MakerDAO Valuation Decoded: Lending + RWA, a Strategy Spanning Bull and Bear Markets

TechFlow Selected TechFlow Selected

MakerDAO Valuation Decoded: Lending + RWA, a Strategy Spanning Bull and Bear Markets

This article uses discounted cash flow (DCF) analysis to reasonably estimate the value of the $MKR token.

Student author: @yelsanwong

Mentor: @CryptoScott_ETH, @Zou_Bloc

TL;DR

-

As one of the established DeFi protocols, MakerDAO's design embodies core blockchain values—transparency, decentralization, and censorship resistance. Despite a series of major setbacks in DeFi during 2022, MakerDAO continues to serve as a key player in the stablecoin and decentralized lending markets. Its integration of real-world assets (RWA) has significantly increased protocol revenue, demonstrating strong market adaptability and innovation.

-

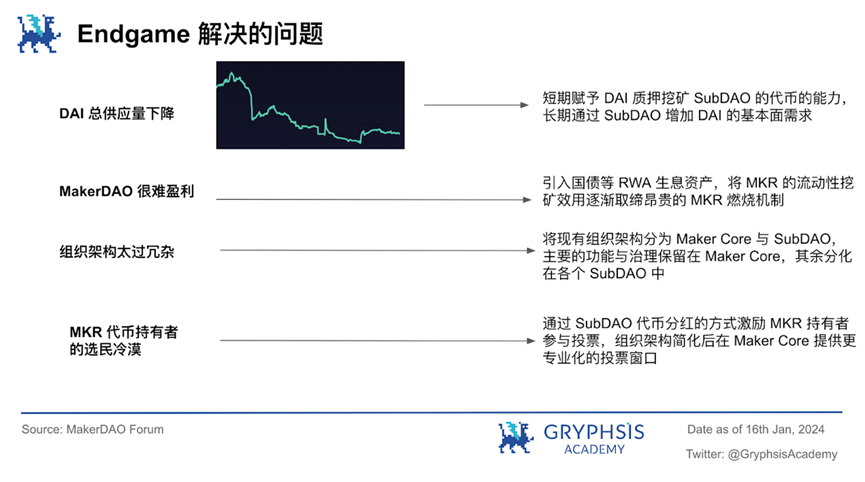

To unlock all existing but currently hidden or low-priority business potential, MakerDAO officially began implementing its Endgame plan in 2023. By splitting operations into specialized SubDAOs tailored to their respective businesses and dynamic governance, MakerDAO aims to greatly enhance risk management and capital efficiency, establishing a more efficient, decentralized, and transparent ecosystem amid its growing complexity.

-

The Endgame plan will progressively strengthen its resilience against real-world risks through four phases—Pregame, Early Game, Midgame, and Endgame—including launching six initial SubDAOs in the early stage, issuing corresponding ERC20 tokens, and distributing them via liquidity mining using $DAI, $MKR, and $ETHD.

-

During the Early Game phase—planned for Q1 2024—MakerDAO intends to rebrand $DAI and $MKR to lay a stronger foundation for the overall strategy. The tokenomics of $MKR and $DAI will differ significantly from today’s model. Both MakerDAO and SubDAOs will lower governance barriers with new token launches, further encouraging token holders to participate in governance.

-

Regarding current RWA risk management, MakerDAO categorizes its exposure into three stages—Dove, Hawk, and Phoenix—based on severity. We expect that over the next two to three years, MakerDAO will continue maximizing yield from its RWA holdings.

-

In mid-2023, MakerDAO changed its $MKR buyback and burn mechanism, replacing it with a Smart Burn Engine that uses part of the protocol surplus to buy back $MKR and provide liquidity by creating an MKR/DAI trading pair on Uniswap V2—an active market-making approach. This engine aims to create a dynamic equilibrium where the number of newly issued $MKR tokens each year equals the number burned, supporting healthy $MKR circulation.

-

Using both DCF and comparable valuation models, we have valued the $MKR token. After a series of assumptions and modeling, we estimate that by the end of Q1 2024, the $MKR price could reach $3,396.72–$4,374.21, with MakerDAO’s fully diluted valuation (FDV) ranging from $3.321 billion to $4.277 billion—indicating upside potential compared to January 16, 2024 data. This valuation is not investment advice; actual market dynamics and MakerDAO’s operational performance will ultimately determine its true market value.

-

While innovating, MakerDAO must remain vigilant about significant regulatory risks. Given its large allocation to U.S. Treasuries as underlying assets, it is likely to face continued scrutiny or even regulatory actions from U.S. authorities. Additionally, the ongoing Endgame plan introduces fundamental changes to its governance token $MKR and stablecoin $DAI, which may impact the protocol’s risk tolerance and future development path.

1. MakerDAO Overview

MakerDAO is an Ethereum-based protocol designed to issue the decentralized stablecoin DAI. Pegged to the U.S. dollar, DAI maintains its value through mechanisms like over-collateralization and surplus buffers, without relying on central issuers or guarantees.

DAI’s stability and value are ensured by smart contracts using automated mechanisms involving collateralized crypto assets—such as Ether and other ERC-20 tokens locked and managed within the MakerDAO platform. This design aims to deliver robustness and reliability, offering users a more trustworthy environment for digital currency transactions and asset management.

The governance token $MKR plays a critical role in MakerDAO’s ecosystem, enabling holders to vote on key decisions such as types of accepted collateral, debt ceilings, stability fee adjustments, and other system parameters. Additionally, $MKR acts as a recapitalization resource when the system incurs losses, enhancing financial resilience.

MakerDAO’s architecture reflects core blockchain principles: transparency, decentralization, and censorship resistance. Automated processes powered by smart contracts reduce intermediaries, providing users with a more seamless and reliable financial service experience.

Amid rapid growth in DeFi, MakerDAO remains a key participant in the stablecoin and decentralized lending space, showcasing strong market adaptability and innovation. Since late 2022, its introduction of RWAs like U.S. Treasuries has not only enhanced DAI’s real-world asset backing but also generated substantial revenue.

To boost continuous innovation, improve organizational efficiency, and better leverage intangible value, MakerDAO began proposing its comprehensive Endgame plan in 2022 and officially launched implementation in 2023. This report incorporates aspects of the Endgame plan to value the $MKR token.

2. Endgame

2.1 Underlying Logic of Endgame

Similar to Alphabet—the parent company of Google—Alphabet achieves stable growth and maximizes profit through Google while operating various autonomous startups under risk-isolated structures, supported by Google and Alphabet’s technology and resources.

Through diversification and risk-spreading, this structure balances stable core operations with high-risk innovation efforts, allowing Alphabet to meet current market challenges and prepare for future shifts and opportunities.

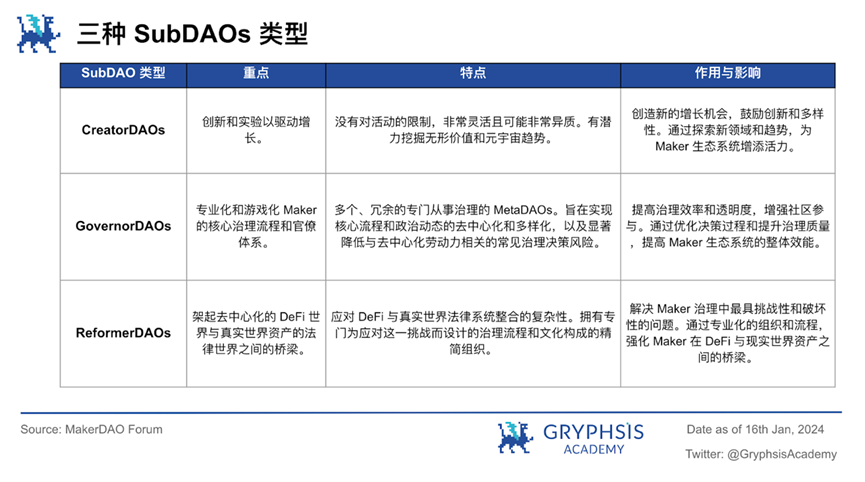

Applied to MakerDAO, valuable and promising ventures—such as lending protocols, decentralized oracle networks, and real-world assets (RWA)—can be spun off from the current MakerDAO into separate SubDAOs. Tokens can then be issued around these initiatives and distributed to cultivate communities, unlocking latent business potentials currently underutilized.

For example, MakerDAO’s current governance process and efficiency struggle to compete with traditional financial institutions when handling complex real-world financial transactions. SubDAOs allow MakerDAO to step back from direct management, instead incubating specialized, self-governed SubDAOs capable of overcoming existing bottlenecks.

MakerDAO can then use the proven D3M framework (Decentralized Direct Deposit Module), leveraging automation and smart contracts to optimize interactions with other DeFi protocols, manage risk, and improve capital efficiency—enabling SubDAOs to conduct RWA operations on behalf of MakerDAO, reducing overhead and complexity.

The main challenge becomes evaluating SubDAO performance and deciding which entities to empower—a decentralization of authority enabling parallel innovation. In the volatile and highly uncertain crypto industry, this approach offers MakerDAO a viable path to long-term survival.

For a globally impactful decentralized ecosystem, efficiency rivaling traditional finance is just one factor. More importantly, intangible value built around community membership tokens and user experience is crucial.

In crypto, top-tier assets like Bitcoin, Dogecoin, and NFTs often see far greater value appreciation than MakerDAO or other稳健 DeFi protocol tokens. Judging crypto purely on fundamentals is misleading. Leveraging meme-like qualities to empower tokens like $MKR—and tapping into the intangible value of communities—not only helps solve governance issues like voter apathy but also accelerates the scaling of SubDAOs.

2.2 Overall Plan

The Endgame Plan roadmap consists of four main phases—Pregame, Early Game, Midgame, and Endgame—aimed at strengthening efficiency, resilience, and participation through balanced governance, laying a solid foundation for parallel growth and product innovation across SubDAOs. This plan fosters optimized governance and diversified innovation within a gradually emerging, community-driven ecosystem.

In the short term, Endgame aims to grow Dai supply beyond $100 billion within three years and ensure the ecosystem continues accelerating autonomously within a vibrant DAO economy. It also seeks to safely maintain governance balance at any scale.

I. Pregame

As a testing phase before full launch, six initial SubDAOs will be deployed to test core functionalities:

-

Issuance of individual ERC20 tokens for each SubDAO, along with three liquidity mining “farms” allowing users to farm SubDAO tokens using $DAI, $ETHD (a synthetic stETH asset), or $MKR.

-

Launch of Meta Elixir I and Metanomics I, forming a DAI:ETHD:MKR = 1:1:1 liquidity pool and distributing $MKR tokens to SubDAOs.

-

Establishment of MIP sets—essentially master guidelines for implementing these measures—to prepare for scalable, automated SubDAO launches.

II. Early Game

After Pregame, the Endgame plan enters the adjusted rollout phase—Early Game—divided into five sub-phases:

Phase 1:

$MKR and $DAI will undergo rebranding to unify them under a single, cohesive identity that better communicates the vision of Endgame. Both tokens will remain, with new versions—tentatively called NewStable and NewGovToken—issued alongside them.

Phase 2:

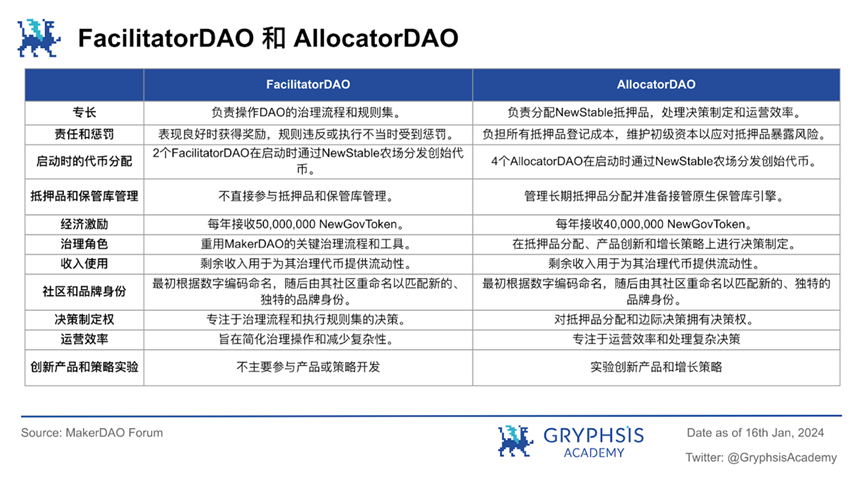

The six tested SubDAOs and NewStable farms will officially launch, distributing SubDAO tokens through the farms. All SubDAOs will focus on user acquisition and maintaining decentralized frontends, categorized based on business focus into FacilitatorDAOs and AllocatorDAOs:

Phase 3:

Once SubDAOs are live, MakerDAO will introduce Atlas to streamline governance and decision-making, making the process more accessible and efficient for NewGovToken holders. Atlas is a comprehensive governance rulebook structured uniformly, containing all principles, rules, processes, and knowledge across the MakerDAO ecosystem. Optimized for integration with specialized AI governance tools, Atlas can be modified, improved, summarized, and interpreted by AI systems.

Phase 4:

Launching the “Governance Participation Incentive Program” is a pivotal component of MakerDAO’s Endgame. This initiative uses the Sagittarius Lockstake Engine (SLE) to encourage deeper engagement from NewGovToken holders in DAO governance. Token holders are incentivized to lock their tokens and delegate voting power toward specific governance strategies via an intuitive, gamified interface.

As rewards for active governance contributions, SLE participants receive 30% of protocol surplus either as NewStable income or SubDAO tokens. To promote long-term involvement and problem-solving, a 15% exit fee is imposed. During the first six months after SLE launch, one-time bonus incentives will compensate for the early limitation where only NewStable users can farm SubDAO tokens.

Phase 5:

“NewChain Launch and Final Endgame State” marks the near-final step of the Endgame Plan. This phase involves deploying NewChain—a dedicated blockchain hosting SubDAO token economies and securing MakerDAO governance backend logic. NewChain ensures NewStable and NewGovToken (alongside $DAI and $MKR) continue operating on Ethereum, protected by an advanced two-stage bridge design.

A core feature of NewChain is using hard forks as a governance mechanism to resolve major disputes, offering ultimate security for users relying on Dai and NewStable. Additionally, NewChain includes features optimized for AI-assisted DAO governance—such as smart contract generation, state leasing, neural tokenomics emissions, and per-SubDAO governance lockstake systems—fostering innovation and growth across the ecosystem.

This outlines MakerDAO’s step-by-step plan from Early Game onward. However, whether Phases 1 to 5 represent the complete journey from Early Game to Midgame and finally Endgame remains uncertain. Therefore, this $MKR valuation report does not speculate beyond currently foreseeable developments.

2.3 Collateral Types

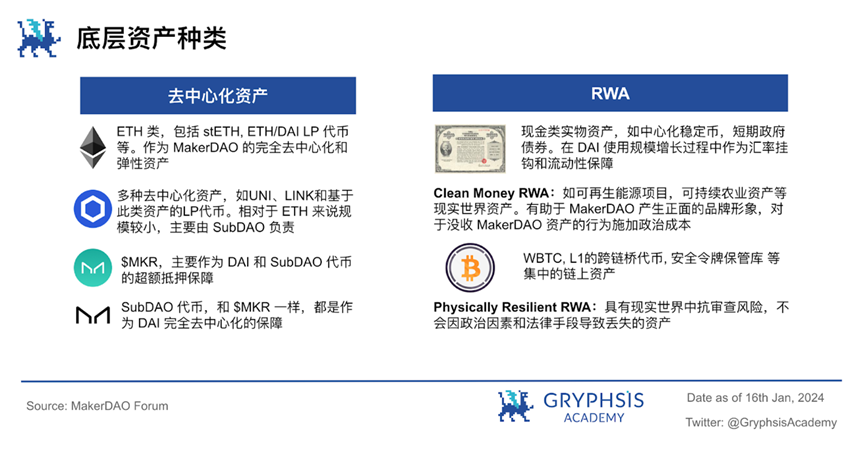

Understanding MakerDAO’s underlying assets is essential for short-term revenue analysis. The Endgame plan divides collateral into two categories: decentralized assets ensuring unbiased integrity, and real-world assets (RWA) providing reliable liquidity and stability.

$MKR:

Its utility as a liquidity support token for DAI is being reduced—from mandatory to optional—depending on governance decisions. Instead, if MakerDAO incurs losses, it may adjust DAI’s target price (its peg to USD) to absorb those losses.

Under the Endgame plan, $MKR becomes a valuable decentralized collateral form via over-collateralized vaults, generating stability fees, participating in governance, and being used to farm SubDAO tokens.

Cash-like RWA:

Currently the most widely used RWA category in MakerDAO, including centralized stablecoins and short-term government bonds. These assets are key to maintaining DAI’s exchange rate stability and, given recent U.S. Treasury performance, are a primary source of revenue for MakerDAO.

However, these assets carry the highest seizure or regulatory risk, which is why MakerDAO plans a three-stage transition to gradually reduce their balance sheet exposure.

2.4 Three Stages

Glossary:

DSR: DAI Savings Rate

SFBR: Stability Fee Base Rate (same as loan interest rate in this report)

TR:

A mechanism that gradually adjusts DAI’s target price over time. A positive TR increases DAI demand and reduces supply. The main purpose of TR is to control MakerDAO’s exposure to RWA assets, encouraging more DAI generation using decentralized collateral like ETH.

In summary, SFBR and TR can be seen as the fee rates for all stable pools and specifically for decentralized asset pools. Increasing SFBR and TR effectively raises DSR, increasing the cost of borrowing DAI, thereby reducing DAI supply and increasing demand—mechanisms used to raise DAI’s price.

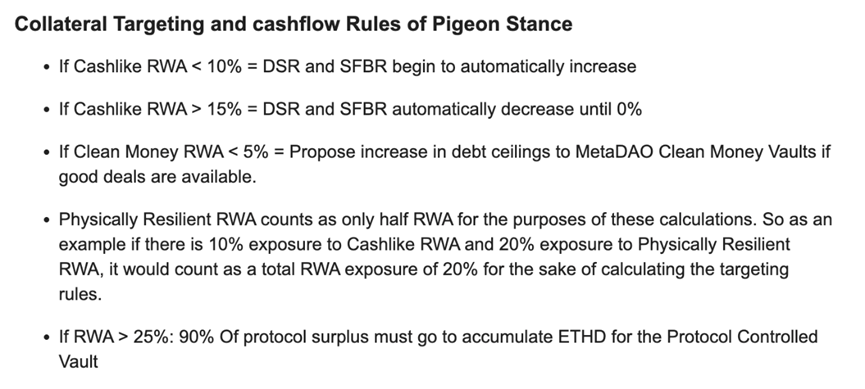

Dove Stage:

In conditions of low regulatory risk and stable global economic conditions, MakerDAO leverages cash-like RWA assets to maximize returns and accumulate ETH in its treasury to prepare for future crises. The original plan envisioned a dove stance until 2025; if no significant regulatory risks emerge, this timeline may be extended to accumulate more capital.

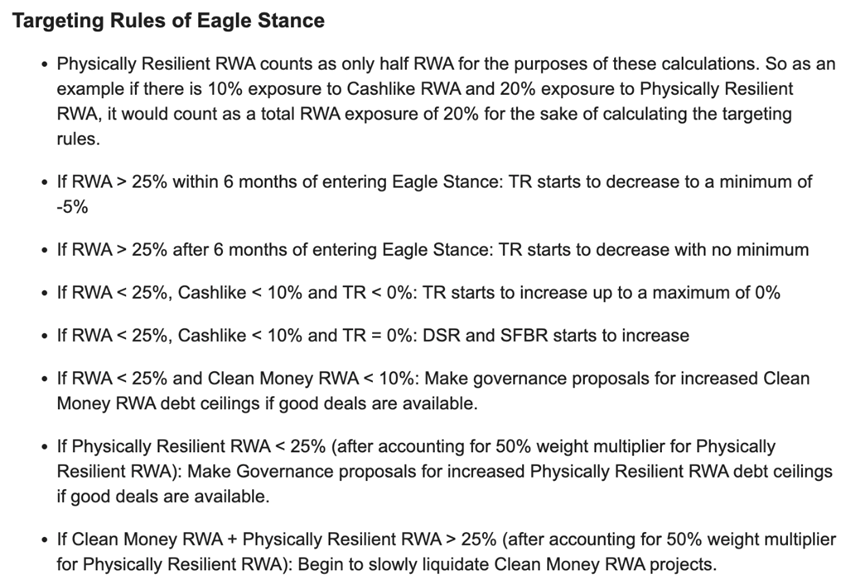

Hawk Stage:

Ensures seizable RWA exposure stays below 25%, and allows DAI to decouple from the dollar if necessary—enabling DAI to withstand severe regulatory pressure while maintaining some connection to real-world assets.

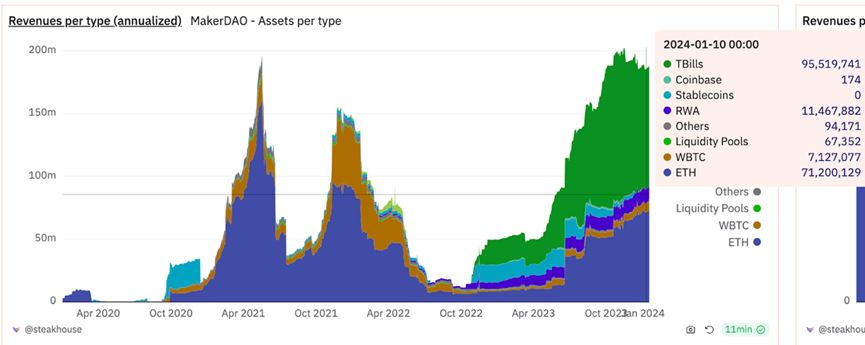

Phoenix Stage:

An emergency response for extreme scenarios, using only decentralized assets and physically resilient RWA as collateral. DAI’s target exchange rate will be adjusted based on market price deviations rather than relying on PSM collateral.

Based on current regulatory sentiment and MakerDAO’s operational status, we predict it will remain in the Dove stage over the next three years. However, the planned RWA allocation under the Dove stage may not fully apply. This valuation report makes projections based on current asset allocations and the general goal of maximizing returns during the Dove phase.

Additionally, prior to any new utility upgrades, we treat $MKR as a project token closely tied to MakerDAO’s revenue.

3. Tokenomics

3.1 $MKR Token Utility

$MKR is central to the MakerDAO ecosystem, serving two primary functions. First, it represents governance voting rights, allowing holders to vote on proposals and directly influence protocol decisions—including system parameters, protocol upgrades, and governance policies.

Second, in the event of insufficient funds to cover DAI liabilities, MakerDAO can issue new $MKR tokens to absorb losses, preserving the economic system’s stability.

This mechanism ensures DAI’s health and systemic stability while giving $MKR holders meaningful influence over the protocol’s future.

3.2 $MKR Token Distribution

MakerDAO manages $MKR supply through a unique stock buyback model centered on the “Surplus Buffer”—the primary destination for all protocol revenues. The Surplus Buffer acts as the first line of defense against shortfall events.

When a shortfall occurs, funds from the Surplus Buffer are used first to cover it. Only if the buffer is insufficient will MakerDAO mint additional $MKR tokens to make up the difference.

Notably, the Surplus Buffer has a predefined cap. When surplus exceeds this cap, excess Dai is used to buy back $MKR tokens. Prior to June 2023, repurchased $MKR was burned—reducing total supply and benefiting existing holders. Over the long term, this buyback-and-burn mechanism decreases $MKR supply.

To date, 22,368.96 $MKR tokens have been bought back and burned—representing 2.237% of total supply. This ongoing activity reflects MakerDAO’s financial health and $MKR scarcity, positively influencing its market value.

Since June 2023, under the updated Smart Burn Engine, surplus beyond the new buffer cap is used to purchase $MKR, which is then paired with an equivalent amount of ¥DAI and provided as liquidity on Uniswap V2. The resulting LP tokens are transferred to protocol-controlled addresses.

This move aims to give the protocol greater control over $MKR and DAI supply and liquidity mechanisms—essentially acting as active market making.

Additionally, the Smart Burn Engine uses a valuation model to optimize burning when $MKR prices are low. If $MKR’s market cap falls below its target valuation, the protocol burns $MKR using accumulated Elixir ($MKR/$ETH/$DAI liquidity tokens).

The plan also includes annual issuance of new $MKR to counteract holder concentration caused by burning. This creates a dynamic equilibrium where annual $MKR issuance equals burning, supporting healthy token circulation. $MKR’s value will be driven by its burn mechanism, SubDAO token yields for active voters, and low-rate, high-LTV DAI generation privileges for engaged participants.

3.3 MakerDAO Revenue Model

3.3.1 Lending Interest Income (Stability Fee)

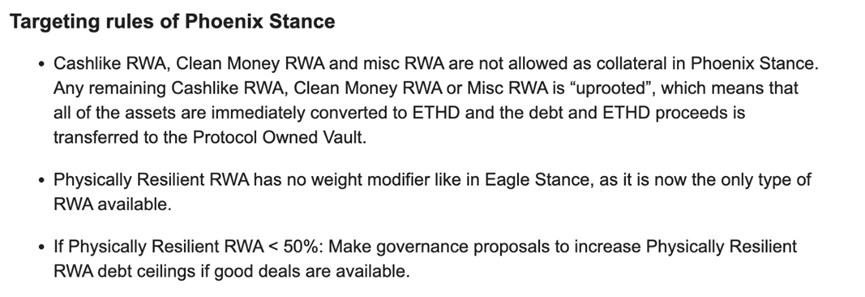

Before introducing RWA assets, MakerDAO’s primary revenue source was lending interest—the fee users paid when borrowing $DAI by locking crypto collateral. Below are MakerDAO’s on-chain collateral pools and their respective interest rates:

Source: makerburn

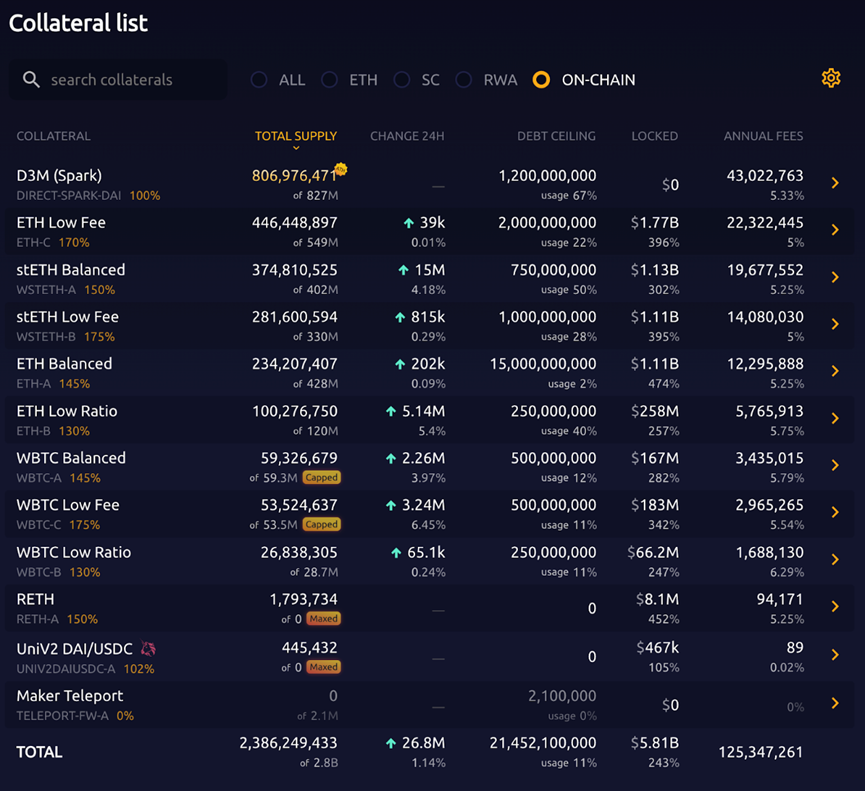

Combined with Dune data, most of MakerDAO’s revenue before October 2022 came from interest in these $ETH lending pools. However, following the $UST collapse in 2022, many users exited crypto, causing stablecoin TVL to plummet. MakerDAO had to cut rates to retain users and stabilize finances. Competitors like Aave also dropped rates to 0%. Concurrently, MakerDAO began shifting $USDC reserves into income-generating assets like U.S. Treasuries.

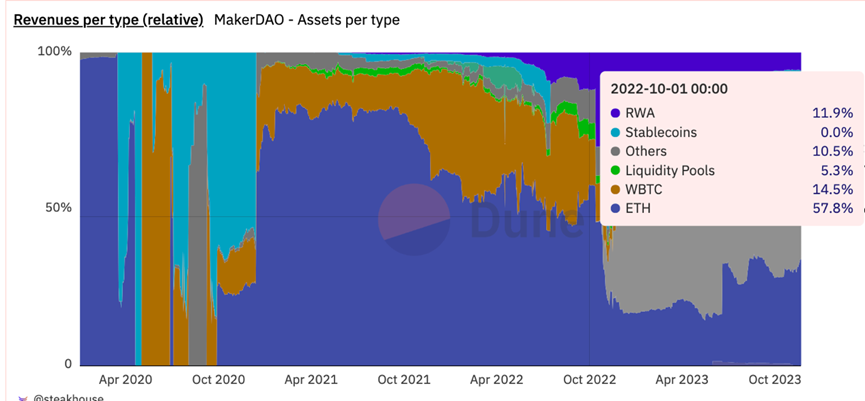

Near-zero stability fees in 2022 made it a nearly unprofitable year for MakerDAO. Starting in 2023, RWA income—particularly from Treasuries—began dominating total revenue.

3.3.2 Real-World Asset Income (RWA Income)

As U.S. Treasury yields rose steadily from late 2021 to present, MakerDAO’s Treasury-backed income has grown accordingly—now accounting for over half of its total revenue.

3.3.3 Liquidation Income

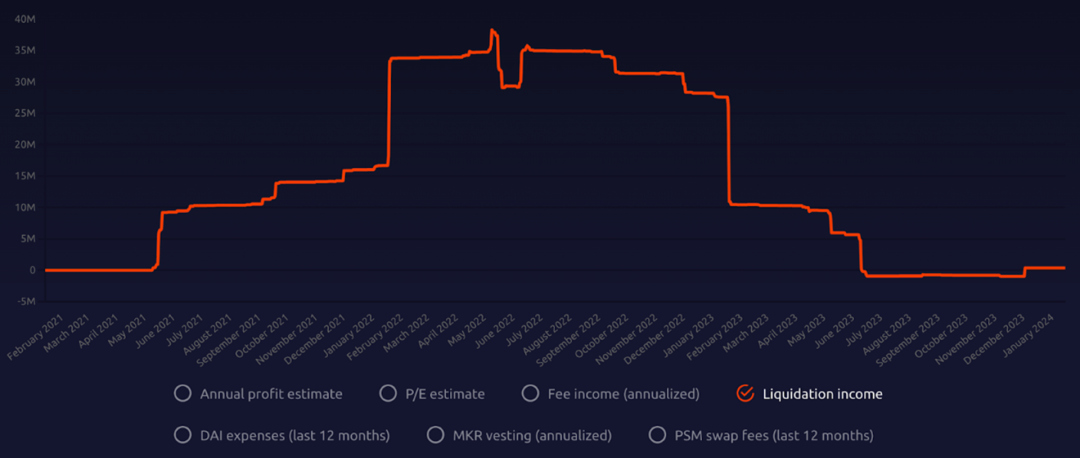

When users’ crypto asset prices fall rapidly below liquidation thresholds, MakerDAO liquidates those positions and charges a fee. This contributed meaningful revenue during the volatile 2022 market downturn but isn’t expected to sustain operations during calmer periods.

3.3.4 PSM (PSM Revenue)

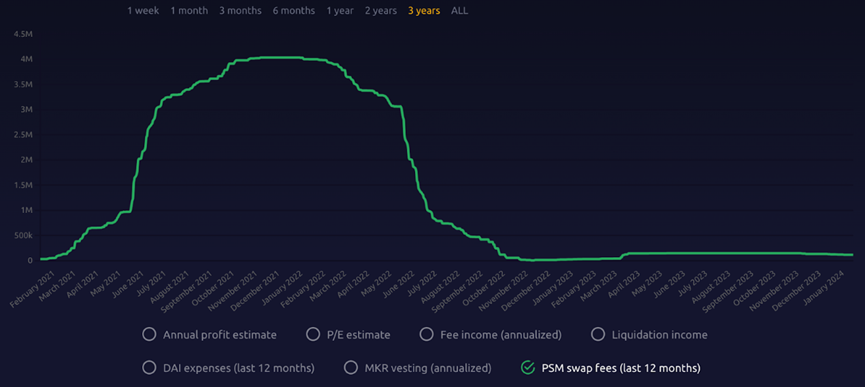

Users can swap $DAI with other stablecoins (e.g., $USDC) via PSM at nearly 1:1 rates. A small fee is charged during this process—PSM swap fees. These fees help regulate $DAI supply, maintain its price stability, and contribute to system revenue. During market volatility, PSM enables MakerDAO to effectively manage $DAI liquidity and price anchoring.

Source: Makerburn

4. Valuation Model

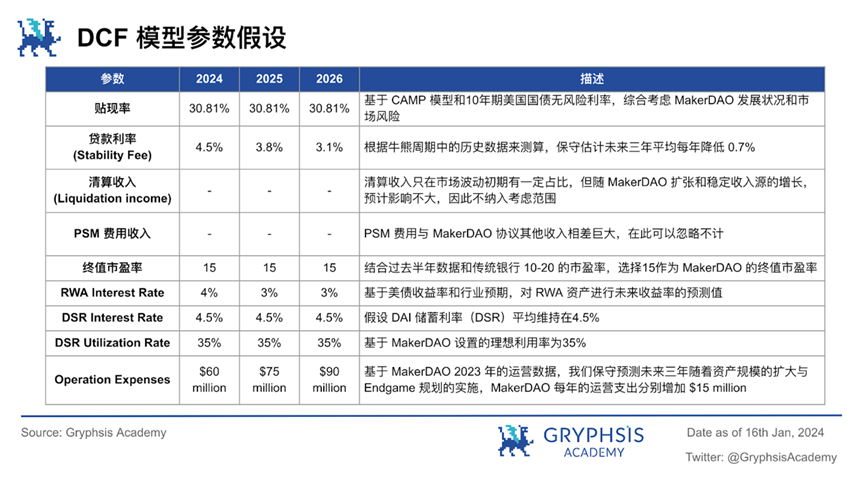

Our valuation is based on discounted cash flow (DCF) analysis, detailed in our valuation model (MKR Valuation Model), and adjustable according to future market conditions. Below is a breakdown of the methodology.

4.1 Discounted Cash Flow Analysis (DCF)

For simplicity, consider MakerDAO as a bank-like monetary institution—unregulated for now. Users obtain $DAI by over-collateralizing assets and pay lending interest to MakerDAO. Simultaneously, MakerDAO uses this interest to fund the DSR, offering depositors yield on their $DAI holdings.

Initially, MakerDAO’s main revenue streams included interest from over-collateralized crypto and RWA loans (Stability Fee), liquidation fees when collateral values fell below thresholds (Liquidation Income), and PSM stablecoin trading fees (PSM Revenue).

Starting late 2022, MakerDAO shifted most PSM reserve assets from stablecoins like USDC to income-generating U.S. Treasuries and ETFs. This fixed-income stream (RWA Income) is now MakerDAO’s largest revenue source, followed by ETH lending interest.

Given this, DCF is the most suitable method for valuing $MKR. DCF is an absolute valuation technique estimating an asset’s value based on expected future cash flows, discounted at a rate reflecting its risk.

Our model uses data up to December 31, 2023, with a 3-year forecast period and terminal value representing long-term cash flows, estimating $MKR’s value as of March 1, 2024.

4.1.1 Assumptions

The model rests on several key assumptions, incorporating Endgame considerations such as RWA allocation across stages and U.S. rate-cut cycles, reflecting forward-looking expectations for MakerDAO’s trajectory. These foundational assumptions are integrated into our valuation framework and allow flexibility for evolving market conditions. Details follow.

DAI Total Supply:

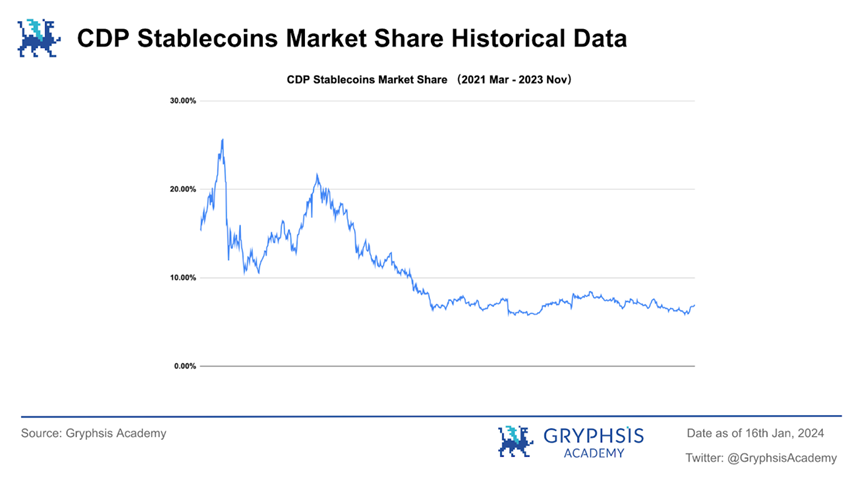

DAI supply growth significantly impacts valuation, directly driving the second-largest revenue stream—interest income—and indirectly affecting liquidation income. Based on prior research, we forecast DAI supply by analyzing CDP stablecoin market share and DAI’s share within that segment.

First, stablecoin TVL—using growth rates from April 2021 to April 2022—we assume three scenarios:

Current: 130,646.0 million

Bear: 2024 -10%; 2025 -20%; 2026 -30%

Base: 2024 +15%; 2025 +30%; 2026 +45%

Bull: 2024 +20%; 2025 +40%; 2026 +60%

We believe we’re in a rising rate cycle, and MakerDAO’s ability to bring off-chain risk-free yield on-chain and distribute it to stablecoin holders—via DSR—is more appealing than traditional $USDC or $USDT models that keep this yield as project profit. However, due to current ecosystem limitations—difficult on/off ramps, poor UX—decentralized stablecoins still hover around 7% market share. (DSR interest primarily comes from MakerDAO’s lending revenue, but theoretically could include RWA yield.)

Given RWA-integrated CDP stablecoins now offer stable yield, we project their market share under three scenarios:

Bear: 2024 12%; 2025 15%; 2026 18%

Base: 2024 17%; 2025 20%; 2026 23%

Bull: 2024 22%; 2025 25%; 2026 28%

Within the CDP stablecoin market, DAI’s share has remained between 60%–70% since July 2022. As CDP stablecoin adoption grows, more players like Aave may enter. With fierce competition and minimal technical moats for leaders, we forecast DAI’s CDP market share under three scenarios:

Bear: 2024 65%; 2025 55%; 2026 45%

Base: 2024 65%; 2025 60%; 2026 55%

Bull: 2024 65%; 2025 70%; 2026 75%

RWA Asset Allocation:

Currently, RWA assets account for 46.40% of MakerDAO’s total assets. According to Endgame, this ratio will gradually decrease—targeting ~15% by 2025—based on regulatory conditions. We assume the following RWA allocations over the next three years:

Bear: 2024 40%; 2025 22%; 2026 4%

Base: 2024 44%; 2025 30%; 2026 16%

Bull: 2024 58%; 2025 63%; 2026 68%

Other projected values are shown below:

$MKR Token Deflation

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News