MT Capital Research Report: Chainflip, an Emerging Competitor in Native Cross-Chain Swap Markets

TechFlow Selected TechFlow Selected

MT Capital Research Report: Chainflip, an Emerging Competitor in Native Cross-Chain Swap Markets

For DeFi to achieve broader-scale adoption, liquidity must be unified rather than further fragmented. Decentralized cross-chain liquidity networks, represented by Chainflip, will facilitate the unification of DeFi liquidity.

Author: Severin, MT Capital

TL;DR

- Chainflip enables native cross-chain value transfers with higher decentralization, security, and composability.

- The $FLIP token will remain inflationary in the short term, and we expect that transaction volume-driven buybacks and burns will not be sufficient to make $FLIP deflationary anytime soon.

- Compared to Thorchain, Chainflip offers a better product experience and design, but Thorchain has first-mover advantages such as high market awareness and market share. Therefore, we predict that Chainflip will struggle to fully replace Thorchain in the near term.

- Chainflip's market cap is approximately $90M, with a fully diluted valuation of around $460M. Thorchain’s market cap stands at $2.1B, with a fully diluted valuation of $3B. From a comparable valuation perspective, $FLIP still has nearly 8x upside potential. However, Thorchain’s market cap is supported by its cumulative trading volume of $68B and recent daily trading volumes exceeding $100M+, while Chainflip has yet to generate any trading volume.

- We maintain a cautiously optimistic outlook on $FLIP’s future trajectory and will closely monitor whether Chainflip’s upcoming mainnet launch incentive program can drive significant growth in trading volume.

Chainflip: A Decentralized Cross-Chain Liquidity Network

Native Cross-Chain Value Transfer

Unlike cross-chain solutions that rely on wrapped assets or require minting/burning assets during intermediate steps, Chainflip adopts a native approach to cross-chain value transfer.

This means that on each chain supported by Chainflip, there exists a liquidity pool holding native assets, forming a universal settlement layer across chains to meet users' needs for cross-chain asset swaps. The benefits of native cross-chain value transfer include:

-

Value transfers are chain-agnostic and wallet-agnostic—users can perform value transfers across any supported chain using regular wallets.

-

Transfers do not involve wrapped or synthetic assets; users simply submit a standard transaction to swap, eliminating exposure to additional asset risks after completion.

-

Chainflip does not need to deploy or execute additional protocols on specific chains, offering greater compatibility and universality, while offloading most computation off-chain to reduce user gas costs.

Chainflip’s native cross-chain value transfer lowers user entry barriers, reduces risk exposure, and delivers a superior user experience.

source: Image Source

Decentralization

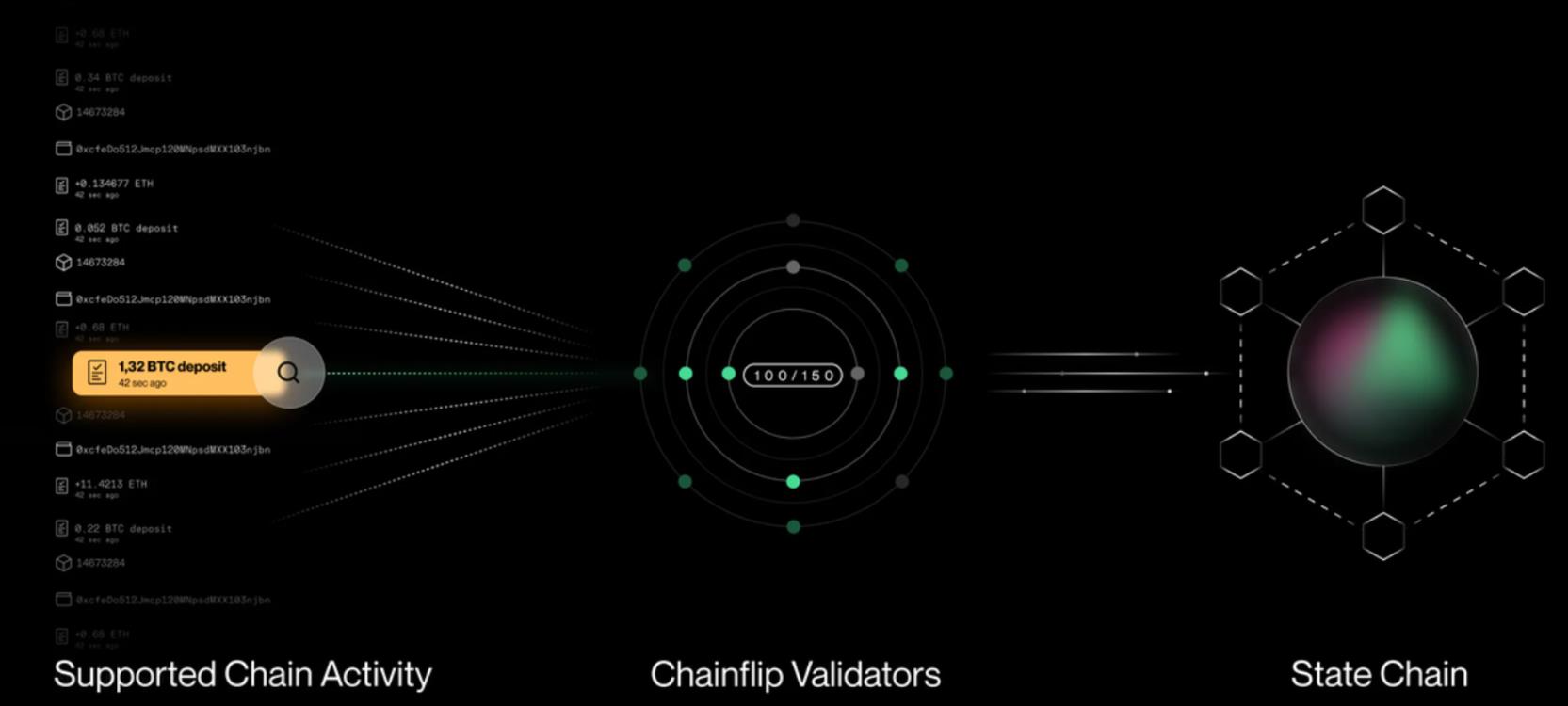

Another key advantage of Chainflip compared to other solutions is its higher degree of decentralization. Chainflip’s validator network consists of up to 150 nodes. These validators secure the network, participate in consensus, monitor events on external blockchains, and jointly control system funds. Participation in the network is permissionless—any user who stakes sufficient $FLIP and wins an auction can become a validator. At the core of Chainflip’s design is the use of MPC (Multi-Party Computation), specifically TSS (Threshold Signature Scheme), to create an aggregated private key held collectively by a permissionless network of 150 validators. All operations and state changes within Chainflip require confirmation from more than 2/3 of the nodes, ensuring enhanced security. Compared to centralized exchanges and highly centralized cross-chain bridges, users don’t have to worry about counterparty risks from centralized entities. Chainflip mitigates single points of failure and malicious behavior through greater decentralization, significantly improving overall system security.

source: Image Source

source: Image Source

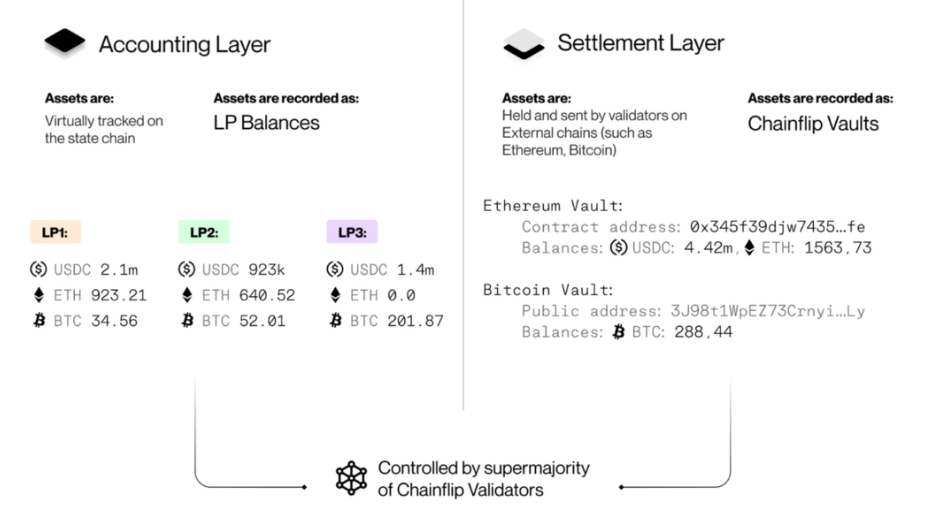

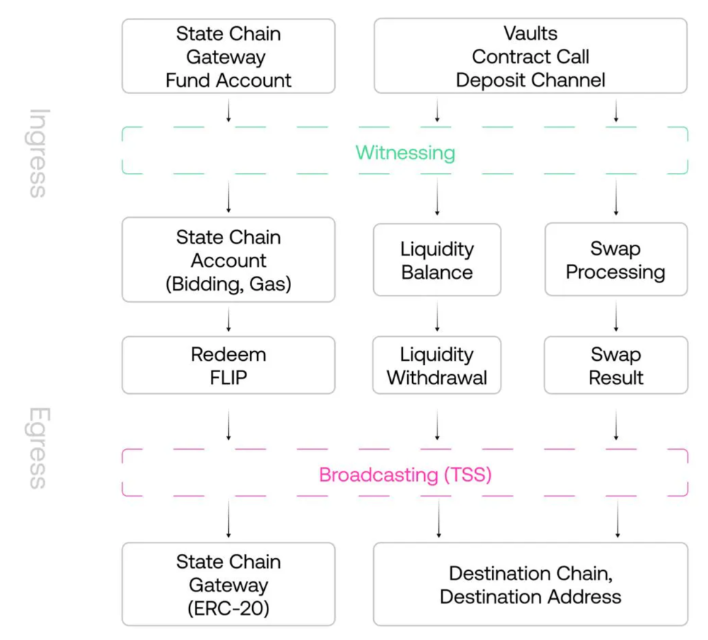

JIT AMM

The computation for cross-chain value transfers is handled by Chainflip’s Just-In-Time Automated Market Maker (JIT AMM), which runs on a Substrate-based state chain. While inspired by Uni V3, JIT AMM differs fundamentally—it is not a set of smart contracts deployed across multiple chains, but rather performs virtual calculations exclusively on the state chain for value transfers. In essence, Chainflip separates accounting and computation onto the state chain, while actual settlements occur via vaults deployed on each respective blockchain. **This workflow dramatically simplifies the complexity of executing cross-chain swaps, accounting, and settlements across different chains, effectively reducing user gas costs. Additionally, the state chain allows greater customization of the JIT AMM.** For example, Chainflip enables liquidity providers (LPs) to dynamically update limit orders in real-time based on incoming trades. This competitive quoting mechanism helps prevent MEV bots from frontrunning and improves LP capital efficiency, allowing users to achieve better prices with lower slippage.

source: Image Source

Composability

Compared to existing cross-chain bridges, Chainflip also offers superior composability. Developers can easily integrate Chainflip’s native cross-chain swapping functionality into existing protocols or products using the Chainflip SDK. Just as Uniswap’s swap function has been widely embedded across DeFi applications, higher composability opens up new use cases for Chainflip. As high-composability applications like omnichain games gain traction, the stacking of modular application-layer components will inevitably increase demand for seamless liquidity movement between chains. Meanwhile, **liquidity fragmentation across L1s and L2s continues to worsen—native cross-chain swapping solutions like Chainflip may become essential built-in features for multi-chain projects.**

Team Background

Chainflip’s team consists of 26 experienced global professionals. Simon Harman is the founder and CEO of Chainflip and also serves on the board of the Oxen Foundation. Prior to Chainflip, Simon led the development of Session, a messaging app built on the Signal protocol. CTO Martin was previously the founder of Covariant Labs and served as CTO and CSO at Finoa. With nearly 60% of the team composed of developers, Chainflip boasts strong technical expertise and a high-quality team structure.

Tokenomics

On November 23, 2023, Chainflip announced its mainnet launch and the issuance of the $FLIP token. Following its release, $FLIP quickly gained market attention, currently trading around $5—nearly 2.7x its ICO price of $1.83.

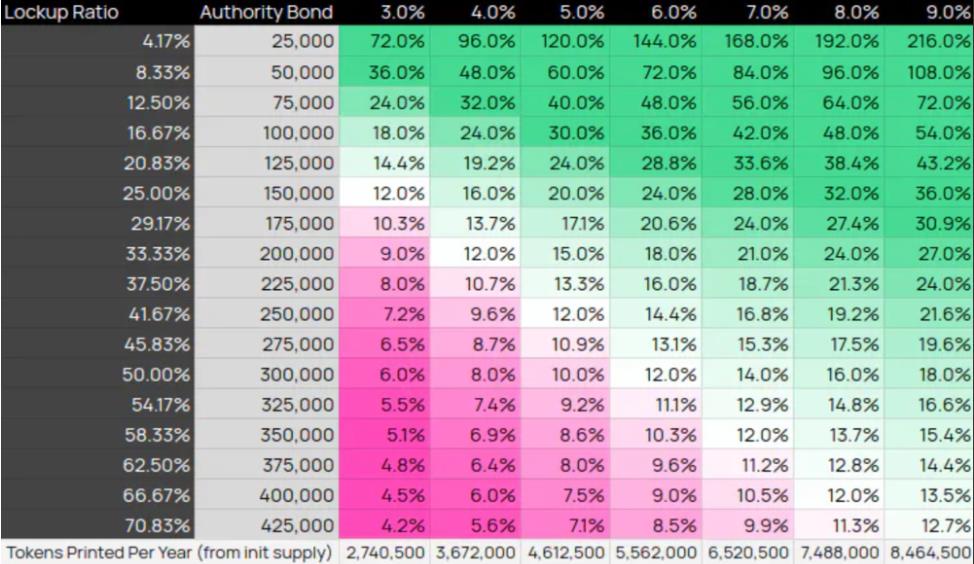

$FLIP is Chainflip’s native ERC-20 token, with an initial supply of 90 million, following a dynamic supply model. Currently, Chainflip expects an annual 8% token inflation rate to incentivize validators. Additionally, transaction fees collected by Chainflip are used to buy back and burn $FLIP, potentially making $FLIP deflationary over time. $FLIP’s primary utilities lie in staking for validation and capturing protocol value.

source: Image Source

$FLIP Staking & Validation

Similar to other validator networks, since the 150 Chainflip nodes control all system funds and operations, nodes must stake a sufficient amount of $FLIP as collateral to deter malicious behavior. Validators with larger $FLIP stakes have a higher probability of being selected as authoritative validators and thus earn additional rewards.

Currently, an annual 7% token reward is expected to be distributed evenly among authoritative validators. Backup validators will receive an annual 1% reward proportionally based on their $FLIP stake. Therefore, **the amount of $FLIP staked significantly impacts validator rewards, increasing demand for holding and staking $FLIP.** Chainflip anticipates a staking rate between 37% and 66% of the total supply, which would help stabilize the token price and reduce market selling pressure.

source: Image Source

$FLIP Value Capture

For every token swap conducted through Chainflip, a 0.1% fee is charged. This fee is collected in USDC and used to purchase $FLIP, which is then immediately burned. Similarly, gas fees on the state chain are also used to buy and burn $FLIP. Chainflip aims to reflect protocol-generated value dynamically in the $FLIP price through this buyback-and-burn mechanism, rewarding $FLIP holders and strengthening its value accrual. Of course, since $FLIP has an inflationary supply, Chainflip must achieve substantial daily trading volume for buybacks and burns to positively impact the $FLIP price.**

Outlook

Potential Market

With the continuous emergence of numerous L1s and L2s, liquidity fragmentation across chains has become increasingly severe. According to DeFiLlama data, there are currently 71 chains with TVL exceeding $10M. The rise of Rollup-as-a-Service and app-specific chains will further exacerbate this fragmentation. Security-compromised traditional cross-chain bridges are no longer users’ top choice for cross-chain liquidity. Native cross-chain swap solutions like Thorchain and Chainflip may gradually enter the mainstream. The total value locked across cross-chain bridges is approximately $12B, while Thorchain’s TVL is only around $300M—native cross-chain swap solutions still have room for tenfold expansion.

Comparison with Thorchain

Overall, Chainflip targets a similar market as Thorchain, though there are subtle differences in product experience and design:

- User Experience: Thorchain requires a dedicated multi-chain wallet, whereas Chainflip works with standard wallets, offering a more seamless user experience. That said, Thorchain is actively working to integrate with mainstream wallets to close this gap.

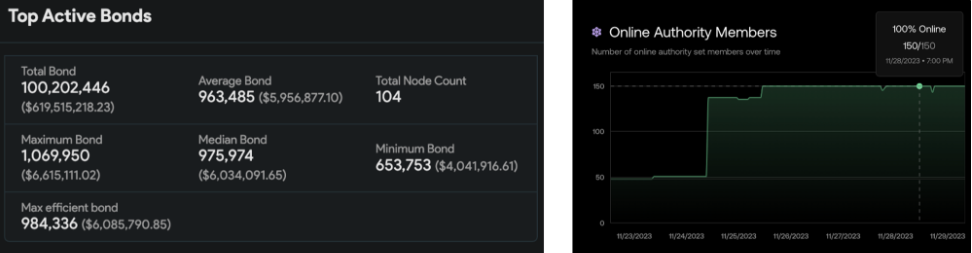

- Decentralization: Thorchain currently has 104 nodes securing its vaults, while Chainflip’s validator network comprises 150 nodes. While Chainflip has slightly higher node count and thus marginally greater decentralization, the difference is not significant.

- Product Design: Thorchain relies on $RUNE as a central intermediary for liquidity pools and swaps, exposing users to $RUNE-specific risks. Chainflip, in contrast, does not depend on any single token, making it inherently less exposed to single-token volatility and therefore more secure.

source: Image Source 1 & Image Source 2

In summary, Chainflip currently offers slightly better usability, decentralization, and security than Thorchain, but Thorchain’s first-mover advantage, brand recognition, and market share remain significant competitive strengths. Therefore, **we believe Chainflip is unlikely to fully replace Thorchain in the short term.** It is more plausible, as suggested by Thorchain’s official Twitter, that Chainflip and Thorchain will coexist and collectively erode the market share of traditional cross-chain bridges.

source: Image Source

Currently, Chainflip’s market cap is approximately $90M, with a fully diluted valuation of around $460M. Thorchain’s market cap is $2.1B, with a fully diluted valuation of $3B. From a comparable valuation standpoint, $FLIP still has nearly 8x upside potential. However, Thorchain’s valuation is backed by $68B in cumulative trading volume and recent daily volumes exceeding $100M+, while Chainflip has not yet generated any trading activity. Therefore, our overall view on $FLIP remains cautiously optimistic, and we will closely watch whether Chainflip’s upcoming mainnet incentive program can drive substantial trading volume growth.

Reference

MT Capital

MT Capital is headquartered in Silicon Valley and is a crypto-native fund focused on Web3 and related technologies. With a global team, diverse cultural backgrounds, and perspectives, we possess deep insights into global markets and the ability to identify regional investment opportunities. MT Capital’s vision is to become a leading global blockchain investment firm, dedicated to supporting early-stage technology companies capable of generating substantial value. Since 2016, our portfolio has spanned various sectors including infrastructure, L1/L2, DeFi, NFT, and GameFi. We are not just investors—we are strategic partners empowering founding teams.

Website: https://mt.capital/

Twitter: https://twitter.com/MTCapital_US

Medium: https://medium.com/@MTCapital_US

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News