Centrifuge: Decentralized Asset Financing Protocol Through the Lens of RWA Essence

TechFlow Selected TechFlow Selected

Centrifuge: Decentralized Asset Financing Protocol Through the Lens of RWA Essence

Centrifuge is a decentralized RWA asset financing protocol designed to bring real-world assets on-chain.

Author: Will Awan

Real-world assets exist off-chain, and their owners can receive expected returns, with ownership rights and benefits governed by legal systems rooted in our social contracts. For the crypto world, real-world asset tokenization (RWA) enables crypto capital to capture opportunities from real-world economic activities; for the real world, RWA allows assets to access instant liquidity from the crypto ecosystem.

In our translated report “Citigroup RWA Report: Money, Tokens, and Gaming,” Citigroup stated that tokenization could bridge on-chain and off-chain ecosystems, helping the industry achieve one billion users and ten trillion dollars in asset value by 2030. As the first protocol to bring real-world assets onto the blockchain, Centrifuge provides a channel to integrate RWA into decentralized finance (DeFi), enabling landmark practical implementations of RWAs in the crypto space.

This article extends our previous piece, “Comprehensive RWA Research Report: Dissecting Current Implementation Paths and Exploring Future RWA-Fi Logic,” offering an in-depth analysis of Centrifuge based on the essence of RWA. It aims to deepen understanding of crypto’s demand for RWA, trace Centrifuge’s evolution from a startup to RWA financial infrastructure, and explore potential future developments in the RWA domain.

I. The Essence of RWA

Before examining Centrifuge, it is essential to clarify my personal perspective on the nature of RWA—particularly from the standpoint of Crypto RWA—to better understand the current landscape of the crypto RWA market and pinpoint protocols/projects like Centrifuge within this ecosystem.

As shown in the diagram above, RWA fundamentally revolves around two sides: the asset side and the capital side, each with its own distinct needs.

The primary need on the real-world asset side is financing, whether through Security Token Offerings (STOs) or collateralized lending (as with Centrifuge). While the fundamental purpose of asset financing remains unchanged, what has evolved is the source of capital—specifically, DeFi’s instant liquidity—and the cost efficiency and operational improvements enabled by blockchain and smart contract technology (e.g., via the Centrifuge protocol).

On the crypto capital side, the core need is investment: how to gain exposure to low-risk, stable-yield, scalable real-world assets uncorrelated with crypto volatility. From a stability perspective, stablecoins are key use cases, serving as transactional mediums unaffected by crypto price swings. From the perspective of stability, yield, and scalability, U.S. Treasury-based RWA emerges as a critical use case, enabling access to risk-free returns.

More importantly, RWA can generate USD-denominated yield-bearing assets, creating a new asset class within the crypto ecosystem. Combined with DeFi’s composability, this USD-yielding asset class opens up vast possibilities, such as interest-bearing stablecoin projects and recently popular interest-bearing Layer 2 initiatives.

With this understanding of RWA’s essence, Centrifuge’s role in the RWA ecosystem becomes clear: acting as a conduit to help off-chain assets capture liquidity from the crypto world, leveraging blockchain and smart contracts to reduce costs and improve efficiency in financing channels.

II. Introduction to Centrifuge

2.1 Project Overview

Centrifuge is a decentralized RWA financing protocol designed to bring real-world assets on-chain, enabling borrowers to raise funds without banks or unnecessary intermediaries by creating on-chain lending pools through asset collateralization, thereby gaining instant liquidity from the crypto ecosystem.

By integrating the entire private credit market on-chain—including securitization, tokenization, DAO governance, and liquidity—Centrifuge is building a more transparent, lower-cost, and 24/7 accessible decentralized financial system (The Platform for Onchain Credit). This reduces funding costs for small and medium-sized enterprises while providing DeFi investors with stable yields decoupled from crypto market fluctuations.

(centrifuge.io)

In traditional finance, lack of transparency, inefficient capital allocation, and high transaction costs prevent many small and mid-sized businesses from accessing competitive financing terms. In contrast, DeFi is an open, borderless, and increasingly mature financial system. Centrifuge seeks to extend the benefits of DeFi to borrowers who have historically lacked access to its liquidity.

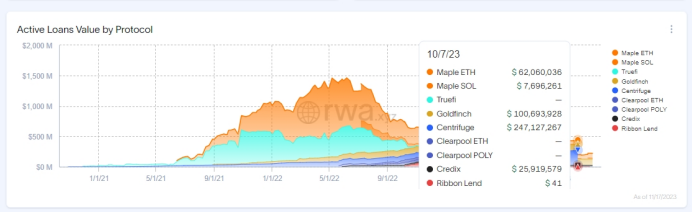

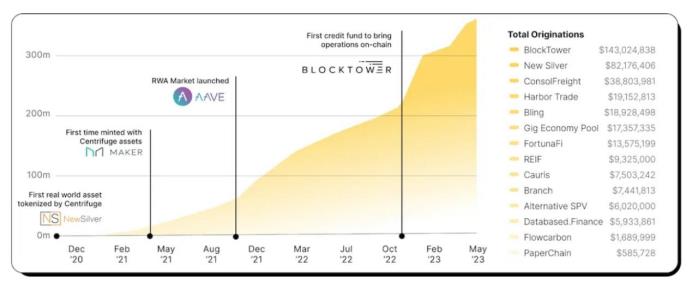

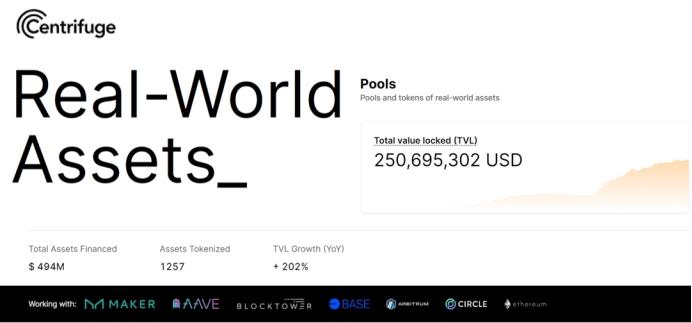

As a key financial infrastructure player in the RWA market, Centrifuge has become the leader in RWA private credit—facilitating financing for $494 million in assets, with a current Total Value Locked (TVL) of $250 million. It has created major RWA pools for MakerDAO, launched an RWA market with Aave, and partnered with BlockTower to bring the first credit fund operations on-chain.

(rwa.xyz)

2.2 Team and Funding

Centrifuge was launched in 2017 by Lucas Vogelsang and Martin Quensel.

Lucas Vogelsang is the founding engineer and CEO of Centrifuge. Prior to this, he founded and successfully exited an e-commerce startup called DeinDeal. He later moved to Silicon Valley and served as a tech manager at Taulia. In October 2017, he co-founded Centrifuge.

Martin Quensel, another co-founder of Centrifuge, currently serves as Chief Operating Officer. His career began at SAP, where he worked as both a software developer and architect. Before Centrifuge, he was a co-founder at Taulia.

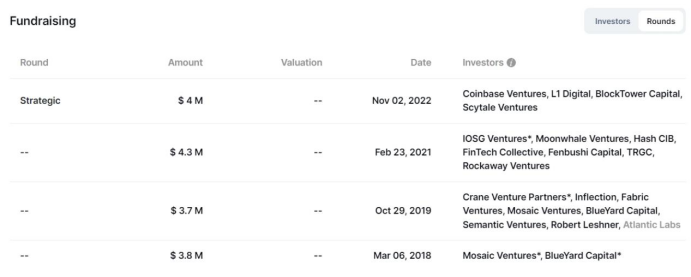

Centrifuge's funding history:

(ROOTDATA: Centrifuge)

In February 2021, Centrifuge raised $4.3 million through a SAFT round led by Galaxy Digital and IOSG, with participation from Rockaway, Fintech Collective, Moonwhale, Distributed Capital, TRGC, and HashCIB.

On May 18, 2022, Centrifuge established a strategic partnership with BlockTower through a $3 million Treasury Token Sale. BlockTower has since become an active member of the Centrifuge community and facilitated the provision of $150 million in real-world assets to MakerDAO via Centrifuge.

In November 2022, Centrifuge completed a $4 million funding round with participation from Coinbase Ventures, BlockTower, Scytale, and L1 Digital.

This strong VC backing has provided Centrifuge with extensive resources in assets, capital, compliance, and beyond.

(Growing Centrifuge with an investment from Coinbase)

III. Centrifuge’s Core Business Architecture

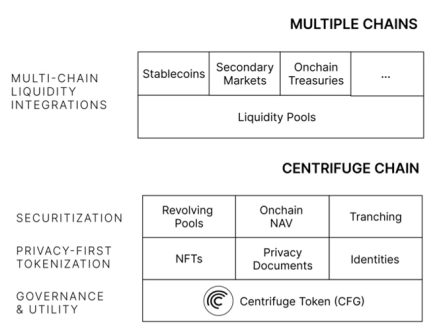

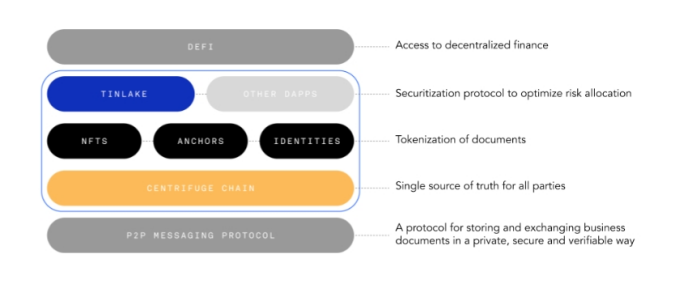

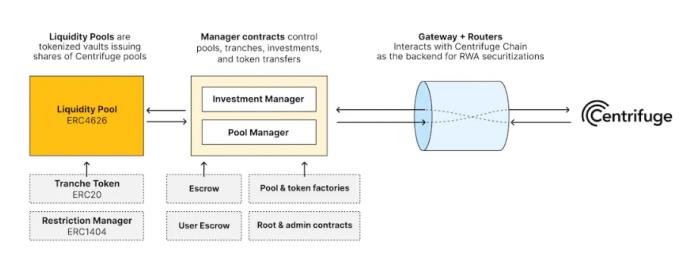

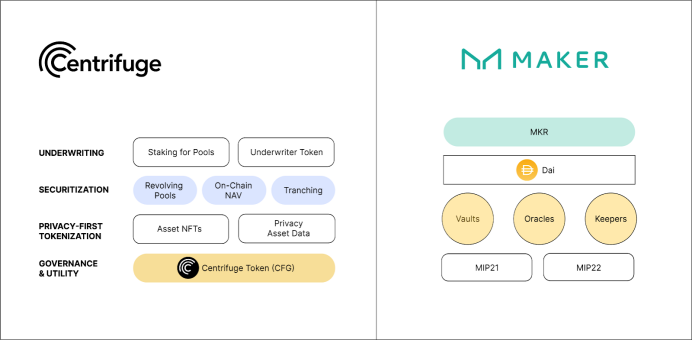

Centrifuge, as a platform/protocol, focuses on bridging off-chain assets and on-chain capital, achieving cost reduction and efficiency gains through blockchain and smart contracts. The current Centrifuge DApp has integrated the former Ethereum-based Tinlake protocol—which served as an open marketplace for RWA pools and accessed Ethereum liquidity—while leveraging Centrifuge Chain to enable fast, low-cost transactions and cross-chain liquidity capture (built as a parachain on Polkadot’s Substrate framework).

(X: @HFAresearch)

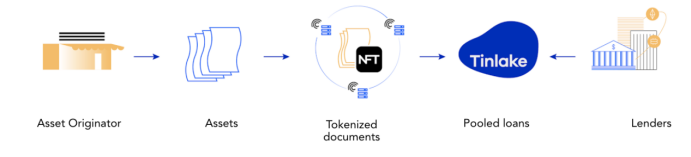

The most critical component of the business architecture is the Tinlake protocol—a smart contract-based, open asset pool that converts real-world assets into ERC-20 tokens via NFT collateralization and grants access to crypto liquidity. Tinlake was Centrifuge’s primary front-end product.

Over four years, Tinlake played a pivotal role in Centrifuge’s success—creating the world’s first RWA pool for MakerDAO, launching an RWA market with Aave, and bringing the first credit fund operations on-chain with BlockTower.

In May of this year, to enhance user experience, Centrifuge officially launched a new, secure, reliable, and streamlined upgraded DApp, gradually replacing the Tinlake protocol. However, core functionalities and logic from Tinlake remain applicable, including asset onboarding, structured investment tiers, on-chain net asset value, and revolving funding pools.

(Introducing the New Centrifuge App)

3.1 Asset Onboarding Logic (Borrower, SPV, Centrifuge Pool)

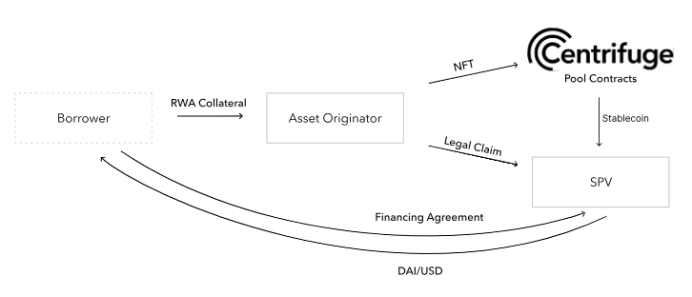

(centrifuge.io)

A borrower can tokenize real-world assets through a Special Purpose Vehicle (SPV) set up by an asset originator within a Centrifuge pool, thereby receiving stablecoin capital from on-chain investors. This process follows traditional financial asset securitization models and connects to DeFi liquidity via Centrifuge pools.

(centrifuge.io)

Asset onboarding steps:

1. Borrower intends to finance real-world assets (e.g., mortgage loans, accounts receivable, invoices);

2. An asset originator (with existing business relationships with the borrower and partial underwriting responsibilities) establishes a separate SPV for the borrower’s assets (the SPV acts as an independent financing entity, ensuring bankruptcy remoteness from the originator);

3. The asset originator initiates and verifies the borrower’s assets within the SPV and mints an NFT on-chain reflecting the asset’s status;

4. The borrower signs a financing agreement with the SPV and pledges the NFT to a Centrifuge pool to access DeFi liquidity;

5. The SPV functions solely as a pass-through financing vehicle, strictly limited in scope per the SPV Operating Agreement;

6. The Centrifuge pool disburses stablecoins (e.g., DAI) to the SPV, which transfers them to the borrower;

7. The entire capital flow involves only the borrower, SPV, and Centrifuge pool (connected to DeFi liquidity);

8. Ultimately, the borrower repays principal and interest to the SPV, which returns funds to the Centrifuge pool. Upon full repayment, the NFT is unlocked and returned to the originator for destruction.

3.2 Investment Structure of Centrifuge Pools (Tranching)

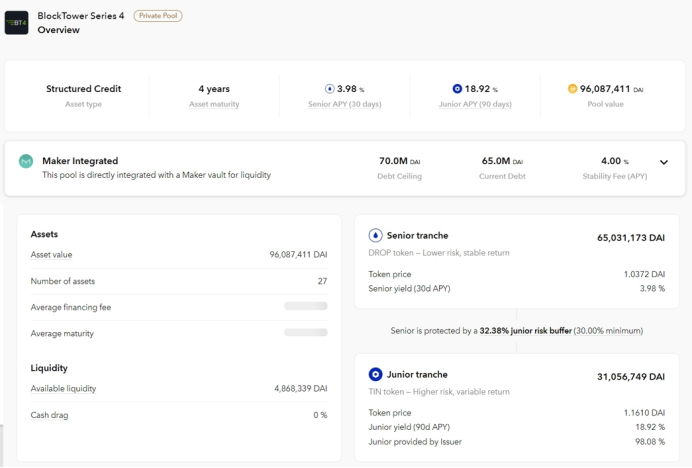

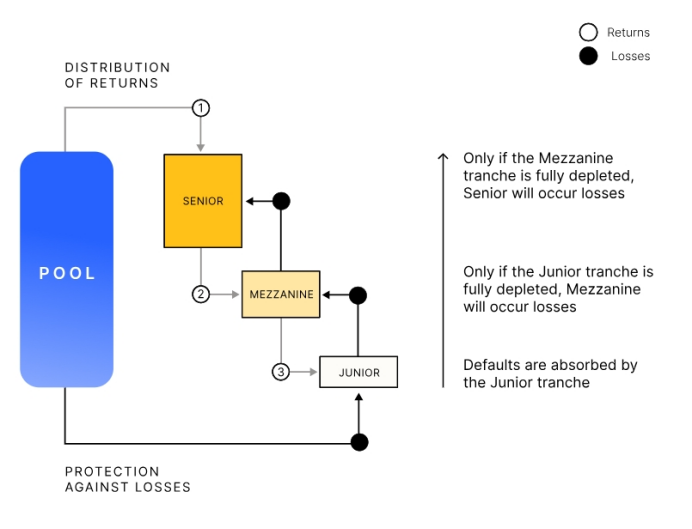

Once assets are onboarded to a Centrifuge pool, structured products offer DeFi investors varying risk-return profiles. Investors can select tranches based on their risk tolerance and return expectations.

(Tinlake: BlockTower S4)

Typically, Centrifuge pools issue two types of ERC-20 tokens: DROP and TIN. Using the BlockTower S4 pool as an example:

DROP tokens represent the senior tranche, offering fixed-rate returns (3.98%) with lower risk and priority in profit distribution.

TIN tokens represent the junior tranche, offering floating-rate returns (18.92%) with higher risk and higher potential returns. TIN holders rank below DROP holders in payout priority and bear initial losses in case of default.

In the waterfall model below, junior tranches absorb first losses during defaults, while senior tranches enjoy last-loss protection after junior and mezzanine layers are exhausted.

(centrifuge.io)

Investment process:

1. Investors complete KYC/AML verification on the Centrifuge DApp;

2. After approval, review the SPV’s executive summary and sign a subscription agreement detailing structure, risks, and terms;

3. Purchase DROP or TIN tokens using stablecoins like DAI;

4. Investors may redeem their tokens at any time.

3.3 Centrifuge Chain for Multi-Chain Liquidity Capture

(centrifuge.io)

Previously relying on Tinlake to capture Ethereum liquidity (including multiple MakerDAO RWA pools), Centrifuge now operates Centrifuge Chain as a Polkadot parachain built on Substrate, aiming to expand across EVM-compatible chains and capture liquidity from Layer 2s like Base and Arbitrum.

Centrifuge Liquidity Pools have thus emerged, allowing investors on any EVM-compatible chain to directly invest in Centrifuge without switching wallets.

These pools act as bridges across chains.

(Liquidity Pools: Real-World Assets on Ethereum, Base, Arbitrum, and Beyond)

Since launching the Centrifuge DApp in May, several major projects on Centrifuge Chain are nearing launch, including Anemoy Liquid Treasury Series 1 (U.S. Treasury RWA pool for Aave’s treasury), New Silver Series 3 (bridge loan pool for real estate), and Flowcarbon Nature Offsets Series 2 (voluntary carbon offset project with Celo).

IV. Centrifuge’s Current Progress

(centrifuge.io)

As the first decentralized RWA financing protocol, Centrifuge has become the largest project in DeFi’s private credit sector by TVL—exceeding $250 million—thanks largely to its collaboration with MakerDAO. Simultaneously, Centrifuge is expanding into the U.S. Treasury RWA market, attracting capital from crypto treasuries like Aave.

4.1 Partnership with MakerDAO: Dominance in Private Credit

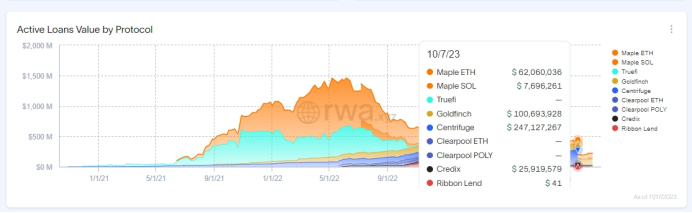

(rwa.xyz)

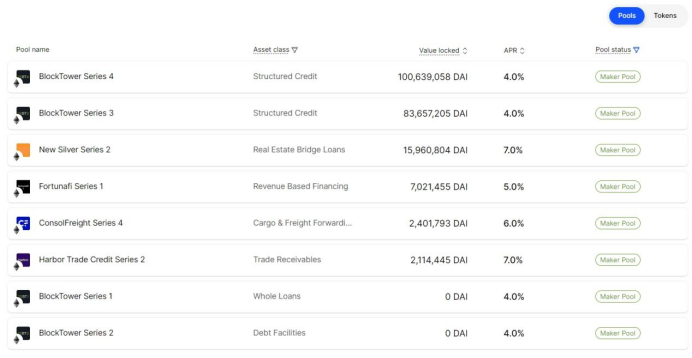

Since collaborating with BlockTower to create MakerDAO’s first RWA pool in 2019, Centrifuge has continuously unlocked RWA potential for MakerDAO. The BlockTower and New Silver series still constitute a major portion of MakerDAO’s RWA holdings.

Among the 14 active pools visible on the Centrifuge DApp, eight are dedicated to MakerDAO. These Maker pools account for over 80% of Centrifuge’s total TVL (including both senior tranches purchased by MakerDAO and junior tranches by originators). Even excluding junior tranches, MakerDAO’s share exceeds 50% of total TVL.

(centrifuge.io)

Beyond Maker pools, other originators’ pools feature diverse underlying assets—shipping invoices, payment advances for fintech firms, inventory financing, commercial real estate, consumer loans, receivables, and structured credit instruments.

Currently, MakerDAO’s largest RWA pools are BlockTower Andromeda ($1.21B TVL) and Monetalis Clydesdale ($1.15B TVL)—both U.S. Treasury RWA projects—highlighting strong crypto capital demand for Treasuries and reinforcing Centrifuge’s strategic push into this space.

4.2 Collaboration with Aave: Entering the U.S. Treasury RWA Market

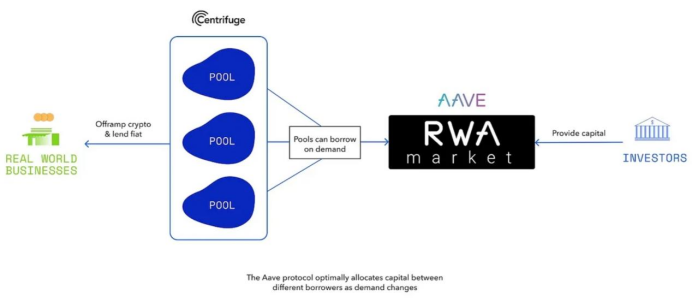

As early as December 28, 2021, Aave launched its RWA market built atop seven Centrifuge Tinlake pools, requiring KYC for investment. Aave depositors could earn stable yields from real-world assets by supplying stablecoins.

(RWA Market: The Aave Market for Real World Assets goes live)

Essentially, the Aave RWA market borrowed liquidity from Centrifuge pools for Aave investors—an initiative that remained relatively quiet until August 8, 2023, when the Aave community proposed investing Aave’s treasury stablecoins into RWA assets via Centrifuge.

The proposal noted that 65% of Aave’s treasury (~$15M) exists as stablecoins. Allocating just $5M into RWA could generate $250K in risk-free returns (assuming 5% yield on U.S. Treasury RWA), making it one of the DAO’s most profitable strategies.

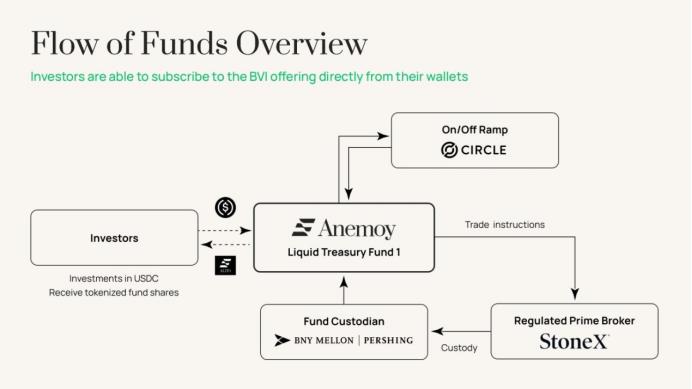

Capitalizing on this, Centrifuge introduced its Prime service to facilitate compliant procurement paths for crypto capital, DeFi protocols, and DAO treasuries seeking exposure to real-world asset yields—especially U.S. Treasury risk-free returns. This partnership enabled Centrifuge to launch its first U.S. Treasury fund, marking its entry into the Treasury RWA space.

(POP: Anemoy Liquid Treasury Fund 1)

Centrifuge Prime consists of two parts:

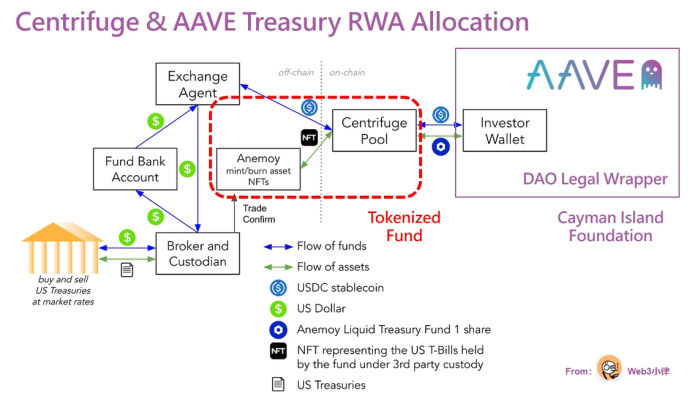

Step 1: Legal structuring for on-chain DeFi protocols—e.g., establishing a Cayman Foundation for Aave. This entity shields DAO members from unlimited liability and serves as a standalone vehicle for RWA value capture, governed by the Aave community, bridging DeFi and TradFi.

Step 2: Creation of a dedicated Anemoy Liquid Treasury Fund 1 pool. Unlike previous pools backed by private credit assets (via SPVs and NFT collateralization), this pool is backed directly by U.S. Treasuries, requiring tokenization of the Anemoy LTF fund itself.

As shown, Anemoy LTF—a BVI-registered fund—is first tokenized via the Centrifuge protocol. Aave then invests treasury funds into the corresponding Centrifuge pool, receiving fund tokens. The pool allocates these funds to Anemoy LTF, which uses custodians and brokers to purchase U.S. Treasuries, thereby bringing Treasury yields on-chain.

(Anemoy Liquid Treasury Fund 1)

While the initial Aave proposal was for $1M, this is merely a pilot. With $15M in stablecoins available, future allocations could reach 20% of Aave’s stablecoin holdings.

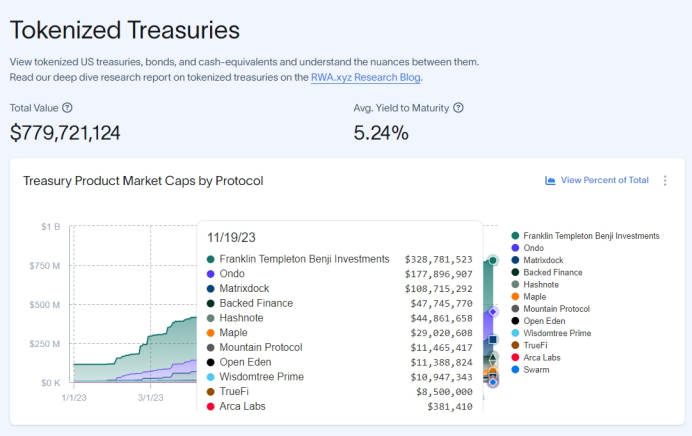

More importantly, this move positions Centrifuge firmly in the U.S. Treasury RWA market—a space characterized by risk-free, stable, and scalable yields. Current Treasury RWA projects already hold $779M in TVL, with MakerDAO alone holding over $2B in Treasury RWAs.

V. Centrifuge Tokenomics and Governance

5.1 Centrifuge Tokenomics

CFG is the native token of Centrifuge Chain, used to incentivize network operations and sustainable ecosystem growth.

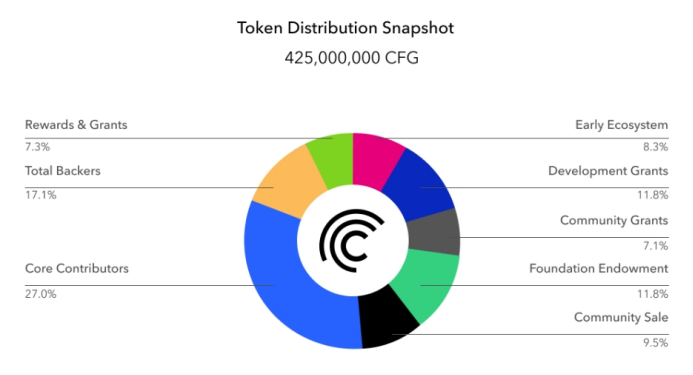

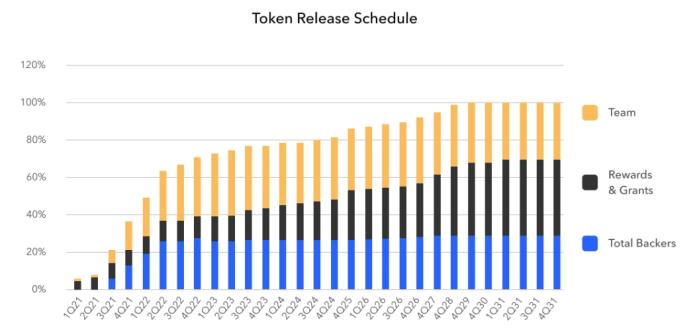

According to official data, CFG has an initial supply of 400 million tokens (3% annual inflation), with a current total supply of 425 million. CFG is used for node staking rewards, on-chain transaction fees, pool liquidity incentives, financing eligibility via staking, and governance participation. Token distribution is as follows:

(CoinList: Centrifuge)

Most CFG tokens are subject to long-term lockups. Core team members face a 48-month lockup followed by 12 months of linear release.

Centrifuge conducted two token sales on CoinList on May 26, 2021, each capped at 17 million tokens: Round 1 priced at $0.55 (immediately unlockable on July 14, 2021); Round 2 at $0.38 (linearly unlocked over two years starting July 14, 2021).

(CoinList: Centrifuge)

5.2 Centrifuge Governance

Previously dominated by the founding team, Centrifuge has gradually transitioned toward governance led by the Centrifuge DAO. The founding team also established organizations such as K/Factory, Centrifuge Network Foundation, and EMBRIO.tech, contributing actively to a healthy, progressive decentralization process.

At the DAO level, in November 2022, the community adopted Founding Documents and formed working groups aligned with the mission of bringing credit on-chain: Protocol and Engineering Group, Governance & Coordination Group, and Centrifuge Credit Group (responsible for evaluating asset onboarding).

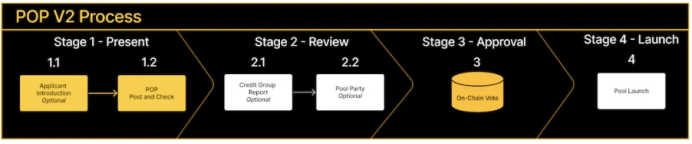

Despite being built on a decentralized network, inherent risks from off-chain financial assets remain significant. Hence, the Centrifuge Credit Group—composed of experts in finance and lending—launched the Pool Onboarding Process V2 to enhance transparency and risk control.

(Centrifuge Governance: Mandated Groups, Active Contributors, and the CFG Token)

Additionally, as the protocol matures, the community actively debates critical issues such as treasury management and fee structures, further strengthening CFG’s utility—a crucial factor determining its long-term value trajectory.

VI. Centrifuge’s RWA Narrative

6.1 Partnership with MakerDAO: Building a Decentralized Credit Market

The RWA narrative is closely tied to MakerDAO’s DeFi vision, making it essential to examine RWA’s significance for DeFi through MakerDAO’s lens.

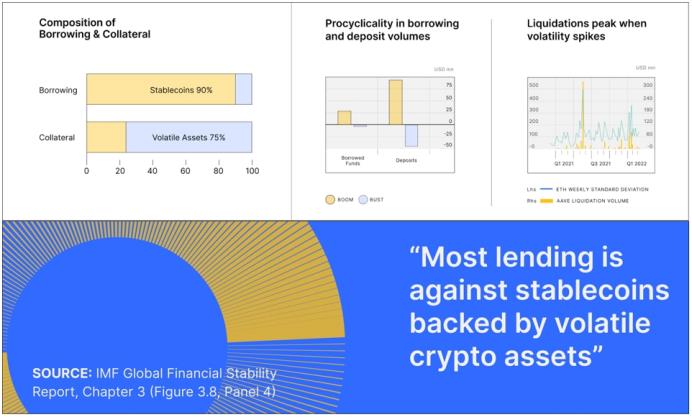

During the 2021 DeFi Summer, unsustainable yield products triggered a market crash, spreading credit defaults throughout the ecosystem. While crypto-native assets are vital to DeFi’s long-term differentiation, current demands do not align with sustainable development goals.

For lending protocols like MakerDAO, a key concern is collateral stability. Previously, MakerDAO accepted volatile crypto assets as collateral, introducing significant risk and limiting its growth potential.

(Centrifuge & Maker: A Partner's View of Real-World Assets)

Thus, MakerDAO and DeFi urgently need a more stable base-layer collateral to support widespread adoption of the DAI stablecoin and establish a sustainable, scalable pathway.

RWA has emerged as a central topic within the MakerDAO community, widely discussed and validated as a key solution. RWA benefits include: (1) improved market risk and asset usage transparency; (2) DeFi composability; (3) enhanced accessibility for underserved populations; (4) value capture from larger, more stable traditional markets.

(Centrifuge & Maker: A Partner's View of Real-World Assets)

For MakerDAO, RWA offers two critical attributes—stability and scalability. More specifically, DAI can expand its utility by pegging to non-volatile, yield-generating, scalable assets, especially relevant amid today’s low crypto yields and high Treasury rates. Through RWA, MakerDAO can grow even during bear markets and prepare robustly for the next bull cycle.

Most importantly, RWA helps MakerDAO realize its grand vision: enabling a credit-neutral, decentralized channel that adds utility to everyday life and enterprise development. By leveraging open, community-driven, programmable, and decentralized protocols, a new DeFi financial market can be unlocked.

However, bringing real-world assets on-chain is challenging—requiring novel product designs, managing financial and technical risks, and navigating unknown unknowns. Balancing cutting-edge innovation with traditional financial stability will require collective effort from the RWA ecosystem.

6.2 Tokenized Asset Coalition

(Tokenized Asset Coalition)

In September 2023, Centrifuge joined forces with Aave, Circle, Coinbase, RWA.xyz, Credix, Goldfinch, and Base to launch the Tokenized Asset Coalition. The coalition aims to unify traditional and crypto finance through education, advocacy, and joint development. Its goal: accelerate institutional adoption of tokenized assets on blockchain and drive trillions of dollars in assets on-chain. By uniting organizations with shared visions, the coalition promotes impactful real-world use cases, demonstrating the true value of crypto assets.

The coalition includes seven founding members—all key players in RWA: Centrifuge and Credix as RWA financing protocols (asset side); Aave and Goldfinch as DeFi lenders (capital side); Circle and Coinbase as critical RWA infrastructure providers (stablecoin exchange, custody); RWA.xyz as an on-chain analytics platform; and Base as an RWA-focused Layer 2. The coalition welcomes all market participants to contribute to transforming traditional finance and building a new open, decentralized financial market.

VII. Future Outlook for Centrifuge

While Centrifuge’s continuous protocol improvements, heavyweight backers, and top-tier partnerships are evident, it’s important to acknowledge potential hurdles before envisioning a bright RWA future.

7.1 Potential Development Challenges

From a liquidity standpoint, expanding from Ethereum’s Tinlake to Centrifuge Chain’s multi-chain approach appears to broaden use cases and capture more DeFi liquidity. But conversely, does this suggest Ethereum’s liquidity has peaked?

Moreover, Centrifuge must overcome dependence on a single major client—MakerDAO.

From a macro-crypto perspective, RWA growth is constrained by the ~$1.5T crypto market size. On/off-ramps, regulatory easing, and mass education are gradual processes. However, traditional finance’s growing recognition of distributed ledger technology, blockchain settlements, and tokenized assets will accelerate adoption—especially following BTC ETF approvals.

From a governance perspective, designing effective protocol fees to capture value for CFG and strategically deploying treasury funds to incentivize users and ecosystem growth are pressing challenges.

7.2 Protocol Enhancements Will Enable Greater Connectivity

Centrifuge’s deployment of Tinlake on Ethereum established its leadership in private credit. Now, integrating Tinlake into the Centrifuge DApp enhances cross-chain usability. As Centrifuge Chain and Centrifuge Liquidity Pools roll out on Arbitrum, Base, and other Layer 2s, they will capture broader DeFi liquidity.

These upgrades benefit the capital side. For the asset side, ongoing governance improvements—such as the POP V2 framework by the asset evaluation group—will foster higher-quality pools and reduce overall protocol risk.

RWA hinges on connecting asset and capital sides. Continuous protocol refinement will create deeper, broader connections between them.

7.3 Strengthen Leadership in Private Credit While Expanding into U.S. Treasury RWA

U.S. Treasuries offer risk-free, stable, and scalable yields, making them highly attractive as the crypto market grows. Evidence lies in Tether’s $72.5B Treasury holdings and MakerDAO’s dominant Treasury RWA pools.

After establishing dominance in private credit, Centrifuge’s expansion into U.S. Treasury RWA via Aave presents significant growth potential.

Currently, Franklin Onchain Funds holds $328M in TVL, followed by Ondo Finance with $177M. This doesn’t include MakerDAO’s two largest Treasury pools: BlockTower Andromeda ($1.21B) and Monetalis Clydesdale ($1.15B).

(rwa.xyz)

7.4 Experiments with USD-Yielding Assets

In our earlier “Comprehensive RWA Research Report,” we argued: the application logic of USD-denominated RWA yield-bearing assets mirrors that of ETH-denominated LSD yield-bearing assets. Tokenizing yield-bearing assets is just the first step; leveraging DeFi composability to build financial Lego will be transformative.

Case 1: Interest-bearing stablecoins backed by U.S. Treasuries.

Mountain Protocol, a project backed by Coinbase Ventures, launched USDM on September 11, 2023. It has since reached $12.14M in TVL. Unlike USDC/USDT, USDM distributes daily rebases at a current 5% APY derived from underlying Treasury yields. Non-U.S. users can earn U.S. Treasury yields simply by holding USDM, aiming to provide global crypto wallet users outside the U.S. access to U.S. bond returns.

Case 2: Layer 2 combining U.S. Treasury and ETH staking yields—Blast.

Blast is the only Ethereum Layer 2 offering native yields on both ETH and stablecoins, launched by Blur founder Pacman and funded with $20M from Paradigm and Standard Crypto.

Blast argues that crypto suffers from inflation; on other Layer 2s, deposited funds earn 0% baseline yield, causing purchasing power erosion. Blast aims to make Layer 2 inherently yield-bearing: users earn periodic returns. It achieves this by staking ETH via Lido and investing stablecoins in U.S. Treasuries.

These two cases perfectly illustrate the value of USD-denominated yield-bearing assets. For Centrifuge—as an RWA financing protocol—successfully integrating into such use cases could trigger a transformative leap.

VIII. Final Thoughts

(X: @wassielawyer)

As Wassie the Lawyer put it, RWA has long existed. North Korean projects have secured multiple rounds of funding—each taking different paths, showcasing diverse strategies.

Yet there is no doubt that RWA has become a vital asset class in crypto. Through years of effort and execution, the Centrifuge team has driven significant progress in the industry and is now collaborating with major crypto partners to advance the RWA

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News