Interview with dYdX Foundation CEO: Bought My First BTC via Taobao, Trust Is Crucial for dYdX

TechFlow Selected TechFlow Selected

Interview with dYdX Foundation CEO: Bought My First BTC via Taobao, Trust Is Crucial for dYdX

Trust is crucial, and dYdX provides users with the best service.

Written by: TechFlow

Last year, dYdX Chain officially launched, and this year, dYdX has become one of the highest-volume DeFi products. While you may frequently use its products or have invested in its token, there’s little discussion about the team behind it, their long-term vision, or how they view competition within DeFi.

During the Hong Kong Web3 Festival, we conducted our first interview with Charles d'Haussy, CEO of the dYdX Foundation, discussing the team behind dYdX, future product plans, views on competitors, and perspectives on the Chinese-speaking market.

Interestingly, we discovered that Charles d'Haussy bought his first Bitcoin via Taobao and previously led a fintech company in Hong Kong for years.

In this feature, we dive into the story behind dYdX to understand the thinking of this OG team—packed with insights.

Key Takeaways

-

dYdX operates through multiple decentralized entities including dYdX Trading, dYdX Foundation, dYdX Operations DAO, and dYdX Grants DAO—each independently functioning, reflecting a decentralized governance model.

-

Trust is paramount; dYdX aims to deliver the best service to users. A new pricing accuracy system will allow faster listing of more cryptocurrencies, enhancing competitiveness.

-

dYdX is actively expanding platform functionality across markets and currencies to meet growing demands in the DeFi ecosystem.

-

dYdX Chain is committed to greater decentralization. The decision to launch dYdX Chain was driven by user-centric service goals, supported by community voting and multiple decentralized entities guiding major decisions.

-

dYdX introduced LP Vaults to address liquidity challenges, enabling broader offerings—including various memecoins—and attracting a wider user base.

-

dYdX focuses on clearly defining its user segments and delivering high-liquidity products to maintain competitive advantage. Improving APIs and exploring prediction markets are key priorities to enrich trading options and enhance user experience.

-

dYdX proactively engages regulators, showcasing blockchain’s transparency and security to advocate for tailored legal frameworks. Its transparent, decentralized operations strengthen user trust and global compliance.

-

Through initiatives like launching Chinese-language Twitter accounts and community groups, dYdX sees Asia as dynamic and fast-growing—a critical region for DeFi's global expansion.

-

dYdX remains focused on core products and value propositions, avoiding distractions from incentives to migrate to other blockchains. Resilience, teamwork, and community involvement are emphasized, along with prudent cash flow and burn rate management to ensure stability amid market cycles.

The dYdX Team: Four Pillars of the Ecosystem

TechFlow: Most people are familiar with dYdX’s product, but know little about the team behind it. Could you introduce your background and journey joining the dYdX Foundation?

Charles d'Haussy:

Certainly. I’m the CEO of the dYdX Foundation. dYdX is a leading decentralized exchange, and the Foundation is one of several entities supporting dYdX’s development. Unlike traditional companies, dYdX operates through multiple decentralized entities. I joined the dYdX Foundation in 2022.

Prior to dYdX, I served as Head of Fintech at the Hong Kong government, responsible for building fintech ecosystems in Hong Kong, Beijing, London, and San Francisco. Later, I joined ConsenSys, a key player in blockchain technology, as Head of Asia, managing teams in Hong Kong, Singapore, Australia, and Japan, overseeing products like MetaMask and Infura, while also leading central bank digital currency (CBDC) projects with countries including Thailand, South Korea, and Australia.

I purchased my first Bitcoin via Taobao back in 2011, marking the beginning of my crypto journey. Joining the dYdX Foundation as CEO appealed to me because it offered an opportunity to work with cutting-edge technologies such as the Cosmos SDK stack and app chains. This role aligns perfectly with my passion for hands-on building and learning—especially within a decentralized, community-driven environment like dYdX.

dYdX recently reached another milestone of $100 billion in trading volume, underscoring its significant market impact.

TechFlow: From conversations with project partners, we noticed that dYdX seems to have many departments. Is this true? Can you share the overall team structure and division of responsibilities?

Charles d'Haussy:

dYdX does not operate under a single company but through multiple entities, highlighting its decentralized nature. Currently, there are four main entities within the dYdX ecosystem:

-

dYdX Trading: Based in New York, it previously operated the platform but now focuses solely on developing open-source software. Around 60 engineers are dedicated to improving the software, though they no longer manage day-to-day operations.

-

dYdX Foundation: Where I serve as CEO, we have a team of around 20 people spread across 10 countries. We focus on protocol governance, branding, communications, engaging with the dYdX community, and managing ecosystem relationships.

-

dYdX Operations DAO: This decentralized autonomous organization handles operational aspects under the new structure, including hosting the frontend application and deploying indexers. The team consists of approximately five members.

-

dYdX Grants DAO: Responsible for allocating grants within the dYdX ecosystem to support various projects and initiatives.

Each entity plays a distinct role and operates independently within dYdX’s overall structure, reflecting a decentralized governance model that enables different groups to manage various aspects of the ecosystem without centralized approval.

Major decisions are driven by community votes, including funding allocations and strategic directions, further emphasizing dYdX’s decentralized nature.

Trust is Paramount: Delivering the Best Service to Users

TechFlow: Overall, dYdX has become a leader in derivatives trading. Can you share future product plans? What problems remain unsolved in the derivatives space or broader DeFi sector?

Charles d'Haussy:

An upcoming major update involves a new pricing accuracy system that will enable us to quickly list 200 to 500 additional cryptocurrencies, giving us a strategic edge over other exchanges in terms of speed.

Additionally, we’re actively expanding our platform’s capabilities across more markets and currencies to meet the evolving needs of the DeFi ecosystem.

One challenge we aim to tackle is our reliance on price oracles from centralized exchanges. The upcoming upgrade seeks to mitigate this by improving the pricing accuracy system—an essential step for precise derivative trading.

Moreover, increasing competition in the derivatives space demands continuous innovation in our product offerings. We also place strong emphasis on building a stable and trustworthy platform, as maintaining user trust through enhanced security and efficient market operations is crucial.

These efforts reflect our proactive approach to expanding product offerings and enhancing platform functionality, while addressing critical challenges in the DeFi derivatives space to maintain leadership in this rapidly evolving market.

TechFlow: Last year, dYdX Chain officially launched, and we’ve seen improvements in platform performance and data. For a dApp, launching its own chain is rare. When you announced leaving the Ethereum ecosystem, some community members expressed opposition. Could you explain the rationale behind this decision—what pain points did you identify, and what future opportunities did you foresee?

Charles d'Haussy:

The decision to launch dYdX Chain was made to deliver the best possible service to users—not out of loyalty to any particular blockchain technology. We are fundamentally blockchain-agnostic because we believe great engineers and product managers should prioritize user needs over technical constraints.

Leaving Ethereum allowed us full control over the entire tech stack, enabling necessary optimizations for peak performance. This was critical, as operating on Ethereum previously hindered us due to high gas fees and slow transaction speeds. Moving to our own chain also reduces dependency on Ethereum’s infrastructure, which may face limitations due to scalability issues.

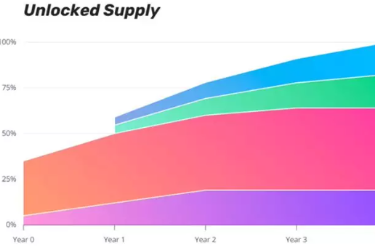

Previously, our token functioned mainly as a governance token within the Ethereum ecosystem. Now, on our own chain, it serves significantly more utility functions, greatly enhancing the value we offer users. This transition has been vital, allowing us the freedom to innovate and implement features previously constrained by existing blockchain infrastructures.

In summary, creating dYdX Chain was about taking control of our destiny in DeFi, ensuring we can provide superior, scalable services. It allows us to respond more effectively to market demands and technological advancements, standing out in the competitive DeFi landscape and building a stronger ecosystem for users.

TechFlow: Recently, you officially announced LP Vaults—an important update. Can you elaborate on this? What impact will it have on the dYdX ecosystem?

Charles d'Haussy:

Regarding the recently announced LP Vaults, this update marks a significant step forward for our platform. LP Vaults are designed to solve liquidity issues that often hinder growth and efficiency on trading platforms. Traditionally, about 80% of our trading volume came from Bitcoin and Ethereum, somewhat limiting our ability to expand into a broader range of assets.

With the introduction of LP Vaults, we can now offer a more diverse set of products, including various memecoins. This isn’t just about increasing the number of tradable assets—it’s about enhancing overall liquidity, which is crucial for maintaining a healthy trading environment. Poor liquidity leads to high slippage and price instability, both detrimental to traders and the ecosystem.

LP Vaults will help us better manage and increase liquidity, especially for newer or less common trading assets. This will attract a broader user base, create more trading opportunities, and ultimately boost the vitality and resilience of the dYdX ecosystem.

In DeFi, trust is crucial. While innovation is important, it alone doesn’t guarantee success—trust matters just as much. Our users need to feel confident that trading on our platform is secure and reliable. By improving liquidity through innovations like LP Vaults, we not only expand our capabilities but also strengthen user trust in our platform. This combination of innovation and trust is essential for long-term success and stability in DeFi.

More Competition, More Innovation, More Users

TechFlow: The derivatives market is highly crowded, with many projects trying new ways to attract users or expand narratives—such as Hyperliquid, Vertex, etc. How do you view relationships with other perpetual DEXs, and how do you maintain a competitive edge?

Charles d'Haussy:

Regarding our position in the crowded derivatives market and our relationship with other perpetual DEXs like Hyperliquid and Vertex, it’s important to understand our unique strategy. The derivatives market is indeed fiercely competitive, but at dYdX, we place strong emphasis on defining and understanding our user base. This clear definition of target audience allows us to tailor our services and products more effectively to their specific needs.

At the same time, we welcome competition in the DeFi space, as it drives innovation and benefits the entire ecosystem—more tokens, more users, and higher trading volumes.

Furthermore, superior liquidity is foundational to our strategy. Better liquidity enables improved price discovery and lower slippage, making our platform more attractive for serious trading activity. We ensure our products are not only diverse but also highly liquid—critical for traders who require a reliable and efficient trading environment.

In short, by clearly defining our audience, delivering excellent products and services, and ensuring robust liquidity, we successfully maintain a competitive advantage in the derivatives market. This focused strategy not only differentiates us from competitors but also strengthens user trust and loyalty, solidifying our market position.

TechFlow: For many users, the more trading pairs a platform lists and the faster the execution, the more directly they judge platform quality. From dYdX’s perspective, what areas should be prioritized and improved in derivatives trading?

Charles d'Haussy:

From dYdX’s standpoint, when evaluating what aspects to prioritize and improve in derivatives trading, several key areas stand out. While it’s true that many users assess platform quality based on the number of listed trading pairs and execution speed, dYdX believes the core drivers of success go beyond these metrics.

First, our API plays a pivotal role in platform functionality. We continuously work to improve our API, as it enhances user experience and ensures seamless integration with various trading tools and systems. This integration capability is crucial for attracting institutional traders and those employing complex trading strategies, both of which significantly contribute to our trading volume and liquidity.

Second, we’re exploring the potential of prediction markets. These allow users to speculate on future events and represent an exciting growth avenue. They not only diversify trading options on our platform but also attract a broader audience, boosting engagement and trading volume.

It’s worth noting that around 80% of our trading volume comes from derivatives. This high proportion underscores the significant influence of derivatives on spot price discovery. Therefore, our development efforts are focused on enhancing the functionality and features of our derivatives products. In doing so, we ensure our platform meets current user needs while anticipating future market demands.

In conclusion, while the number of trading pairs and execution speed matter, at dYdX, we focus on strengthening our API, exploring innovative market types like prediction markets, and continuously improving our derivatives trading capabilities—to better serve our users and maintain a competitive edge.

TechFlow: When dYdX Trading announced the development of dYdX Chain, they mentioned a goal of achieving greater decentralization. Yet many projects talk about decentralization. In your view, how can ‘true decentralization’ be achieved? How should it be evaluated, and where is dYdX’s decentralization reflected?

Charles d'Haussy:

When dYdX Trading announced the development of dYdX Chain, the goal was clearly to achieve greater decentralization, a term frequently discussed among blockchain projects. However, achieving true decentralization goes beyond rhetoric—it requires concrete actions ensuring the system truly operates in a decentralized manner.

In my view, true decentralization is achieved by distributing control and decision-making among a broad and diverse set of stakeholders rather than concentrating power in a few hands. This includes not only decentralized governance via DAOs (Decentralized Autonomous Organizations), but also ensuring infrastructure and operations are distributed across a decentralized network of nodes.

Evaluating decentralization can be challenging for users, as it’s not always clear which criteria to consider, or they may lack technical understanding of what constitutes decentralization. At dYdX, we strive to make this evaluation process more transparent. This transparency is evident in our governance model, where token holders have meaningful input and control over the protocol’s direction.

Moreover, migrating to our own chain represents a significant step toward decentralizing our operational infrastructure, reducing reliance on centralized components.

To deliver a genuinely decentralized platform, we work to distribute both operational and governance functions across a wide network. This approach ensures no single party holds disproportionate control, aligning with core principles of blockchain and DeFi. Thus, dYdX’s decentralization is not merely about reducing dependence on central entities, but about enhancing user trust and security, providing equal opportunity for all to participate in and influence the ecosystem.

TechFlow: Recently, Uniswap’s decision to activate fee switching drew widespread attention. However, dYdX has long shared 100% of protocol fees with its users, empowering $DYDX stakers. How do you view Uniswap’s move, and what distinguishes $DYDX from other platform tokens?

Charles d'Haussy:

Regarding Uniswap’s decision to activate fee switching, I’d highlight that at dYdX, we pioneered this model by sharing 100% of protocol fees with $DYDX stakers. This makes our stakers function almost like shareholders, directly benefiting from fees generated by the platform.

When you stake $DYDX, you receive USDC generated from trading fees paid by users. This model rewards stakers in real time, fluctuating with platform activity and trading volume.

This direct profit-sharing model not only tightly aligns staker incentives with protocol success but also sets us apart from other platforms. Our stakers don’t just earn more tokens—they directly participate in the platform’s economic upside, making our model distinctly different and, in my view, more beneficial for our community. This system transforms $DYDX from merely a utility or governance token into a direct vehicle for economic participation in platform success.

Focus is Crucial

TechFlow: As a leading perpetuals platform, regulation is often a key concern. How does dYdX navigate the complex DeFi regulatory landscape, and what steps are taken to comply with global regulations? What is your outlook on the future of DeFi regulation, and how might it affect platforms like dYdX?

Charles d'Haussy:

Operating a leading perpetuals platform like dYdX means navigating the complex DeFi regulatory environment is indeed a critical aspect. In my view, it’s essential to recognize that regulation isn’t just about restriction—it’s about ensuring safety, transparency, and trust. At dYdX, we emphasize that we are more transparent than centralized exchanges because everything is verifiable on-chain. This transparency forms the foundation of both user trust and regulatory compliance.

We actively engage with regulators to help shape legal frameworks that recognize the unique attributes of blockchain technology. This includes demonstrating how our decentralized structure inherently offers consumer protections different from traditional financial systems. Our platform runs on blockchain technology, which by design provides transparency and security—we leverage this as a core argument for more tailored regulatory approaches.

Looking ahead, I believe DeFi regulation will become more nuanced, recognizing the fundamental differences between decentralized and centralized services. This evolution could benefit platforms like dYdX by eliminating current ambiguities and potentially driving broader adoption and trust.

Innovations such as blockchain’s inherent transparency and trustless verification of transactions and operations are key. These innovations not only challenge traditional models but also provide a blueprint for how DeFi can integrate with the global financial system while enhancing user protection and system integrity.

Going forward, I expect regulation to begin reflecting the unique capabilities and strengths of DeFi platforms, which could greatly benefit dYdX as we continue to prioritize compliance and user safety in our operations.

TechFlow: This year, dYdX appears to be placing greater emphasis on investment in the Chinese-speaking market—for example, establishing Chinese-language Twitter accounts and community groups. What are your thoughts on the Asian market and its users?

Charles d'Haussy:

This year, we’ve indeed invested heavily in the Chinese-speaking market. Recognizing the importance of the Asian market and its users, we’re actively engaging this audience through initiatives like launching Chinese-language Twitter accounts and community groups. Our strategy is rooted in the belief that Asia will play a pivotal role in DeFi’s global expansion—especially for dYdX.

In my view, the Asian market is vibrant and rapidly evolving. Users here are highly tech-savvy and eager to adopt new financial technologies, making it a crucial region for dYdX. To better serve these users, we’re exploring major partnerships with Asian exchanges and enhancing our platform with mobile experience options tailored for Chinese users. This focus on mobile access is critical, as mobile is the primary way many Asian users interact with technology daily.

Moreover, empowering user freedom lies at the heart of our mission. We believe in providing tools and resources so users can interact with our platform in the way that best suits them—free from unnecessary restrictions or complexities. This approach not only respects user autonomy but also aligns with our core principles of decentralization and open access. Our focus on Asia is both a strategic and user-centric decision, aiming to incorporate user preferences and needs into the evolution of our platform.

TechFlow: Finally, as one of the most seasoned projects in Web3, dYdX is considered among the most successful. Managing the success of a project is actually very difficult. Could you share some entrepreneurial lessons that might be valuable for future builders?

Charles d'Haussy:

Managing a successful project like dYdX, especially in the ever-evolving Web3 space, is undoubtedly challenging yet deeply rewarding. Based on my experience, several key insights may prove valuable for future builders entering this field.

First, the importance of focus cannot be overstated. In the world of Web3, possibilities seem endless, and new ideas emerge daily. Staying sharply focused on the core product and value proposition is critical. For dYdX, this means refining our strengths in the derivatives market and continuously improving our product, rather than spreading ourselves too thin across too many features or markets. I’d also caution against chasing incentives to migrate to other blockchain platforms. Remaining committed to our core mission and objectives is key to long-term success.

Second, resilience is essential. The entrepreneurial journey, particularly in emerging and untested markets like Web3, is filled with uncertainty and challenges. There have been countless times when the path forward wasn’t clear and external conditions were far from ideal. Yet persistence and commitment to the vision have been central to overcoming these hurdles. I want to stress the importance of closely managing cash flow and burn rate. At dYdX, we maintain enough cash reserves to last 18 months. This is crucial for sustaining operations through the ups and downs of the blockchain industry.

Third, building a strong team and fostering a collaborative culture is vital. Web3 projects require a blend of skills—not just in blockchain technology, but also in finance, regulation, and user experience. Attracting, nurturing, and retaining talent who are not only skilled but also aligned with dYdX’s vision of decentralization and innovation is extremely important.

Finally, community engagement is indispensable. The decentralized nature of Web3 means community feedback is invaluable. Listening, engaging, and sometimes leading the community helps us refine our product and grow stronger. It’s also a way to stay relevant and truly meet user needs.

These lessons from the dYdX journey are not only applicable to blockchain projects but to any tech-driven entrepreneurial venture. A combination of focus, resilience, teamwork, and community involvement forms a solid foundation for success in the dynamic Web3 landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News