Centrifuge: Bringing rich real-world assets on-chain, a pioneer in RWAFi

TechFlow Selected TechFlow Selected

Centrifuge: Bringing rich real-world assets on-chain, a pioneer in RWAFi

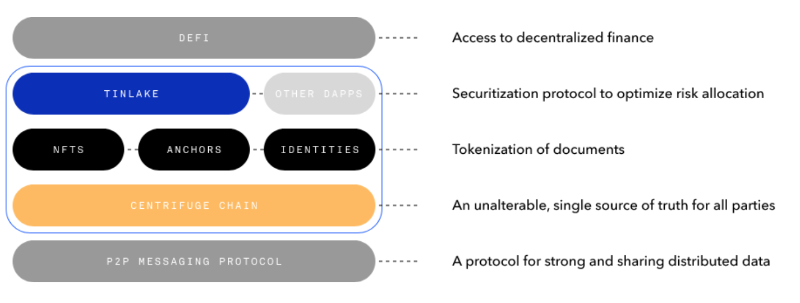

Centrifuge connects real-world assets to DeFi.

Article by aya, TechFlow

To date, most DeFi applications have revolved around tokens and NFTs. However, one of the future trends in blockchain is interoperability with real-world items and assets—and Centrifuge is doing exactly that. Below, we’ll provide a brief introduction to this project.

Project Overview

Centrifuge connects real-world assets (RWA) to DeFi.

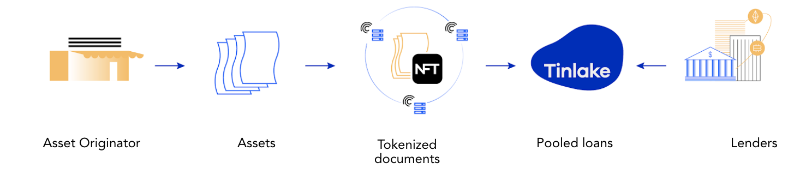

Through Tinlake, a consumer-facing Dapp, businesses or "asset originators" can tokenize real-world assets—such as invoices or mortgages—as NFTs and use these NFTs as collateral in their Tinlake pools to raise capital and gain liquidity within the ecosystem.

For each Tinlake pool, investors can invest in two different types of tokens: TIN and DROP.

-

TIN, known as the "risk token," absorbs losses first in case of default but offers higher potential returns.

-

DROP, known as the "yield token," is protected by TIN and shielded from default risk, offering stable (though typically lower) returns.

Tinlake currently operates on Ethereum and connects to Centrifuge Chain via a bridge. In the future, it aims to enable accurate pricing and risk assessment for any asset type, creating liquid markets for assets such as cars or future farmland revenue—thereby reducing trust barriers in the off-chain world.

Another core component of the ecosystem is the Centrifuge Chain—a Proof-of-Stake blockchain built using Substrate with its own native token, $CFG. It incentivizes participation in Centrifuge, and $CFG holders can engage in on-chain governance to influence the protocol’s development.

The underlying P2P protocol provides a method for creating, exchanging, and verifying asset data. Asset originators can selectively share asset details with service providers, who then evaluate the data and provide pricing and underwriting information. Smart contracts are used to anchor identities and mint NFTs off-chain.

With Centrifuge, enterprises can tokenize non-crypto assets such as mortgages, invoices, and consumer loans, unlocking new investment opportunities. By enabling direct transactions between businesses and investors while bypassing banks and other centralized intermediaries, the protocol democratizes access to capital.

In return, investors earn interest and rewards paid in $CFG, which further supports the ongoing development of the Centrifuge Chain.

Funding History

In February last year, Centrifuge raised $4.3 million from investors including Galaxy Digital, IOSG Ventures, and Rockaway Ventures. In May this year, they announced a strategic partnership with BlockTower and completed a $3 million token sale in their first round.

Most recently, they closed a strategic funding round, raising $4 million from investors such as Coinbase Ventures, BlockTower, Scytale, and L1 Digital.

Project Review

Centrifuge has a relatively robust architecture, featuring its own dedicated dApp, purpose-built blockchain, and corresponding P2P protocol, backed by major players such as BlockTower and MakerDAO.

The RWA sector holds significant long-term promise, and based on Centrifuge's product architecture, it already shows strong potential to become a leading unicorn in this space.

Project Links

Twitter: https://twitter.com/centrifuge

Website: https://centrifuge.io/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News