Last-Ditch Effort: A Brief Analysis of How the U.S. Election Impacts Crypto Market Trends

TechFlow Selected TechFlow Selected

Last-Ditch Effort: A Brief Analysis of How the U.S. Election Impacts Crypto Market Trends

Regardless of whether Trump or Harris wins the election, it will profoundly impact the development landscape of the cryptocurrency market.

Author: Viee, Core Contributor at Biteye

Editor: Crush, Core Contributor at Biteye

Today, November 5, marks the U.S. election "Election Night." The two candidates hold sharply contrasting policy positions, which will not only shape the future of the American economy but also profoundly impact the trajectory of the crypto market.

Will a Trump victory mean bullish for crypto?

Will a Harris victory mean bearish for crypto?

Is it really that simple?

In this article, Biteye analyzes how each candidate's policy agenda could affect the market to provide you with insights and reference.

01 Current State of the Election and Key Timelines

The 2024 U.S. presidential election has been full of drama and volatility. Looking back:

-

July 2024: Trump survives an assassination attempt, leading to a significant surge in public support—many view him as "chosen by fate." Biden withdraws from the race, and Vice President Harris takes over as the Democratic nominee.

-

August–September 2024: During this so-called "new player protection period," Harris briefly surpasses Trump in popularity polls.

-

October 2024: After the protection period ends, Harris performs poorly in several media interviews and falls behind Trump in policy messaging, causing her approval ratings to decline.

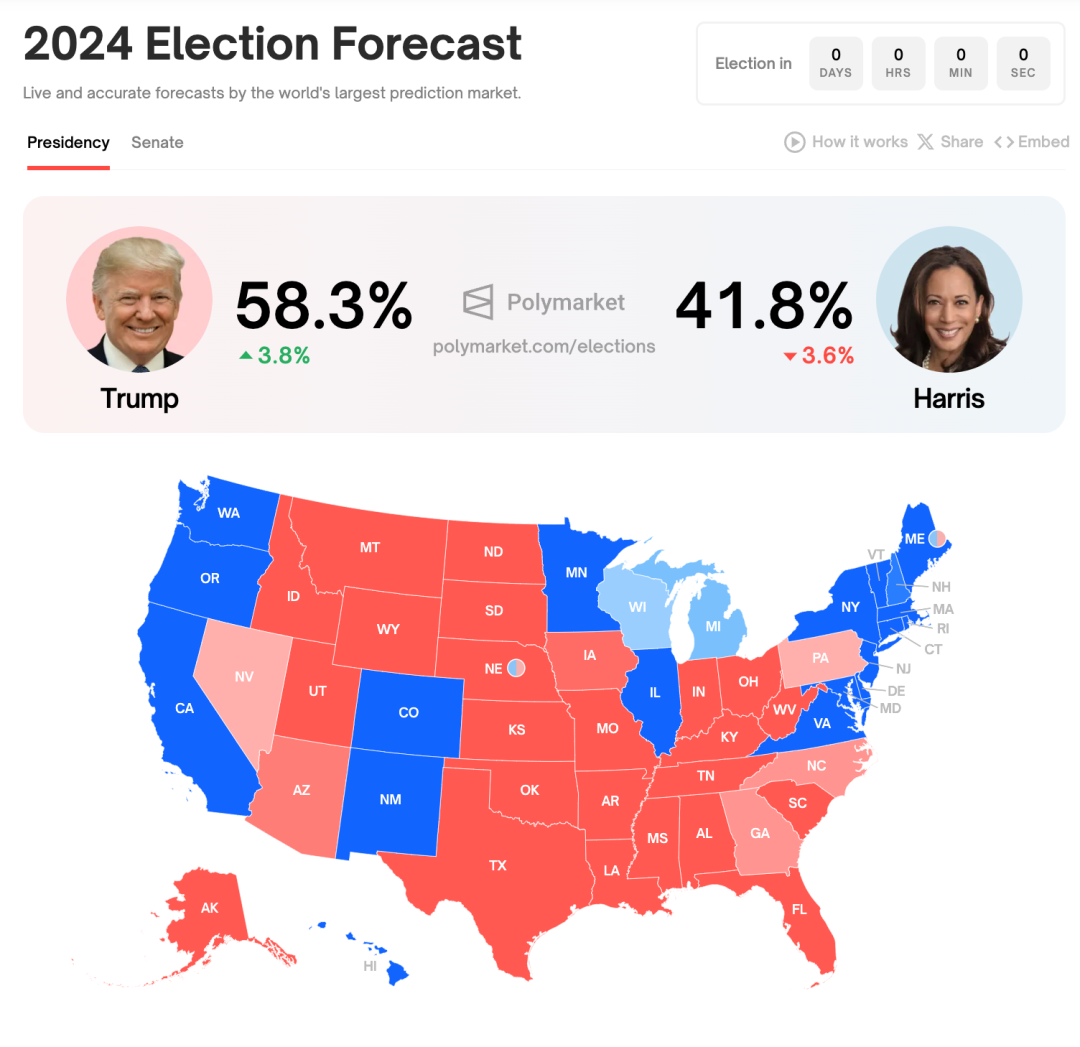

Currently: According to the latest polls, Trump holds a lead in several key swing states. However, due to the complexity of the Electoral College system, the final outcome remains unpredictable.

Below is the election timeline—the results will be revealed on November 6, giving us early insight into the direction of the crypto market over the coming months.

Source: 270towin, Minsheng Securities Research Institute

02 Policy Differences Between Trump and Harris

Analysis shows that the two candidates’ policy platforms have different implications for the cryptocurrency sector.

First, the most pressing question: Who benefits the crypto market?

Trump’s victory: Bullish for crypto markets. Trump’s policies favor tax cuts, deregulation, and encouraging capital inflows, which could boost crypto market activity—particularly in terms of investor sentiment and speculative trading.

Harris’s victory: Potentially bearish in the short term, but bullish long term. Harris supports tighter regulation and higher taxes, which may pressure the crypto industry in the near term. However, her focus on social welfare spending could foster broader economic stability and growth, indirectly benefiting the crypto market over time.

Trump’s crypto-friendly policy positions:

-

Taxation: Supports tax reductions, which can stimulate investment and consumption, increase market liquidity, and drive demand for high-risk assets like cryptocurrencies.

-

Fiscal Policy: Favors reduced government intervention and encourages free-market principles, potentially channeling more capital into financial markets.

-

Trade: Advocates higher tariffs, which could fuel inflation and prompt investors to turn to cryptocurrencies as a hedge. However, rising inflation expectations might also trigger interest rate hikes.

-

Crypto Regulation: Expresses support for cryptocurrencies, viewing them as part of the future financial system, and does not push for strict regulatory measures.

Harris’s crypto-supportive policies:

-

Fiscal Policy: Emphasizes social welfare spending such as child allowances and aid for low-income families, reflecting the Democratic preference for an active government. This could stimulate consumer demand and overall economic vitality. Although the crypto market may face stricter oversight, stronger macroeconomic fundamentals could eventually benefit digital assets.

Next, we analyze their tax proposals in detail:

-

Trump: Supports sweeping tax cuts—for example, reducing the corporate tax rate from 21% to 15%, and replacing income taxes with tariffs, including imposing a base tariff on imported goods and a 60% tariff on products from China. These aggressive tax cuts aim to stimulate investment and consumption, boost liquidity, and increase appetite for high-risk assets like crypto.

-

Harris: Proposes tax increases, particularly targeting large corporations and high earners, raising the corporate tax rate to 28% and increasing taxes on individuals earning over $400,000 annually. This aims to raise government revenue for social programs but could dampen investor confidence and reduce capital inflows.

-

Impact on crypto markets: Trump’s tax cuts could attract more capital into the U.S., energize market sentiment, and indirectly drive growth in the crypto sector. In contrast, Harris’s tax hikes may reduce market dynamism, especially diminishing the appeal of high-risk assets like cryptocurrencies.

03 Impact on BTC Price and the Crypto Market

Impact on Bitcoin price:

According to forecasts from Bernstein and other analysts, a Trump win could lead to a substantial rise in Bitcoin’s price, potentially reaching $80,000–$90,000 by year-end. Analysts at Standard Chartered are even more optimistic, predicting a price target of $125,000.

In contrast, a Harris victory could cause Bitcoin to fall below $50,000, with some estimates suggesting a drop toward $30,000.

Overall, there is a strong correlation between rising Trump support and increasing Bitcoin prices, while a Harris win may trigger short-term price corrections.

This stems from how each candidate’s policies directly influence market expectations and the future path of the crypto industry.

Short-Term Impact:

-

If Trump wins: Increased market volatility is expected, especially amid heightened policy uncertainty. Speculative trading could dominate. Tax cuts and lighter regulation would likely draw significant capital into the market, creating a short-term wave of inflows—benefiting not only BTC but also altcoins like DOGE.

-

If Harris wins: In the short term, the crypto market may face stricter regulations, potentially constraining its development. Investor sentiment could turn cautious, leading to lower liquidity and trading volumes. However, some voices (e.g., @milesdeutscher) argue that fears of Harris cracking down on utility tokens via bottleneck-style enforcement could spark a massive Meme Season—since memecoins are not classified as utility tokens, they fall outside SEC jurisdiction.

Long-Term Impact:

-

If Trump wins: Long-term, his policies could accelerate the development of the crypto market, especially supporting Bitcoin and blockchain applications. Tax reductions, higher tariffs, and deregulation may encourage more capital to flow into crypto, enhancing its status as a potential safe-haven asset.

-

If Harris wins: Over the long run, improved economic stability and a clearer, more structured regulatory framework could create a healthier environment for the crypto industry.

04 Conclusion

Whether Trump or Harris wins, the outcome will significantly shape the future of the crypto market. Trump’s platform favors market dynamism and capital mobility, while Harris emphasizes tighter regulation and higher taxation. For now, market participants should closely monitor the election results to adjust their investment strategies accordingly.

In this political contest, the crypto market will undoubtedly serve as a crucial barometer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News