Global hit song with the same name boosts APT popularity—what ecosystem projects are worth watching?

TechFlow Selected TechFlow Selected

Global hit song with the same name boosts APT popularity—what ecosystem projects are worth watching?

How is ecosystem development progressing amid the growing popularity?

Author: TechFlow

Move-based public blockchains have performed notably well in the market recently. From Sui's aggressive price surge and meme frenzy to the highly anticipated mainnet launch of the Movement ecosystem, Move-based chains are increasingly stepping into the spotlight. Even Aptos, relatively low-key among Move-based projects, has recently started gaining momentum.

Just as the hype around $APE cools down, $APT—one letter different—has taken over the market sentiment. Yesterday, while the overall market declined and altcoins plunged across the board, $APT remained resilient. Today, it逆势 rallied, breaking above $11 to reach its highest level in six months. Its ecosystem TVL (Total Value Locked) is also impressive: according to DefiLlama, Aptos' ecosystem TVL has now reached $900 million, an increase of nearly 9x year-to-date.

The overseas (especially Korean) community supporting Aptos is ecstatic. During previous $APT rallies, Korean users chanted "1 $APT = 1 apartment." But this time, the rallying cry has evolved into the catchy, repetitive chant: "APT APT APT APT APT APT......"

This slogan may seem meaningless at first glance, but it originates from a wildly viral global hit song titled “APT.”, specifically from its most infectious lyrical segment.

So what’s really going on here? How is the recent surge in $APT related to this song? This article from TechFlow explores the background behind the globally trending "APT." phenomenon and highlights key projects worth watching in the Aptos ecosystem that are successfully riding this wave of attention.

The song might be even bigger than you think

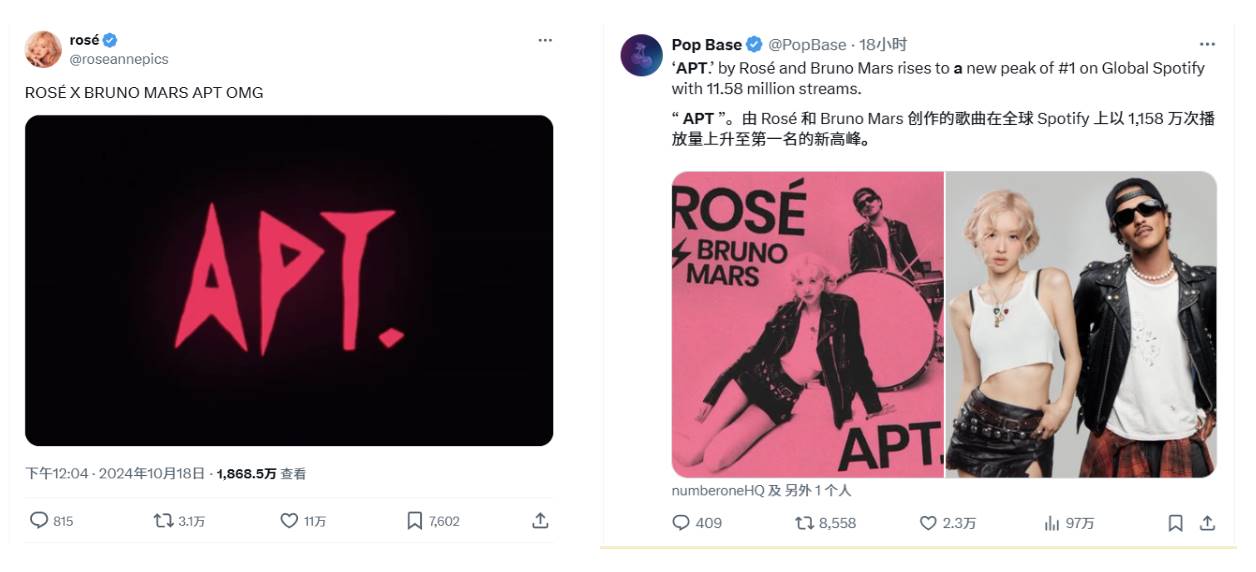

"APT." is a collaborative track by Rosé, a member of the globally renowned girl group BLACKPINK, and celebrated singer Bruno Mars. For readers familiar with both artists, this collaboration marks a particularly unique cross-genre fusion.

Despite their distinct musical styles, “APT.” hasn’t suffered from dissonance—in fact, it rapidly went viral worldwide. Within less than a week of release, the song topped charts across global music platforms, setting multiple #1 records.

To put it into perspective: “APT.” currently generates more social media buzz globally than the entire meme sector combined—across all concepts and angles. Whether on social platforms or search engines, typing “APT” now overwhelmingly returns results about this pink-themed, earworm-like song, temporarily overshadowing cryptocurrency $APT in mainstream visibility.

Coincidence or fan-driven effect?

For Aptos, the global explosion of the song “APT.” is undoubtedly beneficial. Even though there's no direct connection to the project itself, such massive exposure is essentially handed to them on a silver platter. In today’s environment where memes are everywhere and trends come fast and furious, catching a global cultural wave is extremely rare for any crypto project—especially one whose biggest enthusiast base, the Korean community, overlaps perfectly with the primary audience of this hit song.

Already, some creative Aptos ecosystem projects are capitalizing on this trend:

Beneath the hype: How is the ecosystem developing?

As mentioned earlier, Aptos’ TVL growth this year has been clearly visible. Behind this rapid rise lies a growing number of strong DeFi projects taking root and expanding within the Aptos ecosystem. Riding this wave of attention, let’s take a closer look at several standout projects currently thriving in the Aptos ecosystem.

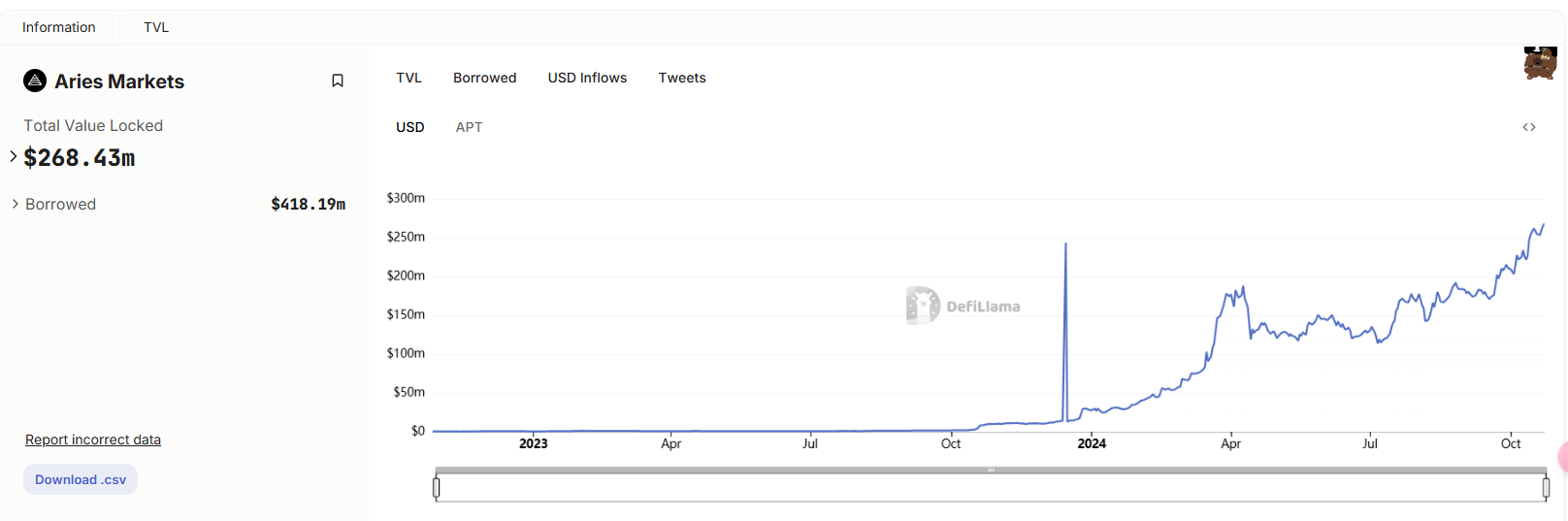

Aries Markets – Largest lending protocol in the Aptos ecosystem

Currently the largest DeFi lending project on Aptos, Aries Markets was also the first OG lending protocol launched on the network. With a TVL of $260 million, Aries Markets alone accounts for over a quarter of Aptos’ total ecosystem TVL. The protocol has facilitated over $400 million in loans. This strong TVL growth and high borrowing volume underscore Aries Markets’ central role in the Aptos ecosystem.

According to its official documentation, Aries Markets offers diverse features including lending, leveraged trading, and yield-bearing assets. A recent major update introduced a new feature called “Efficiency Mode”, designed to enhance capital efficiency and optimize asset utilization for both Aries and Aptos users. Initially applied to $APT-category assets, Efficiency Mode allows users to use APT/amAPT/stAPT as collateral and borrow against corresponding APT-class assets, offering loan-to-value ratios as high as 90%.

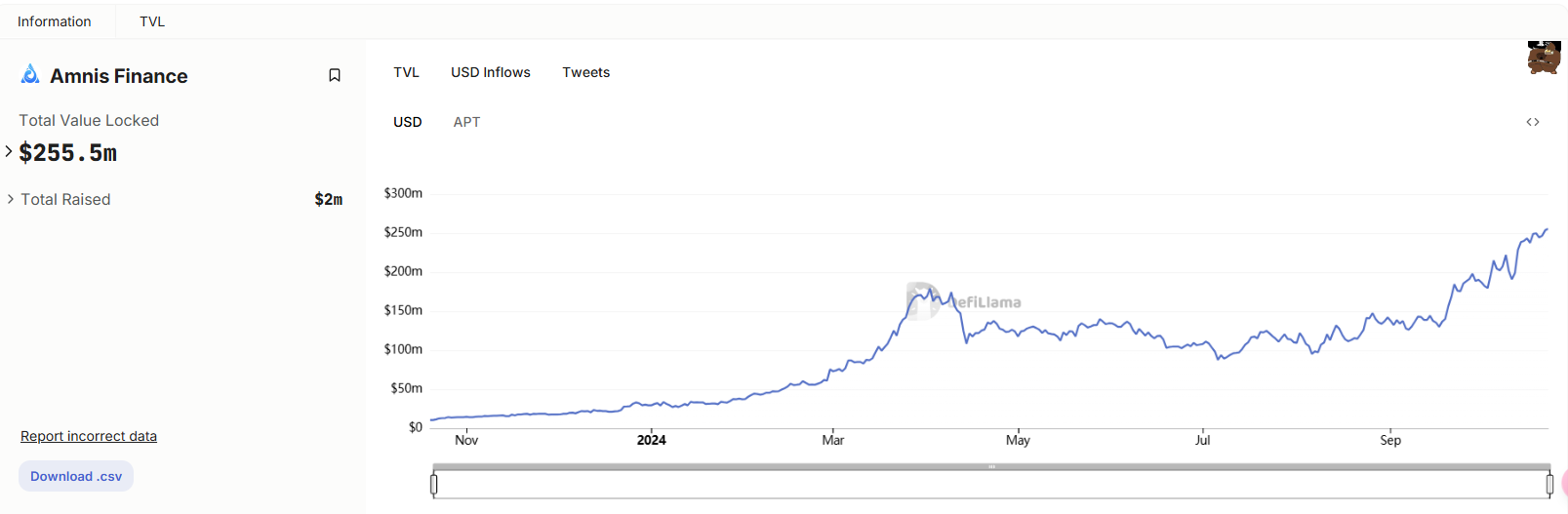

Amnis Finance – Largest liquid staking protocol in the Aptos ecosystem

Amnis Finance is the first liquid staking protocol on Aptos and remains the largest in its category. It boasts a TVL exceeding $250 million, over 300,000 stakers, and nearly 25 million $APT staked. Additionally, Amnis Finance maintains a vibrant and active staking community, frequently engaging with users through its official channels.

Users can stake $APT on Amnis Finance and instantly receive an equivalent amount of $stAPT, which can then be used across other DeFi protocols within the ecosystem. Amnis Finance also pioneers the concept of yield tokenization—wrapping stAPT into standardized yield tokens (SY), which are then split into principal tokens (PT) and yield tokens (YT).

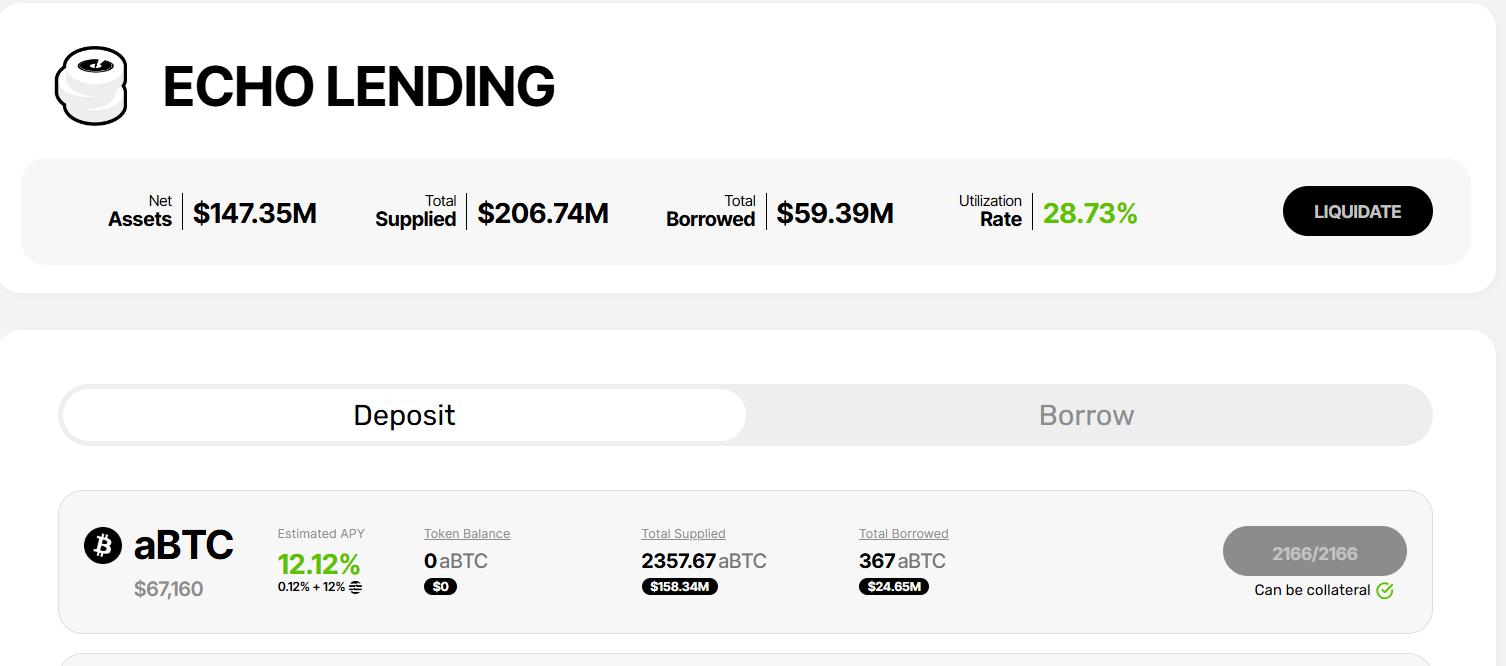

Echo Protocol – A rising star bringing massive inflows

Beyond early DeFi entrants, much of Aptos’ recent TVL growth stems from the newly launched Echo Protocol. In under a month since launch, Echo has contributed $147 million in TVL to the Aptos ecosystem.

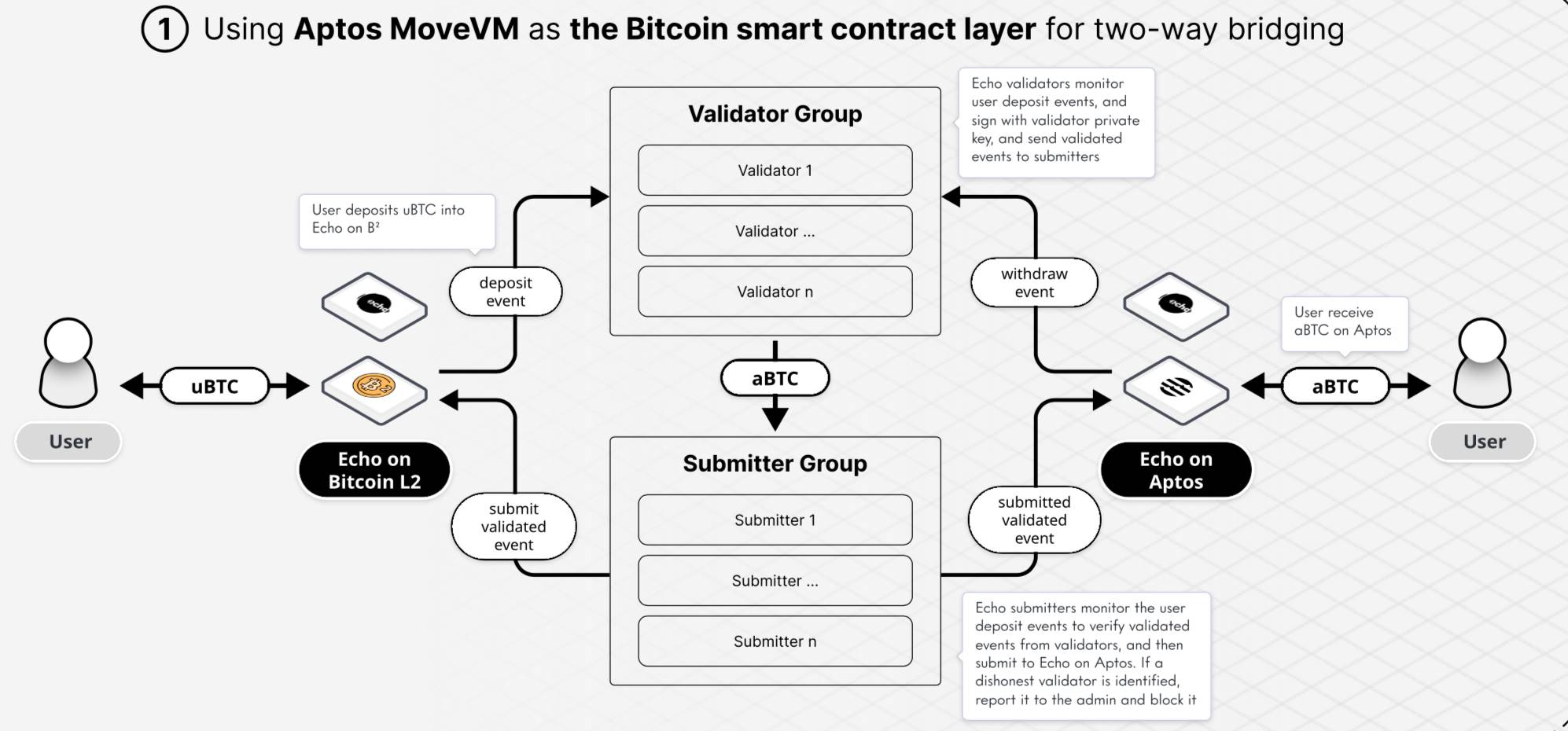

Echo is a multifunctional BTCFi protocol focused on the Move ecosystem, offering cross-chain transfers, liquid staking, and restaking services. Its goal is to bring Bitcoin liquidity into the Move ecosystem and introduce innovative restaking mechanisms for BTC assets. Echo also seamlessly integrates with the broader BTC ecosystem, supporting all native BTC Layer 2 solutions—including Babylon.

Users can directly bridge $uBTC to $aBTC on Aptos via Echo. $aBTC is a 1:1 pegged asset backed by $BTC. Holders of $aBTC earn multi-layered yields from Aptos, BTC Layer 2 networks, and Echo rewards. Additionally, $aBTC can be used as collateral across various lending protocols and utilized on platforms like perpetual contract decentralized exchanges.

Conclusion

Aptos, often seen alongside Sui as one of the twin stars of the Move ecosystem, has remained relatively quiet during this cycle. However, following Sui’s precedent of price-led adoption, market attention and ecosystem activity have gained momentum. Given $APT’s historical price surges and the enduring enthusiasm of its Korean community, this latest wave of global attention could propel $APT even further forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News