LBank Research: The Driving Forces Behind Cardano's Rapid Growth — A Data Analysis

TechFlow Selected TechFlow Selected

LBank Research: The Driving Forces Behind Cardano's Rapid Growth — A Data Analysis

In the future, Cardano will achieve full on-chain governance and self-sustainability through the Chang hard fork, ushering in the Voltaire era.

Introduction

Since its launch in 2017, Cardano (ADA) has evolved into a PoS network designed to push the boundaries of blockchain technology. As a platform committed to security, scalability, and functionality, Cardano is more than just a cryptocurrency—it offers developers and users a robust environment for building decentralized applications and systems. Through close collaboration with organizations such as Input Output Global (IOG), the Cardano Foundation, and EMURGO, Cardano has taken significant steps along its roadmap, entering competitive arenas like smart contracts, DeFi, and NFTs.

This article will guide you through Cardano's latest developments, key data, and network features, exploring ADA’s use cases and its role within the broader crypto economy. Whether you are a developer, investor, or blockchain enthusiast, this piece provides comprehensive insights into the Cardano ecosystem—from governance innovation and financial health to dynamic growth in DeFi—offering a forward-looking perspective on Cardano’s journey toward its ultimate goal: the Voltaire era.

Overview of Cardano

Cardano is a proof-of-stake (PoS) Layer-1 network launched in 2017. Its goal is to provide security, scalability, and functionality for decentralized applications and systems built on its platform. In addition to support from a community of developers, node operators, and projects, Cardano is backed by institutions including Input Output Global (IOG), the Cardano Foundation, and EMURGO. These entities jointly drive the network’s development, adoption, and fundraising efforts, guiding Cardano toward the final phase of its roadmap—the Voltaire era.

Compared to other smart contract platforms, Cardano adopts a unique development approach. The Ouroboros consensus mechanism enables stake delegation, while the extended eUTXO accounting model facilitates native token transfers, scalability, and decentralization.

With a dedicated user and developer base, Cardano has demonstrated resilience. Following the Alonzo hard fork in 2021, which enabled smart contract functionality, Cardano began competing in traditional crypto markets such as DeFi and NFTs.

Key Metrics

Revenue Data

ADA is Cardano’s native asset and serves as the primary medium for transactions on the network. It has four main network-level use cases:

(i) Paying transaction fees: ADA is used to pay fees for transactions conducted on the Cardano network.

(ii) Registering stake pools: Users can use ADA to register a stake pool and participate in network consensus as a Stake Pool Operator (SPO).

(iii) Staking: Whether as an SPO or delegator, staking ADA helps secure the network and earns token rewards.

(iv) Rewarding voters and funding projects: In Project Catalyst, ADA is used to reward voters and fund approved proposals.

The maximum supply of ADA is capped at 45 billion tokens. Until this cap is reached, the circulating supply undergoes inflation. At the end of each five-day epoch, 0.3% of the ADA reserve (un-circulating ADA) is distributed to SPOs as rewards. This "inflation" gradually trends toward zero as the reserve depletes and the circulating supply approaches 45 billion.

The annualized real staking yield accounts for value dilution due to inflation. In Q3, the annualized real staking yield was 0.6%, though it may vary across different stake pools.

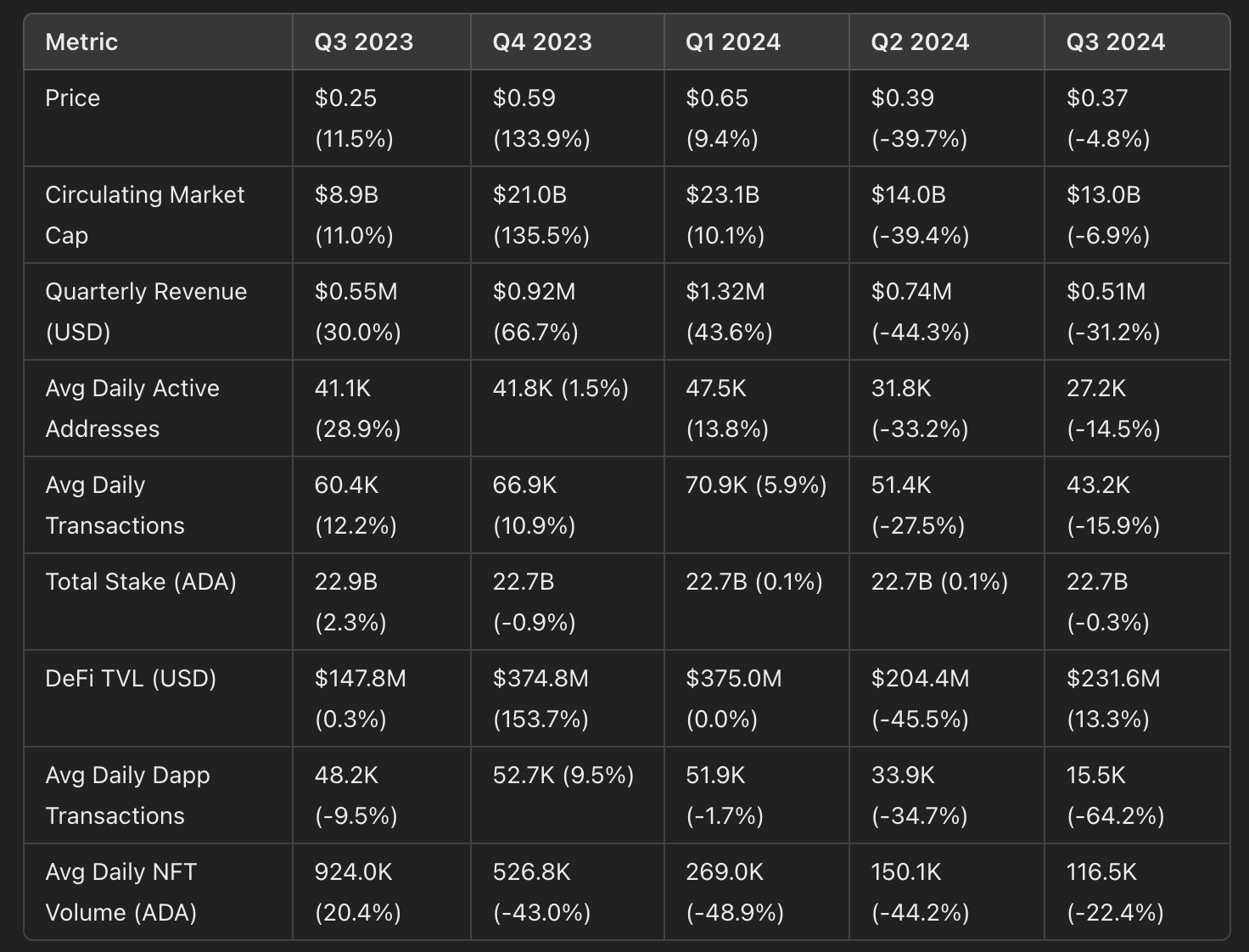

In Q3, ADA’s price declined by 4.8% to $0.37. Consequently, ADA’s market capitalization decreased by 6.9% quarter-over-quarter to $13 billion. The slight discrepancy in market cap is attributed to a 2.2% reduction in circulating supply. Due to the price drop, ADA fell from the 10th to the 11th largest cryptocurrency by market cap during the quarter.

Every transaction on Cardano requires a network fee to cover processing and storage costs. Fees consist of a minimum base plus a variable component based on transaction size. Revenue (in USD) dropped 31.2% quarter-over-quarter to $510,000, while revenue in ADA decreased 14.2% to 1.4 million ADA. This divergence reflects the decline in ADA’s price over the quarter.

Currently, 20% of Cardano’s transaction fees go into the treasury. The treasury balance in ADA decreased by 1.2% quarter-over-quarter to 1.55 billion ADA, but its USD value increased by 3% to $622.92 million.

Daily Activity Metrics

In Q3, Cardano’s average daily transaction volume declined by 15.9% to 43,200, while average daily active addresses (DAAs) dropped 14.5% to 27,200. The average transaction fee remained stable at $0.13. However, the average fee in ADA decreased by 17.9% quarter-over-quarter to 0.54 ADA.

The transaction-to-active-address ratio (txs/DAAs) declined by 1.7% to 1.59. An increasing ratio typically indicates more evenly distributed activity among users; conversely, a declining ratio suggests a growing concentration among “heavy users.”

Total staked ADA and the ADA staking rate decreased by 0.3% and 4.1% quarter-over-quarter, respectively. Due to the drop in ADA’s price, total staked value in USD declined by 5.1% to $8.5 billion. Total staked value in USD represents the network’s economic security.

Governance & Forks

In April 2024, Cardano announced the Chang hard fork—a two-phase network upgrade aimed at enabling on-chain governance and achieving core objectives of Cardano’s final roadmap stage. Voltaire marks the last step toward Cardano’s self-sustainability, combining on-chain voting with off-chain mechanisms and institutions such as the member-based organization Intersect.

- Phase One: Began with the activation of the Chang hard fork on September 1, 2024. This phase initiates a transitional period, setting the stage for decentralized voting and governance actions.

- Interim Cardano Constitution: A placeholder document to fill governance gaps until a finalized constitution is iterated through Cardano Constitution Workshops and formally approved at the Cardano Constitutional Convention in Buenos Aires, Argentina, in December 2024.

- Interim Constitutional Committee (ICC): Comprised of seven members, three of whom are elected by vote. During Phase One, the ICC holds veto power over certain on-chain governance actions.

- Phase Two: Will mark the full activation of Cardano’s on-chain governance once the Cardano Constitution is finalized and ratified. This phase empowers ADA holders to direct technical upgrades and treasury withdrawals, partially through the introduction of new user roles—Delegation Representatives (DReps). ADA holders will be able to delegate their governance rights to DReps and SPOs, who can then vote on governance proposals on their behalf.

- Register as a DRep: Now open, requiring a one-time deposit of 500 ADA.

Upon completion of Phase Two, DReps, SPOs, and the Constitutional Committee will manage all aspects of the network via on-chain voting and treasury systems under CIP-1694. This shifts governance responsibility away from IOG, the Cardano Foundation, and EMURGO—historically the joint holders of all seven genesis keys. Governable actions include constitutional committee appointments, parameter changes, constitutional updates, hard fork initiation, protocol parameter adjustments, and treasury withdrawals.

Intersect & SanchoNet

Testing related to CIP-1694 continues on SanchoNet, a testnet launched in Q3 2023 designed as a sandbox for testing and developing processes and tools for Cardano’s on-chain governance. Developers use this testnet to deploy new infrastructure such as wallets and voting browsers, SPOs test voting and proposal mechanisms, and discussions around DReps take place here.

SanchoNet and the broader rollout of the Voltaire era are spearheaded by Intersect, a membership-based organization serving the Cardano ecosystem by uniting community members, SPOs, and project teams. Intersect was founded to bring ADA holders together around a shared vision of a more transparent, collaborative, and innovative Cardano ecosystem.

Intersect maintains over 60 code repositories, including the full Cardano Haskell implementation, and advances Cardano’s open-source ethos through various standing committees and working groups. Additionally, Intersect is developing an open product roadmap and annual budget process, and operates a grants program that funds projects focused on governance-related areas such as education and DRep platforms.

DeFi

In Q3, Cardano’s DeFi total value locked (TVL in USD) grew 13.3% quarter-over-quarter to $231.6 million, while the DeFi diversity score rose 12.5% to 9. TVL across individual protocols saw notable shifts during the quarter.

- Minswap’s TVL increased slightly by 4.4% to $58.6 million.

- Liqwid’s TVL surged 77.2% to $47.1 million, surpassing Indigo, whose TVL declined 19.7% to $38.4 million.

- Smaller protocols such as Splash Protocol and SundaeSwap grew by 76% and 26% respectively, reaching $16.9 million and $16 million.

Indigo, a synthetic asset issuer offering iUSD, iBTC, and iETH, completed its upgrade to V2.1 one week after Q3 ended. The upgrade introduced an algorithmic interest rate model that shares interest earnings between the treasury and INDY stakers, along with several other improvements.

Splash is a decentralized exchange (DEX) launched in July, following a May token sale that raised 17.2 million ADA via SPLASH. Splash is also developing snek.fun, a protocol similar to Solana’s pump.fun, enabling users to easily launch and trade tokens. The app launched in September and recorded over 2,230 new tokens created and $4.5 million in trading volume on its first day.

SundaeSwap continued its momentum from Q2 with the release of its V3 upgrade, introducing a dynamic fee model and increased transaction throughput. The launch included a 90-day fee waiver, which expired in August, followed by a proposal in September to increase fees. SundaeSwap’s revenue is distributed among SUNDAE token holders, the SundaeSwap treasury, and Sundae Labs.

ADA Token Unlock

Recently, Cardano (ADA) is set to unlock tokens this week. Approximately 16.84 million ADA tokens are expected to be released, representing 0.05% of the current circulating supply.

Outlook

Launched in 2017 as a PoS Layer-1 network, Cardano aims to provide a secure, scalable, and feature-rich platform for decentralized applications and systems. With its unique Ouroboros consensus mechanism and extended eUTXO model, Cardano has proven competitive in the domains of smart contracts, DeFi, and NFTs.

Following the Alonzo hard fork in 2021, which enabled smart contract capabilities, Cardano entered a new phase of development. Looking ahead, Cardano will achieve full on-chain governance and self-sustainability through the Chang hard fork, officially ushering in the Voltaire era. By introducing advanced governance mechanisms, enhancing DeFi ecosystem diversity, and driving TVL growth, Cardano is poised to strengthen its position in the blockchain industry and advance its ecosystem through continuous technological innovation and community-driven governance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News