From tariffs to crypto reserves, what game is Trump really playing?

TechFlow Selected TechFlow Selected

From tariffs to crypto reserves, what game is Trump really playing?

"Success due to the same reason as failure"?

Author: Hedy Bi, OKG Research

On the evening of March 3 (Beijing time), U.S. President Donald Trump confirmed tariffs on Canada and Mexico, with reciprocal duties set to take effect on April 2, dashing hopes that a last-minute agreement might avert sweeping tariffs.

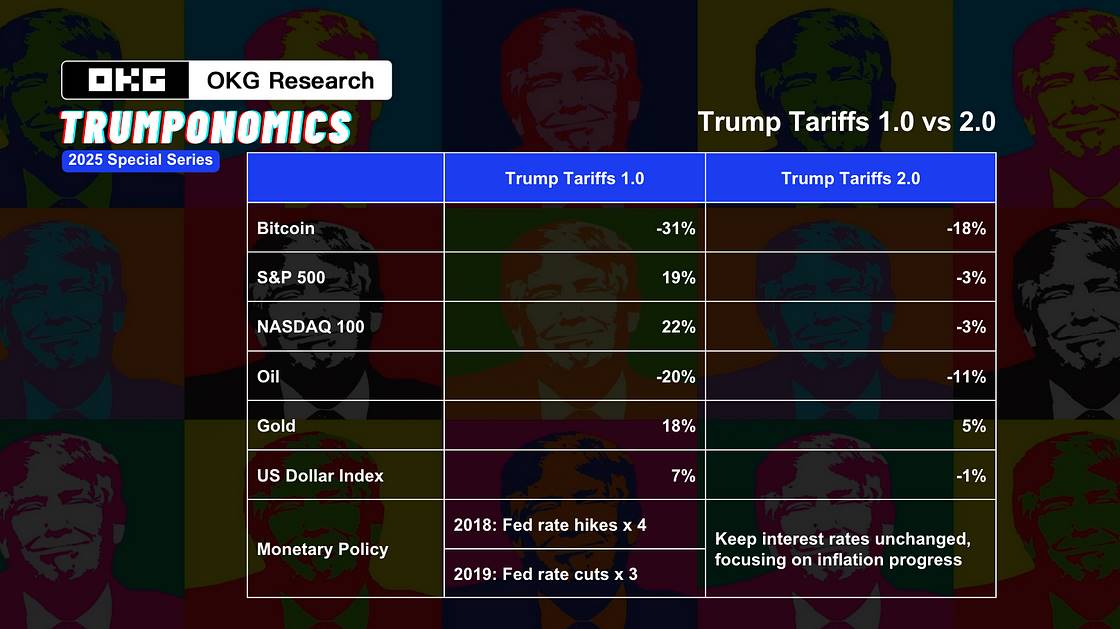

Bitcoin, still digesting the "sweet" news of the previous day’s "crypto strategic reserve" announcement, dropped 8% within 48 hours. Meanwhile, U.S. equities opened the week with a "black Monday," as the Nasdaq Composite fell 2.6%. In just over a month since Trump took office, the crypto market has lost 22% of its value. Trump Media & Technology Group (DJT) plunged 34.75%. Elon Musk, a staunch Trump supporter, was not spared either—Tesla shares fell 32.87%, amid backlash over the DOGE team's blunt approach and Musk's deepening involvement in international politics.

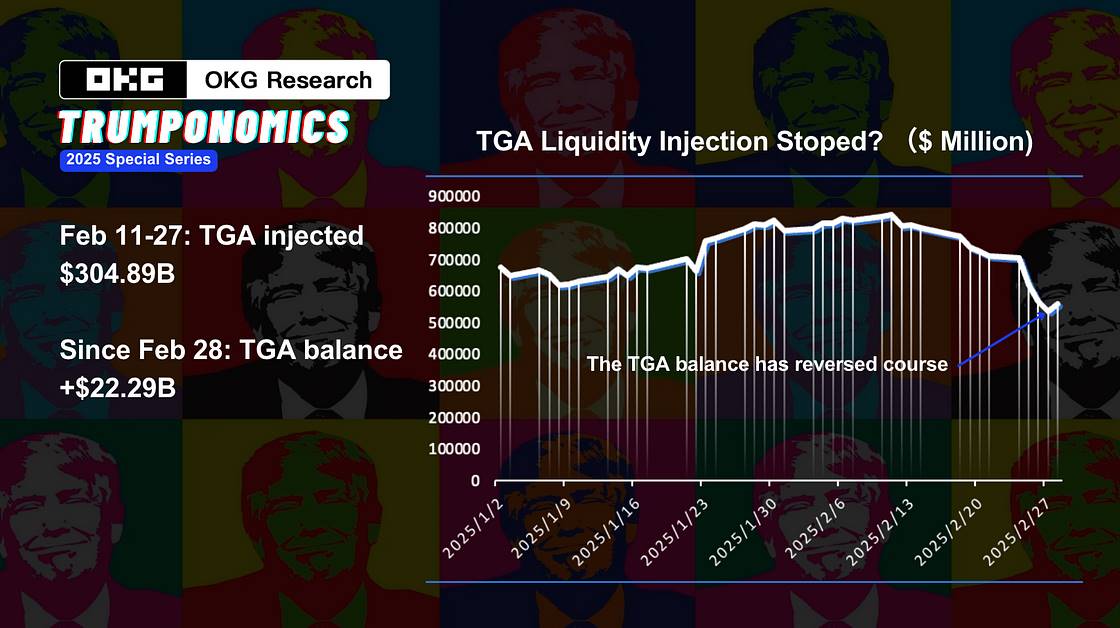

Trump’s every word and action is now tugging at the nerves of the crypto market—a classic case of “live by the sword, die by the sword.” In 2025, OKG Research launches a special series titled “Trumponomics,” tracking the impact of Trump’s second-term administration on the crypto markets. In the previous installment, “New Liquidity Wave: Can Crypto Markets Break to New Highs?” we emphasized focusing on real liquidity (monitoring the TGA balance in the short term) rather than media noise, arguing that without genuine liquidity support, superficial rallies built on rhetoric alone cannot last. Notably, according to the latest U.S. Treasury data, the Treasury General Account (TGA) ceased injecting liquidity into the market as of February 28, after having injected a total of $304.89 billion previously.

The tariff policy—the first heavy blow—has already delivered a significant shock to global risk markets with “American exposure.” Why do both Trump 1.0 and 2.0 favor such seemingly destructive policies? This article, the fifth in OKG Research’s 2025 special series “Trumponomics,” uses trade wars as its central theme to unpack the deeper meaning behind Trump’s strategy of “left hand tariffs, right hand crypto.”

Tariffs as “Chips”

Trump made many promises before and after taking office, but the first major action he took was imposing tariffs.

On the surface, these tariffs aim to reduce trade deficits, boost employment, and stimulate the economy. However, both Trump’s first-term trade war and the 1930 Smoot-Hawley Tariff Act—which triggered a global trade war—prove this is not a sound economic strategy. The Congressional Budget Office (CBO) estimated that the 2018–2019 trade war reduced U.S. GDP by 0.3%, or about $40 billion. Data from the Peterson Institute for International Economics shows that steel and aluminum tariffs alone cost U.S. manufacturing approximately 75,000 jobs in 2018. Moreover, many American companies did not return home; instead, they shifted production to low-cost countries like Vietnam and Mexico (Kearney). Other historical trade wars also ended poorly: After the U.S. enacted the Smoot-Hawley Tariff Act in 1930, global trade volume dropped by around 66%, U.S. exports fell 67%, and price distortions led to widespread farm bankruptcies.

Tariffs are merely the beginning. The Trump administration uses them to create economic uncertainty and gain leverage in negotiations. The core of this tariff game extends beyond goods—it encompasses technology restrictions, capital flows, and currency competition. Today’s trade wars are no longer just about tariff barriers; they represent deep interventions into the global financial system. From foreign exchange and stock markets to Treasury yields and risk assets, no segment of global capital markets remains untouched.

Warren Buffett has rarely spoken out recently, but he warned that punitive tariffs could fuel inflation and harm consumer interests. A shift in expectations for the real economy further complicates the Federal Reserve’s dilemma—how to control inflation without triggering a severe recession. Weakened consumer confidence may drag down economic growth, while persistent inflation limits the Fed’s ability to cut rates, tightening liquidity and leaving monetary policy in a bind.

For the crypto market, which acts as an amplifier of global risk sentiment, price movements mirror those of U.S. tech stocks. Whether it’s the fact that 70% of Bitcoin’s computing power relies on Nvidia GPU-driven mining rigs, or that crypto firms like Coinbase and MicroStrategy are now part of the Nasdaq-100 index, U.S. financial policy and regulatory direction have long been deeply embedded in the crypto ecosystem.

In other words, the crypto market behaves less like a hedge asset and more like a derivative of U.S. financial policy (see OKG Research article “Repositioning Crypto: Growing Pains Amid Global Liquidity Crisis,” July 2024). Looking ahead, assuming macroeconomic expectations remain stable, the market’s response to tariffs will depend on global reactions: if other nations compromise, current crypto market moves are just short-term volatility, and medium-to-long-term prospects remain positive for U.S.-linked risk assets. The U.S. would then achieve its real objectives through tariff-based negotiation leverage. But if other countries retaliate forcefully—including with matching tariffs—risk assets face clear downside pressure.

Crypto Assets as Unconventional Tools in Extraordinary Times

If tariffs fail to achieve their stated goals and even hurt Trump’s own supporters—including MEGA (Mega Interest Groups)—then how does Trump 2.0 plan to “Make America Great Again” through a strategy of “left hand tariffs, right hand crypto,” especially when corporate valuations have dropped 40% despite his tough stance?

In the past several weeks, turmoil in U.S. financial markets reflects an accelerating erosion of “national credibility.” As Paul Krugman, Nobel laureate in economics (2008), recently wrote in his blog: “Elon Musk and Donald Trump, since taking power five weeks ago, have recklessly damaged America across multiple fronts—including rapidly undermining U.S. influence in the world. America has suddenly redefined itself as a rogue nation—one that reneges on commitments, threatens allies, attempts mafia-style extortion, and interferes in democratic elections.”

History teaches us that when national credit begins to unravel, capital does not stand still—it seeks new channels of circulation.

Looking back at the 20th century, Japan’s economic rise caused U.S.-Japan trade imbalances and friction. The U.S. forced the yen to appreciate sharply via the Plaza Accord, crippling Japan’s export-driven economy and triggering financial instability. After asset bubbles burst and Japanese authorities tightened regulations, markets quickly sought alternatives—fueling a black-market economy marked by gold smuggling, surging offshore dollar transactions, and thriving informal forex markets. According to Nikkei, Japan once had as many as 17,000 underground exchange outlets in major cities. This “shadow financial system” emerged as a spontaneous hedge against the collapse of the formal system. After curbing Japan, the U.S. later supported its recovery through defense contracts and financial liberalization, leading to the era when “Tokyo could buy all of America.” Yet excessive rate cuts eventually burst the bubble, and Japan’s economy declined—watching its tower rise, host a feast, then collapse.

Reflecting on this history, both “black markets” and “financial liberalization” played pivotal roles during trade wars. Translating this to today, Trump’s announcement of a national crypto asset reserve may appear to be financial innovation—but it is more likely an “unconventional measure for extraordinary times.”

There are two key reasons: First, with dollar credibility under strain and Fed monetary policy nearing its limits, the U.S. urgently needs new tools to maintain global capital confidence. Crypto assets may serve as a quasi-financial weapon—if the government controls a strategic reserve, it gains greater maneuverability in global capital flows. Second, de-dollarization trends are already evident. As trade tensions escalate, nations will accelerate diversification into non-dollar assets to hedge against dollar-system risks. The steady rise in gold prices since the start of 2025 is proof enough. In this accelerating de-dollarization environment, if crypto assets can maintain true decentralization—rather than being controlled by any single nation—they may gain new geopolitical premiums in global financial competition.

Trump 2.0 holds a more explicit ambition to dominate the global economic order. Rather than directly reinforcing the dollar system, building a crypto reserve offers the government subtler, “non-direct intervention” tools. As crypto technologies advance, the U.S. could develop new cross-border payment systems—and potentially, in the future, a state-led crypto-financial network.

In The Trump Biography, Trump’s family origins are traced to Germany, and he is described as a “fighter” who values passion far more than intelligence or talent. For him, the greatest motivation comes from the thrill of striking deals quickly and defeating rivals. Yet in the context of trade wars, this very impatience to renegotiate and defeat opponents may not lead to the best outcomes for the Trump administration.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News