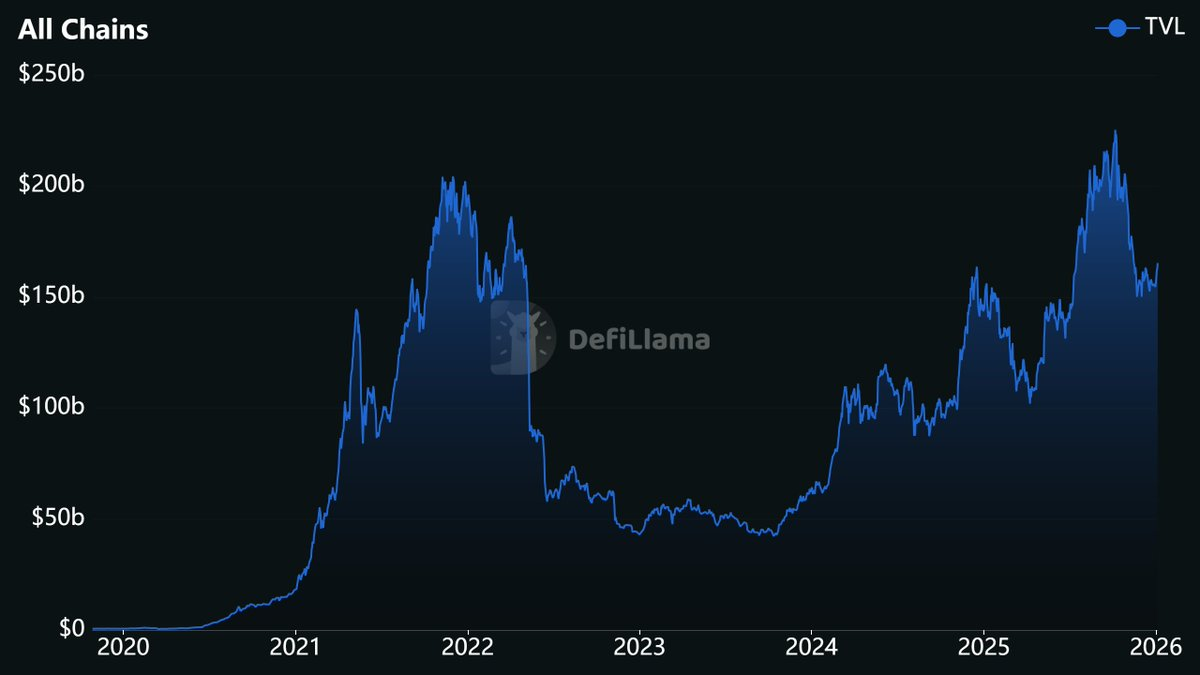

TVL (Total Value Locked)

TVL measures the total value of assets deposited into a protocol’s smart contracts.

- For lending platforms, TVL includes collateral and supplied assets.

- For decentralized exchanges (DEXs), TVL refers to deposits in liquidity pools.

- For blockchain networks, TVL is the sum of all protocol-level TVL deployed on that chain.

Source: https://defillama.com/

In traditional finance (TradFi), TVL is analogous to Assets Under Management (AUM). Hedge funds report AUM to show the total capital entrusted to them by clients. Similarly, TVL reflects the total amount of user funds deposited into a protocol, indicating trust in its smart contracts.

However, TVL has faced criticism over the years—and some of it is valid.

- TVL does not measure activity. A protocol could have billions in deposits yet generate almost no fees.

- TVL is highly correlated with token prices. If ETH drops 30%, the TVL of any protocol holding ETH will decline by ~30% even if no withdrawals occur.

Since most DeFi deposits are in volatile tokens, TVL is vulnerable to price swings. Savvy analysts therefore combine USD net inflows with TVL to distinguish between price effects and actual deposit activity. USD net inflow calculates daily balance changes per asset (multiplied by price) and aggregates them. For example, a protocol fully locked in ETH would see its TVL drop 20% if ETH falls 20%, but its USD net inflow remains $0.

Still, when viewed in both dollar and native token terms—and combined with activity or productivity metrics—TVL remains valuable. It continues to serve as a key indicator of user trust and overall DeFi scale. Just don’t mistake it for a complete evaluation framework.

Fees, Revenue, and Holders Revenue

These terms have different meanings in DeFi compared to traditional accounting, which can cause confusion.

- Fees: From the user’s perspective, fees represent the cost paid when using a protocol. For example, trading on a DEX incurs a fee. This fee may go entirely to liquidity providers or be split with the protocol. Fees reflect the total amount users pay, regardless of final distribution. In TradFi, this is equivalent to Gross Revenue.

- Revenue: This refers to the portion of fees retained by the protocol. How much of the total fees actually flows back to the protocol? Revenue may fund the treasury, team, or token holders. It excludes payments to liquidity providers and is best understood as the protocol’s Net Income.

- Holders Revenue: A narrower metric, tracking only the portion of revenue distributed to token holders via buybacks, fee burns, or direct staking rewards. In TradFi, this resembles a combination of dividends and share buybacks.

These distinctions are crucial for valuation. Some protocols generate massive fees, but if nearly all of it goes to liquidity providers, actual protocol revenue may be negligible.

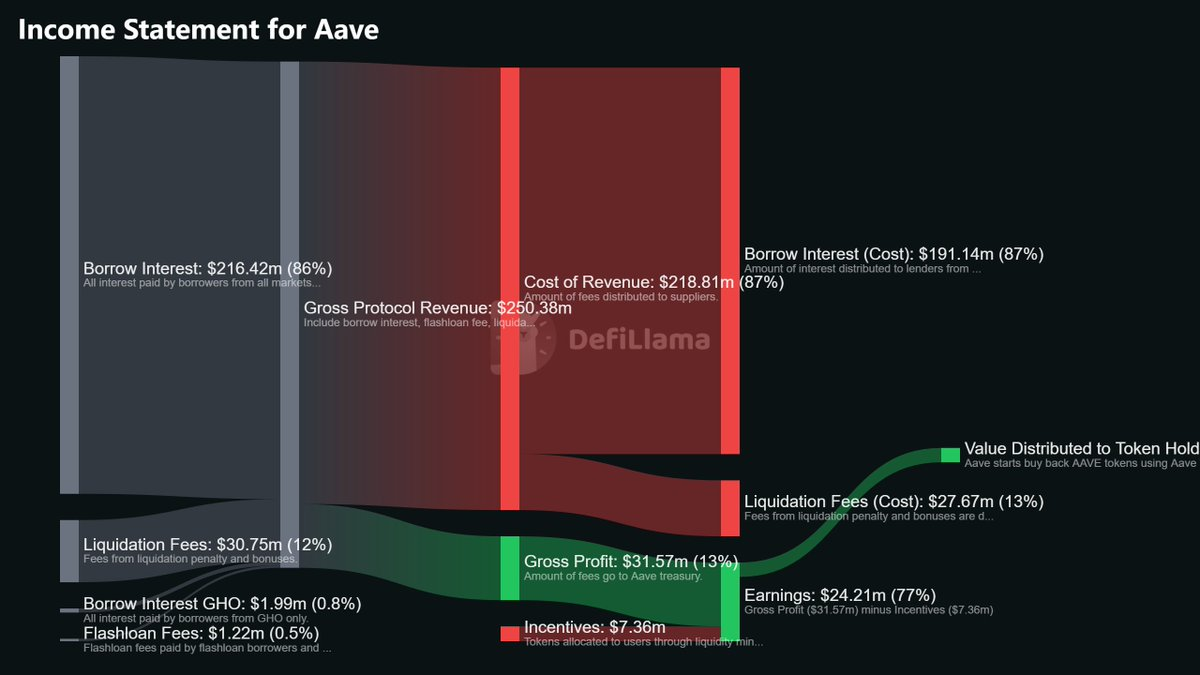

DefiLlama now offers full income statements for many protocols. These are automatically updated from onchain data, breaking down revenue streams and redefining metrics using standard accounting language.

Source: https://defillama.com/protocol/aave

These statements also include cash flow visualizations, showing how money flows from users into the protocol and then out to various stakeholders. They’re invaluable for understanding a project’s economic model in depth.

Source: https://defillama.com/protocol/aave

Volume

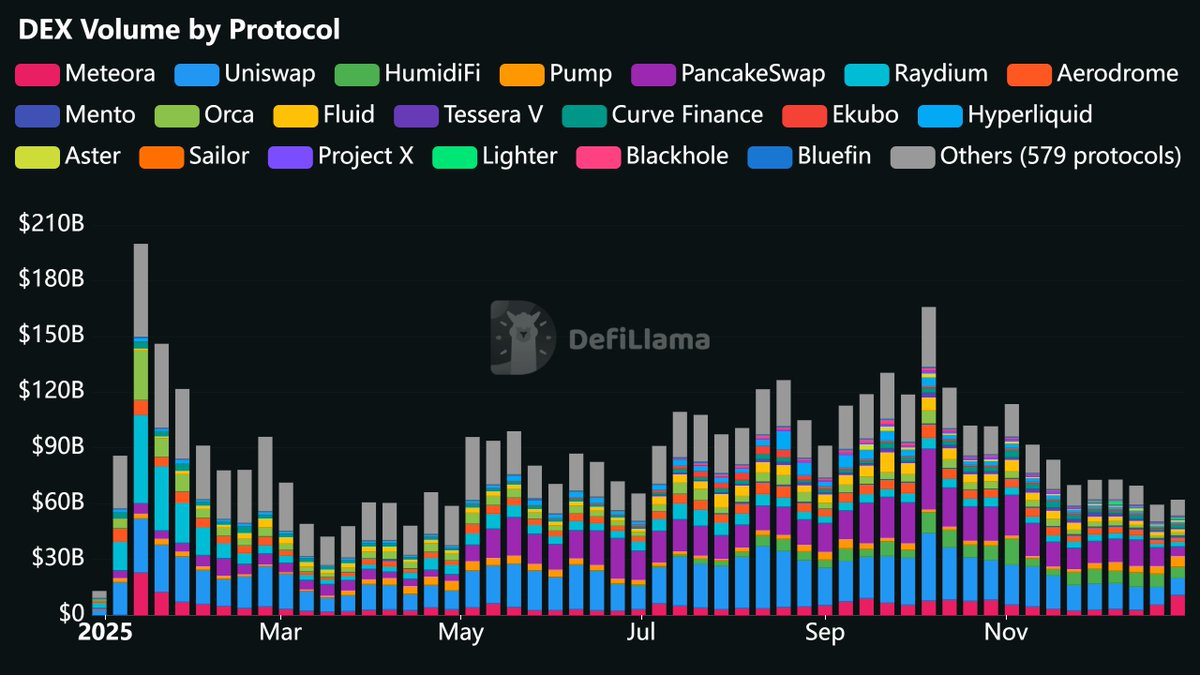

Volume tracks the scale of trading activity.

- DEX Volume: Total swap volume across decentralized exchanges.

- Perpetuals Volume (Perp Volume): Total trading volume on perpetual futures platforms.

Source: https://defillama.com/pro/97i44ip1zko4f8h

Volume is a key gauge of overall crypto market participation. When people actively use digital assets, they trade. Spikes in volume often correlate with shifts in market sentiment—whether driven by euphoric rallies or panic-driven sell-offs.

Compared to previous cycles, perpetuals volume has grown dramatically. In 2021, perp exchanges were barely noticeable. Today, platforms like Hyperliquid, Aevo, and Drift routinely handle billions in daily volume. Given this rapid growth, comparing current volumes to historical data offers limited insight. For example, comparing today’s perp volume to 2021 levels merely confirms sector expansion—not much else.

Within a category, trends in market share matter more than absolute volume. For instance, if a perp DEX grows its market share from 5% to 15%, it’s gaining ground—even if its absolute volume dips temporarily. DefiLlama’s custom dashboard library includes numerous market share charts worth exploring.

Open Interest

Open interest represents the total value of outstanding derivative contracts that haven’t been closed or liquidated. For perp DEXs, it reflects the total capital currently deployed in open positions.

Source: https://defillama.com/open-interest

Open interest is a critical measure of liquidity on derivatives platforms. It shows how much capital is actively engaged in perp markets.

During volatile periods, this metric can collapse rapidly. A wave of mass liquidations could wipe out open interest within hours. Tracking its recovery afterward reveals whether a platform regains liquidity or if capital has permanently migrated elsewhere.

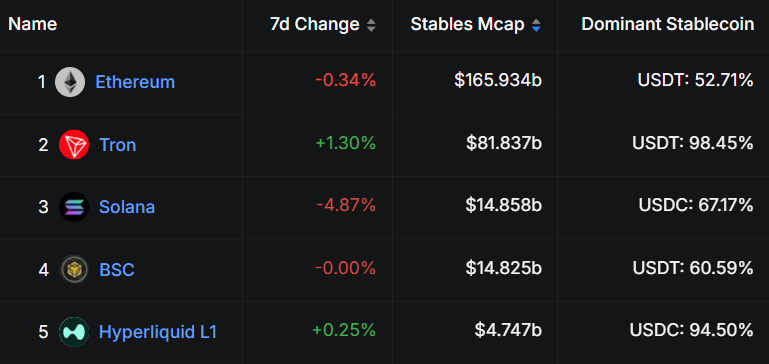

Stablecoin Market Cap

For blockchain networks, stablecoin market cap refers to the total value of all stablecoins deployed on that chain.

Source: https://defillama.com/stablecoins/chains

Stablecoin market cap is a powerful indicator of real capital inflows. Unlike TVL, which fluctuates with volatile token prices, stablecoins represent actual dollars (or dollar equivalents) bridged onto a chain by users. For example, if a chain’s stablecoin market cap grows from $3B to $8B, that means $5B in real capital entered the ecosystem.

Since October 2023, approximately $180 billion in stablecoins have flowed into the crypto market. Much of this inevitably entered DeFi, driving up TVL, volume, and fee generation. Stablecoin flows resemble capital inflows in a national economy—increasing supply signals new money entering, while decreasing supply indicates capital flight.

App Revenue & App Fees

App Revenue and App Fees are chain-level metrics that aggregate revenue and fees generated by all applications on a given blockchain, excluding stablecoins, liquid staking protocols, and gas fees.

I view this as the blockchain’s “GDP”—a measure of real economic activity occurring within the ecosystem.

Revenue is among the hardest metrics to fake because it requires actual user spending. This makes it a high-signal indicator for assessing the level of activity in a DeFi ecosystem.

That said, you shouldn’t value chains based solely on app revenue—valuing something based on income unrelated to its intrinsic assets rarely makes sense. Instead, app revenue and fees are better used diagnostically—to determine whether a chain is growing, rather than to assess its valuation.

How to Interpret These Metrics Effectively?

Understanding individual metrics is step one—but to use them effectively, you need an analytical framework. I recommend the following three-step approach:

- Prioritize consistent, sustainable growth.

- Track both stock and flow metrics.

- Factor in token unlocks and incentive programs.

1. Prioritize Consistent, Sustainable Growth

Protocols whose revenue spikes briefly and then collapses do not demonstrate sustainable value creation. I’ve seen countless protocols hit record revenues one week, only to vanish the next month.

What truly matters is steady, long-term growth. For example, a protocol whose monthly revenue grows gradually from $500K to $2M over six months shows sustainable traction. In contrast, a protocol that spikes to $5M in one week, then crashes to $300K, likely experienced a short-lived anomaly.

Time moves faster in crypto than in traditional markets. One month of sustained growth here is roughly equivalent to a quarter in TradFi. A protocol with six consecutive months of revenue growth is akin to a company with six straight quarters of earnings growth—something worth paying attention to.

2. Track Both Stock and Flow Metrics

- Stock Metrics: Such as TVL, Open Interest, Stablecoin Market Cap, and Treasury holdings—these tell you how much capital is stored in the system.

- Flow Metrics: Such as Fees, Revenue, and Volume—these reveal the level of actual activity happening within the protocol.

Both are equally important.

Activity is easier to manipulate. Protocols can artificially inflate volume through incentives or wash trading—a common short-term tactic. But liquidity is hard to fake. Getting users to deposit real capital and keep it long-term requires genuine utility or compelling yields.

When evaluating any protocol, always analyze at least one stock and one flow metric together. For example:

- For a perp DEX: Open Interest and Volume.

- For a lending protocol: TVL and Fees.

- For a blockchain: Stablecoin Market Cap and App Revenue.

If both metrics rise in tandem, the protocol is genuinely expanding. If only activity increases while liquidity stagnates, deeper investigation is needed—manipulation may be at play. If only liquidity grows while activity flatlines, deposits may come from a few large whales rather than broad adoption.

3. Factor in Token Unlocks and Incentives

Token unlocks create selling pressure. Each week, vested tokens are released, and some portion is typically sold. Without offsetting demand, this can drive prices down.

Before investing, check the token unlock schedule. A protocol with 90% of its supply already circulating faces minimal future dilution. One with only 20% circulating and a major unlock due in three months carries very different risk.

Likewise, a high-revenue protocol becomes less impressive if it pays out more in token incentives than it earns from users. DefiLlama tracks this via the “Earnings” metric, which subtracts incentive costs from revenue. For example, a protocol might earn $10M annually but distribute $15M in token rewards.

While incentives are effective for jumpstarting early growth—and often necessary in a protocol’s early lifecycle—they do create sell-side pressure that must be absorbed by organic demand.

Go Deeper

This article covers the most common DeFi metrics, but it’s only the tip of the iceberg. There’s much more to explore beneath the surface.

I’ve published a comprehensive DefiLlama tutorial on YouTube, walking through how to use the platform to screen undervalued protocols, evaluate blockchains, spot emerging projects, and avoid common analytical pitfalls. Click here to watch.

If you’d like ongoing guidance on DeFi analysis, portfolio construction, and onchain research, I regularly publish content on my Substack. Visit newsletter.dynamodefi.com.

The data is already there. The question is: will you use it wisely?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News