friend.tech has gone, what shall stand in its place?

TechFlow Selected TechFlow Selected

friend.tech has gone, what shall stand in its place?

Where is the future of encrypted social?

Author: Pzai, Foresight News

Introduction

With friend.tech's daily active users dwindling to fewer than a hundred, crypto social seems to be fading from the spotlight. On one hand, social projects primarily driven by token economic models are losing attention; on the other, applications like Farcaster and Solana Blinks are approaching crypto social from different angles, turning social interaction into a traffic-driving tool and bringing new growth potential to their ecosystems. This article aims to explore how crypto social can be built by examining the unique characteristics of various projects.

What Happened to friend.tech?

Yes, the once-prominent friend.tech is now rarely mentioned. Some may still reminisce about the bustling early days when they first joined, while others miss the dopamine rush from buying and selling Keys. Admittedly, at that time, FT was a solid product—especially during a relatively bearish market phase, its Ponzi-like social structure did provide a playground for capital and participants.

If we consider human social behavior as driven by instinct (intrinsic motivation), it can broadly be broken down into animality and collectivity. Animality represents humanity’s pursuit of survival resources, while collectivity guides individuals to enhance self-identity through relational connections. In the case of friend.tech, we can observe how it leveraged these innate tendencies to build its economic model.

-

Individual-centered community building: Consensus is maintained through individual influence, with tokens and attention flowing in via organic migration of influence. The advantage of this model is that it maximizes monetization potential for early participants and helps them achieve a flywheel effect of influence. At the same time, shared cognition aggregates consensus, fulfilling collective needs.

-

Key-based transactions: Keys serve as credentials to access specific channels, priced via Bonding Curves, and accumulate value through trading growth. This accumulation occurs in two stages: an initial phase (building the core community via early adopters) and a later phase (where Key value itself becomes a form of endorsement).

Clearly, this structure brought certain issues, including growth limitations due to ceiling effects and resistance to consensus-building caused by high speculative participation. As one anonymous former whale put it, “(friend.tech) eventually became speculation itself—no one wanted to chat, everyone just wanted to trade Keys.” When participants aren’t primarily motivated by social needs, all interactions within the protocol quickly become confined to token economics, leading to fragmented small communities. This closed social model likely drained broader content engagement, limiting discussion spaces and hindering wider interaction. Under these conditions, the social narrative could not sustain itself. Moreover, the project team’s use of a points-based incentive mechanism further undermined holder confidence (for details, see the author’s previous discussion on points).

The friend.tech example reveals many pain points in building social networks through crypto-economic models—such as economic design directly determining the sustainability of in-protocol social interactions, or creators being more economically driven within the protocol. For creators, financial incentives may not be the primary motivator—they often seek broad engagement and intellectual exchange. Here, economic models inherently limit reach, failing to meet expectations for many. Thus, we now turn to a rising star in social-driven protocols: Farcaster, and examine how it achieved a significant level of discourse.

(Selected) Creators’ Perspectives

What Has Farcaster Done?

It’s fair to say that Farcaster had almost no connection to token economics at launch. Any links were limited to the fact that early users—like Ethereum OGs and crypto investors—had strong crypto-native traits. Thanks to founder Dan Romero’s strict invite-only approach, the high quality of early users ensured meaningful social interactions and set the tone for the protocol’s development: a socially-driven "new crypto community." This community differs from typical private groups and has stronger boundary awareness than apps like X, fostering distinct community culture. Over time, under this crypto-native influence, token economies gradually entered social interactions as interaction tools.

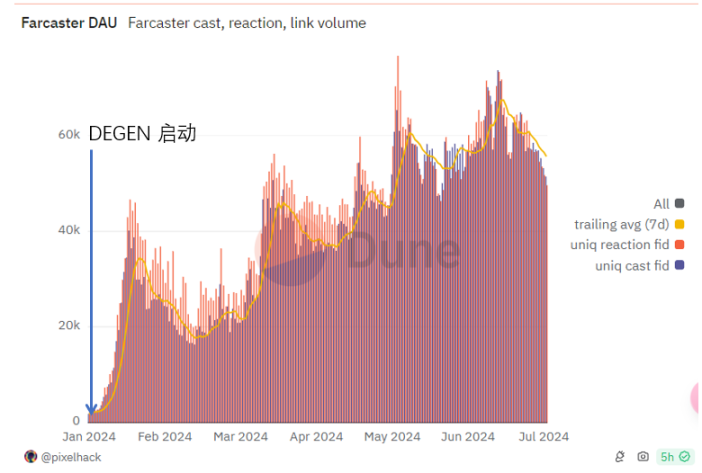

A clear example is DEGEN’s success. Initially launched as a tipping reward token in the Farcaster Degen channel and airdropped to active members, it accomplished three key things:

-

Initial community formation: Through genuine social engagement, it built a highly interactive and strongly aligned group, which then fueled robust growth.

-

Seed funding: A seed round led by 1confirmation in February (raising 490.5 ETH) provided strong momentum for developing the DEGEN ecosystem.

-

Boundary creation: The contrast between inside and outside the channel sparked curiosity and encouraged discussions around community-centric topics rather than isolated posts, enhancing user engagement and consensus-building.

In terms of daily active growth, DEGEN marked the beginning—and even evolved into a cultural symbol of the Base ecosystem.

Yet, challenges began to emerge. DEGEN’s distribution model evolved through mechanisms like active badges and staking, each change accompanied by shifting consensus. Then, at the end of March, the Degen Chain Layer 3 narrative gained full momentum, and many believed DEGEN was the future of both Farcaster and Base. However, the author argues that for a project whose main narrative revolves around MEME, "Buidl" signals indecisiveness to the market—especially when consensus hasn’t fully solidified. While "Buidl" embodies long-term thinking, in the fast-moving crypto market, a project’s ecological position is defined by its current state. Without real breakthroughs in ecosystem development, the peak momentum inevitably fades.

Embracing ecosystem development is not wrong, and having use cases represents tangible progress. Projects like Drakula (a Web3 TikTok supported by Degen) offer diversified services to users. But eventually, market enthusiasm cooled, and so did consensus. Still, the author maintains that Farcaster’s innovation already holds a significant lead over other social protocols—such as Frames, which reinvented on-chain social interactions as an in-protocol paradigm, or its open third-party client model enabling collaborative development. Most importantly, its social graph and framework are open and foundational. Therefore, the author believes more organic use cases will inevitably breathe fresh life into the on-chain social ecosystem.

Blinks – A Broad-Scale Approach

Solana Blinks embed interactive interfaces within links, enabling transactions directly through browser wallets. Functionally similar to Frames, the two share several similarities and differences:

-

Reach: Solana Blinks achieves broad user distribution across multiple platforms and enables direct wallet transactions. Frames, by contrast, interact via wallet addresses linked to Farcaster accounts, using account-based rather than wallet-based signatures.

-

Openness: Both allow developers to embed components in frontends and extend interaction methods, with both teams actively supporting developer ecosystems.

-

Integration: Ultimately, both aim to bridge user experiences between on-chain and off-chain environments.

-

Technical implementation: Solana Actions encapsulate on-chain transactions as APIs, achieving universal frontend integration via Blinks; Farcaster Frames convert static embeds into interactive experiences using OpenGraph standards.

Overall, Blinks does not integrate social functionality per se, but instead embeds on-chain actions into social flows, delivering more personalized user experiences. In other words, Blinks can be embedded into any feed (e.g., Notion), enabling diverse new use cases. We can look forward to more social-feed applications built on Blinks in the future.

Conclusion

Building a social ecosystem seamlessly integrated with blockchain has always been a market focus, and existing projects each have their strengths. Just like the tides of the crypto market, attention doesn’t stay forever. Projects must adapt accordingly, designing products with respect for users and communities at the core, to carve out a path in the competitive social landscape.

Time will tell who survives the test.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News