After the airdrop "wealth-creation illusion" shatters, how should funds withdrawn from Scroll be allocated?

TechFlow Selected TechFlow Selected

After the airdrop "wealth-creation illusion" shatters, how should funds withdrawn from Scroll be allocated?

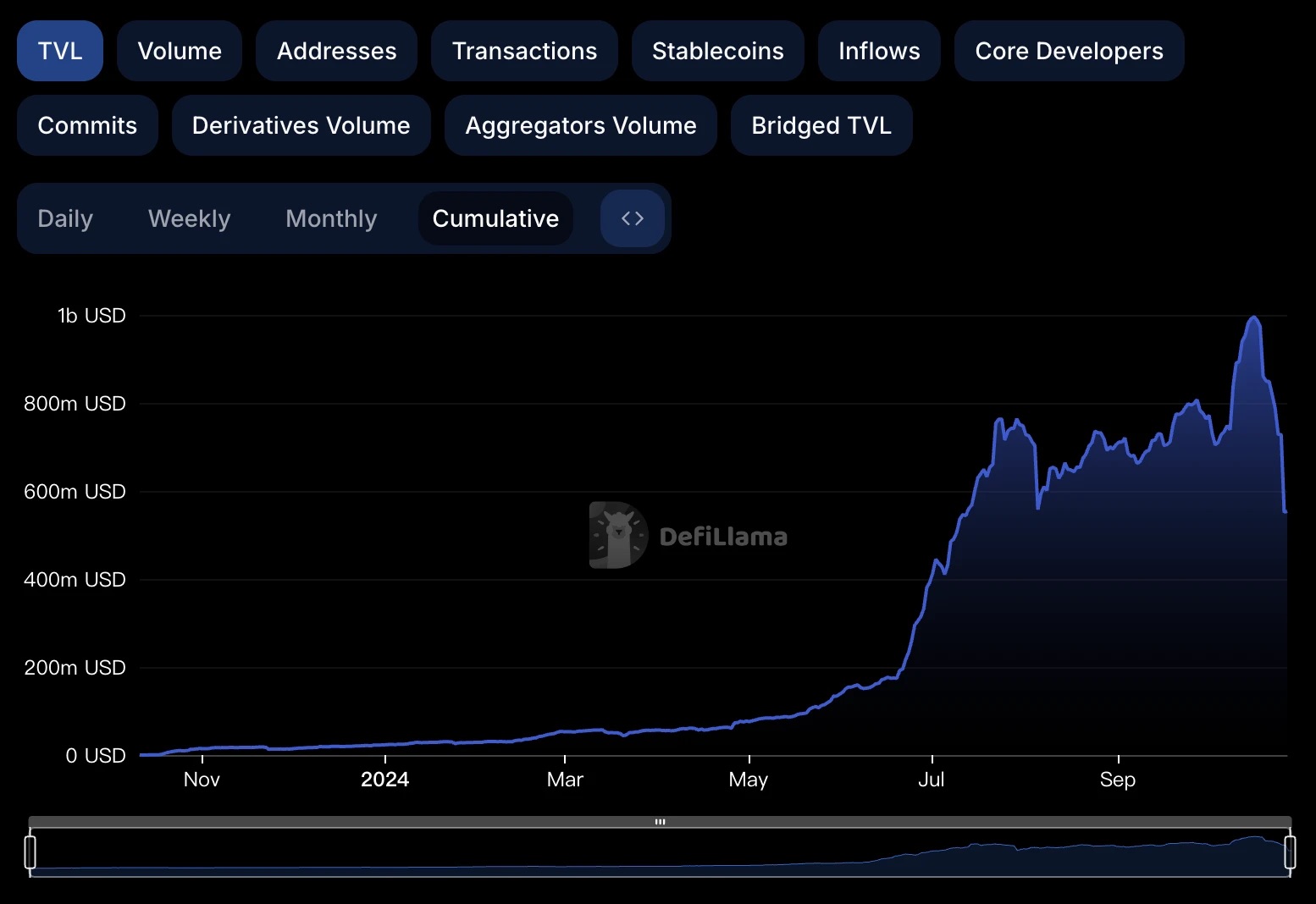

Just one week after the airdrop, Scroll's TVL has nearly halved.

Written by: Azuma, Odaily Planet Daily

Scroll officially launched its first season airdrop last week, but the overall returns have been disappointing. Many users are calling it "anti-farming," with some even claiming that Scroll has ended the wealth-creation era of airdrops.

I’ve also roughly calculated my personal return rate. In total, I had deployed approximately $10,000 worth of ETH and USDC on the Scroll network (mostly in Aave, a smaller portion in Pencils Protocol) over about six months (counting only from April when the Session Zero points program started; actual interactions began earlier). The final airdrop yield was slightly below $500 (due to the small amount, I claimed late, missing an optimal sell point). Excluding gas and transfer costs, this translates to an annualized return of around 10%. However, factoring in the significant entry and exit costs during early participation, the real return is likely lower—possibly even beneath typical on-chain DeFi yields today.

With the airdrop finalized, a large outflow of capital is now leaving Scroll. According to DefiLlama, Scroll’s total value locked (TVL) currently stands at about $550 million, down 44.6% from its all-time high of $991 million on October 16—just three days before the airdrop snapshot—approaching a near 50% decline.

Facing this exodus of real capital, some ecosystems are openly reaching out to attract these mobile funds. Victor Ji, co-founder of Manta Network, echoed Scroll’s earlier mockery of Blast, suggesting disappointed Scroll users try Manta’s Gas Gain campaign instead.

A few days ago, I personally withdrew my funds from Scroll, so I’m now facing the question of where to redeploy this capital.

Below, I’ll outline several high-yield opportunities across major ecosystems, prioritizing “no-loss” interest-bearing strategies, while not ruling out additional potential airdrop gains. It should be emphasized that for safety and manageability, this article will focus only on basic operations within top-tier protocols of each ecosystem. Nonetheless, on-chain risks remain omnipresent—users must always take responsibility for their own funds. DYOR.

Since most of the funds withdrawn from Scroll are in ETH and stablecoins, this analysis will focus exclusively on these two assets.

ETH

ETH is currently at a crossroads. Weak market sentiment has led many users to reconsider holding. If you’re not planning to reduce your ETH position in the short term, consider actively putting your ETH to work to generate yield and boost returns.

Given the current state of Ethereum’s ecosystem development, the most promising yield opportunities still lie in restaking. Following EigenLayer’s token launch, greater attention can now shift to emerging players like Symbiotic and Karak—especially Symbiotic, backed by Lido and Paradigm, which faces less competition.

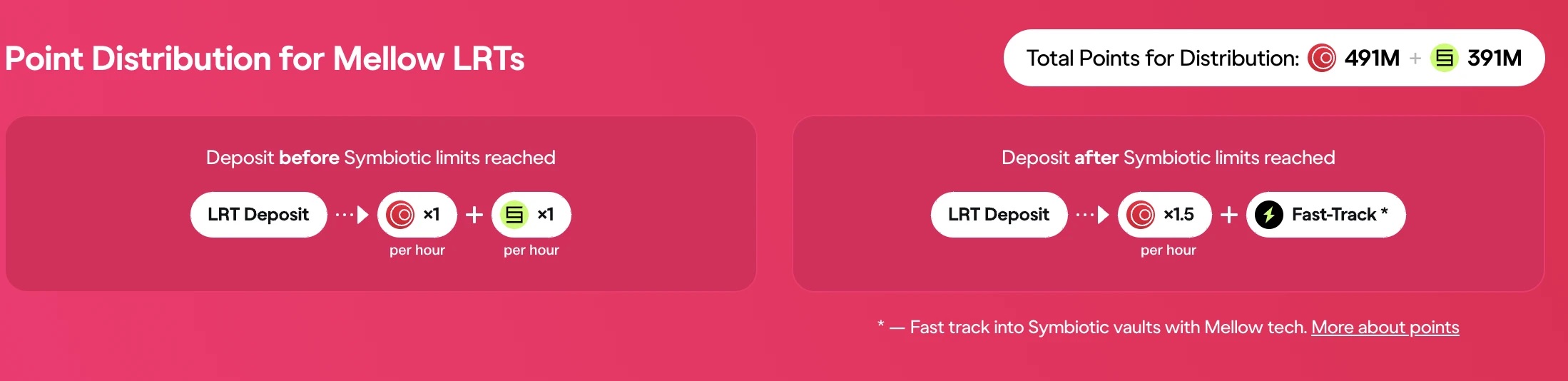

For Symbiotic, users can deposit directly or use liquid restaking protocols (LRTs) such as Mellow Finance (also supported by ether.fi and Renzo). Two reasons: First, many of Symbiotic’s major LST pools are full—LRTs can help manage allocations or wait for capacity to reopen. Second, using an LRT allows you to earn both Symbiotic and the LRT protocol’s native points, amplifying airdrop expectations.

Take Mellow as an example: after depositing, if your funds haven’t yet entered Symbiotic, you earn Mellow points at 1.5x speed. Once your funds are in, you earn points from both Symbiotic and Mellow, plus base ETH staking yield (~3%).

Stablecoins

Stablecoins offer far more deployment options than ETH. With market conditions showing signs of recovery, deposit yields in lending markets and perpetual funding rates have improved, creating attractive stablecoin yield opportunities across multiple ecosystems.

Ethereum Mainnet

On Ethereum mainnet, two pools stand out for now.

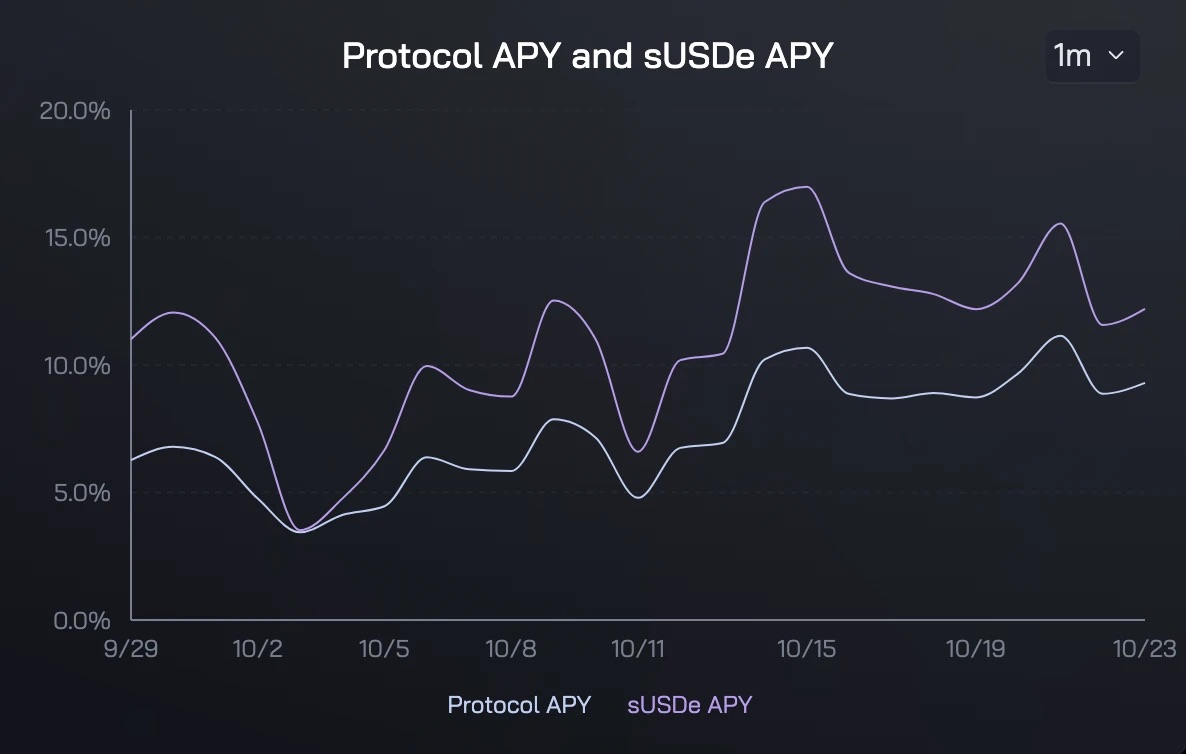

The first is Ethena’s sUSDe—the minted, staked version of USDe. As funding rates rebound, sUSDe’s yield has climbed back to 13%.

In addition, simply holding sUSDe accumulates Ethena points passively, which may be redeemable in a future Ethena airdrop. Users can also deposit sUSDe into Symbiotic (currently full—need to monitor availability) to earn additional Symbiotic points.

The second option is Sky (formerly Maker)’s USDS. Users can deposit directly on Spark or in Aave’s USDS market to earn ~6.5% in pure stablecoin yield.

Additionally, Sky founder Rune Christensen has hinted at SKY token incentives for deposits in these two markets. However, there's uncertainty: the Sky community is considering reverting the name back to Maker, and one proposal suggests abandoning the new SKY token entirely, reinstating MKR as the sole governance token. Users should stay tuned.

Solana

Solana hosts my favorite “dollar-cost averaging tool”—JLP, an index token combining BTC, ETH, SOL, USDT, and USDC, with built-in yield generation. However, given SOL’s recent surge, I don’t recommend buying JLP directly with stablecoins right now. Odaily’s PVP expert Nan Zhi suggested timing JLP rebalances based on SOL’s relative highs and lows—stay tuned to our “Editorial Desk Playbook” series for details.

After a year of active trading, you might find you’d have done better just holding JLP and doing nothing.

Alternatively, I recommend simply depositing PYUSD on marginfi or Kamino for yield. Current rates are ~7% on marginfi and ~9% on Kamino. Both accrue points, though marginfi—which hasn’t launched a token yet—may offer higher airdrop potential compared to Kamino, which has already conducted two airdrops.

For users willing to actively manage health ratios, borrowing SOL against deposits and re-depositing into popular pre-token Solana protocols like Solayer could yield additional airdrop rewards. While borrowing SOL incurs ~6% interest, this is typically offset by staking rewards (~8%) earned on the redeposited SOL.

Sui

Sui recently sparked excitement in secondary markets, and its major DeFi protocols now offer relatively solid yields.

With native USDC now live on Sui, I recommend using native USDC to deposit directly on NAVI or Scallop, avoiding counterparty risks associated with bridged stablecoins.

Current native USDC yields are 7% on NAVI (yield composed of stablecoin + NAVI + SUI rewards) and 8% on Scallop (purely stablecoin yield).

Starknet

Despite lackluster token performance, Starknet’s DeFi Spring remains appealing—rough calculations suggest farming yields here may even exceed those from Scroll over a similar timeframe.

Currently, Starknet’s two major lending protocols, zkLend and Nostra, offer close to 10% APY on USDC and USDT deposits. Rewards are primarily paid in STRK, which can be used to cover gas fees on the network (eliminating the need to hold ETH for gas—more convenient).

Notably, STRK’s price has entered a low-volatility phase. For users interested in managing LP positions, providing STRK-ETH liquidity via EKUBO can yield up to 70%+ in returns.

Other Potential Yield Opportunities

The above covers only a few mainstream yield strategies in select ecosystems, chosen for safety and ease of replication.

In reality, the on-chain landscape offers abundant yield opportunities. For instance, zkSync Era is about to launch a $300 million ZK incentive program—nearly matching Scroll’s airdrop in scale. Additionally, users can leverage Pendle’s yield-tranching mechanism to lock in higher fixed yields.

Still, we must emphasize: on-chain risks are everywhere. Always secure your own assets. DYOR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News