How zkSync Quietly Earned Over $20 Million in Six Months: How Do Layer 2s Actually Make Money?

TechFlow Selected TechFlow Selected

How zkSync Quietly Earned Over $20 Million in Six Months: How Do Layer 2s Actually Make Money?

In the current bear market environment, can building Layer2 projects still be profitable?

Author | Day

This year, Ethereum Layer2 has seen explosive growth. Similar to previous surges in public chains, a large number of projects are now positioning themselves in the Layer2 space—whether there’s gain or not, they’re giving it a shot first. Recently, some have argued that due to expectations around Layer2 token distributions, many user studios have become targets for anti-farming efforts. With both token distribution and fee revenue at play, Layer2 project teams have emerged as the biggest winners in this farming game.

According to analysis by The Block, based on current daily profits, Coinbase could generate $61 million annually from its Base network—outperforming numerous other public chain platforms and DApp applications in the industry. Today, let's take a simple look at how exactly Layer2 projects make money (specifically Rollup-type solutions).

01 How Do Layer2 Projects Make Money?

Layer2 refers to scaling technologies and protocols built atop foundational blockchains, designed to enhance blockchain scalability, performance, and transaction throughput. Traditional blockchains like Ethereum face certain limitations such as high transaction fees, low throughput, and long confirmation times. Layer2 typically introduces new protocols and mechanisms above the base layer, enabling most transactions to be processed off-chain before final settlement on the main chain. These transaction results are then batched and submitted to the main blockchain, reducing its load and achieving higher throughput, lower costs, and faster confirmations—all while maintaining security and interoperability with the main chain.

As one of today’s hottest sectors, Layer2 holds great promise. In the current bear market, can building Layer2 still be profitable? And if so, how exactly?

(1) Transaction Fees

Layer2 platforms can profit by charging users transaction fees. When users conduct transactions on Layer2, they must pay a certain fee, which flows directly or indirectly to the platform operators or node runners. Platforms may implement various pricing models—such as volume-based or value-based fee structures—to generate revenue.

Let’s first break down the composition of Layer2 transaction fees:

-

Computation Fees: Costs associated with executing smart contracts or computational operations on the Layer2 chain, including running contract code and processing state transitions.

-

Storage Fees: Fees paid by users for storing data on Layer2. These cover the cost of data storage and management, varying based on data size, duration, and complexity.

-

Main Chain Transaction Fees: The cost of submitting aggregated transaction results from the Rollup chain back to the main chain. This includes fees for posting hashes of batched transactions or state updates to the main chain for verification and storage. Additionally, minimal on-chain transactions are required to support Rollup operations and security—such as opening or closing Rollup chains and updating states—thus incurring related main chain transaction fees.

Project Profit = Layer2 Gas Revenue – Data Computation & Storage Costs – Layer1 Verification Costs.

This is only a rough calculation—costs such as hardware infrastructure, node operation, and personnel are not included here.

(2) MEV (Maximal Extractable Value)

Layer2 separates transaction validation from sequencing (the process of ordering transactions). Currently, the majority of Layer2 sequencers are centralized and controlled by project teams. For example, Coinbase acts as the sole sequencer for Base, allowing it to capture all gas revenues from Base. Due to this centralization, Layer2 projects also extract a portion of MEV (Maximal Extractable Value).

(3) Developer Tools and Services

Layer2 platforms offer various developer tools and services to support and facilitate development. These may include software development kits (SDKs), smart contract templates, cross-chain bridges, etc. Platforms can monetize these through licensing fees, usage charges, or subscription models for premium features.

For instance, OP Stack: Twitter influencer w3tester revealed that each project joining OP Stack pays 30% of its revenue. Using an "instant chain deployment" service would cost even more. This implies that without proper operations and sufficient transaction volume, launching a Layer2 via one-click tools could still result in losses.

(4) Ecosystem Benefits

The success of a Layer2 platform is closely tied to the prosperity of its ecosystem. If a platform successfully attracts more users and projects, offering better scalability and user experience, the overall ecosystem value increases. The platform can benefit from ecosystem growth through token holdings, equity stakes, or other means. Moreover, a thriving ecosystem brings increased traffic and activity, further boosting gas fee revenues for the Layer2.

(5) Token Economics

Layer2 platforms often issue their own tokens. Token holders can earn returns by participating in governance, staking, or accessing exclusive benefits. Project teams can raise funds through token sales or equity offerings. In a bullish market, especially when the sector takes off, rising token prices can bring significant gains to Layer2 projects.

The above outlines the primary revenue models for Layer2 projects.

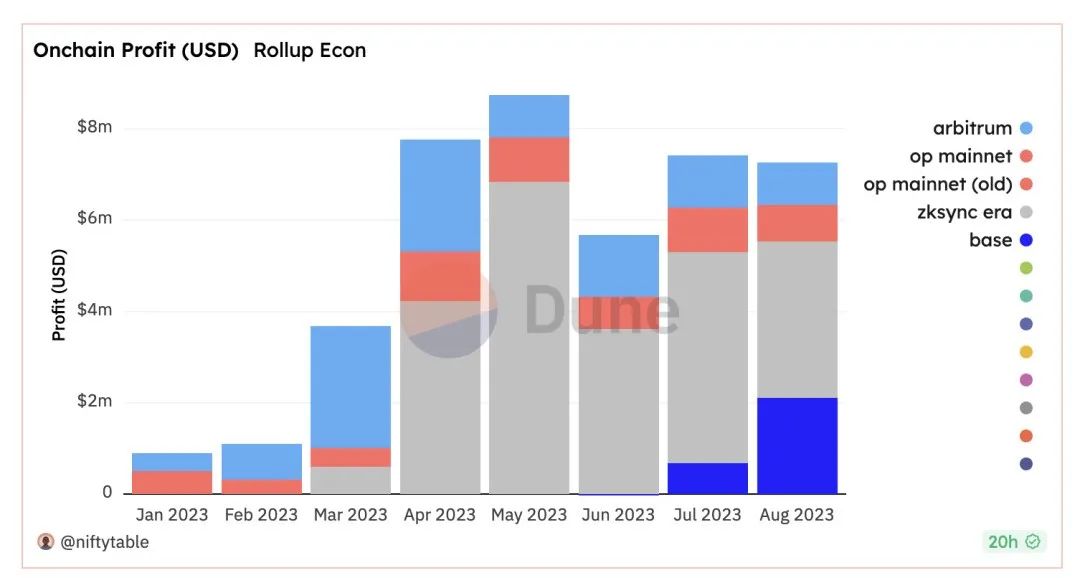

02 Profitability Status of Leading Layer2 Chains

On-chain profit table of top Layer2 chains

Let’s briefly examine the profitability of major Layer2 chains in August. Here, profitability primarily refers to net fee revenue: L2 Revenue = L2 Fees – L1 Data Storage Costs – L1 Verification Costs. This is only approximate, as off-chain resource consumption and operational expenses are not factored in:

zkSync

Around $3.4 million. Since zkSync launched, its profitability has remained leading. If other projects distribute airdrops, zkSync’s income could see another spike. In about six months since mainnet launch, total profits amount to roughly $23.5 million. It’s striking—considering how poor the market conditions have been this year, yet they’ve quietly earned so much. Backed by top-tier institutions and leading the sector, making money seems effortless.

BASE

Approximately $2.1 million. BASE launched last month. Leveraging Coinbase’s massive existing user base and the short-term surge of meme project BALD, BASE attracted substantial traffic. Although BALD eventually rug-pulled, it left behind a significant user base. Coupled with the recent strong rise of social app Friend, along with continued influx of Twitter KOLs, BASE continues gaining momentum. Within less than two weeks, Friend achieved $6 million in total value locked (TVL), generated $3 million in revenue, and attracted over 100,000 users.

Arbitrum

About $930,000. Arbitrum has seen declining热度 recently. In March and April, when Arbitrum’s token launched, its ecosystem surged temporarily—projects like GMX, RDNT, and GNS performed well, increasing chain activity and popularity.

Optimism

Around $800,000. Optimism’s ecosystem has remained lukewarm. However, during the same period when Arbitrum rose, Optimism (also OP stack-based) gained some attention from on-chain users. Recently, projects like Coinbase, BNB Chain, and Worldcoin choosing to build on OP Stack have brought indirect benefits to Optimism, resulting in a slight uptick in on-chain activity.

As mentioned earlier, Layer2 revenue mainly comes from gas fees—the more users, the higher the revenue. When popular projects emerge or favorable developments occur, earnings increase accordingly.

03 Summary

Regardless, every sector has both winners and losers. Profits come easier during market booms, but to earn substantially, one must become a leader. The vast majority of projects are merely runners-up; profits always belong to the few.

Overall, for Layer2 to grow sustainably, it needs to capture greater market share. Only with breakout projects in its ecosystem can it achieve lasting activity and momentum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News