Superscrypt, Temasek's Crypto Fund: Confronting the Current State and Challenges of Blockchain Interoperability and Cross-Chain Bridges

TechFlow Selected TechFlow Selected

Superscrypt, Temasek's Crypto Fund: Confronting the Current State and Challenges of Blockchain Interoperability and Cross-Chain Bridges

In this article, we will introduce the importance of interoperability, the challenges it faces, and current approaches.

Author: Superscrypt, Jacob

Translation: TechFlow

With the proliferation of Layer 1s, Layer 2s, and application-specific chains, having secure, low-cost, and efficient communication between blockchains has become more important than ever.

In this article, we will explore the importance of interoperability, its challenges, and current approaches—this is the first part of our interoperability series.

The Proliferation of Blockchains

Bitcoin, the first public blockchain, launched in 2009. Over the past 14 years, public blockchains have experienced explosive growth, reaching 201 according to DeFiLlama. While Ethereum dominated on-chain activity, accounting for about 96% of total value locked (TVL) in 2021, that share has since dropped to 59% over the past two years due to the emergence of alternative Layer 1s like Binance Smart Chain (BSC) and Solana, as well as Layer 2 scaling solutions such as Optimism, Arbitrum, zkSync Era, Starknet, and Polygon zkEVM.

According to DeFiLlama, there are now over 115 EVM-based chains and 12 Ethereum rollups/L2s, and multi-chain activity is expected to continue for various reasons:

-

Major L2 solutions such as Polygon, Optimism, and Arbitrum positioned themselves early as Ethereum scalability solutions, raised significant funding, and established themselves as low-cost platforms for application deployment (development teams on Arbitrum grew by 2779%, on Optimism by 1499%, and on Polygon by 116% over the past year—though from a small base, still around 200–400 developers);

-

Ongoing launch of specialized L1s optimized for specific needs. Some chains prioritize throughput, speed, and settlement time (e.g., Solana, BSC), while others target specific use cases such as gaming (ImmutableX), DeFi (Sei), or traditional finance (e.g., Avalanche subnets);

-

Applications with sufficient scale and user bases are launching their own rollups or app-chains to capture more value and manage network fees (e.g., dYdX);

-

Several frameworks, SDKs, and "rollup-as-a-service" providers have emerged, enabling any project to easily create its own rollup and reducing technical complexity (e.g., Caldera, Eclipse, Dymension, Sovereign, Stackr, AltLayer, Rollkit).

We live in a multi-chain, multi-layer world.

Growing Importance of Interoperability

This explosion of Layer 1s, Layer 2s, and application chains highlights the growing importance of interoperability—the ability and mechanisms for blockchains to transfer assets, liquidity, messages, and data across chains.

As proposed by Connext, blockchain interoperability can be broken down into three components:

-

Transfer: Moving message data from one chain to another;

-

Verification: Proving the correctness of the data (often involving proving consensus/state on the source chain);

-

Execution: The process by which the destination chain processes the data.

The benefits of transferring assets and liquidity across chains are obvious—it enables users to explore and transact within new blockchains and ecosystems. They can leverage the advantages of new chains (e.g., trading on a lower-fee L2) and discover new profitable opportunities (e.g., accessing higher-yield DeFi protocols on other chains).

The benefit of message passing lies in unlocking a whole suite of cross-chain use cases without moving native assets. A message sent from chain A (source) triggers code execution on chain B (destination). For example, a dApp on chain A could pass a message about a user’s assets or transaction history to chain B, enabling them to participate in activities on chain B without moving any assets, such as:

-

Borrowing on chain B using assets held on chain A as collateral;

-

Participating in community perks on a low-cost rollup (e.g., minting a new NFT collection, claiming event tickets or merchandise) without moving their NFTs from chain A;

-

Leveraging their decentralized identity and on-chain history built on one chain to access DeFi on another chain and obtain better interest rates.

Challenges in Interoperability

Despite its many benefits, interoperability faces several technical challenges:

-

First, blockchains generally do not communicate well with each other—they use different consensus mechanisms, cryptographic schemes, and architectures. If your tokens are on chain A, using them to purchase tokens on chain B is not a straightforward process.

-

Second, at the verification layer, the reliability of interoperability protocols depends on the chosen mechanism to verify that transmitted messages are legitimate and valid.

-

Third, fragmented development across multiple chains leads to a loss of composability—a key building block of Web3. This means developers cannot easily combine components across chains to design new applications and unlock greater possibilities for users.

-

Finally, the large number of chains fragments liquidity, reducing capital efficiency for participants. For example, if you provide liquidity on chain A to earn yield, it's difficult to use the LP token from that position as collateral in another protocol to generate additional yield. Liquidity is the lifeblood of DeFi and protocol activity—the more chains there are, the harder it becomes for any single ecosystem to thrive.

There are currently several interoperability solutions addressing these issues—so what does the current landscape look like?

Current State of Interoperability

Today, cross-chain bridges are the primary enablers of cross-chain transactions. There are now over 110 bridges, each with different features and trade-offs in terms of security, speed, and supported blockchains.

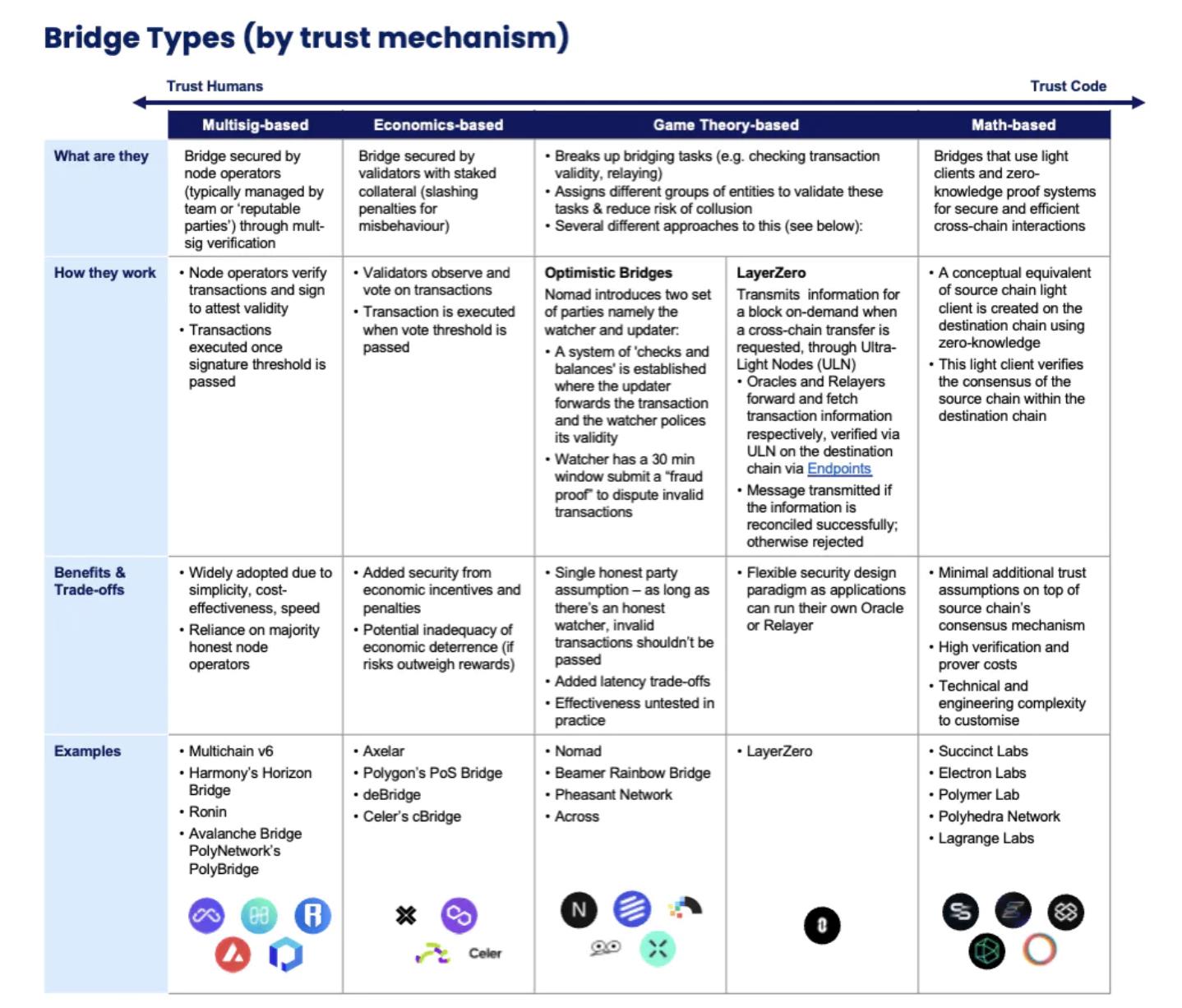

As outlined by LI.FI in their report, there are several types of cross-chain bridges:

-

Wrapped/Minted Bridges—Tokens are secured via multisig on chain A and corresponding tokens are minted on chain B. In theory, wrapped tokens should hold the same value as the original, but their value depends on bridge security—if the bridge is hacked, users may not be able to redeem wrapped tokens back into originals when bridging from chain B to chain A (e.g., Portal, Multichain);

-

Liquidity Networks—Parties provide liquidity on both sides of chains to facilitate cross-chain swaps (e.g., Hop, Connext Amarok, Across);

-

Arbitrary Message Bridges—Can transmit any kind of data (tokens, contract calls, chain state), e.g., LayerZero, Axelar, Wormhole;

-

Use-case-specific bridges (e.g., stablecoin and NFT bridges) burn assets on chain A and release them on chain B.

These bridges employ different trust models, supported by various trusted parties and incentive structures—and these choices matter:

-

Team Human relies on a set of entities to attest to transaction validity;

-

Team Economics uses a group of bonded validators whose staked assets are subject to slashing to deter malicious behavior. This only works if the economic gain from malfeasance is less than the slashing penalty;

-

Team Game Theory distributes various tasks in the cross-chain process (e.g., verifying transaction validity, relaying) among different actors;

-

Team Math uses on-chain light clients and zero-knowledge technologies with succinct proofs to verify the state of one chain before releasing assets to another. This minimizes human intervention but is technically complex to implement.

Ultimately, trust models range from human-based to economically incentivized humans to math-based verification. These methods are not mutually exclusive—some combine approaches to enhance security. For instance, LayerZero’s game-theoretic bridge uses Polyhedra (which relies on zk proofs) as an oracle for its network.

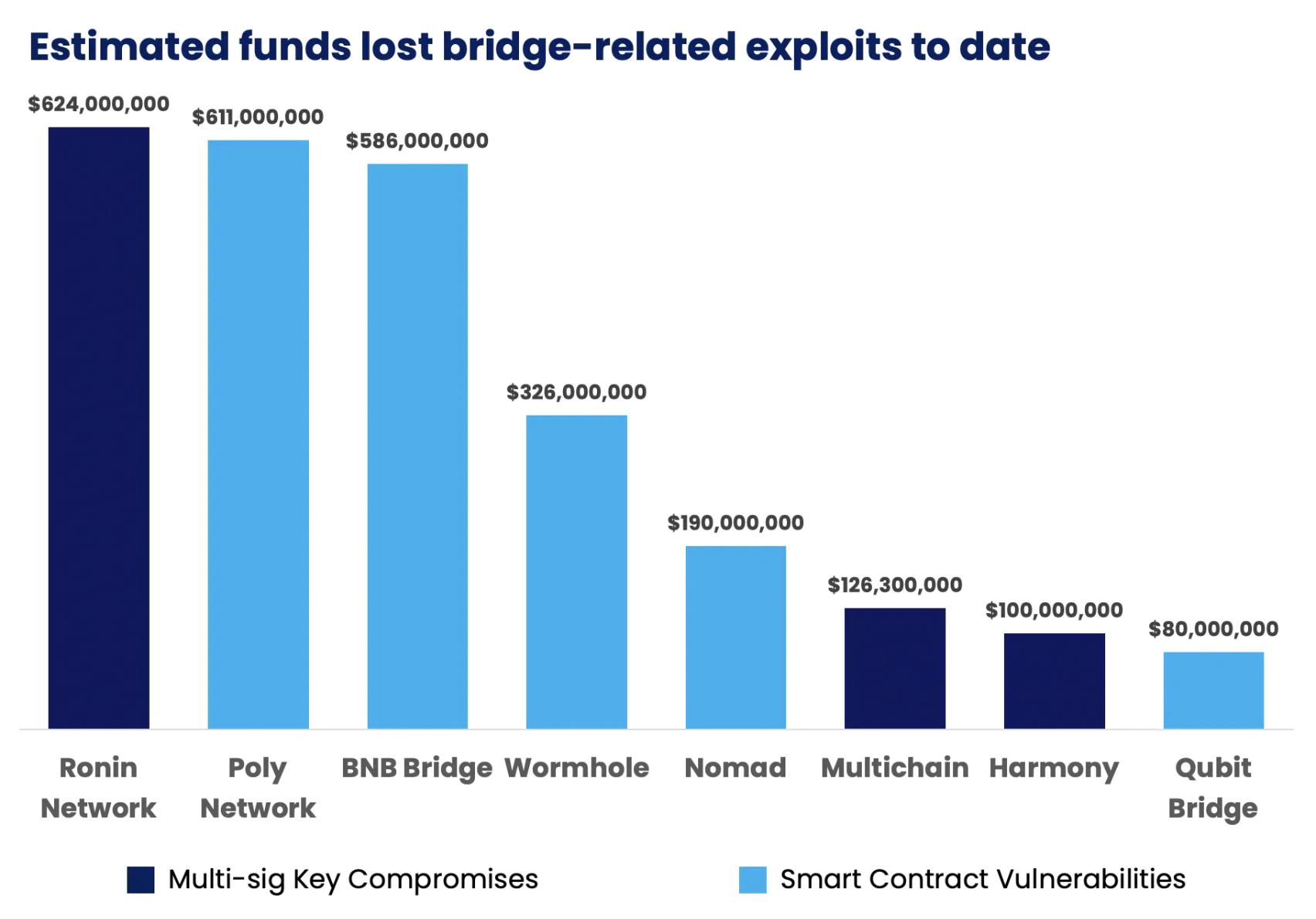

How have bridges performed so far? To date, they’ve enabled massive capital movement—the total value locked (TVL) in bridges peaked at $60 billion in January 2022. Given the vast amounts of capital involved, bridges have become prime targets for attacks and hacks. In 2022 alone, $2.5 billion was lost due to a combination of multisig key compromises and smart contract vulnerabilities. For a financial system, an annual capital loss rate of 4% is unsustainable—it cannot thrive or attract more users.

Attacks continued into 2023, with $126 million drained from multi-chain addresses (50% of Fantom’s bridge assets and 80% of Moonriver’s), revealing that the CEO had control over all "multisig" keys. In the weeks following the hack, Fantom’s TVL dropped by 67% (a large portion of assets on Fantom were bridged via Multichain).

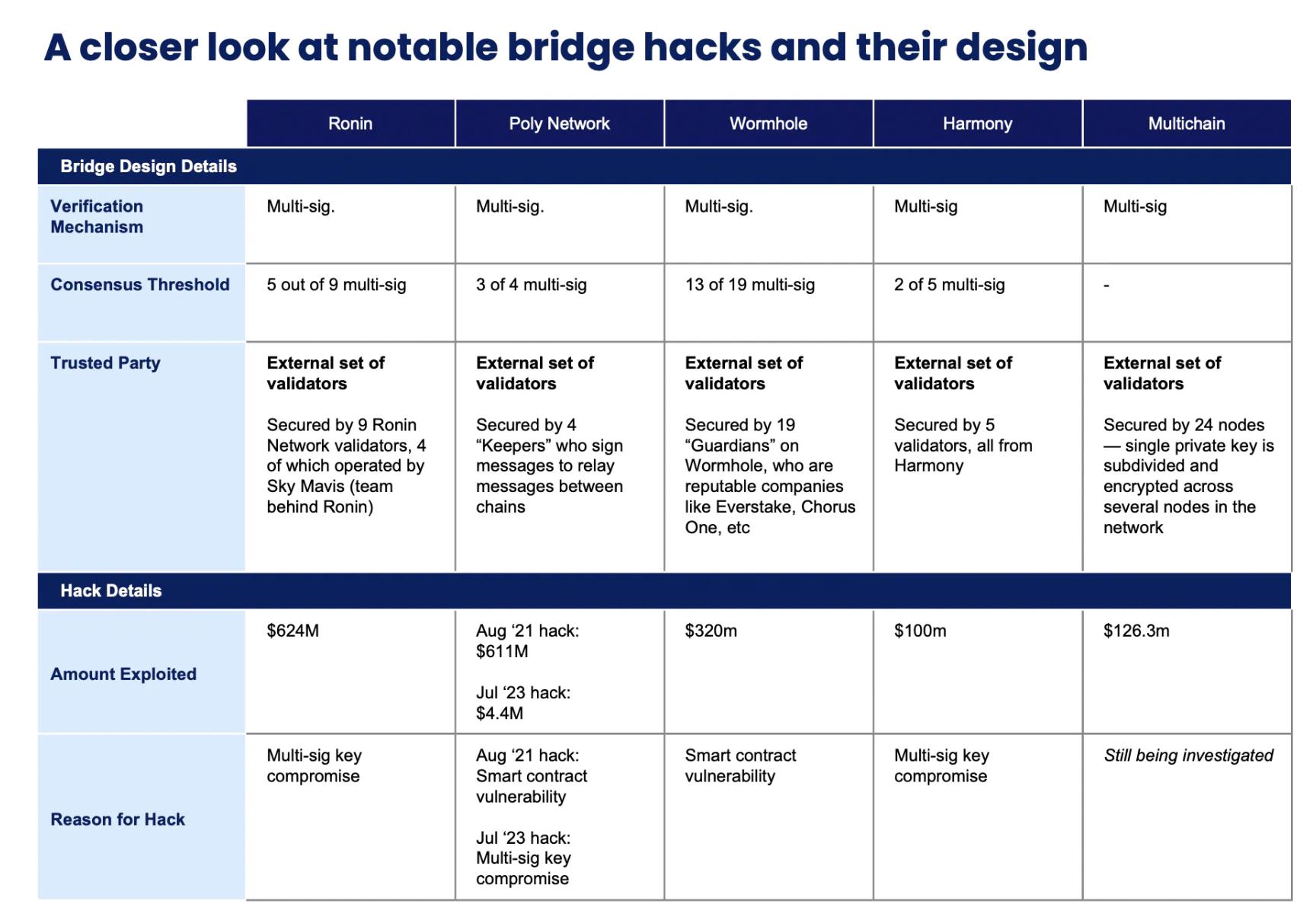

Ultimately, some of the largest bridge attacks and their aftermath stem from multisig vulnerabilities (Ronin: $624M, Multichain: $126M, Harmony: $100M), underscoring the critical importance of the trust model adopted by cross-chain bridges.

Having a small (Harmony), grouped (Ronin), or centralized (Multichain) validator set was a key factor in some of these attacks, but threats can come from many vectors. In April 2022, the FBI, CISA, and the U.S. Treasury issued a joint cybersecurity advisory highlighting tactics used by the North Korea-linked Lazarus Group, including social engineering, email phishing, Telegram scams, and targeting centralized exchange accounts.

So where do we go from here?

Clearly, validation mechanisms ultimately relying on humans are vulnerable to attacks, yet the need for secure and efficient interoperability remains. So where do we go next?

We are now seeing the emergence of trust-minimized verification methods, which excites us:

-

In part two, we’ll cover Consensus Proofs, used to prove the latest consensus of the source chain (i.e., its state/"truthfulness" over recent blocks) to facilitate bridging;

-

In part three, we’ll discuss Storage Proofs, used to prove historical transactions and data in older blocks to enable various cross-chain use cases.

Both approaches center on trust-minimized verification, aiming to reduce reliance on humans and their vulnerabilities, laying the foundation for the future of interoperability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News