With Bitcoin's market dominance remaining high, is there still a chance for altcoins to surge?

TechFlow Selected TechFlow Selected

With Bitcoin's market dominance remaining high, is there still a chance for altcoins to surge?

Bitcoin is the only major liquid asset that has outperformed inflation over the past five years, while cash has actually lost 5% in value and long-term bonds have barely preserved their value.

Author: arndxt_xo

Translation: zhouzhou, BlockBeats

Editor's Note: Bitcoin continues to hit new all-time highs, attracting significant institutional buying and driving structural price appreciation. DeFi is accelerating the integration of AMMs and money markets to enable dual asset utilization and improve capital efficiency. Cross-chain liquidity layers are becoming flatter, resulting in smoother user experiences. Competition for stablecoin yields is intensifying as institutional demand for yield rises. Meanwhile, points systems and verified airdrops have become new tools for user growth. The NFT market remains weak, with capital increasingly flowing toward Memes that offer utility and reward mechanisms—signaling an evolving ecosystem landscape.

Below is the original content (slightly edited for clarity):

Altcoins appear completely dead—and that’s precisely when the setup begins. The market is doing what it does best: testing your conviction.

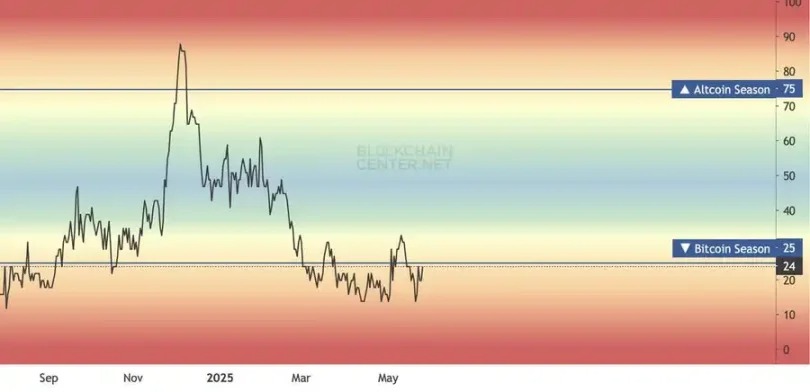

Altcoins continue to underperform against Bitcoin, whose market dominance hovers near cycle highs. Market sentiment is split between bored观望 and aggressive hunger for low-cap coins. This isn’t a call that altseason starts tomorrow—don’t panic or blindly follow the crowd.

We Are Still in a Bull Market

Bitcoin remains the main event. From ETF inflows to corporate treasury allocations (GameStop, Trump Media, Strive), institutional confidence keeps the Bitcoin engine running strong.

This is also one reason why altcoins are struggling—Bitcoin is absorbing liquidity. Until this narrative cools, Ethereum and large-cap alts won’t move meaningfully, let alone small caps.

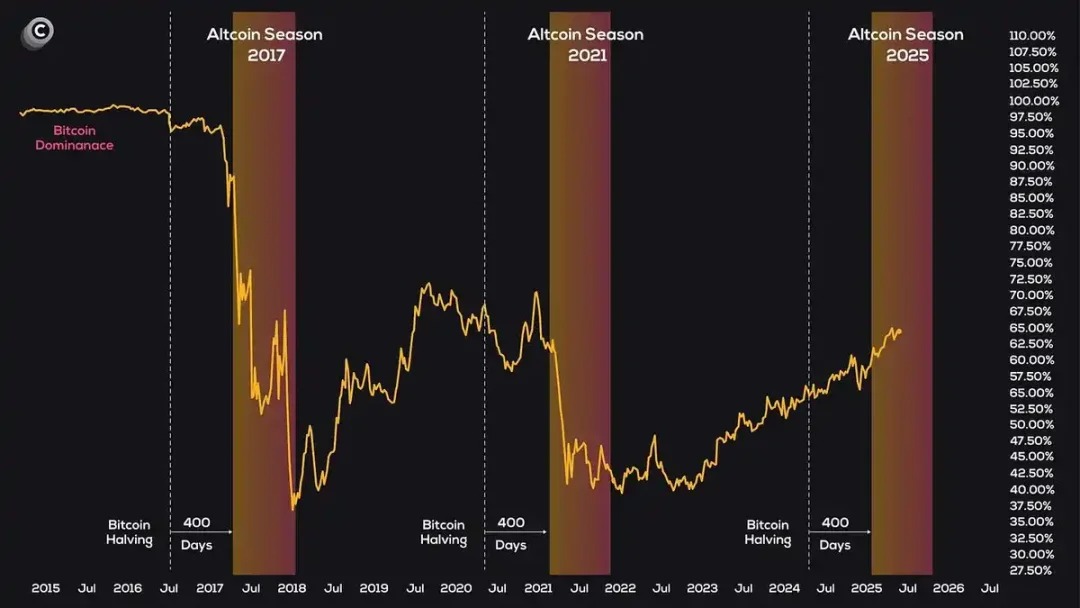

Altseason will begin only after Bitcoin’s dominance clearly declines—not while it’s still consolidating at cycle highs.

Cycle Timing Matters, But So Does Market Structure

Indeed, crypto roughly follows a 4-year rhythm driven by Bitcoin halvings, liquidity conditions, and technology adoption cycles. Viewed from a distance, 2025 looks like the second half of this game—the phase where parabolic moves typically begin.

But this is also when false breakouts are common. In 2021, altcoins exploded after Ethereum outperformed Bitcoin. Today? Ethereum still lags behind Bitcoin. If you’re buying low-cap alts before ETH shows strength, you’re too early—and taking on excessive risk.

A smarter approach: accumulate wisely. Watch which large-cap tokens are showing real accumulation signs (e.g., $AAVE, $UNI, $LINK).

Short-Term Opportunities Exist—but Remain Unconfirmed

Traders are right to watch key breakout levels. A move above resistance could spark rallies in high-risk alts. But execution requires discipline:

→ Use Bitcoin as a trigger signal, not the direct trade.

→ Focus on spot altcoins with clear momentum, such as $HYPE, $AAVE, $CRV, for lower-risk positions.

→ Monitor Ethereum vs. Bitcoin performance. Without ETH strength, there can be no real altseason. It’s that simple.

You Won’t Make 200x Overnight

Real asymmetric returns come from positioning early and allocating significantly to narratives that are actually building value:

· On-chain perpetual protocols (Hyperliquid, Virtual)

· Long-term Ethereum protocols with real cash flows

· DeFi projects executing actual buybacks (AAVE)

· Native chain winners (Base, Solana, BNB—not yet microcaps)

The sequence of altseason unfolds like this: Bitcoin hits new highs (done), then Ethereum breaks out (pending), large caps rise (early signs), mid-caps follow, and finally low caps go vertical.

We’re likely between stage one and two.

Stay patient. Add positions on pullbacks.

Weekly Update

· Capital efficiency is the new arms race

AMMs (automated market makers) and money markets are converging: EulerSwap’s “LP as collateral” model and Hyperdrive’s “lending against investment portfolios” point toward a future where idle liquidity is unacceptable. Strategy suggestion: emphasize this convergence in content—with the message: “every asset should generate dual yields.”

· Bitcoin DeFi is moving from narrative to utility

Mezo’s Bitcoin-backed MUSD and the acceptance of cbBTC in Liquity forks show developers are finally treating Bitcoin as usable collateral—not just digital gold. For yield-focused audiences, frame Bitcoin as “the new U.S. Treasury of crypto”—secure collateral that generates returns.

· Hooks and modular infrastructure

Uniswap v4 hooks (Gamma) and Bittensor’s Uniswap port on EVM indicate permissionless extensibility is enabling CEX-like functionality. Content angle: expect an explosion of customized trading interfaces—position your post as “why hooks turn every DEX into a platform.”

· Cross-chain liquidity layers are flattening

Malda’s cross-chain lending, Katana’s VaultBridge, and Starknet’s USDC-to-Bitcoin bridge all replace traditional bridging UX with native abstraction. Key trend: liquidity no longer cares “which chain.” Recommended entry point: “when users stop seeing chains, the chain wars truly end.”

· Stablecoin yield competition intensifies

From TermMax’s 19% yields, Ripple’s RLUSD incentives, to Pendle’s 20x multipliers, fixed-income-style DeFi is maturing rapidly. For ultra-high-net-worth clients (e.g., Libertas), highlight “institutional-grade yields without custody compromises.”

· Points, quests, and airdrops remain key to growth

Lagrange’s verifiable AI tasks and Humanity’s palm-vein gating suggest Sybil-resistant reward systems are emerging. In marketing, advocate for a shift toward “verified identity airdrops” to stand out from chaotic, spammy drops.

· RWA and institutional bridges continue expanding

Curve on Plume, Origin’s revenue buybacks, and Ripple’s RLUSD are integrating traditional finance mechanisms into DeFi infrastructure. Asset-backed narratives continue gaining traction—emphasize transparency and real yields in your RWA content.

Narrative Overview

Bitcoin is hitting new highs, yet most crypto traders feel unusually fatigued. This emotional split makes sense: nearly all retail investors watch altcoin charts, and most of those assets have been range-bound for months. With summer approaching and traders accustomed to thin order books and sudden dumps, Twitter timelines are filled with tension.

Treasury Gold Rush

We’re back to 2020 vibes. In the past week alone, GameStop, SharpLink, Strive, Blockchain Group, and even Trump Media collectively reserved over $3 billion to directly purchase Bitcoin. Their logic is straightforward: amid 5% real cash depreciation and near-zero returns on long-term bonds, Bitcoin is the only mainstream liquid asset that has consistently outpaced inflation over five years.

This capital shift has major implications:

First, it absorbs spot supply—just like ETF inflows did earlier this year—making each newly minted satoshi harder to acquire.

Second, it sets a new risk benchmark for fund managers: “If a meme-stock-famous retailer allocates 5% to Bitcoin, why shouldn’t we?”

This could transform what used to be cyclical rallies into more structural, gradual uptrends. Ironically, the better Bitcoin performs, the more altseason may be delayed. While dominance may be peaking, the real holders now are CFOs—not churn-happy retail traders.

Capital Efficiency War: AMMs Absorb Money Markets

As treasurers keep buying Bitcoin, DeFi builders spent May erasing the lines between swapping, collateralizing, and earning fixed income.

Euler integrated Uniswap-v4 hooks into its lending engine, allowing LP tokens to automatically serve as loan collateral—instant liquidity, zero idle TVL. Hyperdrive enables Hyperliquid traders to leverage dormant perp collateral (USDe or USDT0). Malda’s ZK-powered “borrow-as-you-go” layer turns cross-chain bridging into a seamless UX detail.

The subtext: any asset in a smart contract should work twice—once for exposure, once for yield. This increases protocol stickiness, allows professional arbitrageurs to tighten spreads, and aligns risk closer to real-world assets.

Liquidity Migration: The Quiet Rise of Layer-2s

Hyperliquid’s TVL climbs weekly. Base sees steady volume growth fueled by the Virtual ecosystem. BNB Chain DEX data explodes (though much of Polyhedra’s surge comes from bot-driven wash trading chasing ZK points).

Ethereum remains the core liquidity hub, but flows are concentrating in large caps: AAVE, UNI, LINK, PEPE. Retail farming season has moved to sidechains—mainnet is now the main road.

Meme Velocity, Buybacks, and Beta Hunting

AAVE’s governance-driven buybacks have turned the token into an institutionally favored accumulation vehicle, generating the cleanest spot inflows since spring. Memes are splitting into two camps: “rotation leaders” accessible to institutions (PEPE, VIRTUAL, SPX6900) and retail speculation vehicles (“trash coins” like DINNER, Fartcoin)—until the music stops.

An interesting divergence: capital flows on Solana are more fragmented—MEW’s Robinhood listing, JUP’s ongoing faucet emissions, and emerging names like BRETT and KAITO are all capturing attention. For growth content, highlighting this fragmentation differentiates from Ethereum-centric narratives.

NFTs: The Forgotten Frontier

Ordinal hype has faded, volumes are flat, and even “old whales” struggle to support floor prices. Without new monetary easing or fresh narratives repositioning JPEGs as utility tools rather than status symbols, capital once chasing NFTs has shifted toward point-based Memes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News