A Brief Analysis of the OP Ecosystem: Project Progress, Development Path, and Investment Potential

TechFlow Selected TechFlow Selected

A Brief Analysis of the OP Ecosystem: Project Progress, Development Path, and Investment Potential

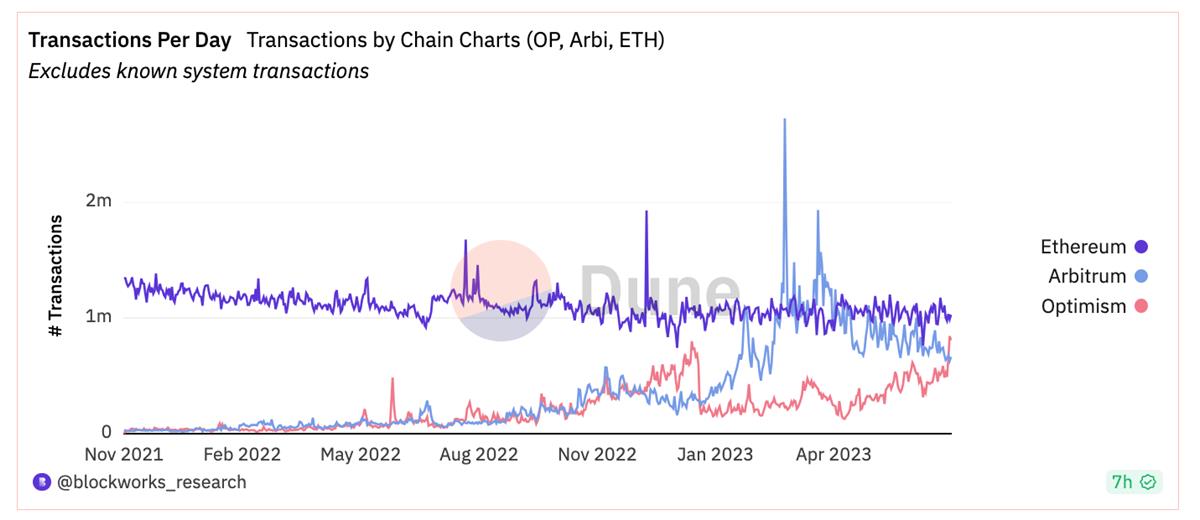

It's worth noting that OP has now surpassed Arbitrum in daily average transaction count, creating a vampiric effect on Arbitrum.

By Rain Sleeping Wildly

How is the OP ecosystem doing now? Is it worth positioning in?

Next, I'll break down OP's current situation from two perspectives.

- Ecosystem & Projects

- The Future of OP Stack

Ecosystem & Projects

As of now, from a data standpoint, Arbitrum remains the leader among Layer 2 solutions, and OP still lags behind in terms of ecosystem development. However, with the widespread adoption of OP Stack, OP has recently gained more market attention (Basechain, Worldcoin)—even amid continuous token unlocks, OP’s overall market cap continues to grow.

Notably, OP has already surpassed Arbitrum in daily transaction volume, showing signs of drawing activity away from Arbitrum.

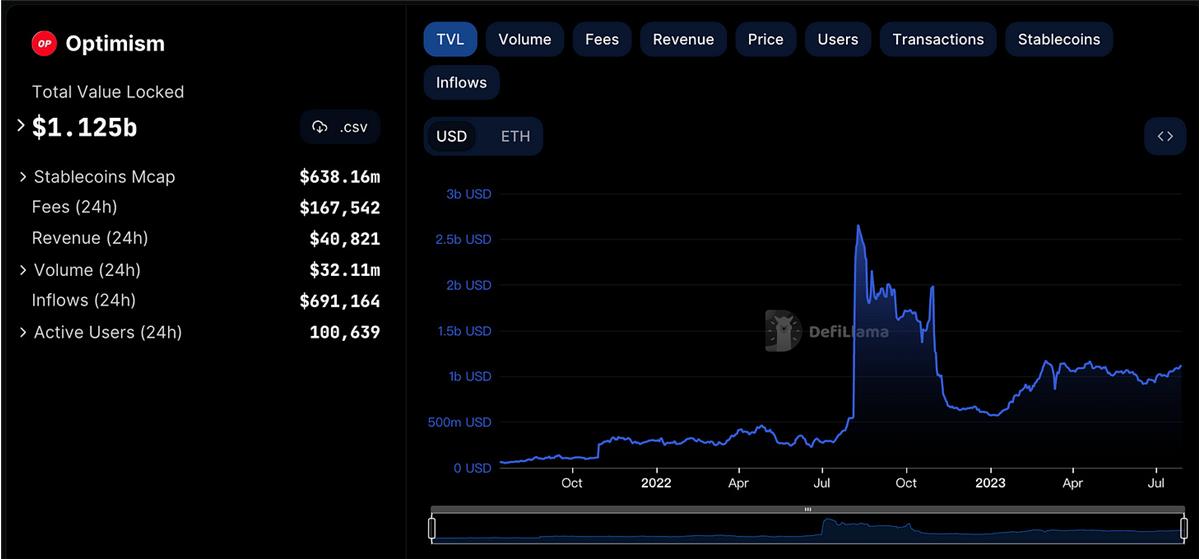

TVL also shows an upward trend.

Velo, the leading protocol on OP, is a DEX built on the ve3,3 model. It remained lukewarm previously due to the scarcity of native assets on OP compared to Arbitrum (GMX, Magic, Dopex, Pendle, etc.). A ve3,3 model requires sufficient protocol participation to kickstart its flywheel effect—the richer and stronger the native assets on a chain, the stronger its ve3,3 will become.

More and stronger native assets → Higher user adoption (mining + trading demand) → Need for deeper liquidity to reduce impermanent loss → ve3,3 meets low-cost liquidity acquisition needs → Increased emission value and bribe rewards for ve3,3 tokens → Positive flywheel

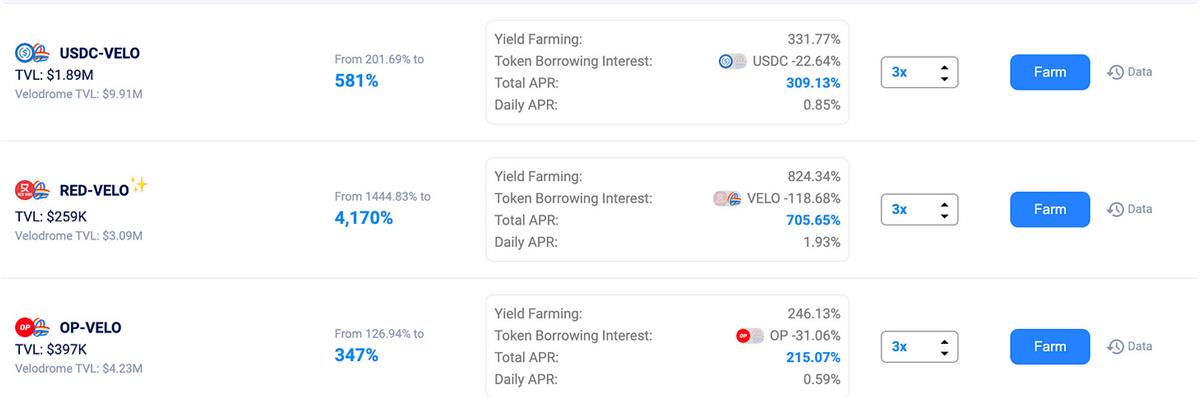

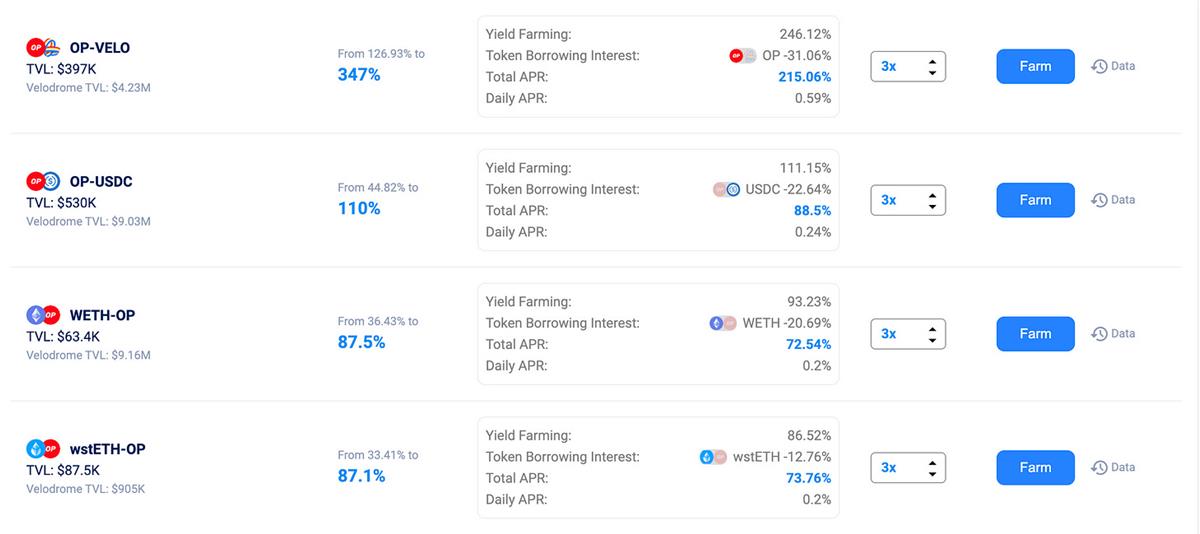

Currently, the OP ecosystem still has a long way to go. However, we can already see many protocols building around Velo, such as Extra Finance and Exactly Protocol.

Extra itself is a lending protocol, but comes with a UI/UX that allows users to leverage their positions to participate in liquidity mining on Velo DEX. The protocol continues to offer high liquidity provider (LP) yields. These generous LP returns help offset the impact of $VELO token emissions for holders (an alternative being locking VE to earn bribes). Currently, its TVL stands at $19M, making it the fastest-growing protocol on OP.

Exactly is a protocol enabling users to switch between floating and fixed interest rates, currently with a TVL of $82M. $EXA, Exactly’s native token, has already deployed a liquidity pool on Velo and enhanced LP rewards through vote bribes.

Extra and Exactly represent two different interaction vectors with Velo—Extra leverages LPs via lending, while Exactly creates liquidity pools to provide more bribes for veVELO holders.

Exactly’s actions reflect the growing demand for liquidity from native protocols on OP, which Velo’s ve3,3 DEX helps fulfill. Extra amplifies the wealth effect on OP, attracting more participants into the ecosystem.

They represent two distinct catalysts—benefiting both Velo and the broader ecosystem. We can see from the increasing Fee and Incentive Rewards on Velo that it is capturing more value as the OP ecosystem grows. If the market attention and sentiment driven by OP Stack continue, Velo is likely to see corresponding growth.

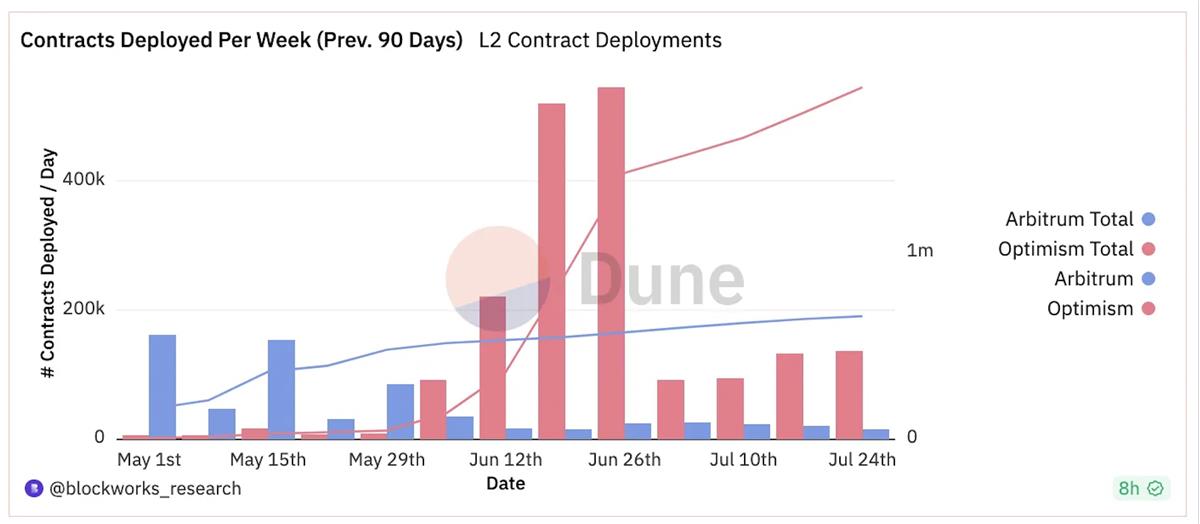

Another indicator of OP's rapid ecosystem growth is the surge in contract deployments over the past 90 days. Therefore, in the coming half-year, several promising protocols are likely to emerge from the OP ecosystem.

Another native OP protocol with strong TVL performance is Sonne Finance, a lending protocol currently holding $107M in TVL.

Synthetix is a well-known multi-chain synthetic asset protocol, so I won’t go into detail here. However, one key difference with GMX lies in GLP: GMX’s GLP serves as a powerful yield-bearing asset Lego within the Arbitrum ecosystem, allowing various protocols to build atop it and create a positive flywheel. In contrast, Synthetix’s sUSD lacks this advantage and even carries shared debt risk. SNX stakers act as liquidity providers, earning inflationary rewards and fees—thus, SNX’s market cap determines the upper limit of its protocol liquidity—a problem they aim to solve with v3 in Q4.

Synthetix’s strength, like Velo’s, lies in offering a robust product Lego for protocols deploying on OP. Unfortunately, it hasn’t introduced a powerful yield-bearing asset Lego to OP like GMX/GLP did.

For the OP ecosystem, this gap represents a potential growth opportunity.

The Future of OP Stack

We can clearly see that OP Stack has gained significant adoption. Brand validation from institutions like Coinbase provides strong credibility for OP Stack. Therefore, we don’t need to worry about future adoption or development of OP Stack. Its main threat comes from zkRollups, but currently, zkRollup technology is far from mature, and OP Stack has already begun exploring ZKP integration.

Another important point is whether chains using OP Stack can feed back value to OP. Basechain previously stated it would return part of its revenue to the Optimism Collective—an encouraging sign for OP. Having revenue flowing into the treasury means "capability," which will eventually reflect in the token price. If more chains follow Basechain’s lead, it would significantly enhance the capability of the Optimism Collective.

Clearly, the OP team recognizes this potential. On July 25, they launched the Law of Chain proposal, aiming to establish a shared governance model and sequencer for all chains using OP Stack—similar in concept to Cosmos’ shared security model. The Law of Chain essentially seeks to formalize the revenue-sharing mechanism. Its implementation could bring additional income to the Optimism Collective.

That concludes my thoughts on OP. Personally, I plan to actively participate in the OP ecosystem going forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News