SocialFi 2.0: Turning Missteps into Success, Attention as a New Financial Asset

TechFlow Selected TechFlow Selected

SocialFi 2.0: Turning Missteps into Success, Attention as a New Financial Asset

If people don't like your content, it's simply not engaging enough.

Translation: TechFlow

Clubhouse—we all remember its golden era. In January 2021, during the pandemic, the Clubhouse app was buzzing in nearly everyone’s ears. It rocketed to the top of app charts with its audio chat rooms. Initially available only to iPhone users by invitation, the exclusivity sparked massive buzz—invites were even raffled and sold. But just as quickly as Clubhouse rose, it faded away.

Fast forward to 2024, and the SocialFi space seems to experience a new “Clubhouse moment” every other week. Exciting new SocialFi apps keep emerging. The most recent standouts have been Friendtech and FantasyTop. While some still use these platforms, they face sustainability challenges. Why is that?

As Eugene Wei wrote in “Status as a Service”, a successful social network relies on three core pillars:

-

The potential to accumulate social capital—i.e., status

-

A metric for how entertained people are on the platform

-

Utility—what we describe as general practical value users can extract

Originally, status on social platforms was earned through "proof-of-work"—those who added value became elite members of the network. However, SocialFi platforms like Friendtech replaced real value with financial incentives, creating problematic dynamics.

In October 2023, Friendtech had over 70,000 daily active users—but today that number has plummeted to just around 400. Let's revisit the three pillars to see what went wrong with Friendtech. Initially, users gained status by holding keys and joining unique but expensive groups. There was a real dopamine hit when people saw their investments double overnight. Yet the third pillar—practical utility—was missing. The primary use case was speculation: users wanted to grow their portfolio value and capture airdrops. Interacting with favorite creators was merely an afterthought for most.

When key prices dropped, the dopamine vanished—and without sufficient practical value, user engagement collapsed. Successful creators found managing another account cumbersome, and as fees declined, so did their participation, leading to the platform’s decay.

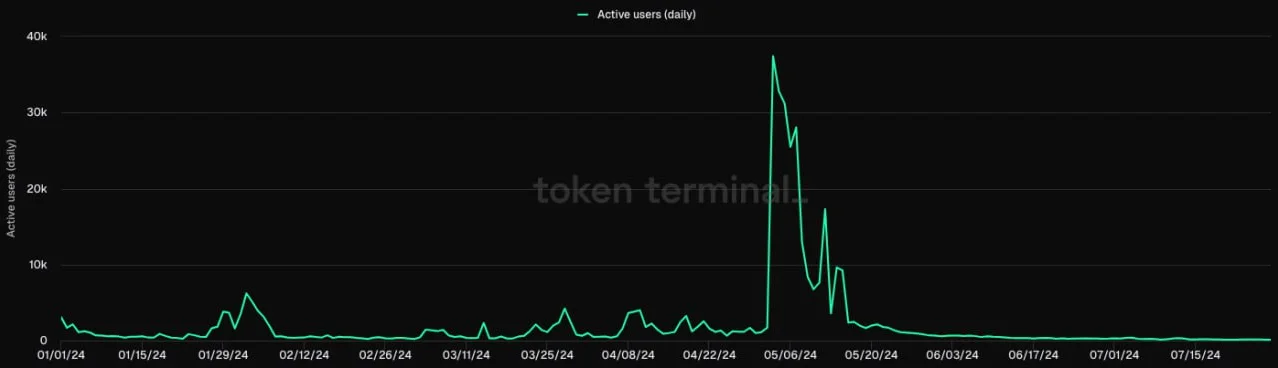

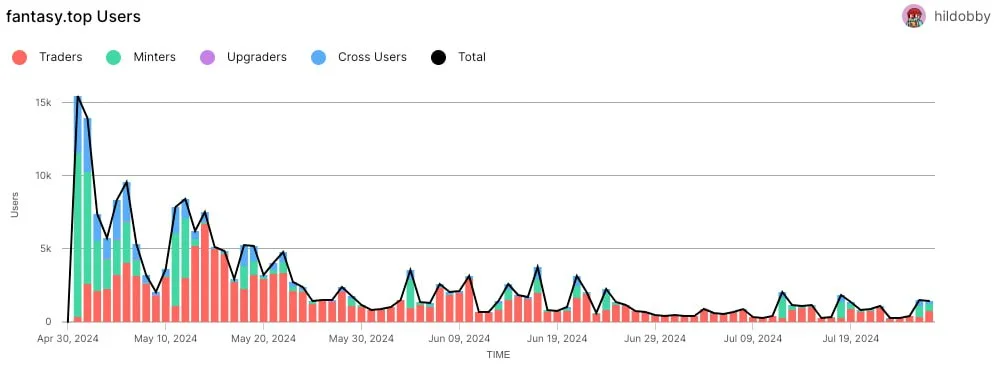

FantasyTop followed a similar path. It launched strongly in April 2024 with five-digit daily active users, but now hovers between 2,000 and 3,000 DAUs.

Unlike Friendtech, FantasyTop feels more like a game with social features—a fantasy sports model akin to fantasy football. Speculation drove initial interest as card prices rose and creators focused on achieving high scores. But as prices fell and rewards dried up, interest waned. Currently, FantasyTop is pivoting into a DraftKings-style fantasy sports app, hoping to regain traction. Most users remain primarily motivated by potential airdrops.

The core issue with these apps—and SocialFi broadly—is their heavy reliance on financial incentives. As those incentives diminish, so does user engagement, creating a vicious cycle. We’ve seen this pattern play out in many famous cases, such as Axie Infinity and Stepn. People tend to stick with established platforms because financial incentives should be a feature, not the main driver—utility must be the foundation.

On the other hand, Orb and Warpcast are decentralized applications (dapps) built around Web3 ideals of ownership and decentralization. Unlike mainstream social media giants, these platforms prioritize user control over content. At first glance, they seem like the future of social networks. But upon closer inspection, they face a major challenge: lack of real-world utility. While theoretically they could match Instagram and Twitter in entertainment value given proper network effects, they offer little beyond that.

Consider a typical 15-year-old girl using social media. She doesn’t care whether she truly owns her photos or captions. Instead, she cares about attention, likes, interactions, and following her idols. Ownership and decentralization feel distant to her.

As Peter Thiel said, from a user experience standpoint, current forms of ownership and decentralization don’t transform the experience from 0 to 1, nor make it ten times better. Instead, these ideals only offer marginal improvements. While they may appeal to tech enthusiasts, they lack the revolutionary pull needed to convince average users to leave familiar platforms.

Currently, the state of SocialFi apps is challenging. They initially rely on speculation to drive capital and user inflow—an inevitable yet temporary growth engine. While decentralization matters, users ultimately prioritize the value delivered by the product. For long-term sustainability, these networks need to evolve enough intrinsic value to keep users engaged beyond the initial monetary game.

To attract broad user bases, crypto must shift from purely financialized products toward those capable of capturing attention economies. If we treat speculation as an engaging bonus rather than a necessity, and step outside the Web3 bubble to capture wider attention, SocialFi could become one of the largest verticals. You might ask: how do we achieve this?

Think Beyond the Crypto Bubble When Integrating Web3

To understand SocialFi’s impact, we must first examine Web2 dynamics:

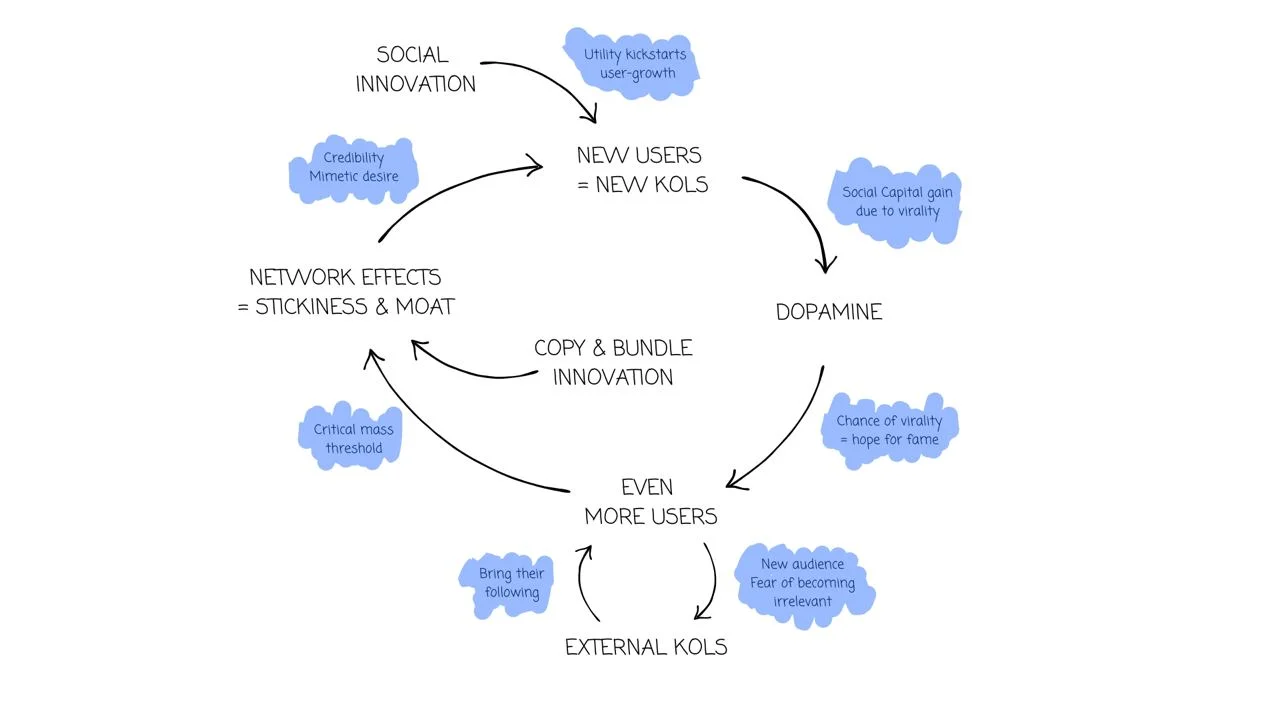

Traditional social media, undoubtedly one of the most used parts of the internet, succeeded through clear flywheel effects. Social innovation—new use cases delivering real value—often goes viral quickly, spawning new KOLs. This opportunity for fame and attention attracts massive user influx.

The dopamine rush from interactions, likes, and exposure—possibly the most consumed “drug” of the 21st century.

This surge draws in existing KOLs eager to reach new audiences and fearful of irrelevance. That, in turn, boosts platform credibility and accelerates user adoption. As this positive feedback loop continues, network effects strengthen, forming moats and increasing user stickiness.

However, with shrinking user attention spans and declining patience, platform operators face immense pressure to evolve—ideally sparking further social innovation and restarting the cycle. We all remember Instagram’s early days. It began as a simple tool to capture, edit, and share photos with followers. Soon, it became a must-have app on every phone. But like any successful platform, Instagram had to evolve to stay relevant.

In 2016, pressured by Snapchat Stories’ surging popularity, Instagram faced intense pressure to adapt. To counter this competitive threat, it launched its own version, copying not just the functionality but even the name. This strategic move aimed to directly retain user engagement and maintain relevance in a fast-moving social landscape.

And that was just the beginning. They soon integrated algorithmic feeds to help users discover content more easily and capture attention more efficiently. Not long after, Reels emerged as a direct response to TikTok’s explosive rise.

Instagram’s message was clear: copy and integrate others’ innovations—or get left behind.

So what does this mean for SocialFi?

Speculation and financialization are undoubtedly interesting features of SocialFi, but they shouldn’t be the primary unique selling proposition (USP). Instead, value propositions should center on social innovation and novel use cases to kickstart the flywheel.

The key question is: How can we leverage Web3 elements to create new, exciting social experiences that challenge Meta, TikTok, and X?

Clearly, we don’t have definitive answers. If we did, we wouldn’t be writing this—we’d be building full-time, competing with Zuckerberg and Musk.

While we lack all the answers, we do have ideas that could inspire developers to build novel social use cases.

Attention as a New Financial Asset

In the Web3 era, we’re great at creating new financial assets. Today, social media is a battleground for attention. Content grows exponentially while attention spans shrink, making attention itself a scarce asset. Attention is measured through likes, comments, follows, impressions, and time spent on-platform. Yet these metrics are highly inflationary—currently available in unlimited supply.

Thus, despite attention being scarce, the tools measuring it are infinitely abundant—making attention increasingly diluted. As each signal captures less attention, its quality declines.

Imagine if Web3 enabled tokenization of these tools to make them scarce—or at least anti-inflationary—with decentralized social platforms acting as their markets. Likes, comments, and follows could become attention tokens, carefully allocated to users and ultimately redistributed to their favorite creators. This would encourage users to curate their feeds more selectively and incentivize creators to produce higher-quality content.

According to Eugene Wei’s three key pillars, this shifts entertainment toward greater utility. The overall attention ratio per piece of content would increase, potentially attracting major advertisers seeking high-quality engagement.

Or imagine if followers themselves became financial assets, with value varying based on their social graph. If someone like Vitalik or Ansem follows you, you could sell that rare “follow credential” to someone willing to pay for their attention.

While these ideas are clearly abstract and require refinement, they point toward promising directions.

A more practical use case might involve tokenizing intellectual property (IP) rights for content. Coinbase recently highlighted this in their new “Mister Miggles” campaign, which addresses current issues in the creator economy and calls on everyone not just to create, but to consume on-chain.

Story Network is taking this idea further. They’re building a new Layer 1 blockchain that enforces programmable IP rights and licensing at the protocol level, allowing people to legally register their IP globally as a new financial asset.

Imagine applying this to decentralized social.

Take the “Finance Girl” video that went viral worldwide. Imagine if it had been posted on a platform powered by Web3 backend technology, directly tokenizing its IP and sharing revenue with early supporters—like those who helped it go viral.

With such a mechanism, you could treat social creators like NFT collections or brands, with early followers forming their NFT communities. Each creator would then have a loyal, incentivized superfan base helping spread their content across the internet, accelerating success while directly participating in it. We’re talking not just about financial gains, but non-monetary value from social capital—like getting backstage passes when “Finance Girl” performs with David Guetta.

Yet no matter how we frame it, we always return to one unavoidable truth:

Make Communities Great Again

Users need to be prioritized again. This has always been a core Web3 principle, and if applied to social platforms, it could become the most powerful feature—especially since network effects are paramount here.

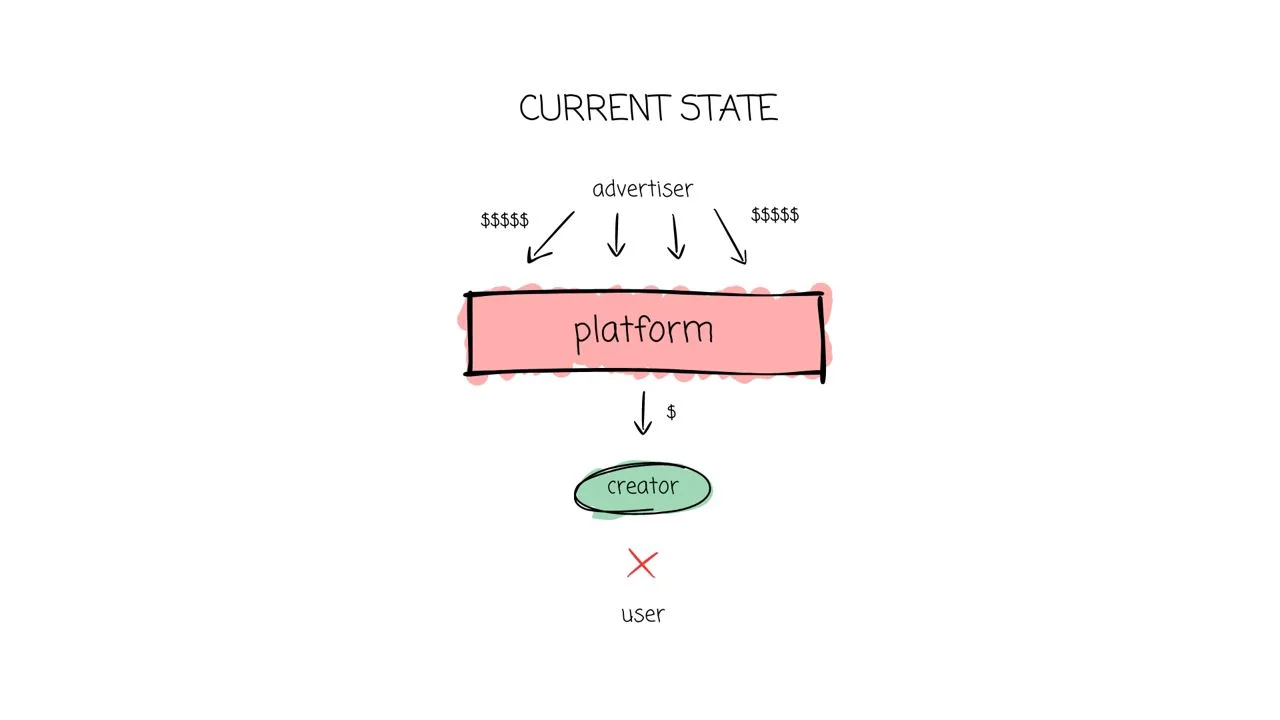

Here’s the current value distribution—whether discussing Web2 or Web3 social platforms, it doesn’t matter:

As Chris Dixon noted in his recent book *Read, Write, Own*, the top 1% of social networks (like Meta and TikTok) control 95% of social traffic and 86% of mobile social traffic. Advertisers generate most of the value, yet platforms monopolize the returns—creators get crumbs, and users get nothing, despite creating the critical network effects. We aim to significantly improve this flow through decentralized social platforms, enabling creators and users to directly participate in the value they generate.

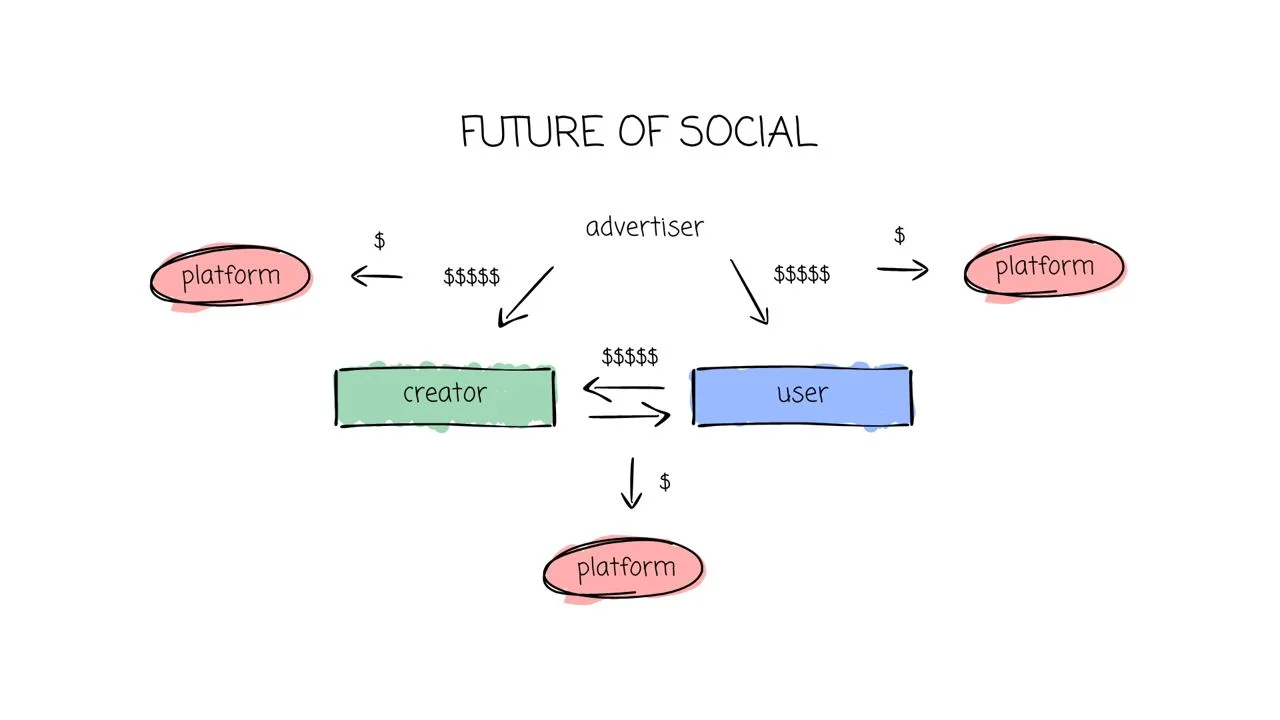

By breaking the monopoly of platform operators as intermediaries between attention suppliers (users and creators) and seekers (advertisers), we envision a fairer future for value distribution. Revenue should proportionally go to those who earn it—or to the target creator’s community.

Therefore, building moats solely by controlling network effects will become much harder. We believe we’ll see significant disintermediation, with various vertically integrated niche social platforms attempting to capture multiple revenue streams instead of a single platform horizontally controlling value flow.

As long as operators create sufficient value for both suppliers and seekers, their social platforms will thrive. In this model, they act as marketplaces between these parties, fairly sharing the value flows they facilitate.

Think of future social platforms as OpenSeas for attention.

Going further, we suggest creators should redistribute all platform income back to their most active audiences in exchange for social capital.

Status as the New Ponzi Scheme

Today, we live in a world where the value of social capital often exceeds that of financial capital. Done right, status can generate money—even large, sustainable sums. Conversely, money rarely buys recognition or fame.

Status opens doors that money alone cannot. Imagine securing exclusive VIP Super Bowl seats, last-minute reservations at the city’s trendiest restaurant for your anniversary, or catching the attention of powerful figures like celebrities or politicians.

These connections and opportunities, if leveraged correctly, can have profound impacts. For KOLs and creators, nothing is more valuable than their reputation. We believe building new social platforms that let them directly return value to their communities will create a flywheel of social capital growth—one that accelerates and leverages in ways similar to what we typically see in Ponzi schemes.

Take Pudgy Penguins as the perfect example. They became one of the most beloved brands, now expanding even beyond Web3, simply because they committed to returning value to their NFT holders—creating a powerful distribution network. Another example is MrBeast, YouTube’s biggest creator ever. While his content is entertaining, his secret to success has always been reinvesting most of his revenue back into the community—either by boosting content quality or through giveaways.

This may be the most powerful market entry and growth strategy for anyone looking to build social capital from zero. It dramatically strengthens the relationship between creators and consumers, driving deeper engagement and support. As a result, these creators’ social capital and status continue to grow, enriching their most loyal communities.

Encoding such mechanisms at the protocol layer could even serve as launchpads for creating and owning new influencers.

Before concluding, we want to propose another idea destined for blockchain integration.

How to Become Famous with a Killer Move

No matter how subtly it manifests, everyone has at some point imagined what it would be like to be famous or have everyone’s attention.

Social media offers a platform to fulfill this dream—this is exactly what everyone posting daily, tweeting, or sharing on TikTok hopes for: that slim chance of going viral, capturing all the attention, and becoming famous.

Yet competing for attention and algorithmic favor isn’t just fiercely competitive—it’s also opaque, extremely complex, and often frustrating.

Blockchain, with its open-source nature, is perfectly suited for this.

Imagine a social media platform where rules for algorithmic preference are immutably coded in the backend, transparently and fairly accessible to every user and creator. You could even layer on analytics and metrics about current trends, top-performing content, etc.

Now combine this relatively complex dataset with gamification mechanics—and voilà—you’ve built an open, fair framework that helps users easily achieve virality and growth.

No more excuses: if people don’t like your content, it’s simply not compelling enough.

With that, we hope to slowly but surely wrap up this discussion.

While we’ve offered mild critique of the current SocialFi landscape, we’re excited about many novel use cases.

The fundamental flywheel of social growth remains unchanged, but Web3 elements can accelerate these processes and enhance user retention. While we urge founders to avoid focusing solely on monetary incentives, tokenization and financialization mechanisms can certainly play a role in driving social innovation.

In our view, the potential for distinctly new experiences is precisely what sets decentralized social apart from other crypto domains. Web3 elements appear capable of enabling radically new experiences at unprecedented scale—something that should attract interest beyond our insular bubble.

We also strongly advocate starting as a simple tool built atop existing social networks (like X or Instagram). This strategy can effectively kickstart growth and ensure smooth UX while focusing on delivering strong value propositions. Fantasy Top is a prime example of this approach. Not only did it fuel explosive early growth, but if they can further expand their user base and deepen engagement, they still have the potential to grow their own network.

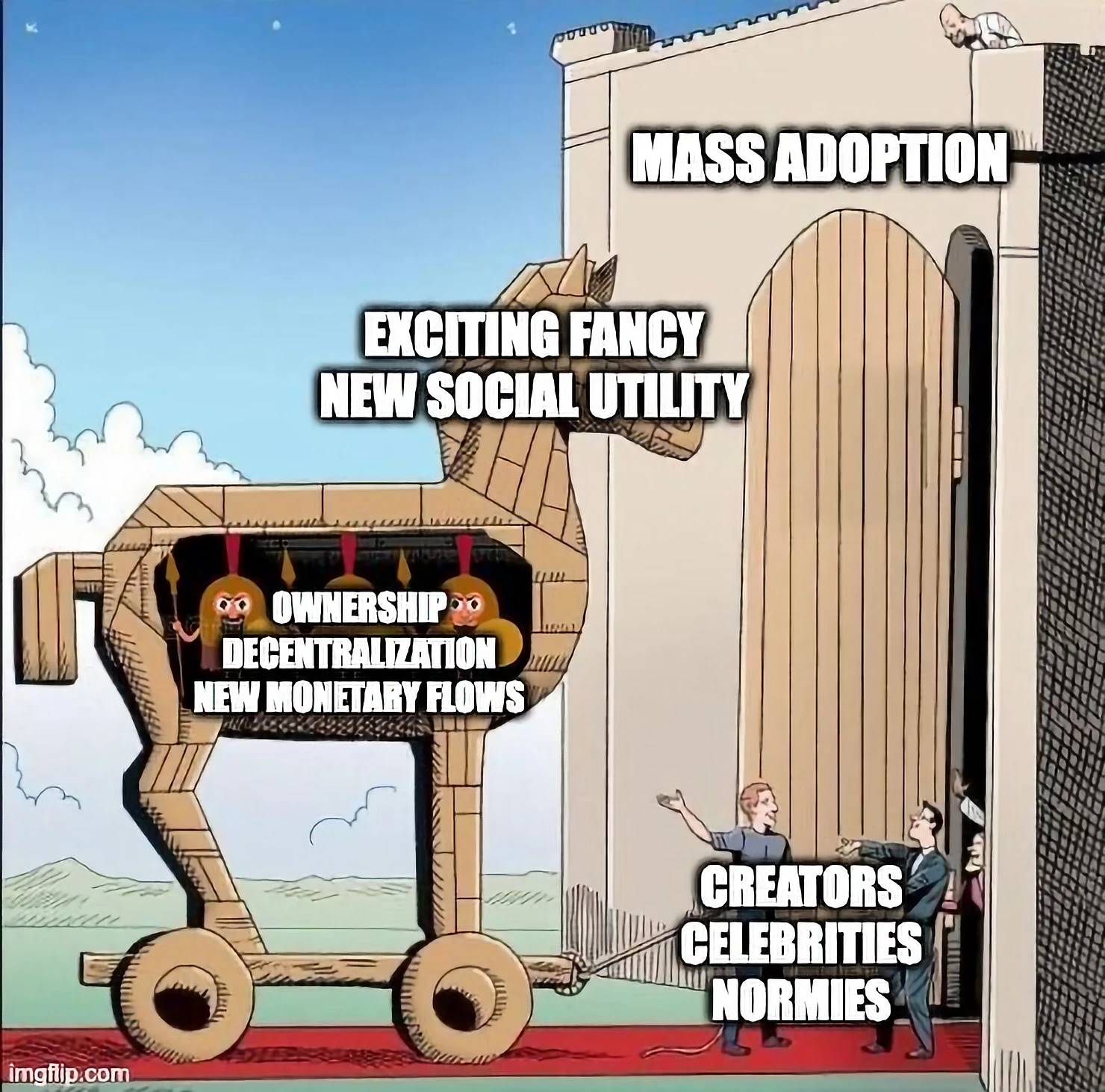

Who knows—if we get it right, we might even leverage these same experiences to eventually impose the real added value of ownership, decentralization, and new monetary flows onto the masses as a secret Trojan horse.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News