Base Data Insights: $51.4 million in revenue this year, TVL exceeds $25 billion

TechFlow Selected TechFlow Selected

Base Data Insights: $51.4 million in revenue this year, TVL exceeds $25 billion

Base achieved the largest growth in average daily transaction volume this year, reaching a record high of 6.1 million.

Author: Cheeezzyyyy

Translation: TechFlow

If you think Base's memecoin summer marked the peak of its on-chain activity, you're wrong.

Things are just getting started.

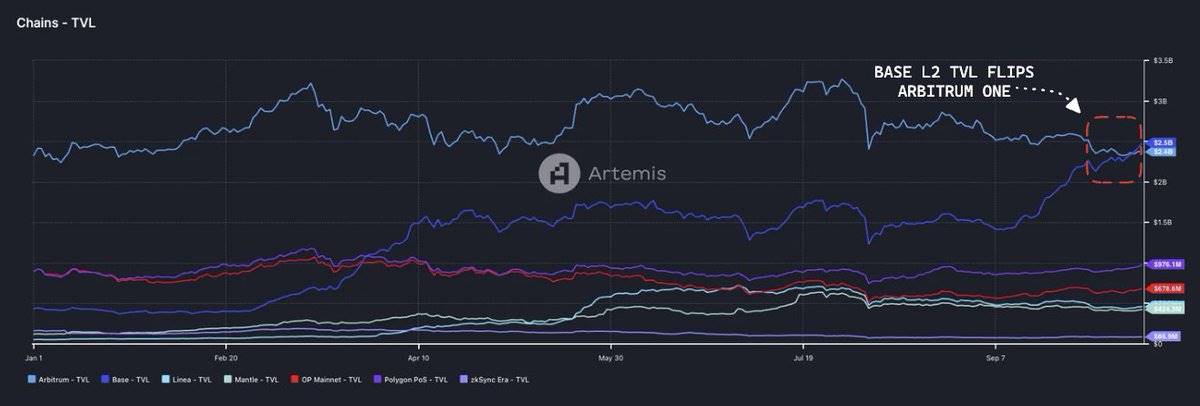

There has been a significant shift in the L2 landscape—Base has become the largest L2, surpassing Arbitrum for the first time.

Here are key insights from @artemis__xyz:

First, the major turning point: @base ($2.5B) has surpassed @arbitrum ($2.4B) in Total Value Locked (TVL) for the first time.

Year-to-date, only three L2s have seen significant TVL growth:

-

@0xMantle Network: from $121M to $424M (+350%)

-

Base L2: from $445M to $2.5B (+562%)

-

@LineaBuild L2: from $53M to $460M (+868%)

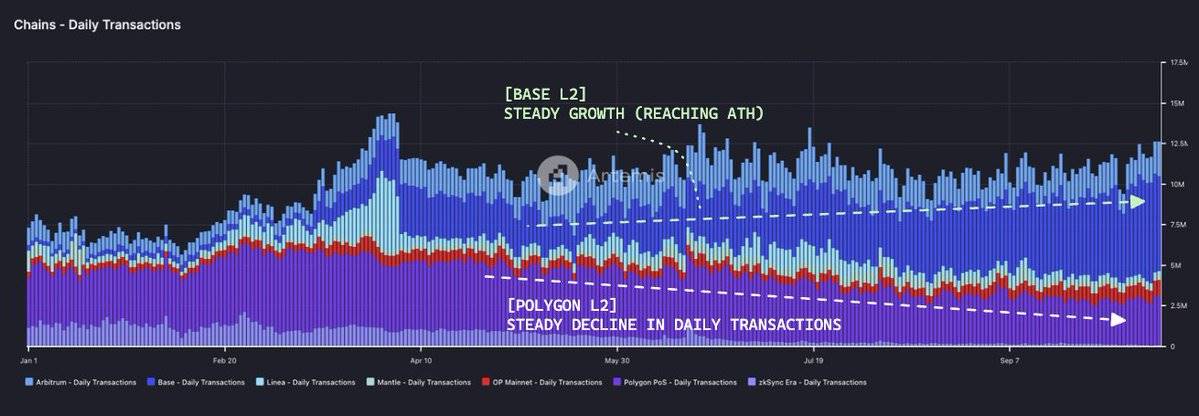

@base achieved the highest growth in average daily transaction volume this year, reaching a record high of 6.1 million.

This growth has overtaken @0xPolygon PoS’s lead and is triple that of @arbitrum.

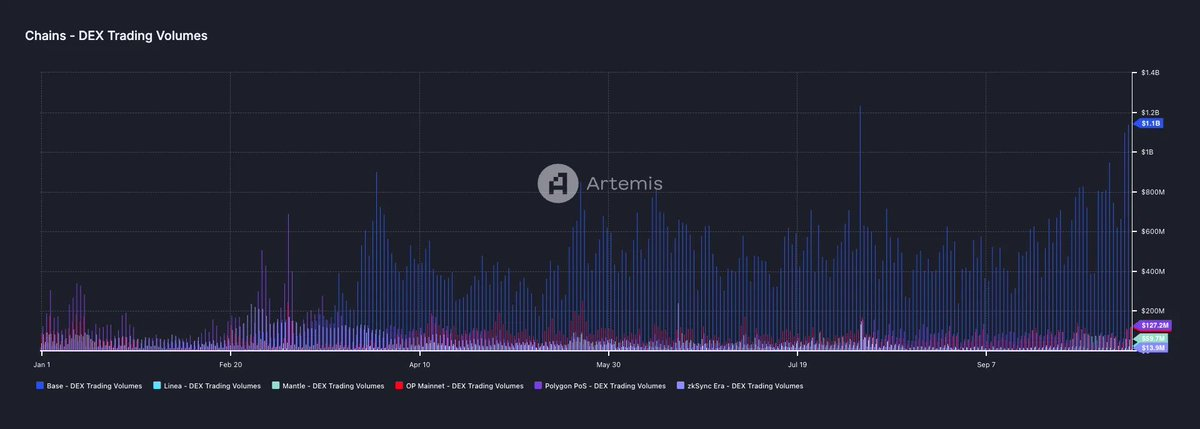

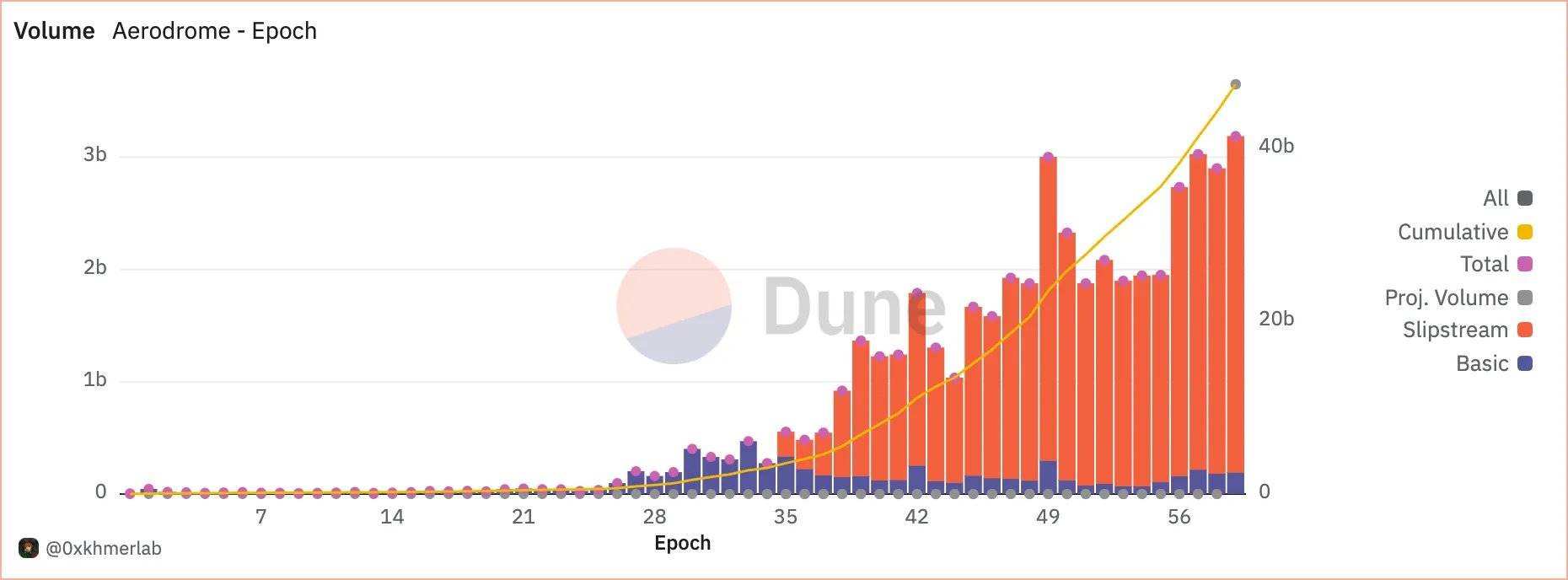

Unsurprisingly, volume growth aligns with the following average historical DEX trading volume.

In detail, DEX trading volume on @base has grown over 15x since the beginning of 2024.

This is by far the largest growth metric, primarily driven by exceptional volume growth on @AerodromeFi.

For other L2s, average volumes appear relatively unchanged.

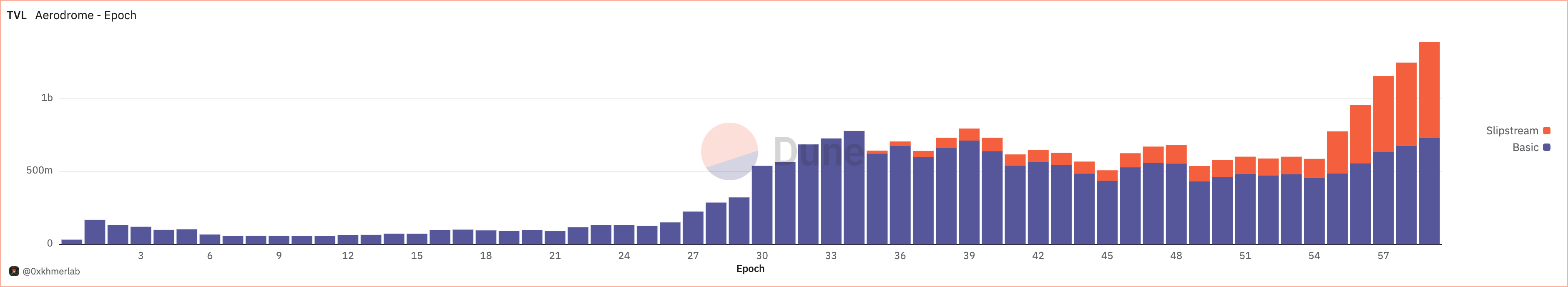

As expected, @AerodromeFi is experiencing:

-

All-time high weekly trading volume (~$3.5B)

-

Total Value Locked (TVL) breaking $1B (~$1.4B)

The concentrated liquidity mechanism introduced by Slipstream further enhances capital efficiency and trading experience. More details here.

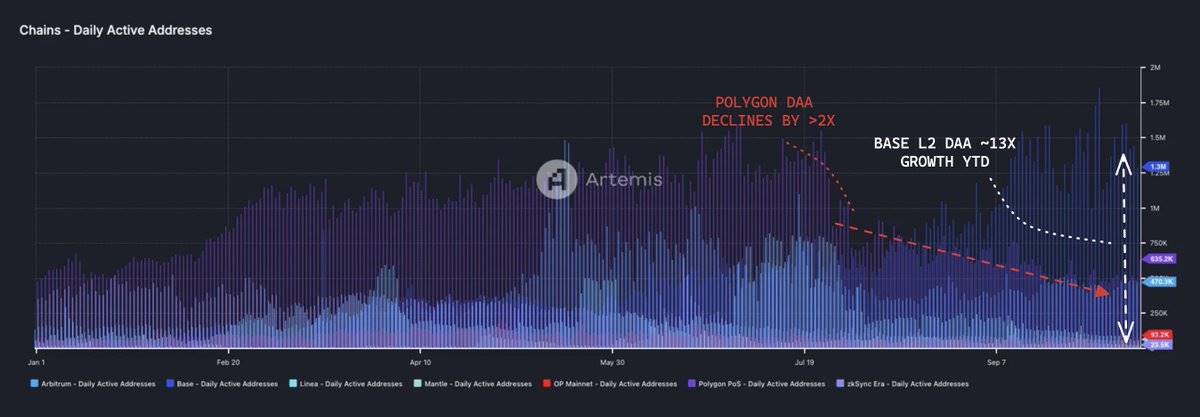

Even in terms of Daily Active Addresses (DAA), @base performs exceptionally well.

DAA reflects user base breadth, growing 13x year-to-date, confirming all previously mentioned trends.

Notably, since Q3 2024, @0xPolygon L2’s DAA has significantly declined, while Arbitrum remains stable.

Finally, the most striking metric is L2 revenue.

@base has long been known for its sequencer's high revenue, earning $51.4M year-to-date.

In data terms, this equates to:

-

Double that of @LineaBuild’s $24.7M

-

2.88x that of @arbitrum’s $17.8M

It is expected to reach around $60M by year-end.

This is not only a massive win for @coinbase, but also for @Optimism.

Because @base is an Optimium (L2) built using the OP Stack and has a profit-sharing agreement.

This not only fuels the growth of the Superchain ecosystem but also expands additional revenue streams.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News