Five Dimensions of LSDFi: Who Can Win the LSD War with DeFi Legos?

TechFlow Selected TechFlow Selected

Five Dimensions of LSDFi: Who Can Win the LSD War with DeFi Legos?

Who can obtain more LSD will directly determine the number of their future collaboration projects and the DeFi Lego built upon it.

Author: waynezhang.eth

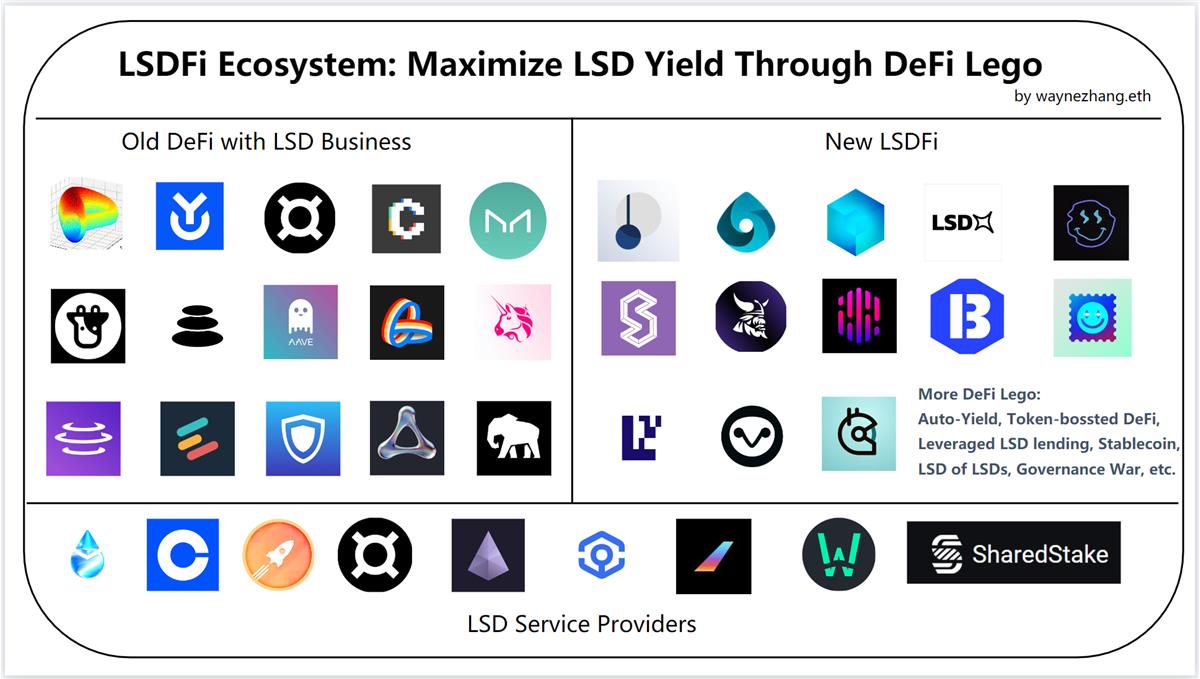

LSDFi refers to DeFi products built on LSD (Liquid Staking Derivatives). Through LSD, stakers can convert their staked ETH into tradable assets, unlocking liquidity. LSD also lowers the barrier for users to stake ETH—allowing staking of any amount—and enables them to receive LSD tokens post-staking, which can then generate multiple layers of yield.

Behind LSDFi lies the concept of DeFi as Lego blocks, and behind DeFi composability is the idea of yield as Lego. New entrants will compete by bribing or acquiring third-party tokens—or using their own tokens—to incentivize users to stake ETH/LSD on their platforms, thereby capturing market share and control over LSD. Some LSDFi projects use variable incentive multipliers or dynamic yields to encourage users to stake with smaller decentralized staking providers, aiming to achieve greater validator decentralization.

Below are five forms of LSDFi:

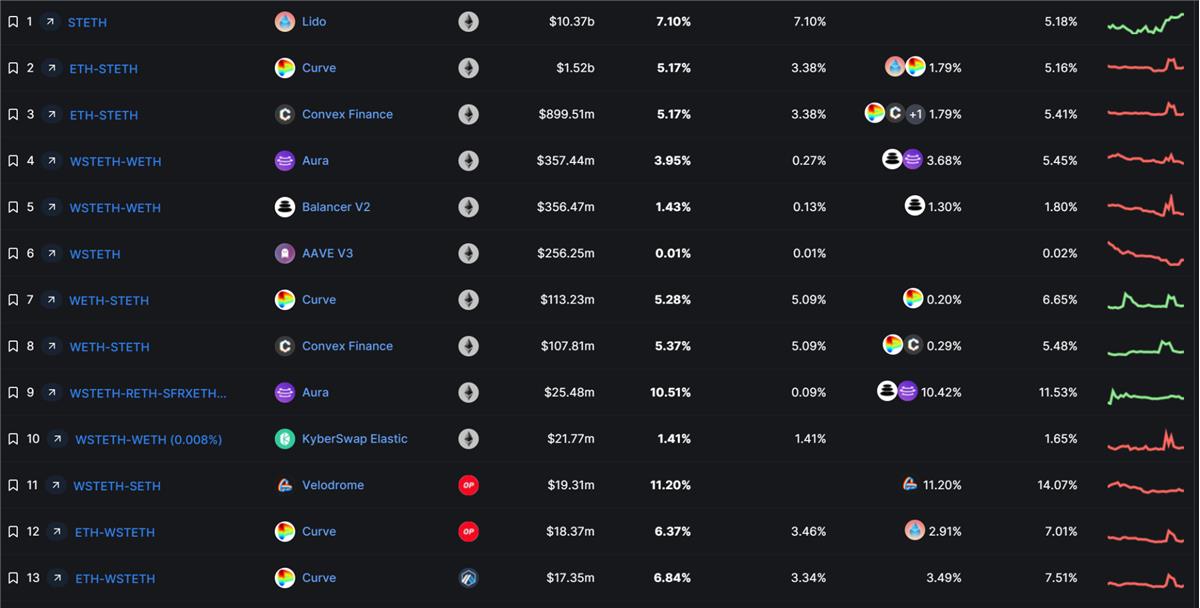

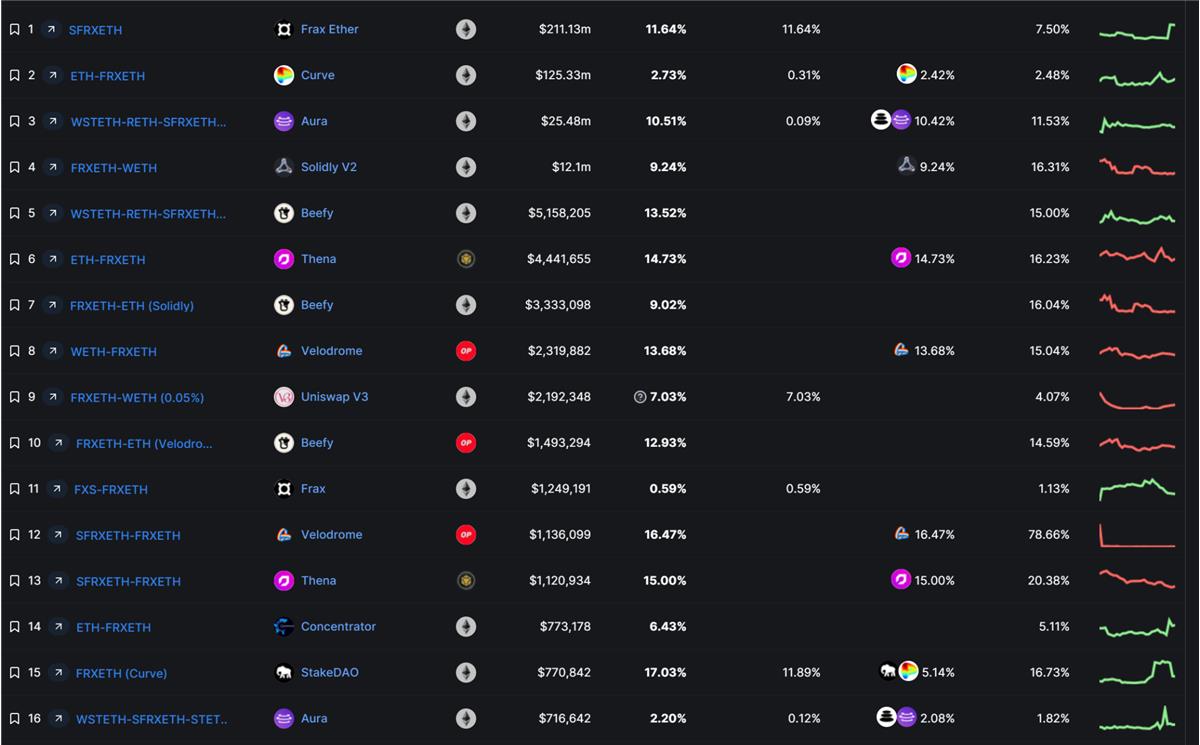

1. LP (Yield 10%+)

Before the Shanghai upgrade, LSD could not be directly exchanged for ETH. As a result, many DeFi protocols established LSD-ETH liquidity pools. Taking stETH as an example, base yields were generally below 5%, with most protocols relying on token subsidies to boost APY. At this stage, stakers earn both network rewards from staking ETH and LP fee rewards. In my opinion, as the LSD base grows, LP规模 may increase rather than decrease after the Shanghai upgrade.

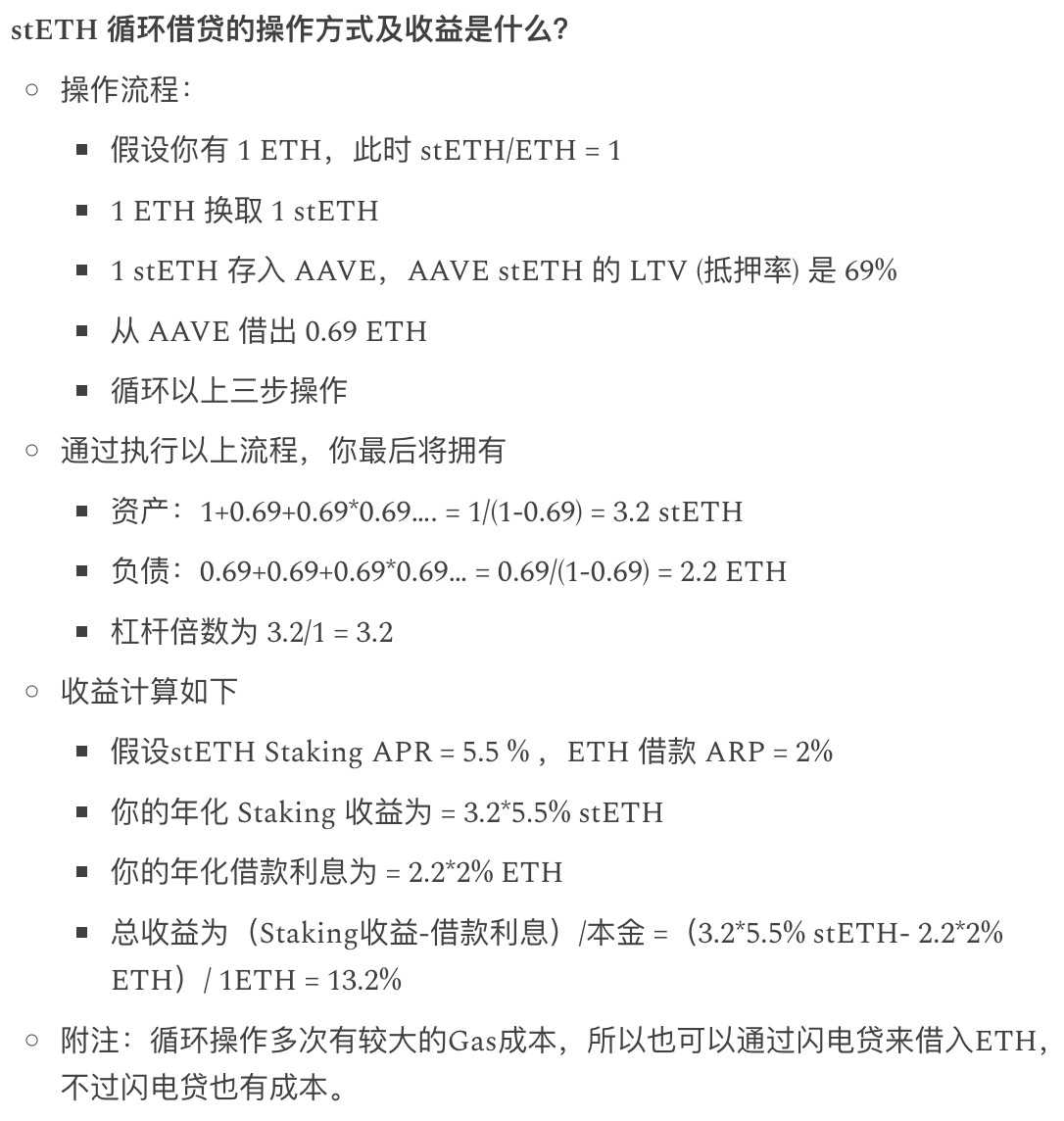

2. Recursive Lending (Yield 10%+)

AAVE and LIDO engaged in billions worth of leveraged bets on Ethereum's mainnet activation following the Merge.

- Stake ETH via Lido to receive stETH;

- Deposit stETH into AAVE and borrow ETH;

- Repeat the above process recursively;

The risk of liquidation is relatively high. The actual APR depends on how many times the loop is repeated. In theory, any lending protocol can support this strategy, and automated recursive lending products are likely to emerge.

3. Yield Aggregators (10%+)

Yearn Finance created liquidity pools on Curve that can boost LSD APY to 5.89%. Users can choose to directly stake stETH. The current pool value is $16.4 million. There are many similar legacy projects that aggregate yields across multiple platforms and add subsidies to enhance returns.

The fact that established DeFi players like Yearn are entering the LSD space reflects the growing importance of the LSD sector.

4. EigenLayer (Unknown Yield)

EigenLayer offers multiple staking methods, including liquid staking (similar to Lido) and superfluid staking. Superfluid staking allows staking of LP tokens. Specifically:

- LSD Staking: Assets already staked with Lido or Rocket Pool can be restaked on EigenLayer;

- LSD LP Staking: For example, Curve’s stETH-ETH LP tokens can be restaked on EigenLayer;

5. Incentivized LSDFi Projects

These projects aim to improve capital efficiency through leverage, structured strategies, options, bond derivatives, etc., or attract deposits through extremely high APYs for various purposes.

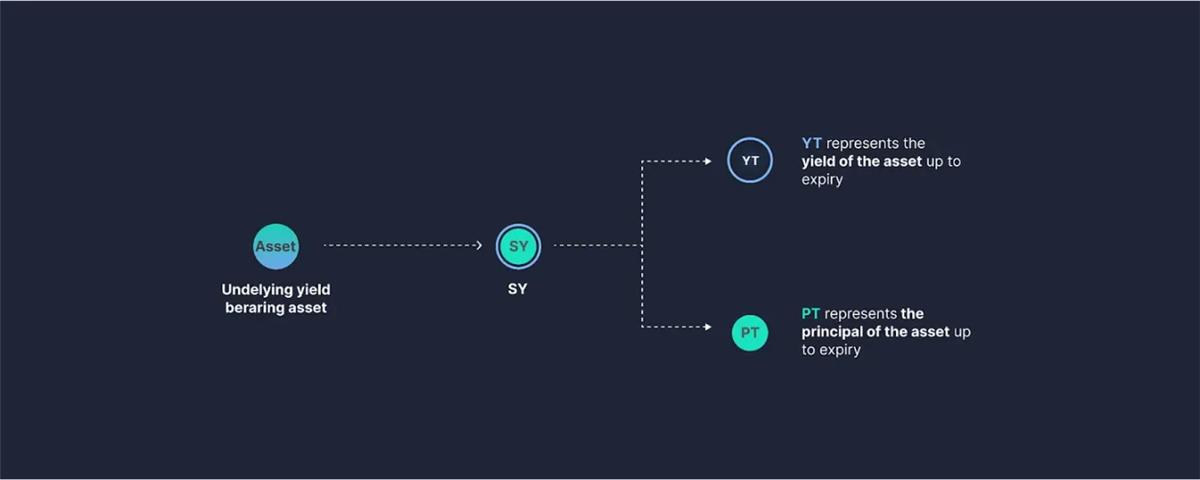

Pendle: A DeFi yield protocol where users can execute various yield management strategies. Starting as a derivatives platform, it now offers staking services and liquidity pools for ETH, APE, LOOKs, etc. Simply put, if ETH is priced at $1,800, you can buy it at $1,600—the $200 difference being your yield (requires a 466-day lock-up), while also earning additional yield by providing liquidity.

Its liquidity pool yields come from pools built on Lido or Aura. After locking for a certain period, users receive yields subsidized by Pendle. Current yields are attractive: discount pricing (around one-year lock-up) offers ~12.5%, and annualized yield in the pool reaches ~95.7%. However, note that the majority of the high APY comes in the form of PENDLE token incentives.

- TVL: $38.44 million;

- Market Cap: $32.8 million;

- FDV: $78.54 million;

Ion Protocol: Project not yet launched. It plans to tokenize LSD tokens and collateralizable assets into allETH and vaETH. allETH is an ERC-20 token where 1 ETH = 1 allETH. vaETH tracks all yield generated from the allETH position.

The project also intends to leverage EigenLayer and others for LSD yield aggregation, though no further details have been disclosed. Still in early stages, with 266 Twitter followers and 38 Discord members.

unshETH: A protocol that uses dynamic incentive distribution to promote validator decentralization. In simple terms, smaller LSD platforms receive higher rewards, while dominant ones like Lido and Coinbase receive less. This encourages users to stake ETH on smaller platforms due to higher incentives, thus promoting decentralization.

Currently, unshETH only supports sfrxETH, rETH, wstETH, and cbETH—still far from its decentralization goal:

- TVL: $8 million;

- FDV: $20 million;

Direct staking requires a lock-up period. Users must deposit LSD/ETH to mint unshETH. Staking unshETH yields around 500% returns, and further staking the token earns about 70%. The LP pool currently has ~$580k depth, with 60% of LP fees going to stakers. If staked on the platform, users can receive over 666% APY incentives. However, I haven’t found more utility for the token yet. I believe adopting a veToken model, where reward multipliers are governed by the USH DAO, could better help achieve its goals.

LSDx Finance: LSDx Finance aims to become a high-barrier DEX for LSD asset submarkets (e.g., stETH, FrxETH, rETH)—akin to Curve—effectively capturing market share in LSD liquidity. It adopts a GLP-like architecture from GMX and has built a unified liquidity pool called ETHx, with plans to launch a stablecoin UM.

Locked 55,000 ETH within 48 hours, gained 8,000 new followers in two days, listed on Bitget and MEXC, and recently announced investment by Foresight Ventures, indicating strong team preparation.

Market Cap: $2.21 million

TVL: $134 million

Currently supports a limited number of LSDs, and features are not fully developed—significant potential remains. Note that starting May 16, there will be a 14-day genesis mining phase, with rewards halving for the first time four days later:

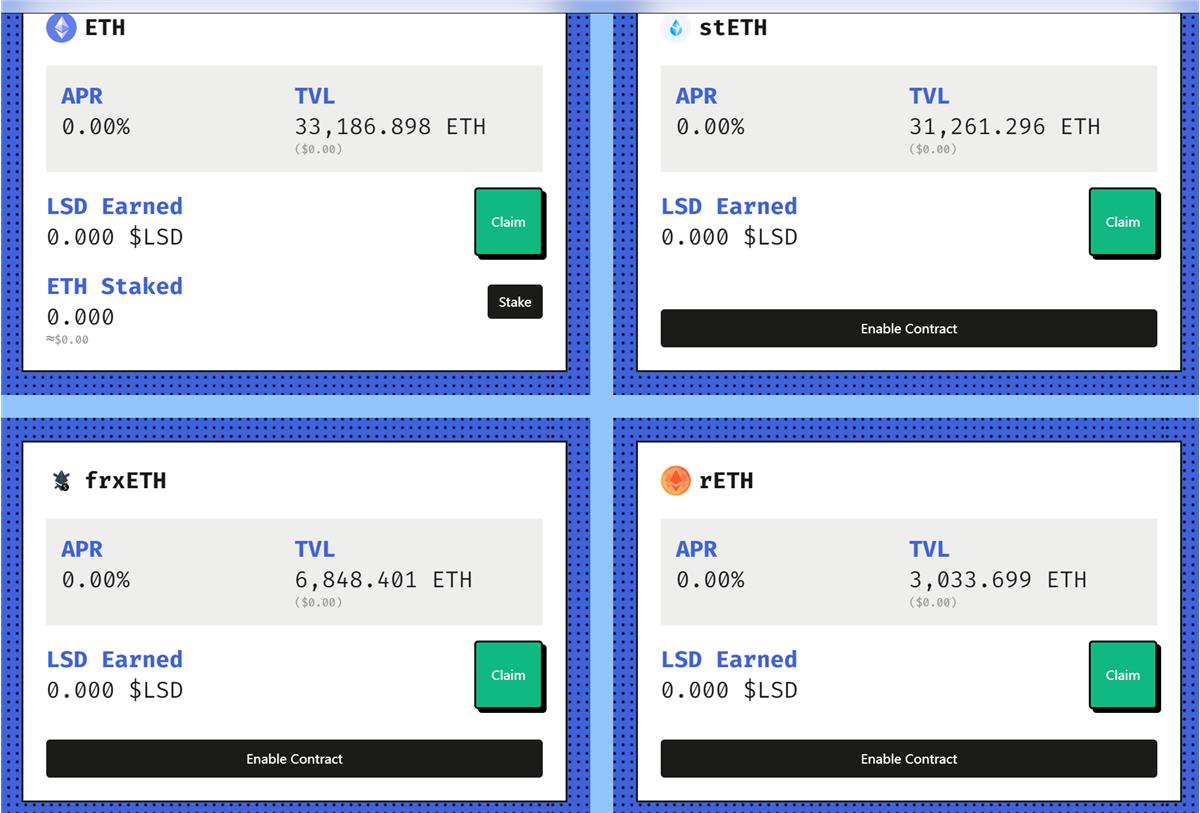

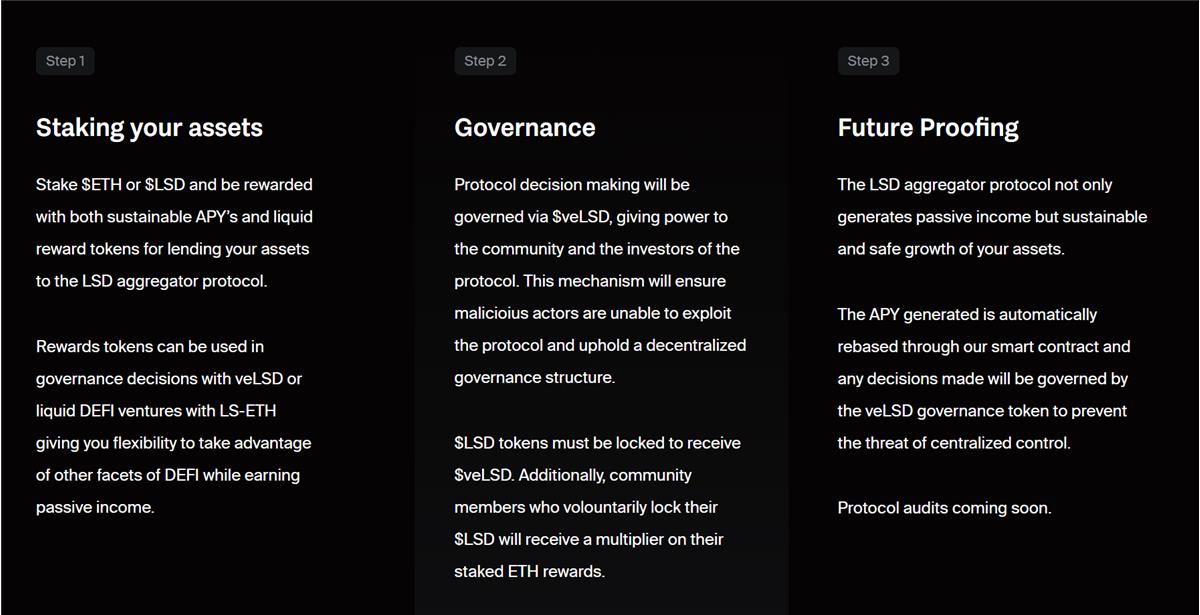

Liquid Staking Derivatives: An LSD aggregator that addresses liquidity issues and maximizes asset leverage by tokenizing deposited assets and issuing derivative tokens. Users stake ETH or LSD to earn reward tokens. These reward tokens (LSD) can be used for veLSD governance decisions or LS-ETH liquidity DeFi investments. Community members who voluntarily lock LSD receive multiplier-enhanced ETH staking rewards.

Directly staking ETH to get LS-ETH yields 6.3% APR. The official site shows only 1.24 ETH staked—very early stage. The LSD liquidity pool is on Uniswap V2, valued at ~$400k, FDV: $5.68 million.

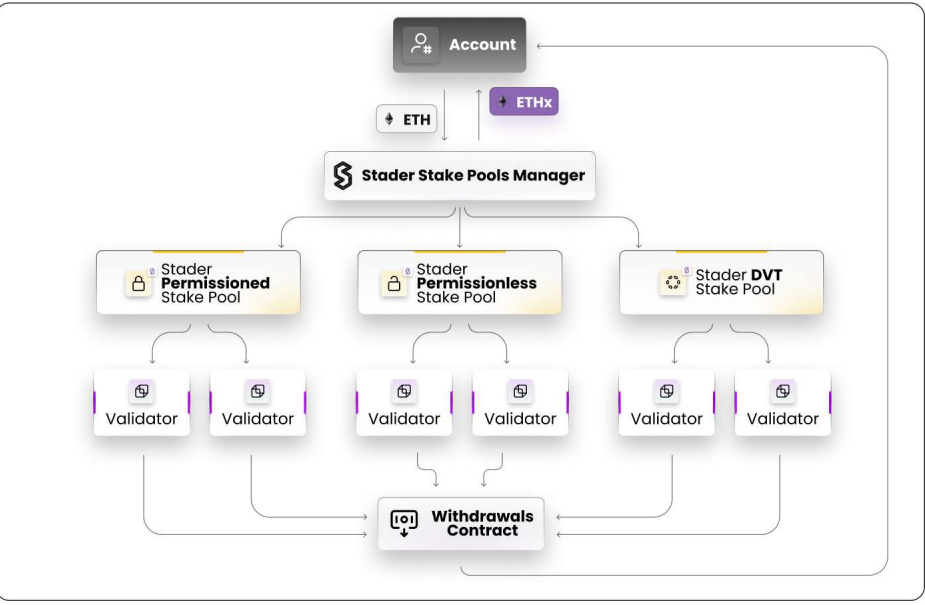

Stader Ethereum: ETH product not yet live. Previously offered liquid staking on other chains; soon launching ETHx. When users deposit ETH, the Stader Pools Manager mints ETHx in return and allocates ETH into three different pools (each acting as a validator node but with different tech: solo 4 ETH operation, DVT-supported, partnered operators). ETHx is expected to integrate with over 30 DeFi protocols including Aave, Balancer, and Qi Dao, unleashing composability.

To run a node, each validator must deposit 4 ETH and SD tokens worth 0.4 ETH as collateral (up to 8 ETH worth of SD can be staked). To incentivize node operators, Stader will distribute SD tokens worth approximately $1–2 million in the first year. Nodes can also earn a 5% commission from user rewards.

- TVL: $125 million;

- FDV: $181.7 million;

Hord: Stake ETH to receive LSD hETH. Rewards accumulate in the staking pool, increasing the value of hETH over time. The project achieves higher APR through multiple channels:

• ETH staking

• MEV rewards

• HORD subsidies

Current APY: 17.9%, 223.22 ETH staked, 57 stakers, FDV: $12.8 million.

Parallax Finance: Provides liquidity infrastructure enabling individuals, DAOs, and other protocols to generate yield on L2s (currently only on Arbitrum). Currently in testing phase—users need Tester资格 to participate. Regarding LSDFi, its product Supernova not only provides staking rewards but also leveraged and lending services for staked assets (no token issued yet; test access available).

bestLSD: Testnet即将 launches. Personally, I see this as a Real Yield aggregator, using aggregated real yield to subsidize its own LSD—bestETH. From GMX to GLP, from veCRV to veVELO, all assets generating strong real yields are under consideration by the team. Both documentation and website remain minimal at this point.

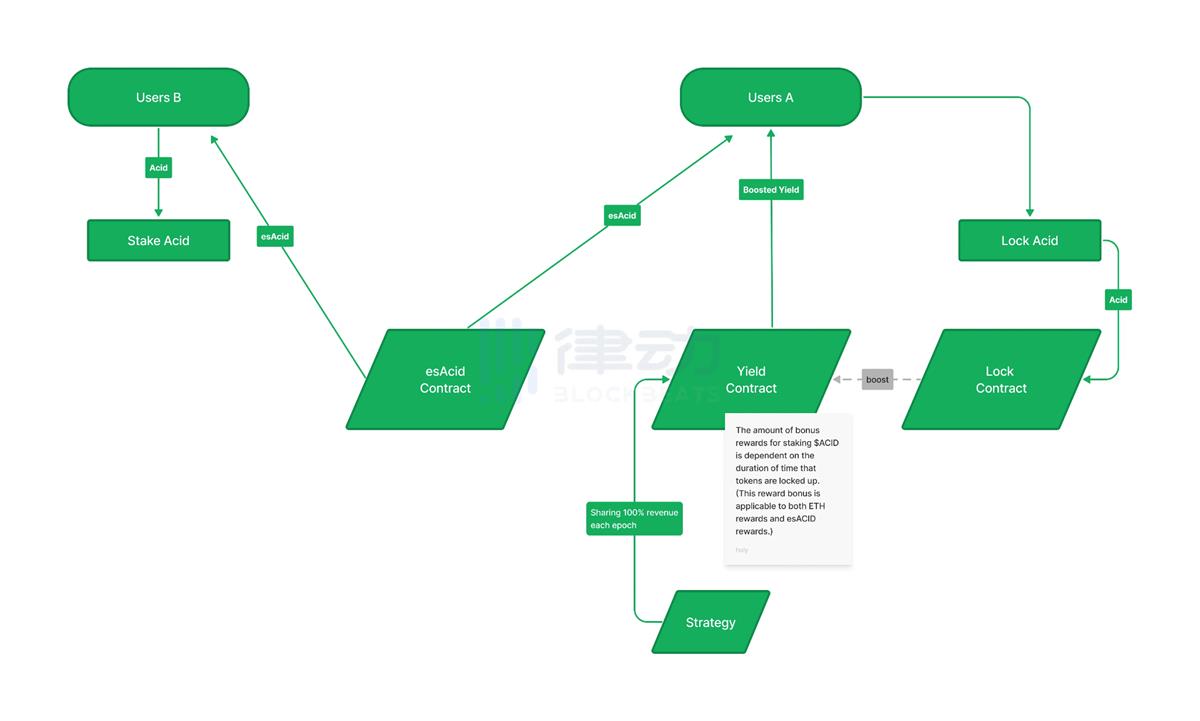

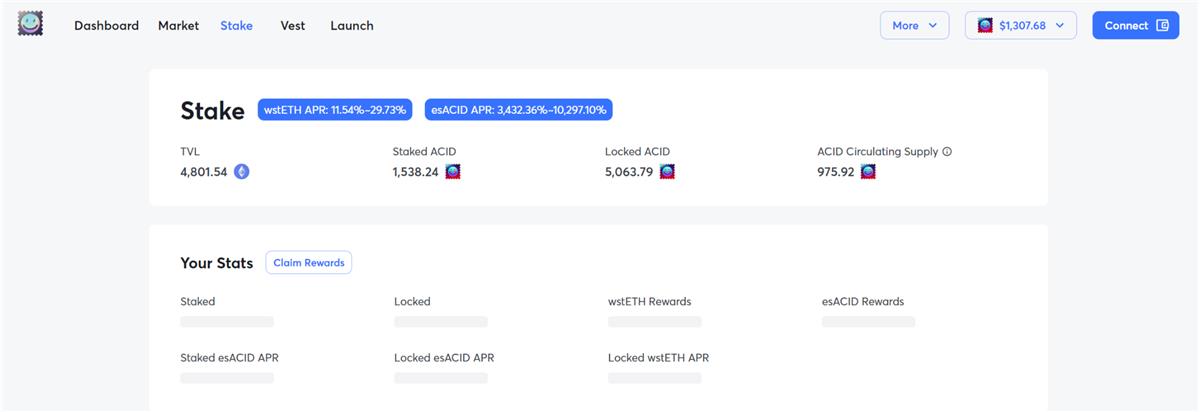

0xAcid DAO: A management protocol aimed at maximizing returns on LSD assets,即将 launching on Arbitrum and Ethereum. Main strategy shown below: allocate most assets to stable nodes, while placing part into high-yield strategies such as token-subsidized Frax or Aura LP pools. Today announced collaboration with Pendle to leverage yield, and offers its own lending and LP services. More details here.

Token price: $1,296.95, FDV: $9.48 million;

TVL: 4,800 ETH;

ETH yield (in bond form): 13.6% discount;

wstETH: 11.54%–29.73%;

esACID: 3,432.36%–10,297.10% (extremely high);

EigenLayer: Already mentioned earlier, but here are some potential DeFi Lego possibilities:

- After staking LSD, can the resulting LP or "LSD of LSDs" be further paired with ETH/LSD to form new LPs for staking?

- Leveraging yield from re-staking;

- Automated leveraged re-staking strategies;

Index Coop: A decentralized crypto index community initiated by Set Protocol. Primarily launching two LSDFi-related products:

- dsETH (Diversified Staked ETH Index): At launch, dsETH will consist of rETH, wrapped stETH, and sETH2. By holding a diversified set of liquid staking tokens, dsETH reduces risks associated with individual tokens and stabilizes returns across the basket. The system automatically adjusts asset weights within dsETH to maintain balance and optimize returns;

- icETH is a leveraged liquid staking strategy product, primarily leveraging AAVE v2 to deliver higher ETH yields;

dsETH currently has only 485 units, charges 0.25% fee, APY: 4.59%. icETH has ~10,000 ETH supplied, charges 0.75% fee, APY: 5.26%, supports only stETH.

Gitcoin: Launched Gitcoin Staked ETH Index (gtcETH) in collaboration with Index Coop. gtcETH yield comes from ETH/LSD/USDC staked in respective strategy pools. Gitcoin and Index Coop take a combined 2% cut, with Gitcoin allocating 1.75% to public goods funding—revealing a novel utility use case. Current supply: 113.85 ETH.

Summary

-

Many incentivized LSDFi projects are competing for influence: whoever controls more LSD will directly determine future partnerships and the DeFi Lego built atop their platform. Similar to other DeFi niches, only a few players may survive in the end, potentially disrupting Lido’s dominant position;

-

Strategy stability serves as both shield and spear for LSDFi projects, while yield currently acts only as a spear. High yields may raise sustainability concerns, but high APY could remain the norm for a long time; in the future, 100%+ APY may not seem particularly high;

-

Which strategy works best? From a yield perspective: stake with Liquidity Staking Providers outside the top 3—such as frxETH—first benefit from Frax’s yield subsidies (~10%), then seek out projects promoting validator centralization via incentives, like unshETH or LSDx, offering hundreds of percent APY for yield farming, sell at peak, and repeat. Of course, skilled users leveraging lending protocols might push APY beyond 1,000%—though risks are high and could result in losing ETH;

-

LSDFi’s impact on validators remains small today. LP + token subsidies dominate the landscape, but in the later stages of the LSD War, actual validator decentralization may significantly improve;

-

There is significant room for collaboration among LSDFi projects—for instance, 0xACID partnering with Pendle—in the future, composability may lead to tiered yield products: segmented by risk and return levels ranging from 4% to 500%+;

-

The LSD War has begun, and it may continue until Ethereum’s staking rate stabilizes above 25%. Why 25%? Because unlike other ecosystems, staking ETH offers relatively low cost-benefit for most people—even with LSDFi incentives. We’ll dive deeper into this 25% figure in a future analysis.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News