Messari Research Report: In-Depth Analysis of Pyth, the Leading Oracle on Solana

TechFlow Selected TechFlow Selected

Messari Research Report: In-Depth Analysis of Pyth, the Leading Oracle on Solana

Pyth has expanded to serve the most blockchains and holds the fourth-largest share of total value.

Author: Messari

Translation: TechFlow

Summary

-

Pyth secures $5.5 billion in assets and supports price feeds for cryptocurrencies, stocks, forex pairs, ETFs, and commodities across 162 protocols on over 50 blockchains.

-

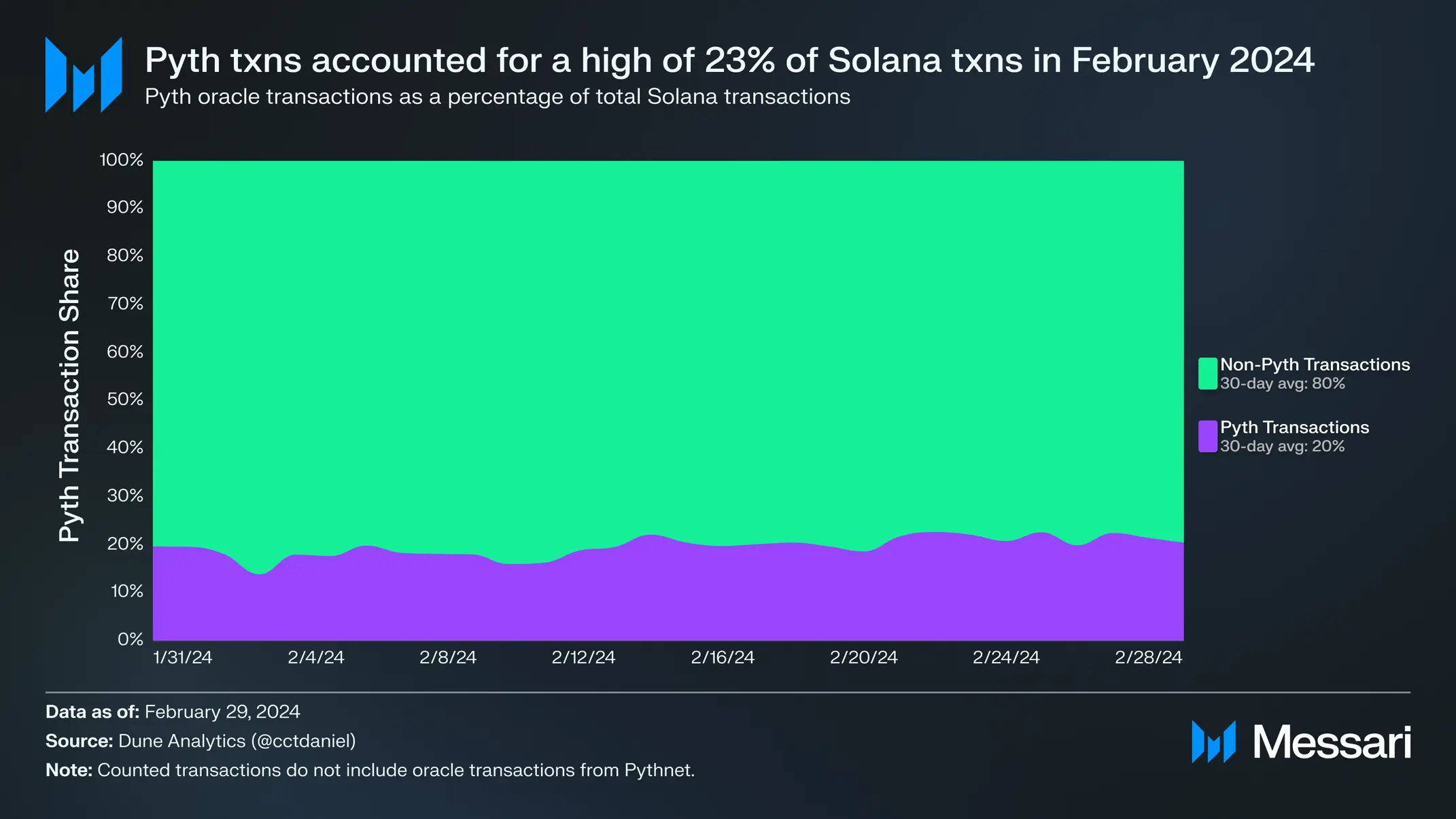

In February 2024, Pyth oracle transactions averaged 20% of Solana’s total transaction volume; meanwhile, Pyth data providers paid $225,000 in fees on Solana during the same month.

-

Pyth Network uses a first-party network of data providers to publish data directly to Solana and Pythnet—an application chain that delivers Pyth oracle updates to all other blockchains. Data providers include institutional traders, renowned market makers, and prominent DeFi protocols such as Jane Street, CTC, and Raydium.

-

By the end of Q2, Pyth plans to fully migrate its Solana push oracle to a new pull oracle model on Solana.

-

As the leading oracle on Solana, Pyth will support numerous applications expanding to and launching on Eclipse, Ethereum’s first SVM-based Layer 2 blockchain.

Background

Blockchain applications often require data from the external world. However, their design inherently limits native interaction with off-chain data. As a result, blockchains rely on oracles to act as intermediaries—aggregating external data and making it usable by on-chain applications.

Typically, oracle networks incentivize nodes to retrieve specific information, reach consensus on the value of a given data point, and post those values to the blockchain at set intervals. This “push” model, however, can be indirect, costly, and difficult to scale. Pyth Network addresses these issues by cultivating a network of primary (first-party) data providers and coordinating a “pull” model. This model reduces latency, scales rapidly, and lowers network costs by shifting update fees onto data consumers—applications and developers.

Pyth is a decentralized network designed to deliver accurate pricing data for cryptocurrencies, equities, foreign exchange pairs, ETFs, and commodities. It offers three core products:

-

Price Feeds – real-time updates for smart contracts

-

Benchmarks – historical market data

-

Pyth Entropy – secure random number generator

The robustness of Pyth’s data largely stems from its contributor network, which includes nearly 100 data providers from global exchanges, trading firms, market makers, institutions, and DeFi platforms. Notable providers include Jane Street, Chicago Trading Company (CTC), Binance, Raydium, Osmosis, Galaxy, and 0x. Pyth focuses on delivering financial market data to developers across an ever-growing list of blockchains—over 50 at the time of writing.

Technology

Beyond bridging data between blockchains and the outside world, oracles must also address the oracle problem—the challenge of ensuring that external data is secure, authenticated, and trustworthy while accounting for potential failures of external sources.

Addressing the oracle problem typically involves the following steps:

-

Validators or oracle nodes source the data

-

Nodes cryptographically sign (verify) the sourced data

-

Aggregation of data and consensus on computed data points

-

Transmission of data to the blockchain network

The oracle problem is commonly solved using either a push or pull model. Most oracles use a third-party push model. In this setup, oracle nodes are third parties that obtain data either from primary sources (e.g., exchanges) or secondary aggregators (e.g., CoinGecko and Kaiko). For instance, Chainlink’s main price feed oracle nodes source data from secondary providers. Push oracles periodically push price updates to individual blockchains, each requiring gas fees for on-chain updates. Adding new price feeds or reducing update latency increases costs for the oracle network, limiting scalability. Moreover, multiple trust assumptions are required: the primary source must be correct and stable, the secondary aggregator must be reliable, and the oracle network itself must function properly.

Pyth Network addresses the shortcomings of third-party push models through its pull model. By leveraging a network of first-party data providers, Pyth eliminates two downstream trust assumptions associated with third-party data reliability. In Pyth’s pull model, data is provided directly by exchanges, market makers, and DeFi protocols within the network—such as Jane Street, Binance, and Raydium. These entities are incentivized to act honestly and provide high-quality data to maintain strong reputations and avoid being banned from the protocol.

Additional benefits come from shifting costs to end users, where price feeds are updated based on demand rather than fixed time intervals. Consumers initiate price updates, pulling them into the same DeFi transaction (e.g., asset swaps, perpetual settlements). By passing costs to users and updating only when needed, Pyth redirects expenses efficiently and scales effectively—as evidenced by its frequent updates across 451 price feeds.

Core Interactions

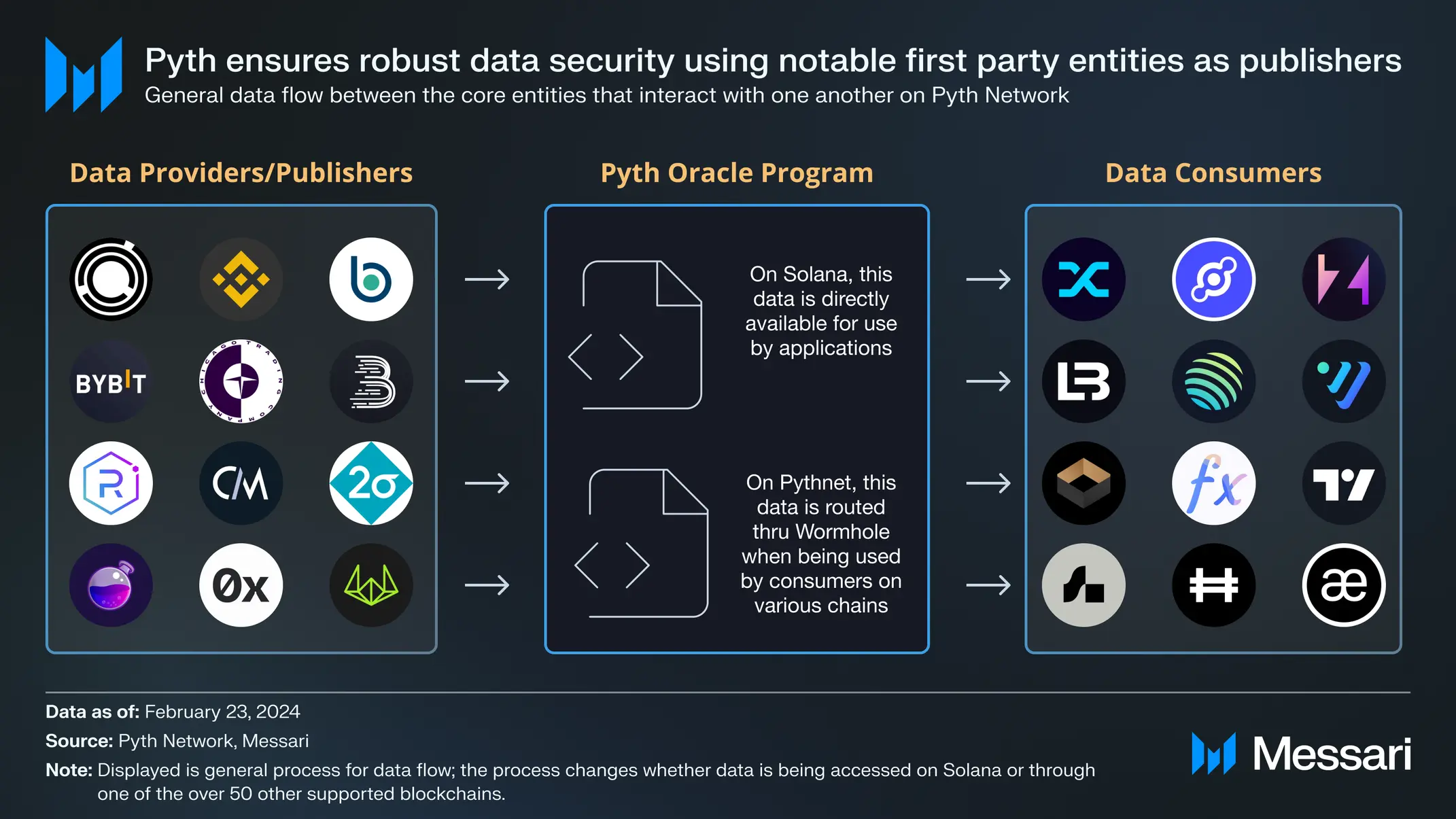

Pyth operates two instances of its protocol: one on the Solana mainnet and another on the Pythnet appchain. The Solana instance serves only Solana-based protocols, while Pythnet provides data to protocols on all other blockchains. Across both instances, three core entities interact to facilitate oracle updates on the Pyth Network:

-

Data Providers/Publishers (e.g., Jane Street, CTC, Binance, 0x, Raydium)

-

Pyth Oracle Program (aggregation algorithm)

-

Data Consumers (applications/developers)

Data providers serve as validators on Pythnet. Previously, the Pyth Data Association was responsible for delegating sufficient stake to validators; however, with governance now live, this responsibility falls to PYTH token holders. At the time of writing, no proposals have been made to alter validator staking dynamics, and all validators currently hold equal weight. As first-party suppliers of Pyth data, providers are compensated via small fees collected across consumer-initiated DeFi transactions.

The Pyth Oracle Program is the aggregation algorithm that combines submissions from providers and computes aggregated prices and confidence intervals for corresponding price feeds. It also maintains price feeds, stores individual provider inputs, and performs additional calculations such as moving averages. Applications and developers act as consumers who request updated price feeds to read the information generated by the oracle program.

Pyth on Solana

Price feeds are represented by two Solana accounts: product accounts and price accounts. Product accounts store metadata about the price feed, such as ticker symbol, asset type, and the corresponding price account. Price accounts contain the names of authorized data providers, each provider’s submitted prices and confidence intervals, exponential moving averages, and more. Both accounts are maintained by the oracle program, which also includes a third account listing all product accounts. This structure allows applications to categorize and access the full list of Pyth price feeds.

Providers submit price updates every 400 milliseconds—the length of a Solana time slot. Each update triggers frequent aggregation of prices and confidence intervals for downstream application use. (Because the oracle stores each provider’s individual submissions, providers can be held accountable for poor or malicious performance.) Solana’s low cost enables Pyth (or any oracle) to run an efficient push model, where developers simply pass relevant price feeds to their applications, deserialize the data, and read/integrate the published values.

Notably: By the end of Q2, Pyth plans to fully migrate its Solana push oracle to a new pull oracle on Solana. According to development channels, the Pyth pull oracle is already operational on devnet.

Pythnet Appchain

Pythnet is an authority-proof fork of the Solana mainnet, serving as a computational base layer for processing and aggregating data from Pyth’s network of data providers. The resulting price feeds on Pythnet are accessible to over 50 blockchains—not just Solana—since they are directly posted to chains. Because Pythnet is a fork of Solana, the oracle frameworks on Solana and Pythnet are somewhat similar, but key differences exist.

The push model described above on Solana is structurally similar on Pythnet. However, Pythnet is not a target chain and does not charge providers for submitting prices. While data providers push data to Pythnet for aggregation and serialization into accounts via the oracle program, this data is subsequently broadcast to other blockchains via Wormhole’s cross-chain messaging protocol. Costs are incurred by consumers on the destination chain when initiating data transfer through regular DeFi transactions—effectively pulling in data updates.

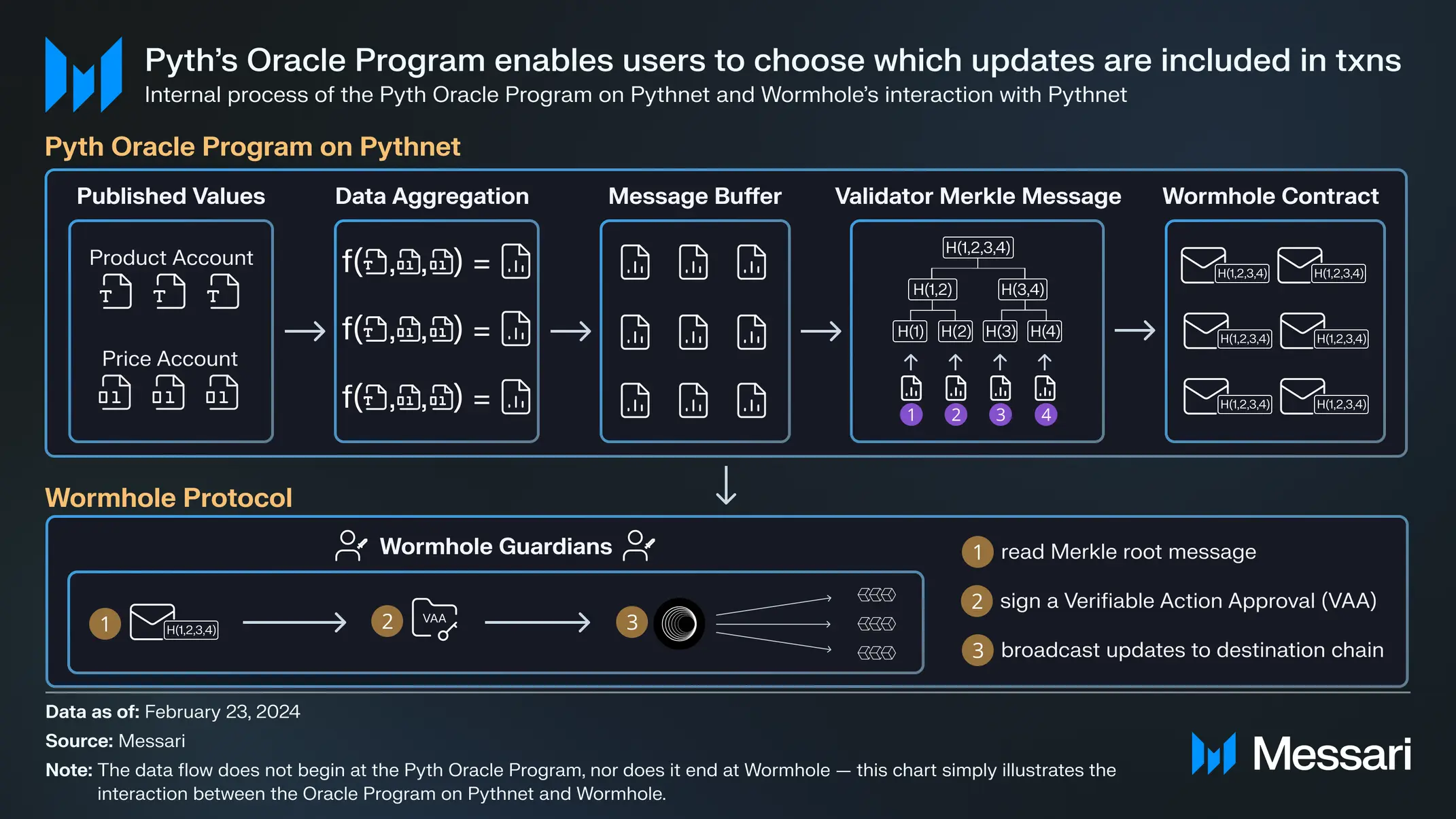

Cross-Chain Messaging

After data is published and aggregated on Pythnet, it is not immediately routed via Wormhole. Instead, Pyth routes its data through a message buffer and hashes it into a Merkle tree. This allows users to selectively include specific updates in a single transaction, keeps user costs low, and enables arbitrary computation within data updates. After each aggregation, the program adds a message to the buffer. For each time slot, Pythnet validators read messages, construct a Merkle tree, and send a message containing the Merkle root of all prices to the Wormhole contract on Pythnet.

Wormhole Guardians (nodes) then read the Merkle root message, create a Verifiable Action Approval (VAA), and broadcast the price update to the relevant blockchain. The VAA ensures reliable and secure data transmission. It contains signatures from Wormhole Guardians confirming they have witnessed and validated the information in the message—specifically, the Merkle root of the prices. The signed VAA is a verifiable and secure method to confirm that data transferred from Pythnet to the target blockchain has been authenticated by trusted parties (Wormhole Guardians).

Hermes

Hermes is a Web API that abstracts away the developer’s process of initiating updates. Without a service like Hermes, developers must manually compile an update payload with required price feeds and retrieve corresponding data and Merkle proofs from Pythnet using the Wormhole-verified Merkle root. Hermes allows developers to simply query a web service to access oracle prices. It enables data consumers to retrieve the latest prices via REST or WebSocket APIs.

REST (subset of HTTP) API Features

-

Best suited for applications needing instant access to the latest data, irregular data fetching, or conditional data requests.

-

Easy to implement and use.

-

Cleaner client-server interactions since each request is independent.

-

Use cases: portfolio tracking, loan disbursement or repayment, etc.

WebSocket API Features

-

Ideal for applications requiring real-time, continuous data streams.

-

Low maintenance overhead: after initial setup, data can flow back and forth without repeated HTTP header overhead, making it highly efficient for frequent transfers.

-

Persistent connection enables real-time updates and immediate data propagation.

-

Use cases: arbitrage trading, yield optimization tools, DEX trading, etc.

Hermes is permissionless, allowing any third party to build simplified access points to Pyth Network. Due to operational complexity, the Pyth Data Association maintains a public version. However, companies such as Triton, P2P, Liquify, and EXTR also host their own versions of Hermes. A growing list of node providers offering Hermes can be found here.

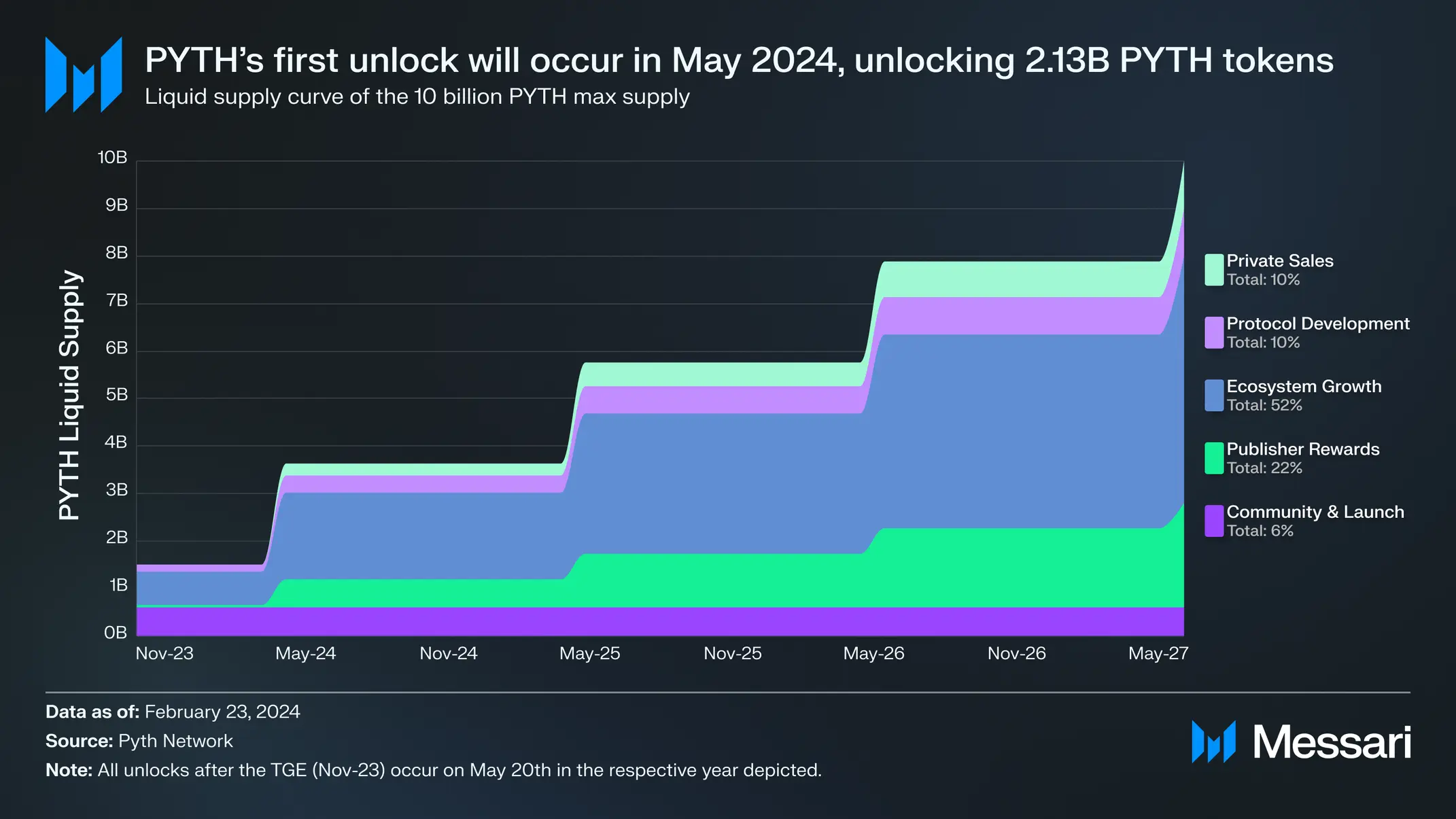

Tokenomics

Pyth’s ecosystem token, PYTH, has a maximum supply of 10 billion tokens. After the initial unlock in May 2024, its distribution will reflect the following allocation:

-

Community & Launch (6%): For initial launch activities and related initiatives.

-

Provider Rewards (22%): For the Pyth data provider network. Used for rewards, funding programs, and incentives to encourage providers to support new assets that may initially lack liquidity.

-

Ecosystem Growth (52%): For contributors to the Pyth network, including but not limited to developers, researchers, educators, and early providers. Aimed at encouraging initiatives and rewarding contributions beyond the founding team and core contributors.

-

Protocol Development (10%): For core contributors building tools, products, and infrastructure (i.e., Douro Labs).

-

Private Sale (10%): For two funding rounds. Pyth has not publicly disclosed the price per PYTH or valuation. In December 2023, Pyth released an update on its early strategic round, which included notable investors such as Castle Island Ventures, Wintermute Ventures, Borderless Capital, CMT Digital, Bodhi Ventures, Distributed Global, Multicoin Capital, and Delphi Digital.

Governance

PYTH is an SPL token on Solana (equivalent to ERC-20 on Ethereum). The core utility of PYTH is governance. Token holders can guide protocol development by staking assets and voting on Pyth Improvement Proposals (PIPs). To date, the only proposals voted on or under vote have included elections for the Pythian Council and approval of the Pyth DAO Constitution. Governance covers and may modify typical topics such as:

-

On-chain software upgrades

-

Reward structures for data providers

-

Rules for creating permissioned providers

-

Size, denomination, and existence of oracle update fees

-

Adding new price feeds and determining who supports them

The Pyth DAO consists of the Pythian Council and the Price Feed Council. Both councils hold elections every six months to rotate members. Members who participate less than one-third of the time are excluded from re-election. This system ensures active member engagement and alignment with Pyth’s goals. Both councils are responsible for voting on and executing certain operational PIPs.

Pythian Council

-

Eight members and the operating wallet holder are signers of the Pythian 7-of-9 multi-sig wallet.

-

Four members are replaced in each election.

-

Delegated voting power on operational PIPs involving oracle program updates, validation mechanisms, adjustments to oracle update fees and denominations, and PGAS (the gas token allocated/delegated to validators on Pythnet).

Price Feed Council

-

Seven members and the operating wallet holder are signers of the Price Feed 5-of-8 multi-sig wallet.

-

Three members are replaced in each election.

-

Authorized to vote on operational PIPs concerning management of the set of provided price feeds, selection of publishers, and price feed requirements (e.g., minimum and maximum providers per feed).

Following discussions on Pyth’s Discord forum, PYTH holders can vote on proposals via the governance portal on Realms when reaching the “voting phase.” Currently, a proposer must hold 25 million PYTH tokens to create a proposal.

There are two types of PIPs in Pyth DAO: constitutional and operational. Constitutional PIPs involve protocol updates, structural determinations, and guidance for Pyth DAO governance. They require over 67% support to pass. Operational PIPs concern treasury management, elections, and oversight of the Pythian and Price Feed Councils. Voting on these PIPs can be delegated to council members and requires over 50% support to pass.

Pyth Usage

Pyth is one of the most widely used protocols on Solana. During February 2024, its oracle transactions accounted for an average of 20% of all Solana transactions. Over the same period, Pyth data providers paid $225,000 in fees on Solana. Pyth oracles protect 95% of the value secured on blockchains. As of January 2024, Pyth also protected over 90% of value on nine other blockchains and over 50% on 16 additional chains.

Notable Users

Thanks to its ability to expand sources on Pythnet, Pyth has become one of the most widely adopted oracle protocols across various blockchains. Instead of adding new data sources directly to target chains, Pyth simply adds them to Pythnet, allowing its oracle contracts to use these sources across every supported chain. As a result, Pyth can build oracle contracts for any chain it plans to support. With ongoing support for multiple blockchains, numerous projects have adopted Pyth’s oracle network. Below are some notable examples.

Synthetix

Synthetix is a decentralized liquidity provision protocol enabling the creation of synthetic assets (synths) that track the value of cryptocurrencies and real-world assets such as currencies, commodities, and stocks. Synthetix allows users exposure to various assets without holding them directly, broadening investment opportunities and enhancing liquidity in crypto markets. A key component of Synthetix functionality is integration with Pyth Network oracles. These oracles provide high-fidelity, real-time price feeds essential for maintaining the accuracy of synth valuations.

Helium

Helium is a decentralized Internet of Things (IoT) network. It features a token-based economic incentive system that rewards participants for deploying wireless devices providing mobile network coverage. Helium leverages Pyth Network oracles to deliver accurate on-chain market prices for its native token HNT. These values are critical for various network operations, including converting burned HNT into Data Credits (DC) and accurately measuring fund allocations. Although Helium is not DeFi, its use of Pyth oracles in a decentralized connectivity platform highlights the importance of precise data in managing even DePIN protocol economics.

Eclipse

Eclipse recently raised $50 million in a Series A round to launch the first Layer 2 blockchain using SVM (Solana Virtual Machine) for execution and Celestia for data availability, while deriving security from Ethereum as a settlement layer. Eclipse’s launch is expected to attract liquidity from Ethereum users and direct it toward Solana-based decentralized applications on Layer 2. As Solana’s leading oracle, Pyth will support many applications expanding to and launching on Eclipse.

Competitive Analysis

The oracle space is highly competitive and dominated by Chainlink. Although Chronicle Protocol created the first on-chain oracle for MakerDAO in 2017, it did not launch a public oracle network until late 2023. It currently offers feeds on only two blockchains but plans to expand. Chainlink captured significant market share during DeFi’s growth years, launching various oracle-based products serving broad markets. To date, only three protocols secure more value than Pyth Network: Chainlink, Chronicle, and WINkLink—these four top protocols collectively represent 90–95% of the oracle market cap. Nonetheless, Pyth leads in both the number of supported blockchains and secured value. Chainlink remains Pyth’s biggest competitor in terms of blockchain diversity and secured value.

Chainlink

Critics refer to Chainlink as a “black box” due to low transparency regarding where oracle nodes source their data. Neither on-chain nor on Chainlink’s oracle node website are data sources explicitly identified. In contrast, every data point on Pyth Network can be traced back to an individual provider’s public key by copying the transaction hash from Pyth’s price feed page to any Solana block explorer. While Chainlink data can also be traced to Chainlink oracle nodes, Pyth’s data providers are first-party sources. Unlike Chainlink, Pyth’s published data comes directly from the internal operations of exchanges, trading firms, and market makers. However, provider public keys are not publicly linked to identities, adding a layer of trust managed by Pyth (originally a permissioned provider system) in overseeing its provider network.

While Pyth focuses on traditional finance and crypto pricing, Chainlink offers several products, including an interoperability protocol (CCIP), proof-of-reserve feeds, developer tools (VRF, API functions, automation services), and its market data feeds. Thus, Pyth’s core product primarily competes with Chainlink’s leading market data feed offering, although Pyth also offers a random number generator via Pyth Entropy. Below is a comparison between Pyth and Chainlink in market data feeds:

Data Sources

Pyth

-

Pyth aggregates data directly from primary sources and updates price feeds every 400 milliseconds on Pythnet and Solana.

-

Outside Solana, other chains must initiate price updates to publish them on-chain, meaning data staleness ranges between 400 milliseconds and the next on-demand update.

-

For data providers who also trade, there is a conflict of interest in publishing honest data points that could be disadvantageous to specific trades. Assuming most providers are honest, reputation-conscious, and do not coordinate updates, Pyth’s aggregation algorithm mitigates this risk by assigning low weights to outlier data points.

-

Direct sourcing from primary data enables rapid addition of price feeds for newly created trading pairs.

Chainlink

-

Chainlink aggregates data from secondary sources (data aggregators) and posts price feed updates on-chain according to each blockchain’s frequency.

-

Data staleness depends on both the secondary source’s update frequency and the oracle network’s aggregation cycle.

-

Even if primary sources support a specific trading pair, price feed availability depends on whether secondary aggregators also cover that data point. This may create friction in adding new feeds, though it is less of an issue for major trading pairs.

Pull vs. Push Model

Pyth

-

Pyth on Solana uses a push model, publishing updates every 400 milliseconds.

-

Pyth on Pythnet uses a pull model: users initiate updates on the target chain, and updates posted on Pythnet are routed via Wormhole to the requesting chain. In this model, users bear the cost.

-

Since all market price feeds (outside Solana) reside on Pythnet, Pyth gains scalability and reduces the cost and time of integrating feeds on supported or new chains. However, this scalability introduces latency and an additional layer of trust/dependency on Wormhole.

Chainlink

-

Chainlink’s primary market feeds use a push model, frequently posting updates at the target chain’s block time. This can burden oracle nodes with costs and occasionally cause update transactions to fail during high volatility (though rare).

-

Adding price feeds to new or existing chains is more expensive, as each supported network requires implementing a new feed.

-

Does not rely on additional relayers and does not introduce extra trust assumptions between Chainlink’s oracle network and target blockchains.

-

Chainlink also offers a pull model in its Data Streams product.

-

Similar data processing to push model, except data is delivered to Chainlink’s off-chain data engine, which provides price updates upon on-chain request.

-

Currently, Data Streams is only available on Arbitrum and maintains eight price feeds.

Usage

-

Pyth secures $5.5 billion in value across 162 protocols on over 50 blockchains.

-

Chainlink secures $38.7 billion in value across 371 protocols on 19 blockchains.

Both systems have strengths and weaknesses in market data feeds. Pyth’s model is better suited for scaling the number of price feeds and maintaining high update frequency. However, Pyth’s ability to maintain high-fidelity data relies on the assumption that reputation and collusion costs outweigh potential gains from malicious behavior. Its network stability also depends on Wormhole’s continued operation. Conversely, Chainlink’s model requires fewer trust assumptions regarding original data sources and between the oracle network and supported blockchains, as it pulls data from secondary aggregators and posts directly to target chains. However, scaling data feeds and covering a broader range of blockchains is more costly. Regardless, as cryptocurrency continues to grow, new protocols must carefully consider various options, trade-offs, and risks when implementing oracle price feeds.

Conclusion

Pyth Network is a novel protocol

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News