Paradigm Dethroned? From Top-Tier Mega VC to the "Master of Overpriced Deals" Everyone Now Avoids

TechFlow Selected TechFlow Selected

Paradigm Dethroned? From Top-Tier Mega VC to the "Master of Overpriced Deals" Everyone Now Avoids

Not being led by the nose and finding your own way to thrive is where the demystification of navigating the crypto world begins.

Author: TechFlow

In the crypto world, an endorsement is worth a fortune.

Whether doing research or chasing new projects, market participants once shared an unspoken understanding:

Projects backed by major VCs often meant big opportunities.

Due to extreme information asymmetry in the industry, large VCs were seen by many as "information filters"—professionals using expertise, capital, and reputation to select promising projects, making it highly likely that following them would yield profits.

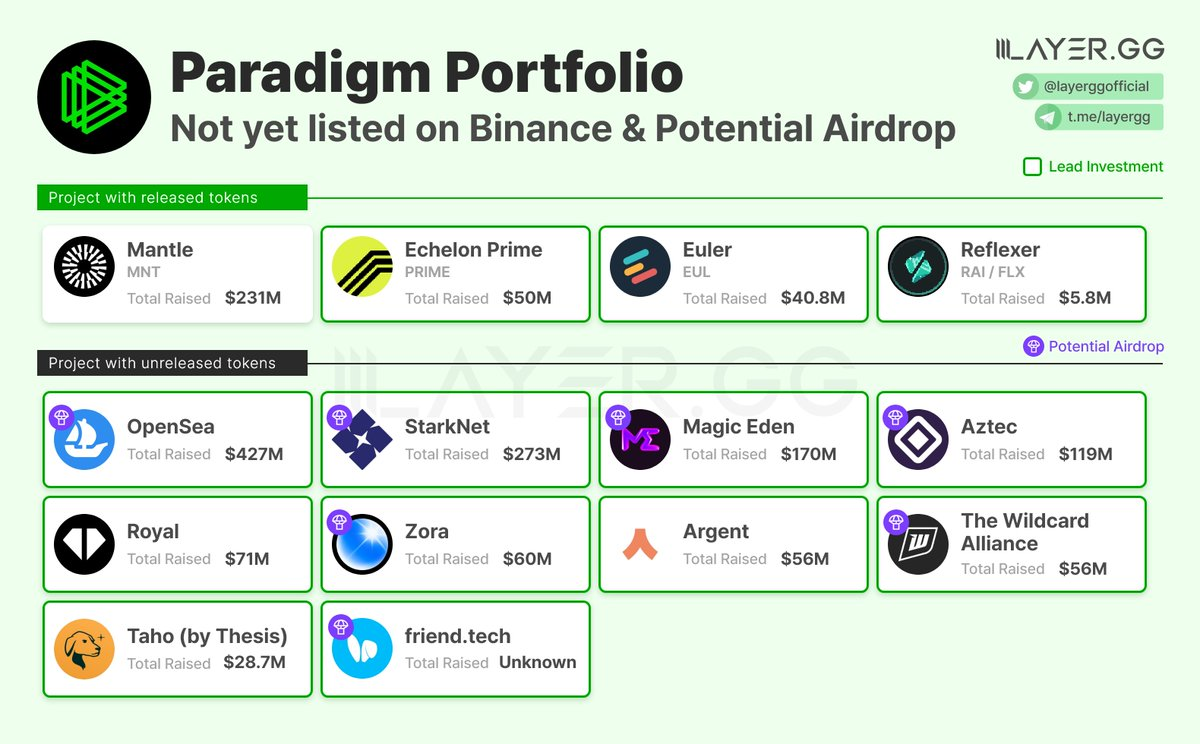

Take Paradigm, one of the top-tier VCs in the crypto space, which has invested in Coinbase, Maker, Uniswap, and the once-dominant FTX—renowned for its sharp investment judgment.

During the last bull cycle, the saying "Paradigm leads, no small gains" was widely circulated.

But recently, avoiding Paradigm seems to have become a new consensus among retail investors.

Scroll through social media, and you'll increasingly hear voices advising to steer clear of any project funded by Paradigm.

Some even joke sarcastically that since Paradigm’s office is in Shenzhen, its portfolio projects behave much like Shenzhen-style Ponzi schemes—the VC itself gradually becoming skilled at running schemes but poor at building real products...

From being a top-tier VC with trendsetting influence to now being avoided like a "scheme master," how did Paradigm fall from grace in the eyes of retail investors?

From Paradigm to "Puadigm"

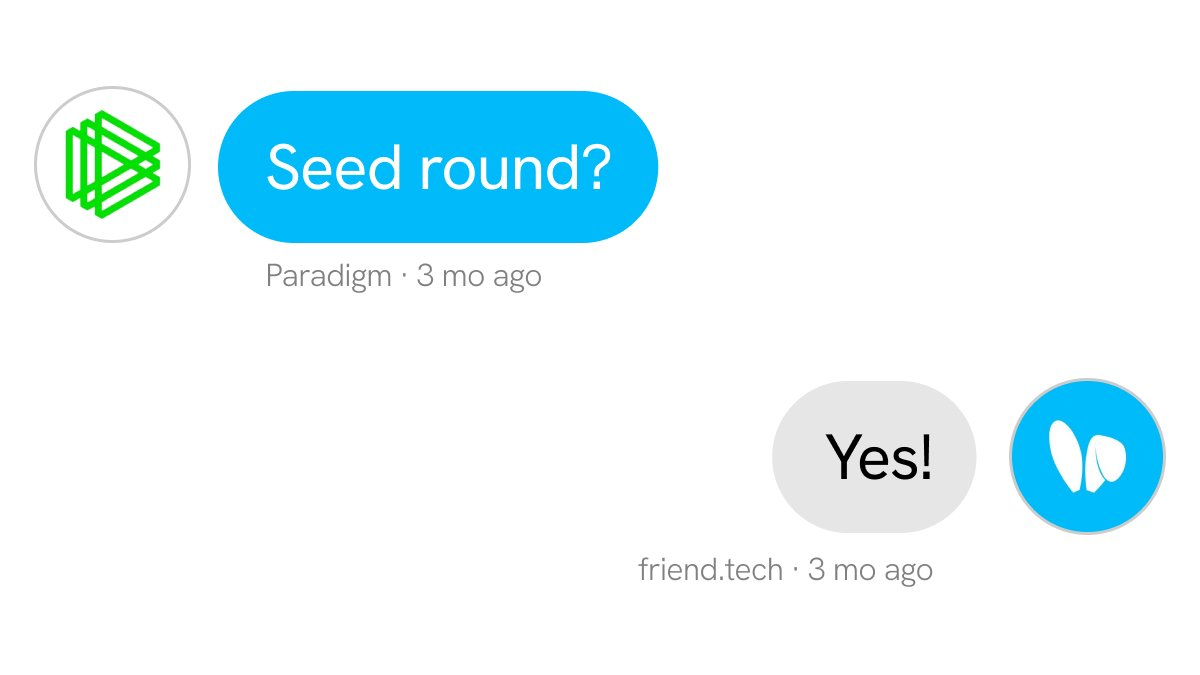

The initial shift in sentiment began with FriendTech.

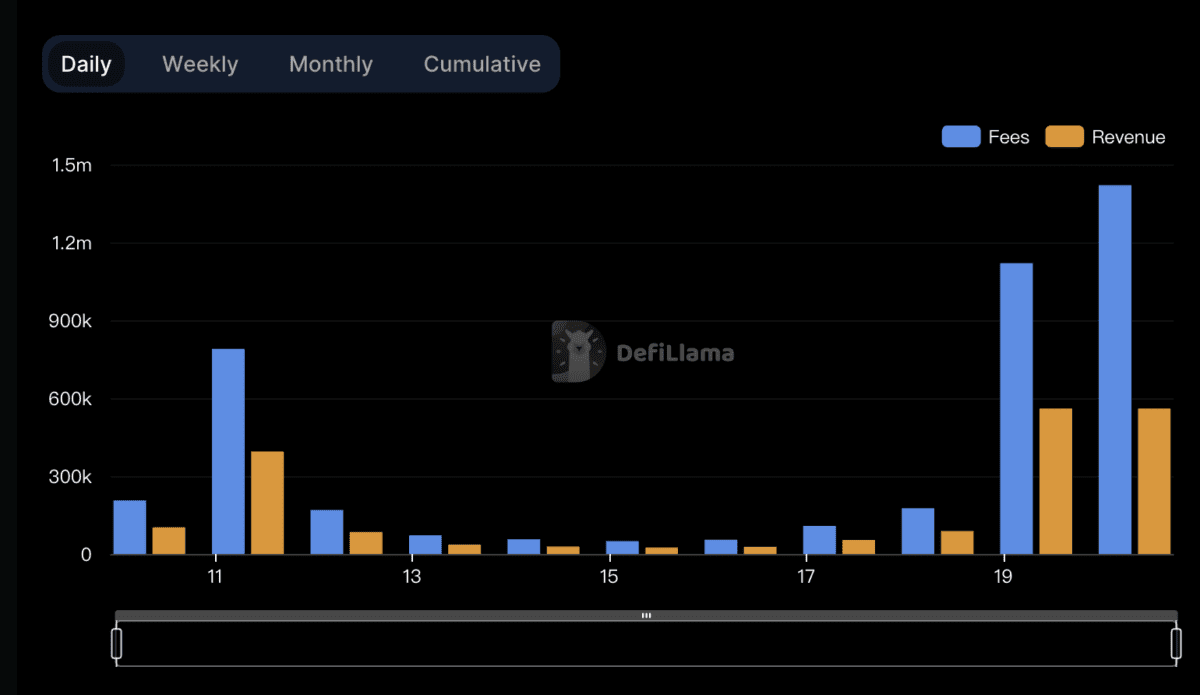

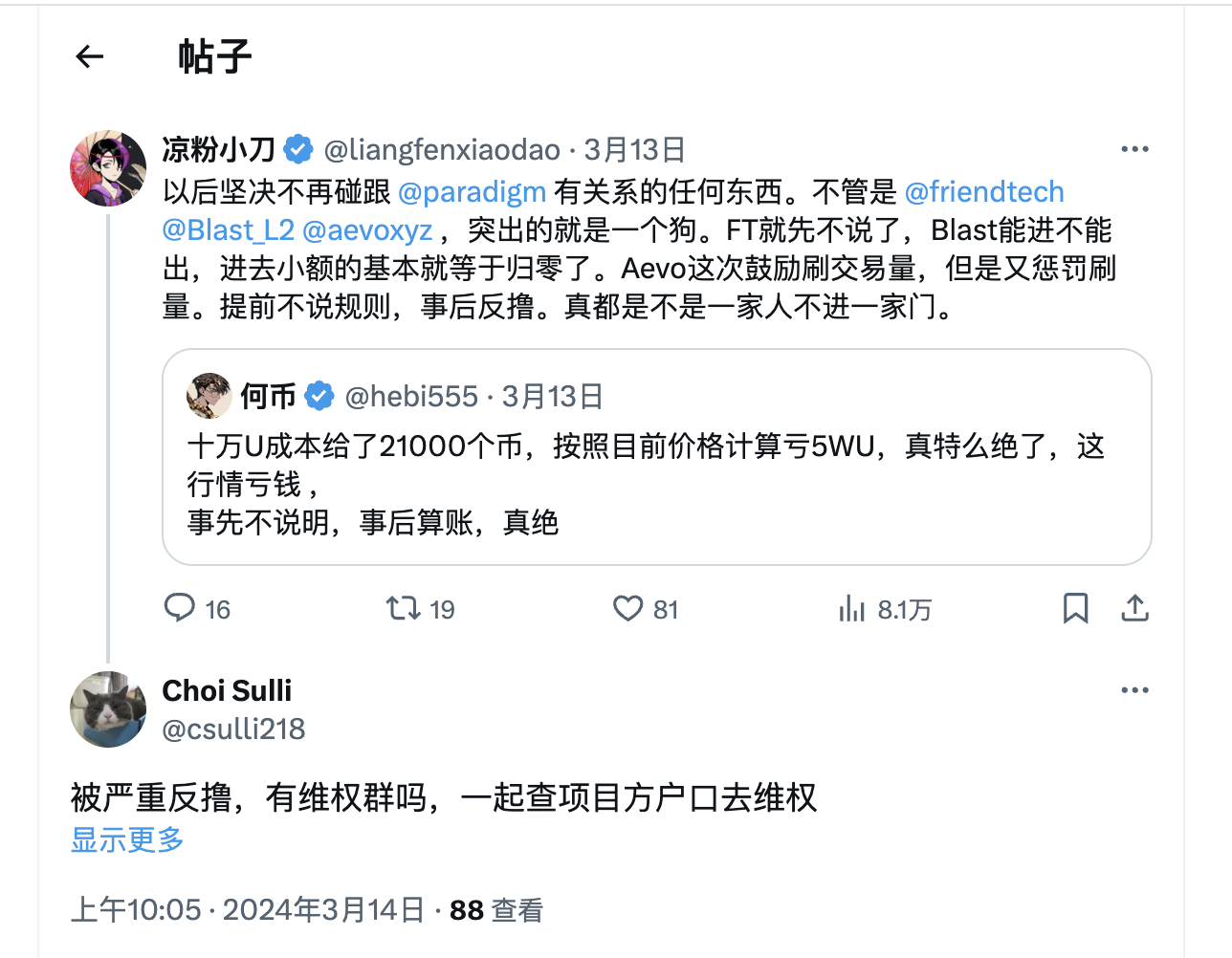

FriendTech (hereinafter FT) sparked a social frenzy last year. While influencer promotions and share-purchasing economics helped drive adoption, what truly triggered a surge in user participation was the announcement that Paradigm had invested in FT's seed round.

Acting on the subconscious belief that a major VC investment must mean profit potential, FT saw a noticeable spike in user activity and transaction fees after the news broke.

But everyone knew the truth: people weren’t there for socializing—they were chasing airdrops.

FT later adopted a points system—more active users who bought more shares earned more points and higher rankings, with points eventually redeemable for token airdrops.

But that “eventually” never came—even as SocialFi cooled down completely.

Crypto trends shift rapidly, especially in social products. Activity plummeted, TVL drained out, and even if you stayed active on FT, there was hardly anyone left to interact with.

And when the dust settled, retail investors realized—doesn't this feel a bit like PUA?

Encouraging continuous investment, exerting ongoing control, and dangling a reward that never materializes.

This feeling resurfaced again with Blast, another Paradigm-backed project.

The first L2 with built-in yield—contribute more TVL for longer, earn more points, and get a sweeter future airdrop... same old recipe, same familiar taste.

Although Paradigm’s research lead publicly expressed disagreement with certain execution strategies of Blast, and Pacman clarified that Paradigm had no control over Blast’s GTM (Go-To-Market) strategy;

Still, with the same VC and the same PUA flavor, it’s hard not to associate Paradigm by proxy. Users gradually formed the impression that Paradigm is exceptionally good at PUA.

Not to mention Blast’s further PUA tactics after mainnet launch, leaving early ETH depositors stuck in a lose-lose situation—anger and frustration peaked:

Whether Paradigm actually participated in designing these schemes or colluded with teams to absorb TVL no longer matters. What matters is the repeated PUA experience inflicted on retail users through its portfolio projects, reinforcing this perception:

Paradigm has become "PUAdigm." Once, seeing their name meant guaranteed gains; now, it means guaranteed disappointment.

Third time’s the charm? Not quite—similar issues reappeared with Aevo, where recent high expectations met crushing disappointment. Ambiguity around wash trading dealt another blow to those counting on "no small gains" from Paradigm-backed projects.

Note: we still can't confirm whether Paradigm reached any PUA-like agreements with project teams. But the longer things drag on, the murkier the rules, the higher the opportunity cost, and the greater the uncertainty—these are undeniable facts.

What makes retail investors especially conflicted is that Paradigm’s golden reputation still stands—leading to obvious chicken-and-egg dilemma:

If you don’t participate, someone else will.

If you opt out due to PUA fatigue, competitors will rejoice—fewer rivals mean less competition. After all, the crypto market never lacks people willing to go to great lengths for free meals, especially when they know your withdrawal means a bigger slice of the pie for them.

Tasteless to eat, yet fearful others might feast.

Caught between having returns and possibly getting nothing, retail investors repeatedly tormented naturally turn their anger toward Paradigm.

Long-termism Hurts Retail

However, worsening public opinion doesn’t mean Paradigm is entirely without merit.

Founded in 2018, Paradigm’s initial backers included endowment funds from Yale, Harvard, and Stanford universities. Academics and researchers aren’t fools—they wouldn’t blindly fund an organization lacking investment capability.

Its first $400 million fund came from Yale’s endowment, backing foundational DeFi projects like Uniswap and infrastructure giants like StarkWare.

Don’t forget, the word "Paradigm" itself means "paradigm." In business model selection, Paradigm consistently backs innovative projects representing new paradigms.

FriendTech, Blast, and Aevo—all follow this pattern, differing significantly from existing market offerings.

When top VCs focus on identifying paradigm-shifting projects, it implies these ventures possess genuine innovation and transformative potential.

It just might take a very long time for that potential to materialize.

So long that retail investors grow exhausted and resentful of PUA mechanics, point farming, acceleration multipliers, referral systems, and similar tactics.

If focused on long-term project development, such extended marketing strategies—including these tactics—are naturally justified from a VC and incubation perspective.

But retail investors hate the term "long-termism" above all.

In the crypto arena, no one will endlessly support a project’s growth without tangible interim rewards. Without realized benefits, all loyalty is meaningless.

Moderate PUA may be acceptable—but persistent PUA is shameful. That’s the true consensus among retail investors.

Just Because I Can’t Get Rich, It Doesn’t Mean They’re Bad?

Finally, we must recognize:

Paradigm may represent the pinnacle of crypto investing, but it doesn’t guarantee success for your personal portfolio.

A VC’s goal is neither to ensure nor capable of ensuring individual investment success. Backing a strong project and profiting from it aren’t always aligned—such as enduring PUA tactics firsthand.

VC stands for venture capital—how can you expect guaranteed profits just by copying their moves?

Even if a project succeeds, you might still miss out. But if you label a VC as trash simply because you didn’t profit, that’s perhaps unfair.

Today, Paradigm bears the brunt of PUA-related backlash. Tomorrow, which VC will face hatred? Criticizing every crypto VC and avoiding all PUA projects won’t increase your returns by a single dollar.

Recall the inscription and fair launch waves—VCs didn’t profit either. Different roles in the ecosystem have different ways of generating returns.

As some KOLs put it: abandon worship, question authority, think independently.

Stop being led by the nose. Find your own way to profit—that’s where demystifying the crypto world begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News