Web3 social media leader Friend.tech "runs away"—what does this mean for KOLs issuing tokens?

TechFlow Selected TechFlow Selected

Web3 social media leader Friend.tech "runs away"—what does this mean for KOLs issuing tokens?

Is it social networking or pyramid scheme?

Author: Gao Mengyang, Senior Criminal Lawyer at Shanghai Manqin Law Firm

Recently, a series of actions by Friend.Tech, the leading project in the SocialFi sector, have sparked industry-wide debate over whether "SocialFi can succeed" is a genuine possibility or a false proposition.

The controversy began with a report from The Block stating that Friend.Tech's development team had relinquished control over its smart contracts and frozen platform development. Although Friend.Tech later clarified it had no plans to shut down the app and that current functionality remained unaffected, most within the crypto community still expressed concern about both the application and the broader SocialFi space.

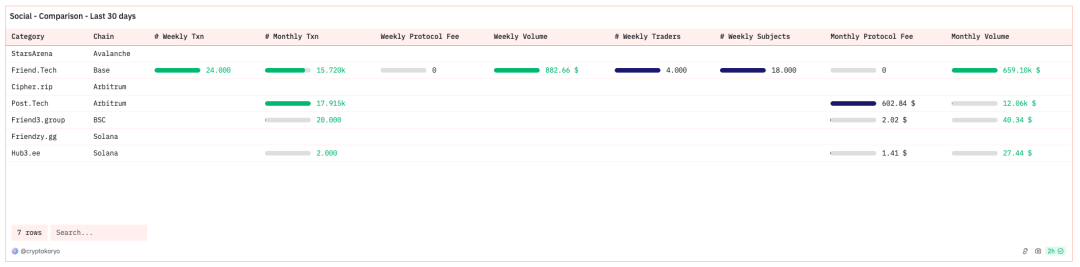

* Image source: Dune

At the time of writing, Friend.Tech has only four weekly trading users and a transaction volume of just $882.66—indicating the platform has long been abandoned. So what led to Friend.Tech’s downfall? And after this so-called “soft rug,” what risks do KOLs (key opinion leaders) on the platform now face? Before exploring these questions, we must first understand Friend.Tech’s mechanism.

Friend.Tech Gameplay Mechanism

Previously, lawyers Liu Honglin and Shao Shiwei from Manqin Law Firm analyzed Friend.Tech’s model and published an article titled “KOLs Minting Tokens to Monetize Fan Economies: Legal Risks Behind the Popularity of Friend.tech and TimeStore”, discussing regulatory compliance issues related to such platforms.

As a decentralized social platform with financial attributes, Friend.Tech’s core mechanism transforms KOLs’ Twitter accounts into tradable NFTs called “keys.” When users purchase a KOL’s key, they gain access to a private chat group where they can directly communicate with the KOL. This offers ordinary users a unique opportunity to interact directly with industry experts—for example, sharing a resume when job hunting, staying updated on industry trends through the KOL’s insights, or simply investing in a KOL whose popularity they believe will grow, thereby increasing demand for their keys. After payment, users enter the chat group, but crucially, each user only sees their own conversation with the KOL—not messages between other members.

* Image source: Friend.Tech Twitter screenshot

In terms of revenue models, Friend.Tech earns income through transaction fees charged whenever users trade on the platform. For KOLs, monetization comes from multiple sources: a share of transaction fees generated when others buy or sell their keys, profits from issuing tokens, and additional earnings in Version 2 via referrals. For regular users, the primary profit strategy is capital appreciation—buying keys of promising KOLs early and selling them after value increases.

Some analysts attribute Friend.Tech’s failure to inherent flaws in its gameplay—a Ponzi-like system built on leveraging personal networks. Whether it’s the platform, KOLs, or fans, everyone needs to recruit more participants to increase the value of their keys. As new users replicate this cycle, if actual value creation is absent, the model risks devolving into a pyramid scheme.

Once the promised content monetization and fan economy lose credibility and initial enthusiasm fades, players may resort to luring more people in just to exit profitably—significantly increasing criminal liability risks. At that point, the original vision behind SocialFi becomes irrelevant.

Impact on Token-Issuing KOLs

Manqin Law Firm previously conducted risk assessments for KOLs issuing tokens on Friend.Tech, highlighting China’s Initiative on Preventing Financial Risks Related to NFTs, which states: "We firmly curb the financialization and securitization of NFTs and strictly guard against illegal financial activities." From this perspective, even if KOLs label their keys as NFT digital collectibles, they still fail to comply with China’s regulations on digital collectible issuance, exposing themselves to serious legal compliance issues.

Now that Friend.Tech’s official team has announced operational suspension, what implications does this have for KOLs on the platform? Attorney Gao Mengyang from Manqin Law Firm points out:

First, the act of launching tokens on such platforms is inherently illegal under Chinese law—an established fact within China’s crypto community. Whether this constitutes illegal business operations or other criminal offenses remains uncertain, but it represents a constant legal threat hanging over KOLs. Avoidance is likely the safest course of action. When the platform announces shutdowns, FOMO (fear of missing out) could trigger mass sell-offs of platform tokens and keys, causing market collapse and intensifying conflicts between KOLs and their followers, potentially triggering legal disputes.

Second, there is another latent risk: some KOLs, eager to boost key sales, may make ambiguous promises or implied guarantees across public forums or private channels to attract buyers (“piggyback investors”). When the tulip bubble eventually bursts, the last holders may retaliate by filing reports or lawsuits to recover losses. In such cases, KOLs will find it extremely difficult to avoid consequences—something that demands high vigilance.

Manqin Lawyer Summary

Crypto KOLs and Web3 users continuously flock to innovative projects, with SocialFi platforms often among their top choices. Many domestic KOLs join these platforms, leveraging their influence to achieve mutual benefits. Making money isn’t shameful—but caution is essential.

To help KOLs avoid potential legal pitfalls, Manqin Law Firm offers the following recommendations:

1. Conduct Project Background Checks Before Joining

Thoroughly investigate a project’s background and compliance status. Avoid projects with exaggerated claims. KOLs should ask themselves: “Is this project compliant? Is its business model legal? Are user mechanics overly speculative? Does it have long-term viability?” If any of these questions lack clear answers, proceed with extreme caution.

2. Promote Responsibly After Participation

Understand your role and contribution during operation and promotion. Stay within legal boundaries when marketing—avoid aggressive selling that could lead to legal liability, and don’t overstep into roles that might make you a scapegoat.

3. Proactively Prepare Risk Mitigation Strategies

If signs of project abandonment or instability emerge, prepare contingency plans in advance—such as safe exit strategies or methods to calm follower concerns—to minimize personal risk and protect your interests.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News