U.S. election and Fed decision countdown intensifies, fueling heightened bullish-bearish confrontation

TechFlow Selected TechFlow Selected

U.S. election and Fed decision countdown intensifies, fueling heightened bullish-bearish confrontation

Investors' risk appetite has significantly decreased; prepare for expected volatility.

By BitpushNews

As the U.S. election enters the final countdown and the Federal Reserve's interest rate decision approaches, investor risk appetite has significantly declined, with market participants preparing for anticipated volatility.

Data shows that the Deribit Bitcoin Volatility Index has reached its highest level since late July. Similarly, the MOVE Index, which tracks implied volatility in U.S. Treasuries, rose last Friday to its highest point since October 2023.

Fed Watch data indicates a 98% probability priced in by traders for a rate cut announcement at this week’s Fed meeting. Post-meeting remarks from Chair Powell will also be closely watched, as his comments will directly influence market expectations for future monetary policy and could trigger market turbulence.

According to Bitpush data, Bitcoin traded above $68,500 during the morning session but came under pressure in the afternoon, falling to an intraday low of $66,803. At the time of writing, it was trading at $67,807, down 1.44% over the past 24 hours.

In the altcoin market, losses dominated gains. THORChain (RUNE) corrected by 16%, Popcat (POPCAT) dropped 12.6%, and Ponke (PONKE) fell 12.3%.

The total cryptocurrency market capitalization currently stands at $2.21 trillion, with Bitcoin’s market dominance at 59.41%.

U.S. equities closed lower on the day, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite declining 0.27%, 0.60%, and 0.32%, respectively.

Bitcoin Options Market Reflects Mild Optimism

In the options market, QCP Capital reported increased buying in $75,000 call options expiring by the end of November, reflecting growing demand for upside exposure. Analysts noted that election-related options have also seen increased activity, with implied volatility spiking.

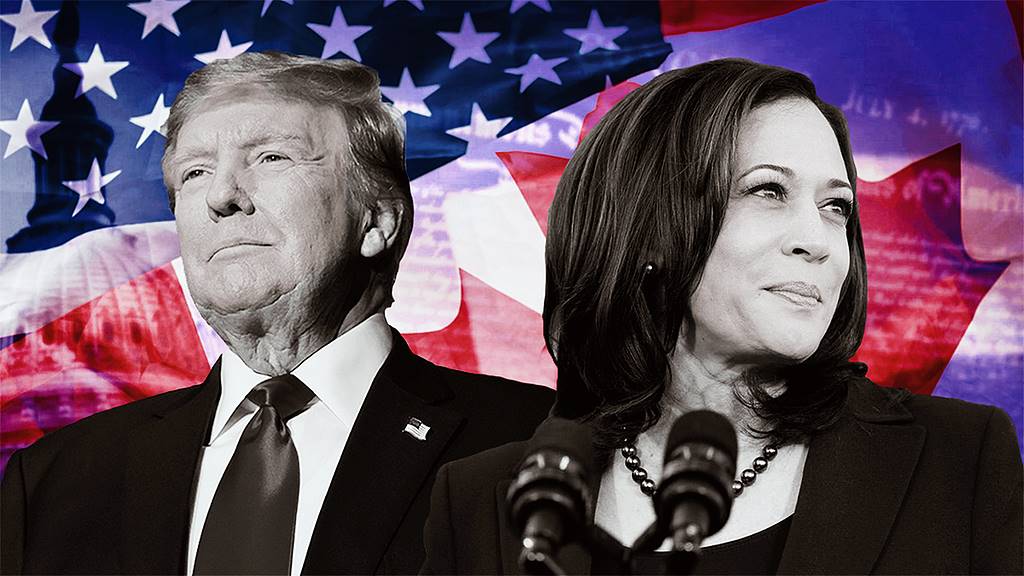

Coinglass data shows that BTC open interest currently stands at 582,000 contracts, unchanged from the previous week and 10% higher than levels one month ago. This suggests that despite recent uncertainty and price pullbacks, investors are still increasing leveraged positions. Combined with top traders’ long/short data, this reflects mild bullish sentiment—indicating that even after Bitcoin surged above $73,500 on October 29, professional investors remain optimistic about Bitcoin’s long-term outlook and are actively positioning themselves.

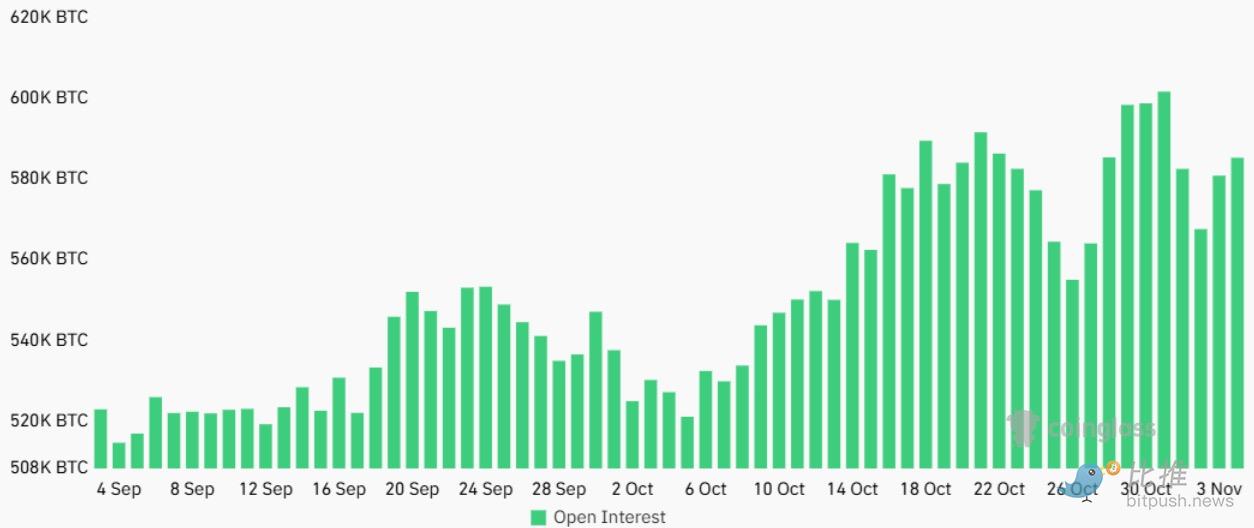

V-Shaped Reversal After Testing $66,000?

Chart analysts note that Bitcoin broke below the $68,500 level on the daily chart, with the next key area to watch now around $65,000–$66,000.

On-chain analyst Skew pointed out that during the most recent bullish rally, the Bitcoin market saw sustained demand around the $65,000–$66,000 range, which helped push prices above $70,000 by the end of October.

Analysts say Binance platform data revealed strong buying pressure in the $66,000–$67,000 range, driving Bitcoin above $69,000. The high liquidity in this zone suggests that market participants expect strong support and resistance levels here, meaning future price action may continue to revolve around this range.

As shown in the chart below, the $66,000–$67,000 range previously acted as a key resistance level multiple times before being breached. Therefore, following the U.S. election results, this critical zone could provide support for a potential V-shaped reversal in Bitcoin.

Bitfinex analysts stated: "Ahead of the election, markets perceive a Republican victory as favorable for BTC, while a Democratic win introduces greater uncertainty. The average betting odds for a Trump victory have declined from 64.9% to 56%."

They added: "Although there is broad anticipation of heightened volatility ahead of the U.S. election on November 5, many market participants appear hesitant to act and are instead adopting a wait-and-see approach. Even with last week’s pullback, Bitcoin’s overall rebound from its September lows remains significant. In short, current market dynamics suggest the coming week will be an exciting one. Whether you’re a trader, investor, or casual observer, the road to Election Day will not be uneventful for the crypto market."

Kippsten, CEO of Swan Bitcoin, also expects volatility to surge. He said: "The recent surge in Bitcoin’s price, nearing all-time highs, can be attributed to investor optimism surrounding the election, as both campaigns have been actively engaged, and substantial capital has flowed into Bitcoin ETFs. A Trump victory could lead to a short-term spike in Bitcoin’s price, potentially breaking through $80,000 or even $90,000. If Trump fulfills his Bitcoin commitments, it could accelerate adoption of Bitcoin by individuals, corporations, and even nation-states."

He added: "A Harris victory might result in a more moderate response, with Bitcoin’s price stabilizing in the short term or experiencing a more gradual rise. The Harris administration is still viewed positively toward Bitcoin and may foster a friendlier environment with greater legal and regulatory clarity."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News