Puffer: The Dark Horse in the LSD Sector, Empowered by Secure Signer

TechFlow Selected TechFlow Selected

Puffer: The Dark Horse in the LSD Sector, Empowered by Secure Signer

Puffer boasts a strong team and financial backing, and its pioneering Secure-Signer technology offers enhanced security for user funds, positioning it to secure a place in the LSD sector where the Matthew effect is prominent.

Author: Yuuki, LD Capital

After the Shanghai upgrade enabled withdrawals on the Beacon Chain, the ETH staking rate rose from 14.13% to 21.46%. Currently, the Beacon Chain allows 2,470 validators to exit or activate per day (for every additional 65,536 active validator nodes, one more validator can exit or activate per epoch). The emergence and gradual increase of node liquidity have laid the foundation for new LSD protocols to compete for market share. However, since the Shanghai upgrade on April 12, Lido’s market share has slightly declined from 31.62% to 30.77%, while the combined market share of the top three LSD protocols (Lido, Rocket Pool, and Frax) has increased from 34.71% to 34.84%. No new LSD protocol has emerged significantly in the sector. The reasons mainly include high entry barriers due to complex product structures, first-mover advantages created by cross-side network effects, and technical and trust costs associated with security considerations.

Puffer boasts a strong team and financial backing, enjoys support from the Ethereum Foundation, and pioneered Secure-Signer technology to enhance fund security. This enhanced security enables nodes to operate with lower collateral requirements, reducing participation barriers and increasing capital leverage. As a result, Puffer is well-positioned to carve out a space in the LSD sector, which is heavily influenced by the Matthew effect.

What Problems Does ETH Staking Face Today? (Why Do We Need Puffer?)

1. To ensure decentralization, censorship resistance, and security of the ETH network, it is critical that no single validator set controls 1/3, 1/2, or 2/3 of total validators. Currently, Lido holds a 30.77% market share, making it a potential risk to the security of the Ethereum network. A more diverse and distributed validator ecosystem is needed.

2. A large amount of staked ETH is concentrated within centralized exchanges (CEXs), large mining pools, and relatively centralized LSD protocols. These entities are vulnerable to regulatory pressure, which undermines the network's censorship resistance. To strengthen censorship resistance, Ethereum needs widespread participation from decentralized individual or household validators.

How Does Puffer Address These Issues?

Puffer identifies three major barriers limiting individual participation in staking: the high entry threshold (32 ETH per validator), severe slashing penalties due to validation errors, and relatively low annual staking yields.

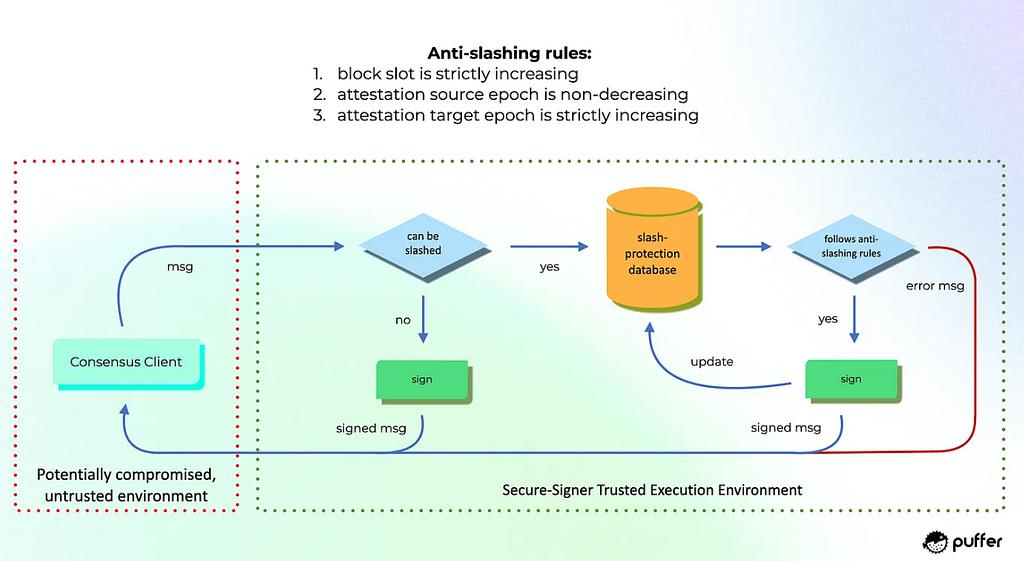

To address the high entry barrier and slashing risks, Puffer developed Secure-Signer secure signing and RAVe remote attestation technologies. Leveraging Intel SGX hardware to create a Trusted Execution Environment (TEE), Puffer moves validator key management and signing logic from the consensus client into an Enclave. By enforcing strict signing rules and restricting access to private keys, this setup prevents slashing caused by operational errors. Compared to DVT (Distributed Validator Technology), Secure-Signer offers a more cost-effective and user-friendly solution to avoid slashing—though both technologies are compatible and can be used together. With reduced slashing risks, Puffer can safely lower node collateral requirements to just 2 ETH, dramatically lowering the barrier to individual participation. This technological advancement has been recognized and funded by the Ethereum Foundation.

How Puffer Prevents Slashing

Source: Puffer Whitepaper

Regarding the current low staking yields, Puffer builds on EigenLayer, enabling Puffer nodes to re-stake via EigenLayer’s AVS (Actively Validated Services). This increases hardware utilization efficiency and boosts overall returns.

Overall, Puffer’s protocol structure resembles that of Rocket Pool, but its proprietary Secure-Signer technology reduces slashing risks, allowing node collateral to drop to 2 ETH (compared to Rocket Pool’s minimum of 8 ETH). This lowers the barrier to entry for individuals and increases capital leverage. Higher leverage enables the protocol to charge lower commission fees, thereby increasing net yield for users and improving Puffer’s competitiveness in capturing market share. Additionally, integration with EigenLayer enhances overall yield.

Puffer is currently in the early stages of development, with a testnet expected in the second half of the year and mainnet launch planned for 2024. The team has strong technical credentials and received a $120,000 grant from the Ethereum Foundation. Justin Drake, an Ethereum Foundation researcher, serves as an advisor. Puffer has completed two funding rounds: the first raised $650,000 in June last year, led by Jump Crypto and joined by Arcanum Capital and IoTeX; the second secured $5.5 million, announced on August 8 this year, led by Lemniscap and Lightspeed Faction. Participants included Brevan Howard Digital, Bankless Ventures, Animoca Ventures, Kucoin Ventures, Sreeram Kannan (founder of EigenLayer), Frederick Allen (Head of Coinbase Staking), Shencat (co-founder of F2Pool and Cobo), Richard Malone (Chief Business Officer at Obol), Mr. Block (core contributor to Curve), and Ramble (President of the North American Blockchain Association). The strong investor backing will further support the protocol’s healthy growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News