Trump Family's Web3 Investment Preferences: Another Spring for MEME & DeFi Sectors?

TechFlow Selected TechFlow Selected

Trump Family's Web3 Investment Preferences: Another Spring for MEME & DeFi Sectors?

The crypto industry is expected to face more opportunities and challenges in the coming years.

Author: HashKey Exchange

1. What Does Trump's Ascension Mean for the Crypto Industry?

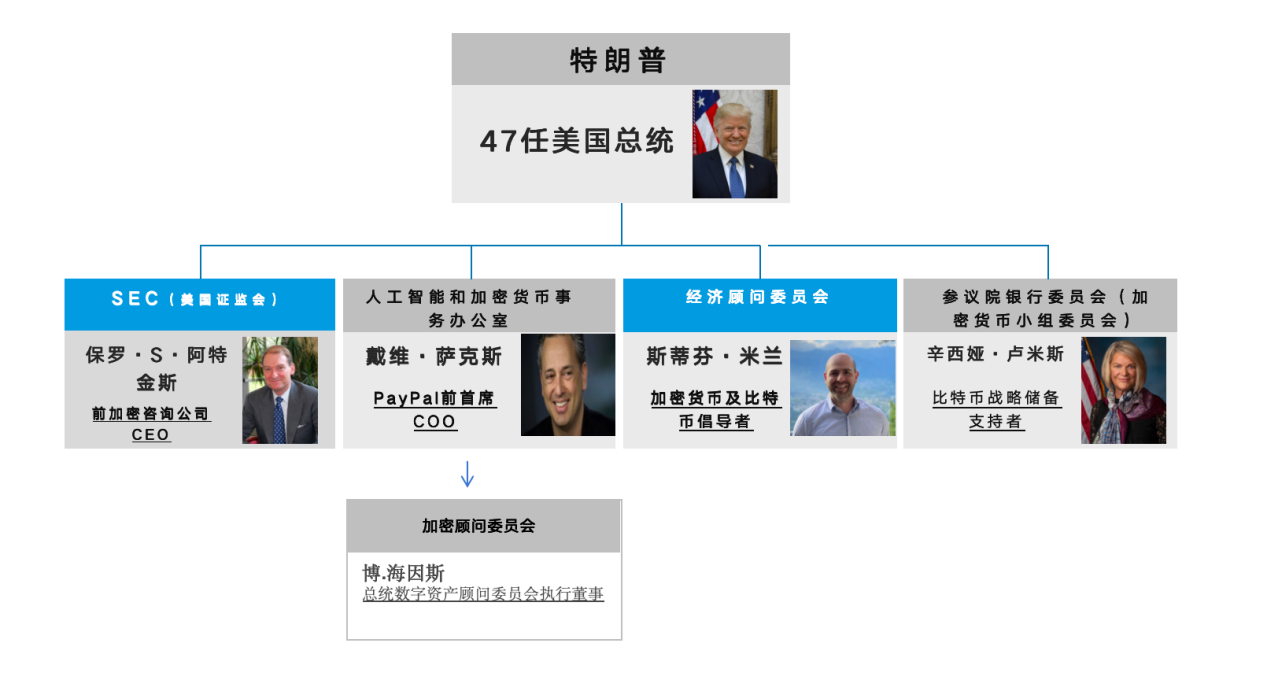

Since December, the so-called "Trump trade" has ignited market enthusiasm. For the crypto industry, the focus has now shifted to how fully Trump will deliver on his campaign promises. During the power transition period, Trump swiftly nominated key officials—appointments that will shape U.S. and even global crypto policy over the next four years. This means Trump’s return to office will fundamentally reshape the current industry landscape. Regardless of the extent to which he implements his policies, it signals both new, significant opportunities and accompanying policy uncertainty for the sector. Before Trump officially takes office, let’s first review which officials have been nominated for key roles and their respective stances toward the crypto industry. Under the U.S. political system, a president's cabinet consists of two main components: formal cabinet members requiring Senate confirmation (e.g., Secretary of State, heads of major executive departments), and cabinet-level officials who may not require such confirmation (e.g., Chief of Staff, National Security Advisor). Currently, within Trump’s emerging administration, the following positions are either held by crypto supporters or significantly influence the direction of crypto policy:

1) Make the U.S. the global cryptocurrency capital

2) Immediately cease crackdowns on cryptocurrencies upon taking office

3) Block the development of a central bank digital currency (CBDC)

4) Establish a strategic Bitcoin reserve

5) Fire the SEC Chair

6) Halt the sale of Bitcoin held by the U.S. government

7) Use Bitcoin to address U.S. national debt

8) Develop a more comprehensive cryptocurrency policy

9) Establish a Crypto Advisory Committee

From Trump’s personnel appointments during the transition phase, at least items 5 and 9 have already been fulfilled. From the creation of new advisory bodies to changes in Senate cryptocurrency committees and the replacement of the SEC chair, these appointments—with strong crypto backgrounds—indicate that Trump is indeed moving forward with his campaign promises. For the crypto industry, this suggests that, at the very least, previously restrictive regulatory policies may gradually ease, while more robust legislation could further mainstream the industry.2. What Do the Trump Family’s Initial Project Investments Reveal?

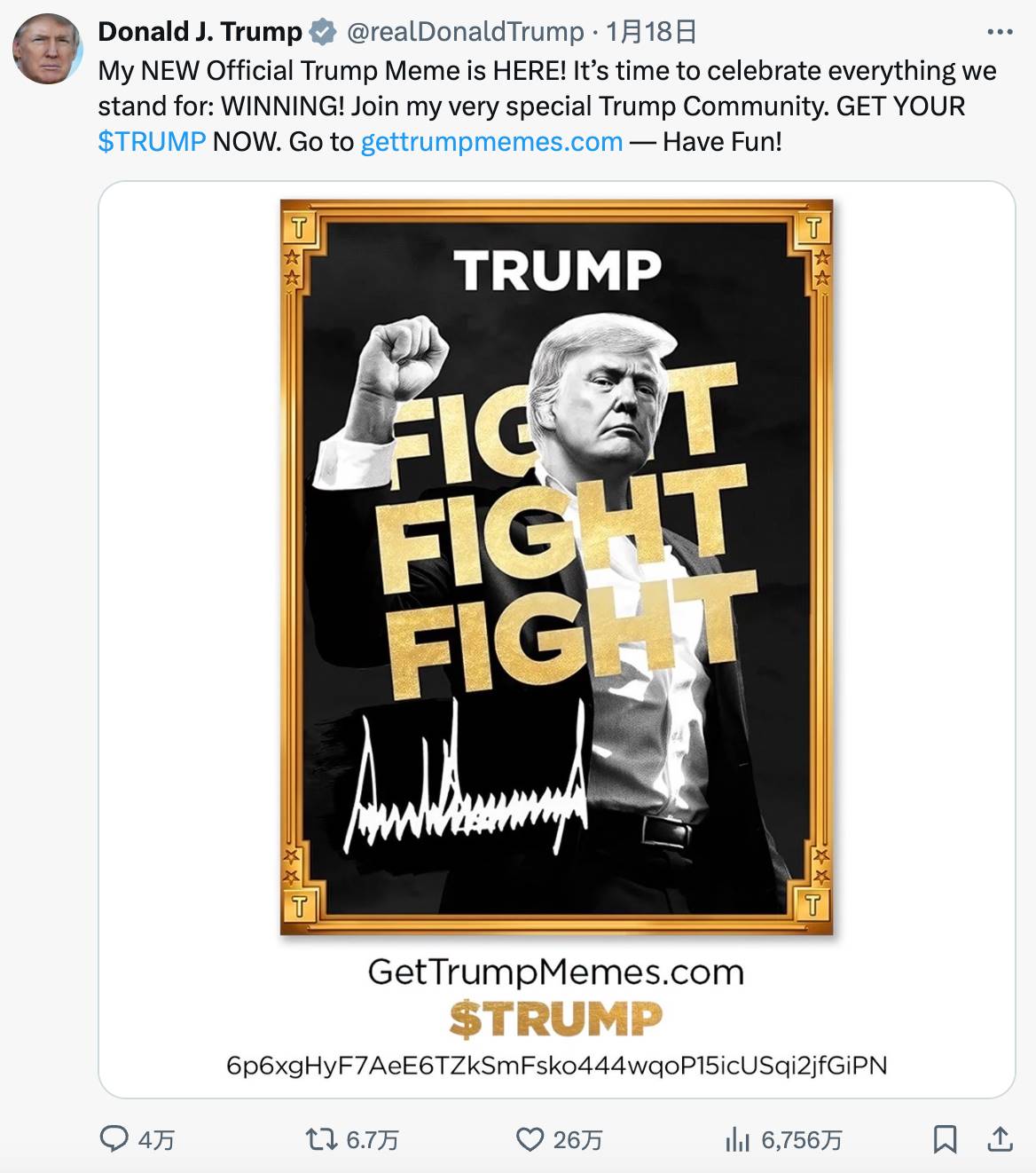

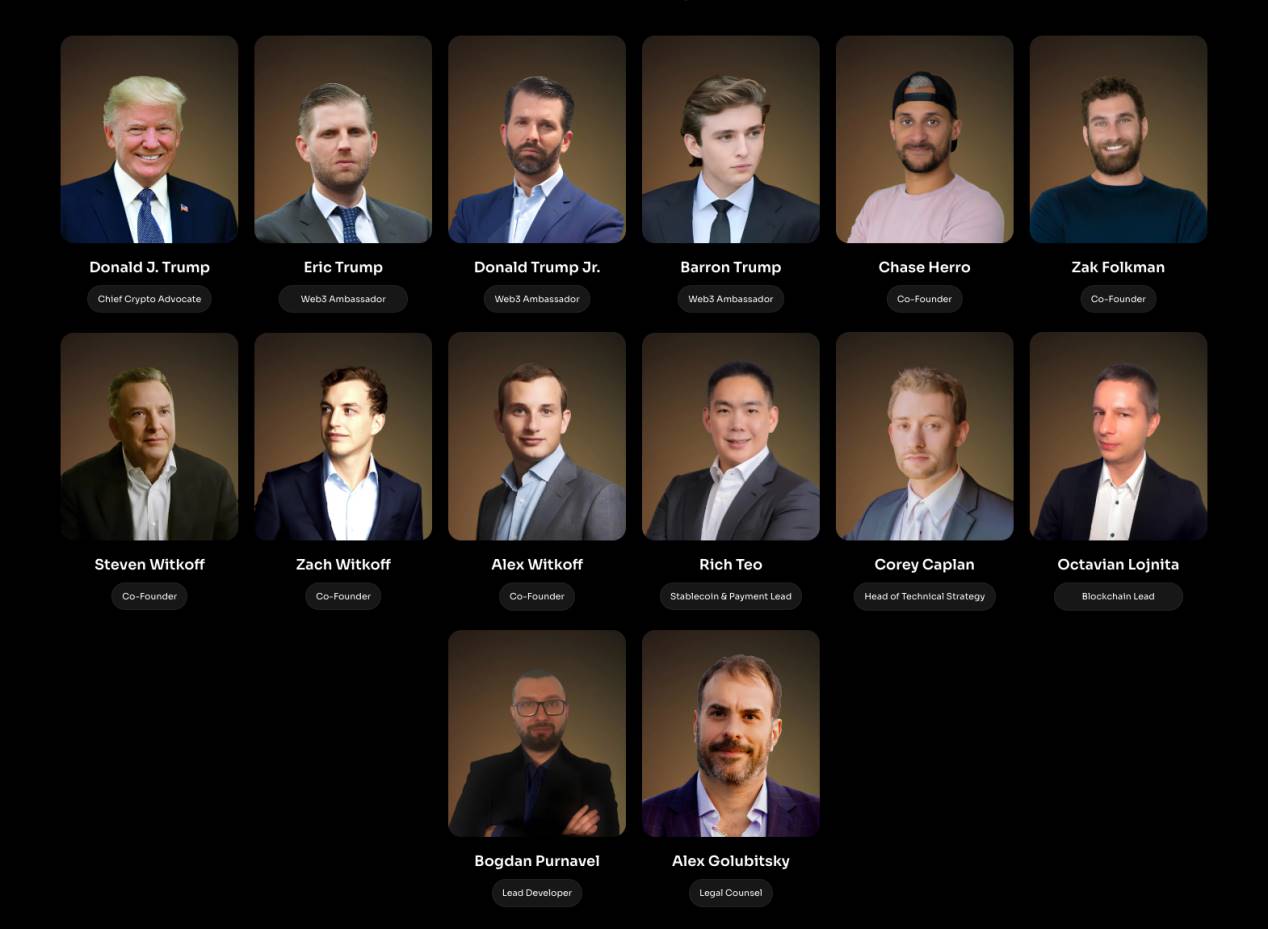

Trump’s shift in attitude toward cryptocurrencies during his second term has significantly boosted the industry—not only through the establishment of a cabinet-level advisory team but also through direct family involvement in crypto investments, providing early signals of future regulatory relaxation. At the start of 2025, the biggest catalyst in the industry was undoubtedly the meme coin TRUMP, personally launched via Trump’s official X account. The project surged past a $30 billion market cap within one day, creating yet another instant wealth legend in the crypto space.

3. How Will the Trump Family’s Projects Impact the DeFi Sector?

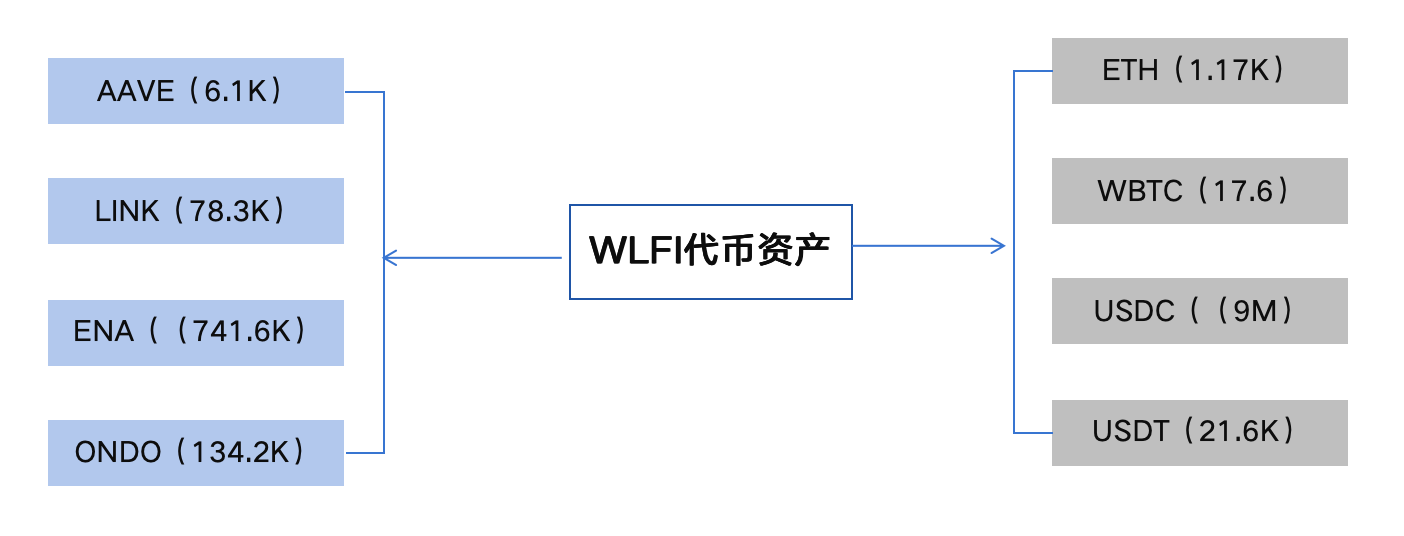

The market imagination sparked by Trump’s meme coin is enormous. A sitting president launching a cryptocurrency is unprecedented. Setting aside considerations of personal gain, this move clearly signals a general trend toward a more relaxed regulatory environment for the industry over the next four years. Further analysis reveals that this was not a spontaneous or hastily executed token launch, but rather one carefully prepared within legal, compliance, and institutional frameworks. The certainty and powerful narrative behind a presidential token are unique, creating a one-of-a-kind on-chain phenomenon. However, current support remains limited to expectations of regulatory easing. Long-term sustainability remains unproven. The Trump family appears more intent on establishing WLFI as a sustainable, long-term project. By examining WLFI’s operational moves and subsequent investment patterns, we can infer that the project has proactively addressed regulatory compliance. Combined with the U.S. Internal Revenue Service’s proposed DeFi tax rules at the end of December 2024, it is reasonable to anticipate that systematic legislative oversight targeting DeFi could emerge in 2025. While perhaps less stringent than initially proposed by the IRS and other agencies, increased compliance requirements—such as KYC (which WLFI also requires), anti-money laundering (AML), and counter-terrorism financing measures—are likely to become key developments in 2025. In a more optimistic scenario, WLFI—as the Trump family’s first non-meme project—signals strong confidence in the DeFi sector, particularly its future growth potential. From a policy standpoint, the project’s comprehensive compliance design from inception indicates clear anticipation that under Trump’s administration, regulatory easing and enhanced compliance will proceed in parallel—paving the way for DeFi to enter the mainstream. Considering Trump’s own token launch, his cabinet appointments, and the family-backed DeFi project, his supportive stance toward the broader crypto industry is now relatively clear. However, the extent of regulatory relaxation remains uncertain. Markets will continue adjusting expectations around evolving policies. Nevertheless, until the 2027 U.S. midterm elections, resistance to Trump’s policy initiatives is expected to be significantly reduced—making this a relatively favorable and critical period for DeFi and the entire crypto industry.Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News