Which are the emerging Cosmos star chains with wealth creation potential?

TechFlow Selected TechFlow Selected

Which are the emerging Cosmos star chains with wealth creation potential?

Over the past year, risk capital has continued to flow into the Cosmos ecosystem.

Author: 1912212.eth, Foresight News

During the last bull-and-bear cycle, Cosmos and Polkadot—once dubbed the "Cross-Chain Titans"—fiercely competed. However, circumstances have shifted, with Cosmos now gaining the upper hand while Polkadot appears relatively subdued. Even though the Cosmos ecosystem suffered a setback in the second half of 2022 due to the Terra incident, it quickly recovered from the turmoil.

In particular, over the past year, risk capital has continuously flowed into the Cosmos ecosystem. High-quality projects—including public chains and liquid staking protocols (see recommended reading: Why did Stride rise rapidly to become the top staking protocol in the Cosmos ecosystem?)—have sprung up like mushrooms after rain, securing funding and expanding their markets. Now is an ideal time to review the standout public chains within the Cosmos ecosystem.

Celestia

Celestia is the first modular data availability (DA) network designed to scale securely alongside user growth. This modularity enables anyone to easily launch independent blockchains.

As a representative modular public chain, Celestia attracted significant market attention upon launch. After briefly consolidating around $2, its token price surged to nearly $20, achieving a tenfold return within less than six months.

Meanwhile, its token TIA became something of a "golden shovel," with projects such as AltLayer, Dymension, and Stride distributing airdrops to TIA stakers, encouraging more participation in staking and creating a virtuous cycle.

Meanwhile, its token TIA became something of a "golden shovel," with projects such as AltLayer, Dymension, and Stride distributing airdrops to TIA stakers, encouraging more participation in staking and creating a virtuous cycle.

Celestia has placed considerable pressure on Ethereum's suite of DA solutions. Moreover, in October last year, Celestia Labs launched Blobstream—an Ethereum modular data availability (DA) solution. Blobstream allows L2 developers in the Ethereum ecosystem to integrate Celestia, which provides dedicated blobspace priced independently of Ethereum gas costs, thereby maximizing data throughput.

Over recent months, Blobstream has integrated with Starknet, Orderly Network, RSS3, AltLayer, Manta Pacific, Polygon CDK, OP Stack, Hyperlane, and Arbitrum Orbit, steadily expanding its influence.

Celestia’s most recent major funding round occurred in October 2022, co-led by Bain Capital Crypto and Polychain Capital, with participation from Placeholder, Galaxy, Delphi Digital, Blockchain Capital, Protocol Labs, Figment, Spartan Group, FTX Ventures, Jump Crypto, A&T Capital, and angel investor Balaji Srinivasan, among others.

dYdX Chain

In October last year, dYdX launched dYdX Chain, officially upgrading to a derivatives-focused appchain. The V4 upgrade significantly revised the tokenomics, allocating all transaction fees to stakers. Following the upgrade, market maker incentives were promptly initiated. Additionally, a proposed three-year budget of $30 million was approved, ensuring sufficient future team funding. However, due to substantial token unlocks leading to selling pressure, the token price has performed poorly.

Notably, dYdX Chain recently announced that its trading volume has surpassed $30 billion—just three months after the official launch of v4.

Notably, dYdX Chain recently announced that its trading volume has surpassed $30 billion—just three months after the official launch of v4.

dYdX released its 2024 roadmap, focusing on three main areas: permissionless markets, core trading improvements, and user experience/onboarding upgrades. For permissionless markets, the final state of dYdX software should feature:

1. Instant and permissionless market listing;

2. Immediate liquidity via LP Vaults, providing ample liquidity for all markets;

3. Expanded oracles enabling perpetual inventory for any asset;

4. Cross-margin and isolated margin at the protocol layer to strengthen risk management. Regarding core trading improvements,

In terms of core trading optimization:

1. Enhance reliability and infrastructure of the exchange software;

2. Add trading features to help traders execute trades quickly and accurately;

3. Add support for additional clients in languages such as C++, Rust, and Go.

Regarding user experience upgrades:

1. Simplify registration by increasing entry options and creating more connection methods;

2. Improve exchange usability by better presenting and alerting users to important information;

3. Integrate social elements into the trading platform software.

Injective

According to Injective’s 2023 Year-in-Review report, the number of active wallet addresses grew from 14,000 to over 290,000, while trading volume increased from $140 million at the beginning of the year to over $390 million. According to CoinGecko research data, among the top 100 cryptocurrencies by market cap in 2023, INJ ranked second with a gain of 2,976.4%, trailing only BONK.

On January 11 this year, Injective completed the Volan mainnet upgrade, introducing new features including faster transactions, enhanced interoperability, support for CosmWasm smart contracts, compatibility with the Ethereum Virtual Machine (EVM), and reduced barriers for developers migrating applications. That same month, Injective rolled out its gas compression feature, reducing the cost per transaction on the platform to just 0.00001 INJ—one of the lowest transaction fees across all major public chains.

Sei

Sei is a Layer 1 blockchain specifically designed for digital asset trading, covering gaming, social, NFTs, DeFi, and other sectors, and is also one of the key players in the narrative around parallelized chains. After launching its mainnet in August last year, its token price rose from a low of $0.1 to above $1—a tenfold increase. (See recommended reading: A Comprehensive Overview of the Sei Ecosystem: What's New on This Trading-Optimized L1?)

On January 2 this year, Sei co-founder Jay Jog stated that the codebase for Sei V2 had been completed and was undergoing audit. In a recent interview, Jay Jog added that Sei Labs plans to roll out the Sei V2 upgrade in the first half of the year, which will implement EVM parallelization, allowing developers to deploy Ethereum-based protocols on Sei. Currently, developers must use programming languages like Rust or C++ to build protocols on Sei, but after the v2 upgrade, they will be able to use Solidity and Vyper—the same languages used by Ethereum developers.

On January 2 this year, Sei co-founder Jay Jog stated that the codebase for Sei V2 had been completed and was undergoing audit. In a recent interview, Jay Jog added that Sei Labs plans to roll out the Sei V2 upgrade in the first half of the year, which will implement EVM parallelization, allowing developers to deploy Ethereum-based protocols on Sei. Currently, developers must use programming languages like Rust or C++ to build protocols on Sei, but after the v2 upgrade, they will be able to use Solidity and Vyper—the same languages used by Ethereum developers.

In April 2023, Sei Network raised $50 million for its ecosystem fund, with investors including Bitget, Foresight Ventures, OKX Ventures, Jump Capital, Distributed Global, Multicoin Capital, and Bixin Ventures.

Axelar

Axelar Network is a cross-chain infrastructure protocol. At the beginning of last year, it launched the Axelar Virtual Machine (VM), enabling developers to build a DApp once and run it across all chains. Mid-year, it partnered with Microsoft. By year-end, it collaborated with RWA protocol Ondo Finance to launch the Ondo Bridge. This year, it has remained active—partnering with Frax Finance to promote the frax and frxETH ecosystems—and integrating with high-profile project Monad in January.

In 2023, the number of networks supported by Axelar increased from 30 to 55. Data from Messari shows that cross-chain transactions and active addresses grew 478% and 430% year-on-year, respectively.

Although Axelar boasts a prestigious lineup of investors and fundraising achievements, its token launched late in the previous bull market, causing its price to remain below $1 for over a year. With rising interest in projects like Wormhole and LayerZero, Axelar may soon regain market attention.

Neutron

Powered by Tendermint and built using the Cosmos SDK, Neutron is a permissionless smart contract platform for Interchain DeFi.

Since launching its mainnet in May last year, Neutron has remained highly active. In June, it secured $10 million in funding, co-led by Binance and Coinfund. By year-end, it acquired a 25% stake in CosmWasm developer Confio to enhance Neutron’s virtual machine capabilities, including native zero-knowledge proofs.

Notably, Neutron completed its most significant technical upgrade last year—"Neutrality." This upgrade integrates Duality into the protocol, enabling developers to create efficient markets for any asset and replicate any AMM curve—stable pools, weighted pools, concentrated liquidity pools, etc. It also introduces the Block SDK developed by Skip Protocol, allowing application developers to transparently define how the network builds and validates on-chain blocks, offering executable and clear methods for managing and redistributing miner extractable value (MEV).

NTRN achieved nearly a tenfold gain in under a year—its price performance has been exceptionally strong.

THORChain

As a well-known decentralized exchange protocol, THORChain shone brightly during the last DeFi wave and received backing from several prominent venture capitalists. However, it fell into a prolonged period of dormancy following hacking incidents.

Notably, benefiting from the explosive growth of the Bitcoin inscriptions ecosystem, THORChain rapidly emerged as the leading on-chain BTC trading protocol. In August 2023, it launched a highly anticipated lending protocol featuring no forced liquidations, no interest, and no maturity dates—this unique tri-mechanism quickly boosted its profile.

Today, the protocol has integrated products including the cross-chain brand THORSwap, lending (LENDs), savings (Saver), and stablecoin TOR, and supports the Solana network. Future plans include launching contract and orderbook trading functionalities.

Recently, as broader market conditions improved, RUNE achieved a peak tenfold gain since July last year.

Kujira

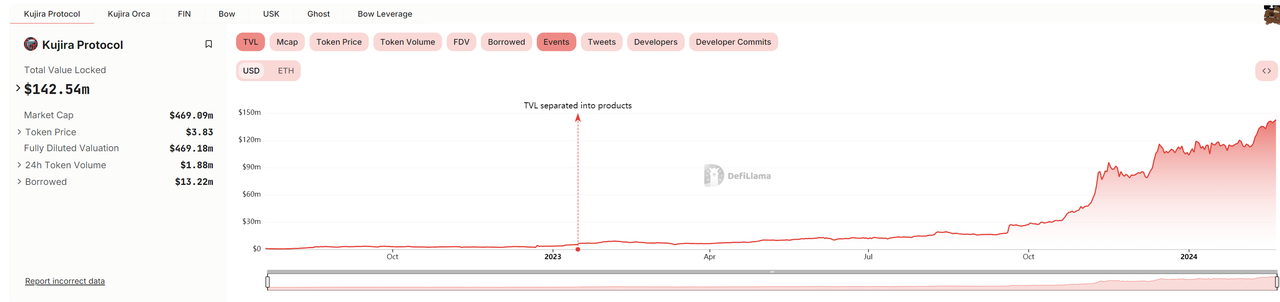

Previously positioned as a collateral liquidation protocol on Terra, Kujira launched its own public chain mainnet in July 2022 after Terra's collapse, repositioning itself as an L1 focused on delivering real yield. Kujira also has its own over-collateralized stablecoin, USK. Over the past three months, its total market cap has nearly tripled, although it still remains under $8 million—negligible within the broader stablecoin ecosystem. (See recommended reading: Rising Quietly from the Ruins of Terra: Is Kujira a New Dark Horse in the Cosmos Ecosystem?)

Its ecosystem development and partnerships have been lackluster. Recently, it integrated with Wormhole to initially enable SOL cross-chain transfers to Kujira. According to DeFiLlama data, its TVL has exceeded $140 million—doubling from $70 million on November 9 last year.

Its ecosystem development and partnerships have been lackluster. Recently, it integrated with Wormhole to initially enable SOL cross-chain transfers to Kujira. According to DeFiLlama data, its TVL has exceeded $140 million—doubling from $70 million on November 9 last year.

Dymension

Dymension, a modular blockchain network leveraging Cosmos and Celestia technologies, raised $6.7 million in early last year and attracted significant attention this January by airdropping 70 million DYM tokens to users of Ethereum, Cosmos, and Solana. (See recommended reading: Beyond the Modular 'Lego' Narrative: What Catalysts Should We Watch in Dymension?)

Additionally, Dymension integrated with the cross-chain protocol Wormhole and officially launched its mainnet on February 6. Recently, it announced the launch of its modular liquidity layer and embedded AMM, with a portion of transaction fees converted into DYM and burned as protocol fees—reducing the circulating supply of DYM.

Overall, most of the star public chains based in the Cosmos ecosystem have delivered solid results over the past year—both in terms of ecosystem developments and token price appreciation. Looking ahead, the launch of highly anticipated projects such as Berachain (see recommended reading: Raised $42 Million, Mainnet Launch Imminent... How to Deeply Engage with the Overcrowded Berachain Testnet) could further enhance the wealth effect within the Cosmos ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News