Clash of Words: The Pain and Reflection on LayerZero Airdrop Farming

TechFlow Selected TechFlow Selected

Clash of Words: The Pain and Reflection on LayerZero Airdrop Farming

Opportunities to get rich overnight from airdrops will become increasingly rare.

Author: Bitpush News Asher Zhang

Regarding LayerZero's anti-sybil mechanism, we previously published an article titled "LayerZero Activates 'Whispered Accusations' Ahead of Token Launch—What Dangers and Opportunities Lie Ahead?" In it, we stated: "This culture of mutual surveillance resembles ancient emperors using 'whispered accusations' to avoid blocked channels of communication. Historical lessons show this approach is not necessarily beneficial." Now, with a report identifying 470,000 suspected sybil addresses submitted to LayerZero, public debate and criticism over this anti-boosting mechanism have reached a peak. What feedback and frustrations has the community expressed? How has the project responded? Coincidentally, the recently popular project Taiko adopted a completely opaque airdrop mechanism, which has also drawn significant market backlash. How are Web3 airdrops—once widely praised—evolving? Perhaps it’s time to reflect on the concept of airdrops, a product of the Web3 era.

The Battle of Interests Behind LayerZero’s Anti-Boosting Mechanism

In a sense, the current community debate around LayerZero is fundamentally about利益—利益—interests, and LayerZero’s anti-gaming mechanism cleverly leverages human nature to resist exploitation. When LayerZero threatens the profits of farming syndicates, an unprecedented war of words becomes inevitable.

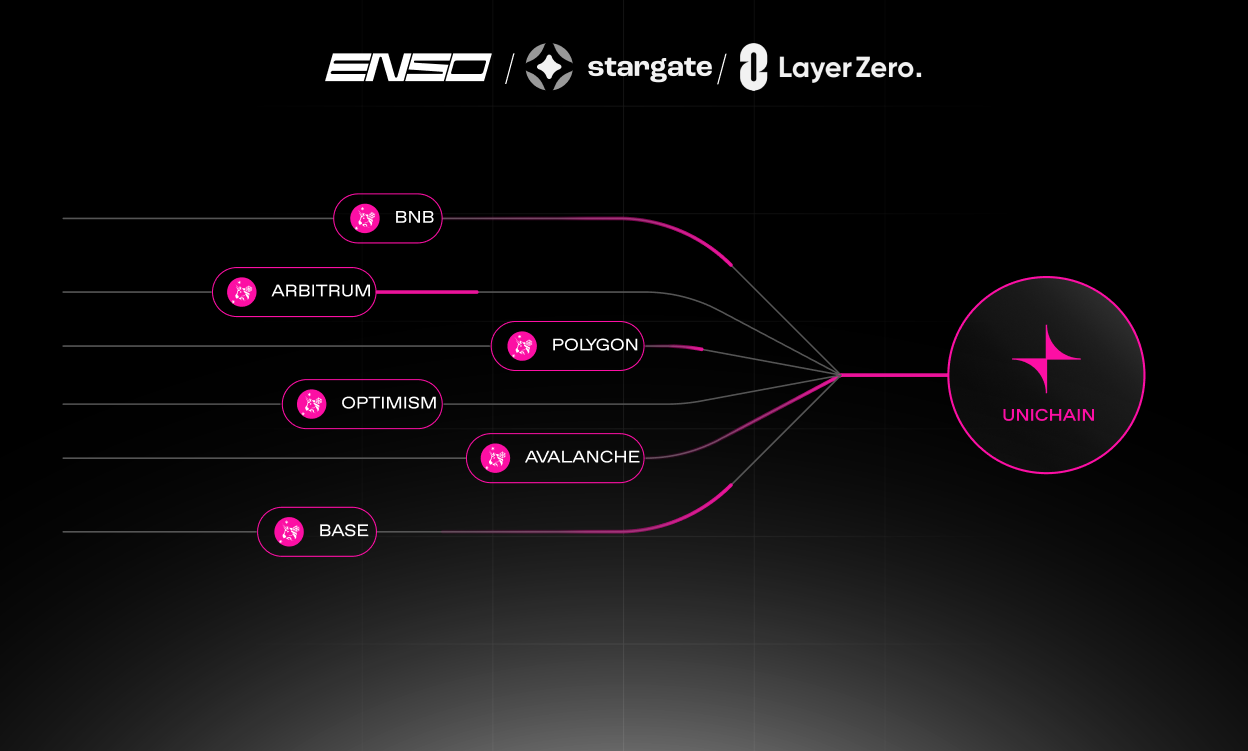

LayerZero is a highly renowned cross-chain interoperability protocol with a high valuation, backed by prominent crypto investors including Multicoin, Binance Labs, a16z, and Sequoia Capital. As such, Web3 farmers had long targeted this “lamb” awaiting slaughter. WOO X Research, the analytics arm of WOO X, estimates that LayerZero’s upcoming airdrop could be worth between $600 million and $1 billion. Conservatively, assuming a TGE valuation at four times the previous round and an initial circulating supply of 15%, LayerZero’s expected TGE market cap would be $1.8 billion with a FDV of $12 billion, resulting in an airdrop value of $600 million—translating to individual allocations between $750 and $1,500. Optimistically, if the TGE valuation reaches 4.5x the last round with a 20% initial circulation, the TGE market cap could rise to $2.7 billion (FDV $13.5 billion), increasing the airdrop value to $1.08 billion, with average user rewards ranging from $1,350 to $2,700.

With such a massive airdrop worth $600 million to $1 billion, the stakes are undeniably high—farmers simply couldn’t afford to miss out. Yet LayerZero is determined not to let farming syndicates profit at its expense. At its core, LayerZero’s strategy consists of three elements: “self-reporting,” “review,” and “mutual exposure.” Self-reporting allows users to retain 15% of their potential airdrop allocation; those caught without self-reporting receive nothing, while successful mutual reports earn the reporter 10% of the reported address’s allocation.

In practice, LayerZero filtered out a large number of sybil accounts—but clearly not enough. According to LayerZero CEO Bryan Pellegrino, within hours of launching the bounty program, the team received over 3,000 sybil reports and 30,000 appeals. He later noted that only 6.67%–13.33% of the 6 million identified addresses might qualify for the airdrop; 90%–95% of the reports were valid or even higher, though invalid submissions were quickly discarded. “Nothing is perfect,” he added. On June 5, Pellegrino further wrote on X: “I wish I had two more months to process these sybil reports. There are some very obvious large sybil clusters involving tens of thousands of addresses, but due to time constraints, I’ve had to abandon reviewing them because they’re extremely unlikely to qualify for LayerZero’s final airdrop eligibility. Still, I’m certain they may qualify for other airdrops. This is just my personal frustration—I simply don’t have enough time. The LayerZero TGE timeline remains unchanged.”

Amidst the Chaos: Debating Right and Wrong

From LayerZero’s perspective, the most valuable users deserve airdrop rewards—those demonstrating “persistence,” defined as users most likely to continue using LayerZero or maintaining past usage patterns. More specifically, LayerZero aims to eliminate farming organizations. The project has made its stance clear: protecting small individual users while primarily targeting large-scale sybils—i.e., farming studios. LayerZero emphasized that the “self-reporting” policy does not target individuals but organized operations, and LayerZero employees are strictly prohibited from claiming airdrops—violators will be fired. The verification process will also be rigorous to prevent “hunters” from making false reports to maximize gains, thereby harming genuine users.

On the other hand, farming studios argue they invested real money, helped improve project metrics, and stress-tested network performance—only to be discarded afterward. Under the mutual exposure system, chaos emerged: employees of farming studios resigned to report internal accounts; major airdrop recipients of certain projects were reported; users began targeting known farming KOLs’ sybil clusters for mass reporting. Market rumors even suggest a security firm submitted 470,000 suspected sybil addresses to LayerZero in one go.

Crypto influencer Marco commented that “mutual reporting” has become not only a battleground between projects and farming studios but also among studios and individual users. Since 90% of a successfully reported account’s airdrop tokens return to the pool, each user’s share increases accordingly—making mutual reporting a tool for ordinary farmers to assert what they see as “farming justice.”

Dao Shuo Blockchain stated: “Events like this involving LayerZero were foreseeable in trend. From the project side, as launch costs rise, teams will inevitably grow more cautious about token distribution. Going forward, airdrop qualification criteria will become increasingly strict. For users—whether professional farmers or retail participants—the profitability of farming will gradually shrink, eventually reaching a point where returns barely cover costs. Getting rich overnight via airdrops will certainly become history. I support projects identifying sybils, but I strongly oppose using举报—reporting—mechanisms to do so.”

Rethinking the Industrialization of ‘Airdrop Farming’

In a way, wherever there’s a chance for overnight wealth, people will flock in. This was true during the 2017 ICO boom, and it’s true today with airdrop farming. However, LayerZero’s mutual exposure reveals a deeper phenomenon: airdrop farming is becoming industrialized and professionalized—and this comes with serious drawbacks. Before token launches, farming syndicates flood the ecosystem, creating artificial on-chain activity. Once tokens are distributed, these groups dump en masse, causing sharp price declines that deter many genuine investors. This may partly explain why many high-profile projects have seen immediate post-launch sell-offs in this cycle.

Looking ahead, the tug-of-war between projects and farming syndicates will persist, centering on balanced利益—interests—distribution. In early stages, projects do benefit from high transaction volumes for network testing, but the subsequent dumping harms long-term stability. Projects could consider reserving part of the profits or implementing linear token vesting to alleviate short-term selling pressure.

Overall, the days of getting rich quick through airdrops are fading. Project teams and farming entities may eventually reach a new equilibrium. Moreover, perhaps both sides can bring what’s currently underground into the open—transforming covert operations into transparent, fair arrangements.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News