Revisiting Stacks: Bitcoin's Oldest L2 Completes Nakamoto Upgrade, Will BTC DeFi Be the Next Focus?

TechFlow Selected TechFlow Selected

Revisiting Stacks: Bitcoin's Oldest L2 Completes Nakamoto Upgrade, Will BTC DeFi Be the Next Focus?

The core of the Nakamoto upgrade lies in the comprehensive innovation of the PoX consensus mechanism in Stacks 2.0.

Author: TechFlow

As Bitcoin surpassed $90,000, every ecosystem in the crypto market began its own celebration.

AI narratives remain hot, and memes continue to fuel wealth-making myths... Yet amid this carnival, projects within the Bitcoin ecosystem feel more like outsiders: "The fun belongs to them; I have nothing."

Clearly, the positive effects of Bitcoin’s price surge haven’t significantly spilled over into its native ecosystem projects.

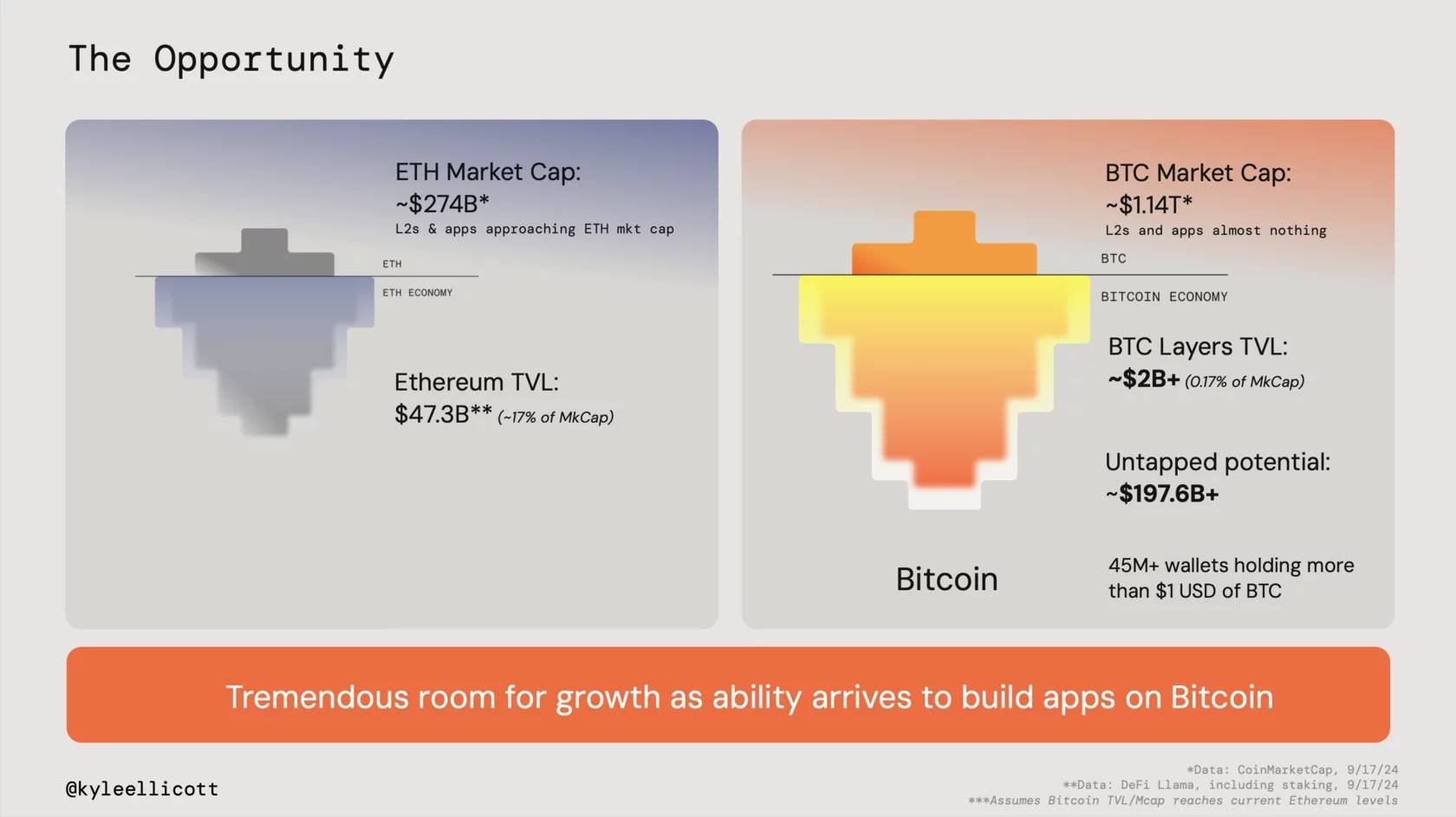

Even compared to Ethereum—the so-called “least impressive”—whose DeFi sector accounts for nearly 17% of its total market cap, Bitcoin maintains roughly 50% of the entire market's valuation, yet its DeFi ecosystem's total value locked (TVL) represents less than 1% of the overall market (data from CMC report).

However, the crypto market consistently follows cycles driven by attention and narrative rotation.

Such large disparities also contain阶段性 opportunities. After inscriptions and staking trends, the BTC ecosystem fell quiet—but such a gap could reignite at any moment.

Long-standing projects deeply rooted in the Bitcoin ecosystem may finally get their chance—often, all it takes is one catalyst.

While various meme coins take turns surging in dramatic rallies, Stacks—one of Bitcoin’s earliest Layer2 solutions—has quietly chosen a different path: focusing on technical upgrades, and has now completed the long-promised Nakamoto upgrade.

Don’t forget, last year STX briefly exhibited meme-like qualities, with its price surging tenfold.

What will this upgrade bring? Could it mark a new beginning?

In today’s highly speculative market environment, how much potential remains for innovation-focused projects like Stacks?

Let’s revisit our old friend, Stacks.

The Nakamoto Upgrade: More Than Just Technical Refactoring

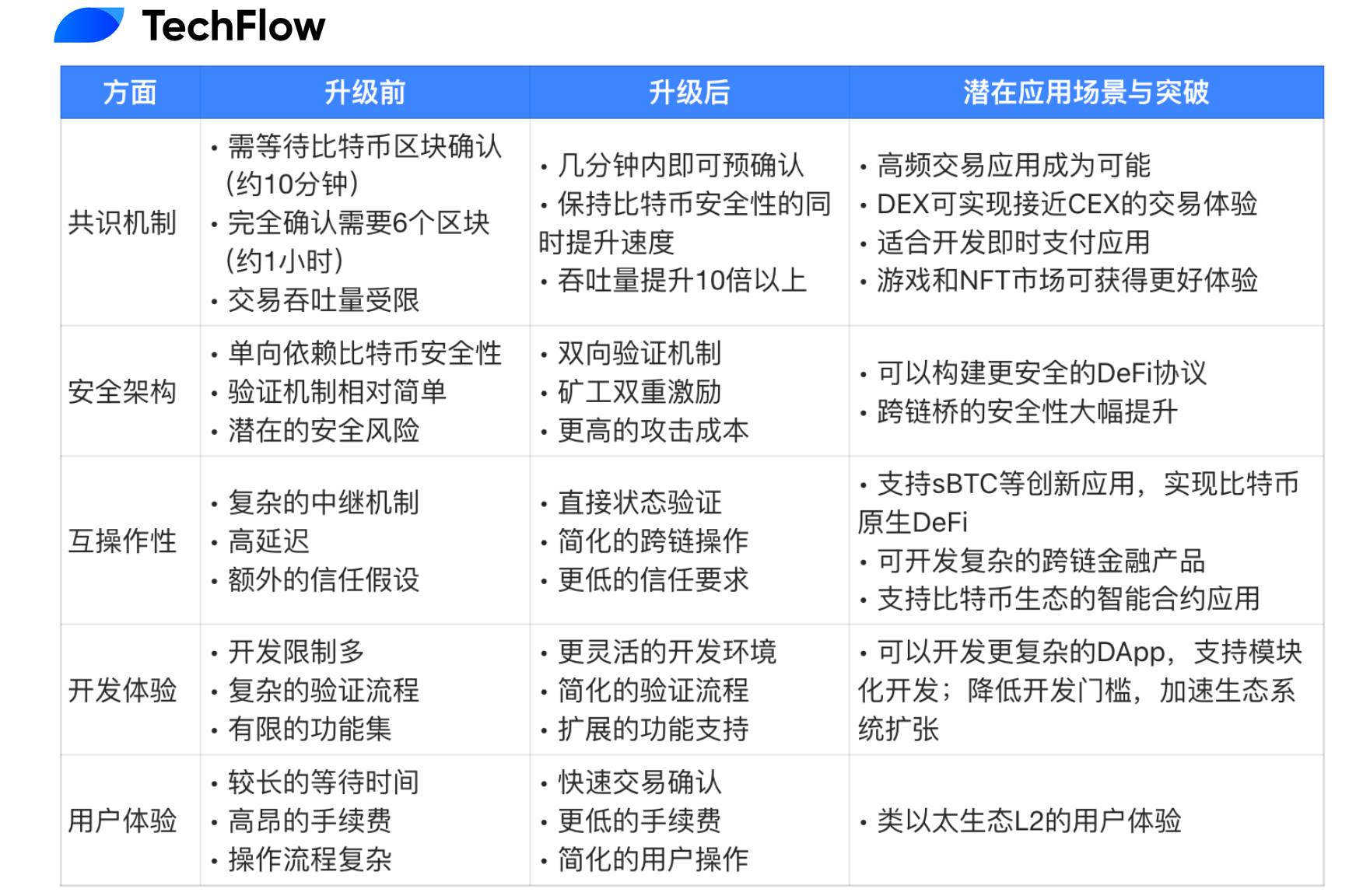

The core of the Nakamoto upgrade lies in a comprehensive overhaul of Stacks 2.0’s PoX consensus mechanism. To understand the significance of this upgrade, we must first examine the limitations of the current PoX model.

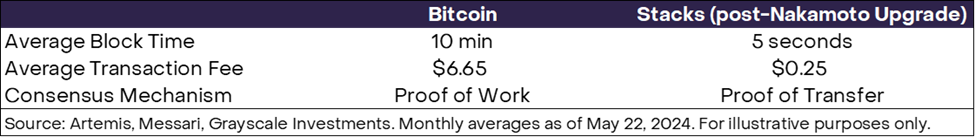

Under the existing PoX mechanism, confirmation of Stacks blocks depends on the generation of a new block on the Bitcoin network. While this design inherits Bitcoin’s security, it introduces efficiency issues: even simple transactions require waiting for Bitcoin’s ~10-minute block time. More importantly, because Stacks block finality relies on Bitcoin block accumulation, users often need to wait for multiple Bitcoin blocks (typically six, about an hour) before transaction finality can be assured.

GrayScale’s analysis offers a more intuitive illustration of the performance differences pre- and post-upgrade:

(Source: Grayscale Research Report)

The new Nakamoto PoX addresses this bottleneck via a “fast block confirmation” mechanism. The upgraded system allows preliminary transaction confirmations through internal network consensus while still awaiting Bitcoin block finalization. This enables most transactions to be confirmed within minutes, while maintaining security linkage to the Bitcoin network.

On the security architecture front, the upgrade brings substantial improvements. Although the original Stacks wrote its block hashes into Bitcoin transactions, this one-way security inheritance carried inherent risks. Under the new architecture, miners must participate simultaneously in Bitcoin mining and Stacks validation, creating a two-way security verification loop. This not only raises attack costs but also ensures honest validator behavior through economic incentives.

Interoperability gains stem from fundamental architectural restructuring. Previously, interactions between Stacks and Bitcoin required complex relay mechanisms, increasing latency and introducing additional trust assumptions. The new design adopts direct state verification, enabling Stacks nodes to directly read and validate Bitcoin network states, greatly simplifying cross-chain operations. This improvement lays the groundwork for future innovations, especially the implementation of sBTC.

We can quickly grasp the details and implications of the Nakamoto upgrade using the following table:

According to Grayscale’s research report, after the Satoshi upgrade, the Stacks protocol will enable unique functionalities including:

(i) Bitcoin-collateralized stablecoins,

(ii) Bitcoin-based lending (and native Bitcoin rewards),

(iii) Bitcoin-native decentralized autonomous organizations (DAOs).

Just as basic financial primitives fueled the growth of Ethereum’s DeFi ecosystem in 2017, given Bitcoin’s current prominence, its ecosystem may now be poised for similar expansion.

sBTC: An Innovative Application of Bitcoin on Stacks

This upgrade looks promising—but what concrete changes will it bring to the ecosystem and applications?

From Stacks’ own first-party perspective, one major product arriving alongside the upgrade is sBTC.

As a decentralized, two-way pegged Bitcoin protocol, sBTC has a simple goal: make Bitcoin—the “digital gold”—more flexible and transform it into a truly programmable, productive asset.

You can think of sBTC mentioned above as an innovative Bitcoin wrapping protocol that allows BTC to operate in smart contract form on the Stacks network.

Infrastructure projects need to get closer to issuing assets to attract attention and enable new use cases.

This vision isn’t novel. There have been many similar attempts in the market—for example, wBTC on Ethereum, which despite being custodial, once achieved TVL between $5–15 billion. But sBTC aims higher—it seeks to deliver a truly decentralized solution aligned with Bitcoin’s ethos.

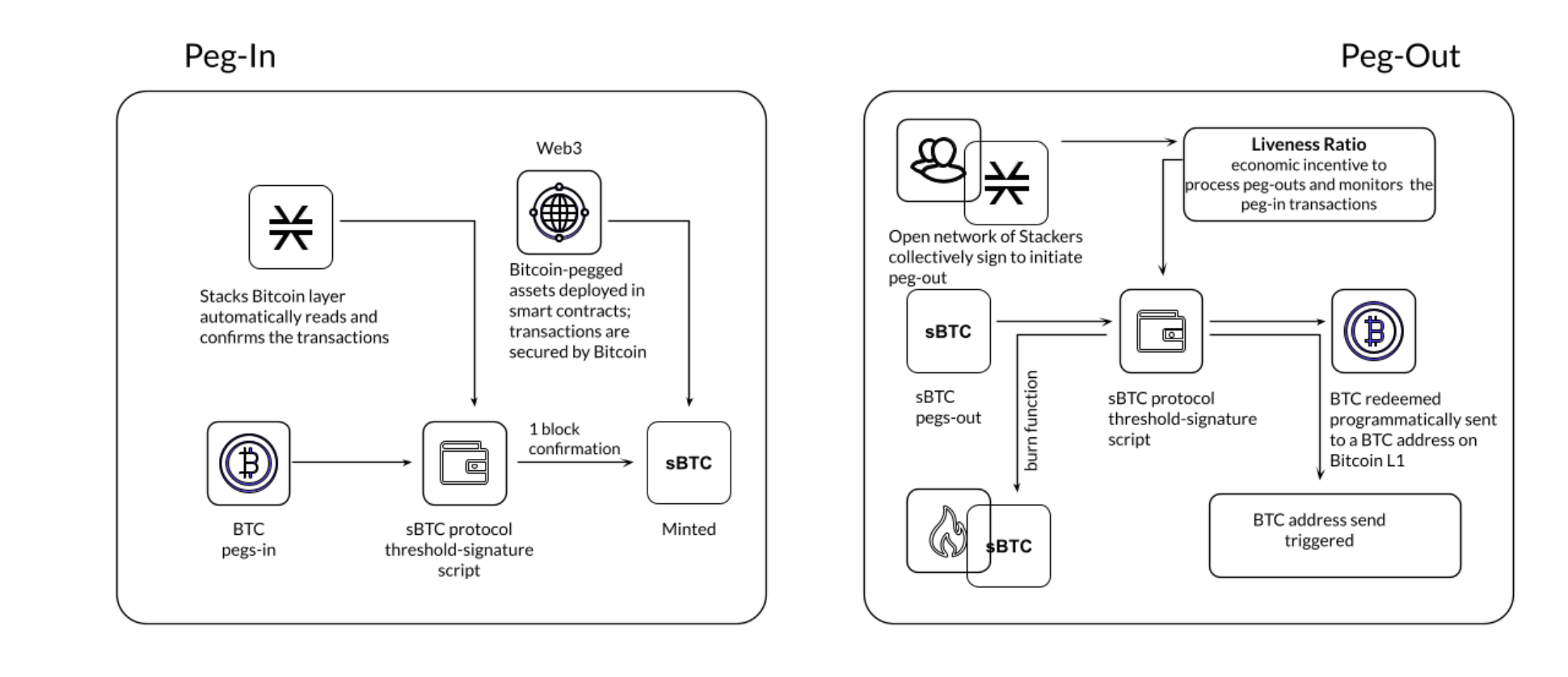

The core mechanism of sBTC is straightforward: when users lock BTC on the Bitcoin mainnet, an equivalent amount of sBTC is minted on the Stacks network, strictly maintaining a 1:1 peg. Users can then utilize sBTC in smart contract interactions. When redemption is needed, burning sBTC triggers the automatic release of the corresponding BTC.

It sounds simple, but the real technical challenge lies in ensuring decentralization and security throughout the process—this is where sBTC truly stands out.

There is no predefined administrator. Instead, an open, dynamic group of signers operates the system. All critical operations occur on the Bitcoin mainnet, inheriting Bitcoin’s security properties.

Signers earn BTC rewards through the Stacks consensus, creating economic incentives that ensure the system runs continuously and reliably. More importantly, sBTC implements a price oracle directly on the Bitcoin mainnet without relying on external data sources.

Timing is crucial. sBTC arrives at just the right moment in the Bitcoin ecosystem. With the completion of the Nakamoto upgrade, the necessary technical foundation is now in place.

From a market perspective, Bitcoin DeFi’s TVL占比less than 1%, a stark contrast to its market capitalization—indicating vast room for growth. Even more encouragingly, multiple major Bitcoin organizations have publicly expressed support for the sBTC initiative, signaling industry recognition of this innovation.

A clarification about sBTC: it is not a direct component of the Nakamoto upgrade, but rather one of the key applications enabled by it. The Nakamoto upgrade provides the essential technical underpinnings—enhanced interoperability and improved security architecture—that make sBTC possible.

According to recent announcements from Stacks' blog, the sBTC rollout is expected to begin in early December 2024. Currently, the community is voting on SIP-029, a proposal that will optimize the Stacks token issuance mechanism and pave the way for sBTC’s launch.

If you want a quick overview of sBTC, the official one-pager should give you a solid understanding.

At a time when the Bitcoin ecosystem sees rising prices but stagnant ecosystem development, sBTC might just be the catalyst needed to change that. Just as Ethereum’s DeFi ecosystem was propelled forward in 2017 by foundational financial primitives, perhaps Bitcoin’s ecosystem simply needs a similar spark.

Ecosystem and Data Overview

Regardless of upgrades, Stacks remains infrastructure—its progress depends heavily on ecosystem development.

Post-Nakamoto upgrade, enhanced scalability, sBTC, and Bitcoin-powered smart contracts are expected to unlock liquidity across the BTC ecosystem, benefiting various projects within it.

The Stacks ecosystem includes over 60 DApps, mostly in DeFi and NFTs. Among these, DeFi protocols stand to benefit the most from the upgrade. Thanks to the Nakamoto upgrade, users can now lock BTC to mint sBTC on Stacks and use it in DeFi applications such as stablecoin borrowing/lending, asset swaps, etc. For DeFi protocols built on Stacks, users can earn BTC-denominated yield rewards.

Prominent DeFi protocols currently include:

-

Alex Labs: Building the most comprehensive Bitcoin DeFi ecosystem on Stacks. Alex Labs expands products like Lisa (liquid staking on Stacks), launchpad, and cross-chain bridges into the Runes ecosystem;

-

Arkadiko: Uses a CDP (collateralized debt position) model similar to MakerDAO, allowing users to mint stablecoins and earn Bitcoin yield;

-

StackingDAO: A liquid staking protocol on Stacks that allows users to stake STX for additional yield;

-

Zest: On-chain lending protocol;

-

Bitflow Finance: A DEX in the ecosystem;

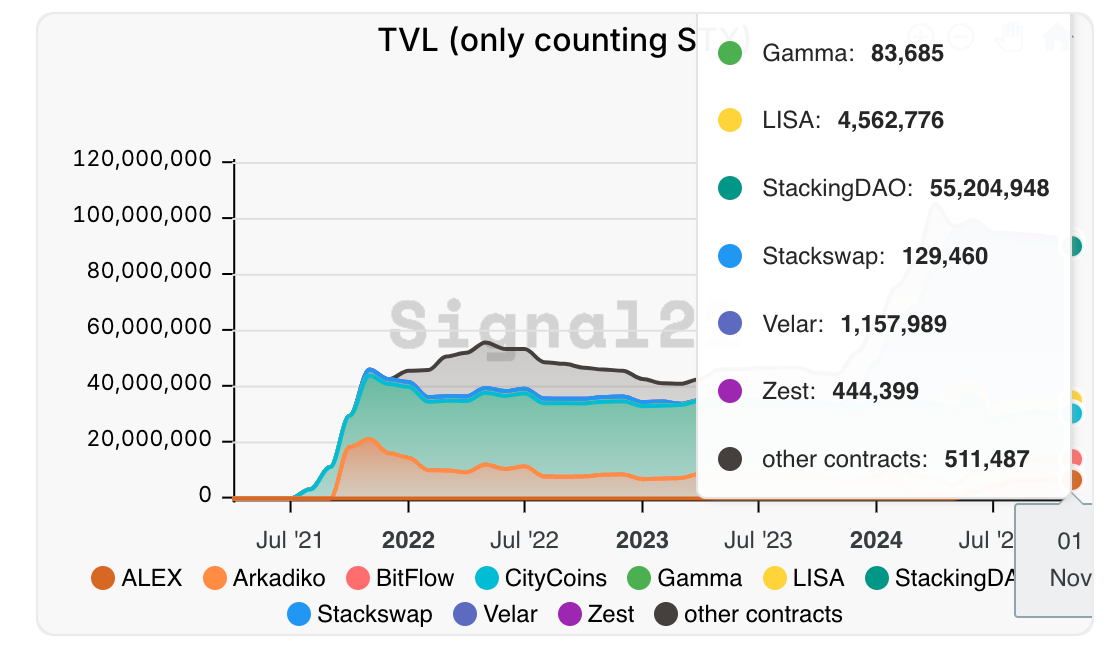

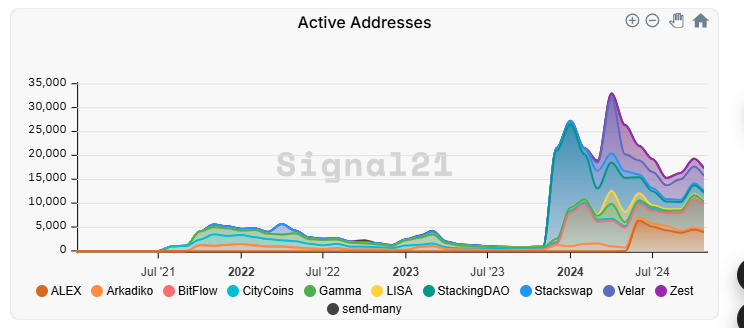

Data from Signal 121 shows that most staked STX flows into StackingDAO, followed by LISA and Stackswap.

Correspondingly, active addresses in the Stacks ecosystem are primarily concentrated in the DeFi protocols shown above. Funding size and user activity levels across different projects show a strong positive correlation—protocols with the highest deposits typically have the most active addresses.

Yet in absolute terms—total TVL and number of addresses—DeFi on Stacks still lags far behind Ethereum. From another angle, this data quantitatively confirms the article’s opening argument: what we really need is a breakout moment—a catalyst—to turn this gap into upward momentum.

And this gap cannot easily be bridged by memes alone. It’s worth noting that Stacks does host some meme projects, but they fall short in cultural resonance, influence, market cap, and engagement compared to Solana’s meme scene.

Therefore, as Stacks’ infrastructure matures, whether new asset-creating dynamics—similar to the earlier inscription trend in the BTC ecosystem—will emerge will directly impact overall ecosystem vitality.

The bridge is built. What kind of vehicles will run on it? That remains to be seen.

Outlook: Where Technological Innovation Meets Ecosystem Incentives

Within the Bitcoin ecosystem, we often ask: what is the relationship between technological innovation and market adoption?

Does superior technology guarantee market acceptance? The answer is clearly No—market response often hinges on a project’s strategy and execution.

The technical upgrade is just the foundation. The real game-changer for Stacks will be driving participation in sBTC from both supply and demand sides.

Hence, Stacks recently launched its "Best & Brightest" initiative—an ambitious call for groundbreaking projects in the Bitcoin ecosystem. Simply put, it offers full support to developers and teams building innovative applications on Bitcoin—akin to a “Bitcoin ecosystem innovation accelerator.”

The program kicks off gradually from late November 2024, covering key sectors like miners, wallets, and exchanges across the Bitcoin ecosystem. It supports individual developers while providing ample funding for established teams.

To ensure these innovations are secure, Stacks has brought in top-tier security experts. For instance, Immunefi—the on-chain security platform protecting over $190 billion in assets with a network of more than 45,000 white-hat hackers—will host dedicated "Attackathon" events to test and strengthen the security of these emerging projects.

Interestingly, the timing of this initiative is impeccable. As Bitcoin hits new highs and the market descends into speculative frenzy, Stacks chooses a seemingly slower but potentially more visionary route: building lasting possibilities for the Bitcoin ecosystem through solid technological innovation and grassroots development.

Looking at institutional backing, sBTC already enjoys support from over 20 prominent players, including BitGo, Blockdaemon, Figment, Copper, and Asymmetric. This broad endorsement reflects not just confidence in the technical design, but a vote of trust in the entire ecosystem’s future.

We may soon witness a wave of innovation built on Bitcoin. This goes beyond mere ecosystem expansion—it could redefine our very understanding of “Bitcoin applications.”

After all, as Satoshi once wrote on a Bitcoin forum: “In decades to come, when block rewards become too small, transaction fees will become the primary incentive for nodes. I believe that in 20 years, either there will be very high transaction volume, or none at all.” Today, through initiatives like this, Bitcoin appears to be steering toward the former scenario.

Still, technological innovation ultimately requires market validation. At a time when the Bitcoin ecosystem sees rising coin prices but stagnant ecosystem growth, will Stacks’ approach win market approval?

The answer may only emerge once sBTC launches and more innovative applications built on Stacks begin to appear.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News