MakerDAO's Endgame plan reaches new milestone: launching first SubDAO and new token, with Phase One set to roll out this summer

TechFlow Selected TechFlow Selected

MakerDAO's Endgame plan reaches new milestone: launching first SubDAO and new token, with Phase One set to roll out this summer

Shortly after announcing the launch plans for its new stablecoin NewStable (NST) and new governance token NewGovToken (NGT), MakerDAO today announced the upcoming debut of its first SubDAO, Spark, along with its native token SPK.

Author: Nancy, PANews

The veteran DeFi protocol MakerDAO is accelerating the rollout of its Endgame plan. Shortly after announcing the launch roadmap for its new stablecoin NewStable (NST) and new governance token NewGovToken (NGT), MakerDAO today revealed plans to launch its first SubDAO, Spark, along with its native token SPK.

Launching First SubDAO with Community-Driven Governance

As a key transformation for MakerDAO, Endgame aims to scale DAI supply to $100 billion or more by enhancing efficiency, resilience, and accessibility. To build a fairer, more transparent, and effective governance system, MakerDAO is introducing the popular DAO governance model—subDAO—and assigning each subDAO a specific application or responsibility.

As MakerDAO’s first subDAO, SparkDAO is built around the lending protocol Spark. According to official information, Spark’s main products include SparkLend and Cash & Savings. The former allows users to borrow large amounts of DAI using highly liquid assets, while the latter offers bank-like on-chain financial products that combine cash and savings account functionality with the Dai Savings Rate (DSR), supporting assets such as DAI, USDT, and USDC. Data from DefiLlama shows that as of May 15, Spark Protocol’s TVL has reached nearly $2.19 billion, making it the 4th largest lending protocol and capturing 7.3% of the lending market share.

Official sources reveal that SparkDAO will also launch its native token SPK and multiple SPK liquidity mining programs. The total supply of SPK is set at 4 billion tokens, to be distributed over 10 years. In the first two years, 1 billion tokens will be distributed annually, with the issuance rate halving every two years thereafter. Users of the new stablecoin NewStable and the staking protocol Lockstake Engine will receive 70% (700 million) and 30% (300 million) of the SPK tokens, respectively.

Once SparkDAO launches, SPK tokens can be mined via liquidity mining. SPK holders will gain immediate access to mine NewGovToken (NGT), enabling participation in governance across the MakerDAO ecosystem. Official estimates suggest NGT liquidity mining will occur at a rate of 80 million tokens per year. Currently, MakerDAO has already initiated a pre-mining campaign for SPK tokens on SparkLend, with mined tokens to be distributed upon SparkDAO’s official launch.

Additionally, SparkDAO promotes a community-driven governance model supported by SPK token voting, to be rolled out progressively. Initially, token holders will guide areas such as community marketing, and over time, all aspects of SparkDAO governance will become fully autonomous and seamlessly integrated into the broader Maker SubDAO ecosystem.

Earlier disclosures from MakerDAO indicate that six SubDAOs are planned for launch during the second phase of Endgame, each targeting different niche markets and community interests—such as SubDAOs focused on RWA or gaming. The implementation of SubDAO governance will be supported by user-friendly interfaces and AI-powered tools designed to assist and streamline governance decisions.

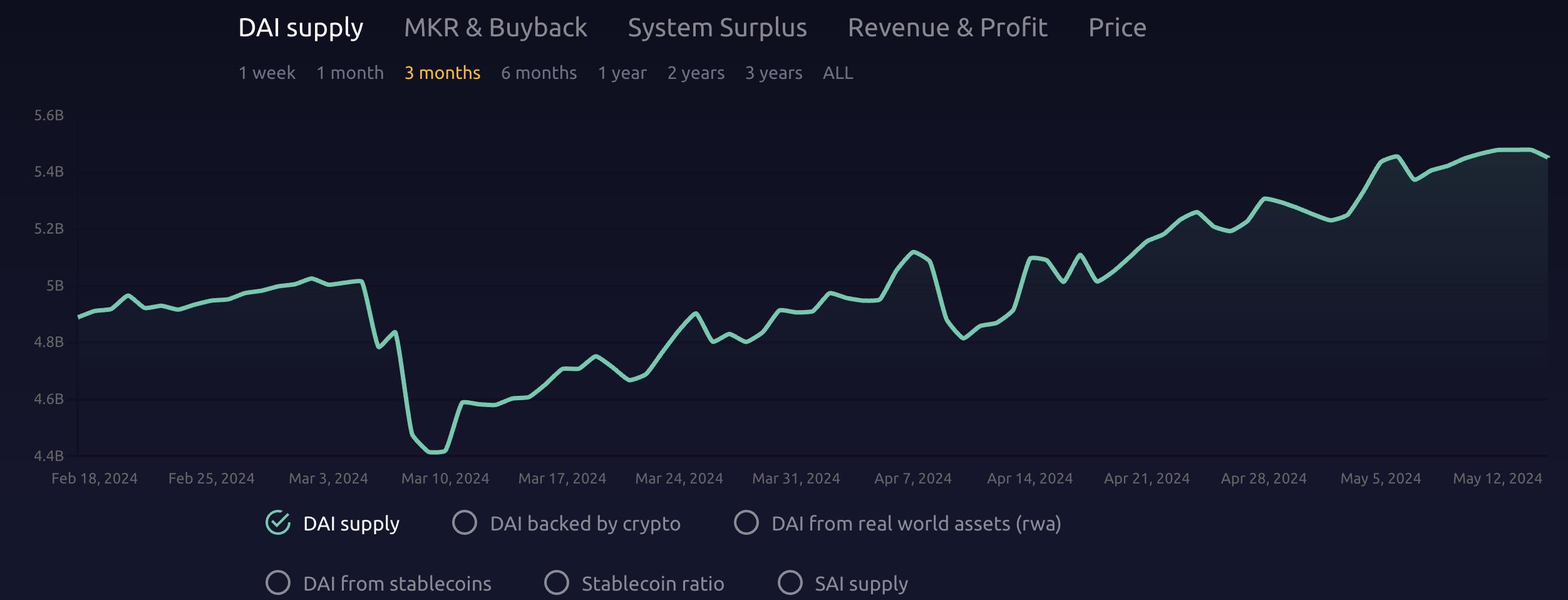

Endgame Phase One Set for Summer Launch, Multiple Features Rolling Out

As a long-standing "veteran" in the DeFi space with over $5 billion in TVL, MakerDAO has maintained a dominant position for years. According to Maker Burn data, as of May 15, the total DAI supply has risen to 5.45 billion, an increase of over 850 million in just the past two months—the highest level since October last year. Meanwhile, Maker’s annualized profit stands at $65.405 million, with annualized fee revenue reaching $330 million and a PE ratio estimated at 38.35.

According to a MakerDAO research report published in April by Ryan Watkins, co-founder of Syncracy Capital, MakerDAO captured nearly 40% of Ethereum’s DeFi profits over the past six months, driven primarily by the monetary premium of its stablecoin DAI. The report also notes that although Maker’s annual revenue exceeds all crypto projects except Ethereum, Tron, and Solana, its P/E ratio has remained suppressed. The launch of “Endgame” could reverse this trend, potentially unlocking billions of dollars in fee opportunities and elevating Maker’s project valuation to $40 billion.

This transformative Endgame initiative has seen new developments this year. In March 2024, MakerDAO founder Rune Christensen officially announced that the first phase of Endgame—“Launch Season”—will begin this summer, featuring the gradual rollout of new tokens, SubDAOs, NewBridge, and the Lockstake Engine, aiming to drive exponential growth in DAI adoption.

In addition to the aforementioned subDAO, MakerDAO recently announced plans to introduce two new tokens—NewStable and NewGovToken—to replace DAI and MKR. NewStable will serve as an upgraded version of DAI, designed for broader adoption with enhanced stability features. NewGovToken represents an evolved governance mechanism within the ecosystem; each MKR will convert to 24,000 NGT, aiming to encourage broader participation and more dynamic decision-making. The final names for both tokens will be revealed through a branding announcement.

In summary, as Endgame progresses, MakerDAO’s large-scale restructuring has quietly begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News