All Because of Airdrops? Tracking EigenLayer Employee Wallets Reveals Over Ten Circumvented Geographic Restrictions to Claim Airdrops

TechFlow Selected TechFlow Selected

All Because of Airdrops? Tracking EigenLayer Employee Wallets Reveals Over Ten Circumvented Geographic Restrictions to Claim Airdrops

Excluding U.S. users from the airdrop might be more like a farce.

By Danny Nelson, with Sam Kessler contributing, CoinDesk

Translation: Felix, PANews

Key Takeaways:

-

Out of legal caution, many crypto projects exclude U.S. users from token airdrops.

-

American crypto users—including employees at cautious projects—often find ways to claim tokens anyway.

-

Lawyers say this "hypocrisy" could undermine industry efforts to avoid U.S. regulatory jurisdiction.

The United States presents a paradox for some crypto startups.

They can't afford to ignore the tech-savvy U.S. workforce, nor can they risk having their newly issued tokens fall afoul of the world's strictest financial regulations.

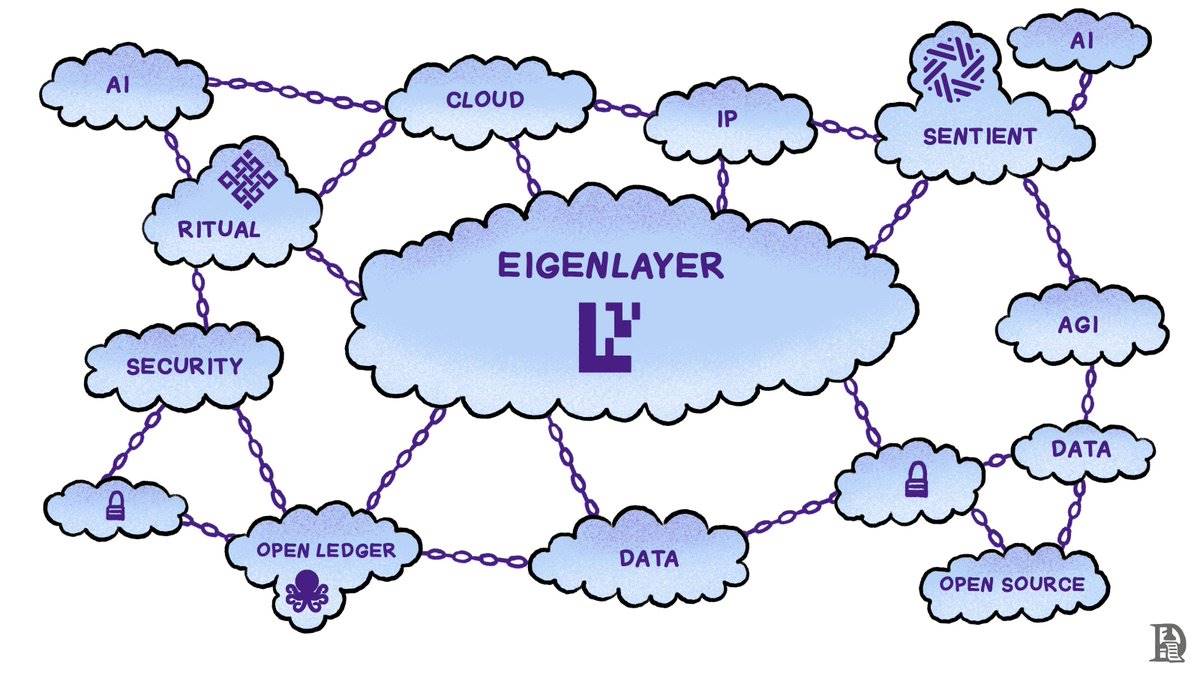

EigenLayer, one of the hottest projects on Ethereum, uses a common workaround in crypto: hiring U.S. developers through a U.S.-based company, while an independent legal entity on an island where U.S. securities and tax laws don’t apply issues the EIGEN token.

Two projects in the EigenLayer ecosystem, Renzo and Ether.Fi, explicitly ban U.S. users from claiming airdropped tokens.

But that clearly didn’t work.

Blockchain data analysis shows wallets linked to at least 10 U.S.-based Eigen Labs employees—engineers, directors, executives, and the chief legal officer—claimed hundreds of thousands of dollars worth of airdropped tokens from Renzo and Ether.Fi.

CoinDesk typically does not report on individuals’ finances. But according to blog posts by Eigen Labs, many employees chose to “publicly” claim their cryptocurrency. The post detailed that EigenLayer had banned ecosystem projects from airdropping directly to Eigen Labs staff; if any airdrop were to happen, it should go only to the company.

Moreover, their on-chain activity reveals a selective approach to compliance—one that crypto insiders say is widespread across the industry.

An Open Secret

Few crypto teams believe their tokens should be classified as securities. Yet, out of fear of U.S. regulators, most projects theoretically exclude American users from airdrops.

This theory may be more farce than fact.

A dozen U.S.-based industry insiders, speaking anonymously, said they’ve found ways around project-imposed restrictions to receive airdrops.

Ignoring or bypassing geographic blocks is common in U.S. crypto circles.

A U.S. industry lawyer privately admitted to previously claiming tokens from airdrop projects that attempted to enforce geographic restrictions.

The lawyer described the chaos as “an unfortunate but foreseeable outcome of the industry’s lack of regulatory clarity for years.”

Risk vs. Reward

Given the U.S. SEC’s long-standing crackdown on the crypto industry, most self-issuing teams are reluctant to draw attention to their airdrops.

Projects aim to keep their tokens out of regulatory jeopardy. They prohibit U.S. users via strict terms-of-service agreements and set up geo-blocking to detect traffic originating from the U.S.

Yet, unlike banks and other financial institutions that require rigorous KYC when opening accounts, projects rarely conduct thorough identity checks when distributing new tokens.

Unsurprisingly, these weaker safeguards prove ineffective.

A U.S. executive at a startup said geo-blocking offers plausible deniability, allowing his firm—which issues tokens through an offshore entity—to privately admit using a VPN to claim restricted airdrops from other projects.

Terms-of-service agreements carry even less weight. EigenLayer’s airdrop barred claims from the U.S., Canada, and other “prohibited jurisdictions,” as well as anyone using a VPN, from receiving EIGEN.

Sundel, an anonymous EigenLayer user based in Canada, called EigenLayer’s geo-blocking a “silly” defense against what he sees as SEC overreach.

Sundel said he wasn’t deterred by EigenLayer’s rules and successfully claimed tokens with the help of a VPN and some network configuration tweaks.

A former employee at a prominent crypto firm said such jurisdiction-avoidance tactics are “just preparation for potential regulatory scrutiny.” A European crypto consultant claimed companies deliberately implement weak restrictions.

Banning U.S. users has always been purely a legal safeguard. But you want—and need—U.S. users. You hope they can access airdrops as easily as possible.

Employees in the U.S. crypto sector admit they generally don’t care about geo-blocking.

“If you know someone is intentionally violating terms and conditions, and you know people are lying about not being in the U.S., it won’t help much when regulators come knocking,” said Dan McAvoy, co-chair of Blockchain + Business at Polsinelli PC.

Offshore Tokens

Eigen Labs, the developer behind EigenLayer, is headquartered in Seattle—a hub for software engineers. The Eigen Foundation, responsible for the EigenLayer airdrop, is setting up offices in the Cayman Islands, whose favorable laws attract many crypto firms.

According to registered addresses, the future office of the Eigen Foundation sits directly opposite Ether.Fi, one of the largest restaking projects on EigenLayer. As reported by Canadian tech news site Betakit, its CEO Mike Silagadze, a Canadian expatriate, relocated to the Cayman Islands after being pushed out by domestic regulations to launch Ether.Fi.

When Ether.Fi launched its new token in March, it allocated large amounts of ETHFI tokens to each Eigen Labs employee. Silagadze said the project had previously requested a list of employee crypto wallets from Eigen Labs.

“We only got a list of 50 addresses, no names attached, so we didn’t know who these tokens were going to,” Silagadze said. (Eigen Labs confirmed it sends lists of all employee wallets to projects planning airdrops.)

In a follow-up interview, Silagadze said, “We use geo-blocking, VPN blocking, and terms of service to block U.S. users.”

Note: Bullish, CoinDesk’s parent company, is an investor in Ether.Fi.

Another EigenLayer ecosystem restaking project, Renzo, issued its token in April through an offshore entity and blocked U.S. web traffic. “Our terms of service clearly state U.S. users cannot claim tokens,” said Kratik Lodha, representative of RestakeX Foundation, the token-issuing body.

Blockchain data shows dozens of wallets tied to Eigen Labs employees claimed airdrops from both Ether.Fi and Renzo.

“The airdrops received by Eigen Labs employees went through the same strict limitations and verification processes as any other participant,” said Kratik Lodha.

Onshore Treasure

Despite Renzo and Ether.Fi’s efforts to block U.S. users, their airdrops to Eigen Labs staff complicate matters—the majority of the company’s employees appear to reside in the U.S.

LinkedIn profiles show that during the airdrop period, over half of Eigen Labs employees lived in U.S. cities like Austin, San Francisco, and Seattle.

To determine whether U.S. users claimed restricted airdrops, CoinDesk reviewed transaction records on the Ethereum blockchain and compiled a list of all Eigen Labs employees. It then searched for Ethereum Name Service (ENS) nicknames matching their names. CoinDesk narrowed the list to wallets that claimed at least one airdrop, ultimately identifying over a dozen wallets clearly linked to Eigen Labs employees known to reside in the U.S.

CoinDesk will not publish individual employees’ names, providing only enough detail for context. None of the employees mentioned in this article responded to requests for comment.

The wallet associated with Eigen Labs’ general counsel was a clear recipient of the Ether.Fi airdrop.

In January 2022, the company’s current chief lawyer tweeted an ENS nickname. Eleven months later, the wallet controlling that nickname transferred the ENS to another wallet.

On May 27 this year, the second wallet claimed 10,490.9 ETHFI from Ether.Fi—worth $52,000 at the time. (Hours after CoinDesk requested comment from the general counsel, the 2022 tweet containing the ENS was deleted.)

The director of developer relations at Eigen Labs had previously disclosed his ENS on social media. On March 18, a wallet with that ENS claimed 10,490.9 ETHFI (then worth $33,000), and on May 3, claimed 66,667 REZ (then worth $12,000).

On April 12, a wallet with an ENS matching the name of Eigen Labs’ chief operating officer claimed 10,490.9 ETHFI from Ether.Fi (worth over $53,000 at the time).

Other wallets linked to Eigen Foundation’s chief strategy officer, Eigen Labs’ protocol development director, and several engineers also claimed hundreds of thousands of dollars worth of tokens from Ether.Fi and Renzo. According to their respective LinkedIn profiles, they are all U.S. residents.

Legal Scrutiny

Whether Ether.Fi and Renzo’s distributions violate U.S. securities law remains hypothetical. No regulator has accused these projects, Eigen Labs, or its employees of wrongdoing.

One industry insider tracking compliance trends said, “All lawyers advise everyone to follow securities laws when issuing tokens—even projects that claim their tokens aren’t securities.”

Renzo’s RestakeX Foundation said it tried to block U.S. users to “fully comply with U.S. securities laws, including Regulation S.”

Regulation S allows issuers to sell securities without registration, provided buyers are not U.S. persons.

Two unnamed industry lawyers said that if a project knows its airdrop will reach employees of a U.S. company, qualifying for securities exemptions could become significantly harder.

A third lawyer said that, broadly speaking, crypto insiders openly admitting they ignore geo-blocks could further complicate protocols’ attempts to shield themselves from U.S. jurisdiction.

Fast Money

Eigen Labs helping its U.S. employees obtain restricted airdrops feels ironic. EigenLayer made it hard for all U.S. users to claim its own airdrop, yet readily accepted deposits from them.

“Working for a company that blocks U.S. users from receiving airdrops, while personally receiving airdrops from others, certainly calls into question the legitimacy of geo-blocking,” said one industry lawyer.

After the airdrop incidents, Eigen Labs said it implemented a “post-airdrop lock-up period,” meaning employees are banned from selling claimed assets for a certain time. Eigen Labs did not disclose when this policy took effect.

According to blockchain data, the wallet tied to Eigen Labs’ general counsel claimed the Ether.Fi airdrop at 9:46 p.m. Pacific Time on May 27.

Eighteen minutes later, the wallet had already sold more than half of its ETHFI, netting at least $21,000.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News