Paradigm Founder's New Work: The Gambling Table on Mars, Cryptocurrency Frontier and Speculation

TechFlow Selected TechFlow Selected

Paradigm Founder's New Work: The Gambling Table on Mars, Cryptocurrency Frontier and Speculation

In the world of encryption technology, focus on substantive development and genuine applications, rather than merely chasing speculative trends.

Written by: Matt Huang, Co-Founder and Managing Partner at Paradigm

Translated by: MarsBit, MK

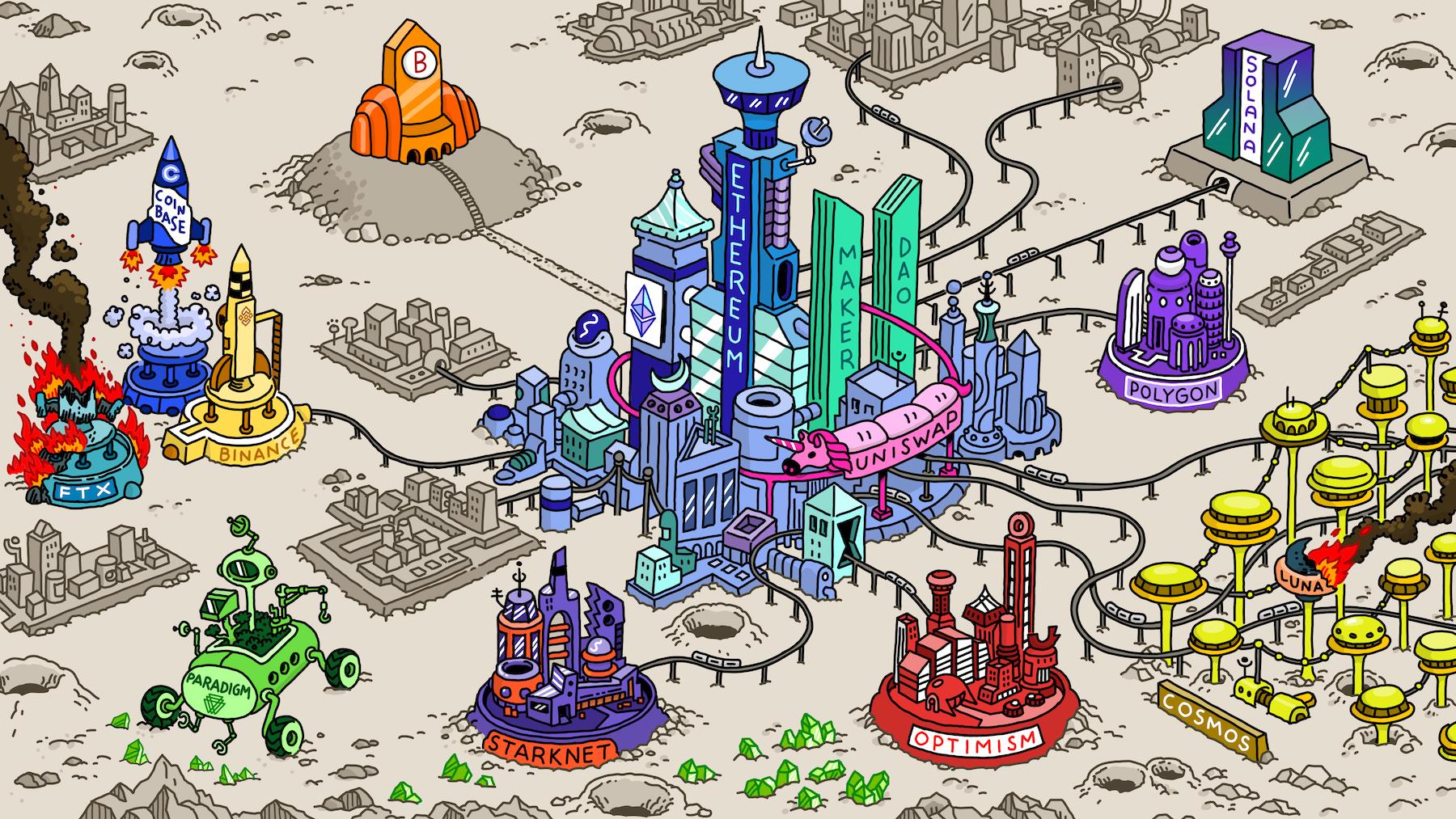

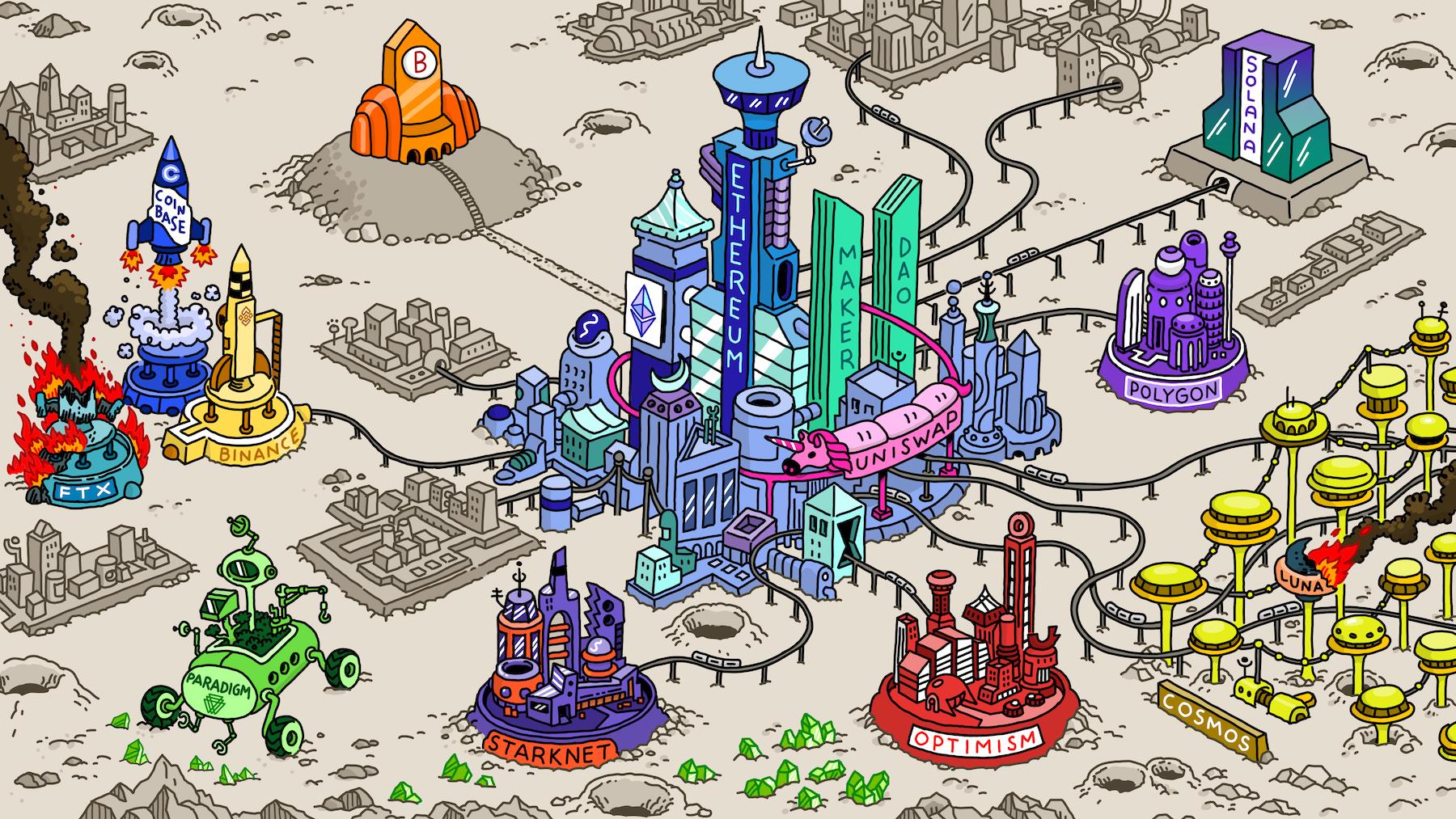

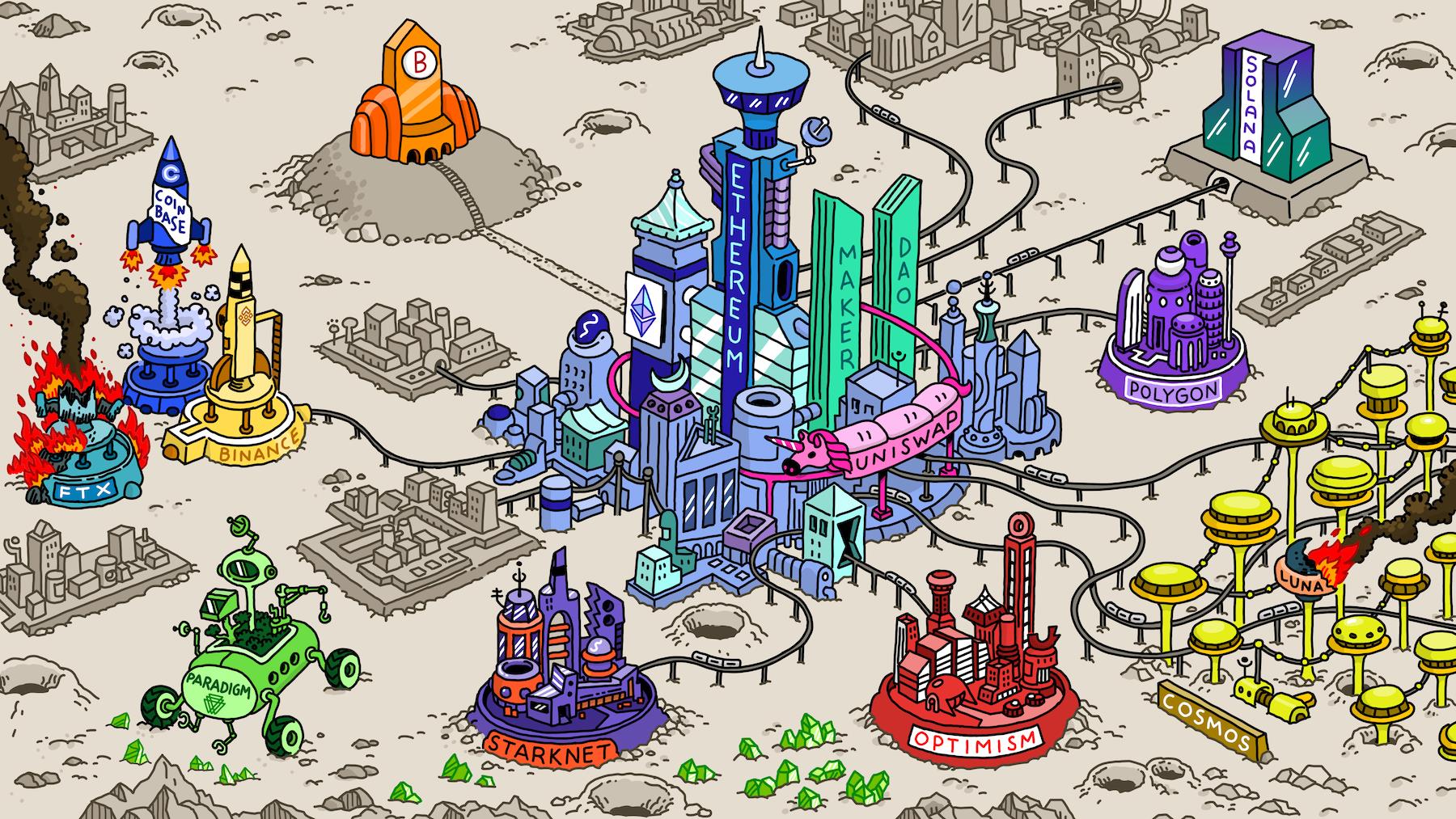

We can think of cryptocurrency as a new planet being colonized.

Many critics see it as a barren and worthless planet, or even just a dirty casino. Optimists, however, see its untapped potential—a place where we can build more advanced financial systems and internet platforms.

The new settlers are diverse: explorers drawn by cutting-edge technology, along with some unsavory speculators. Innovators and researchers are attracted by new possibilities, while ordinary people—especially those marginalized on Earth—are joining too.

Governance remains uncertain. Some Earth jurisdictions ban their citizens from traveling to the new planet, while others are trying to establish a foothold in this emerging world.

The history of this new planet has been marked by cycles of speculation and hype, leading many to question its future direction. Today’s crypto speculation is merely a self-booting process. Just as the 1849 Gold Rush transformed San Francisco from a quiet village into a major port (and eventually a hub of technological innovation), today’s crypto boom is attracting settlers and driving infrastructure development, turning a barren planet into a thriving cryptographic civilization.

The new crypto planet has already been born. Bitcoin was among the first settlers, while exchanges like Coinbase and Binance make travel to and from this planet easy. Ethereum has become the largest city, and Uniswap is one of the best transportation systems...

Why should we choose crypto?

Settling a new planet undoubtedly requires tremendous effort. But is it really worth it?

Where existing systems fail, we most need a new property rights system. BTC, ETH, and stablecoins are already in global use, especially in countries like Argentina, Turkey, and Ukraine, where they’re widely adopted by ordinary people.

While many are still waiting for crypto’s “killer app,” it has already arrived—it’s just less noticeable to those living in the developed world. Ask someone in Argentina about crypto, and they’ll immediately tell you what it’s good for. Today, cryptocurrency isn’t just a useful tool; it’s also a high-end speculative market. It’s rapidly evolving into a classic Christensen-style disruptive innovation, becoming increasingly valuable to more people.

Money is just the first “killer app,” and it won’t be the last. Cryptocurrency will give rise to a new suite of transparent, programmable, and open financial services. It offers a cheaper, more accessible, and inclusive alternative for those excluded from banking due to high fees or distrust in increasingly centralized banking systems. We’re seeing rapid growth in stablecoin payments, and loans can now be accessed through simple code rather than complex bank or brokerage procedures. Systemic risk could even be reduced through global collateral tracking.

Looking ahead, as crypto infrastructure expands, we can expect entirely new consumer applications to emerge. Creators will gain greater control over their work, and users will have better ownership of their digital identities.

On a broader level, this new planet gives us an opportunity to rebuild and upgrade outdated systems into more advanced and flexible ones. Crypto can do for money, finance, and digital assets what the internet did for information and media.

More importantly, crypto provides a counterbalance to an increasingly centralized world. In an era where “big” dominates, we’ve gradually lost appreciation for small and diverse forces. By enabling smaller, decentralized actors to collaborate effectively, crypto becomes a powerful force against centralization—one that promotes freedom and protects us from the control of big corporations and big governments.

Speculation and Cryptocurrency

While crypto has its advantages, is its speculative nature really necessary? In fact, speculation isn’t just essential—it can be highly productive.

Speculative investment is the bedrock of technological revolutions. From telecommunications and the internet to railroads, electricity, and automobiles, breakthroughs in new technologies are often intertwined with speculation and asset bubbles. As Carlota Perez has thoroughly documented, they are inseparable stages on the path to mainstream adoption. In crypto, speculation drives attention, capital inflows, talent attraction, infrastructure development, academic research, and corporate adoption.

Further, there is a deeper connection between speculation and crypto: it is the “Hello World” of digital property rights. When people are given the ability to create scarce assets, they naturally start trading them. Give a group of kids Pokémon cards and watch what happens. The real value of a new property rights system lies in reliably recording transfers of ownership—and that’s why people instinctively begin experimenting with and testing it. If the system hasn’t yet gained broad legitimacy, it may evolve into a pluralistic future, where price volatility and trading activity appear more speculative.

Back in Bitcoin’s early days, the idea that it might one day achieve legal recognition and value seemed absurd. I watched early participants mine, contribute, experiment, and even buy pizzas with pure excitement. Now, over a decade later, BTC and other crypto assets like ETH are steadily transitioning from speculative novelties into globally recognized commodities.

Speculation also plays a central role in crypto’s evolution into a decentralized financial system. Many financial products serve clear “use cases” on one side but rely on speculation to fulfill demand on the other. For example, someone may need a 30-year mortgage to buy a house, but there’s no natural counterpart willing to offer a 30-year loan. Our modern financial system mediates between such practical needs and more abstract demands for financial returns. In crypto, a similar ecosystem is forming—one that includes speculative traders, infrastructure providers, market makers, MEV searchers, blockchain builders, DeFi protocols, stablecoin issuers, and Uniswap arbitrageurs. Building such an N-sided market is difficult and takes time. But as participants mature, liquidity improves, and on-chain financial markets grow stronger.

The “casino” side of speculation has a dark side

While some criticism of crypto lacks imagination, certain concerns are valid. A casino can be a useful onboarding tool, but it can also bring unwanted consequences and backlash.

Innovation depends on capital and labor being directed toward valuable experiments. Excessive speculation, airdrop farming, and other gimmicks generate noise that can distort price signals—which otherwise could guide beneficial innovation. Even well-intentioned entrepreneurs may be misled by faulty price information or distracted by short-term profits, slowing down the real work needed to advance crypto.

Short-term speculation is essentially a zero-sum game, where skilled traders extract value from newcomers, potentially causing lasting harm. A free market should welcome all participants as long as their actions are legal and ethical. But if we view crypto adoption as a social coordination game, choosing the right time horizon becomes a prisoner’s dilemma. Only through long-term cooperation can we reach a more desirable outcome.

Finally, bad actors remain common: scammers, fraudsters, and hackers continue to pose threats. Imagine a world full of rogues who “welcome” newcomers through violence and theft—that’s the frontier of crypto today. Like the early internet or the Gold Rush era, this open frontier breeds both innovation and crime. While good actors ultimately prevail—as seen in the rise of world-class white-hat security experts—the space still needs more self-regulation and standards.

Why is progress so slow?

Crypto has been around for nearly 15 years. Shouldn’t it already be widespread and mainstream?

In reality, pioneering a new frontier takes time. Most people won’t migrate until the infrastructure is solid and social stigma fades. Technological progress also has limits—it can only move so fast. The social spread of new ideas is rarely linear; it’s full of setbacks. Due to its speculative nature, crypto experiences cyclical booms and busts—sometimes hailed as the future of everything, only to be declared dead the next moment.

Building social consensus around crypto is even harder than creating network effects for communication protocols or social networks. People quickly grasp the utility of WhatsApp or Instagram because they can use them to chat with a small circle of familiar friends. But a new property rights system is about securely transacting with people you don’t know well or fully trust—this requires much broader recognition and legitimacy. We still have a long way to go, but it’s encouraging that today you can already transact using BTC, ETH, or stablecoins with over a hundred million people.

Looking beyond the casino

Many technologies we now take for granted were once seen as impossible, useless, dangerous, or fraudulent. Apple is now the world’s most valuable company, but in 1980 Massachusetts banned the sale of its stock, deeming it too risky. Similarly, since 2010, there have been annual declarations that Bitcoin is dead.

Yet human history repeatedly shows that we often resist change—especially disruptive change—because we cling to the status quo. Crypto touches deep concepts around money, value, governance, and human collaboration. We must keep an open mind and explore the possibility of building better systems, rather than rejecting crypto outright due to skepticism.

We must look beyond crypto’s speculative aspects and recognize it as a guiding mechanism for one of today’s most important technologies. We need to dive deeper into the crypto world—the new planet—and focus on meaningful construction and real utility, not just chasing speculative trends.

Appendix

What does it mean to treat crypto technology as a new planet?

Crypto Community

The crypto space represents a cohesive ecosystem—we should all work together to build it. Among the different cities on this new planet, there is far more shared vision than division. More important than internal extremist conflicts is convincing Earth’s inhabitants to settle on the new planet—or protecting it from poorly designed Earth regulations.

As Vitalik said, thinking deeply about how to build a robust system is crucial for crypto. The new planet cannot forever rely on Earth’s infrastructure. Currently, we depend on networks like Google, Twitter, GitHub, and credit card systems—while China has its own parallel stack including WeChat, Alipay, Weibo, and DCEP. We need to build a standalone crypto stack that functions like China’s system but is more open and guarantees user sovereignty.

For a new planet, having a distinct culture is beneficial. We probably don’t want crypto to fade into the background or become indistinguishable from Earth.

Builders

Building in crypto isn’t just a technical question (“What can be built on the new planet?”), but also a social one (“Do the planet’s residents actually need this?”).

A good way to find startup ideas in crypto is to consider what early settlers might need. Do they need food or shelter? Then maybe offer those services. Another approach is to leverage the unique properties of the new planet—perhaps gravity works differently, opening up novel product opportunities.

Some products are best suited for settlers on the new planet, like decentralized finance (DeFi). Others act as bridges between the new planet and Earth, such as centralized finance (CeFi). Still others use new-planet technology to serve Earth, like fintech apps powered by stablecoins.

A common failure mode is building products for mainstream users before they’re ready to migrate. A smarter strategy is focusing on those already adapted to—or preparing for—the new planet. At the same time, another pitfall is focusing too narrowly on early adopters and ignoring the massive wave of future users.

Existing Enterprises

Established companies on Earth can also play a role. The most natural path is acting as a bridge between the new planet and Earth, though they may also try building native products.

Think of crypto as an emerging market—not just about adopting new tech, but entering a new realm with its own culture. Just as restaurants adapt menus for different countries or firms hire local CEOs, tailoring your team and product to the new planet’s characteristics is key.

A common failure is misunderstanding the new planet’s essence—for instance, when banks once pushed “blockchain, not Bitcoin.” That’s like slapping a new skin on a bank to make it look like the new planet, while missing its core meaning entirely.

Policy Makers

Contrary to intuition, crypto may ultimately benefit the U.S. dollar. Dollar-backed stablecoins have become one of the most popular currencies on the new planet, surpassing the influence of any other Earth currency.

Witnessing chaos and lawlessness on the new planet might tempt authorities to take extreme measures—like banning travel or tightly restricting activities. But this would prevent the planet from evolving past its primitive stage into one capable of long-term innovation.

A better approach is taking a long-term view, preserving safe harbors and permissionless innovation. Punish criminals when they commit crimes, but maintain openness for well-intentioned actors to experiment and innovate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News