Bitget Research: AAVE leads gains in DeFi sector, rising volatility in major cryptocurrencies signals potential market breakout

TechFlow Selected TechFlow Selected

Bitget Research: AAVE leads gains in DeFi sector, rising volatility in major cryptocurrencies signals potential market breakout

Over the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, and they could very well be the next wealth-generating opportunities.

Summary

Yesterday, Bitcoin rose to $61,800 before pulling back. AAVE's surge led a broad rally in the DeFi sector, with the following highlights:

-

The most wealth-generating sectors were: DeFi (AAVE, UNI) and BGB;

-

User-searched tokens & topics: DOGS, Story Protocol, Matic;

-

Potential airdrop opportunities: Solayer, Symbiotic;

Data as of: August 22, 2024, 4:00 AM UTC

1. Market Environment

Yesterday, the U.S. Department of Labor revised downward new job additions by 818,000, indicating that the U.S. labor market is not as strong as previously reported. Following the data release, markets briefly rallied before retreating.

On the ETF front, Bitcoin ETFs saw net inflows of $39.5 million yesterday, marking five consecutive days of net inflows. Ethereum ETFs, however, experienced $18 million in net outflows, also for five consecutive days.

In terms of sectors, legacy DeFi projects surged collectively yesterday, led by AAVE and UNI. The main reason was AAVE’s fundamental metrics reaching all-time highs, demonstrating sustained profitability. Additionally, proposals are underway to reform AAVE’s tokenomics, including introducing a revenue-sharing mechanism to enhance token utility.

2. Wealth-Generating Sectors

1) Sector Movement: DeFi (AAVE, UNI)

Main reasons:

-

AAVE protocol metrics continue to grow beyond previous cycle highs, reflecting strong product-market fit. Despite this, the token remains undervalued, prompting market-driven valuation correction. Aave Chan Initiative (ACI) has recently proposed reforms to AAVE tokenomics, aiming to introduce revenue sharing to boost utility. UNI is also exploring similar revenue-sharing mechanisms.

Price performance: AAVE up 39.3% over the past 7 days; UNI up 12.0% over the past 7 days.

Factors influencing future trends:

-

Protocol Metrics: These are key indicators of a protocol’s activity level, including daily active users, trading volume, and profitability. For example, AAVE achieving record-high metrics under current market conditions naturally attracts market revaluation. Conversely, without growth in these metrics, there is little reason for market optimism.

-

Revenue Distribution: An increasing number of DeFi protocols are linking their native tokens to protocol revenues. This business model reignites trading interest, giving investors strong incentives to hold the token. Thus, progress in revenue distribution significantly impacts token prices.

2) Sector to Watch: BGB

Main reasons:

-

Bitget Exchange has recently entered a deep collaboration with the highly popular Telegram Bot project DOGS. As a result, the Bitget app entered the top 10 in Finance category downloads on App Store across 11 countries. Given Bitget’s steady development and numerous project partnerships, users have greater incentive to hold BGB in anticipation of future exchange initiatives.

Factors influencing future trends:

-

LaunchPad/LaunchPool Events: As an exchange token, one of BGB’s primary utilities is participation in Bitget’s LaunchPad and LaunchPool events. With Bitget actively partnering with major projects, deeper integration with trending ones could significantly increase BGB demand if these launch events generate strong returns, thereby driving up the token price.

3. User Search Trends

1) Popular Dapp

DOGS

Market attention is focused on DOGS, a high-traffic Telegram Mini App within the TON ecosystem. The DOGS airdrop claim period ends on August 22, with the Token Generation Event (TGE) scheduled for August 26. DOGS now supports direct airdrop pre-deposits to Bitget. Additionally, Bitget has launched a "BitgetLuckyDogs" campaign: users depositing at least 1,000 DOGS automatically enter a raffle (grand prize: 1 BTC).

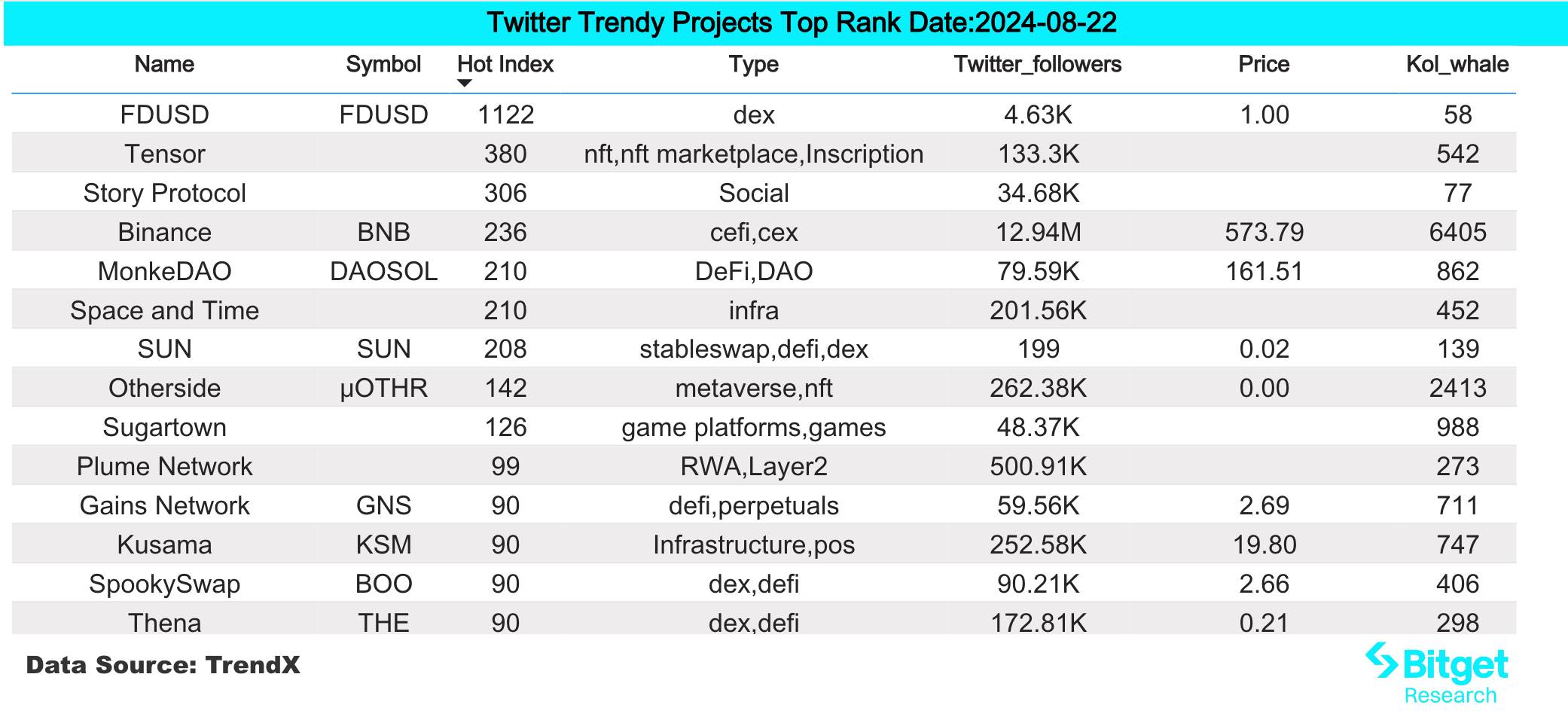

2) Twitter

Story Protocol

Story Protocol is an IP management protocol leveraging blockchain to transform how humanity records history. The project recently raised $80 million in a Series B round led by a16z Crypto, with participation from Foresight Ventures, Hashed, and others. To date, PIP Labs—the open team behind Story Protocol—has raised $140 million at a $2.25 billion valuation. It has attracted significant market attention and may emerge as a leading project in a new blockchain sector. Recommended for close monitoring.

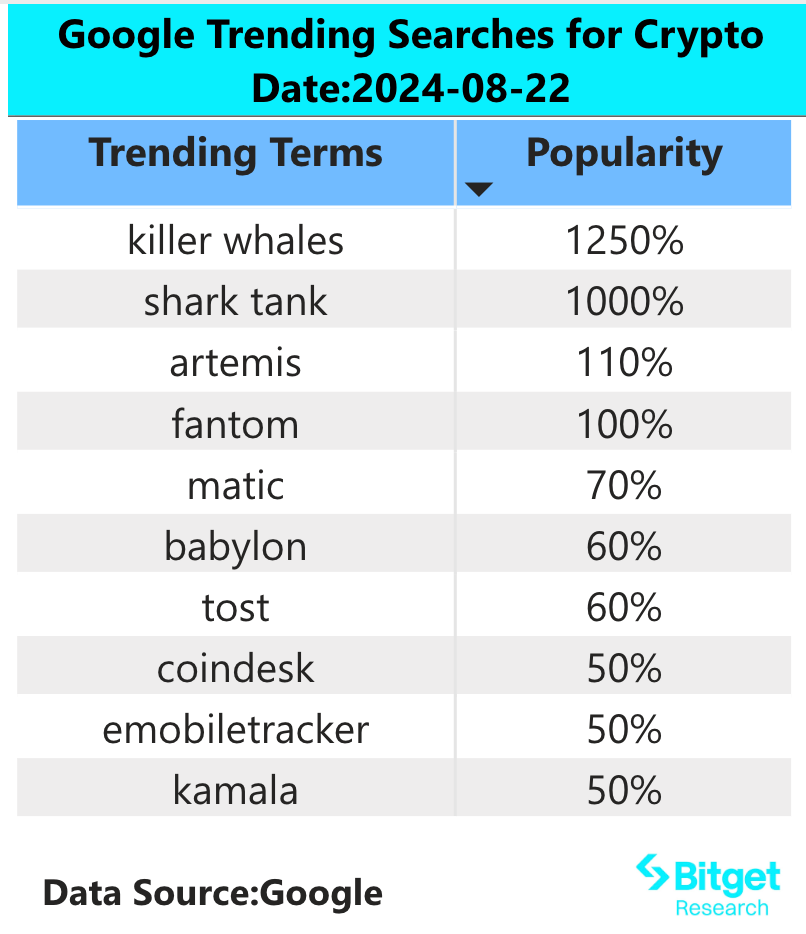

3) Google Search & Regional Trends

Global Overview:

Matic

Polygon will complete its MATIC token upgrade on September 4, introducing new tokenomics. POL will become an asset with a 2% annual issuance rate, distributed primarily to validators and the community treasury, enhancing community influence over Polygon’s future roadmap. Coinbase has added POL to its listing roadmap, making POL a top Google search term in English-speaking and European regions. So far, MATIC has risen 15% in 24 hours, with high trading volume and community engagement.

Regional Search Trends:

(1) Asia: Asian markets show strong interest in major assets such as BTC, ETH, and DOGE. Different countries exhibit varied focus—Pakistan shows interest in TON-based game BLUM, Indonesia in ETHFI, and Singapore in AI project FET.

(2) CIS Region: The CIS region maintains high enthusiasm for mini-games on the Ton app. Projects like Blum appear in Uzbekistan, Ukraine, and Belarus.

(3) Latin America: There is concentrated interest in dog-themed tokens such as Floki, Bonk, and Shiba Inu. Interest in gaming projects like SAND and MANA is also rising.

4. Potential Airdrop Opportunities

Solayer

Solayer is building a restaking network on Solana. It leverages economic security and high-quality execution to serve as decentralized cloud infrastructure, enabling application developers to achieve higher levels of consensus and customizable blockspace.

In July 2024, Solayer announced the completion of its builder round funding, with undisclosed amounts. Investors include Binance Labs, Anatoly Yakovenko (co-founder of Solana Labs), Rooter (founder of Solend), and Richard Wu (co-founder of Tensor).

How to participate: Stake SOL or supported SOL LSTs (jitoSOL, mSOL, bSOL, INF) to earn points per epoch. The mainnet is live—staking SOL yields sSOL and platform points.

Symbiotic

Symbiotic is a universal restaking project enabling decentralized networks to bootstrap powerful, fully sovereign ecosystems. It provides decentralized applications with a method called Active Validation Service (AVS) to mutually secure each other.

Recently, Symbiotic completed its seed round, raising $5.8 million from Paradigm and Cyber Fund.

How to participate: Visit the project’s official website, connect your wallet, and deposit ETH or ETH LSD assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News