DeFi Year-End Review: Market, Regulation, Modular Blockchains, MEV, and Innovation

TechFlow Selected TechFlow Selected

DeFi Year-End Review: Market, Regulation, Modular Blockchains, MEV, and Innovation

Despite the market downturn in 2022, DeFi remains a powerful sector, supported by projects of all sizes.

Written by: Chris Powers

Compiled by: TechFlow

It’s that time of year again for year-end recaps (and a good opportunity to revisit our top DeFi memes from 2021 and 2020). Despite the bear market in 2022, DeFi remains a robust space supported by projects large and small. It continues to stand as a compelling vision for a transparent, global, digital financial system.

Unfortunately, the state of crypto memes looks bleak to the average person. When any cryptocurrency is labeled a scam, it becomes difficult for DeFi to grow. However, this will pass quickly. In the meantime, there's still significant work to be done to push DeFi forward—from infrastructure to application layers and fundamental market structures.

Overall, 2022 may go down as the year when regulatory conversations around DeFi—especially concerning stablecoins—became more serious.

1. Market Collapse

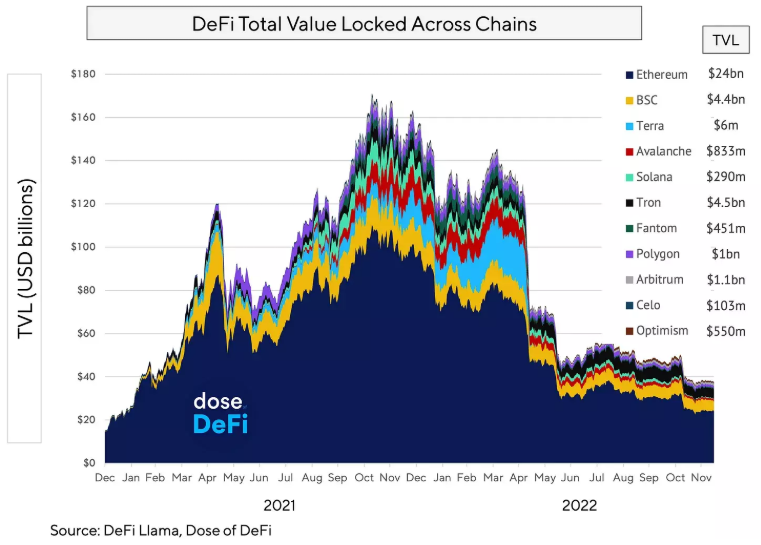

In 2022, nearly all crypto assets and DeFi metrics saw steep declines. This was exacerbated by two major implosions: first, the collapse of Luna and the Terra stablecoin, followed just last month by the massive fraud at FTX.

Yet, neither event struck at the core of DeFi. In fact, FTX’s bankruptcy has strengthened the case for non-custodial exchanges and transparent lending ledgers. Meanwhile, Terra’s failure demonstrated that algorithmic perpetual motion machines are pure fantasy.

What’s often overlooked is that the market crash did not cause DeFi protocols themselves to fail.

Indeed, compared to March 2020 and Black Thursday, DeFi performed flawlessly.

Nonetheless, ETH’s sharp decline and massive outflows from stablecoins significantly reduced DeFi’s TVL and revenue-generating capacity, slowing investment into the sector. Yet this may prove a healthy development, encouraging longer-term building rather than rushing products and ideas to market before the noise dies down.

2. Regulation

In a year marked by intense regulatory scrutiny, Senator Elizabeth Warren just passed a major piece of legislation this week. The proposed bill represents a sweeping attack—mandating KYC checks on all wallets and even penalizing node operators—though its chances of becoming law are slim. Still, it reflects a broader theme among proposed regulatory changes. We admit we were somewhat naive in assuming crypto’s appeal to authorities would translate smoothly into legislative outcomes. The reality this year is that regulators have gained a much clearer understanding of both the inner and outer workings of DeFi and the broader crypto ecosystem.

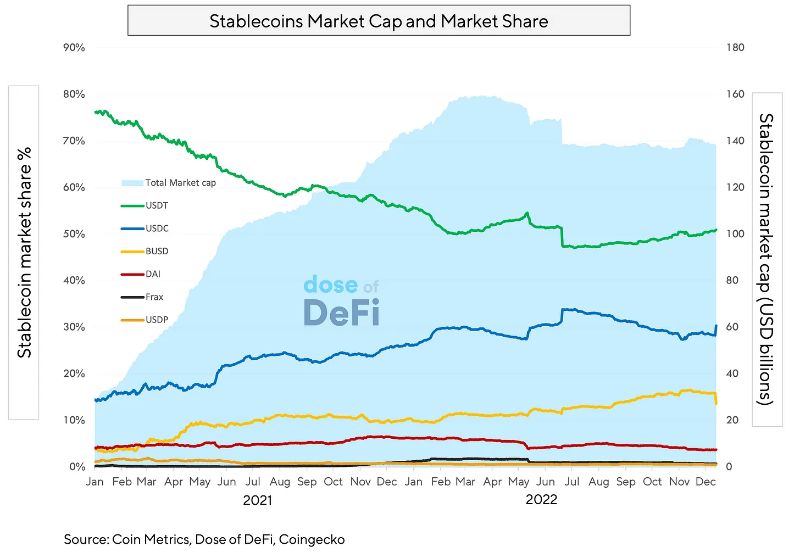

Nowhere is this truer than with stablecoins. Centralized giants like Tether, USDC, and BUSD have grown so large they’re now seen as shadow banks, posing potential systemic risks to the global financial system.

Meanwhile, the collapse of the Terra stablecoin raises questions about whether regulators will impose stricter oversight on anything claiming to be pegged to the U.S. dollar. For the industry, this means constrained growth and a shift in liquidity toward “safer” centralized stablecoins like USDC and BUSD, rather than Tether. That said, the long-term momentum for stablecoins remains strong.

3. Cosmos, App Chains, and Modular Blockchains Enter DeFi

Initially, DeFi operated solely on Ethereum’s mainnet, then expanded in 2020 and 2021 to other EVM-compatible chains, including Layer 2s. This reduced user costs while maintaining the same composable market structure as Ethereum. In 2022, as DeFi matured and bottlenecks emerged, the industry began exploring entirely new infrastructure. Cosmos has existed for years, but only in 2022 did it finally build out an ecosystem of wallets, blockchain explorers, and DEXs offering a user experience comparable to mature blockchains. As we explored in our April deep dive on Cosmos, its defining feature is its ability to connect different blockchain networks—an inherent capability built directly into the network. Projects to watch next year include Agoric (supporting smart contracts written in JavaScript) and Archway (directly allocating incentives from smart contracts to developers).

dYdX, one of the oldest DeFi projects, joined Cosmos this year and launched its own chain. It now offers free trading for unexecuted orders and optimized validators to store order books. dYdX could be considered the first successful app chain—a competitive vision to the EVM model centered on composability. Now, many suggest that all major DeFi protocols, such as Uniswap, should launch their own app chains.

This vision has been further advanced by the rise of modular blockchain design. While still unrealized, it received significant attention in 2022. Celestia and Polygon Avail are two new blockchains addressing data availability through modular architecture. Unlike existing blockchains, these networks do not validate transactions; instead, they focus on ensuring new blocks are added to the network via consensus and made available to all nodes. Early partners of Celestia demonstrate potential use cases: dYmension (allowing rollups to issue tokens and choose their data availability layer), AltLayer (high-throughput “one-off” rollups for NFT generation, later bridged to L1), and Eclipse (a rollup using Solana VM and IBC protocol).

4. Consolidation of MEV

In 2022, MEV became professionalized. Yes, anonymous developers still roam the dark forest, but it’s increasingly seen as a playground for the world’s most sophisticated traders. Flashbots, the leading player in MEV, grew even more successful in 2022 with the transition to PoS (nearly 90% of Ethereum validators now run MEV-boost). However, this success has also highlighted the centralization and censorship risks inherent in this market design.

The current reliance on Flashbots as a trusted intermediary is unsustainable. As we examined in last week’s deep dive, it’s clear that the MEV landscape will migrate from Ethereum to a dedicated network capable of balancing the benefits of MEV profit extraction with the need for democratization and decentralization of this market.

Flashbots’ answer is SUAVE, a brand-new blockchain designed to build blocks across any chain. It’s ambitious, yet conceptually similar to CoW Protocol’s approach of limiting MEV extraction via batch auctions, or Chainlink’s Fair Sequencing Service. All recognize that transaction ordering is critical to preserving blockchain’s credible neutrality and limiting rent extraction.

5. Where Are the New DeFi Applications?

Dose of DeFi launched in June 2019, as people and projects began rallying under the DeFi banner. 2020 validated core concepts. In 2021 and 2022, new projects and capital flooded into the space, but as we argued in our March piece, “Has DeFi Innovation Stalled?”:

It’s true—since 2021, it’s been hard to find any major DeFi innovations matching the impact of Uniswap (November 2018), Synthetix (January 2019), MakerDAO’s multi-collateral Dai (November 2019), Curve (January 2020), COMP yield farming (June 2020), or YFI governance distribution (July 2020).

Today, the most important and promising DeFi projects are almost all those launched over two years ago.

While not entirely inaccurate, this view focuses exclusively on the application layer—or end-user experience. In our opinion, this undervalues DeFi by reducing it to fintech, which is merely modern packaging for traditional financial systems.

DeFi is bigger than the application layer. It also includes an infrastructure layer and a market structure layer. And in these areas, 2022 has seen tremendous progress.

Current DeFi applications are built atop the infrastructure and market structures established in 2018.

While the entire industry spent 2022 researching and building the next generation of DeFi infrastructure and market structures, more progress is needed before innovation fully returns to the application layer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News