HoldStation Counteroffensive: From Wallet to zkSync's "GMX"

TechFlow Selected TechFlow Selected

HoldStation Counteroffensive: From Wallet to zkSync's "GMX"

HoldStation is not just a wallet on the blockchain, but more like an all-in-one DeFi platform.

DeFi and public blockchain sectors are entering a new era, with AA wallets and DEXs becoming the focal points of competition. Ethereum is stepping into the background, while its various Layer 2 solutions will take on the challenge from heterogeneous chains like Solana.

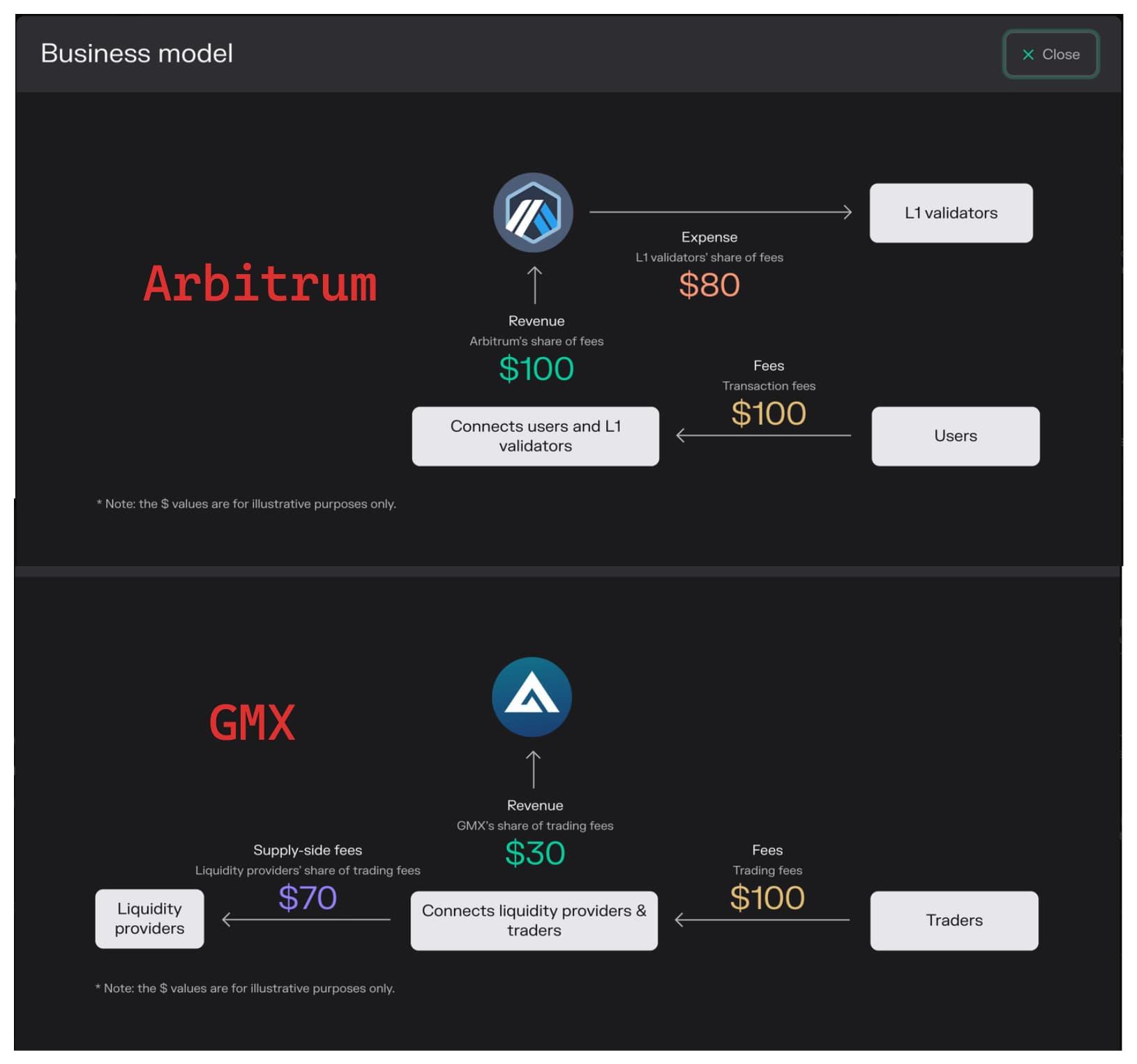

The central battleground lies in the synergy between on-chain derivatives DEXs and Layer 2s—akin to the close collaboration between GMX and Arbitrum—where both parties see growth in TVL and trading volume, forming a mutually reinforcing alliance.

OP-based models must be embraced by ZK-based ecosystems as well. zkSync enhances transaction efficiency and scalability while maintaining compatibility with the Ethereum mainnet, significantly reducing transaction costs. This enables dApps on Ethereum to seamlessly migrate to zkSync without sacrificing security or decentralization, further strengthening the dominance of the EVM ecosystem in DeFi.

Similar to how GMX competes head-on with dYdX through its partnership with Arbitrum, emerging omnichain wallet HoldStation stands out within the zkSync ecosystem and currently supports 12 EVM-compatible chains.

HoldStation represents an evolution beyond traditional wallets, integrating wallet services, oracles, spot and perpetual DEXs, and other key DeFi components, transforming the wallet into a comprehensive on-chain trading platform.

Web3 users can efficiently manage assets and engage in on-chain interactions like assembling Lego blocks.

As a bull market looms large, competition between wallets and DEXs in 2024 is set to intensify. Solana’s DEX trading volume has briefly surpassed that of the EVM ecosystem again. With escalating rivalry, Ethereum must maintain its lead by having L2s like zkSync more actively embrace on-chain markets.

All-in-One On-Chain Wallet: HoldStation Fundamentals

After a year of exploration in 2023, AA (Account Abstraction) wallets have gradually become an industry consensus, especially gaining attention from major exchanges. Bitget acquired BitKeep and rebranded it as Bitget Wallet, while OKX integrated its Web3 wallet directly into its app. The trend of wallets becoming gateways for mass adoption is increasingly clear.

AA Wallets on the Brink of Breakout

With Vitalik Buterin championing AA wallets, they have become one of the most watched developments in the space. However, market expectations remain high regarding concrete product execution.

Emerging player HoldStation is actively positioning itself to build an AA wallet enabling seamless interaction across on-chain and off-chain, Web2 and Web3 environments—free from the legacy burdens of existing centralized platforms.

The underlying philosophy is crystal clear: a wallet is not just a simple entry point, but the first touchpoint of user experience.

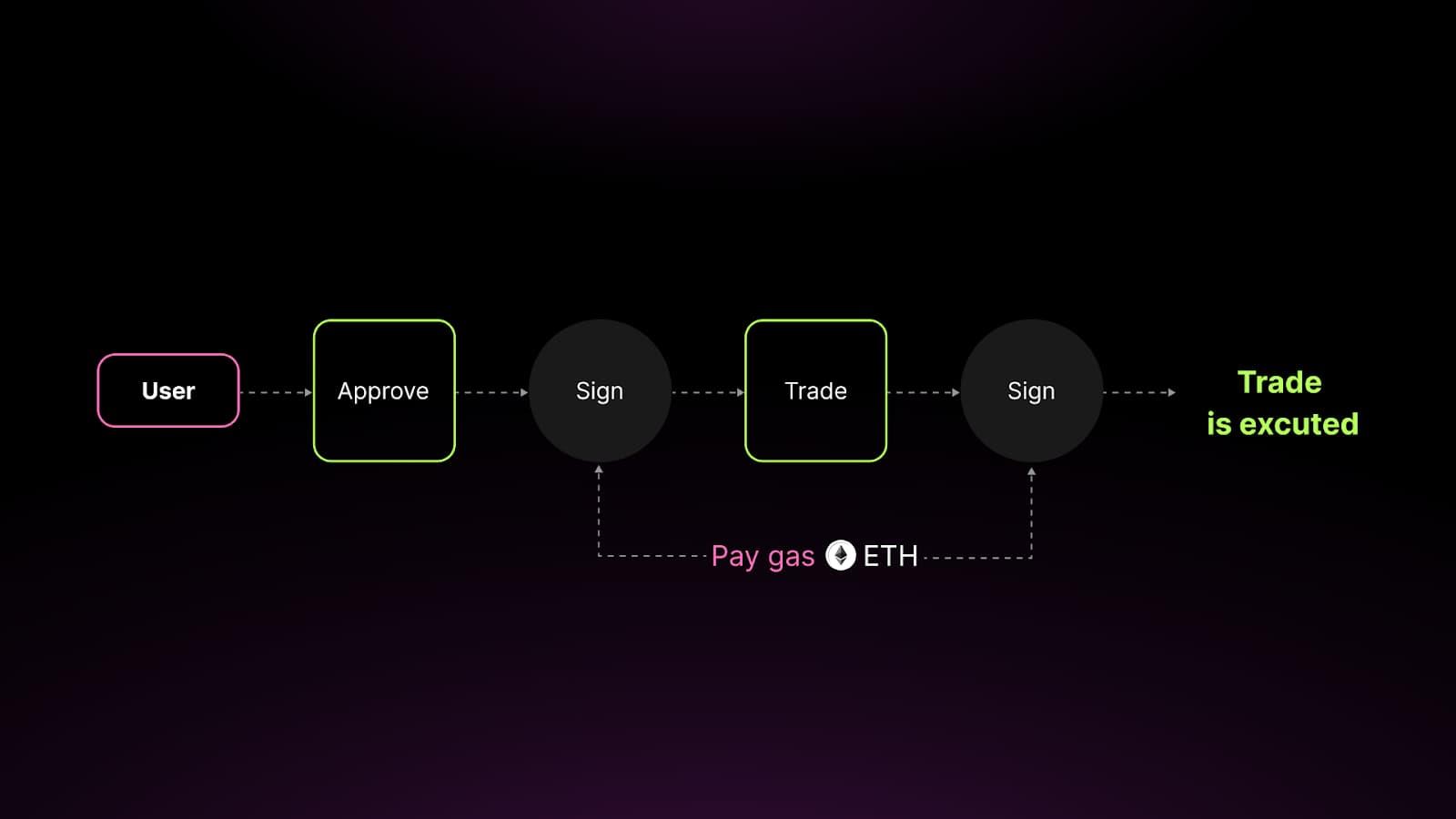

According to zkSync, AA functionality allows accounts on zkSync Era to initiate transactions like EOA accounts while executing complex smart contracts, enhancing flexibility. HoldStation chose zkSync as its technical foundation precisely because of zkSync's high Ethereum compatibility and operational efficiency among ZK-based Layer 2 solutions, providing all necessary development support.

-

zkSync Era was the first to natively implement account abstraction, and ongoing EVM compatibility tests have revealed no significant issues.

-

zkSync refers to abstracted accounts on its system as "Smart Accounts" and introduces "Paymasters," which can sponsor transaction fees for users—for example, allowing stablecoins instead of $ETH to pay gas fees.

Based on this, HoldStation is more than just an on-chain wallet—it functions as a one-stop DeFi platform delivering CEX-like efficiency and convenience, such as helping users batch-complex operations while saving on gas fees.

One-Stop DeFi Platform: A New Paradigm for Full On-Chain Operation

HoldStation also receives support from ChainLink’s BUILD program, enabling it to build a decentralized DEX oracle based on on-chain data, gradually eliminating reliance on centralized exchanges.

Through multi-faceted optimization—including MPC technology, a Seedless (keyless) secure account model, and locally implemented account recovery—HoldStation improves user experience across multiple dimensions.

In HoldStation’s design philosophy, the provision of diversified wallet features aims to retain users and generate revenue—a fundamental departure from paid wallet models like Zengo.

Just as GMX successfully attracted users through synergies with the Arbitrum ecosystem and grew its TVL and trading volume by earning trading fees, HoldStation anticipates a similar mutually beneficial partnership with zkSync.

Current market data shows that HoldStation has generated $600,000 in trading fees from $1 billion in trading volume. As zkSync grows, HoldStation’s profitability is expected to increase further.

DeFi and Wallets Converge

DeFi is moving into wallets—not merely using wallets as access points. More specifically, HoldStation integrates various DeFi services directly into the wallet, overcoming the limitations of traditional wallets that serve only as interactive gateways. In practice, HoldStation reduces user participation costs by optimizing trading experiences, such as offering lower gas fees for stablecoin trades.

Notably, HoldStation’s derivatives trading service includes DeFutures linked to multiple assets, offering up to 500x leverage, featuring an FMM market-making mechanism and social-driven promotion strategies.

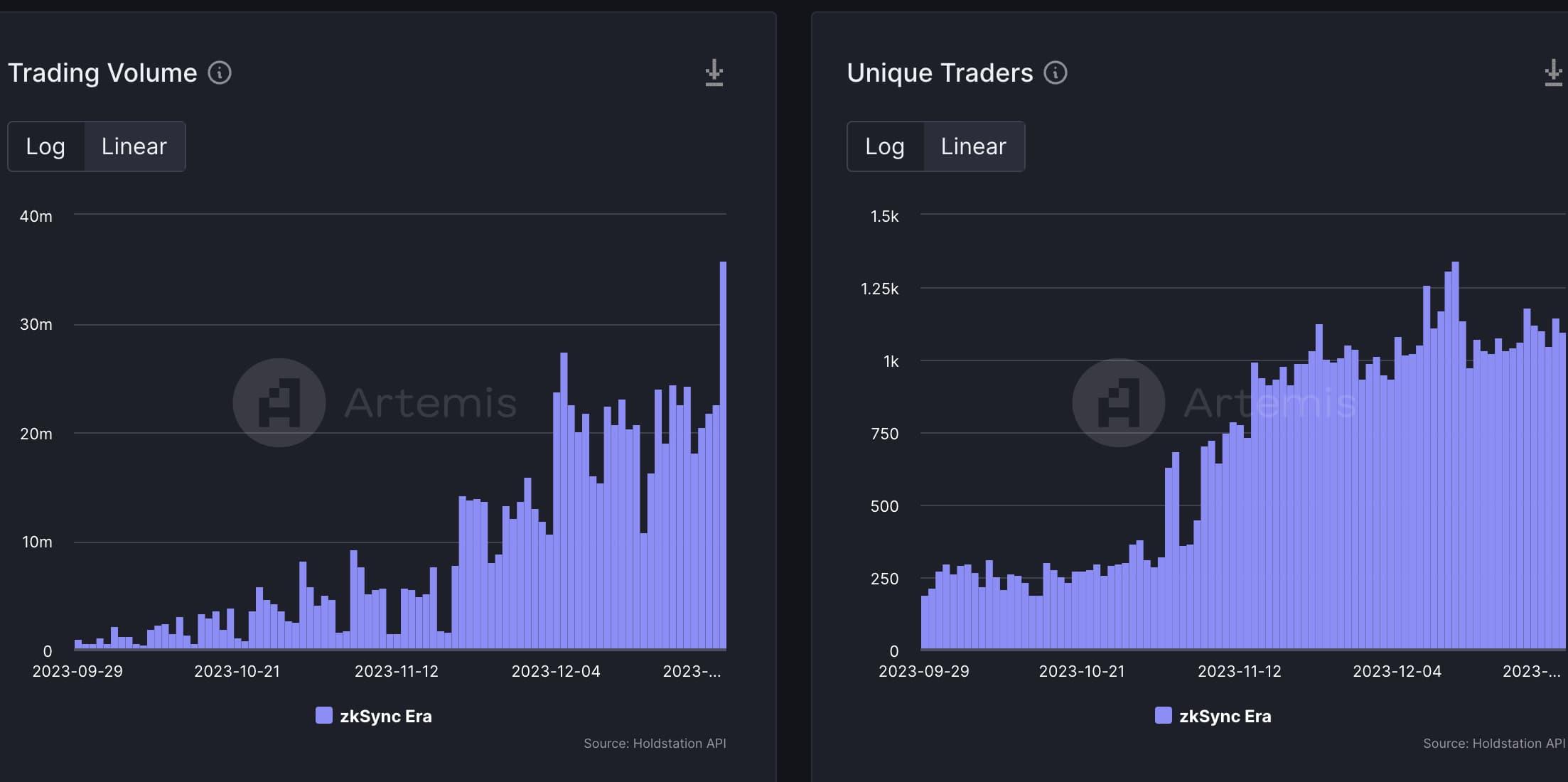

Currently, HoldStation ranks among the top four on-chain derivatives DEXs, achieving approximately $30 million in daily trading volume with over 1,000 active traders.

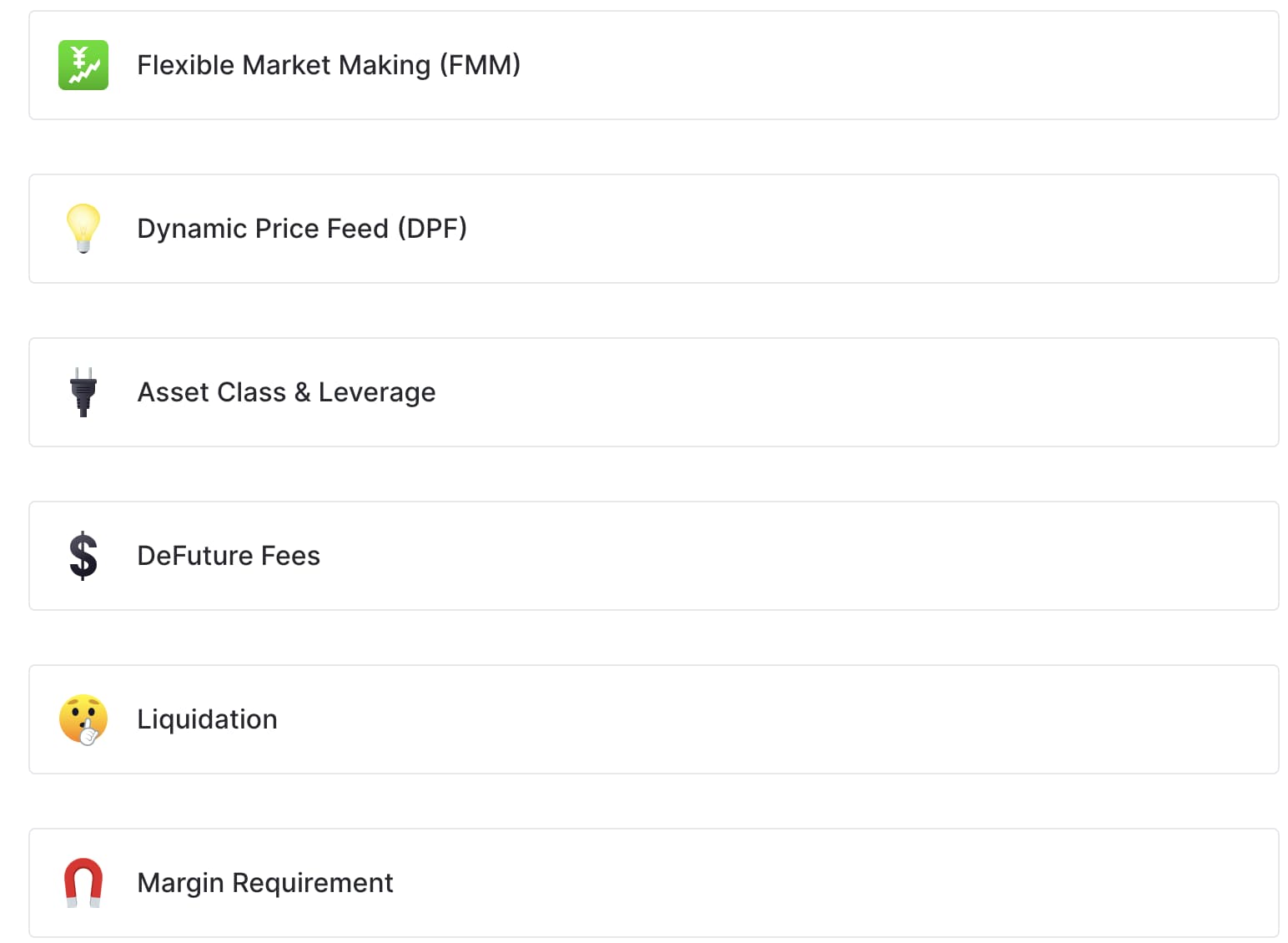

From a technical architecture perspective, it consists of six core components: FMM (Flexible Market Making), DPF (Dynamic Price Feed), Asset Class & Leverage, DeFuture Fees, Liquidation, and Margin Requirement.

-

FMM: Inspired by Dodo, it uses a unified pricing logic for funds and trades to reduce gas fee consumption.

-

DPF: Works alongside FMM, aggregating multiple data sources to minimize the impact of incorrect or anomalous data, accurately calculating average prices for all assets on the platform.

-

Asset Class & Leverage: HoldStation offers 24/7 trading for crypto markets, supporting popular tokens like BTC, ETH, and BNB, as well as forex and commodities, with up to 500x leverage available in forex trading.

-

DeFuture Fees: Cryptocurrency open/close fees are 0.08%, forex at 0.008%, and commodities at 0.01%. Up to 60% of opening fees are rebated to referrers.

-

Liquidation: Three liquidation bots handle limit orders and liquidations. Limit orders incur an additional 0.02% fee, distributed as rewards to executors to promote network decentralization.

-

Margin Requirement: Uses an isolated margin system to separate risks across positions, with individual margin requirements per asset class. The system automatically calculates liquidation prices.

Moreover, HoldStation features a critical community revenue-sharing mechanism, allowing users to share profits generated by others. Statistics show that up to 80% of all trading fees will ultimately be returned to users, strengthening community consensus and advancing HoldStation’s decentralization.

Full Breakdown of Tokenomics: HoldStation’s Market Expansion Strategy

By securing a strong position on zkSync, HoldStation has already demonstrated its technological advancement and service reliability. In the anticipated bullish environment of 2024, HoldStation is entering a crucial phase of market expansion.

HoldStation’s market expansion plan includes several key elements: leveraging successful models from existing exchanges and offering comparable on-chain user experiences—including generous commission rebates—to attract and grow its user base. Additionally, unlike the blunt airdrop strategies seen on Arbitrum or Optimism, HoldStation plans to encourage use of Smart Accounts and Paymaster features to enable targeted airdrops, distinguishing genuine users and offering them unique incentives.

Quick Overview of HoldStation Tokenomics

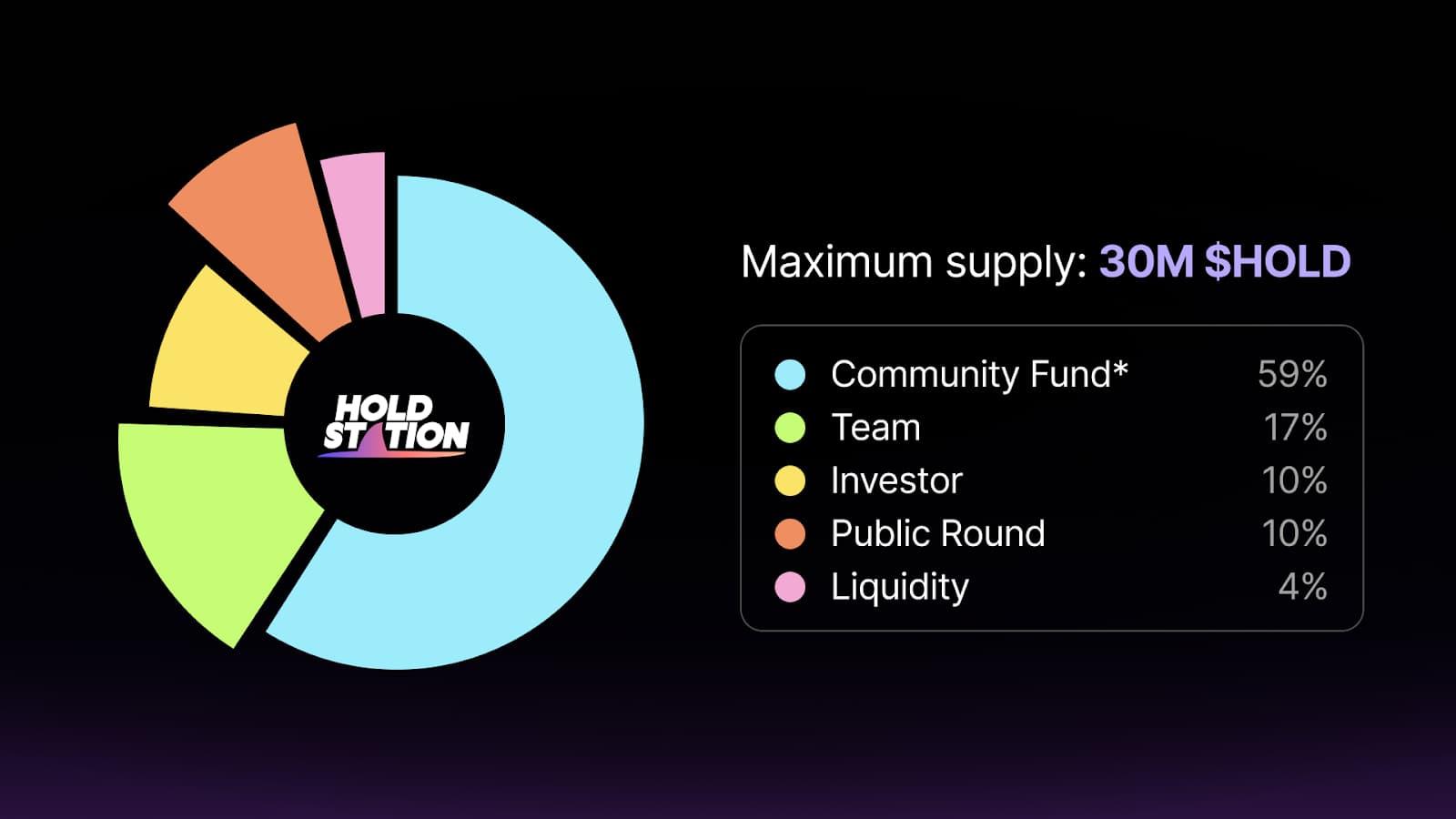

HoldStation has a total supply of 30 million tokens, with an initial circulating supply of 17.25%, approximately 5,173,500 tokens. The public sale round accounts for 10% and will be fully unlocked at TGE to enhance liquidity.

The community treasury accounts for 59%, with 5.5% unlockable during TGE. This portion will primarily fund future airdrops and DEX adoption initiatives.

Team and advisors hold 17%, subject to a 12-month lock-up period followed by linear vesting over 60 months.

Initially, 4% of the allocation will go toward liquidity and will be unlocked at TGE to provide initial liquidity for $HOLD.

Real Yield Program

In token distribution, HoldStation emphasizes fair rewards for the community and individual users, gradually promoting understanding of the economic model through transparent allocation details. Central to this is empowering the token via RealYield (real yield).

-

Trading fee sharing: 40% allocated to $USDC stakers, another 40% to $HOLD holders, and the remaining 20% to the community treasury;

-

Transaction fee discounts: Users who pay gas fees with $HOLD enjoy a 30% discount, with an additional up to 40% discount when staking extra $HOLD;

-

Token deflation mechanism: Quarterly buybacks and burn programs will gradually reduce the circulating supply of $HOLD, increasing passive returns for holders;

-

Governance token for future HoldStation DAO, serving as proof of voting rights;

-

LaunchPad privileges under Fair Launch: $HOLD stakers will receive at least 2% of token allocations in upcoming Launchpad projects.

It should be noted that HoldStation plans to realize the Fair Launch model in the on-chain market via its LaunchPad. The platform prioritizes transparency and fairness, ensuring all users have equal participation opportunities and their rights are respected throughout project launches.

Furthermore, HoldStation’s strategy and product lineup have already gained market recognition, attracting support from prominent investors and partners including ViaBTC Capital, DexTool, Pendle founder, and Ankr, among others.

Conclusion

As an innovator in the DeFi space, HoldStation’s market expansion strategy is comprehensive, combining user experience, technological innovation, transparency, and sound tokenomics.

As it deepens its commitment to the Real Yield initiative, we look forward to seeing HoldStation replicate the success of GMX in the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News