Which promising protocols in the Cosmos ecosystem have not yet launched their tokens?

TechFlow Selected TechFlow Selected

Which promising protocols in the Cosmos ecosystem have not yet launched their tokens?

A Guide to 4 Promising Cosmos Ecosystem Protocols That Haven't Launched Tokens Yet.

Author: Sleeping Hard in the Rain

Let’s dive in together ⬇️

1. ZetaChain

ZetaChain is a Layer1 blockchain with built-in cross-chain interoperability, EVM-compatible, enabling users and developers to achieve universal smart contracts and message passing across any chain—including non-smart contract chains like BTC and Doge.

Developers can use its toolkit to build omnichain DApps from a single point based on ZetaChain.

Currently, over 150 DApps have joined the ZetaChain ecosystem, and testnet users have exceeded 3 million. For details, click this link.

Reasons to watch ZetaChain:

1. LayerZero is about to launch its token, igniting the omnichain narrative (Wormhole is also expected to launch its token soon);

2. ZetaChain supports the BTC chain, aligning with the native BTC narrative. In the future, DApps on ZetaChain may all gain the ability to support native BTC assets (Sushi announced cooperation with ZetaChain in November 2023 to provide native BTC support, allowing Sushi users to swap native BTC across 30 networks).

3. ZetaChain has recently announced many partnerships, including SushiSwap mentioned above, as well as Curve and Bounce.

4. Magic, a key partner of ZetaChain and a WaaS (Wallet-as-a-Service) provider, completed a $52 million funding round last year led by PayPal.

ZetaChain has already released its vision and roadmap outlook for the mainnet 1.0 launch.

Additionally, Meta Merge, a sub-game of Ultiverse backed by Binance Labs, has joined the ZetaChain testnet for development. In the future, Ultiverse will leverage ZetaChain to expand its multichain interoperability as a metaverse platform. The progress of this collaboration is equally worth watching.

Now, we can also participate in ZetaChain testnet interactions via OKX Web3 Wallet: Link

2. Dymension

Dymension is also part of the modular blockchain movement—it functions as a modular settlement layer.

Celestia extracted the DA (Data Availability) layer as a standalone modular component, providing DA services to Layer2s. This allows Layer2s to focus solely on execution while settling data on a Layer1. The fundamental reason Layer2s choose Celestia as their DA layer boils down to "higher cost-effectiveness" (which translates to higher profitability).

Dymension was introduced to address fragmentation among Layer2s. Previously, Layer2s were custom-deployed with different multisig bridging methods and varying security assumptions. Dymension aims to unify Layer2s via IBC (Inter-Blockchain Communication), standardize processes, and ultimately realize the vision of a Web3 internet built by RollApps.

Simply put, Dymension uses the IBC protocol to standardize Layer2s and integrate liquidity, leveraging the Dymension Hub to secure liquidity within the network and publishing transaction data to a DA layer (such as Celestia or Near—RollApps can choose their preferred DA layer).

An interesting aspect of Dymension is that it builds around RollApps (a new crypto primitive), allowing developers building on top to focus purely on refining products and enhancing user experience.

Also, two competing projects in the same space:

- Eclipse is a competitor to Dymension;

- Fuel is a modular execution layer.

3. Saga

To simplify understanding Saga, you can view it as part of the modular ecosystem. Saga's primary service is helping other developers build dedicated chains. These developers can make product design trade-offs according to their specific needs.

The Saga team believes that competition among current Web3 applications is essentially a battle for blockspace. Therefore, Saga's vision is to enable developers to build their dedicated Web3 application chains in the simplest way possible.

In other words, one-click chain deployment.

Saga further lowers barriers on top of Cosmos. With Saga, developers can launch their own EVM chain within 10 minutes. Saga calls this initiative The Unblock Movement.

Saga’s focus leans toward building an interoperable gaming (metaverse) ecosystem.

From my perspective, this direction aligns perfectly with the services Saga offers. Based on Saga, game developers can concentrate on game design while gaining greater flexibility and interoperability.

4. Berachain

Berachain is a Cosmos-based Layer1 blockchain architected on EVM, using PoL (Proof of Liquidity) consensus. Berachain has now launched its public testnet "Artio," where developers and users can claim faucet funds to participate in Galxe interaction tasks.

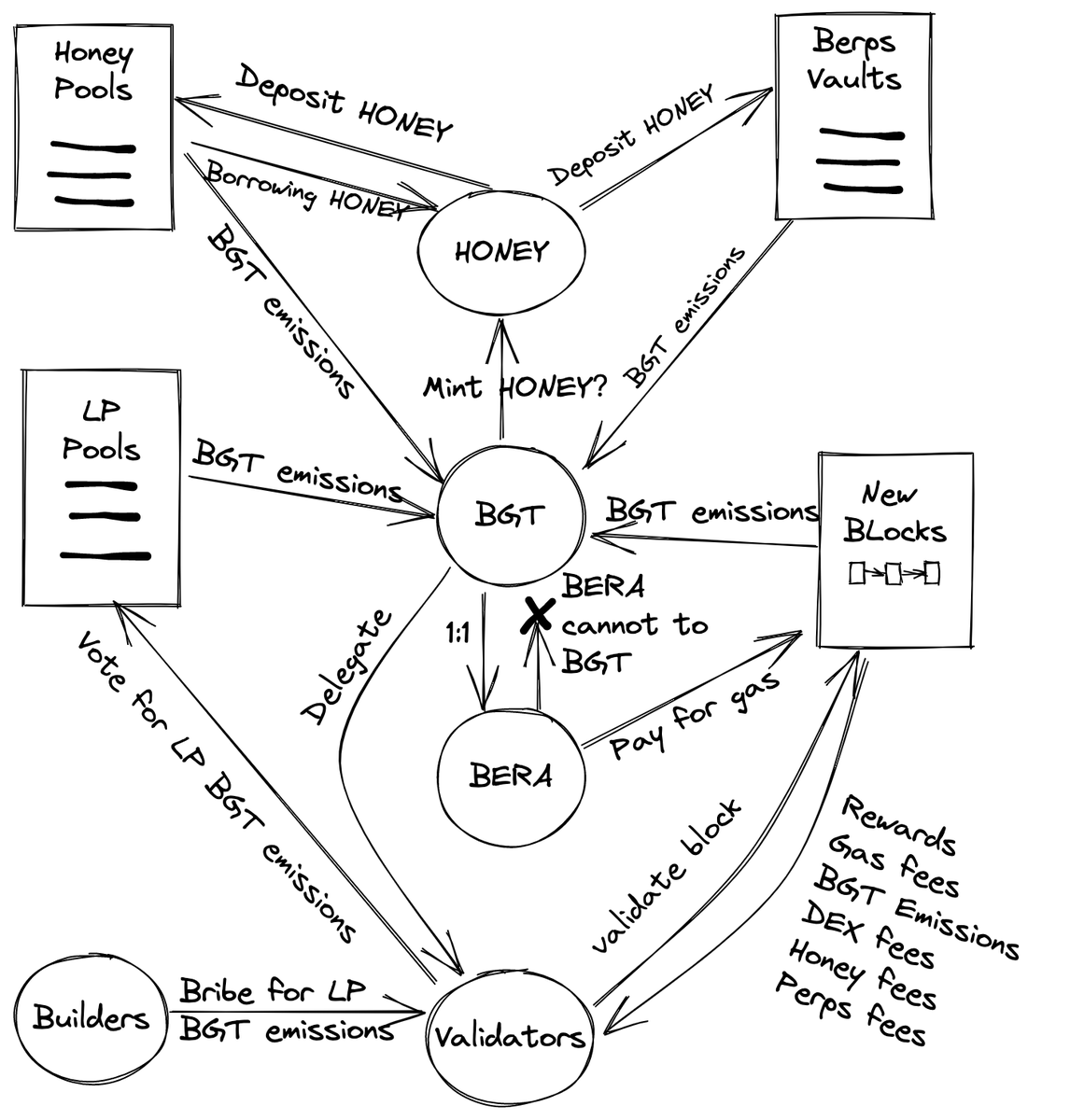

It features a three-token model in its design:

$BERA: Gas token with 10% inflation;

$BGT: Governance token, non-transferable, obtained only through asset staking;

$HONEY: Over-collateralized stablecoin and medium for protocol revenue distribution.

After Berachain mainnet launches, users will be able to stake assets such as wBTC, wETH, wstETH, USDC, USDT, and DAI, earning DeFi activity rewards and BERA. The weightings for yield distribution across various assets will eventually be governed by $BGT. In the future, the Berachain ecosystem will likely see liquid staking and governance aggregation products similar to Stride and Convex.

As for airdrop details, the official team has not yet disclosed them. My personal guess is that aside from NFT holders, Berachain might also airdrop to TIA stakers.

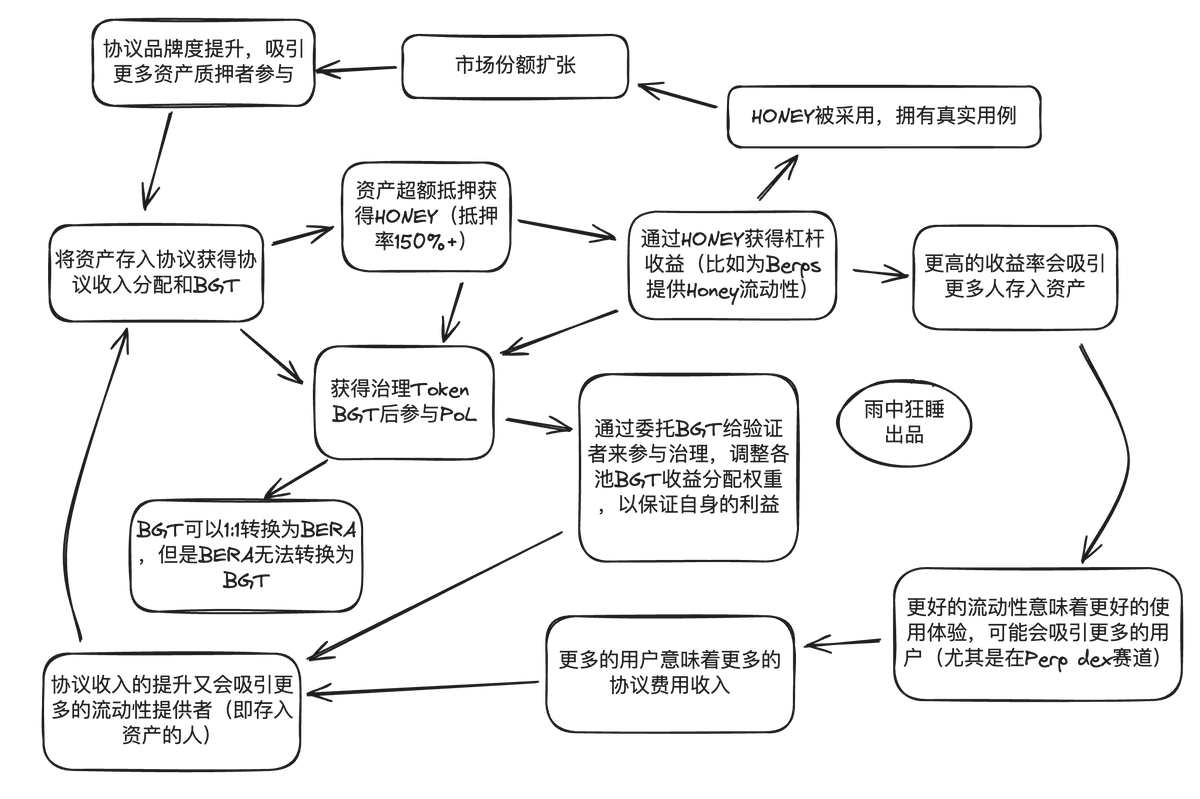

From my viewpoint, Berachain has built a flywheel mechanism as illustrated below.

At initial launch, Berachain's model resembles Canto's—using inflationary tokens to drive TVL growth. However, as user numbers increase and fee revenues rise, Berachain will diverge onto a different path than Canto. Moreover, the built-in governance mechanics and stablecoin will further boost market demand for its gas token, BERA.

Finally, a summary of what various chains in the Cosmos ecosystem protocols have been working on lately:

Neutron is consolidating remnants from the Luna era, heavily expanding the AEZ (ATOM Economic Zone) ecosystem. Its launchpad Eclipse Fi is also worth watching.

Osmosis²'s main themes are LSD, inflation suppression, and merger with Umee (now UX).

Injective, despite a relatively weak ecosystem, benefits from strong core supporters and has shown excellent price performance.

Kujira has also performed exceptionally well, with Kujira staking rewards derived from real revenue rather than inflation.

THORChain follows the native BTC cross-chain narrative, with two similar projects being Maya Protocol and CHAINFLIP.

Stride is the LSD player in Cosmos, holding over 90% market share. New competitors to Stride have recently emerged in the market.

Sei is now pushing the parallel EVM narrative and has received significant market attention recently.

Kava has halted inflation in its new generation of tokens.

Axelar Network initially surged due to listing on Upbit. It is now proposing governance changes to reduce token inflation and is expected to be affected by upcoming token launches from Wormhole and LayerZero.

Canto Public chose to leave Cosmos and embrace the Polygon ecosystem. Its core narratives are RWA and omnichain stablecoins, making it susceptible to impacts from LayerZero's token launch.

Additionally, the market has recently been speculating on LRT concepts, leading to widespread attention and strong price performance for Cosmos-based LRT token $PICA (which is currently expanding to Solana).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News