SynFutures V3: A DEX Combining On-Chain Order Books and AMMs

TechFlow Selected TechFlow Selected

SynFutures V3: A DEX Combining On-Chain Order Books and AMMs

SynFutures V3 and its mysterious Oyster AMM are preparing to reshape the perpetual DEX landscape.

Author: PAUL VERADITTAKIT

Compiled by: TechFlow

As SynFutures prepares to launch its latest innovation, SynFutures V3, the DeFi world stands on the brink of a transformative moment. Let’s dive into what users can expect from V3 in this permissionless perpetual contract DEX, focusing on the new Oyster AMM and its potential to reshape the DeFi derivatives landscape.

Introduction

SynFutures is a perpetual DEX with a business model reminiscent of Amazon, democratizing access to derivatives markets and enabling an infinite number of long-tail assets. This approach allows users to easily participate in asset trading and list customized futures and perpetual contracts within seconds. By fostering a free market and maximizing the diversity of tradable assets, SynFutures is lowering entry barriers and creating a fairer derivatives market. Anyone can list and trade anything at any time.

Since its launch in 2021, SynFutures has become a leading perpetual DEX, amassing over $21 billion in trading volume to date, nearly 100,000 traders, and 270 listed trading pairs. The protocol is backed by prominent firms including Pantera Capital, Susquehanna International Group (SIG), Polychain Capital, Standard Crypto, Dragonfly Capital, Framework Ventures, and HashKey Capital.

Oyster Automated Market Maker (AMM)

While V2 marked a significant milestone in the project’s evolution, V3 represents a major leap forward in the overall product roadmap. At the heart of this transformation lies the Oyster AMM—a meticulously designed automated market maker model built to improve upon its predecessor.

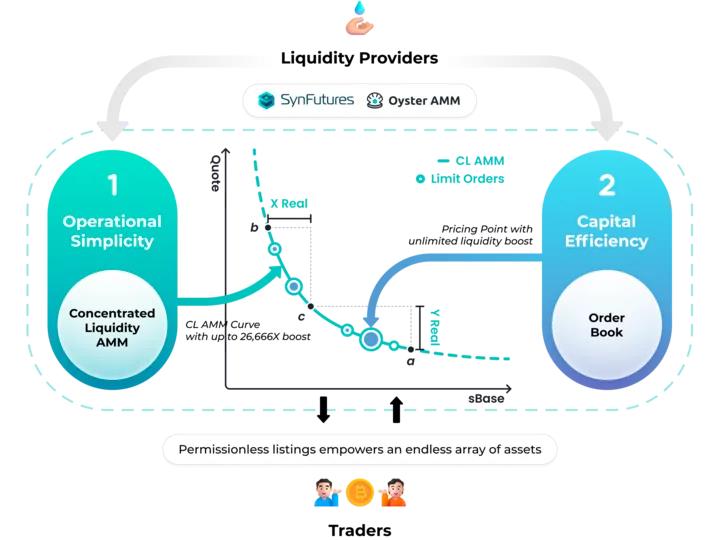

The Oyster AMM aims to harmoniously blend the simplicity of automated market making with the efficiency of order book models, creating a seamless experience for both newcomers and seasoned traders.

Key features of the Oyster AMM (as outlined in the SynFutures V3 whitepaper):

-

Single-token concentrated liquidity for derivatives: The Oyster AMM enables liquidity concentration within specific price ranges and incorporates leverage to enhance capital efficiency. Unlike conventional spot market liquidity models, it introduces a derivatives-specific margin management and liquidation framework, simplifying the trading ecosystem by using only one token.

-

A fully on-chain order book: While AMMs democratize market access, they require substantial liquidity to achieve price impact equivalence compared to order book models. To address this, SynFutures V3 introduces an on-chain order book model alongside its concentrated liquidity AMM, ensuring transparency, trustlessness, and censorship resistance while eliminating reliance on centralized administration.

-

Unified liquidity under a single model: The Oyster AMM integrates concentrated liquidity and order book functionality into a single unified model, offering tailored liquidity solutions for both active traders and passive liquidity providers. This cohesive approach ensures efficient atomic trades and avoids synchronization issues present in dual-process execution systems.

-

Stability mechanisms for user protection: The Oyster AMM introduces advanced financial risk management mechanisms to enhance user protection and price stability. These include a dynamic penalty fee system that discourages price manipulation and balances risk-return profiles for liquidity providers.

V3 Trading Experience

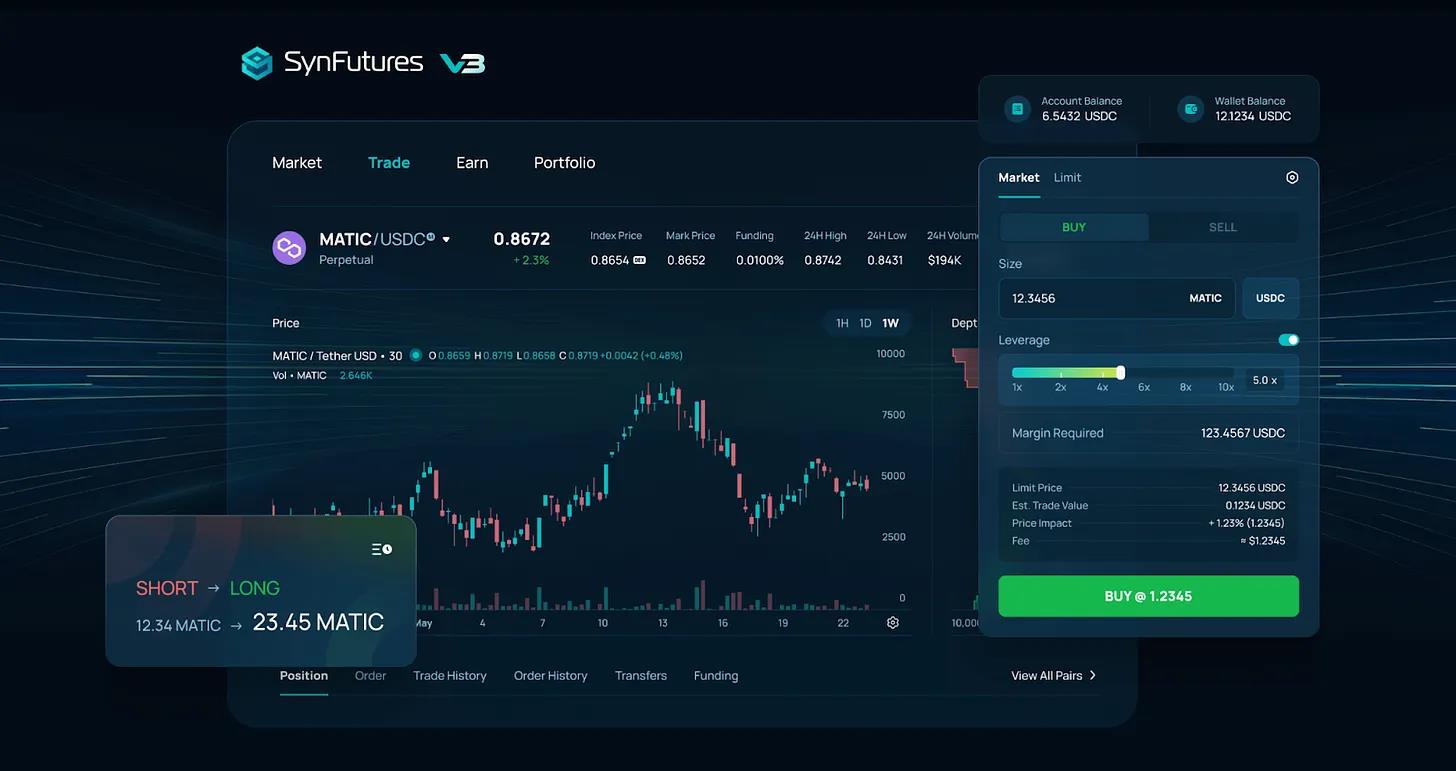

Although V3 introduces a completely new AMM model, the one-click trading experience familiar to users remains as smooth as ever. V3 is currently live on public testnet, allowing anyone to experience the new AMM risk-free. After connecting their wallet and minting test assets, users can begin trading with up to 100x leverage. Under "Portfolio," traders can manage their positions and view trading and order history.

With the release of V3, SynFutures has redesigned its website to reflect the latest developments and expanded product offerings.

The Significance and Impact of SynFutures V3

Following a successful public testnet phase, the next milestone will be the mainnet beta launch, expected by the end of this year across multiple chains. SynFutures is also actively collaborating with market makers to prepare for the mainnet rollout.

SynFutures V3 and its enigmatic Oyster AMM are poised to reshape the perpetual DEX landscape. The symbolism of the oyster signifies infinite possibilities, and within SynFutures V3, individuals are invited on an exciting journey where the realm of decentralized derivatives truly belongs to them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News