Exclusive Interview with Gyroscope Co-founder: Complex Systems, Stablecoin Encyclopedia, and Challenging MakerDAO

TechFlow Selected TechFlow Selected

Exclusive Interview with Gyroscope Co-founder: Complex Systems, Stablecoin Encyclopedia, and Challenging MakerDAO

Integrating decentralized stablecoins directly into DeFi applications can provide advantages that centralized stablecoins currently cannot offer.

Author: Sunny, TechFlow

Guest: Ariah Klages-Mundt, Co-founder of Gyroscope

“Integrating decentralized stablecoins directly into DeFi applications can provide advantages that centralized stablecoins currently cannot achieve.”

Ariah Klages-Mundt, Co-founder of Gyroscope—

“Many decentralized stablecoins are moving toward designs backed by centralized reserves, including Dai and Frax.”

The above quote from Ariah Klages-Mundt reflects a trend in stablecoin design choices following major failures of non-custodial stablecoins. These incidents include MakerDAO’s "Black Thursday" in 2020, the Luna collapse in 2022, and concerns over Curve's stablecoin in 2023. Since then, to ensure stability under volatile cryptocurrency market conditions, the stablecoin space has leaned toward custodial design approaches.

Stablecoins can be categorized as either custodial or non-custodial (or centralized versus decentralized). Custodial stablecoins are backed by centralized assets such as USDT, USDC, Treasury bills, or other real-world assets. Non-custodial stablecoins, on the other hand, are fully backed by crypto-native assets like Ethereum and Bitcoin.

Klages-Mundt is the co-founder of Gyroscope, aiming to develop a new type of stablecoin design that challenges the current stablecoin landscape. Prior to co-founding Gyroscope, Klages-Mundt earned a PhD in applied mathematics from Cornell University, focusing on the design of decentralized finance (DeFi) protocols and economic networks. Before “Black Thursday,” Klages-Mundt successfully predicted the event, arguing that the original DAI design could lead to a "deleveraging spiral."

The term “deleveraging spiral” describes feedback mechanisms within a stablecoin’s asset structure that during crises cause liquidity shortages, exacerbating collateral depletion. This phenomenon defines the system’s dynamic stability under specific conditions.

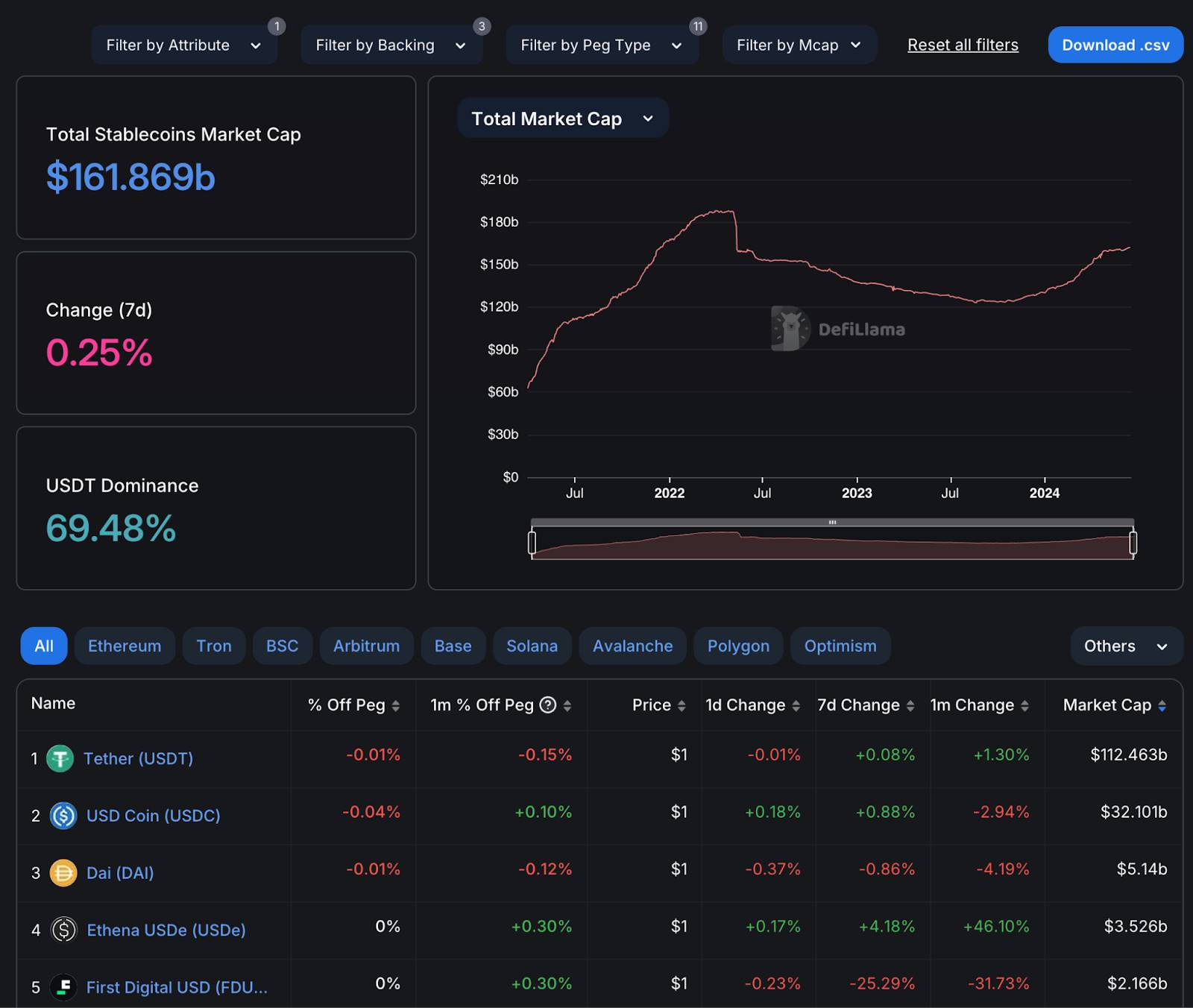

Today’s stablecoin market is dominated by Tether’s USDT, which currently has a market cap of $112.5 billion and a market share of 69.48% (see DefiLlama data below), followed by Circle’s USDC, MakerDAO’s DAI, Ethena’s USDe, and First Digital USD.

Market capitalization of Tether stablecoins with the largest market share (Source: DefiLlama, 2024)

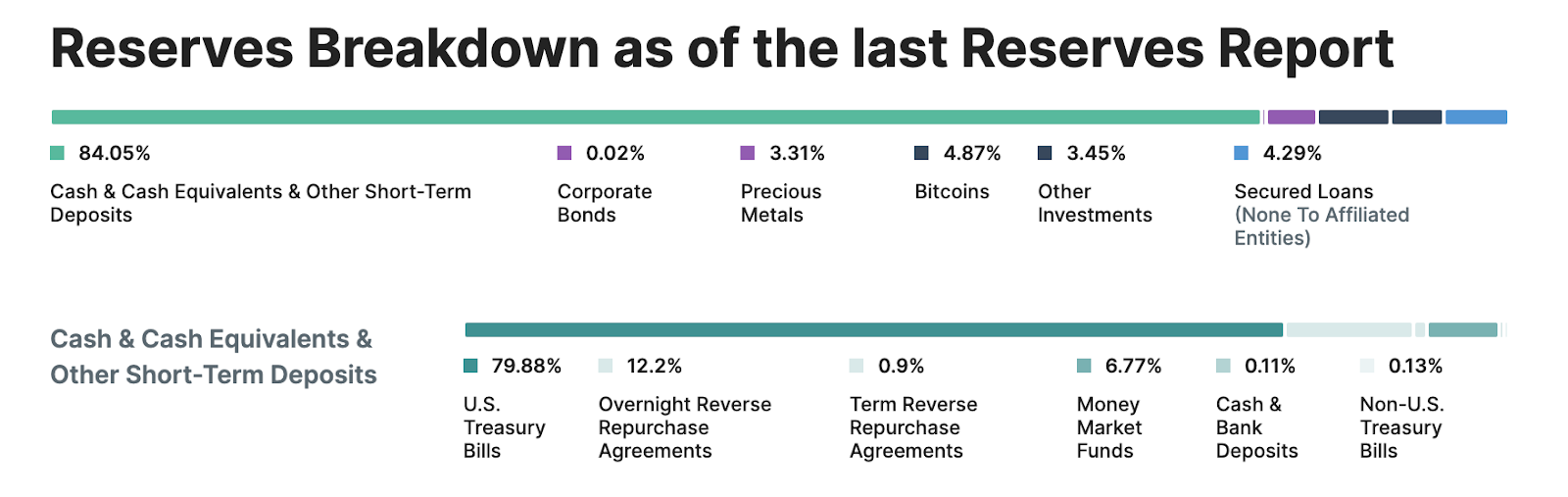

Taking USDT as an example, only 4.87% of its reserve backing consists of crypto-native assets like Bitcoin, while the rest is backed by centralized assets such as government-issued or real-world assets. In the case of DAI, MakerDAO governance has also voted to shift DAI’s decentralized collateral reserves to a multi-collateral system (MCD), with over 24% of DAI now backed by USDC.

Breakdown of Tether’s USDT reserves (Source: Tether, 2024)

In a market where everyone aims to reduce the “deleveraging spiral” by backing their stablecoin designs with centralized assets, what are the advantages of a fully blockchain-supported, crypto-native stablecoin?

“Non-custodial stablecoins have struggled competing against USDC and USDT, but if you build it smartly, it’s possible to outperform even decentralized stablecoins,” said Klages-Mundt.

He argues that current custodial stablecoin designs not only face centralization credit risk but also suffer from a centralized liquidity pool problem. If savings assets like USDT de-peg, these issues could jeopardize the stability of today’s dominant stablecoins. Therefore, diversifying both collateral backing and liquidity pools is a top priority for next-generation stablecoin design.

At Gyroscope, GYD is a stablecoin designed by learning from past “deleveraging spirals” and key economic events such as the UK pound’s “Black Wednesday” in 1992. Both cases share a common thread: overly optimistic assumptions about favorable market conditions without adequately considering the cyclical nature of the markets they operate in.

Below is the full conversation between TechFlow and Klages-Mundt, covering a comprehensive review of the current stablecoin landscape, Klages-Mundt’s proposed universal stablecoin design framework following his doctoral research, and how Gyroscope’s GYD is pushing innovation in this field.

(Due to the length and richness of the discussion, a table of contents is provided at the beginning to guide reading.)

Table of Contents

1. Klages-Mundt’s motivation for founding Gyroscope began with identifying the “deleveraging spiral” in the original MakerDAO stablecoin design

2. MakerDAO’s “Black Thursday” and the 1992 British Pound Crisis: How do complex systems fail? What lessons can economic history teach us about stablecoin design?

a. Through MakerDAO: The initial design of DAI

b. George Soros shorting the British pound

3. A universal design framework for a new type of non-custodial stablecoin

a. Foundational principles

b. Luna’s Ponzi-like design due to its endogenous issuance mechanism

4. Design review of DAI, Frax, and Ethena

5. Gyroscope: Going beyond PSM and automated monetary policy adjustments

a. Routing liquidity through GYD instead of USDC or USDT

b. Automated governance vs. off-chain governance

c. Early users of GYD

6. Popular products vs. ideal products: When can decentralized stablecoins surpass centralized ones?

Klages-Mundt’s motivation for founding Gyroscope began with identifying the “deleveraging spiral” in the original MakerDAO stablecoin design

TechFlow: I’ve seen your interview with Economic Design and your PhD defense talk. Your background is very interesting, especially your research in mathematics and graph networks applied to modeling complex systems like financial systems.

Could you first talk about how your background in designing complex financial systems led you to focus on stablecoin design?

Klages-Mundt:

I explored various topics both theoretically and practically, with the ultimate goal of bringing everything back to real-world applications.

I started with pure mathematics and did extensive work in that area during my undergraduate studies. Then, I moved into practical work in financial and economic modeling. That experience motivated me to create better models to solve more complex problems and highlight the gap between practical application and sophisticated modeling. I had some experience in ETF design and mortgage-backed securities modeling, but I realized what truly interested me was developing new models to understand complex dynamics that have real-world impact. That drove me to pursue a PhD focused on building such models.

During my PhD, I began developing graph-theoretic models of complex financial systems. These models involved network relationships among different types of firms, aiming to understand how risk propagates through the system and the dynamics involved. Because of the computational challenges in this research, the field spans both economics and computer science.

As I published my first paper in this domain, MakerDAO emerged around 2017–2018 in the crypto space. While I was already interested in cryptocurrencies, this development became a pivotal point, showcasing another area where new models were needed to understand complex dynamics with real consequences. I incorporated it into my doctoral research, writing my first paper on DAI dynamics and describing the “deleveraging spiral,” similar to a short squeeze effect. This theoretical work later proved predictive, foreshadowing the occurrence of “Black Thursday” in 2020.

This experience solidified my interest in stablecoins. I saw it as an open field requiring new models for better understanding, with direct practical implications. My co-founder and I, both PhD students working on related papers, were inspired to build Gyroscope as a new type of stablecoin aimed at avoiding the problems we identified in existing models.

TechFlow: Before we dive deeper into stablecoins and your views on non-custodial stablecoin design, I’d like to understand your thought process. Can you define what a complex system is? And how do you think such systems can be controlled so that risks can be buffered through artificial systems, interventions, or new stablecoin designs?

Klages-Mundt:

I don’t think there’s a single clear definition of a complex system, butyou can think of it as something computationally complex, requiring new infrastructure—especially computer science infrastructure—to understand its behavior. There are many types of complex systems, but I focus on financial systems.

For instance, consider a complex network of financial institutions. In the cryptocurrency world, particularly in DeFi, you see something similar.

In DeFi, there are numerous protocols interconnected, often described as “financial Lego blocks,” where different components stack together.The innovative potential of DeFi allows great flexibility and creativity in financial products, but it also layers risk on top of risk.

Understanding how these different DeFi protocols interact is itself a complex system—a challenging problem that requires grasping all potential outcomes.

MakerDAO’s “Black Thursday” and the 1992 British Pound Crisis: How do complex systems fail? What lessons can economic history teach us about stablecoin design?

-

Through MakerDAO: The Initial Design of DAI

TechFlow: In previous interviews, you compared traditional fiat currencies to non-custodial stablecoins like DAI. Could you elaborate on how DAI represents a complex system, and how its components differ from those of traditional money?

Klages-Mundt:

In non-custodial stablecoins, there are various agents or protocols performing different roles and interacting with each other. For example, consider the original DAI system, which connected borrowers (or single coin holders) and those seeking leveraged exposure to crypto assets.

In its simplest form, someone wanting to speculate on ETH prices would act as a borrower, posting ETH as collateral, minting DAI via overcollateralized loans, and selling that DAI to people who want to use it as a stablecoin.

Typically, borrowers use the DAI to buy more ETH, thus achieving leverage. This is a basic setup, but when more people seek leverage, the system becomes complex, forming a network of decisions and potential issues. Additionally,understanding the demand side of DAI—the amount of demand for holding DAI as a stablecoin and its use cases—is equally critical.

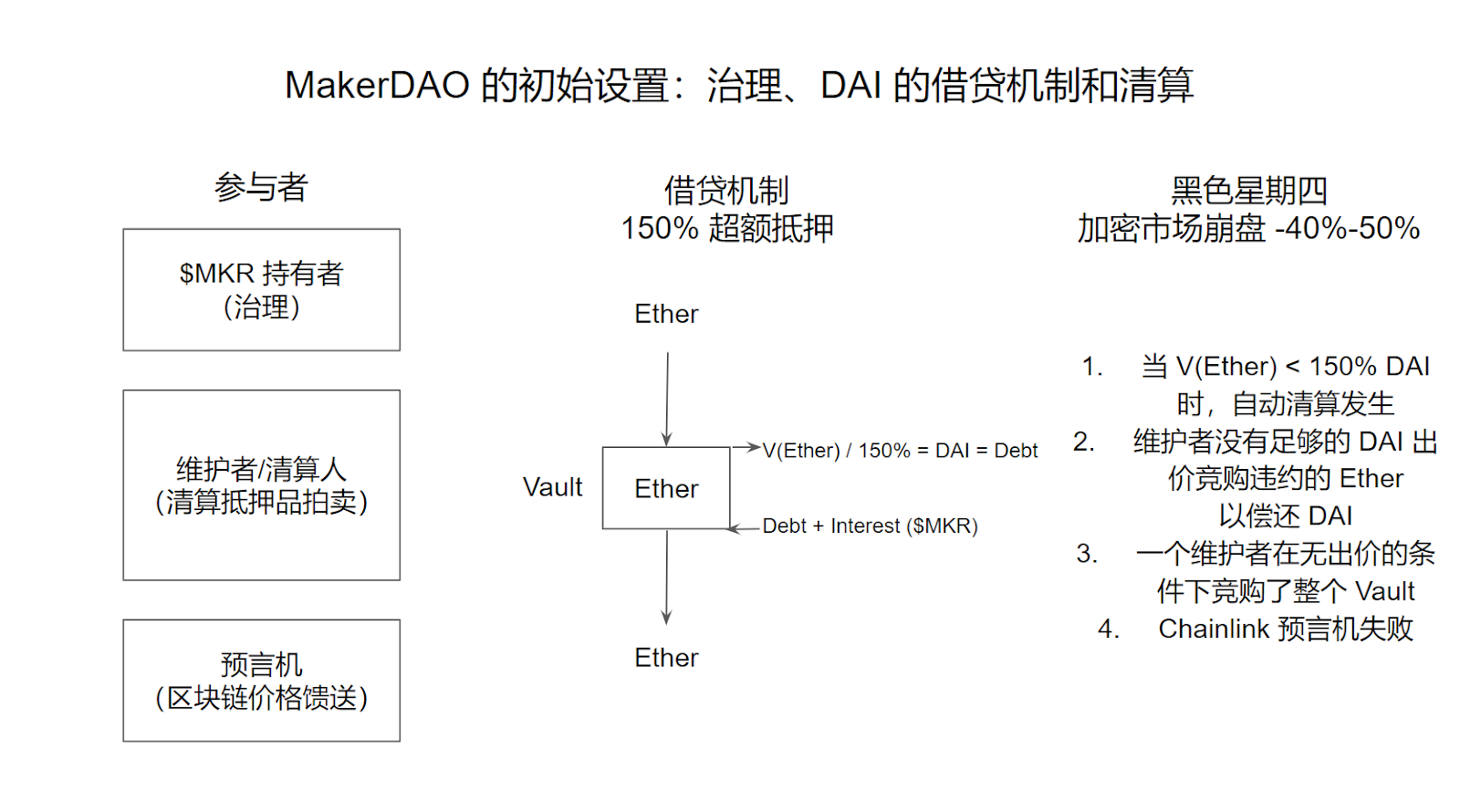

MakerDAO’s initial mechanism: The initial failure of the MakerDAO system can be summarized by four factors:

(1) Only two collateral options (Ethereum and BAT), lack of diversification could lead to a “deleveraging spiral” during a broad crypto market crash;

(2) Instantaneous decision-making process in governance;

(3) Insufficient demand for DAI;

(4) Oracle failure.

For example, during a “deleveraging spiral” like what happened to DAI on “Black Thursday,” DAI’s liquidity and usage significantly impacted the system.

Modeling all these components is extremely complex because you need to account for various agents’ decisions and the overall demand dynamics for the stablecoin.

-

George Soros Shorting the British Pound

TechFlow: By contrast, traditional money also sounds very complex. What would be the traditional currency equivalent of DAI’s “Black Friday” case? What triggered both situations, and in what ways are they similar?

Klages-Mundt:

Finance is inherently very complex. Most people don’t fully understand how banks or monetary systems work; they just know how to interact with them through banking. Many might think traditional finance is simpler than cryptocurrency,but it’s equally, if not more, complex. The difference is that traditional finance hides its complexity, whereas in crypto, especially in DeFi, it’s transparent.You can see all the connections, which is an important innovation. However, for newcomers, this transparency can also lead to information overload, making crypto seem more complex. In reality, all financial systems are complex.

This complexity is a key motivation behind creating Gyroscope. There’s already a wealth of research in finance and economics—we should learn from it. While certain models need adaptation for crypto, there’s still a solid foundation to build upon. For example, consider currency attack models like George Soros’s move against the British pound. There are well-established models explaining the mechanics and profitability of such attacks, which help in designing resilient monetary policies.

Unfortunately, many stablecoins (like Terra) launched without learning these lessons. Terra’s system appeared superficially vulnerable to de-pegging attacks because it was undercollateralized. Applying traditional models, one could predict such a system might spiral down to zero. Terra’s design led to major problems, highlighting the importance of integrating established economic principles into stablecoin development to avoid future financial disasters.

On September 16, 1992, Black Wednesday occurred, forcing the British pound to exit the European Exchange Rate Mechanism (ERM). Despite the UK government’s attempts to maintain the pound above its ERM floor by raising interest rates and buying pounds, pressure from George Soros and other institutions caused the pound to devalue and ultimately exit the ERM. The UK lost approximately £3.3 billion trying to stabilize the currency but ultimately failed.

A Universal Design Framework for a New Type of Non-Custodial Stablecoin

-

Foundational Principles of Decentralized Stablecoin Design

TechFlow: Before Gyroscope, you mentioned a universal design framework for non-custodial stablecoins, referencing two terms:Tangible and intangible. You pointed out that Terra UST focused only on the tangible part and neglected the intangible. Could you briefly introduce this universal design for non-custodial stablecoins and apply it to the current environment?

Klages-Mundt:

When discussing decentralized or non-custodial stablecoins, the two most important factors are:

-

What actual assets back the stablecoin?

-

What is the issuance mechanism—how are new stablecoins created and retired? Is there a redemption process? When does the stablecoin exit circulation?

Most problems with existing stablecoins can be traced back to issues in these two mechanisms.

Regarding the assets backing a stablecoin, the key distinction lies in exogenous versus endogenous collateral.

Exogenous collateral refers to assets that exist externally to the system and have independent value.

Endogenous collateral is an asset whose value is generated internally within the system. Its value depends on the success of the system. For example, Luna only has value if the Terra system operates normally and grows. If confidence in the system collapses, its value may plummet to zero, causing the entire system to fail. This circular value derivation introduces inherent risk, making the stablecoin prone to devaluation when system confidence wavers.

Many existing stablecoin problems stem from neglecting or mishandling these foundational factors. By thoroughly considering these two aspects during design, the stability and reliability of a stablecoin can be greatly improved. This is also the fundamental principle we follow in designing Gyroscope. We aim to create a more stable and secure non-custodial stablecoin system by learning from past mistakes and incorporating existing knowledge from economics and finance.

-

Luna’s Ponzi-Like Design Due to Its Endogenous Issuance Mechanism

TechFlow: Are you suggesting that stablecoins fully backed by crypto-native assets are inherently flawed given the current uncertainty and high volatility?

Klages-Mundt:

Not exactly. For example, some stablecoins may be backed by assets like ETH, while others, like Terra, are backed by endogenous assets like Luna. Take ETH as an example—it has value independent of the stablecoin system’s operation. For instance, DAI is backed by ETH, and although ETH is highly volatile, it holds intrinsic value outside the stablecoin system.

On the other hand, Luna’s value is intrinsically tied to the success of the Terra system. If the Terra system functions properly and grows, Luna has value. But if confidence in the system weakens, Luna’s value could spiral down to zero, leading to the collapse of the entire system, as we saw in the Terra crash. This circular value derivation is why we caution against using endogenous collateral—especially as the primary mechanism.

Systems similar to Terra may resemble Ponzi schemes. When you break it down, funds from new entrants are used to pay early investors. This makes it extremely dangerous, as the system relies on continuous growth and new investments to sustain its value. In contrast, reserve-backed stablecoins are a better choice because they’re supported by assets with independent value, offering greater stability and transparency.

TechFlow: How does exogenous collateral avoid this circularity?

Klages-Mundt:

If you consider ETH, it has various uses beyond serving as collateral in a stablecoin system. In any monetary system, you eventually reach a point where value is based on a coordination game, whether it’s the dollar, gold, ETH, or Bitcoin.The key is that some assets have a stronger, already-established coordination game, giving them intrinsic value.

For stablecoins, the relevant factor is the strength of this coordination game. Assets with established external value are less fragile because their value is already recognized and likely to persist. In contrast, assets whose value is derived solely within the system have newer, weaker coordination games and are more prone to collapse.

Technically, while all monetary systems involve some degree of coordination, those built on stronger, pre-existing foundations are more robust. Therefore, using assets with external value as collateral makes the system more resilient.

Current Design Review of DAI, Frax, and Ethena

TechFlow: That’s very interesting. In today’s stablecoin landscape, we see DAI, Frax, and now Ethena. What are your thoughts on these three stablecoins? How do these different design spaces influence your decisions in building Gyroscope?

Klages-Mundt:

DAI itself has evolved, which is worth highlighting, and we can also show how Frax fits into this evolution. Ethena is a separate case, so I might address that later.

For DAI, starting from the original design—which I studied in my early papers—we identified a deleveraging spiral effect that eventually occurred. After that, DAI’s design underwent significant evolution.

DAI no longer relies solely on leveraged support systems and introduced the Peg Stability Mechanism (PSM). The PSM enables convertibility between Dai and USDC. Introducing this mechanism overcame the short squeeze effect (deleveraging effect). If Dai’s price rises during a short squeeze,those wanting to deleverage can exchange USDC for Dai at a 1:1 ratio. This prevents the deleveraging spiral because this redeemability feature creates a hard ceiling at $1.However, it also introduces centralization risk—sometimes Dai may be primarily backed by USDC. When people question why they should hold Dai if over 60% is backed by USDC, it leads to another crisis for Dai.

DAI further evolved to include real-world assets like Treasury bills. Now, DAI is a hybrid stablecoin, partially backed by Treasuries and partially by crypto-based leverage mechanisms. This isn’t to say this approach is bad,but it does introduce different risks.When evaluating DAI’s risk, you must consider the risks of all supporting and issuance mechanisms.

On the other hand, Frax initially had a design similar to Terra, which was concerning. The original Frax design was partially backed by USDC and partially by endogenous collateral, carrying de-pegging risks similar to Terra. However, after Terra’s collapse and the failure of many Frax clones, Frax is moving toward a more fully collateralized model, resembling a reserve-backed design. This is a positive development.

Many decentralized stablecoins are moving toward centralized reserve-backed designs, including significant portions of DAI and Frax.

With Gyroscope, we aim to introduce the greatest innovation by building what we believe is the safest stablecoin,automating risk control by managing a reserve-backed system and liquidity both inside and outside the system.

As for Ethena, it’s a different design because it operates as a centralized system. Ethena uses a perpetual leverage mechanism, pairing long positions with short positions, hoping for a positive net interest payment distributed as yield. Ethena achieves this by executing trades on more liquid centralized exchanges, but this introduces centralization risk and the possibility of negative net yields, affecting peg stability.

Gyroscope: Beyond MakerDAO’s Peg Stability Module (PSM) and Automated Monetary Policy Adjustment

TechFlow: From what you just said, DAI hasn’t been fully non-custodial since “Black Thursday” because it has a centralized reserve mechanism. Frax isn’t fully non-custodial either, and Ethena is centralized. It seems current stablecoins carry both centralized and decentralized risks. How does Gyroscope mitigate these risks? I believe you also have a reserve mechanism supported by some centralized stablecoins like USDC and USDT.

Klages-Mundt:

At Gyroscope, our approach is to design from scratch, clearly understand the risks involved, and manage them as effectively as possible. We don’t claim to eliminate all risks—that’s impossible—but we believe we can manage them better than simpler solutions like Maker’s original PSM. Our motivation at Gyroscope is to build infrastructure that better manages these risks.

A particular focus in Gyroscope’s design is preventing risk concentration in the system’s backing assets.Maker’s simple PSM ultimately led to excessive exposure to USDC, which proved harmful when USDC de-pegged, prompting Maker’s next evolution away from relying solely on USDC.

Another issue is that governance in simple designs is both slow and reactive to system changes. For example, during last year’s USDC de-pegging, maintaining DAI’s price stability required immediate action from Maker’s governance. We believe decentralized governance is ill-suited for such rapid responses. Instead, we favorautomated monetary policy adjustments. Governance should pre-approve policies that the system automatically executes when certain events occur, eliminating the need for immediate human intervention. This principle is a key aspect of Gyroscope’s design.

The USDC de-peg highlighted several key issues that Gyroscope aims to solve.

-

One issue is oracle risk—the challenge of accurately pricing the system’s backing assets. Current oracles typically rely on multisig security models. We believe stronger approaches exist, including multiple data sources and enhanced security models. Our system layers additional checks to ensure pricing data reliability and prevent extreme actions when data inconsistencies arise.

-

Another issue is decentralized liquidity. Bootstrapping liquidity is difficult, and many decentralized liquidity channels route through USDC or USDT. If these assetsde-peg,they could disrupt most liquidity channels, even if assets are locked in automated market makers (AMMs). We aim to make Gyroscope’s trading infrastructure more robust to prevent complete liquidity paralysis when a single asset de-pegs.

Independent Liquidity Pools: Routing Liquidity Through GYD Instead of USDC or USDT

TechFlow: Let’s start with the last point you mentioned: the centralization risk of USDT and USDC. How does Gyroscope plan to make the system more robust against de-pegging of USDT and USDC?

Klages-Mundt:

A good example occurred during last year’s USDC de-peg. At that time, main liquidity routes usually went through Curve’s 3pool (including DAI, USDT, and USDC). When USDC de-pegged, the pool became flooded with USDC, causing liquidity for trades involving other stablecoins to dry up. This affected the entire liquidity ecosystem for stablecoin trading, even for stablecoins unrelated to USDC. The ability to route transactions through liquidity pools collapsed.

At Gyroscope, we aim to solve this by placing GYD at the center and enablingindependent trading pools that can enter and exit through GYD. This approach aims to resist the impact of individual de-pegging as much as possible. If a stablecoin (e.g., USDC) de-pegges, liquidity in one trading pool might be disabled, but other pools remain relatively unaffected. This way, liquidity can bypass USDC rather than go through it.

For example, during the USDC de-peg, I checked how to swap BUSD for USDT. Despite these stablecoins being unrelated to USDC, the best on-chain quote had a market impact exceeding 10%, making stablecoin-to-stablecoin liquidity nearly unusable. Through Gyroscope’s design, we aim to prevent this by maintaining stronger and more independent liquidity channels.

TechFlow: Just a random question—I know Gyroscope has a dual-token system: one is GYD, the other is SPY, which is more governance-focused. We can discuss that later. Regarding GYD, how does adding another token help stabilize or prevent instability?

Klages-Mundt:

You can think of GYD as a tokenized way of holding stablecoins in the optimal risk-diversified manner. It’s itself a stablecoin, but also a means of managing the risks of holding stablecoins. This dual perspective explains GYD’s value.

You asked how GYD helps stabilize the trading system.By placing GYD at the center, we create a system where independent trading pools can enter and exit through GYD.This setup aims to handle risk efficiently and resist individual de-pegging as much as possible. If a stablecoin (like USDC) de-pegges, liquidity in one pool might be shut down, but others remain unaffected. This allows liquidity to bypass USDC rather than flow through it, maintaining a more robust trading system.

TechFlow: What does it actually mean to tokenize other components into GYD? If I understand correctly, how does this help stabilize the system?

Klages-Mundt:

GYD is a stablecoin designed to offer the optimal way to hold stablecoins with well-managed risk diversification and underlying asset risk. If you want to hold stablecoins, we believe GYD is the best choice because it effectively manages risk allocation and diversification.

To obtain GYD, you need to provide other stablecoins or specific assets that the GYD system wants to hold. The system has rules about what risks it can take, so it informs users which assets are needed to maintain diversification. You follow the protocol, provide the required assets, and receive newly minted GYD. This process helps you manage your own risk exposure by holding a well-diversified stablecoin.

Once you own GYD, you can use it across various DeFi protocols as integrations expand. This allows you to focus on using your stablecoin without worrying about managing different risk exposures across multiple stablecoins. GYD handles these challenges for you.

Additionally, GYD helps manage yield risk. The system holds assets on its balance sheet and deploys them into various yield-generating opportunities, applying the same diversification rules. This ensures that the yields on the balance sheet represent the best risk-diversified returns available in DeFi.

Soon, there will be an sGYD (savings GYD) version, serving as a tool for anyone to access this risk-diversified yield potential. Thus, holding GYD not only helps manage your asset risk but also optimizes yield sources, making your stablecoin holdings more efficient and secure.

Automated Governance vs. Off-Chain Governance

TechFlow: Is this where decentralized governance plays a role in understanding risk exposure and tokenizing other stablecoins into GYD?

Klages-Mundt:

I mentioned automation earlier, but there are limits to what can be automated. You can anticipate certain scenarios and decide how the system should respond, but some developments are unpredictable. One unpredictable factor is how the DeFi and stablecoin asset space will evolve.

At this point, we believe governance’s primary role is to continuously make decisions that cannot be automated. However, these decisions should be as slow and deliberate as possible. Our argument is to automate what you can, ensuring automatic responses to predictable events. For unpredictable developments, governance should be a slow, thoughtful process.

Decentralized governance is inherently messy, and that’s okay. Decision-making needs to be slow to ensure careful consideration and adaptation to changes in the space. We aim to prevent governance from impacting the system’s immediate health issues while still allowing it to make thoughtful decisions to keep pace with the evolving crypto environment.

Early Users

TechFlow: Who are the main users of Gyroscope stablecoin currently?

Klages-Mundt:

Currently, our largest users are liquidity providers, though this may soon change with the launch of sGYD. sGYD will help people access diversified yield sources. Currently, we offer what we believe is a risk-diversified liquidity provider tool.

The liquidity structure I mentioned earlier—with independent pools entering and exiting through various stablecoins into GYD—has two benefits. First, it makes routing more robust in potential stablecoin de-peg scenarios. Second, it benefits liquidity providers by reducing exposure to de-pegging of any single stablecoin.

For example, if you’re a liquidity provider in a stablecoin-to-stablecoin pair and want to reduce exposure to de-pegging of a single stablecoin (like USDC), you can distribute funds across multiple pools, entering and exiting through GYD. In the worst case, if one or more pools are affected by a stablecoin de-peg, the others remain independent and continue operating, allowing you to earn trading fees.

This is a key advantage compared to being a liquidity provider in Curve’s 3pool. When USDC de-pegged, liquidity providers in Curve’s 3pool were forced to hold USDC, suffering major portfolio losses. In contrast, by spreading exposure across GYD pools, you reduce this risk because these pools remain as independent as possible. Your portfolio suffers less impact, and you continue benefiting from trading fees.

Popular Products vs. Ideal Products: When Can Decentralized Stablecoins Surpass Centralized Ones?

TechFlow: Your explanation is very detailed. I think it would be fascinating to explore how decentralized monetary policy interacts with governance, but I suppose our time is limited today. So, my final question is broader. I believe stablecoins like USDC and USDT are currently the best products, especially for people affected by geopolitics who need stable currencies. I also appreciate the idea of non-custodial stablecoins—they feel like an ideal product. How do you define your motivation for building non-custodial stablecoins? How should ordinary people view the future of non-custodial finance, rather than a market dominated by USDT and USDC?

Klages-Mundt:

That’s a great question. I want to emphasize the potential for innovation. There’s a lot you can do with crypto-native infrastructure that centralized stablecoins simply can’t achieve.Non-custodial stablecoins have always competed against USDC and USDT, but if you build it smartly, you might surpass centralized stablecoins.

-

A good example is risk management. Centralized stablecoins always carry issuer risk, which is unavoidable. However, you can mitigate this risk—that’s why we built diversified infrastructure for GYD and implemented various policy automations. We believe this approach can outperform centralized stablecoins.

-

Another area is liquidity. Launching a new centralized stablecoin and building liquidity sufficient to compete with USDC and USDT is difficult.

-

Moreover, the issuance process for centralized stablecoins is rigid, relying on holding dollars or Treasuries. In contrast, crypto-native infrastructure allows greater flexibility in bootstrapping liquidity. For example,innovations around protocol-owned liquidity can directly inject liquidity into markets like central bank operations. This offers significant advantages, though it also introduces risks we carefully consider.

One of our main motivations is leveraging this innovation potential to create solutions better than centralized stablecoins. This includes DeFi-specific features that resonate with us, such as creating non-custodial

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News