MT Capital Research Report: A Comprehensive Analysis of the Ethereum Cancun Upgrade, Potential Opportunities, and Beneficiary Sectors

TechFlow Selected TechFlow Selected

MT Capital Research Report: A Comprehensive Analysis of the Ethereum Cancun Upgrade, Potential Opportunities, and Beneficiary Sectors

The Dencun upgrade will further drive the prosperity of the L2 ecosystem, with Optimism, Arbitrum, and Metis particularly worth watching.

Author: Severin, Ian Wu, MT Capital

TL;DR

-

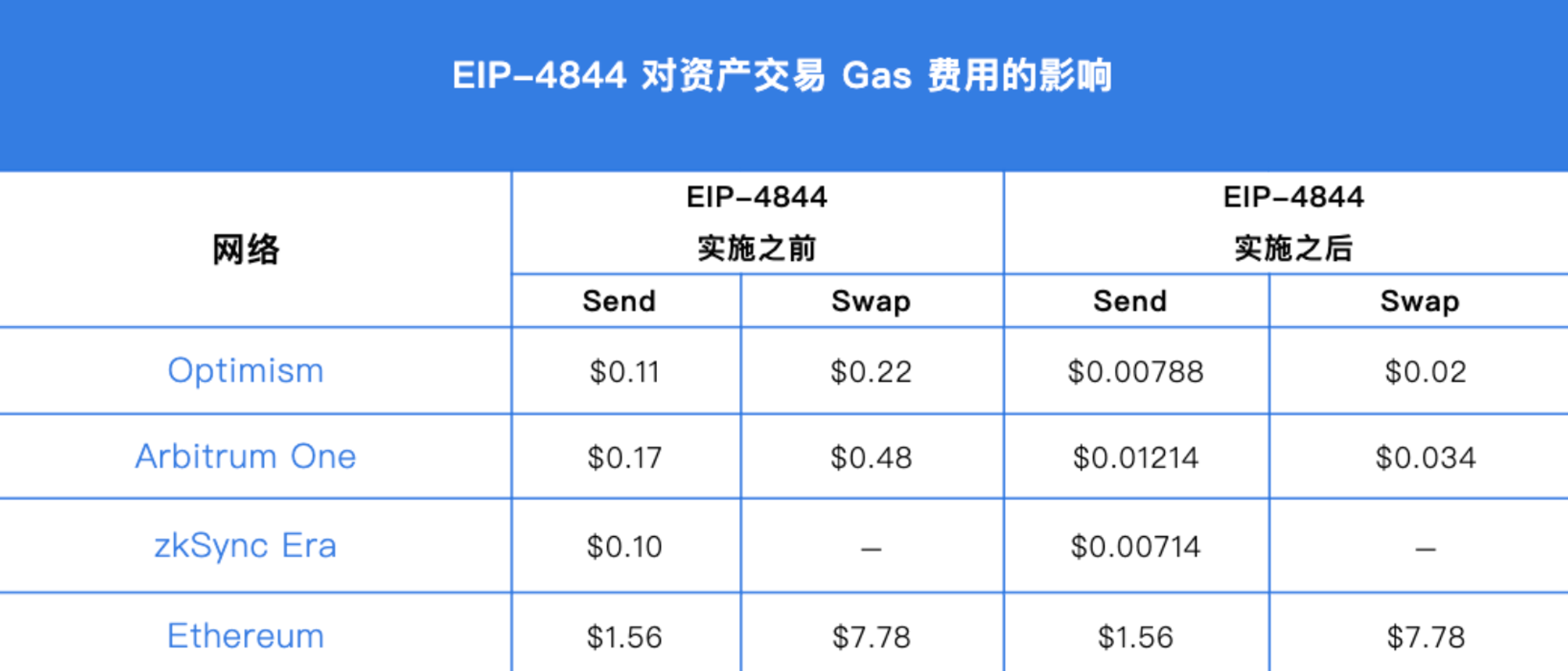

One of the core components of the Dencun upgrade is the introduction of a new data structure called "blob" via EIP-4844, which stores transaction data submitted by L2s to Ethereum, significantly reducing transaction costs for Ethereum L2s, increasing L2 throughput, and benefiting the entire L2 ecosystem.

-

The Dencun upgrade also introduces new transient storage opcodes through EIP-1153, enabling smart contracts to read and call temporarily stored data, thereby lowering Ethereum's storage costs and gas consumption, improving scalability on the mainnet, and benefiting mainnet-based applications.

-

According to the Shadowfork test report released on December 19 and the 178th Ethereum core developer execution meeting held on January 4, current testing of the Dencun upgrade has been going well, and the mainnet Dencun upgrade is expected to be completed by the end of February.

-

The Dencun upgrade will boost the prosperity of the L2 ecosystem and drive demand in infrastructure sectors such as decentralized storage, DA (Data Availability), and RaaS (Rollup-as-a-Service). On the application layer, sectors like Perps, LSD, ReStaking, and FOCG will also benefit from the Dencun upgrade.

Cancun Upgrade

Background of the Cancun Upgrade

On December 28, 2023, Vitalik published an article titled Make Ethereum Cypherpunk Again, discussing his vision for cryptocurrency. He emphasized that one of the key reasons blockchain remains limited to asset speculation is rising transaction fees. High network costs have shifted users from active participants to mere speculators. To realize blockchain’s real-world utility, transaction fees must drop by at least an order of magnitude. Although L2s have already reduced costs compared to the Ethereum mainnet, this progress remains insufficient.

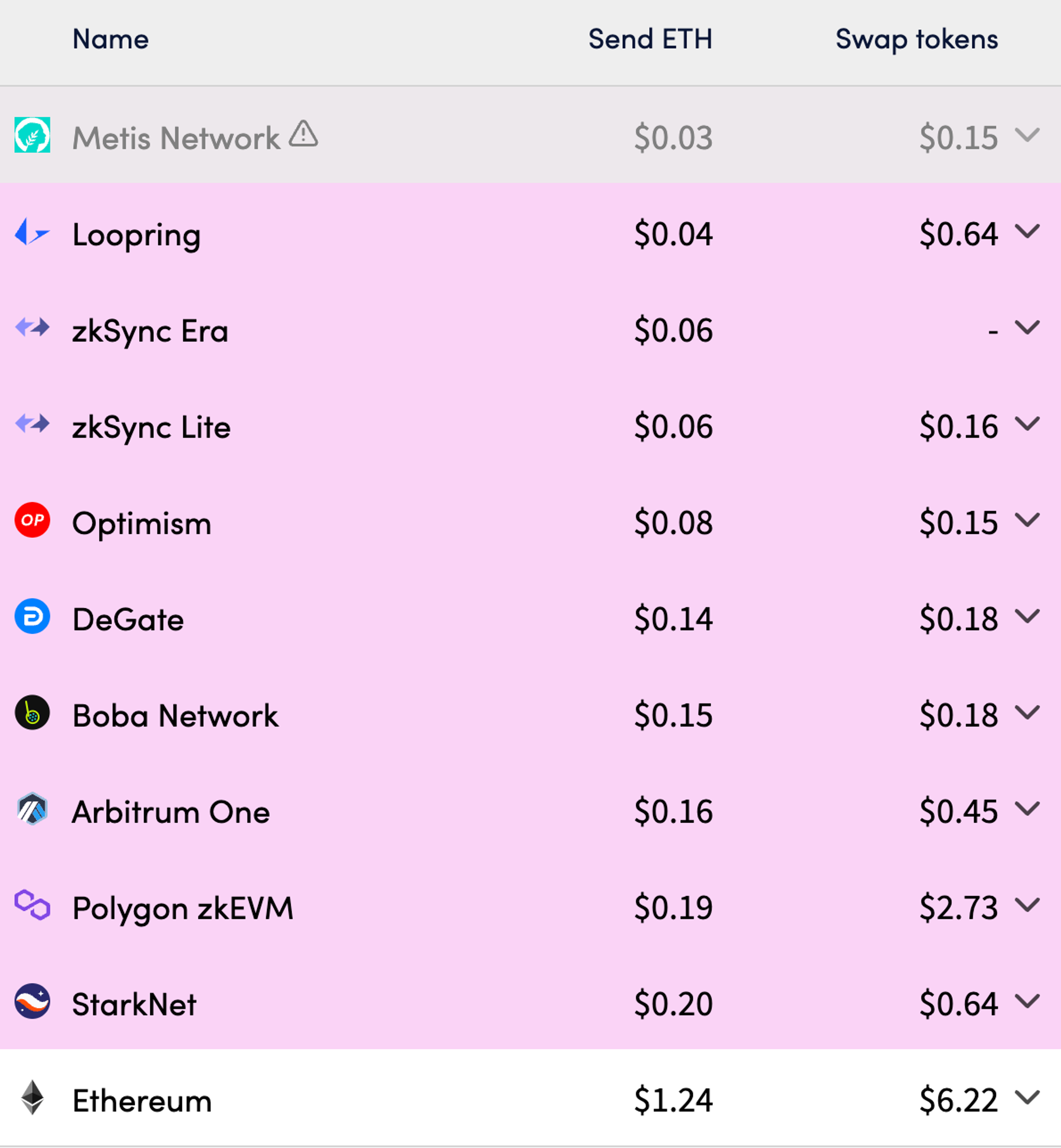

Similarly, Solana’s rapid growth at the end of 2023 was largely due to its extremely low transaction fees. While Ethereum L2s often incur gas costs around $0.5, Solana charges just ~$0.0005 per transaction—almost negligible. These ultra-low fees fueled vibrant meme trading, DeFi interactions, and DePIN application migrations on Solana. Notably, cNFTs on Solana reduce minting costs by up to 1000x compared to Ethereum NFTs, driving innovation in creator economies and DePIN projects built around NFTs. This demonstrates how affordable transaction fees significantly promote network activity and ecosystem growth.

Ethereum L2s still face high gas fees

Of course, Ethereum has long recognized this issue. In Ethereum’s roadmap, the next major phase after “The Merge” is “The Surge,” aimed at boosting TPS and reducing transaction costs across the Ethereum ecosystem. The upcoming Dencun upgrade is part of “The Surge,” designed to enhance Ethereum’s transaction throughput and scalability through the implementation of Proto-Danksharding.

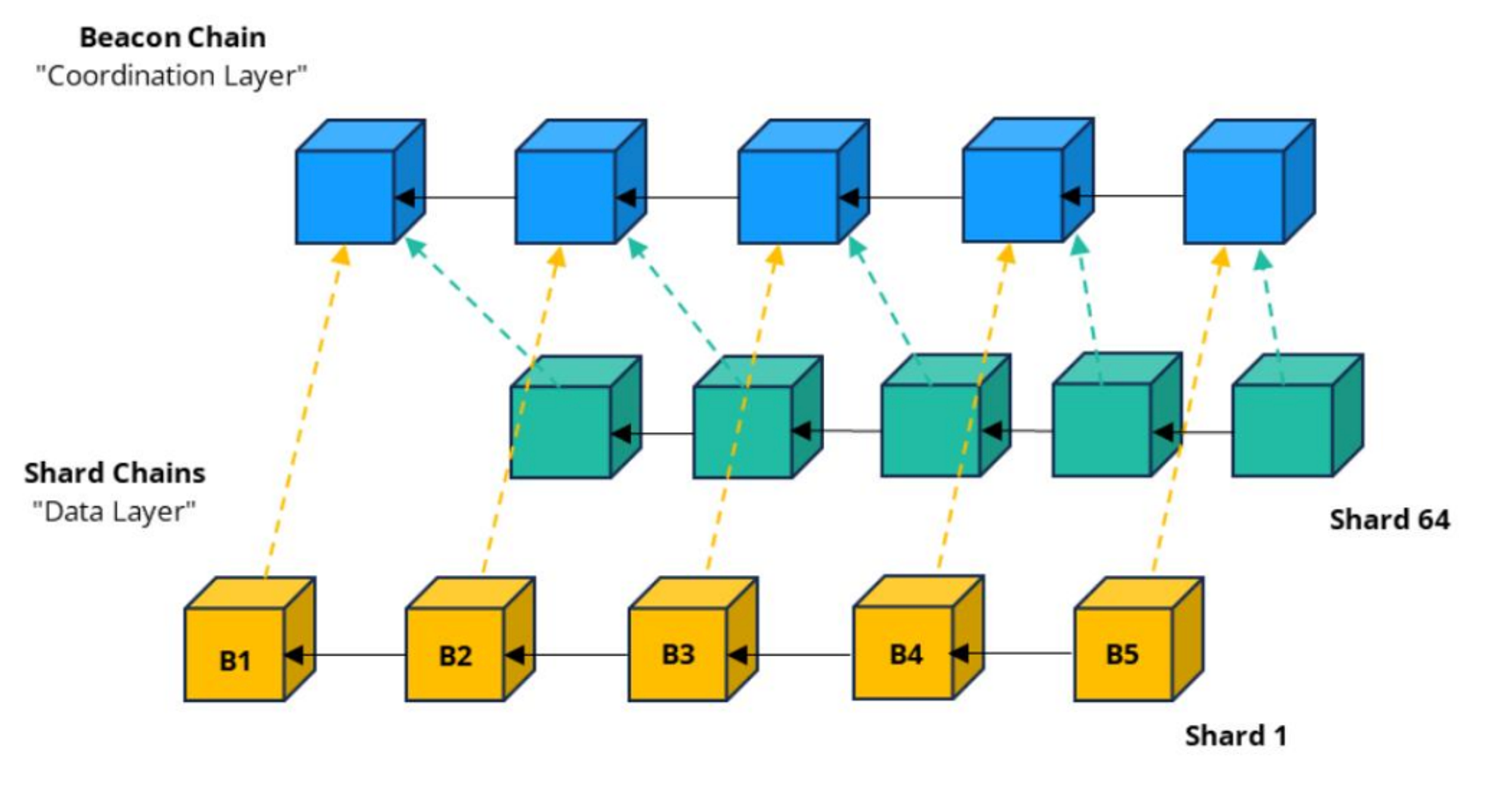

A central component of the Dencun upgrade is the introduction of the Proto-Danksharding module, which prepares Ethereum for full sharding scalability. Originally, Ethereum’s scaling plan involved splitting the network into multiple shards, distributing computational load so each shard would store a subset of transaction data and process transactions in parallel—ultimately aiming for over 100,000 TPS with 64 shards under the original ETH2.0 proposal.

Source: Crypto.com Research

However, sharding proved highly complex and slow to develop. In contrast, Rollup-based scaling solutions—which offload execution to Layer 2 while relying on Ethereum for settlement, consensus, and data availability—have advanced rapidly, achieving lower costs and higher throughput, satisfying many of Ethereum’s scalability needs. As a result, Ethereum gradually abandoned its original sharding-centric path in favor of data sharding tailored for Rollups.

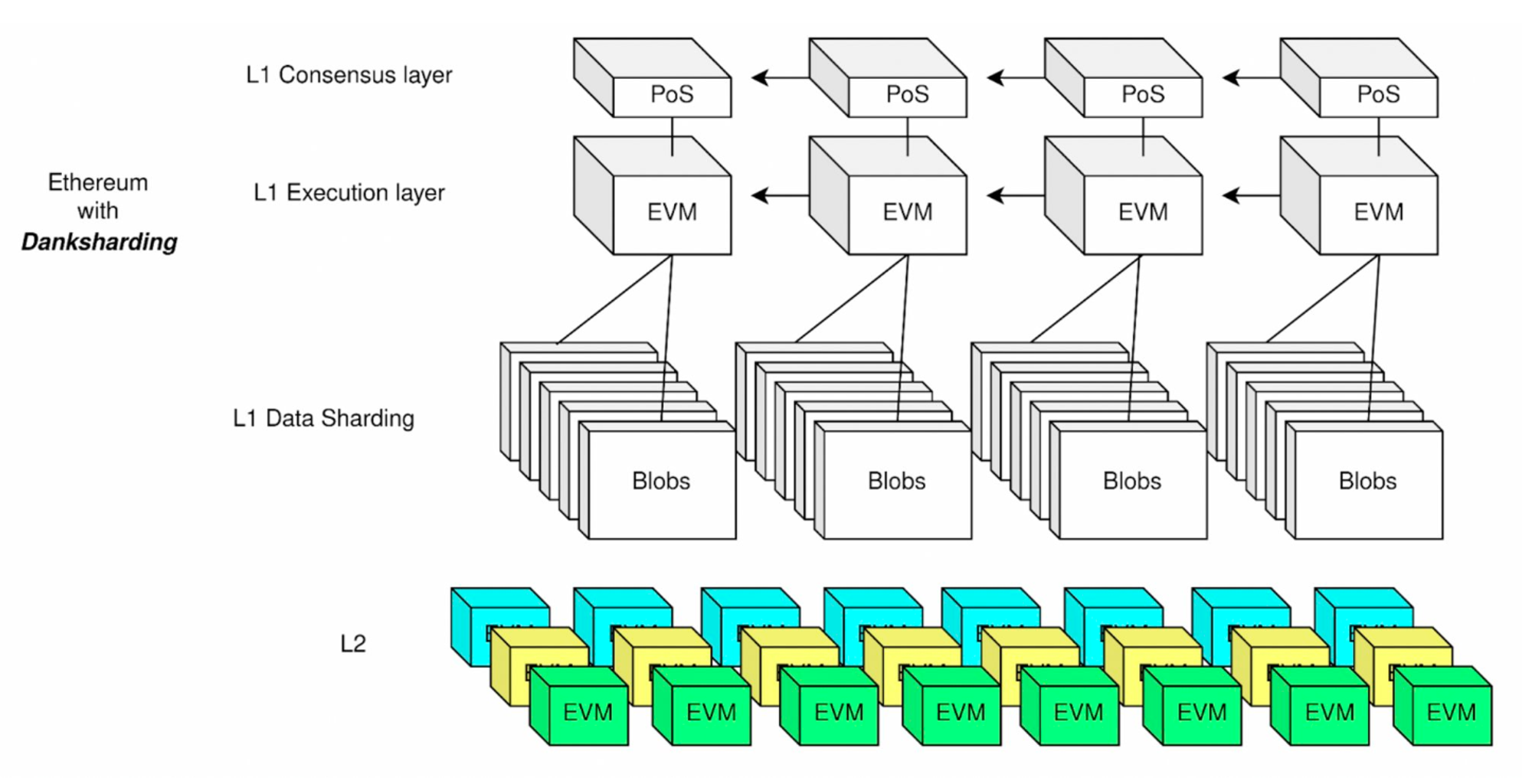

Compared to traditional sharding approaches, Danksharding offers a simpler scalability path. The imminent Dencun upgrade will introduce Proto-Danksharding, bringing blobs into block space to optimize data availability costs and improve L2 scalability. This marks the first step toward full Danksharding, laying the groundwork for future advancements such as proposer-builder separation and data availability sampling (DAS).

Core Mechanics of the Cancun Upgrade

Proto-Danksharding

Proto-Danksharding, also known as EIP-4844, is the most critical component of the Dencun upgrade. The name combines contributions from two researchers: Proto Lambda and Dankrad Feist. Proto-Danksharding reduces L2 costs and improves performance by introducing a new data structure called "blob."

Blob-Carrying Transaction Type:

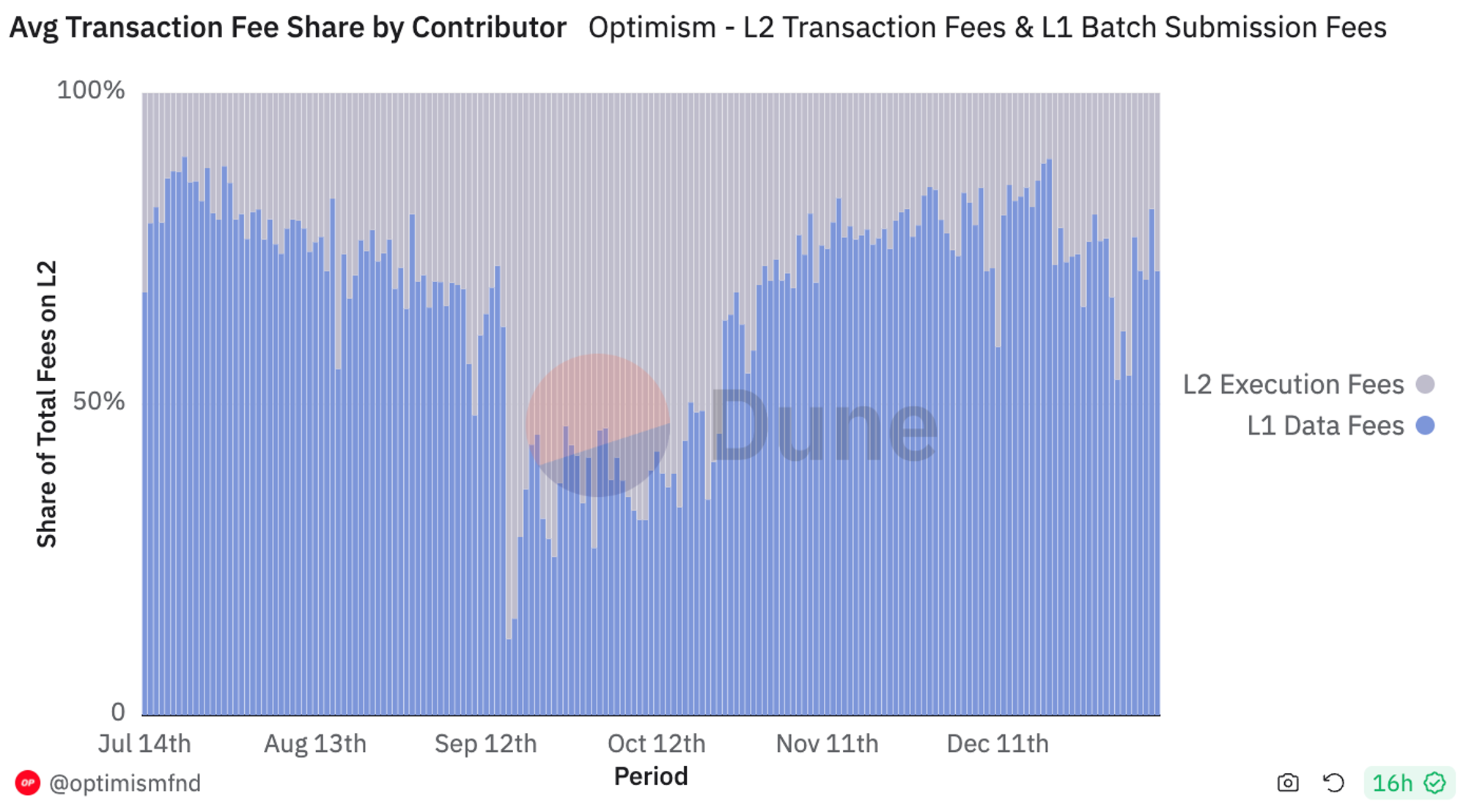

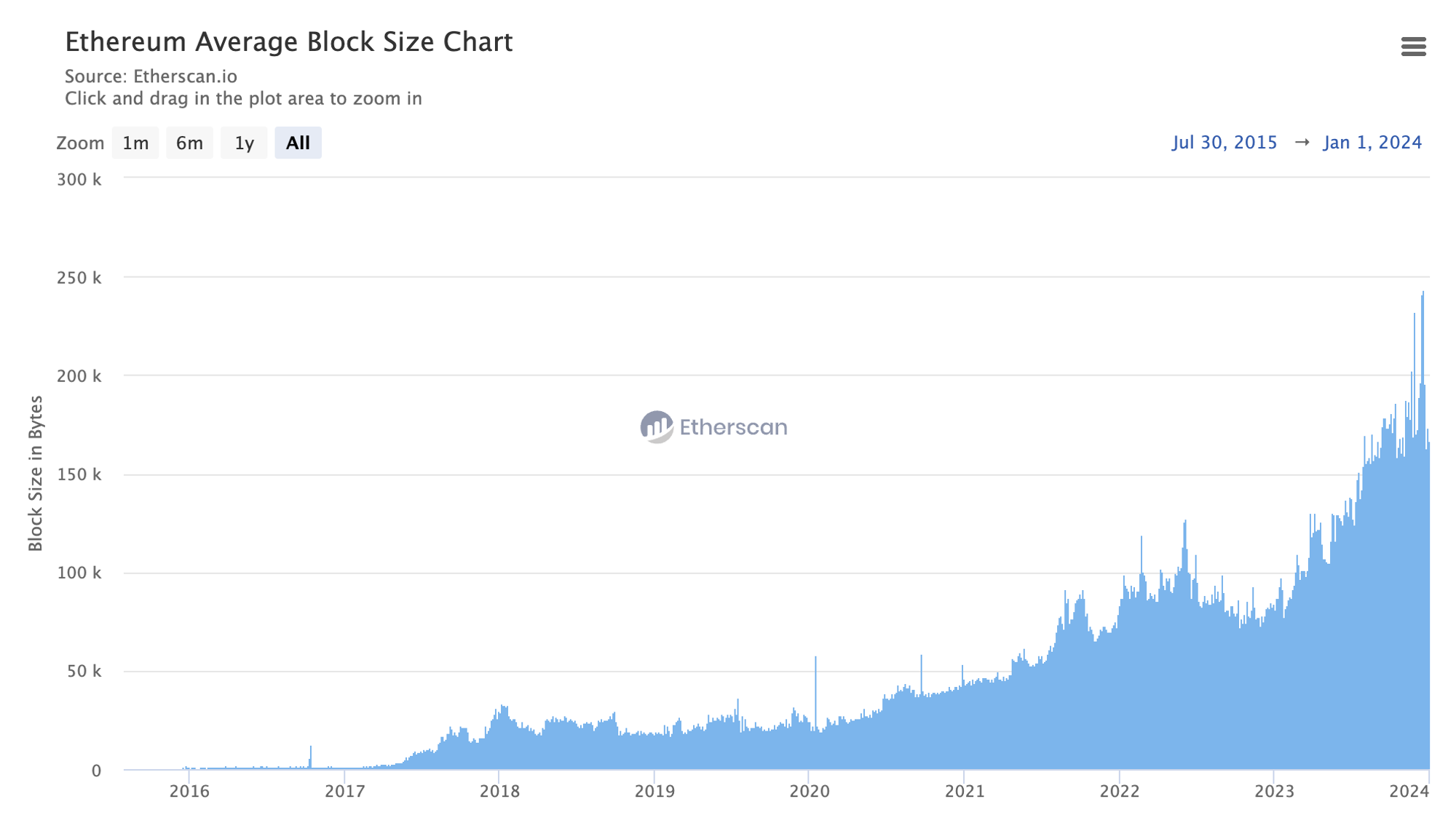

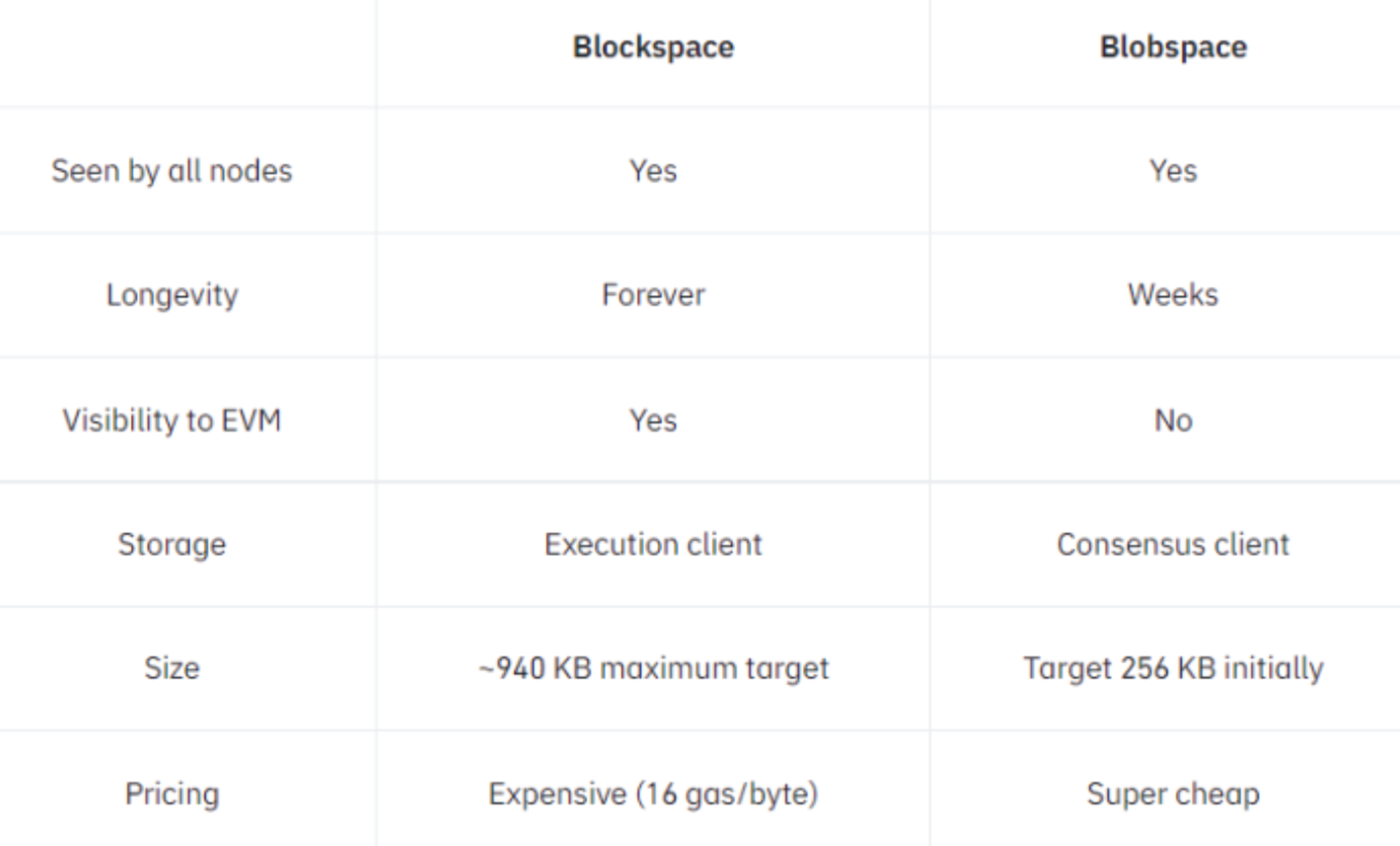

Previously, all Ethereum L2 transactions were stored in L1 calldata. Calldata is inherently limited in size, and all data within it is permanently stored and processed by Ethereum nodes, leading to high data availability costs. However, L2 transaction data does not need permanent storage—only temporary retention sufficient for fraud proof verification. Effectively, L2s lacked an appropriate storage solution. Data shows that 80% of L2 transaction costs and gas fees stem directly from expensive calldata storage.

Proto-Danksharding introduces a new data structure—blob—into Ethereum blocks, specifically designed to store transaction data submitted by L2s to L1.

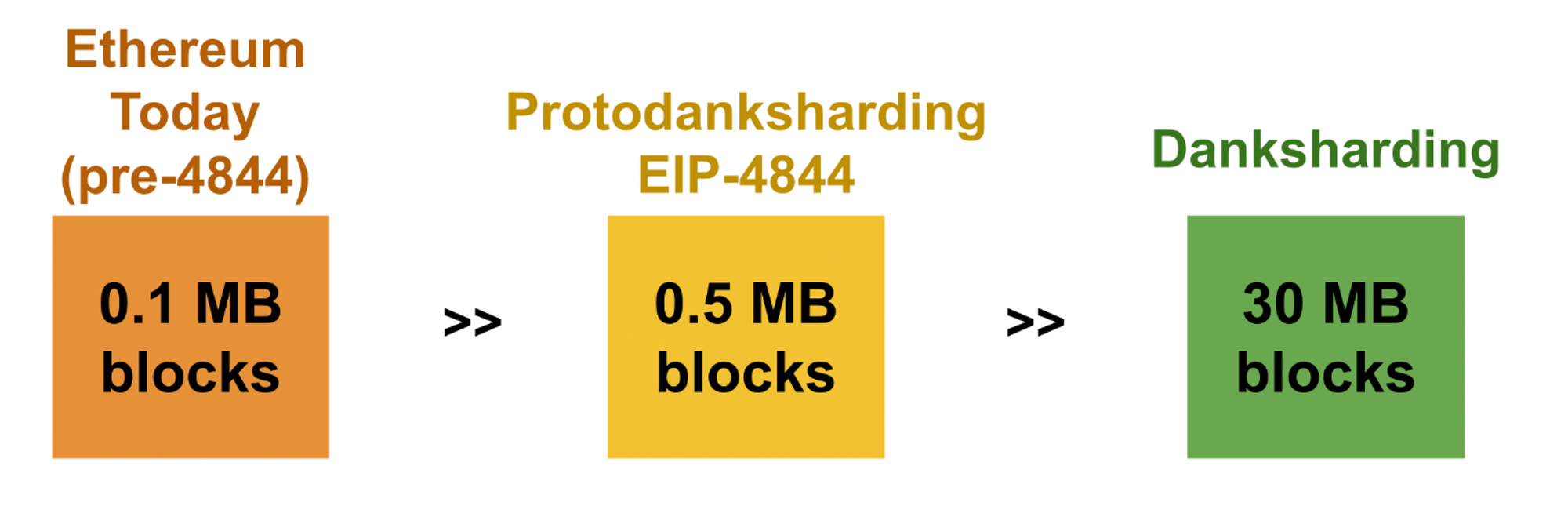

Each blob introduced by Proto-Danksharding is 128 KB in size, with plans to include 3–6 blobs per Ethereum block (0.375 MB – 0.75 MB), eventually scaling up to 64 blobs.

Each blob introduced by Proto-Danksharding is 128 KB in size, with plans to include 3–6 blobs per Ethereum block (0.375 MB – 0.75 MB), eventually scaling up to 64 blobs.

In comparison, current Ethereum blocks can hold less than 200KB of data. With blobs, available block space will increase dramatically.

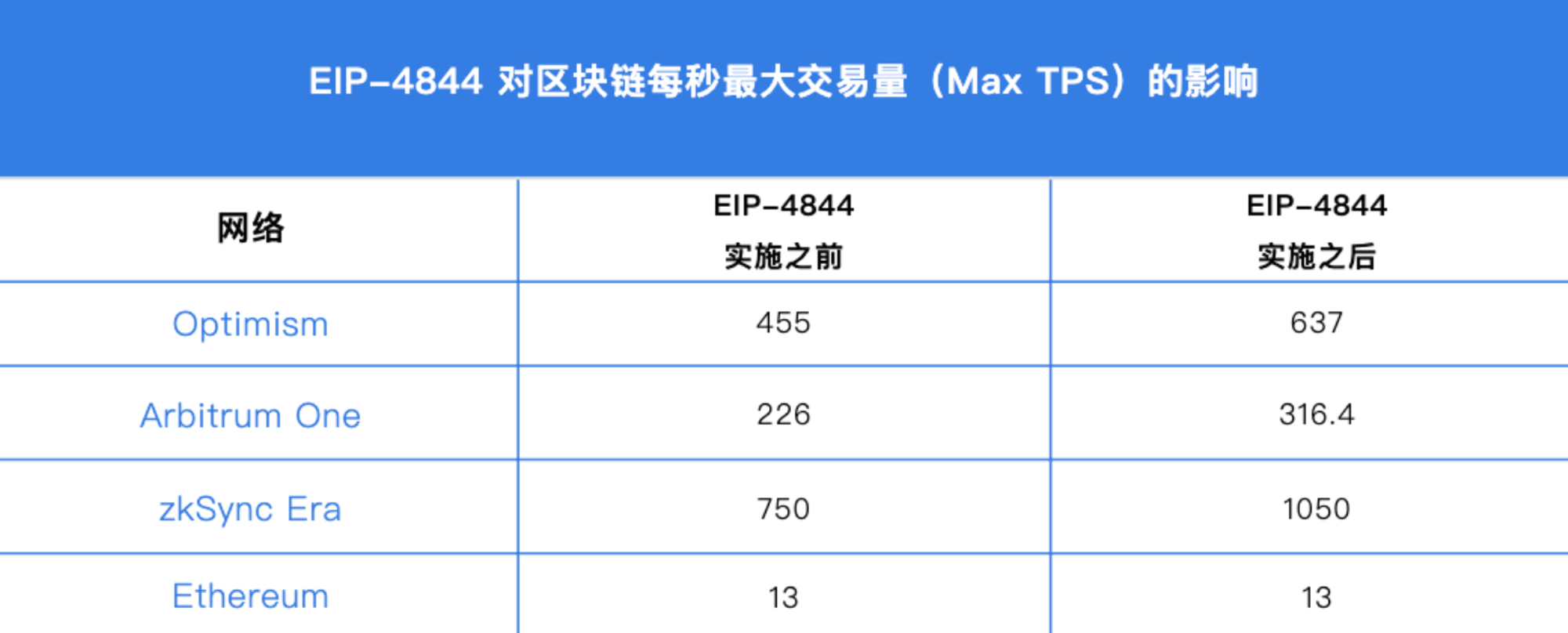

With blobs, L2 transaction data no longer competes for scarce calldata space but instead gets stored directly in blobs. Furthermore, blob data is automatically deleted after about one month, reducing unnecessary long-term storage burdens. This means L2 transaction fees could drop drastically (~90% reduction), and since blobs effectively expand block space for L2s, their transaction throughput will rise significantly. If Dencun successfully averages three blobs per block post-upgrade, L2 throughput could nearly double. If the target of 64 blobs per block is achieved, throughput could increase nearly 40-fold.

Additionally, blobs come with their own fee market. Proto-Danksharding introduces a new type of gas called "blob gas." Rooted in the existing EIP-1559 mechanism, blob gas allows blob space to be priced independently based on demand. This means the blob fee market operates separately from base fee markets, enhancing flexibility and efficiency in resource allocation. Blob storage costs approximately one data gas per byte, whereas calldata costs 16 data gas per byte—making blob storage far cheaper.

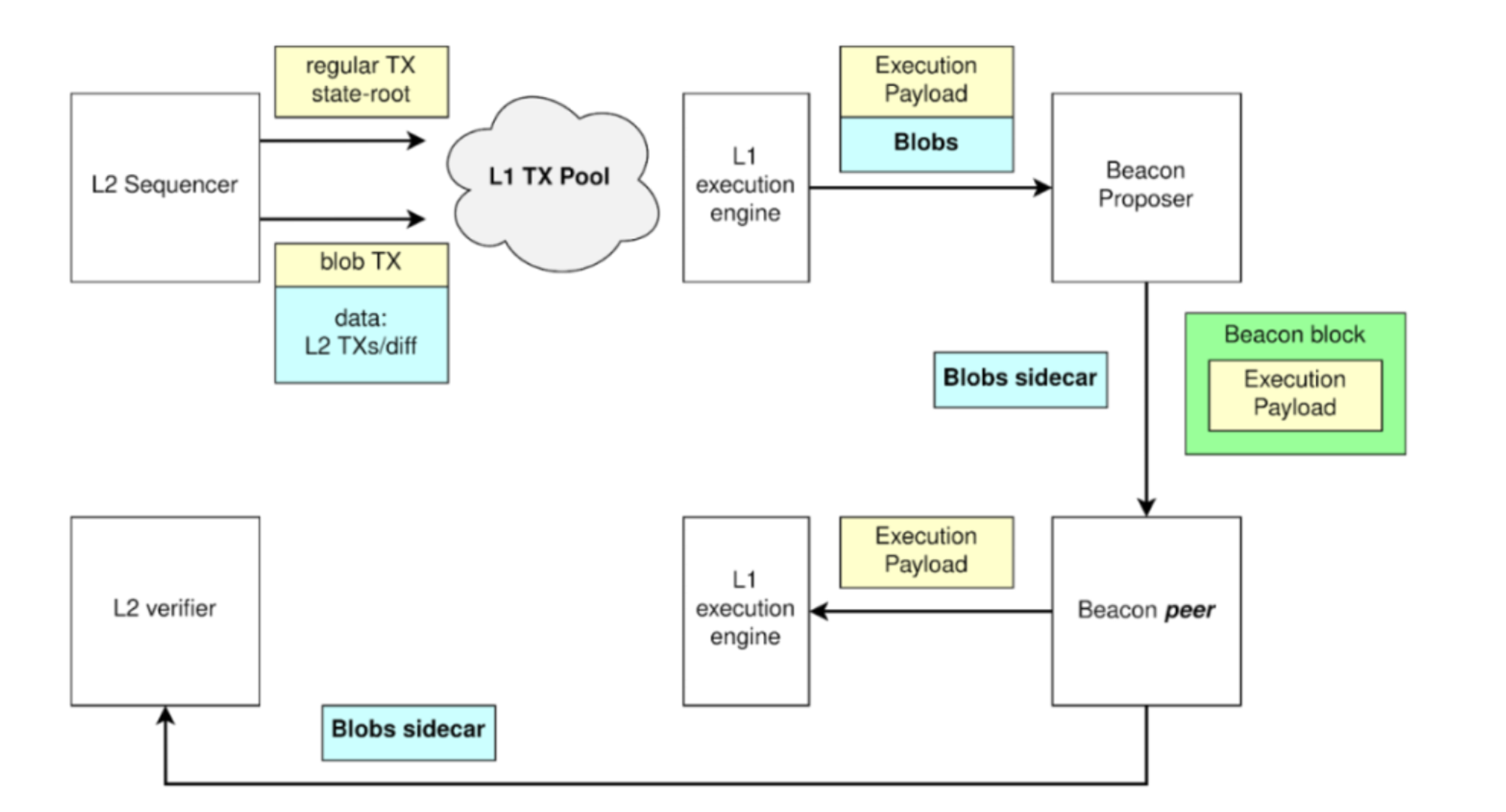

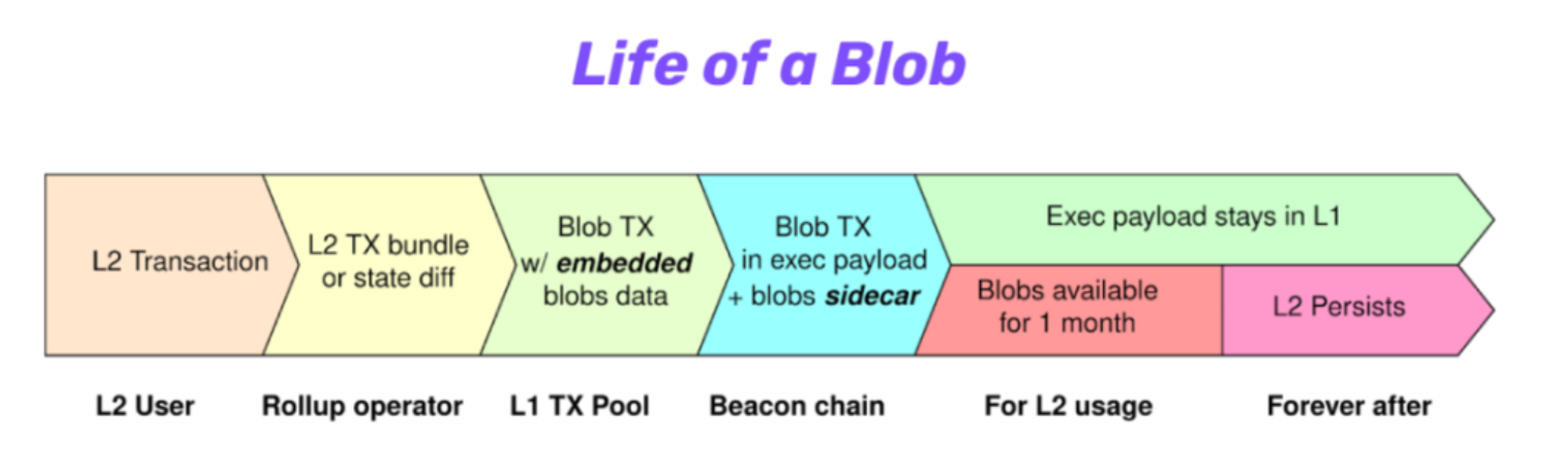

After blob integration, the operational flow between L1 and L2 networks will change. First, L2s must publish commitments to their transaction data on-chain. Then, they submit the actual data to blobs. Nodes verify that these commitments are valid and confirm data availability. Consensus layer nodes attest that they’ve seen the data and verified its propagation across the network. After roughly one month, nodes delete blob data, which may then be archived in external DA layers.

Source: OP in Paris: OP Lab's Protolambda walks us through EIP-4844

KZG Commitments

EIP-4844 also introduces the KZG (Kate-Zaverucha-Goldberg) commitment scheme as part of blob validation and proof generation. KZG is a polynomial commitment scheme allowing a prover to commit to a polynomial using a short cryptographic string, enabling verifiers to efficiently check claims without reading the full data. Simply put, KZG simplifies large-scale data verification into checks over compact cryptographic proofs.

Data blocks can be represented as polynomials and paired with polynomial commitment schemes to generate commitments. These commitments allow efficient verification of specific properties of a data blob without downloading or parsing its entire content. The implementation of KZG paves the way for Data Availability Sampling (DAS) in future Danksharding upgrades. With DAS, validators can verify a blob’s integrity and availability by sampling small portions rather than downloading the whole blob—greatly improving efficiency and scalability.

Other EIP Upgrades:

In addition to EIP-4844, the Dencun upgrade includes four other key EIPs:

-

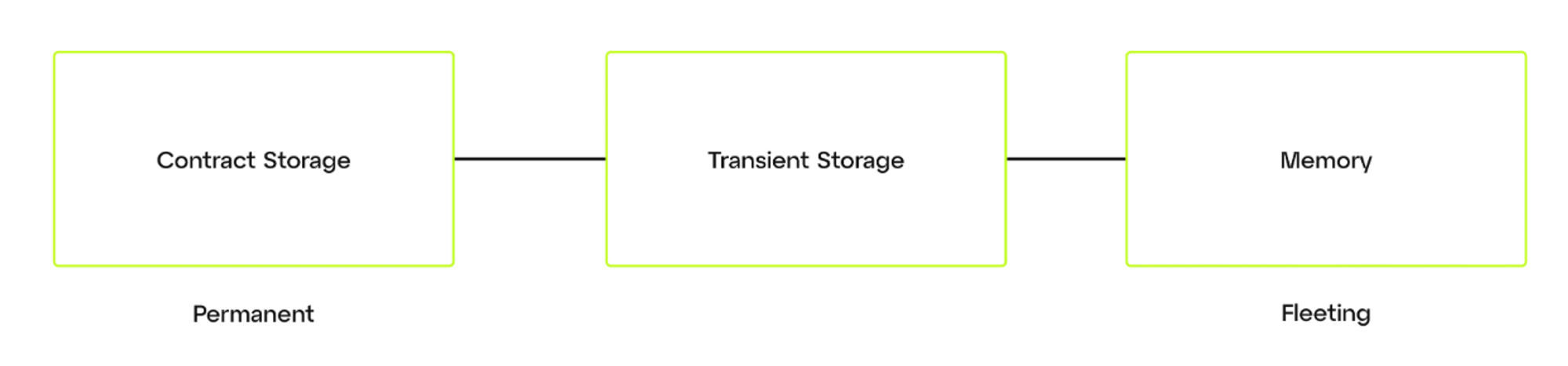

EIP-1153: Introduces a new storage state called "transient storage." Previously, all storage on Ethereum was permanent, consuming block space and requiring gas. For ephemeral data—such as values only needed during a single transaction—permanent storage is wasteful. EIP-1153 adds transient storage opcodes, allowing smart contracts to use temporary data. Once a transaction completes, this data is automatically cleared, reducing overall storage costs and gas consumption on Ethereum.

-

EIP-4788: Brings beacon block roots into every EVM block. Previously, Ethereum’s two core components—the EVM and the Beacon Chain—operated independently, unable to communicate directly. The EVM couldn’t access consensus-layer data natively and relied on external trusted oracles. EIP-4788 acts like a protocol-level oracle, relaying consensus state to the execution layer. It introduces a new field in the execution block header: “parent_beacon_block_root.” The EVM can derive consensus layer data directly from this field. Parent beacon block roots are stored in a circular buffer retained for about one day. When new entries arrive and the buffer reaches capacity, the oldest entries are overwritten, ensuring efficient and bounded consensus storage. EIP-4788 enables trust-minimized access to consensus-layer data, eliminating reliance on external oracles and reducing risks of oracle failure or manipulation.

-

EIP-5656: Introduces a new EVM opcode called MCOPY, designed to optimize memory copying during smart contract execution. Previously, developers used MLOAD and MSTORE together for memory copying—a cumbersome process. MCOPY consolidates these functions, filling a gap in EVM capabilities. Using MCOPY reduces the cost of copying 256 bytes of memory from 96 gas down to just 27 gas. This improvement makes memory operations faster, cheaper, and more efficient, enabling better optimization of memory-intensive smart contracts.

-

EIP-6780: Restricts the functionality of the SELFDESTRUCT opcode. By limiting self-destruct behavior, Ethereum can better manage state bloat, contributing to a more stable and predictable blockchain. This is crucial for long-term scalability and simplifies future upgrades.

Current Status of the Cancun Upgrade

December 19 Shadowfork Test Report

According to the Shadowfork test report released on December 19, the Ethereum Cancun upgrade tests have gone smoothly. The Ethereum Foundation plans to continue intensive testing via repeated Shadowfork forks over the next two weeks. Goerli, Sepolia, and Holesky testnets are scheduled for upgrades on January 17, January 30, and February 7 respectively. If testnet performance remains stable, the mainnet Cancun upgrade is expected to be completed within February.

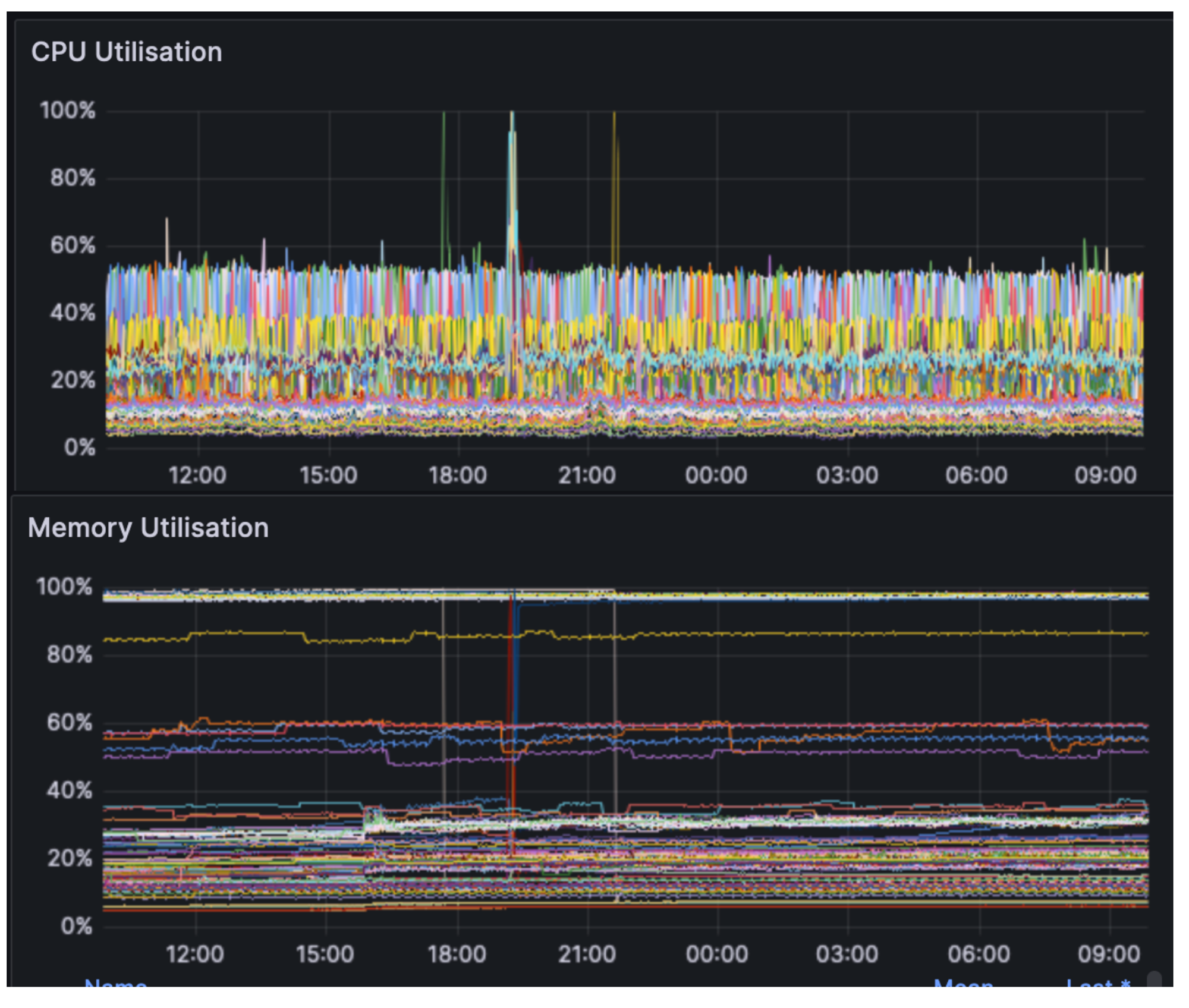

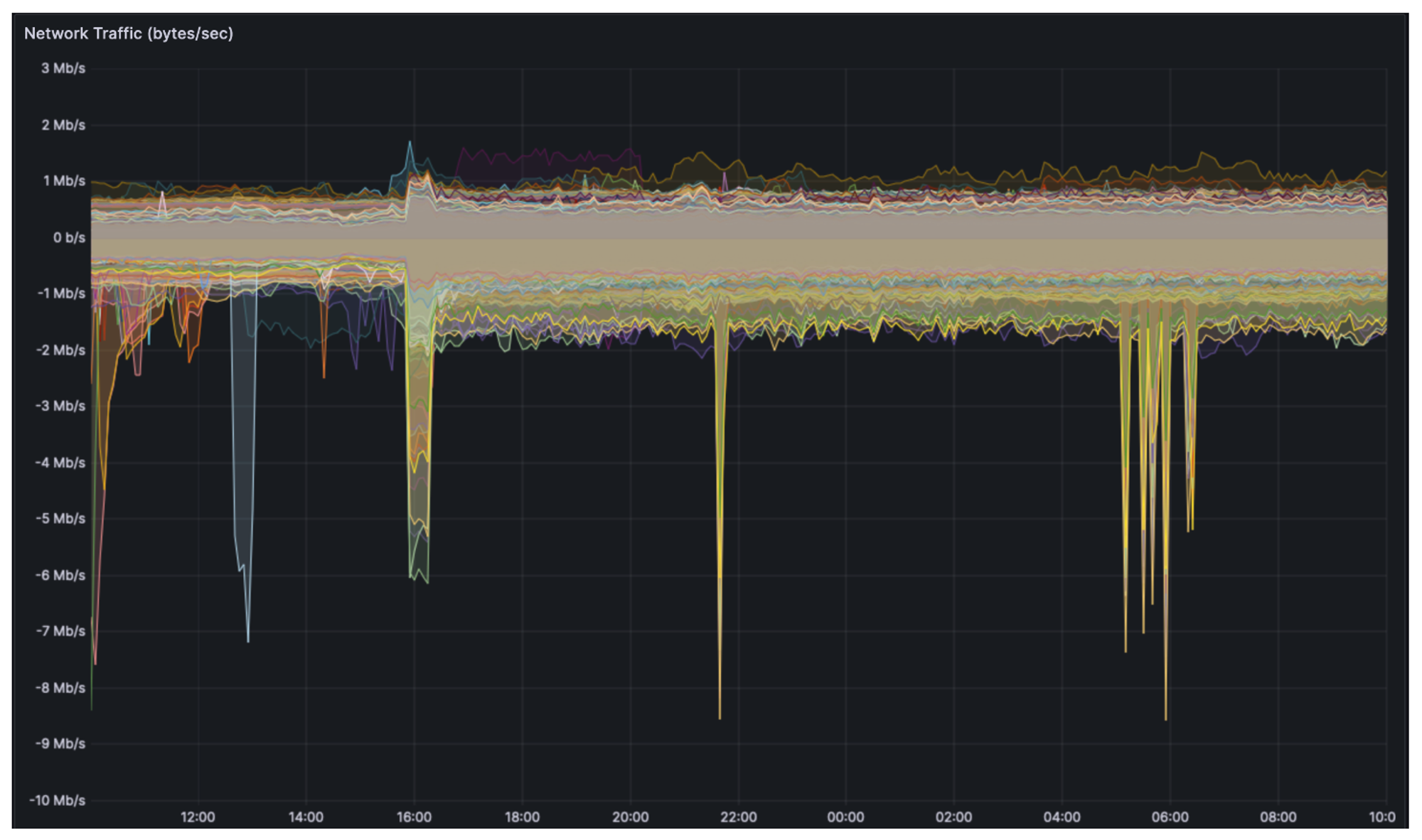

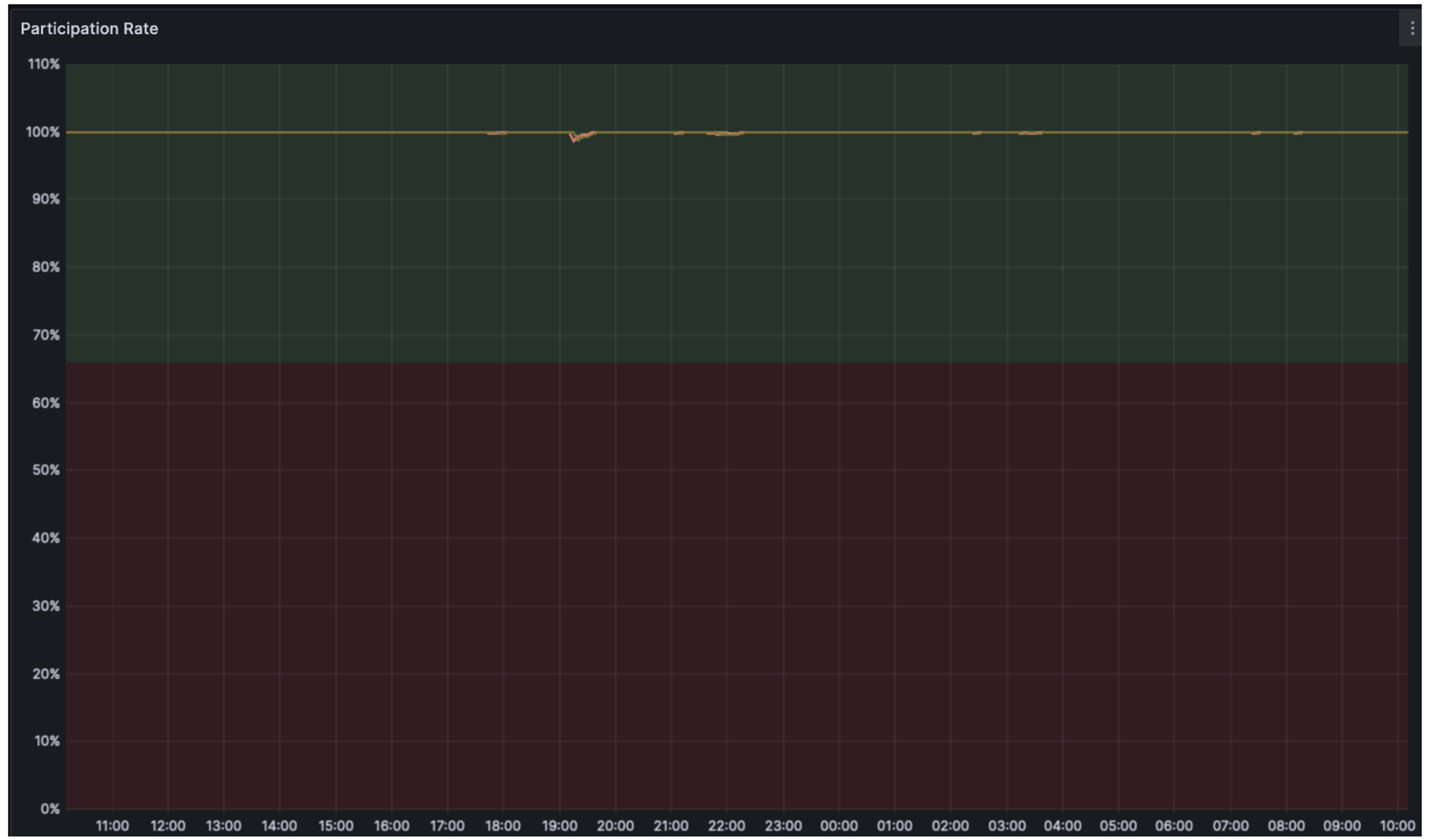

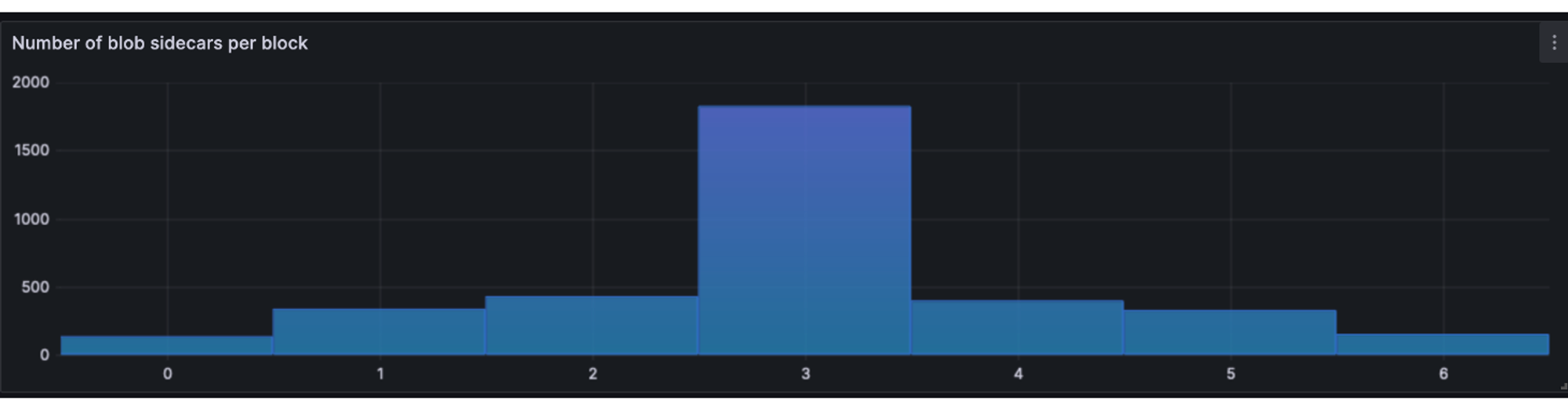

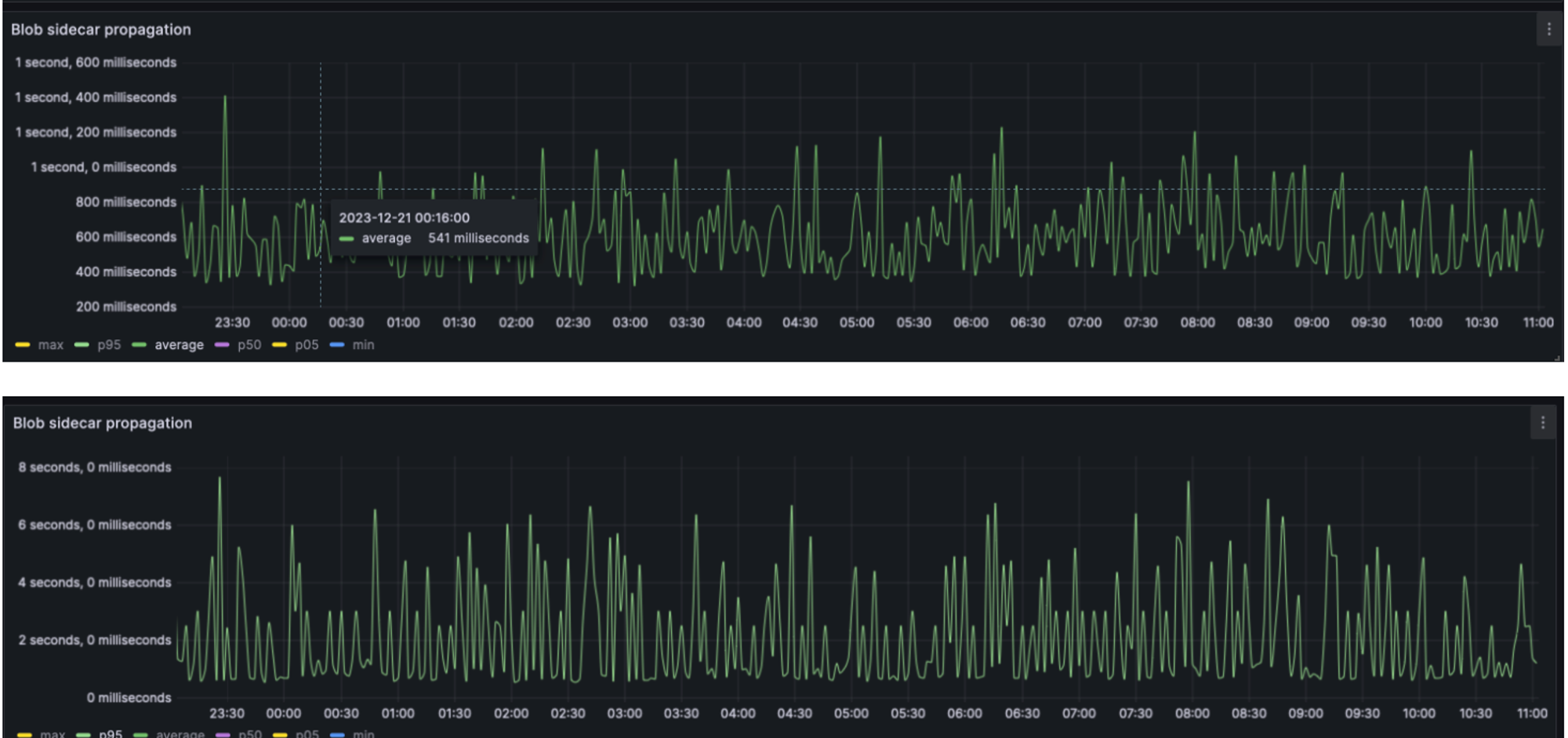

From the Shadowfork test results, node resource usage, overall network utilization, health metrics, and blob distribution and propagation all met expectations.

In terms of CPU and RAM usage, there were no significant fluctuations before and after the Cancun fork—resources remained stable overall.

Network usage increased as expected after the Shadowfork upgrade. With healthy blob usage, network bandwidth is projected to increase by approximately 200 kbps.

Throughout testing, the network remained stable—with no client crashes and smooth operation across all clients.

During testing, most blocks contained 3 blobs, aligning with the target number.

Blobs propagated to 95% of nodes in under 2 seconds, with most spreading fully across the network within 500 milliseconds. Ideally, block propagation time is expected to increase by about 250 milliseconds.

January 4 Conference Call

On the evening of January 4, the 178th Ethereum core developer execution call was held online. During the meeting, the timeline for Dencun upgrades on testnets was finalized. Developers unanimously agreed to conduct upgrades on Goerli, Sepolia, and Holesky testnets on January 17, January 30, and February 7, respectively.

To quickly address any issues arising during testnet upgrades, developers decided to convene the 179th meeting the day after the Goerli testnet upgrade on January 17, to review results and determine whether the test schedule needs adjustment.

Although no final decision was made on the mainnet upgrade date, based on current Shadowfork test data, testnet schedules, and development momentum, the Ethereum mainnet Dencun upgrade is very likely to occur by the end of February.

Potential Opportunities and Benefiting Sectors

Layer 2 (L2)

One of the most direct beneficiaries of the Dencun upgrade is the L2 sector. The introduction of blobs significantly lowers transaction fees and moderately increases throughput. Dencun empowers L2s to compete more effectively against alternative Layer 1 chains by offering lower costs and superior performance, attracting high-quality projects and users from other ecosystems.

While the Dencun upgrade benefits all Ethereum-based L2s broadly, we should focus on identifying those with unique competitive advantages that can capture disproportionate value from the upgrade.

L2 Ecosystem

Arbitrum

Currently, Arbitrum and Optimism lead the Ethereum L2 landscape, though their strengths differ slightly. Arbitrum leads in diversity of protocols built on Arbitrum One, while Optimism excels in inter-chain ecosystem diversity via the OP Stack.

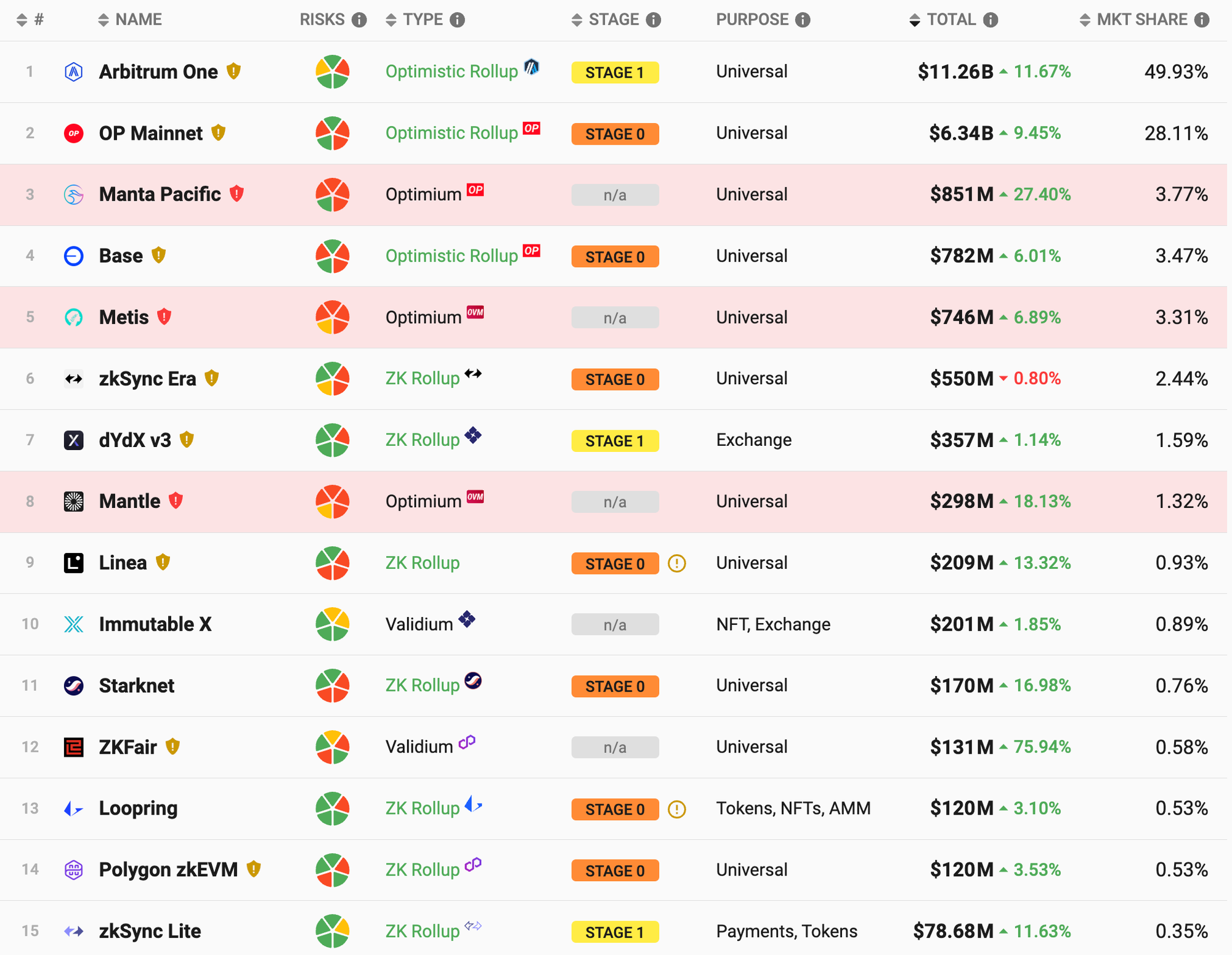

Arbitrum remains the most diverse L2 in terms of supported protocols. According to incomplete data from DeFiLlama, Arbitrum hosts around 520 protocols—far exceeding Optimism’s 216. According to L2beat, Arbitrum’s TVL stands at approximately $11.26 billion, capturing nearly half of all Ethereum rollup TVL.

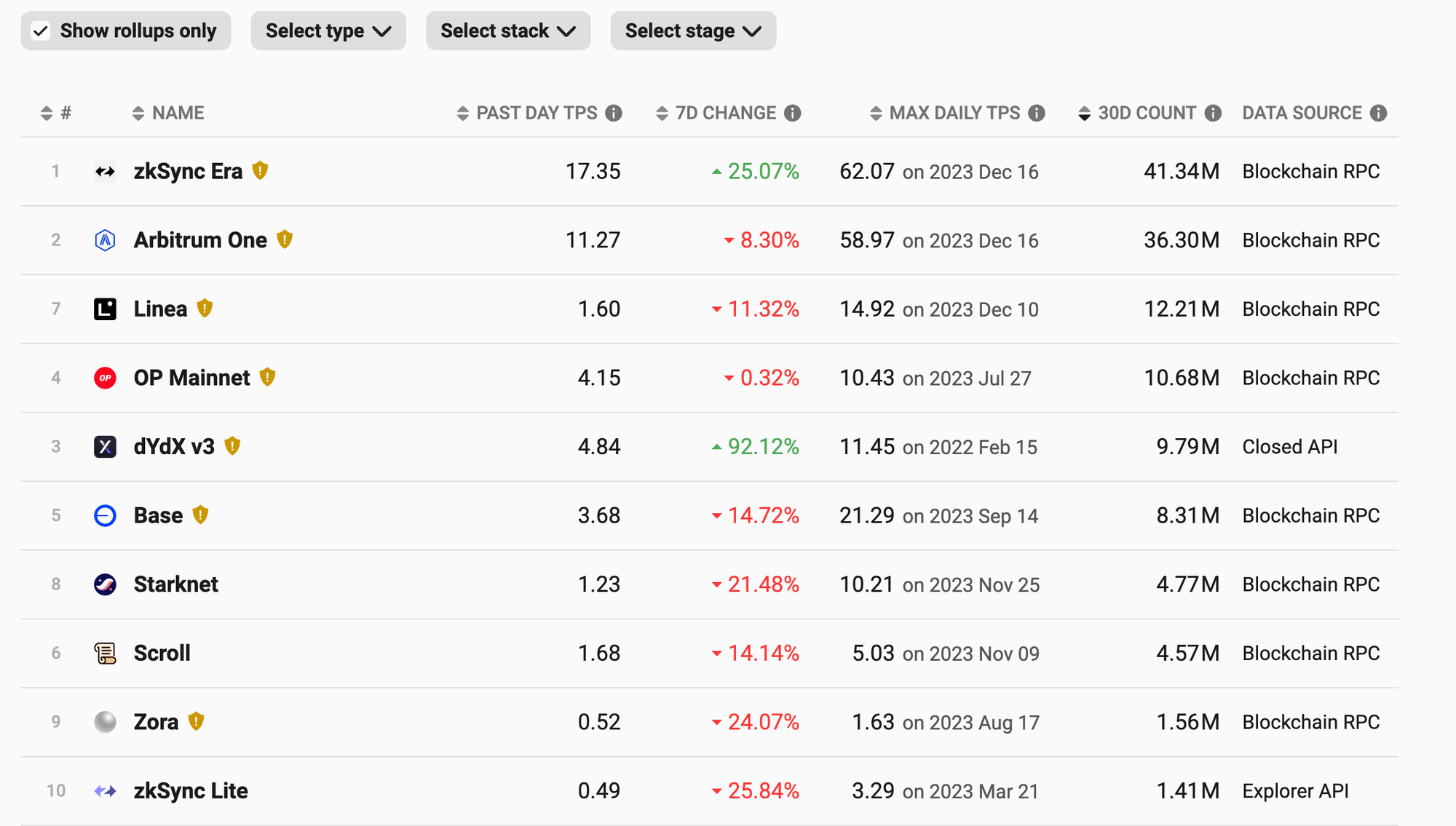

Moreover, on-chain activity on Arbitrum is thriving. Over the past 30 days, Arbitrum recorded about 36 million transactions—second only to zkSync, which still attracts massive farming activity due to pending token emissions. Excluding airdrop-driven interactions and comparing only launched tokens, Arbitrum leads Optimism by a factor of three in transaction volume.

Overall, Arbitrum—with the highest transaction volume—stands to gain the most from reduced transaction fees. Improved TPS will also benefit performance-sensitive protocols like GMX and GNS. From a fundamental network perspective, Arbitrum is clearly one of the biggest winners of the Dencun upgrade. Additionally, Arbitrum is actively promoting Arbitrum Orbit and Stylus language, enabling developers to build Rollups using both EVM and WASM VMs, strengthening its network effects.

Optimism

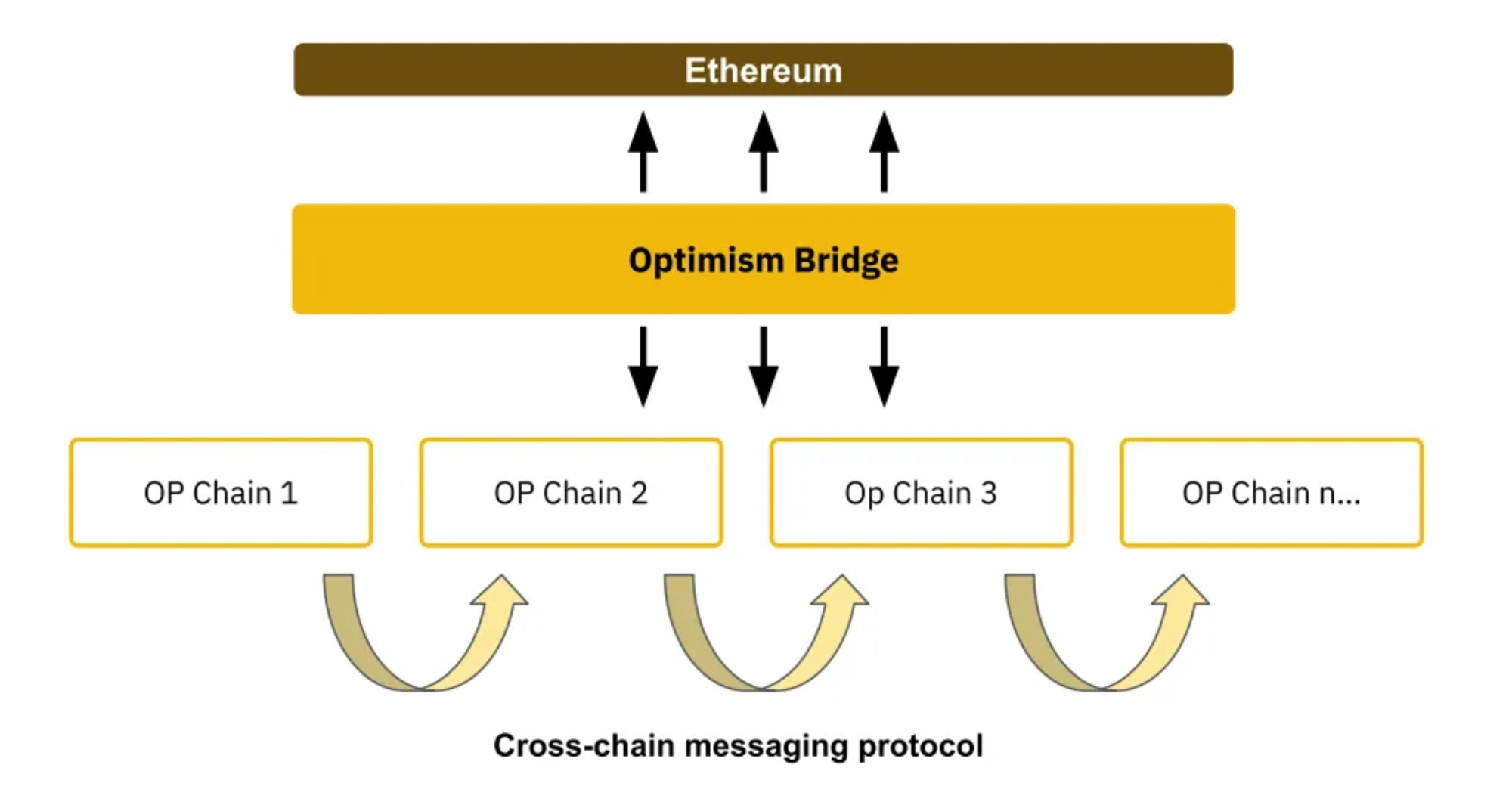

Unlike Arbitrum, Optimism focuses heavily on building the Optimism SuperChain network based on the OP Stack. Its value increasingly depends on the aggregate network effect of the SuperChain.

Since the release of the OP Stack, numerous projects—including Base, Lyra, opBNB, Redstone, Zora, Mode, and DeBank—have built their own L2s using it. The Bedrock upgrade further optimized transaction costs, intra-block processing, and node performance, making OP Stack even more attractive. Under the Optimism SuperChain vision, all OP Stack-based Rollups will become standardized OP chains. These chains will communicate directly via cross-chain messaging protocols, sharing a common Ethereum bridge and sequencer network.

If the Dencun upgrade benefits all L2s equally, Optimism gains additional upside through the combined network value of all OP Stack chains. If Dencun spurs the creation of new L2s, Optimism stands to benefit further if more teams adopt the OP Stack—bringing it closer to realizing the SuperChain vision.

Sequencer Decentralization

Metis

Arbitrum and Optimism primarily compete in protocol diversity, network activity, and ecosystem strength. However, another pressing challenge is the lack of decentralization in L2 sequencers—an elephant in the room. As Dencun fuels L2 proliferation, centralized sequencers’ risks—including single points of failure, malicious MEV extraction, front-running, and transaction censorship—will grow increasingly severe.

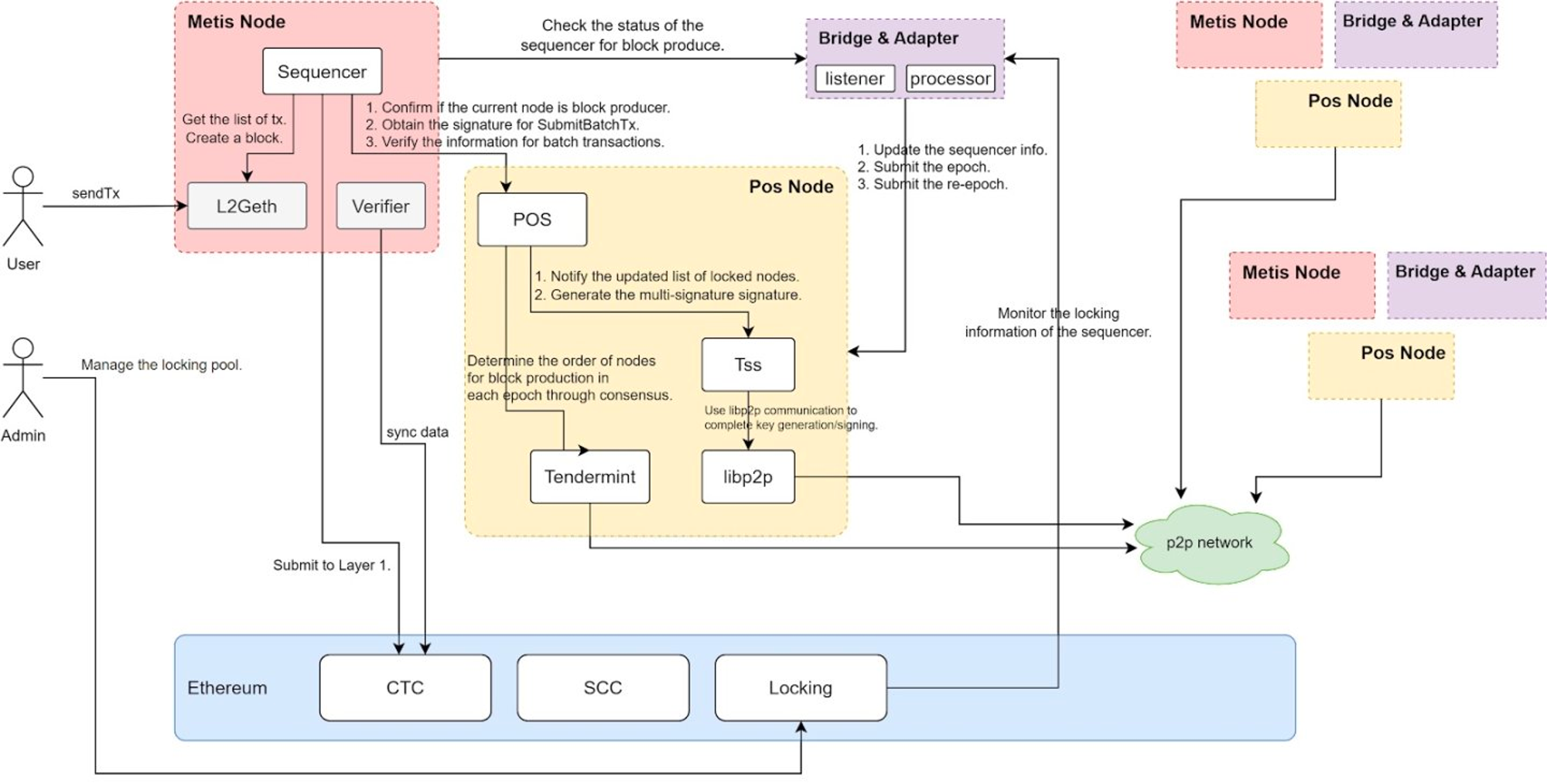

Metis has taken early action here and may become the first Ethereum L2 to run a decentralized PoS sequencer.

Metis breaks away from centralized sequencing by allowing nodes that stake at least 20,000 METIS tokens to join a sequencer pool. Sequencers in the pool determine transaction ordering and require signatures from at least 2/3 of them to submit data to L1. To further prevent malfeasance, Metis introduces verifiers who perform random sampling audits to ensure correct transaction sequencing.

Metis voluntarily shares sequencer revenue with stakers—the most lucrative part of the stack. As more staking protocols emerge, broader participation in sequencer staking and profit-sharing becomes possible. Metis’ innovations in sequencer decentralization and METIS token utility have driven higher token prices, staking rates, and capital inflows. As the Metis ecosystem grows and sequencer income rises, more METIS will be staked, reducing circulating supply and increasing market demand—fueling a positive flywheel of growing TVL, ecosystem strength, and token price.

Decentralized sequencer competition may become a defining theme among L2s post-Dencun.

Token Utility

Another key determinant of L2 token valuation is token utility. Currently, almost all Ethereum L2s use ETH as the gas token, leaving their native L2 tokens useful only for governance. Without consistent utility or burn mechanisms, these tokens remain speculative assets easily discarded. Tokens with real economic utility—like METIS—are more likely to enter a virtuous cycle of strong fundamentals and rising prices.

Beyond METIS being usable for decentralized sequencer staking and revenue sharing, another notable example is ZKF. ZkFair’s token ZKF serves both as a gas token and allows stakers to earn a share of network gas revenues. Like METIS, this dividend model promotes upward price momentum. Additionally, Arbitrum Orbit now supports custom gas tokens.

As previously noted, all OP Stack-based Rollups share a common sequencer network. Imagine if Optimism followed Metis’ lead and introduced a module allowing OP staking to participate in decentralized sequencing—this could create massive demand and buying pressure for OP. Rising token prices would attract more capital and users to ecosystem applications, reinforcing overall growth. How L2s design token utility post-Dencun will be a critical area to watch.

Others

As discussed, the Dencun upgrade’s reduction in transaction fees and increase in L2 TPS will benefit every Ethereum L2. Beyond the projects highlighted above, others are also worth watching.

Base ranks among the top-performing L2s of 2023. Its tight integration with Coinbase enables seamless onboarding of users and capital, propelling it to third place in Ethereum L2 TVL rankings. Base’s rise owes much to popular apps like Friend.tech and FrenPet. These applications feature frequent, low-reward interactions and serve large user bases—requiring high-performance infrastructure. The benefits of the Dencun upgrade align perfectly with these needs. We may see more social and gaming dApps emerge on Base, injecting fresh user activity and capital into its ecosystem.

Additionally, emerging L2s like Manta and Blast—still pre-token launch—are quietly building momentum. These chains attract early engagement through token anticipation and yield farming strategies. Dencun’s lower interaction costs will further stimulate on-chain activity. However, their post-airdrop trajectories remain uncertain, warranting cautious optimism for now.

Data Availability Layer

One of the core aspects of the Dencun upgrade is the introduction of blobs to store L2-submitted data on L1. However, blob data is not permanent—it will be deleted after about one month. Yet this data retains potential value for analytics and auditing, creating demand for decentralized storage services.

ETHStorage

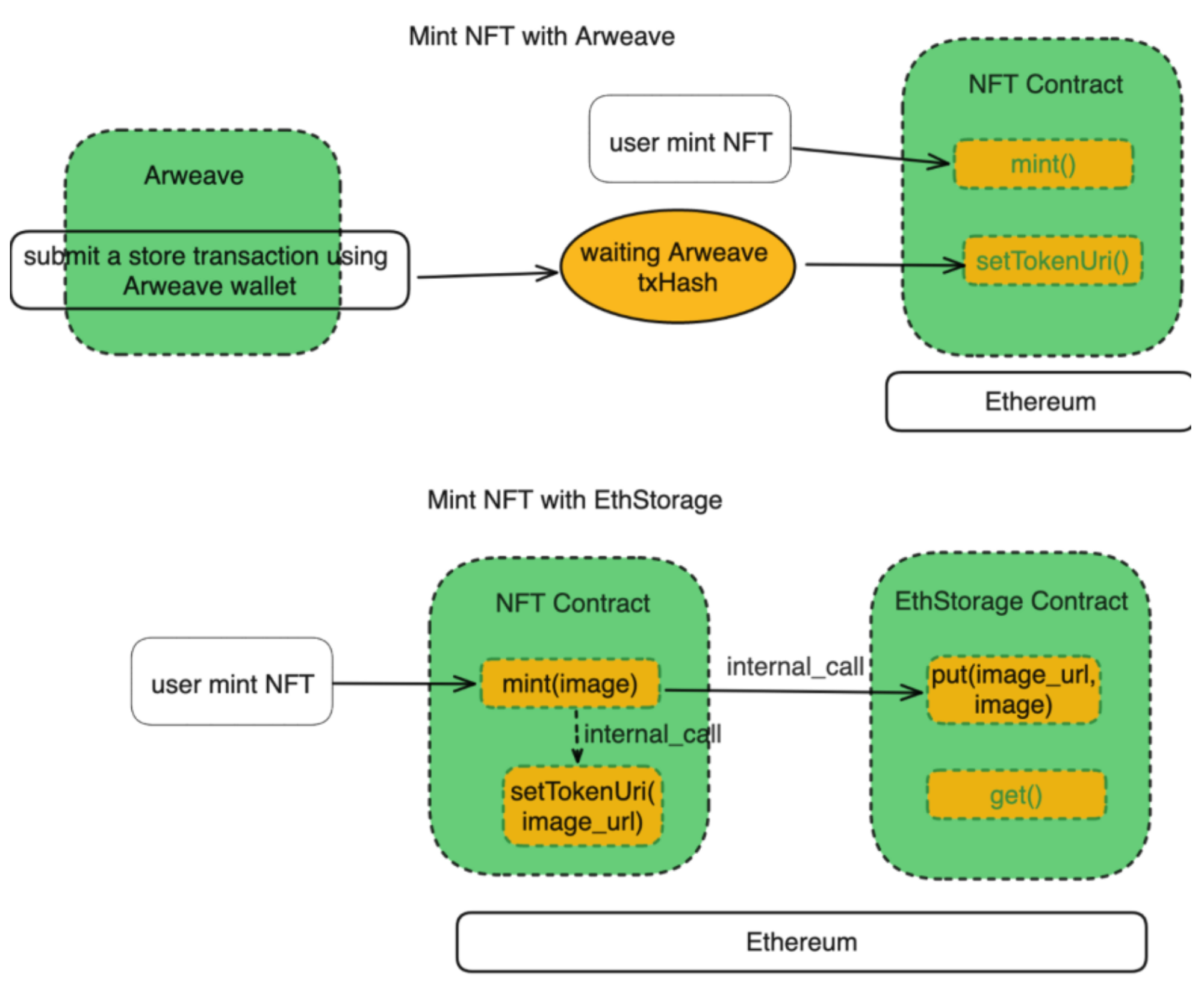

EthStorage is the first Layer 2 solution offering programmable dynamic storage built atop Ethereum’s data availability. It extends programmable storage to hundreds of terabytes or even petabytes at 1/100th to 1/1000th the cost.

EthStorage is deeply integrated with ETH. Its client is a superset of the Ethereum client Geth, meaning EthStorage nodes can simultaneously operate as Ethereum validators and data storage nodes.

Furthermore, ETHStorage offers stronger interoperability with the EVM, achieving full compatibility. For instance, minting an image stored on Arweave as an NFT on Ethereum requires three smart contract calls, while ETHStorage accomplishes it in just one.

ETHStorage uses a key-value storage paradigm supporting full CRUD operations (create, read, update, delete).

Positioned as Ethereum’s first storage-focused L2, ETHStorage’s seamless EVM interoperability and ultra-low storage costs position it well to absorb L2 state data discarded from blobs.

Covalent

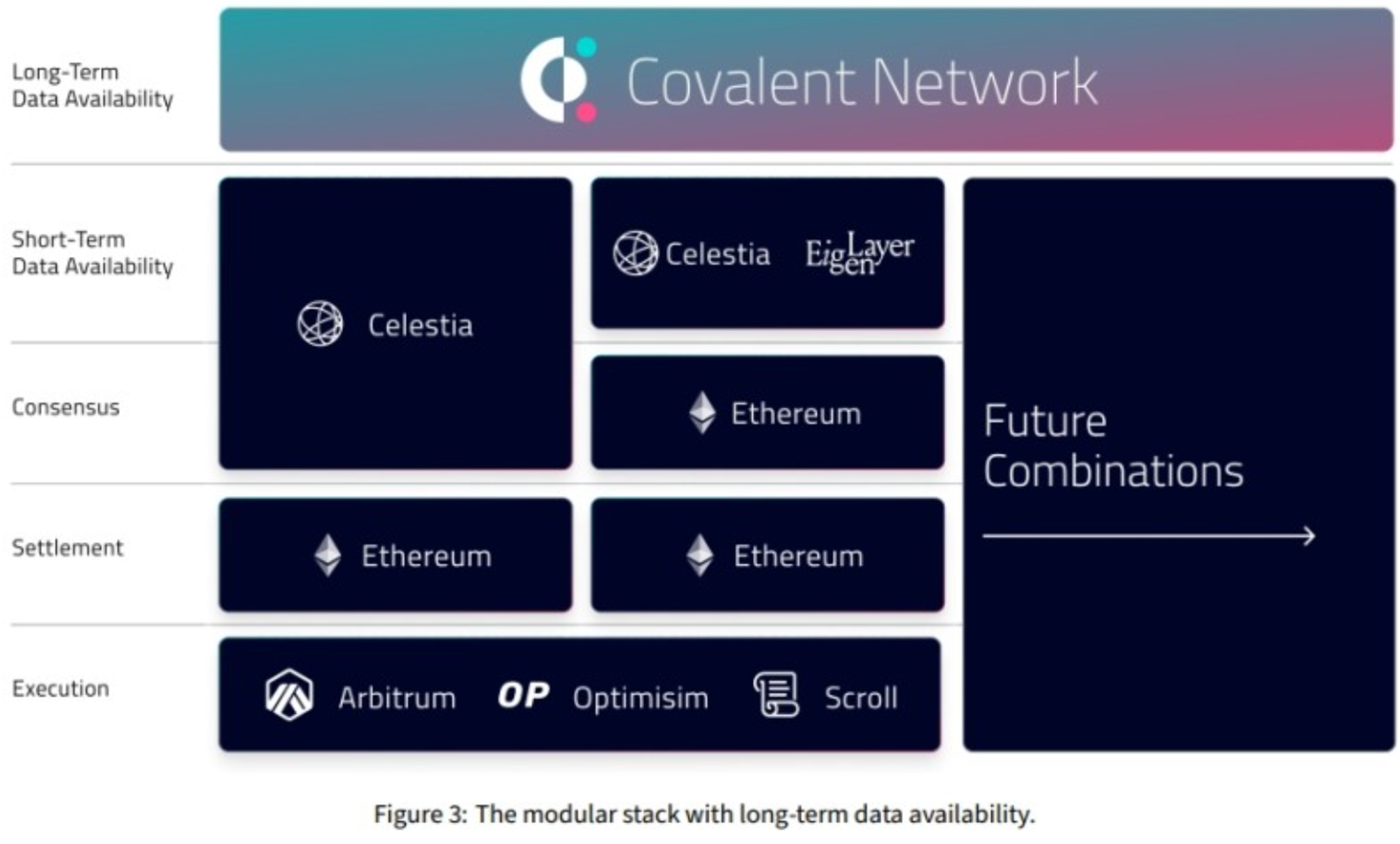

Another noteworthy decentralized storage project is Covalent. Recognizing business opportunities in post-Cancun data availability, Covalent launched the “Ethereum Wayback Machine (EWM)” in November 2023 to permanently archive L2 state data discarded from blobs.

However, merely storing data offers limited value. Therefore, Covalent goes beyond archiving by integrating blob-discarded L2 data into its existing decentralized data analytics infrastructure. It enables seamless blockchain data access, serving specialized users such as arbitrageurs, MEV researchers, AI researchers, and blockchain data platforms.

Regardless of how modular blockchain architectures evolve—with separate execution, settlement, consensus, and short-term data availability layers—Covalent aims to serve as the permanent data availability layer for all projects, providing enduring data storage and accessibility.

With the impending Cancun upgrade, the data storage and availability sector is expected to attract renewed attention. Backed by major exchanges like Binance and Coinbase, and leading investors including 1kx and Delphi Digital, Covalent—with solid fundamentals—is well-positioned to thrive amid competition.

Filecoin, Arweave, Storj, and Other Established Decentralized Storage Projects

The Cancun upgrade will also increase practical demand for established decentralized storage platforms like Filecoin, Arweave, and Storj. These projects are likely to absorb some of the L2 state data discarded from blobs. Since this data mainly serves niche audiences focused on analytics and research—and doesn’t require frequent updates—Arweave, with its one-time payment for permanent storage, may capture a larger share of this growing market.

Looking ahead, L2s may require dedicated data availability layers. In the long term, blobs might not store raw L2 data or states, but only Merkle roots of computations. This would allow Ethereum to shed extraneous data storage responsibilities and return to its core role: consensus.

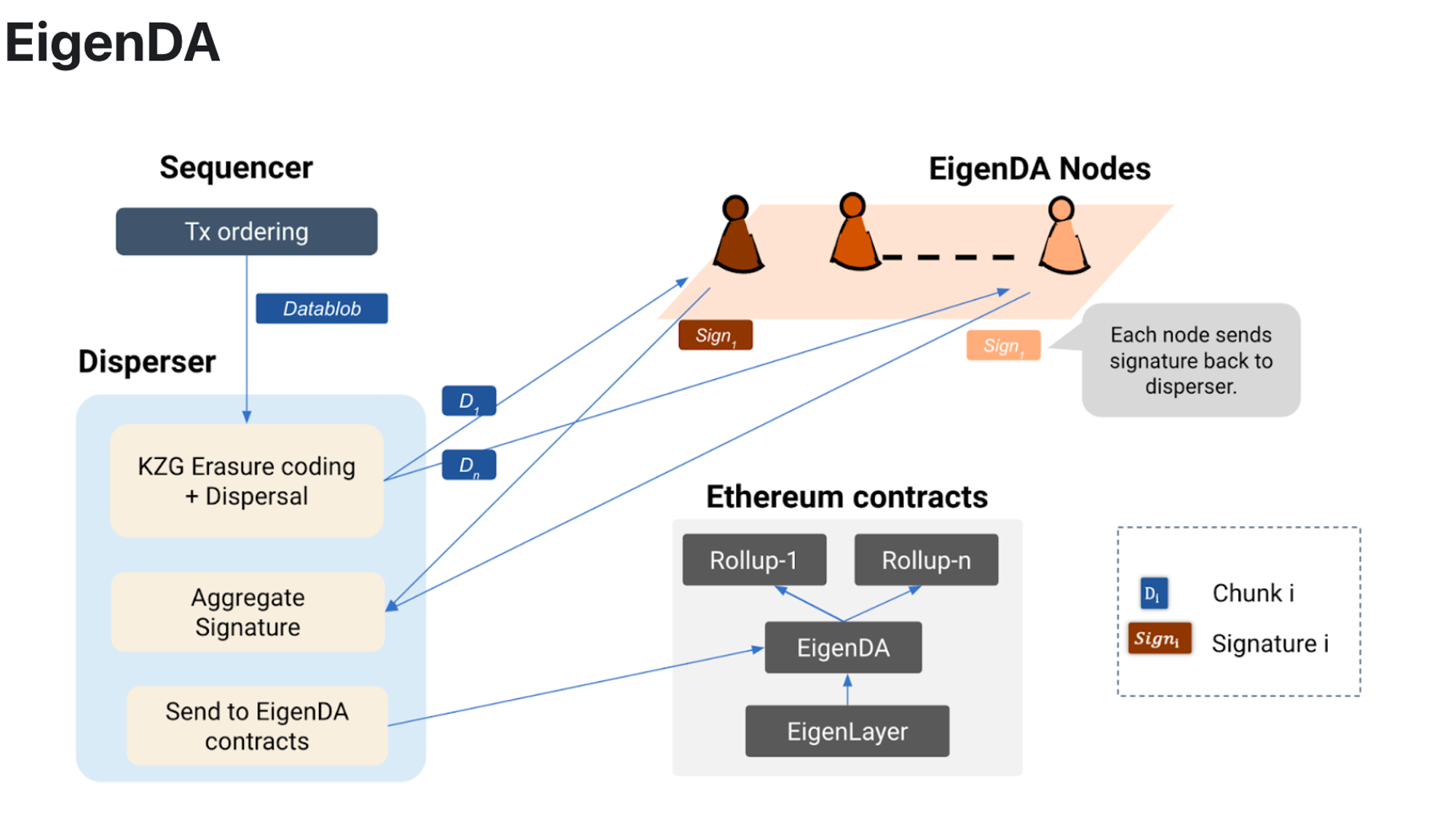

EigenDA

EigenDA is a promising DA solution that decouples data availability from consensus. First, Rollups encode data blobs using erasure coding and KZG commitments, publishing the KZG commitment. Then, EigenDA nodes—comprised of re-stakers—verify and reach consensus on the commitment. Only after consensus confirmation is the data submitted to the Ethereum mainnet. EigenDA’s core innovation lies in reusing Ethereum’s consensus layer, abstracting out the verification and finality steps of DA and outsourcing them to a shared consensus mechanism.

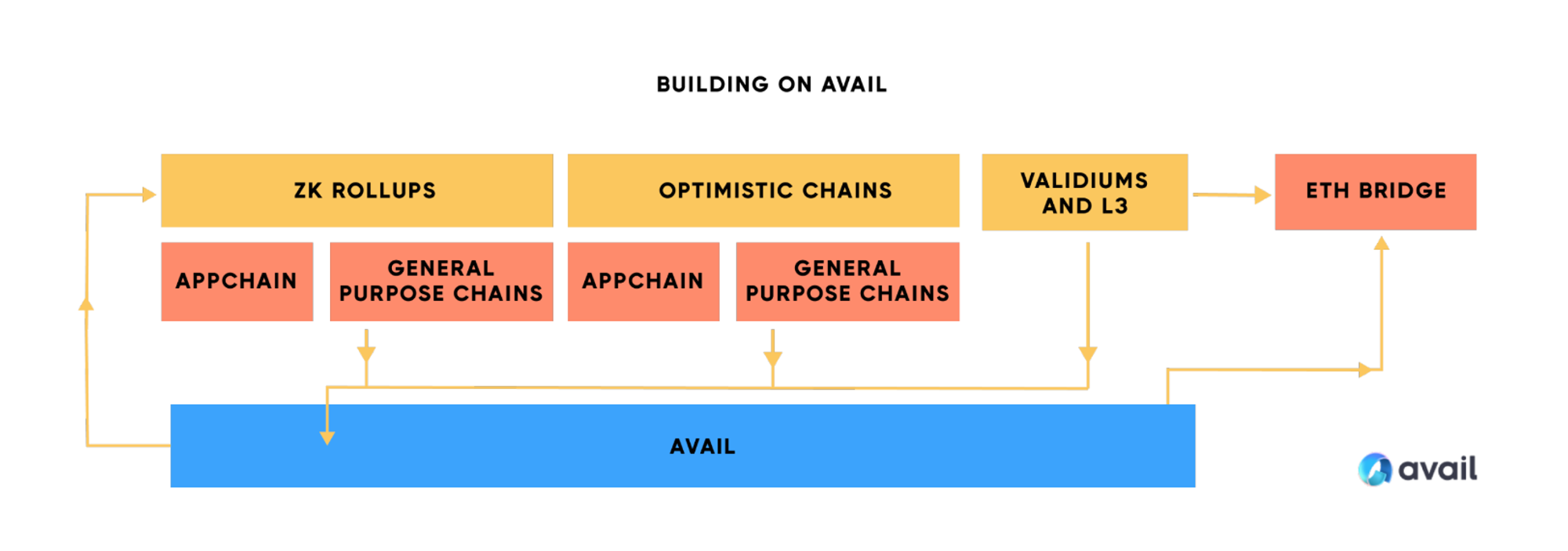

Polygon Avail

Polygon Avail is Polygon’s project focused on solving data availability in Ethereum’s scaling roadmap. Avail provides DA services for L2s, sidechains, and other scaling solutions. It supports EVM-compatible Rollups publishing data to Avail. Avail efficiently orders and records transactions, offering data storage and validity verification. For validity proofs, Avail uses KZG polynomial commitments, providing more succinct proofs than Celestia and reducing node requirements for memory, bandwidth, and storage. Designed from the outset to align with Ethereum’s scaling evolution, Avail allows developers to store data on Avail while settling on Ethereum. Amid the trend toward modular blockchains, Avail is poised to become a foundational DA provider for more EVM Rollups.

Rollup-as-a-Service (RaaS)

RaaS providers abstract away the technical complexity of blockchain construction, enabling users to deploy L2s quickly—even via no-code tools. As discussed earlier, the Cancun upgrade will spark an L2 boom. Enhanced usability and performance will accelerate the emergence of new L2s, benefiting underlying Rollup-as-a-Service infrastructure.

Among current RaaS offerings, debates persist over choosing between OP-based and ZK-based solutions. OP-based solutions offer better compatibility, richer ecosystems, and lower entry barriers. ZK-based solutions provide greater customization and higher security. While ZK solutions offer stronger differentiation and long-term advantages in functionality and performance, OP-based solutions currently excel at amplifying the cost and performance benefits brought by Dencun—quickly leveraging mature EVM tooling to achieve fast user and capital growth, delivering more immediate leverage.

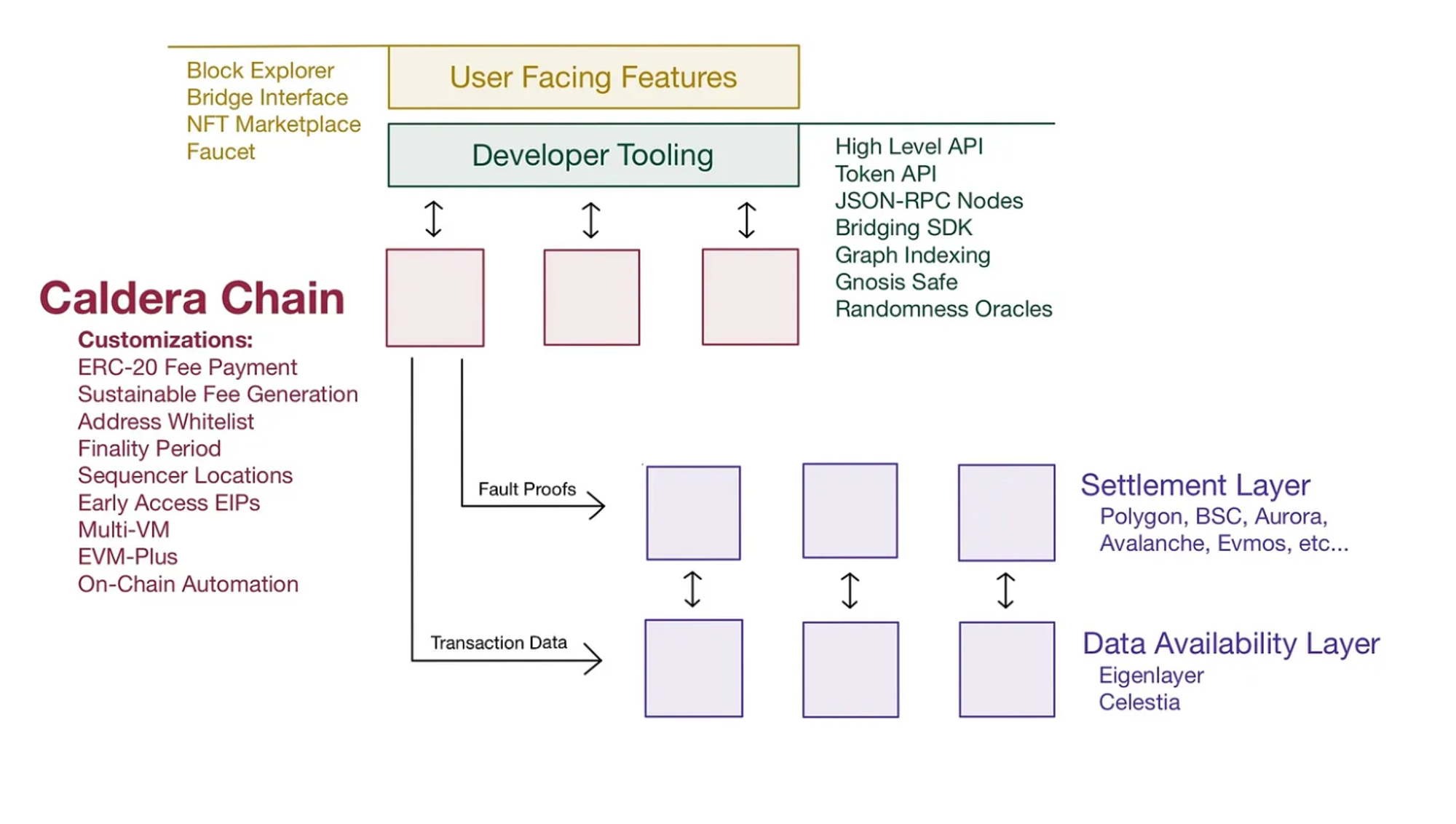

Caldera

Caldera is a RaaS provider built on the OP Stack, offering no-code deployment of Optimism L2s. Chains launched via Caldera achieve full EVM compatibility, drastically lowering developer barriers and enabling reuse of existing EVM ecosystem projects—providing robust infrastructure out of the box. Beyond the L2 itself, Caldera equips users with essential blockchain tools such as explorers and testnet faucets, further reducing deployment and usage costs—truly plug-and-play.

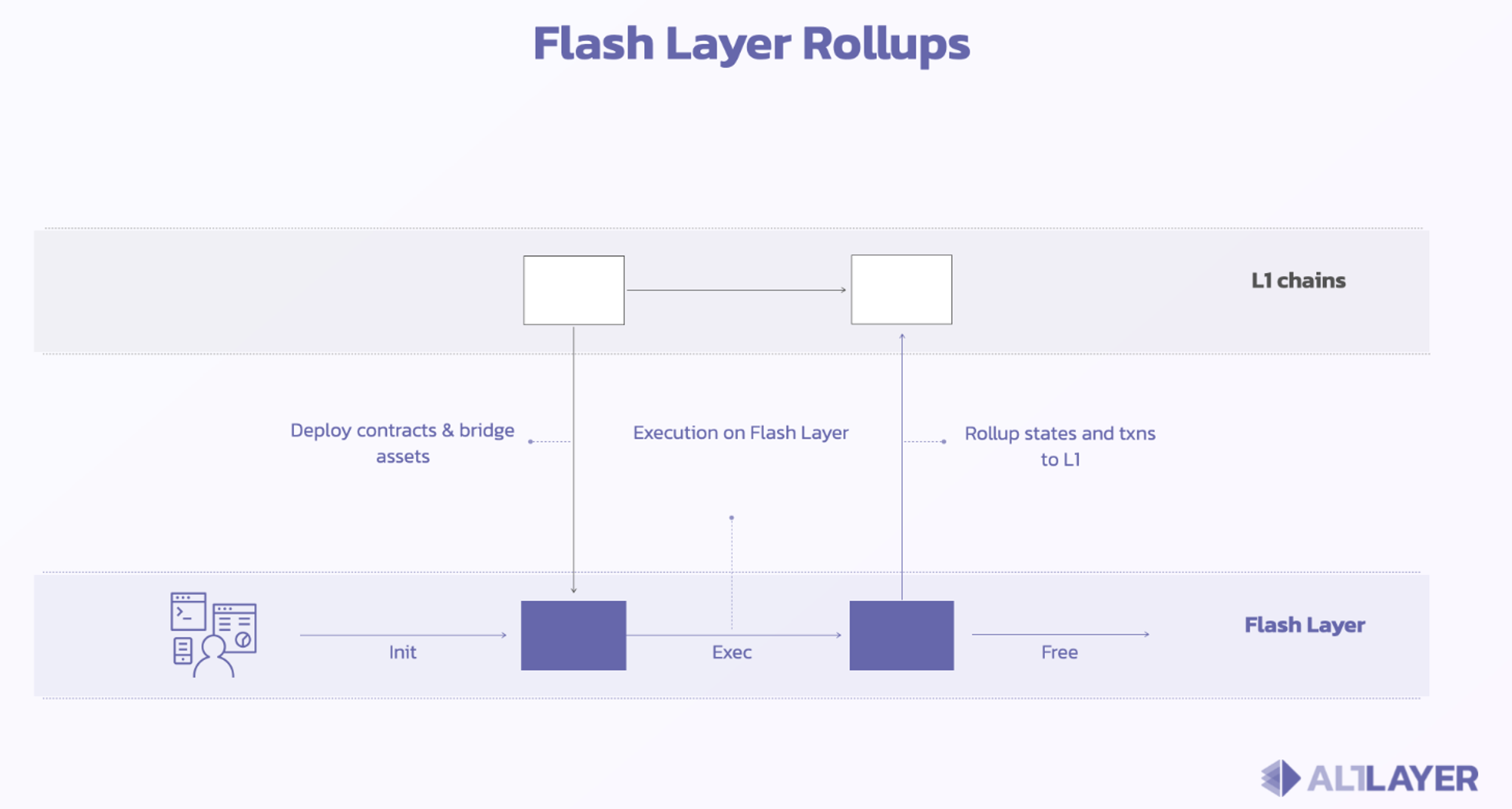

Altlayer

Altlayer is another notable RaaS solution within the Optimism ecosystem. It supports no-code L2 deployment—developers can create a Rollup chain through simple GUI operations. Moreover, Altlayer supports elastic Rollups—Flash Layers. When app demand spikes—such as during popular NFT mints or DeFi airdrops—developers can rapidly deploy a Rollup via Altlayer to handle temporary performance demands. After the event concludes and assets are transferred back to the base chain, the Flash Layer can be deleted. Altlayer offers a waste-free, on-demand scaling solution capable of handling complex business scenarios.

Lumoz

Lumoz (formerly Opside) is a ZK-based RaaS solution enabling developers to instantly deploy their own ZK-Rollup and generate customized zkEVM appchains. The proliferation of ZK-Rollups will also drive massive demand for ZKP computation power. Lumoz has built a decentralized ZKP marketplace supporting ZK mining to generate zero-knowledge proofs for ZK-Rollups. Practically, developers don’t need to understand ZK technology—just simple frontend actions suffice to deploy a ZK-Rollup. Computational needs during operation can be fulfilled via Lumoz’s ZK-PoW service, greatly reducing operational overhead. Notably, Lumoz supports 0 Gas Fee contracts, offering users frictionless DApp experiences. Recently popular ZKFair is one of the L2s built on Lumoz.

Application Layer

Earlier, we detailed the benefits of the Dencun upgrade for infrastructure sectors like L2, DA, and RaaS. Improvements in L2 cost and performance will also catalyze innovation and growth at the application layer. Below, we briefly analyze application sectors that stand to gain significantly from Dencun.

Perps

Overall, DeFi interactions tend to be infrequent but high-value per transaction. In this sense, DeFi isn’t particularly dependent on high throughput, as individual gains often outweigh interaction costs. However, decentralized derivatives are an exception—performance bottlenecks and high fees are magnified in derivative protocols.

Due to L2 performance constraints, Perps projects struggle to run on-chain order books or efficiently match real-time orders. High fees severely limit market makers and high-frequency traders. These issues result in poor trade efficiency, higher slippage, inability to attract deep liquidity or professional traders, and subpar user experience compared to CEXs.

We believe Dencun can mitigate these issues—especially performance improvements, which are crucial for derivatives. Compared to pool-based AMM models, Dencun particularly benefits order-book-based L2 Perps like ApeX Protocol, Aevo, and Vertex Protocol. Lower fees will also stimulate trading on mature platforms like GMX, Synthetix, and GNS.

LSD

Beyond EIP-4844, the Dencun upgrade includes EIP-4788, which embeds beacon block roots into every EVM block. This enables trust-minimized access to consensus-layer data on the mainnet, removing dependency on external oracles and reducing associated risks of failures or manipulation. While not immediately visible to users, EIP-4788 represents a significant security enhancement for LSD and ReStaking protocols. It allows liquid staking protocols like Lido, Rocket Pool, Swell, and restaking protocols like Eigenlayer to directly access validator balances and status from the consensus layer—improving both security and operational efficiency. We remain highly optimistic about the post-Dencun growth of LSD, especially ReStaking led by Eigenlayer. Eigenlayer has been active recently—supporting multiple LSTs, launching Restaked Rollups with Altlayer, rolling out EigenDA Phase 2 testnet, and seeing its Renzo restaking protocol go live. Its TVL has reached $1.7 billion and continues to climb. The ReStaking narrative is just beginning, and EIP-4788 provides its foundational security layer.

FOCG

Fully on-chain games are among the biggest beneficiaries of the Dencun upgrade. Unlike Web2.5 games where only assets are on-chain while game logic remains off-chain, fully on-chain games have all content, rules, mechanics, and assets stored on-chain. On-chain gas fees dictate the cost of every player interaction, and network performance determines user experience. Clearly, due to performance limitations, prior fully on-chain games were restricted to simple turn-based strategy genres. High interaction costs and the need for frequent gameplay deterred many players.

Dencun directly alleviates these constraints and may even enable new types of fully on-chain games. We expect more games to be built on engines like Mud and Dojo, running on L2s such as Redstone and StarkNet. Existing titles like Sky Strife, Loot Survivor, Isaac, and Influence may attract more genuine players thanks to improved user experience post-upgrade.

The Dencun upgrade will inject fresh vitality into the Ethereum ecosystem. Of course, beyond benefiting the sectors mentioned, it will also diminish the appeal and competitiveness of alternatives like sidechains and non-EVM scaling solutions. The drastic cost reductions and performance gains in EVM-based L2s and L3s will further marginalize solutions like Polygon, while non-EVM chains like BSC lose their cost and performance edge. Dencun will refocus market attention back onto the Ethereum ecosystem centered around L2 and L3 scaling.

Summary

-

The Dencun upgrade, part of Ethereum’s “The Surge” roadmap, aims to further reduce usage costs and improve scalability across the Ethereum ecosystem. It introduces transient storage opcodes via EIP-1153 to lower mainnet storage costs and gas consumption, enhancing mainnet scalability. It also implements EIP-4844, introducing the blob data structure to significantly reduce L2 transaction costs and increase L2 throughput.

-

Based on the current Shadowfork test report and the recent 178th Ethereum core developer meeting, Dencun upgrade testing is progressing well. Three major testnets are scheduled for phased upgrades from January to early February. Assuming successful testnet outcomes, the mainnet Dencun upgrade is expected to be completed within February.

-

The Dencun upgrade will further fuel L2 ecosystem growth, with Arbitrum, Optimism, and Metis particularly worth watching. It will also drive demand in infrastructure sectors including decentralized storage, DA, and RaaS. Projects like EthStorage, Covalent, EigenDA, Polygon Avail, Caldera, Altlayer, and Lumoz deserve close attention.

-

The Dencun upgrade will also foster innovation at the application layer. Order-book-based Perps like ApeX Protocol, Aevo, and Vertex Protocol will benefit significantly. EIP-4788 enhances the foundational security of LSD and ReStaking protocols, particularly accelerating the growth of the ReStaking sector led by EigenLayer. Fully on-chain games will deliver vastly improved user experiences post-upgrade.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News