Restaking on-chain special report: Number of participants down 90% since February, fewer than 1,000 per day

TechFlow Selected TechFlow Selected

Restaking on-chain special report: Number of participants down 90% since February, fewer than 1,000 per day

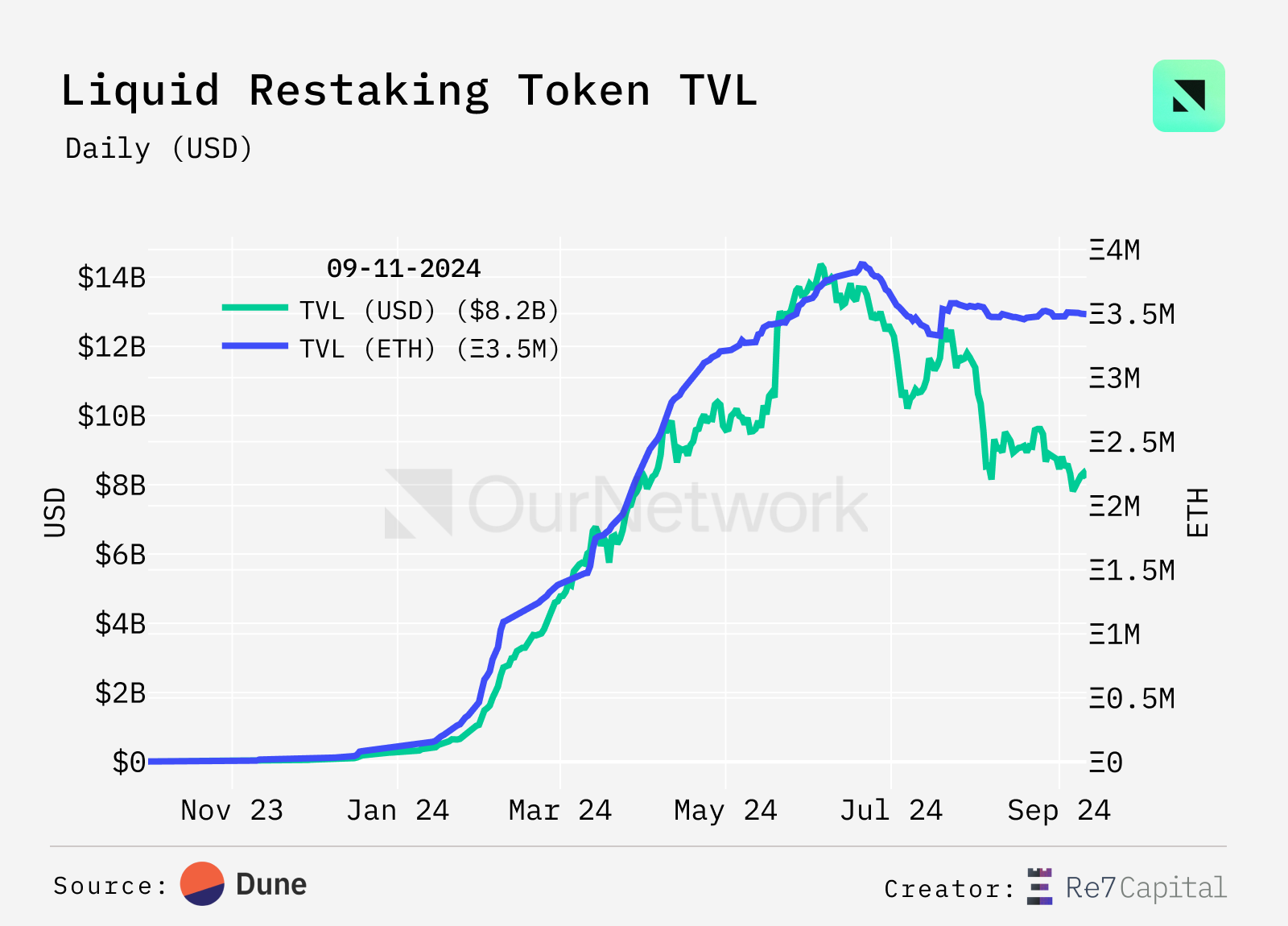

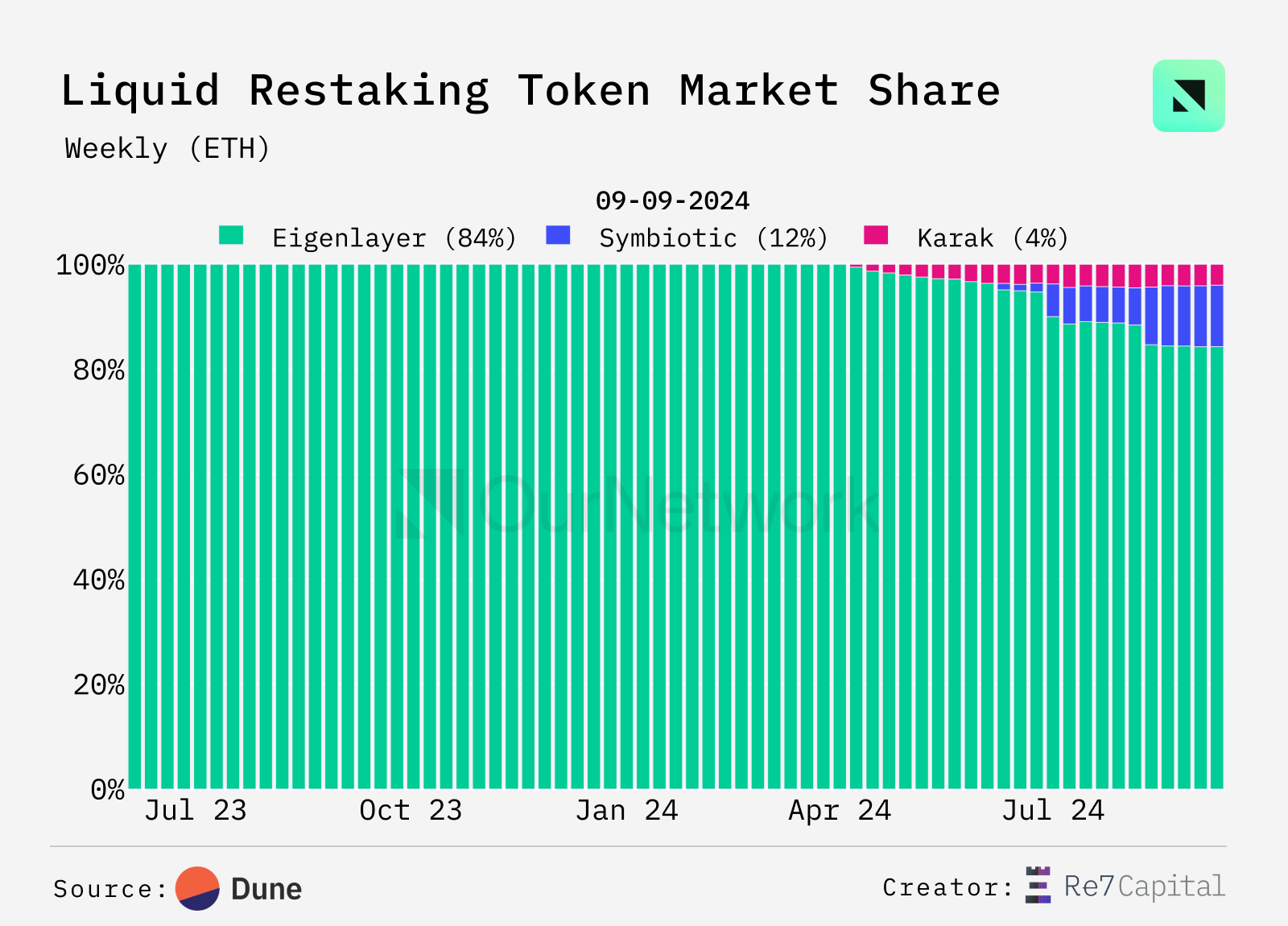

Since June, ETH's TVL in restaking has grown by 30%, with fewer than 1,000 daily users participating in restaking; EigenLayer holds 84% of the market share.

Author: OurNetwork

Translation: TechFlow

Restaking

EigenLayer | Ether.fi | Swell | Symbiotic | Karak

Since June, ETH total value locked (TVL) in restaking has grown by 30%, with fewer than 1,000 daily users participating; EigenLayer holds 84% market share.

-

Restaking protocols aim to increase yield on staked assets by supporting external systems, typically known as Active Validation Services (AVS). These protocols have given rise to billions of dollars in Liquid Restaking Tokens (LRT), representing deposits within restaking protocols. Interest in restaking increased during the first half of 2024 but has since stabilized—USD-denominated total ETH staked across restaking protocols has declined by 38% from its peak in June. After adjusting for ETH-USD volatility, the amount of staked ETH units has remained stable, with very limited net new inflows. Currently, there are 23 AVSs, and liquid restaking accounts for 75% of total TVL.

-

EigenLayer is the leading restaking protocol, holding 84% market share. Emerging protocol Symbiotic ranks second with 12%, while Karak comes third with 4%. As of September 12, EigenLayer experienced a net outflow of -94,000 ETH, approximately $222 million. Karak also saw an outflow of -14,000 ETH, around $33 million, during the same period. Symbiotic was the only protocol with positive growth, increasing by +253,000 ETH, roughly $598 million.

-

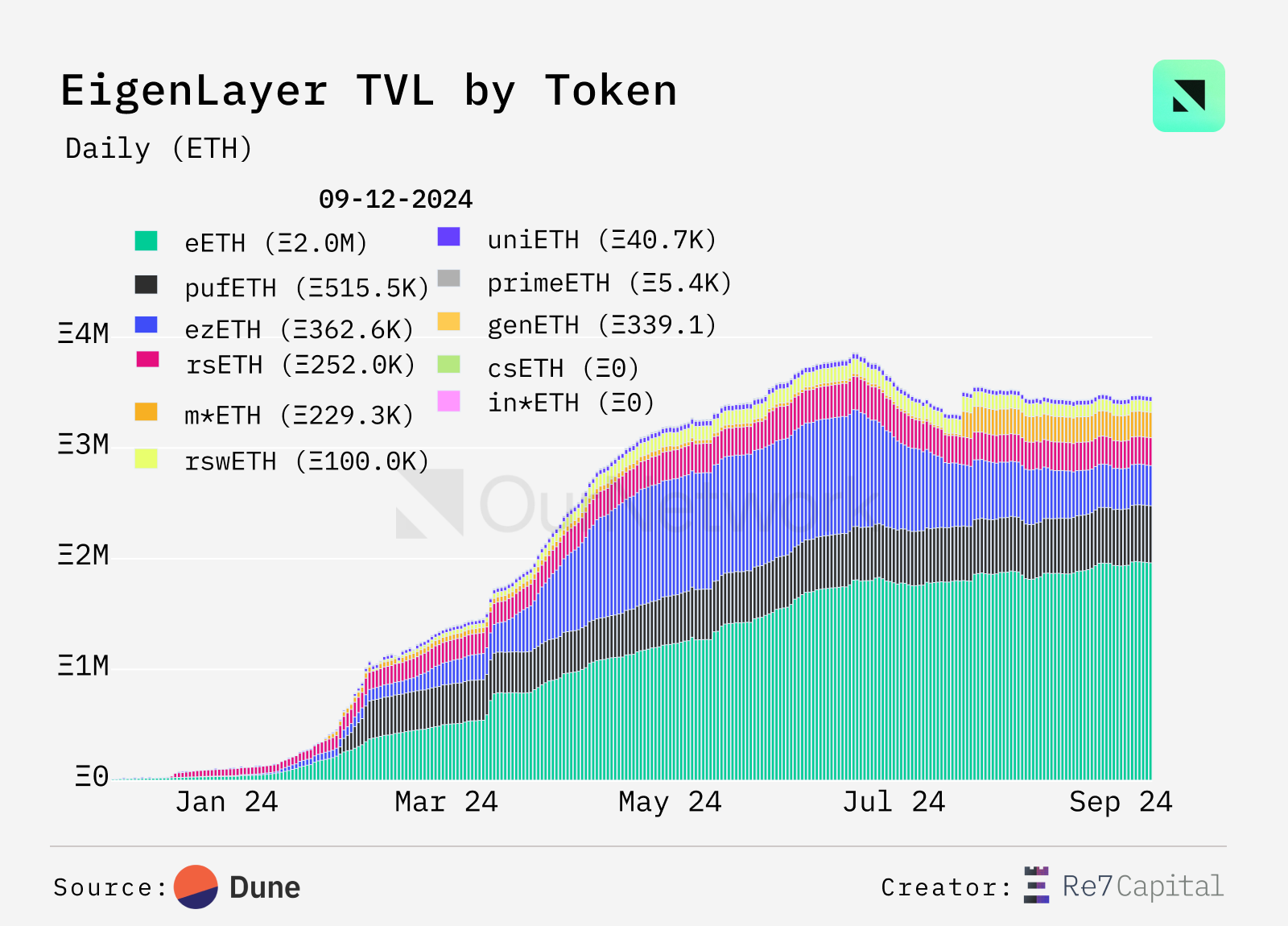

Users can deposit directly into EigenLayer using ETH and LSTs or indirectly through liquid restaking projects like Ether.fi. Liquid restaking protocols issue a liquid token called LRT, representing claims on restaked assets within protocols such as EigenLayer—Ether.fi’s eETH is the largest EigenLayer-backed LRT, with 1.96 million issued and a market cap of $804 million. Puffer’s pufETH has issued 515,000, and Renzo’s ezETH has issued 363,000.

-

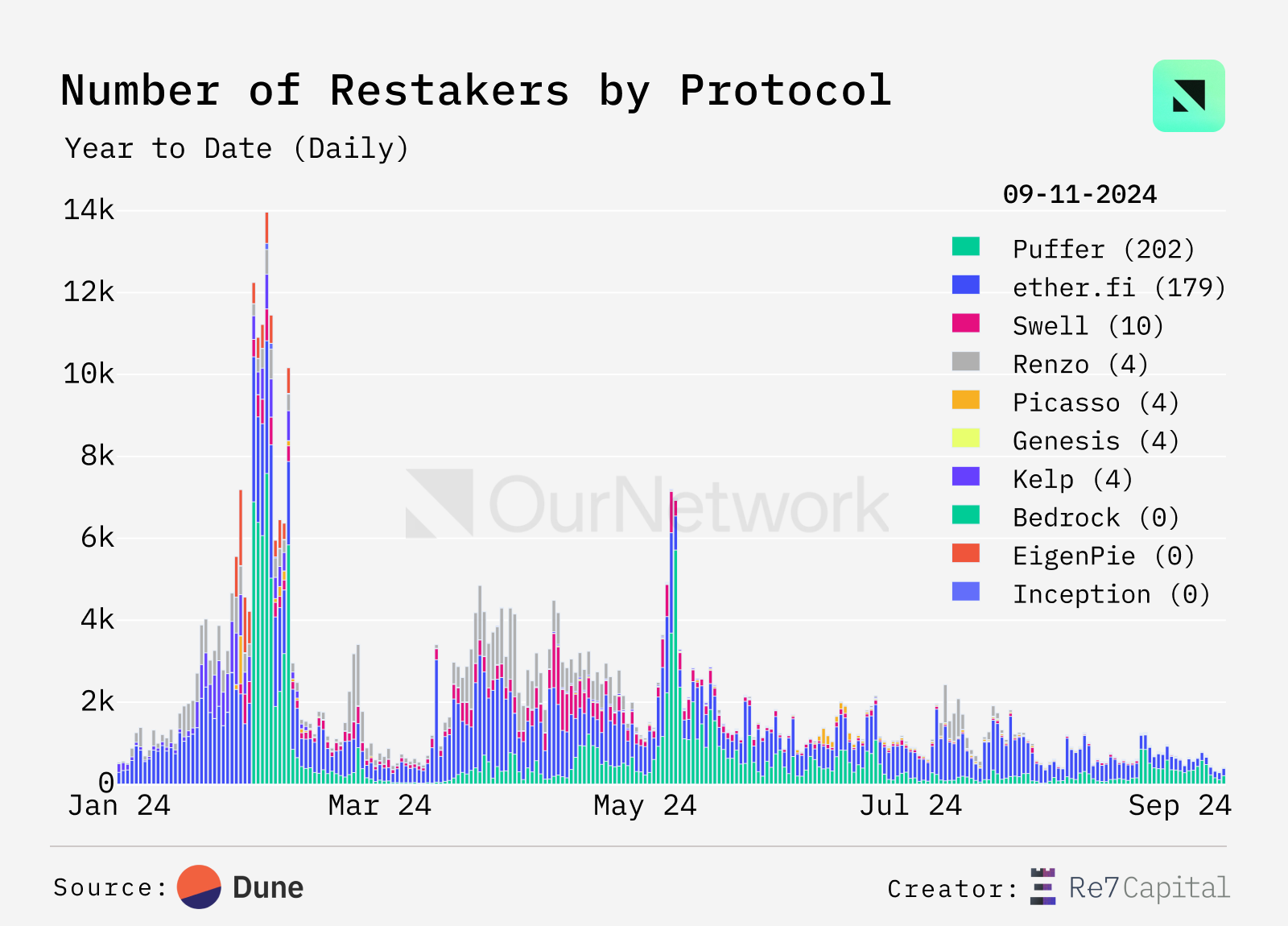

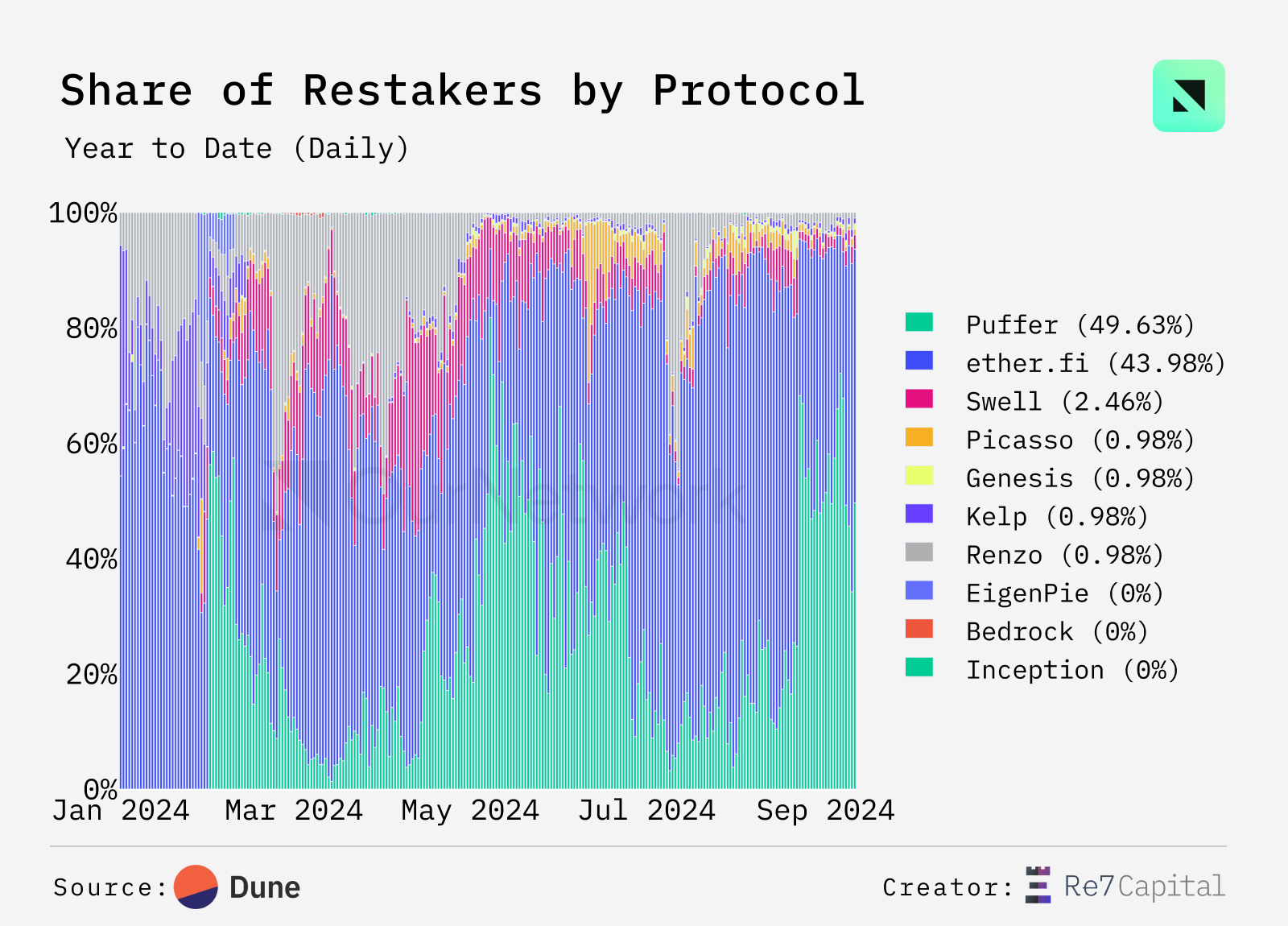

The number of liquid restakers has dropped 90% from a peak of 10,000 in February. Among the remaining ~1,000 individuals, the vast majority (over 95%) operate via Ether.fi and Puffer.

-

Transaction highlight: This was the initial funding transaction for Kiln, which operates as an AVS operator (AVS operators use restaked assets for validation). Today, this address has become one of EigenLayer's top operators, managing over 39,000 ETH and 5,400 delegators.

Ether.fi

Matt Casto | Website | Dashboard

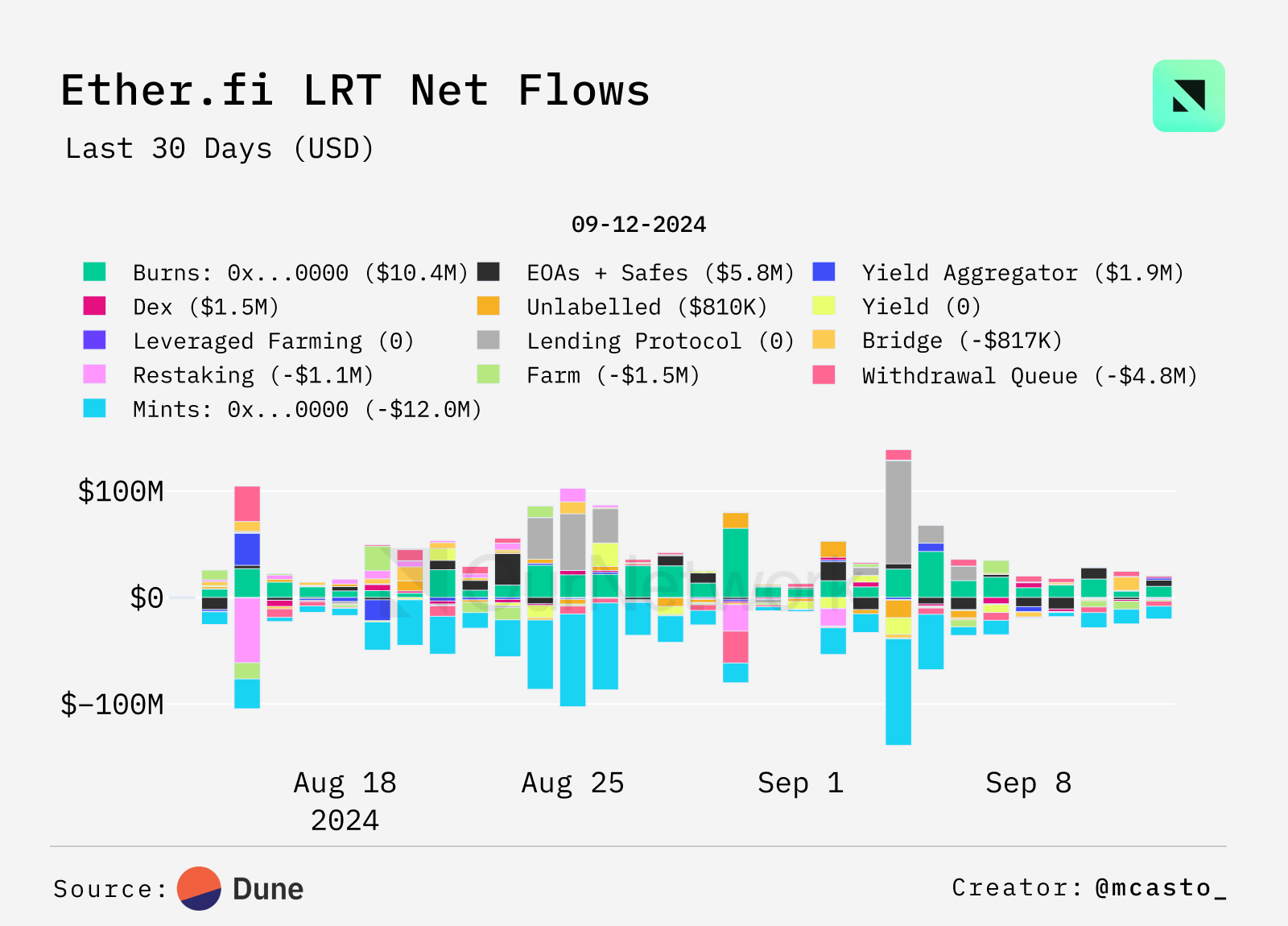

In the past month, lending protocols became the largest beneficiaries of weETH/eETH liquidity flows

-

Over the past month, lending protocols saw the highest net inflow of Ether.fi’s weETH/eETH (the leading LRT), totaling $252 million. During the same period, users allocated $52 million to bridge protocols and $39 million to EOAs and Safes. The largest net outflows came from restaking, down $52 million, primarily due to a significant $61 million outflow on August 15. This coincided with the launch of Ether.fi’s other LRT, eBTC, and supply may have been redirected toward Symbiotic’s eBTC/weETH, potentially explaining part of the outflow.

-

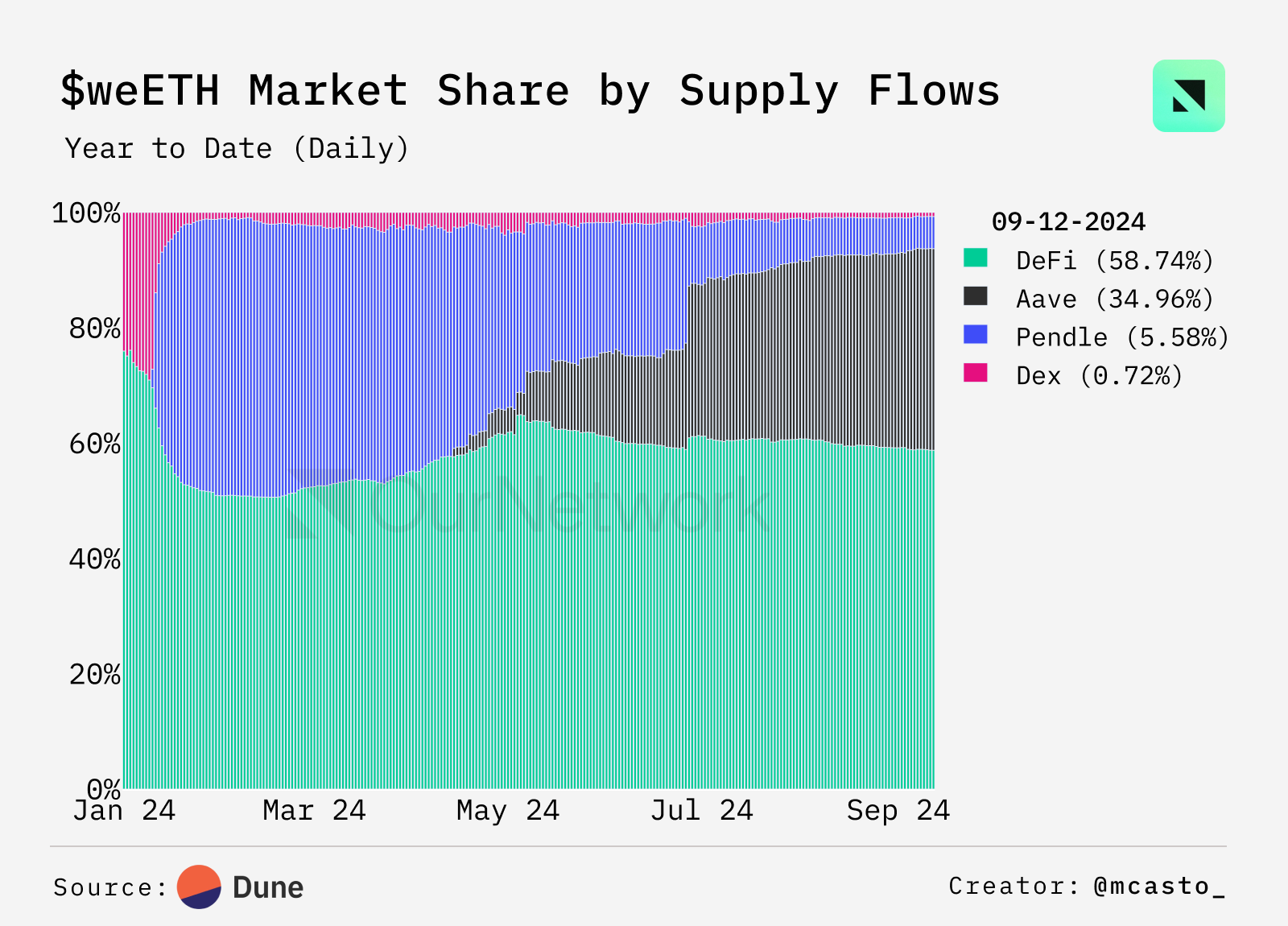

So far this year, Aave has seen the largest growth in weETH supply liquidity, increasing its market share from 1.4% at launch in mid-April to 35% today. This growth is largely driven by user looping strategies and strong demand for borrowing stablecoins using weETH as collateral.

-

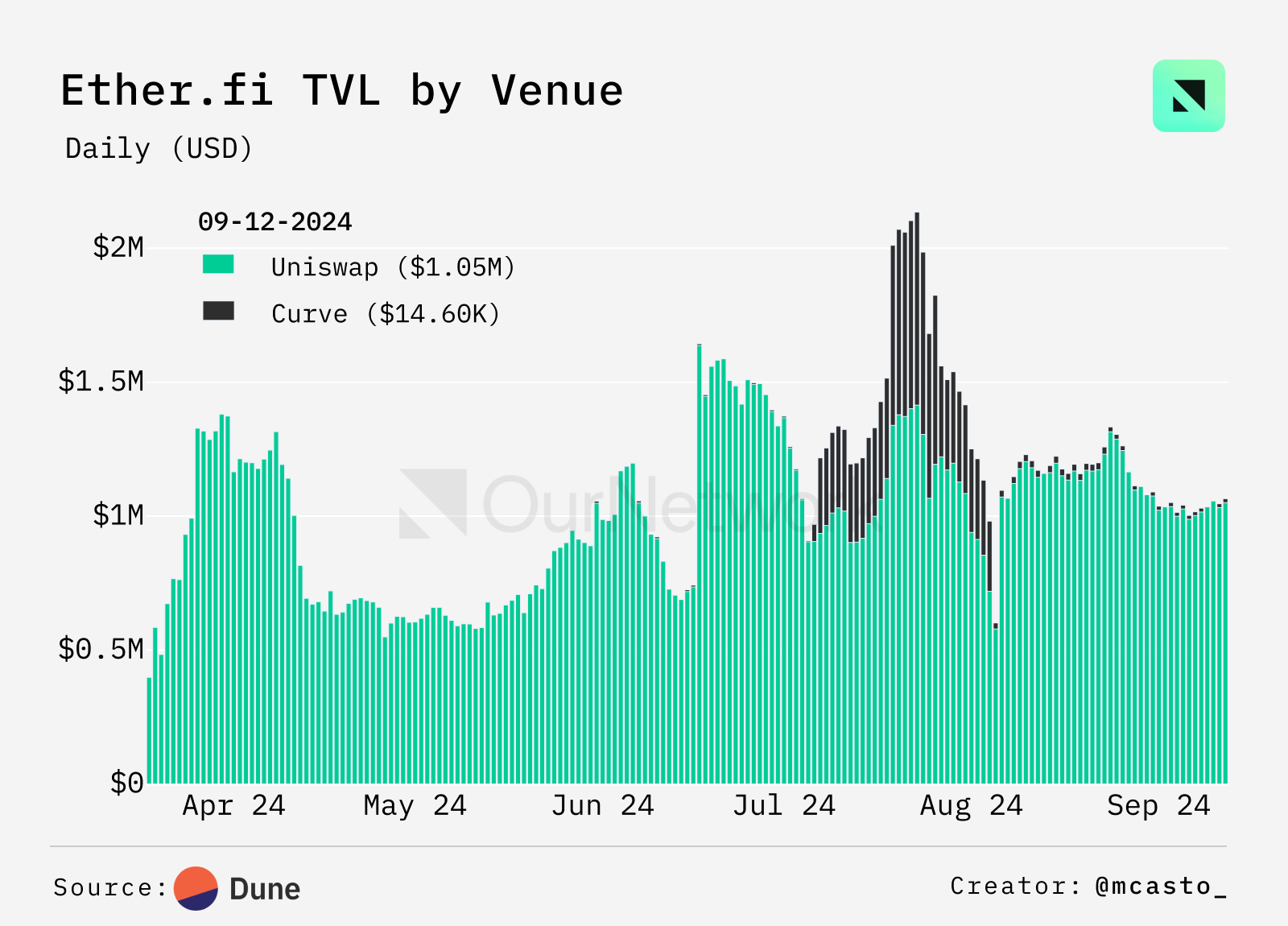

Within the DEX ecosystem, Ether.fi’s governance token ETHFI recently saw increased TVL on Uniswap v3, mainly due to liquidity migration from Curve in early August. This move was initiated by the Ether.fi team, transferring treasury-funded liquidity to Arrakis on Uniswap v3.

-

Transaction highlight: This transaction injected liquidity into Arrakis, an automated liquidity solution, after withdrawing it from Curve. It was the second-largest liquidity injection since the pool’s inception. Additionally, 80 ETH worth $409,000 at the time were added. Following this transaction, nearly all ETHFI DEX liquidity has flowed through Uniswap v3 pools.

Swell

Ian Unsworth | Website | Dashboard

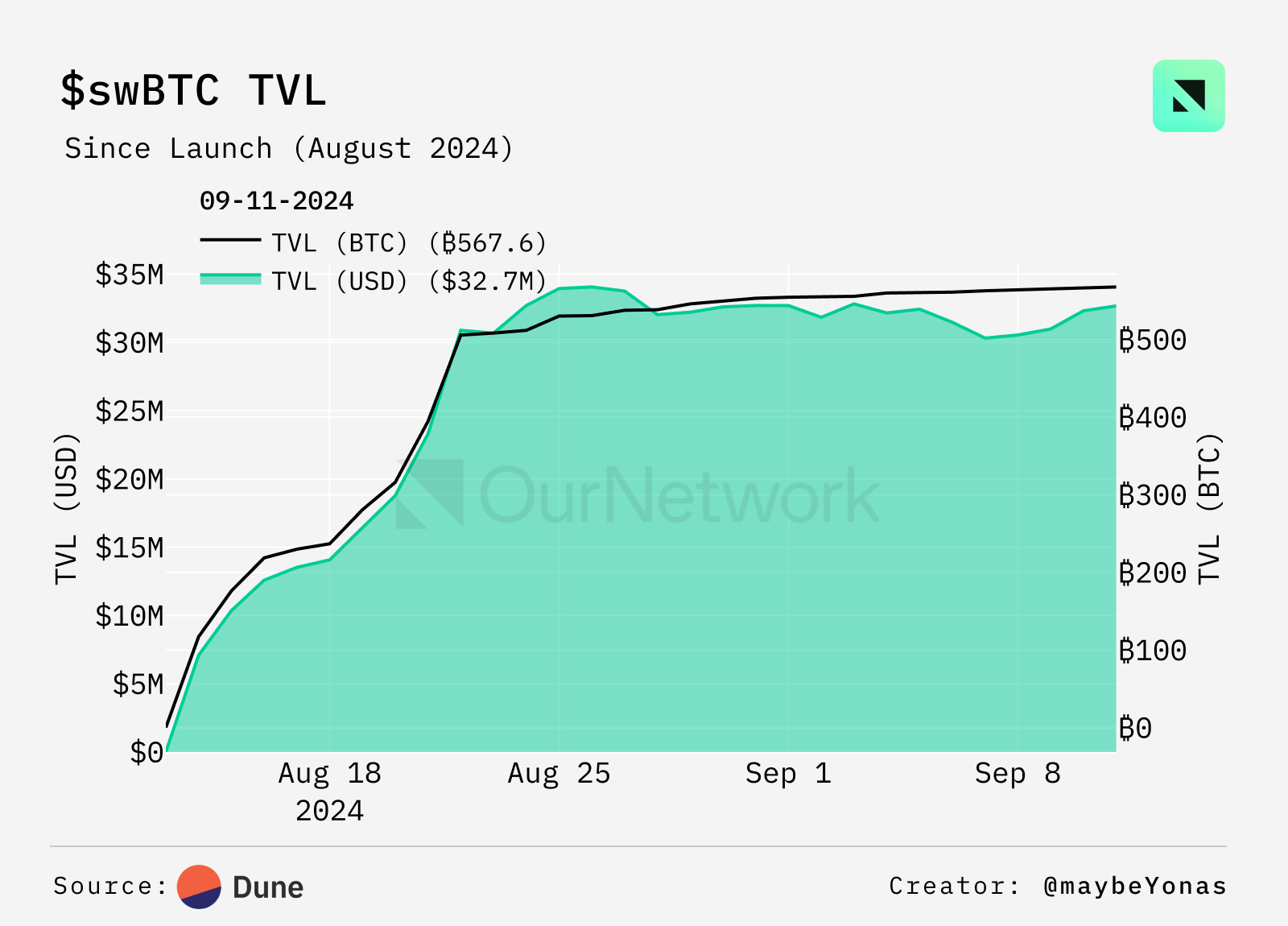

Swell’s swBTC TVL surpasses $30 million

-

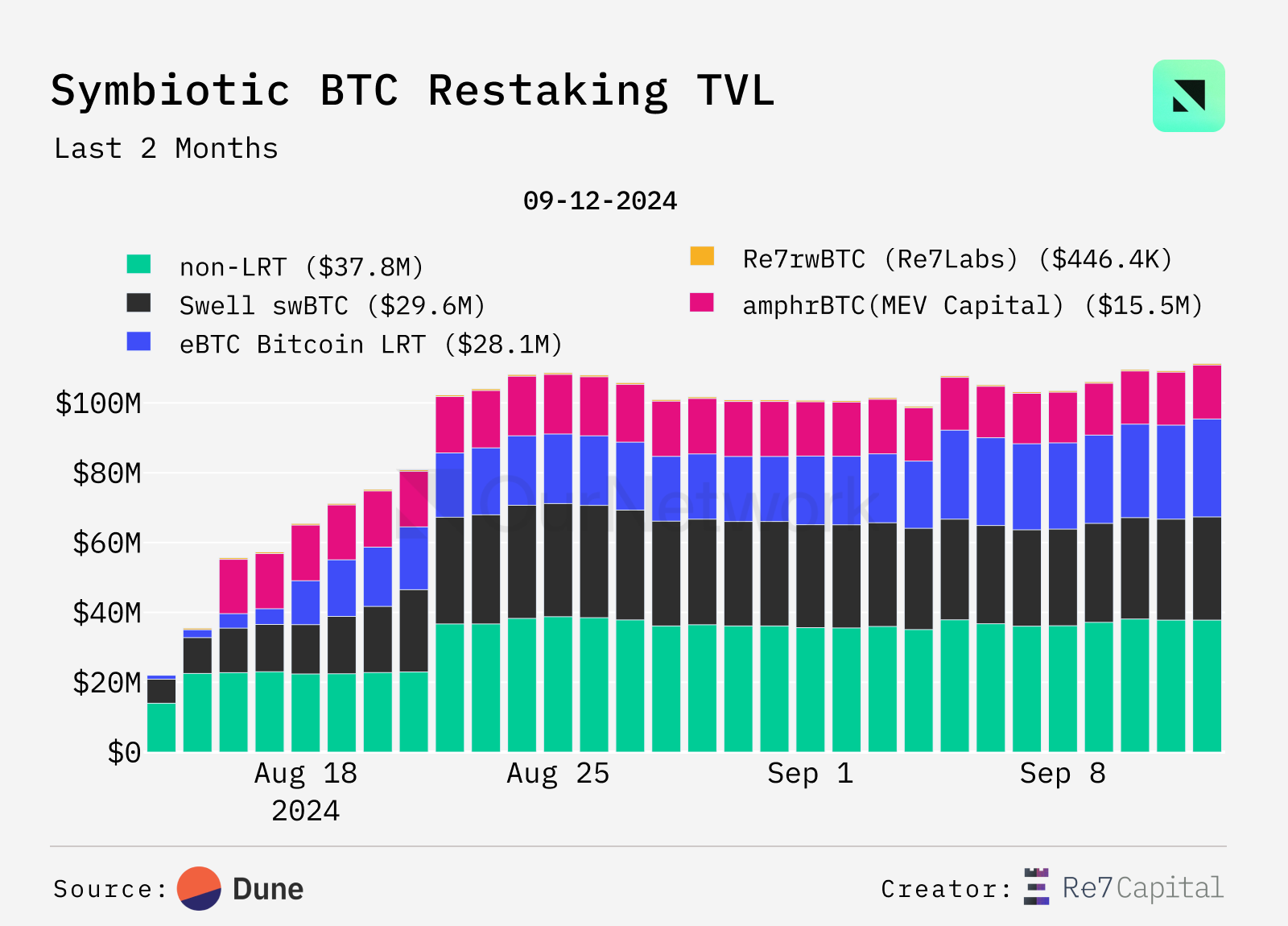

While much of the restaking discussion centers around ETH LRTs, Swell’s new LRT, swBTC, has recently drawn attention. Swell’s product allows users to earn potential restaking rewards across the top three Ethereum restaking platforms—EigenLayer, Symbiotic, and Karak. Within just 10 days, swBTC TVL surpassed $30 million, with over 560 unique depositors. As BTC liquidity becomes an ongoing trend, growing BTC LRTs could serve as a positive on-chain catalyst.

-

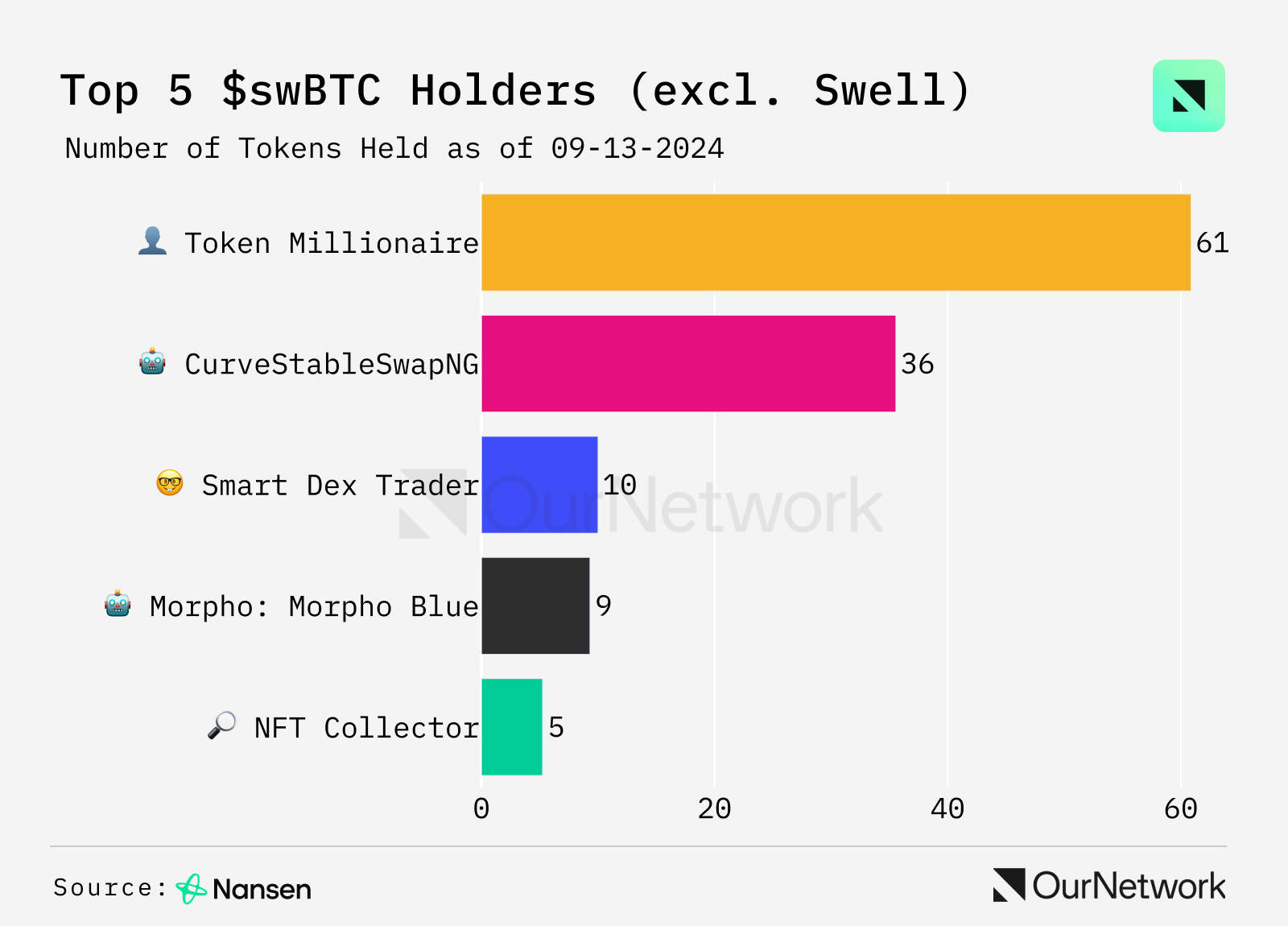

About a month after launch, portions of swBTC supply have flowed into key DeFi protocols such as Curve and Morpho, accounting for about 8% of total supply. Additionally, Swell is developing a Layer 2 platform, with users already depositing 68% of swBTC supply into the scaling platform’s contracts ahead of launch.

-

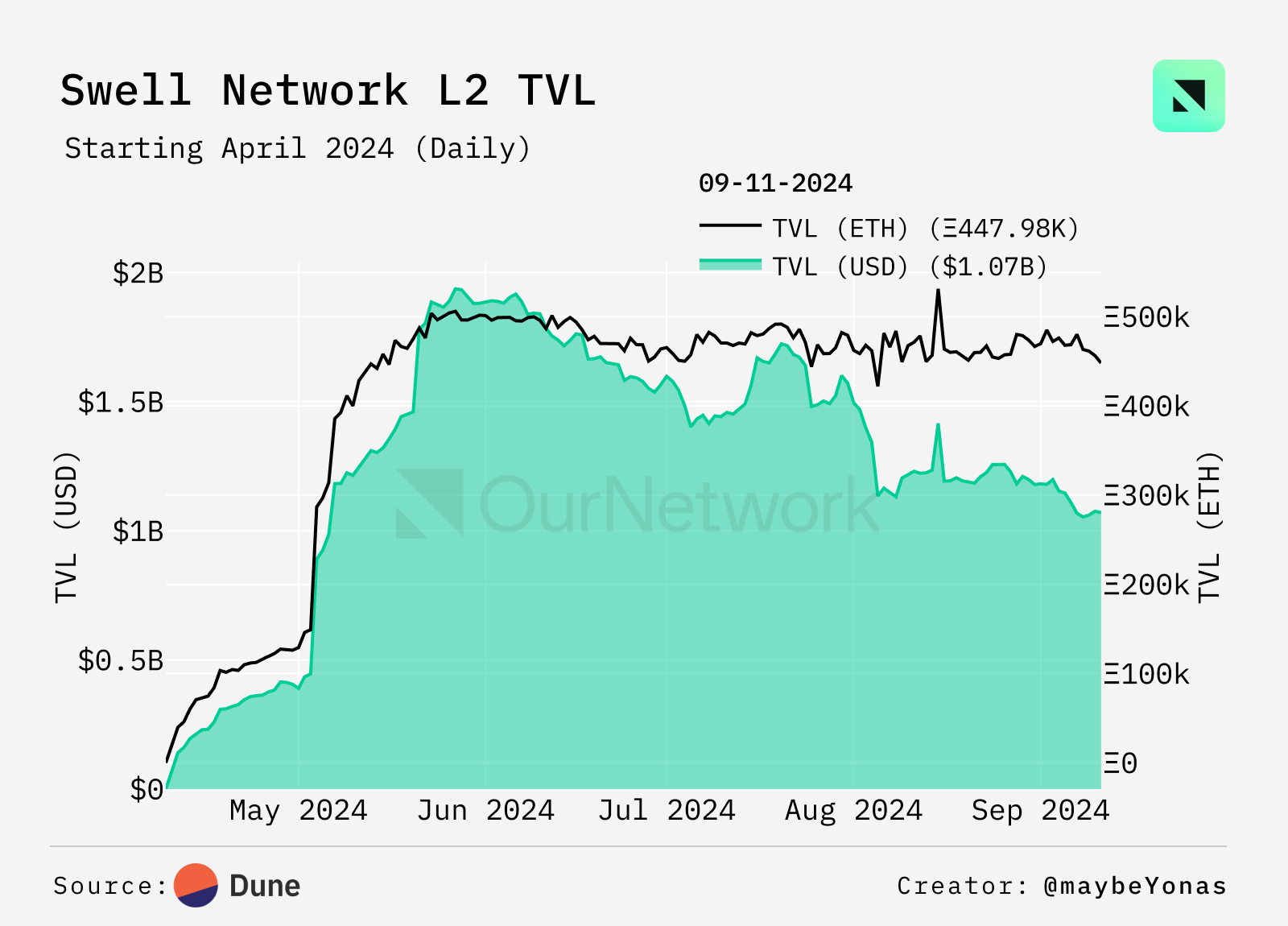

Users continue to demonstrate strong interest in potential use cases by depositing into Swell’s Layer 2 contract. Despite the snapshot for the announced airdrop having concluded, approximately 460,000 ETH and over $1 billion remain deposited. The scaling solution is scheduled to officially launch by the end of Q4.

-

Transaction highlight: Examining early adopters’ usage of swBTC, this wallet deposited 100 swBTC, worth over $5.9 million, into the Swell L2 contract. Based on associated wallets, this address may belong to Amber Group, a well-known asset management firm serving over 3,000 institutional clients.

Symbiotic

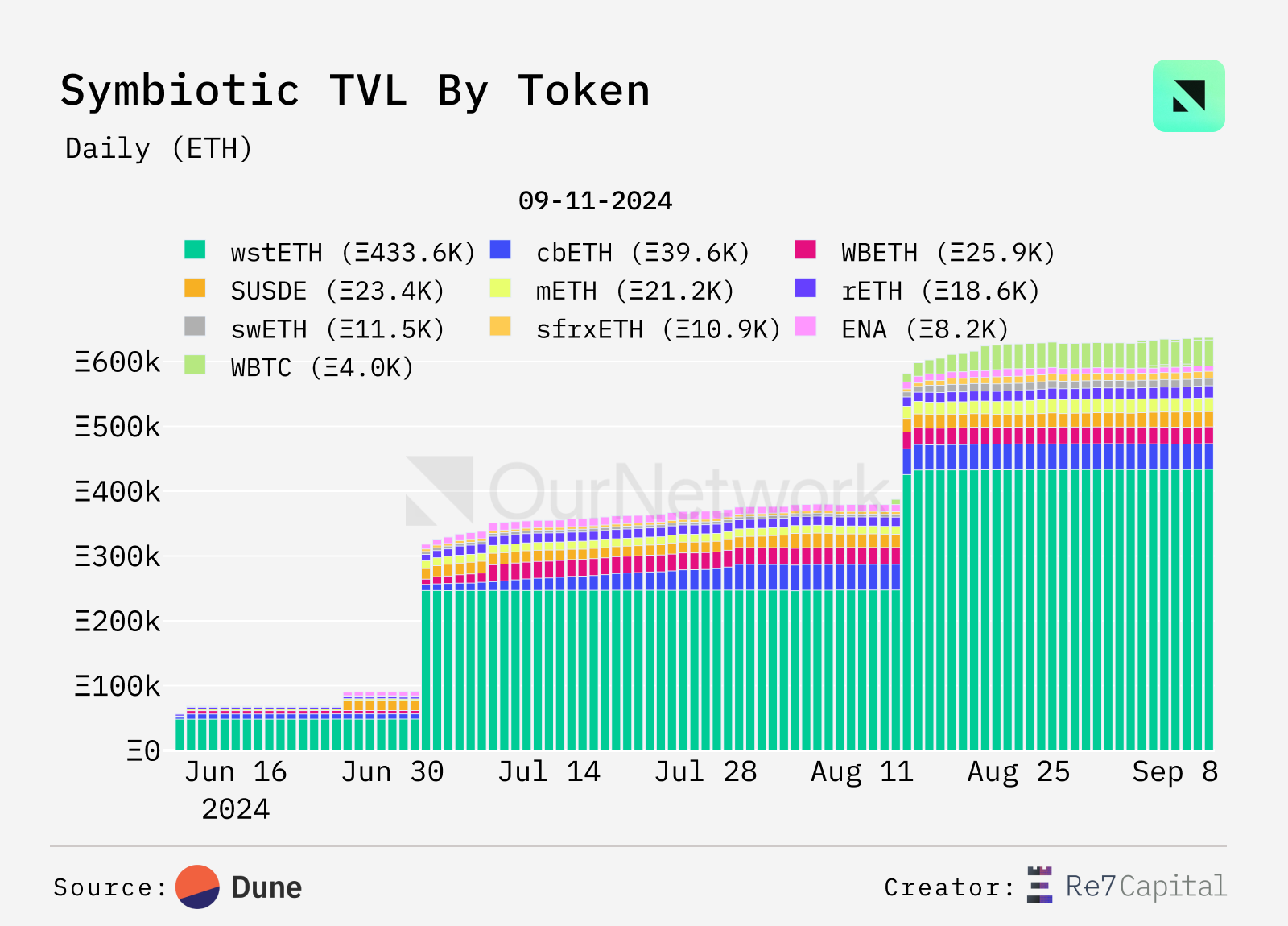

Symbiotic’s TVL exceeds $1.5 billion with addition of new tokens

-

Symbiotic’s TVL, as the second-largest restaking protocol after EigenLayer, has surpassed $1.5 billion, now including additional assets such as BTC, Ethena, and sUSDe.

-

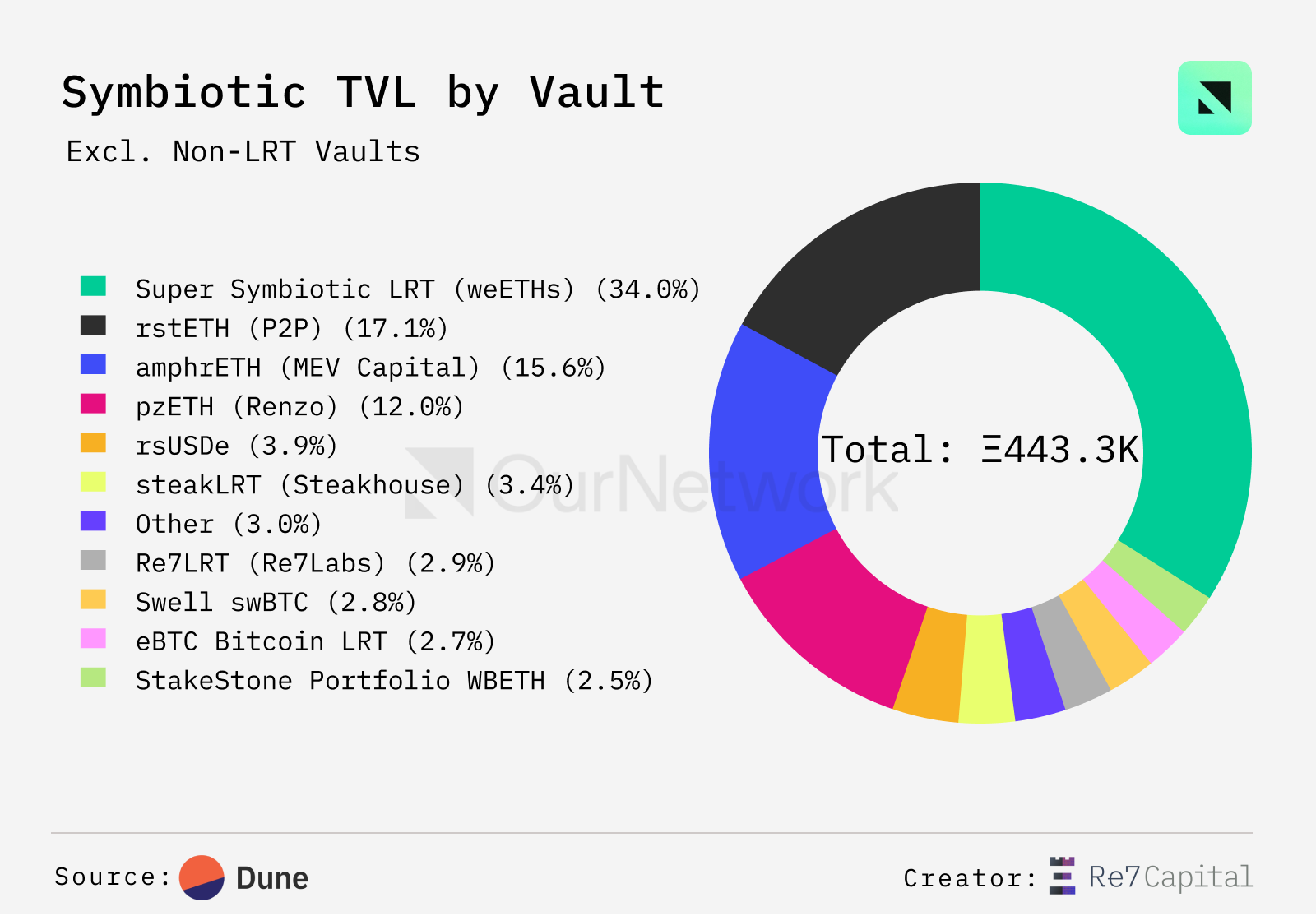

Pools like Re7LRT account for over 70% of depositors, reflecting the growing presence of liquid restaking tokens on the Symbiotic protocol.

-

BTC restaking has officially launched, with Symbiotic being one of the primary platforms for BTC deposits. Over the past month, more than $100 million in BTC has been deposited, driven by explosive growth in BTC LRTs from Re7, Ether.fi, and Swell.

-

Transaction highlight: Yield farming with Re7LRT remains active. A major player secured fixed yields exceeding 300 ETH via Pendle, a yield-splitting protocol, with Re7LRT maturities in September and December.

Karak

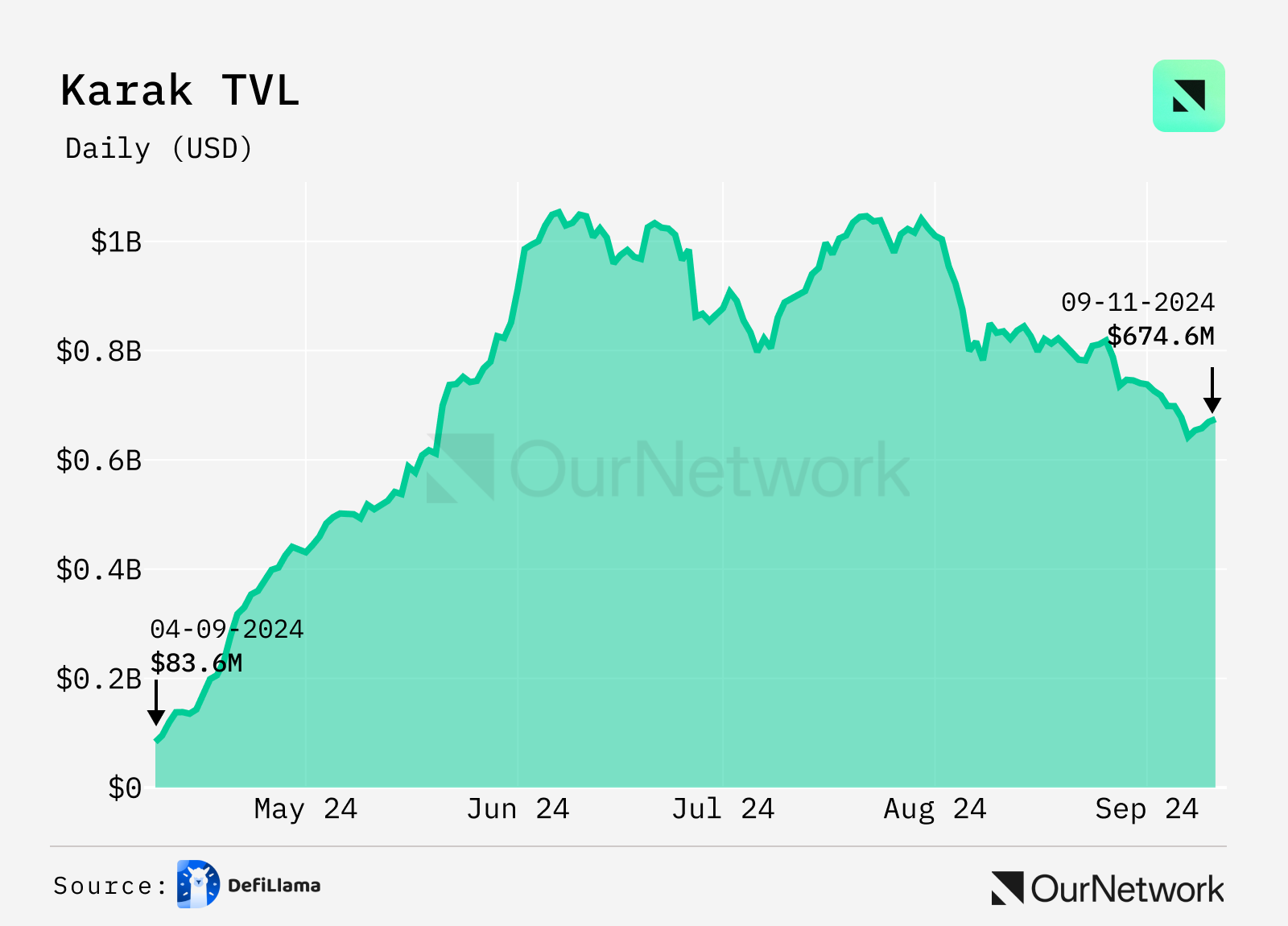

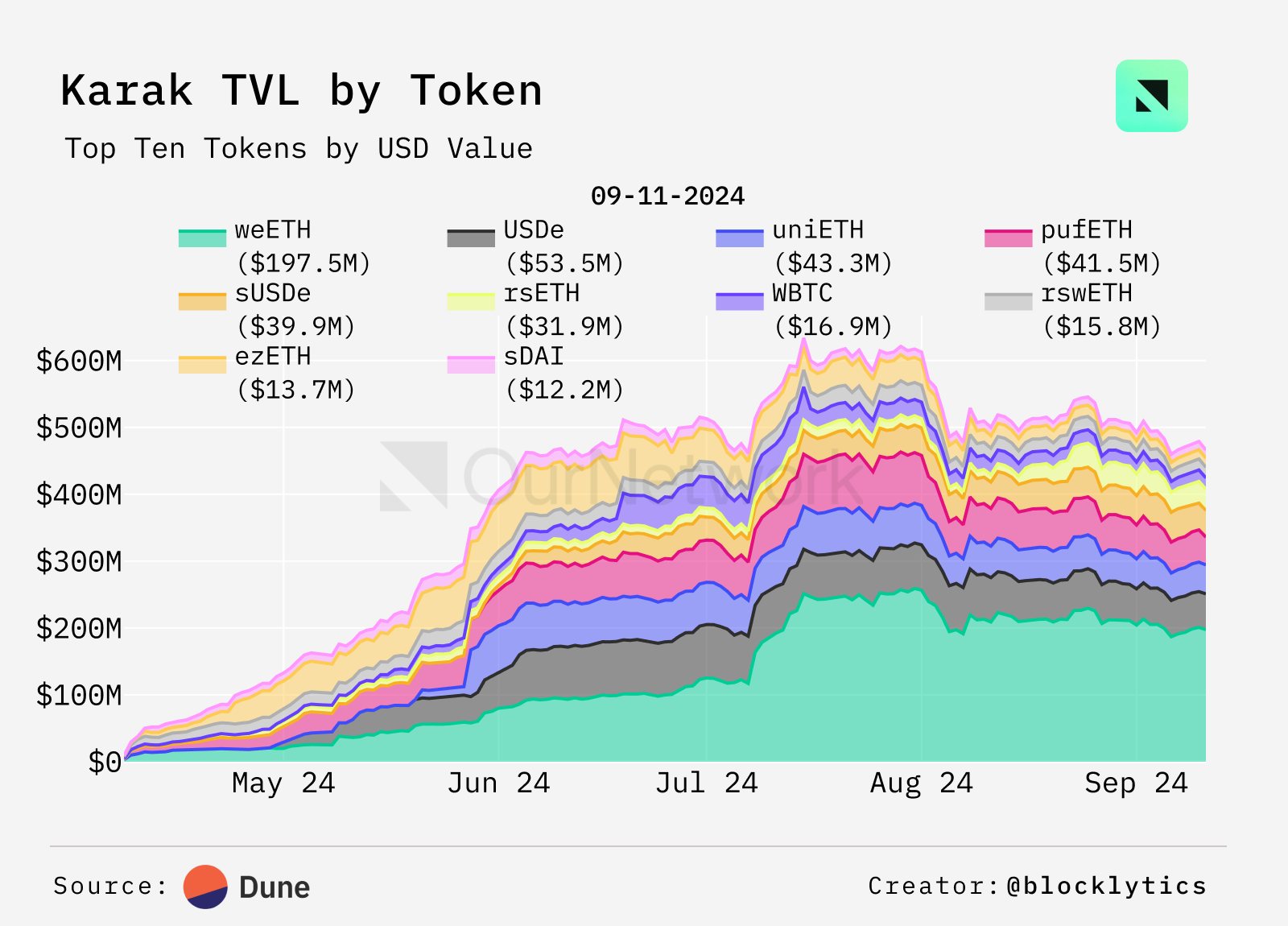

Karak’s ETH TVL stabilizes at 280,000, maintaining steady levels for nearly 3 months

-

Karak, the third-largest restaking protocol by total value locked (TVL), has consistently maintained 280K ETH in deposits but has seen no significant new inflows over the past three months. This stagnation may stem from challenging market conditions and competition from newer entrants like Symbiotic, which launched after Karak but now attracts triple the ETH volume. To keep pace, Karak is accelerating its introduction of new assets.

-

In the past 7 days, users withdrew 6,025 ETH from Karak, indicating lack of growth compared to competitors. Users may be withdrawing due to declining appeal of Karak’s points program.

-

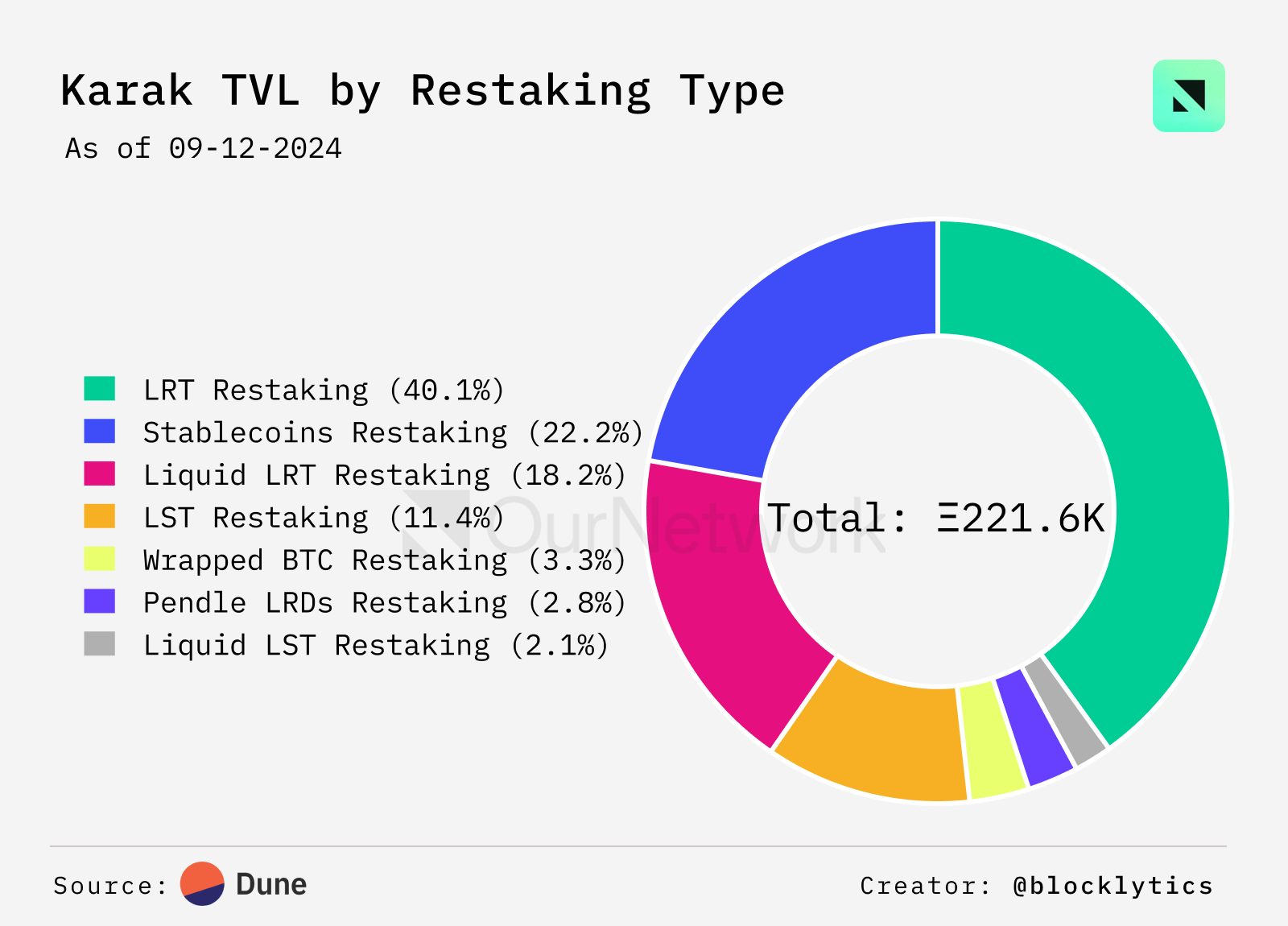

This pie chart shows that LRTs from EigenLayer and derivative LRTs from Pendle constitute a significant 61% of Karak’s total value locked (TVL). Given this heavy reliance on competitor assets, Karak may need to explore new strategies to mitigate risks associated with such dependencies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News