Pendle Bets on Terminal Finance, a New Move to Unlock Institutional Capital

TechFlow Selected TechFlow Selected

Pendle Bets on Terminal Finance, a New Move to Unlock Institutional Capital

This is institutional-grade DeFi in the true sense.

Author: Cheeezzyyyy

Translation: TechFlow

For institutions, the dawn of a new era of DeFi-native financial assets has arrived.

The early integration between Pendle and Terminal Finance is not just another "yield opportunity".

It marks the beginning of a new financial age:

TradFi <> DeFi native financial assets converging at the most fundamental level.

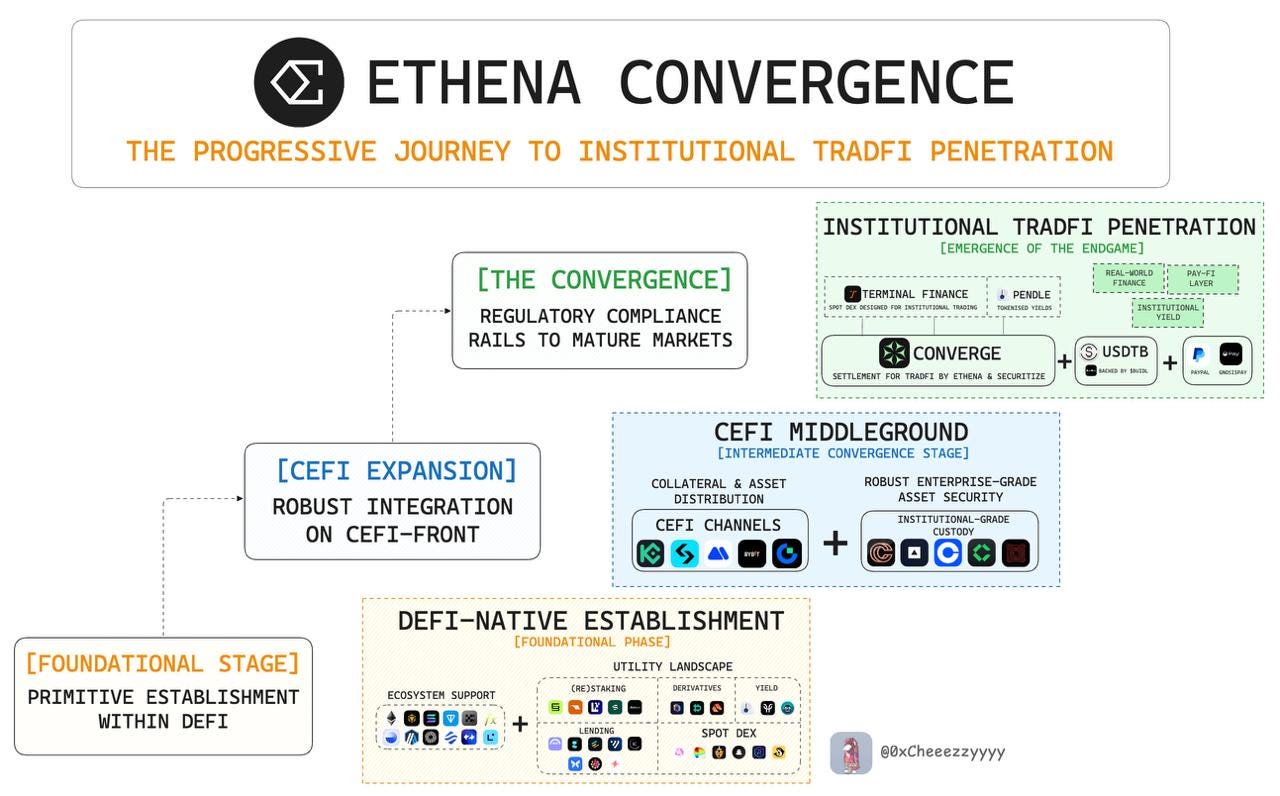

This is foreshadowed by Converge’s strategic partnerships with Ethena and Securitize aimed at TradFi, paving the way for institutional capital inflow.

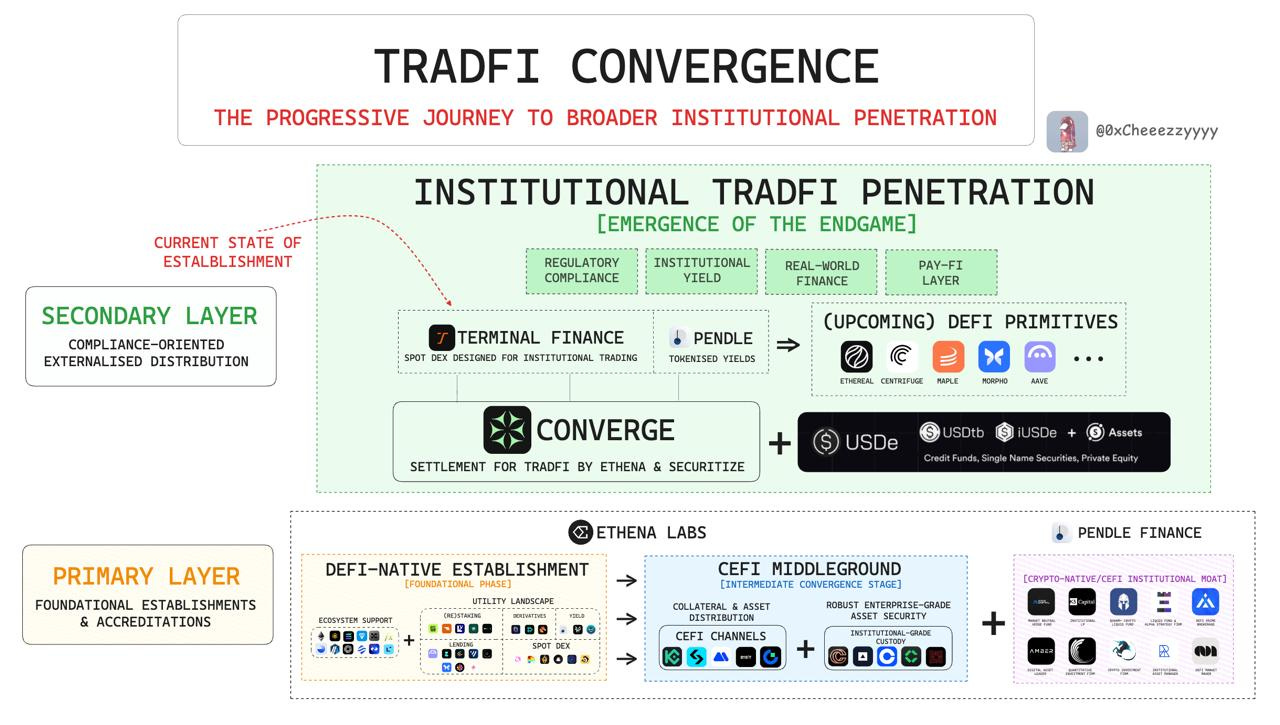

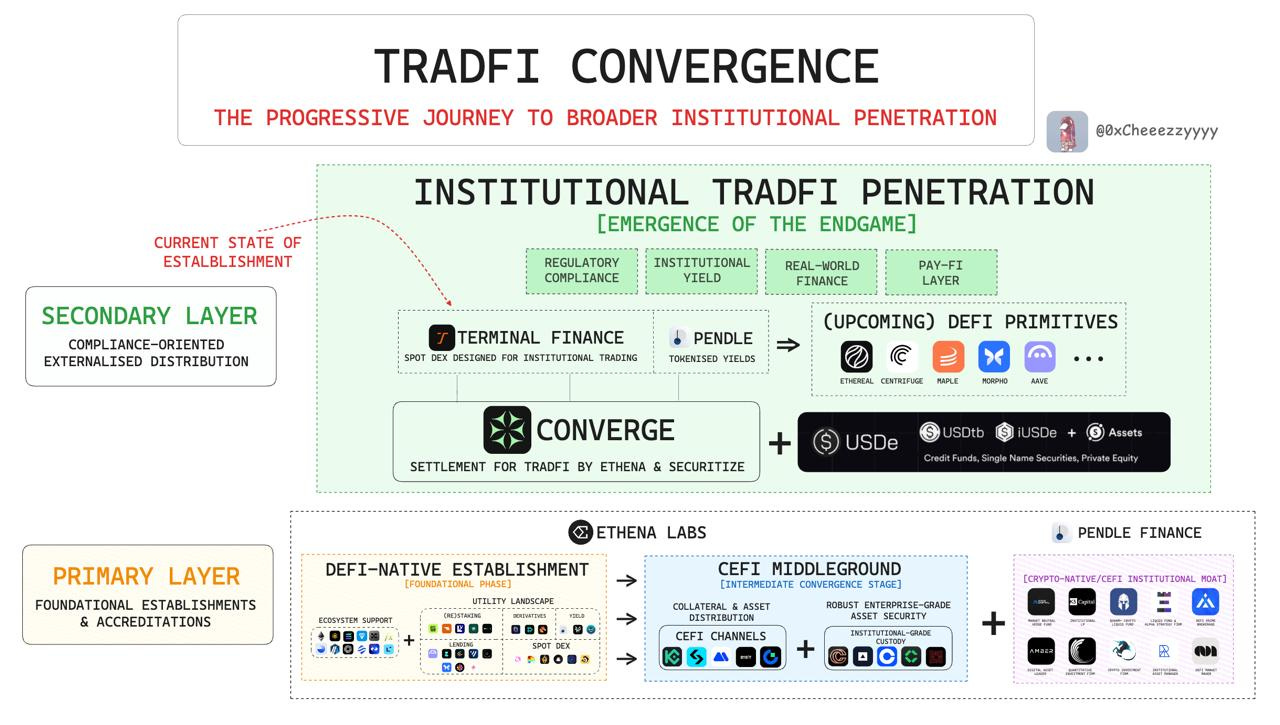

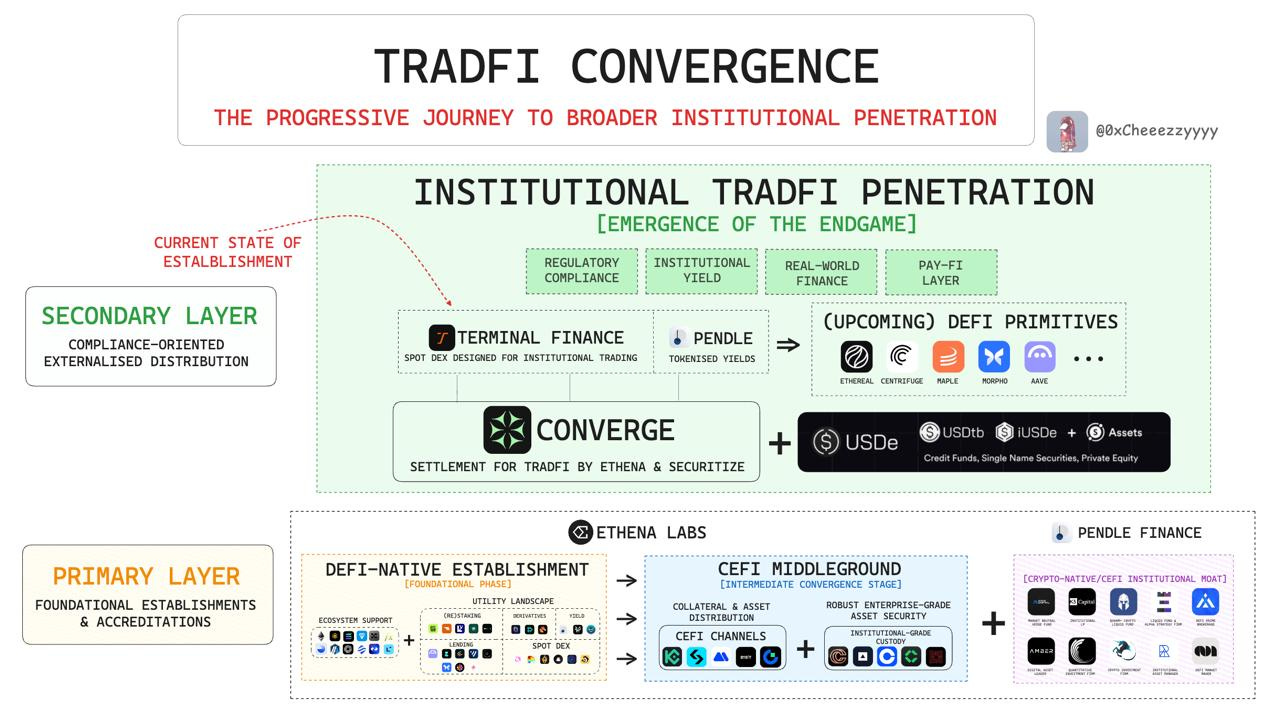

As TradFi begins to recognize the powerful synergies unlocked by DeFi, the driving force behind this shift stems from a new theory of institutional adoption fueling this financial transformation.

Headlined by Terminal Finance and combining cutting-edge technologies from Ethena and Pendle, the Converge ecosystem unites the most institutionally-aligned forces in DeFi.

Its credibility comes not only from market-driven speculative appeal but also from meticulously engineered financial architecture:

-

DeFi-native infrastructure with deep integration and high composability

-

Strong CeFi external distribution capabilities

-

Closed-loop institutional participation model

Together, these form a solid foundational structure that enables broader institutional capital entry into DeFi.

Next Phase: Second-Layer Formalization

This phase marks the final externalization of the Converge ecosystem, aiming to build a system fully compatible with traditional finance (TradFi), anchored on key pillars:

-

Traditional financial strategic distribution channels

-

Compliance and regulatory frameworks

-

Institutional-grade liquidity coordination mechanisms

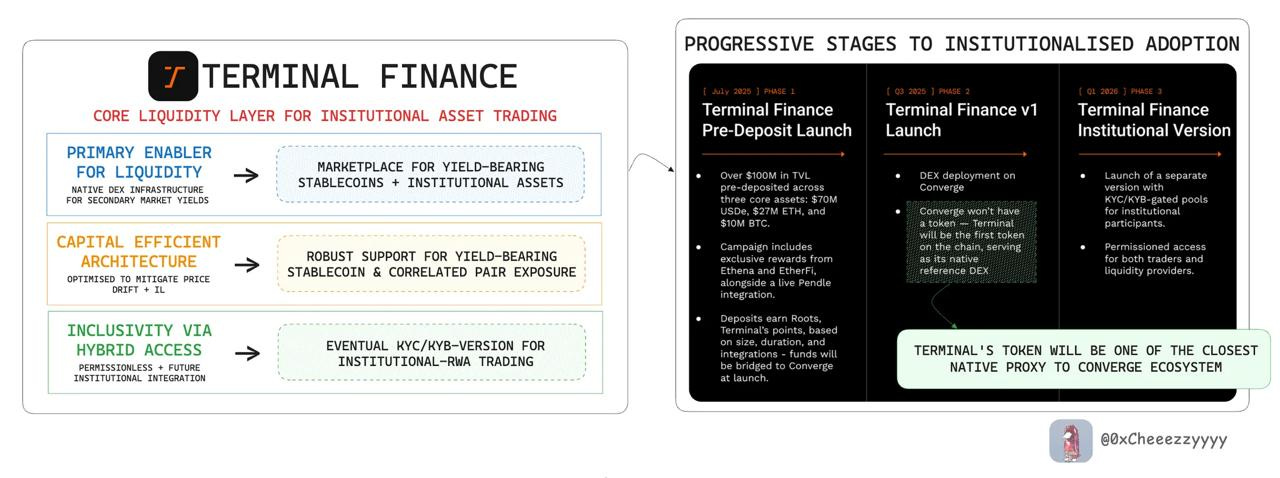

Through bottom-up design, Terminal Finance becomes the core liquidity hub of Converge for TradFi, tailoring the entire financial architecture for institutional trading.

The entire spirit of "Money Legos" that defined early DeFi was built on one principle: composable liquidity.

However, without deep, reliable, and accessible liquidity, composability is meaningless. This is precisely where TerminalFi fills the critical gap as the cornerstone of the Converge ecosystem.

It is not merely an ordinary decentralized exchange (DEX), but an innovative platform designed specifically for institutional needs:

-

Ecosystem Core Enabler: Building robust secondary markets for institutional-grade assets and yield-bearing stablecoins

-

Capital Efficiency First: Reducing price drift and impermanent loss (IL) through optimized design, enhancing returns for liquidity providers

-

Inclusive Accessibility: Supporting both permissionless trading and gradually rolling out KYC/KYB-compliant institutional real-world asset (RWA) trading

Clearly, TerminalFi as an institutionally-native financial component offers a unique and highly attractive value proposition.

Yet, in the absence of a token roadmap for Converge, TerminalFi effectively serves as the closest native proxy to capture the potential growth value of Converge.

Strategic Dual Synergy: Pendle x Ethena

TerminalFi's YBS (yield-bearing stablecoin) thesis strategically positions sUSDe as its core base asset, further reinforced by its simultaneous launch with Pendle.

This is no coincidence.

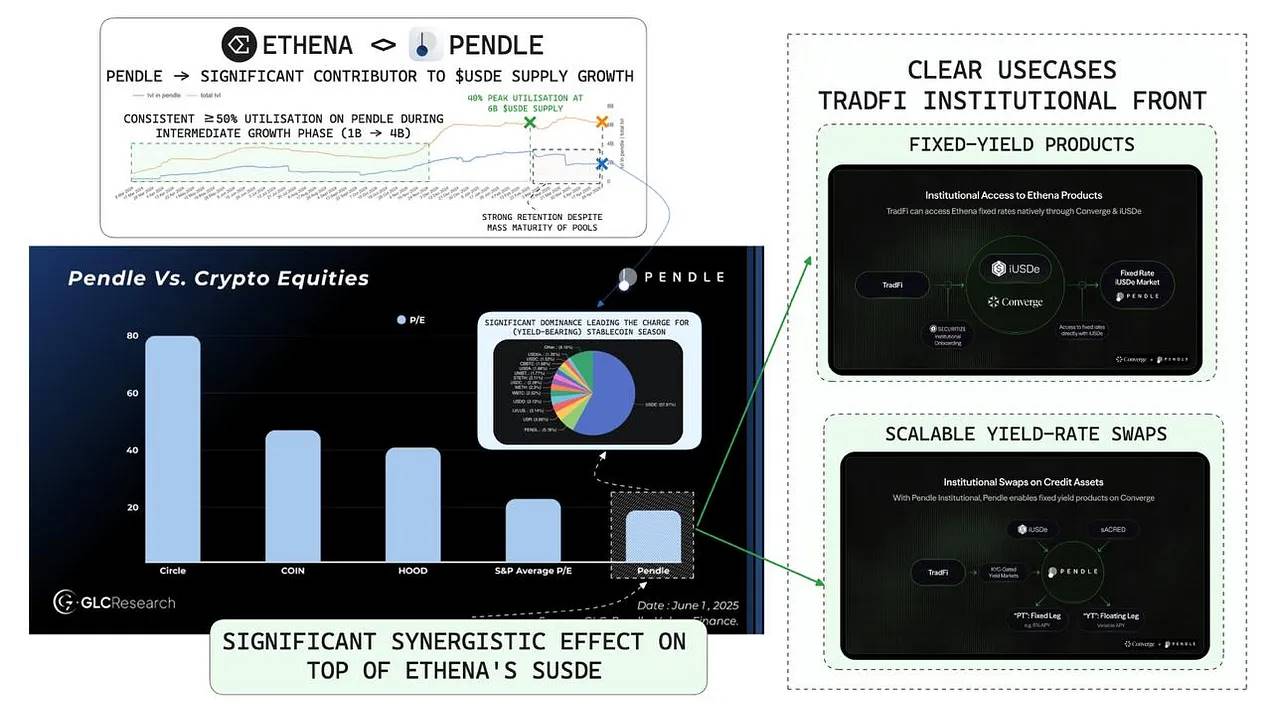

@ethena_labs achieved over $6 billion in supply scale within less than a year, with Pendle Finance playing a significant role in this growth:

-

During sUSDe supply growth from $1 billion to $4 billion, over 50% of sUSDe supply was tokenized via Pendle.

-

At the $6 billion supply level, peak utilization reached 40%.

High sustained utilization on Pendle demonstrates market fit for fixed and floating yield tokenization within DeFi-native portfolios. More importantly, it highlights the strong synergy between Ethena and Pendle: mutually reinforcing each other, creating a durable compound network effect loop with profound implications for the entire ecosystem.

But the synergy doesn’t stop here.

Ethena and Pendle are targeting more than just DeFi users. They are jointly aiming at a larger institutional market opportunity:

-

Fixed Income Products: A $190 trillion market in traditional finance

-

Interest Rate Swaps: An even larger segment, valued at $563 trillion

Through Converge’s certified and regulated distribution channels, the crucial bridge connecting institutional asset allocators is now in place. This breakthrough grants institutions broad access to crypto-native yield sources—characterized by faster settlement, composable structures, and yield-centric design.

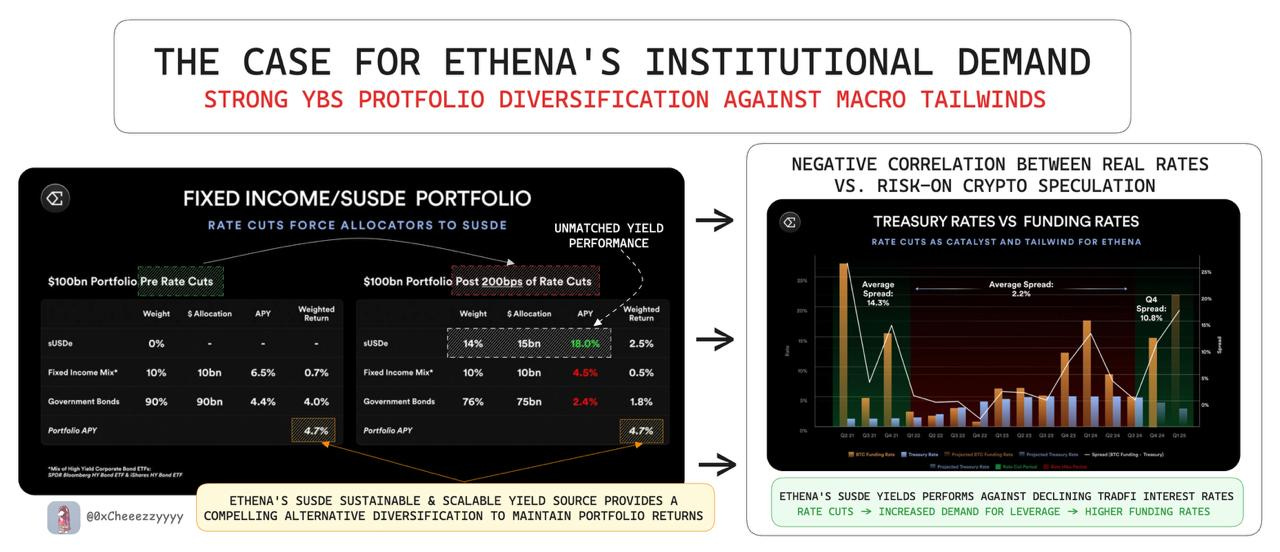

The success of this thesis relies on innovative financial-native assets properly designed to leverage upcoming macro tailwinds—and Ethena’s sUSDe perfectly fits this requirement:

sUSDe yield is negatively correlated with global real interest rates, unlike other debt instruments in traditional finance.

This means sUSDe can not only survive changes in interest rate environments but actually benefit and thrive.

With current rates (~4.50%) expected to decline, institutional portfolios will inevitably face yield compression challenges—further cementing sUSDe’s position as a logical alternative to preserve portfolio returns.

In 2020/21 and Q4 2024, BTC funding spreads exceeded real interest rates by over 15%.

What does this mean?

From a risk-adjusted return perspective, sUSDe and its extended version iUSDe (the TradFi-wrapped variant) possess structural advantages. Combined with significantly lower capital costs compared to traditional finance (TradFi), this unlocks potential 10x yields for untapped traditional financial sectors.

Dual Synergy Growth Effect: The Key Role of Pendle

Next Stage: Convergence

Clearly, Ethena and Pendle are strategically aligned and moving toward the same ultimate goal: convergence with traditional finance (TradFi).

Since its inception in Q1 2024, Ethena has successfully established itself at the intersection of DeFi-native and CeFi through robust infrastructure:

-

USDe and sUSDe assets integrated across over 10 ecosystems + top-tier DeFi integrations

-

Multiple CeFi distribution channels via CEXs, enabling perps adoption and collateral utility

-

Payment layer integrations such as PayPal and Gnosis Pay

This solid foundation sets the stage for the final phase of institutional TradFi penetration, with Terminal Finance emerging as Converge’s core anchor, advancing the development of a TradFi liquidity hub tailored for institutional trading.

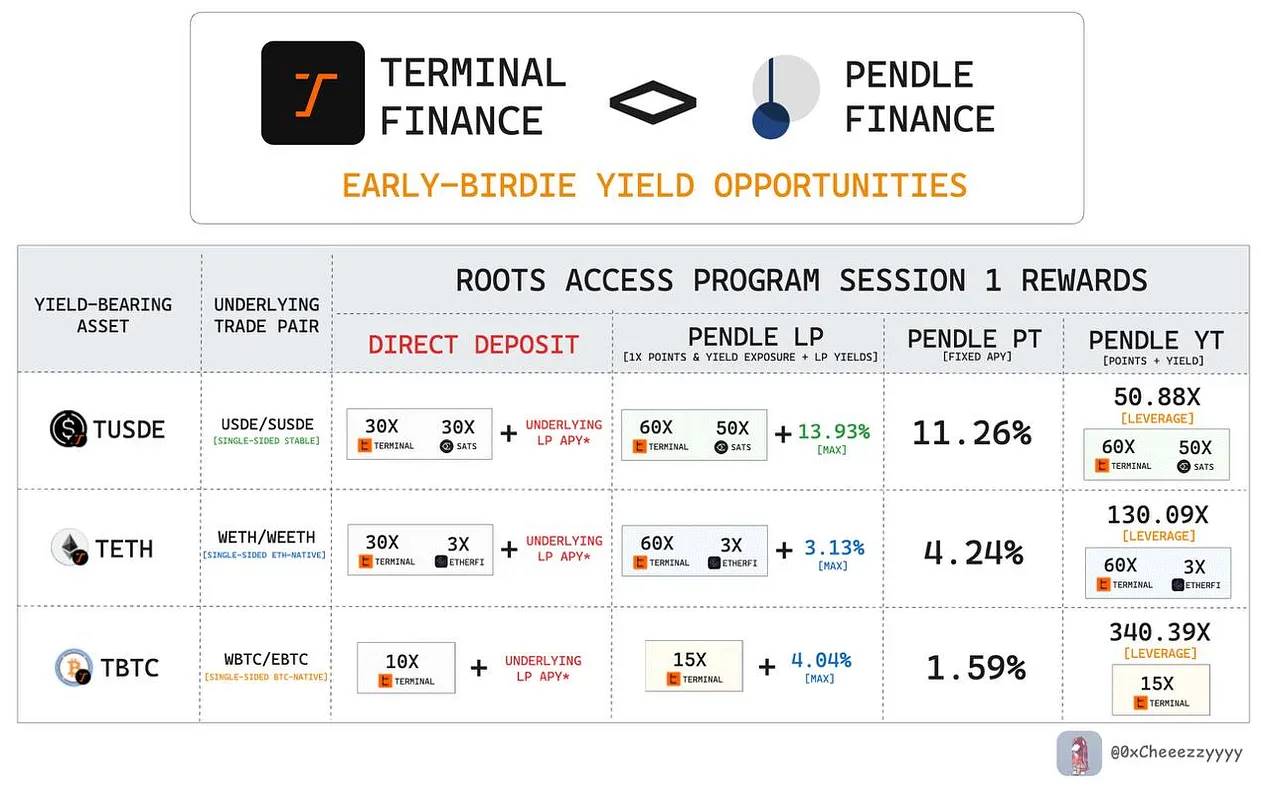

Undoubtedly, Pendle’s involvement unlocks the financial potential of YBS-native assets. Additionally, Pendle has introduced LP token pre-staking functionality for initial pools:

-

tUSDe: sUSDe/USDe pool

-

tETH: wETH/weETH (provided by EtherFi) pool

-

tBTC: wBTC/eBTC (provided by EtherFi) pool

*These pools are specifically designed for single-sided beta exposure while minimizing impermanent loss (IL) risk, attracting committed long-term liquidity providers.

About Early Opportunity: Roots Access Program Phase One

The early bootstrapping phase features exclusive multiplier rewards from Pendle, which are time-sensitive:

-

Terminal Points: 15x to 60x multipliers (compared to 10x to 30x for direct deposits)

-

tUSDe Rewards: 50x Sats multipliers

-

tETH Rewards: 3x EtherFi multipliers

-

LP Annual Percentage Yield (APY): Up to 13.93%, including yield and point rewards, with negligible single-sided exposure and impermanent loss.

-

Fixed APY: tUSDe offers 11.26%

-

Highly Capital-Efficient YT Exposure: Total yield and points ranging from 51% to 340%

Clearly, no other path offers such a strategically significant opportunity in the early stages of emerging institutionally-native assets.

Final Thoughts:

In the big picture, the emergence of Converge marks the birth of a next-generation financial operating system for economically-native assets.

If you haven't seen it yet:

-

Ethena delivers yield-bearing dollars

-

Pendle builds the yield structuring layer

-

Terminal leads institutional market access

Together, they form the core framework of a unique on-chain interest rate system—composable, scalable, and capable of meeting the global fixed income market’s demand for higher yields across trillions of dollars in capital.

This is what truly opens the box of institutional-grade DeFi.

And this transformation has already begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News