At the last moment, U.S. bonds "bet on Harris," Bitcoin "bets on Trump"

TechFlow Selected TechFlow Selected

At the last moment, U.S. bonds "bet on Harris," Bitcoin "bets on Trump"

Bonds fear a broad sell-off, but crypto wins either way?

Author: Zhao Ying, Wall Street Insights

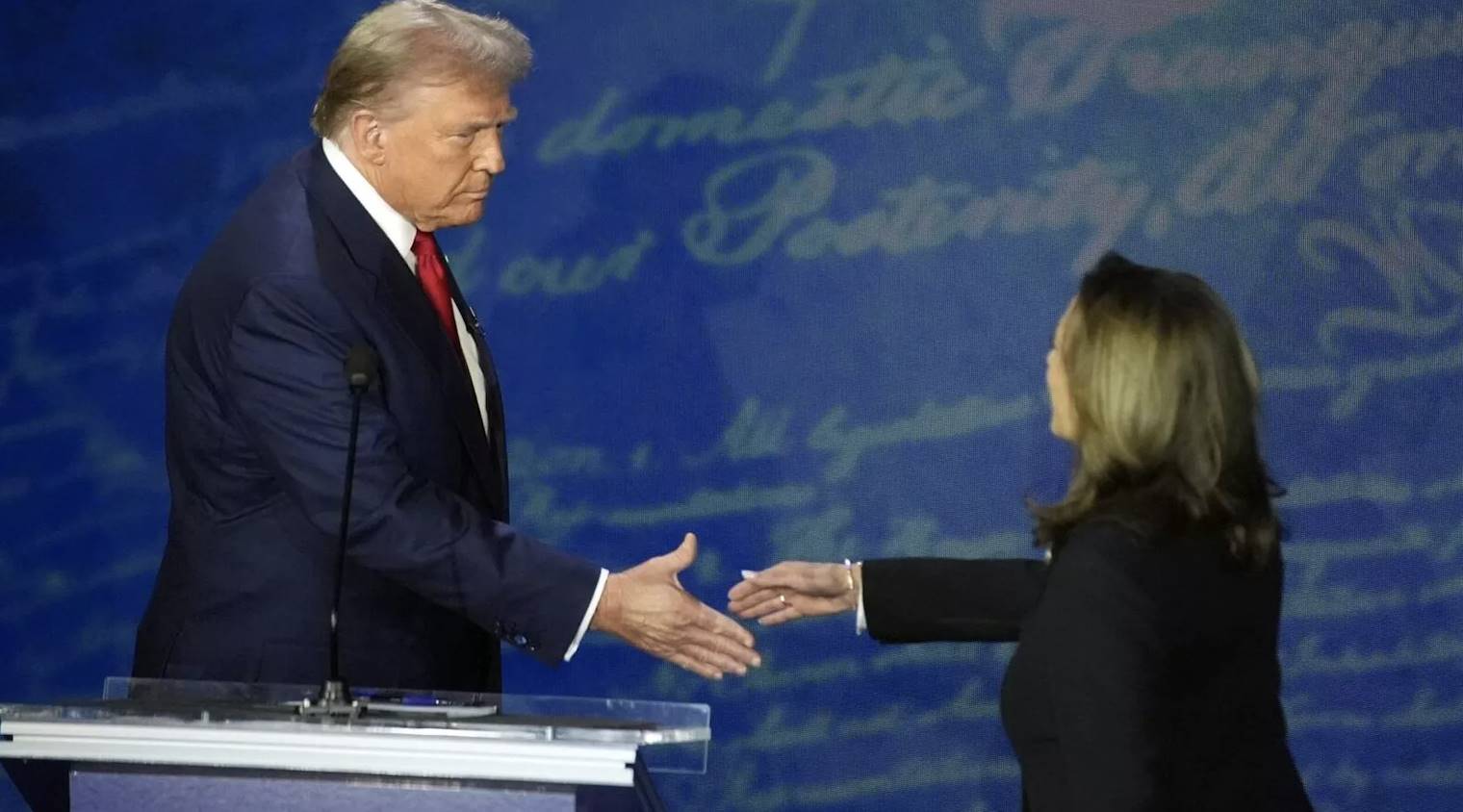

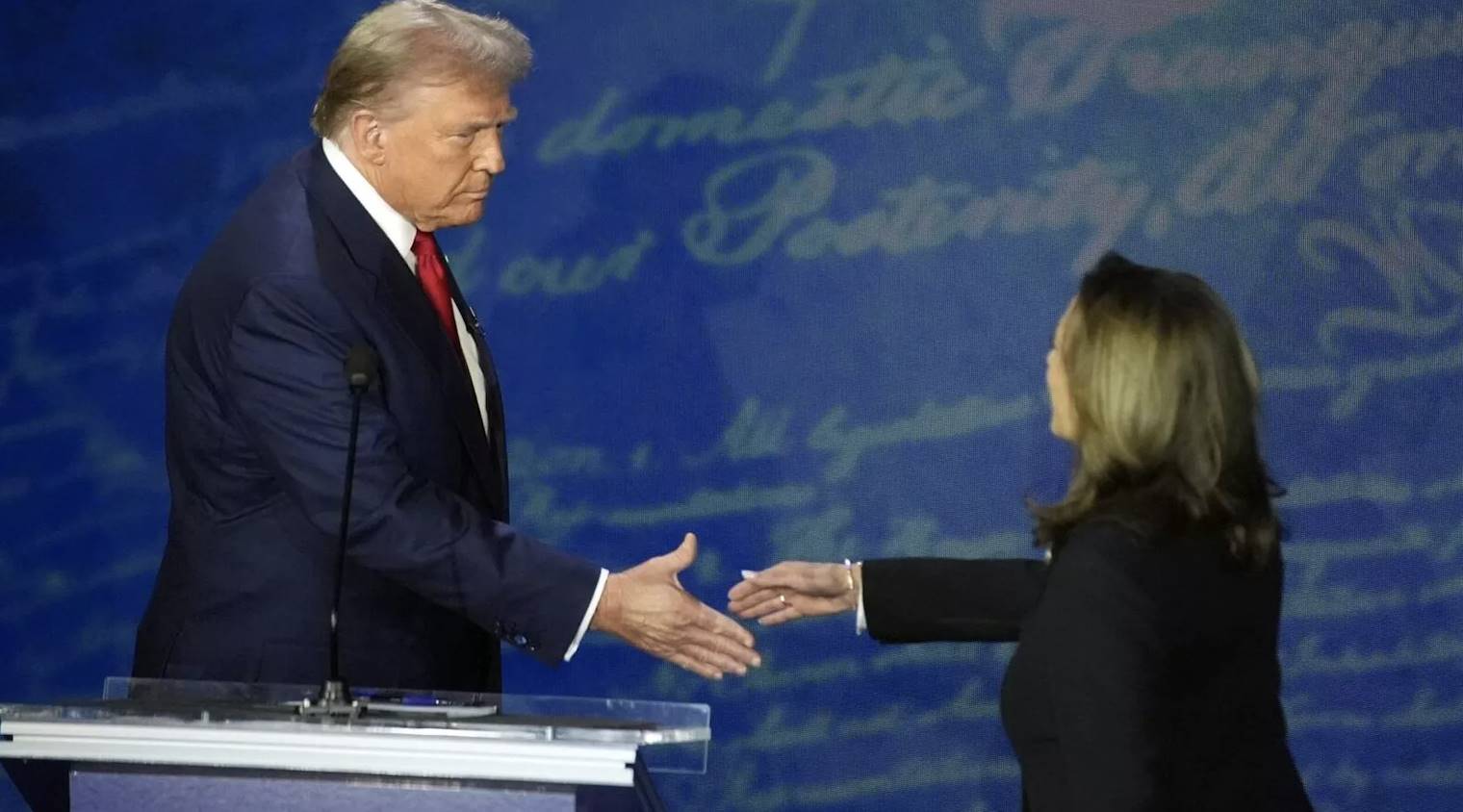

The U.S. presidential election remains extremely tight, shaping up to be one of the most evenly matched in history. Markets are positioning for different outcomes, with U.S. Treasuries shifting toward a "Harris bet" at the last minute, while Bitcoin continues to back Trump.

On Wednesday, as the U.S. election entered the vote-counting phase, bond traders ramped up bullish bets on U.S. Treasuries in the final moments. Options, futures, and cash positions all turned upward, increasing wagers on Kamala Harris potentially winning the election.

Meanwhile, Bitcoin remained firmly in Trump's camp, extending its gains by over 2% on Wednesday to trade at $71,033, marking its largest weekly gain.

Analysts suggest that bonds fear a Republican sweep—Trump’s plans for tax cuts and tariffs would widen fiscal deficits and reignite inflation, pushing up yields on 10-year U.S. Treasury notes. In contrast, cryptocurrencies could win under either scenario. Trump is clearly pro-crypto, while Harris has signaled she won’t continue Biden’s aggressive crackdown on the industry.

Treasuries Shift Toward "Backing Harris"

Bond investors are heavily entering trades that benefit from rising Treasury prices, betting this outcome is more likely if Harris wins, while reducing their positions against a Trump victory.

Since Monday, U.S. options activity has been dominated by short-term bullish bets, as weekend polls showed Harris gaining an edge over Trump. Traders are positioning themselves ahead of a possible Harris win.

A similar shift is visible in the futures market, where new long positions emerged on Monday, including notably increased demand for longer-dated bonds. For the week ended October 29, asset management firms increased their net long position in 10-year Treasury futures by approximately 182,000 contracts.

In addition, according to JPMorgan’s latest client survey, net long positions in U.S. Treasuries are at their highest level in about three months—another sign of shifting market sentiment.

These moves mark a clear reversal for traders who had previously built bearish positions anticipating a Trump victory. With opinion polls showing a deadlocked race, investors are now preparing for the opposite outcome and bracing for market volatility.

Bitcoin Still "Stands With Trump"

On Wednesday, Bitcoin extended its gains beyond 2%, reaching $71,033—the biggest weekly increase in a week—and now sits less than 5% below its March peak.

As Trump supports digital assets, the rally in Bitcoin is seen as part of the so-called "Trump trade."

Trump has pledged that, if re-elected, he will make the U.S. the global hub for cryptocurrency, establish a strategic Bitcoin reserve, and appoint regulators friendly to digital assets—positioning himself as the most pro-industry candidate. Harris, by contrast, has taken a more cautious approach, promising support for a regulated framework for the sector.

Bonds Fear a Sweep, Crypto Wins Either Way?

Overall, the bond market fears a Republican sweep, whereas cryptocurrencies are expected to perform well regardless of the outcome.

Analysts view a sweeping Republican victory as an “explicit threat” to bondholders. With unified control of Congress and the White House, Trump would likely advance tax cuts and tariff policies, expand fiscal deficits, and reignite inflation—pushing up 10-year Treasury yields and potentially driving further declines in bond prices.

Conversely, a Harris victory under a divided Congress could trigger a relief rally, increasing the likelihood of legislative gridlock that may help contain government spending.

Other scenarios remain highly debated. Strategists at JPMorgan expect that a unified Democratic government and Congress would lead to higher government spending, pushing yields upward. However, RBC Capital argues such a scenario would be most favorable for bonds due to potential corporate tax hikes, creating a less business-friendly environment and dampening risk appetite.

For cryptocurrencies, analysts believe Bitcoin stands to benefit from a Trump victory. As a strong crypto advocate, Trump has vowed to create a strategic reserve of the original cryptocurrency and appoint industry-friendly regulators. Yet a Harris win isn't necessarily negative—she has indicated she won’t pursue Biden-style aggressive enforcement against the sector.

In the short term, investor optimism around crypto may have already been partially priced in. Bitcoin has reclaimed the $70,000 level, spot Bitcoin exchange-traded funds have seen record inflows, and with the election still too close to call, hedging demand in the crypto options market has surged significantly.

Bloomberg data shows that on Monday, 12 Bitcoin ETFs managed by BlackRock, Fidelity, and others saw a record outflow of $579.5 million. Option pricing implies an expected market move of 8% the day after the election.

Additionally, options traders are preparing for substantial future gains. According to data from Deribit, the largest crypto options exchange, for contracts expiring in March, the largest open interest is concentrated around strike prices of $100,000 and $110,000.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News