Bitcoin: Trading Opportunities Amid Global Liquidity Shifts

TechFlow Selected TechFlow Selected

Bitcoin: Trading Opportunities Amid Global Liquidity Shifts

Global liquidity is the key factor driving Bitcoin's price.

Author: fejau

Translation: Luffy, Foresight News

I want to write about something I've been thinking deeply about for a while—the potential behavior of Bitcoin as it undergoes the most significant shift in capital flows it has ever seen since its inception. I believe that once deleveraging concludes, Bitcoin will present an exceptional trading opportunity. In this article, I will elaborate on my reasoning.

What drives Bitcoin’s price?

I’ll build upon Michael Howell’s research into the historical drivers of Bitcoin’s price movements, and use his framework to better understand how these interconnected factors may evolve in the near future.

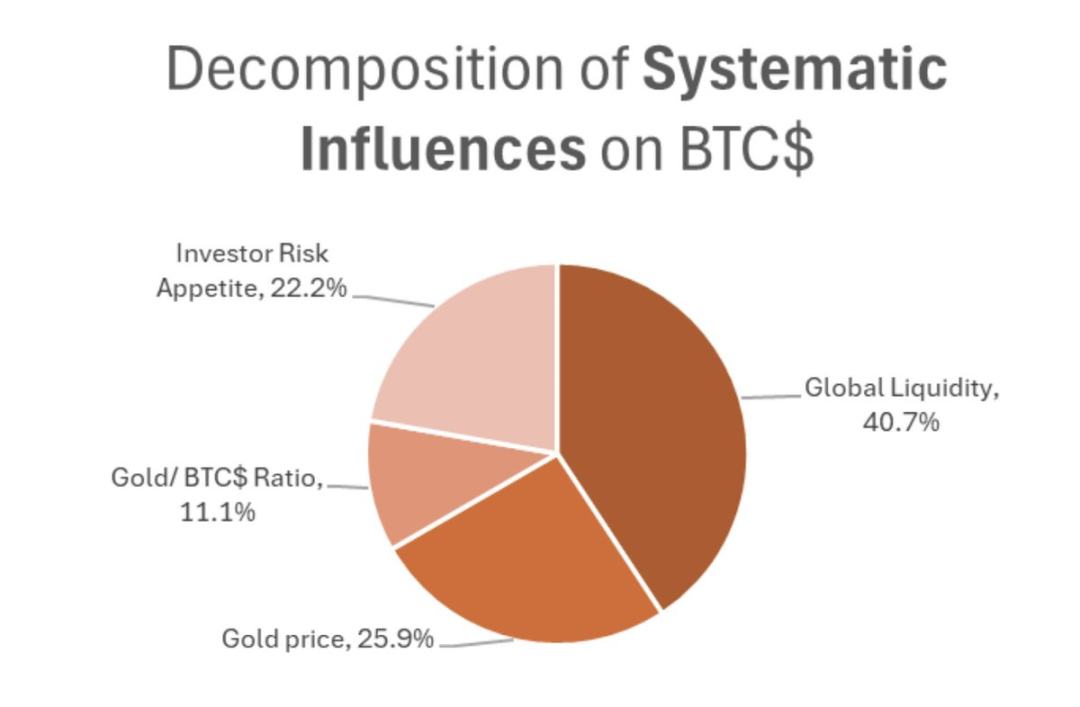

As shown in the chart above, Bitcoin’s price is driven by three key factors:

-

Investor appetite for high-risk, high-beta assets

-

Bitcoin’s correlation with gold

-

Global liquidity

Since 2021, I’ve found a simple yet effective way to understand risk appetite, gold performance, and global liquidity—by using the fiscal deficit as a percentage of GDP as a proxy to gauge the dominant fiscal stimulus shaping global markets during this period.

Mechanically, a higher fiscal deficit relative to GDP tends to fuel inflation and raise nominal GDP, which directly benefits corporate revenues—since revenue is a nominal figure. For companies benefiting from economies of scale, this environment supports stronger earnings growth.

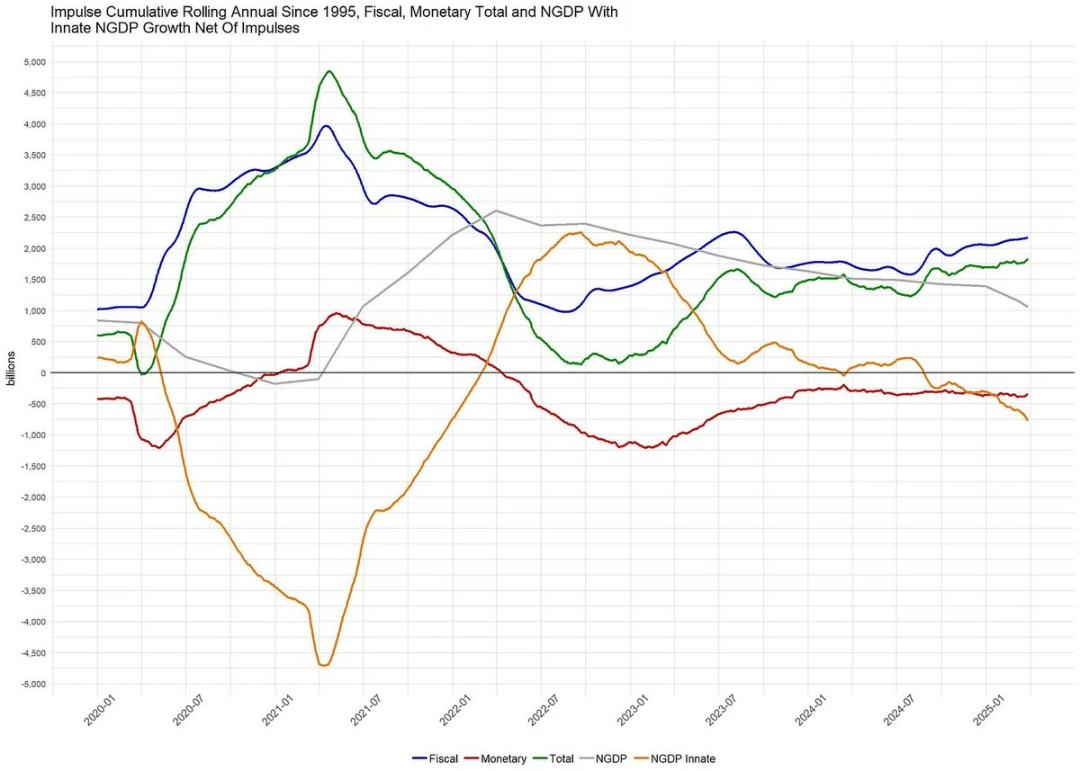

To a large extent, monetary policy has taken a backseat to fiscal policy, which has become the primary driver of risk asset activity. As George Robertson frequently highlights in his updated charts, U.S. monetary stimulus has remained weak compared to fiscal measures. Therefore, for the purpose of this discussion, I will set aside monetary stimulus entirely.

The chart below illustrates that among major developed Western economies, the U.S. fiscal deficit as a share of GDP far exceeds that of other nations.

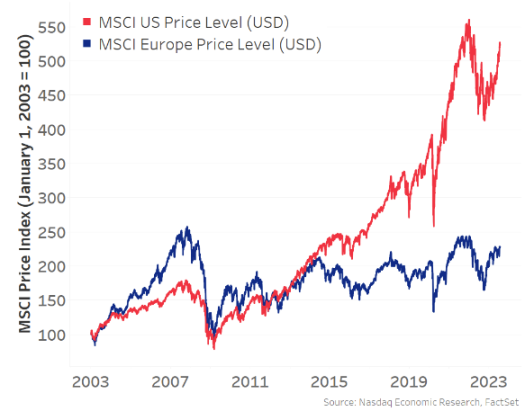

This massive fiscal deficit has made revenue growth the dominant force, enabling U.S. equities to outperform those of other economies:

U.S. equities have become the marginal driver of risk asset growth, wealth effects, and global liquidity. As such, they have attracted global capital, where it is best rewarded. This dynamic of capital inflows into the U.S., combined with a large trade deficit, means America exchanges goods for foreign-held U.S. dollars—dollars that are then reinvested into dollar-denominated assets like U.S. Treasuries and the "Magnificent Seven" tech stocks. As a result, the U.S. has become the primary engine of global risk appetite:

Returning now to Michael Howell’s earlier research: over the past decade, risk appetite and global liquidity have been predominantly driven by the U.S. Since the pandemic, this trend has accelerated due to the U.S.’s exceptionally large fiscal deficits relative to other countries.

Because of this, even though Bitcoin is a globally liquid asset (not solely tied to the U.S.), it has exhibited a positive correlation with U.S. equities—a correlation that has strengthened since 2021:

However, I believe this correlation between Bitcoin and U.S. equities is spurious. By “spurious,” I mean statistically speaking—there exists a third, unobserved causal variable that explains both, which correlation analysis alone fails to reveal. That variable, I argue, is global liquidity. As we’ve discussed, U.S. dominance has shaped global liquidity for nearly a decade.

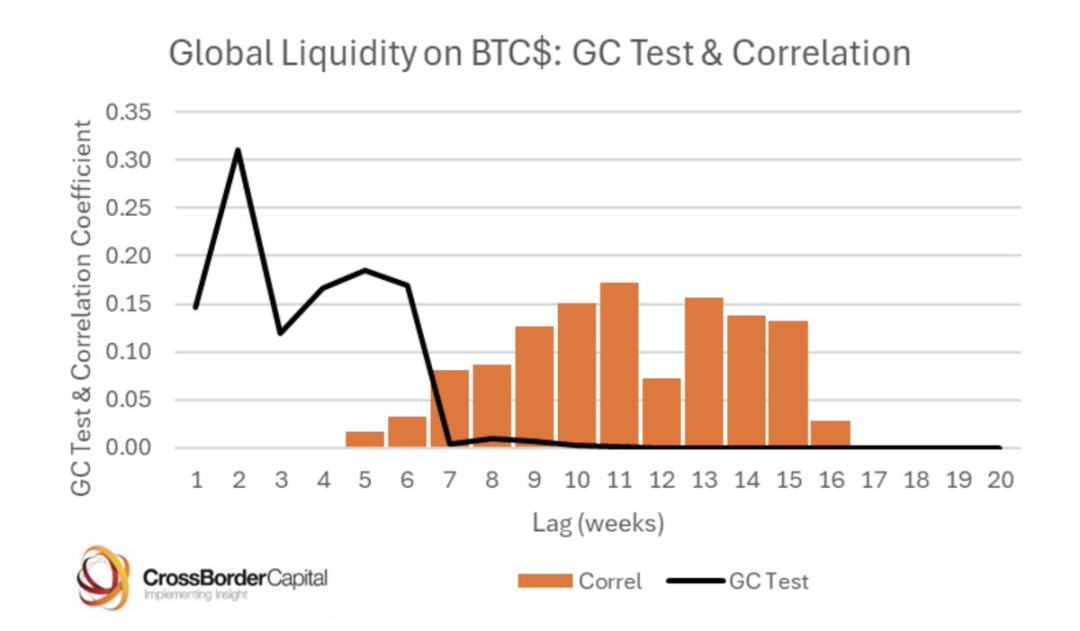

When digging deeper into statistical significance, we must also establish causality—not just correlation. Fortunately, Michael Howell has done excellent work here, using Granger Causality tests to confirm a causal relationship between global liquidity and Bitcoin:

What conclusion can we draw from this as a foundation for further analysis?

Bitcoin’s price is primarily driven by global liquidity. Because the U.S. has dominated global liquidity expansion, Bitcoin has developed a spurious correlation with U.S. equities.

In the past month, amid speculation about Trump’s trade policies and the restructuring of global capital and commodity flows, several key narratives have emerged. I summarize them as follows:

-

The Trump administration aims to reduce trade deficits with other nations. Mechanically, this implies fewer U.S. dollars flowing abroad—which were previously recycled into U.S. assets. Trade deficit reduction cannot occur without this shift.

-

The administration believes foreign currencies are artificially suppressed and the dollar is artificially strong, and seeks to rebalance this. Put simply, a weaker dollar and stronger foreign currencies would lead to higher interest rates abroad, encouraging capital repatriation to capture those yields—especially when viewed on a currency-adjusted basis—and boosting local equity markets.

-

Trump’s “shoot first, ask questions later” approach to trade negotiations is pushing other countries to move away from their historically low fiscal deficits relative to the U.S., investing instead in defense, infrastructure, and broader protectionist government spending to enhance self-sufficiency. Whether or not tariff tensions ease (e.g., with China), I believe the genie is out of the bottle—this shift will continue and won’t be easily reversed.

-

Trump wants other countries to increase defense spending as a share of GDP, given the disproportionate burden currently borne by the U.S.—which would further widen fiscal deficits abroad.

I’ll set aside my personal opinions on these points, as many have already weighed in. Instead, I’ll focus on the logical implications if these trends play out:

-

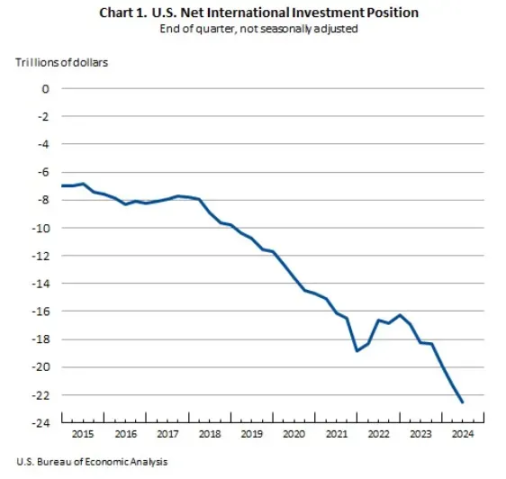

Capital will exit dollar-denominated assets and flow back to home countries. This implies underperformance of U.S. equities relative to the rest of the world, rising bond yields, and a weakening dollar.

-

The returning capital will allow fiscal deficits in recipient countries to expand unchecked. Other economies will begin aggressive spending and money printing to fund growing deficits.

-

As the U.S. shifts from a global capital partner to a protectionist stance, holders of dollar assets will demand higher risk premiums on what were once considered premium securities, requiring wider safety margins. This will push up bond yields. Foreign central banks will seek to diversify their balance sheets beyond U.S. Treasuries into more neutral assets like gold. Similarly, sovereign wealth funds and pension funds may follow suit in portfolio diversification.

-

A counter-narrative holds that the U.S. remains the center of innovation and technology-driven growth, unmatched by any other nation. Europe, burdened by bureaucracy and socialism, cannot replicate American-style capitalism. I acknowledge this view—it may suggest this trend isn’t multi-year in duration, but rather a medium-term phenomenon.

Returning to the title of this piece: the first phase of trading involves selling over-allocated dollar assets and avoiding the ongoing deleveraging process. Given widespread overexposure to these assets, deleveraging could turn messy when large fund managers and highly leveraged, stop-loss-driven participants like multi-strategy hedge funds hit risk limits. At that point, margin calls emerge, forcing broad asset sales to raise cash. The key now is survival through this phase and maintaining sufficient cash reserves.

Yet, as deleveraging stabilizes, the next phase begins: portfolio diversification into foreign equities, foreign bonds, gold, commodities, and even Bitcoin.

We’re already seeing early signs of this rotation during calmer market days—no margin calls, no panic. The DXY index is falling, U.S. equities are underperforming global peers, gold is surging to new highs daily, and Bitcoin is holding up surprisingly well against traditional U.S. tech stocks.

I believe as this unfolds, the marginal growth in global liquidity will reverse course completely from what we’ve grown accustomed to. The rest of the world will take the baton in driving global liquidity and risk appetite.

When I consider the risks of diversifying into foreign risk assets amid a global trade war, I worry about tail risks—such as negative headlines on tariffs disrupting these positions. Therefore, in this shifting landscape, gold and Bitcoin stand out as my preferred vehicles for global diversification.

Gold is performing exceptionally strongly, setting new all-time highs every day. Meanwhile, although Bitcoin has held up remarkably well throughout this transition, its beta exposure to risk appetite has so far capped its upside, preventing it from matching gold’s stellar performance.

Thus, as we progress toward global capital rebalancing, I see the next compelling opportunity emerging in Bitcoin after this initial phase.

When I overlay this framework with Howell’s correlation research, the pieces fit together:

-

U.S. equities are influenced only by liquidity measured via fiscal stimulus and some capital inflows—not broader global liquidity. Bitcoin, however, is a truly global asset reflecting the overall state of global liquidity.

-

As this narrative gains traction and risk allocators continue rebalancing, I expect risk appetite to be driven by the rest of the world—not the U.S.

-

Gold is performing brilliantly, and Bitcoin’s partial correlation with gold aligns perfectly with expectations.

Taken together, for the first time in my life, I see a real possibility of Bitcoin decoupling from U.S. tech stocks. I know this is a high-risk idea—one that often coincides with local tops in Bitcoin prices. But this time, the shift in capital flows could be profound and lasting.

So for a risk-seeking macro trader like me, Bitcoin feels like the most compelling trade to enter after this current phase. You can’t impose tariffs on Bitcoin. It doesn’t care which national border it resides within. It offers high-beta returns without the tail risks associated with U.S. tech stocks. I don’t need to assess whether the EU can solve its structural issues. And crucially, it provides exposure to global liquidity—not just U.S. liquidity.

This market regime is Bitcoin’s moment. Once the dust of deleveraging settles, it will be the first to sprint forward, accelerating ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News