RWA Sector Project Analysis: Why Is the RWA Narrative Gaining Popularity?

TechFlow Selected TechFlow Selected

RWA Sector Project Analysis: Why Is the RWA Narrative Gaining Popularity?

The tokenization of RWAs and decentralized finance models have non-negligible disruptive potential for traditional markets, and will exhibit exponential growth over the coming years.

Author: R3PO

Over the past few years, the narrative around RWA (Real World Assets) has remained relatively quiet, but recently it has begun to gain momentum. Many traditional financial institutions have started entering the RWA space—for example, J.P. Morgan executed its first live transaction on the Polygon blockchain using tokenized versions of the Japanese yen and Singapore dollar, while BlackRock, which manages over $10 trillion in financial assets, is actively expanding into permissioned blockchains by converting stocks and bonds into digital tokens.

A report from Citibank指出 that nearly anything of value can be tokenized, and the tokenization of finance and real-world assets could become the “killer application” for blockchain adoption. It forecasts that by 2030, there will be $4–5 trillion worth of tokenized digital securities, and trade finance transactions based on distributed ledger technology (DLT) could reach $1 trillion.

Hong Kong also anticipates developments in the RWA sector. In February this year, the Hong Kong Special Administrative Region government successfully issued HK$800 million in tokenized green bonds under its Government Green Bond Programme—the first such issuance globally by a government. The OKLink Research Institute believes that Hong Kong’s push for Web3 and virtual assets is not merely theoretical but must be practical. Only by bridging the gap between the crypto market and the real world—enhancing the utility of virtual assets and ultimately serving Hong Kong’s socioeconomic development—can Web3 truly take root. RWA serves as a crucial bridge connecting virtual assets and Web3 applications with the real economy, making it one of the most promising directions for Hong Kong's future Web3 growth.

Some industry insiders even suggest that 2023 may mark the inflection point for tokenization. Blockchain technology will transform how we trade, consume, and interact with financial products; enabling publicly traded stocks to be traded on-chain in a regulated manner is just the beginning.

Part 1: Why Is the RWA Narrative Heating Up?

RWA refers to physical assets brought onto the blockchain through tokenization. These assets can include any tangible asset class—real estate, equities, bonds, commodities, artworks—and when represented as tokens on a blockchain, they become more liquid, tradable, and easier to finance, while also increasing transparency, liquidity, and value. According to R3PO analysis, two main factors are driving the growing interest in RWA narratives.

Firstly, rising U.S. Treasury yields and an underperforming DeFi market have shifted the crypto industry’s attention toward RWA. As U.S. Treasuries—seen as risk-free assets—offer higher yields, returns in DeFi have declined, leading to a cooling off of the crypto market frenzy. Total Value Locked (TVL) in DeFi plummeted by over 70% from its peak near $180 billion in December 2021, falling to $48.9 billion as of May 6.

With increased market uncertainty, DeFi investors are increasingly seeking diversified portfolios of real-world assets to achieve stable returns uncorrelated with cryptocurrencies. At this juncture, RWA presents new opportunities: via blockchain technology, yield-seeking DeFi investors can access traditional off-chain debt markets and participate more easily in global financial systems.

In fact, for DeFi to grow sustainably, it must establish meaningful connections with the real world. By digitizing real-world assets, DeFi can offer users broader financial services, thereby fostering innovation and development across the entire financial industry.

Secondly, traditional financial institutions are recognizing the commercial value and potential of RWA tokenization and have begun entering this space. Traditional institutions hold vast amounts of physical assets such as real estate, equities, and bonds. Tokenizing these assets enhances their liquidity and value, boosting institutional profitability and competitiveness. Moreover, RWA tokenization opens up new avenues for fundraising and investment, expanding business scope and market share.

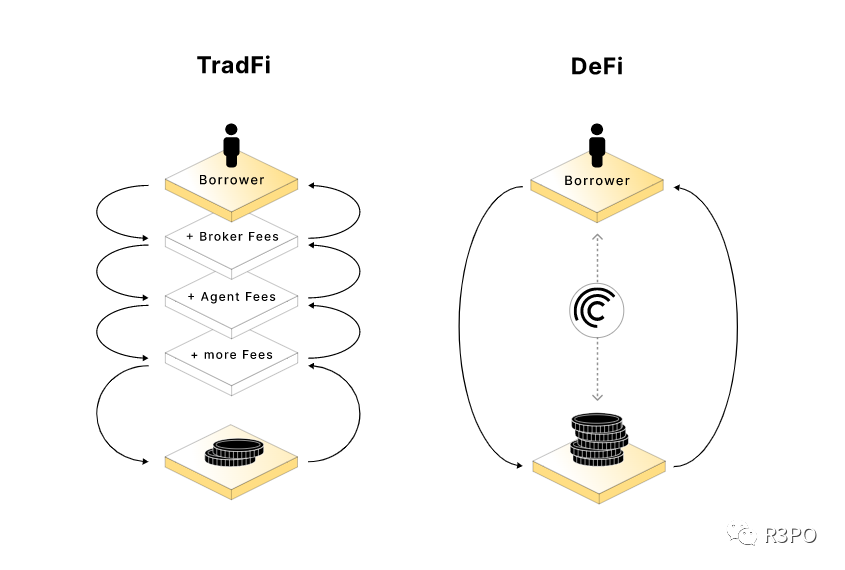

In traditional finance, ownership and transactions typically require verification and oversight by intermediaries, entailing significant time and cost. RWA adoption reduces reliance on such intermediaries, automates processes, and increases liquidity, delivering tangible benefits to enterprises.

Take real estate as an example: tokenizing physical property allows fractional ownership to be represented and traded via digital tokens. Investors can then purchase these tokens to indirectly own a portion of the property, gaining exposure to real estate investments and associated returns. Additionally, smart contracts enable automated execution and management—such as rent distribution and maintenance scheduling—further enhancing asset liquidity and operational efficiency.

Of course, the surge in RWA interest has been amplified by institutional support. Citi, Goldman Sachs, Binance, and others have all expressed bullish views on the RWA赛道. Overall, the growing momentum behind RWA indeed brings substantial opportunities and room for innovation for both the DeFi sector and traditional financial institutions—offering investors expanded financial services while providing institutions with greater liquidity and value creation.

Part 2: Analysis of Key Projects in the RWA Sector

According to a Boston Consulting Group report, as various illiquid assets—from real estate to carbon credits and natural resources—become ripe for tokenization, the sector is projected to become a $16 trillion market by 2030.

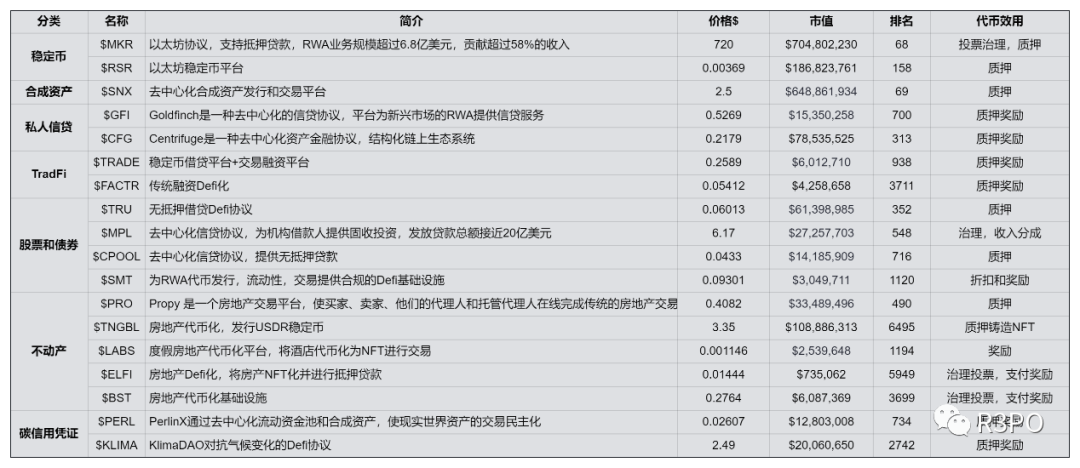

Depending on the nature of the asset and method of tokenization, RWAs can be categorized into stablecoins, private credit, equities and bonds, real estate, carbon credit certificates, metals, etc. Below, R3PO analyzes major types within the current RWA landscape along with representative projects.

1. Centrifuge ($CFG) – Private Credit

Centrifuge is a decentralized asset financing protocol that connects DeFi with RWAs. It aims to reduce funding costs for small and medium-sized enterprises (SMEs) while offering investors a stable income source. The project’s primary goal is generating profits independent of volatile crypto assets, pursuing the transfer of real monetary value from fiat to cryptocurrency.

In December 2022, Centrifuge, MakerDAO, and cryptocurrency investment firm BlockTower Credit announced a $220 million fund—the largest on-chain investment in real-world assets to date—and marked the first institutional credit fund to bring mortgage lending onto the internet.

2. MakerDAO ($MKR) – Bonds, Stablecoins

MakerDAO is an open-source decentralized autonomous organization created on the Ethereum blockchain in 2014, where anyone holding its MKR token can participate in governance. MakerDAO also issues the Dai stablecoin, whose value is supported and stabilized through a dynamic system of Collateralized Debt Positions (CDPs), feedback mechanisms, and incentivized external actors.

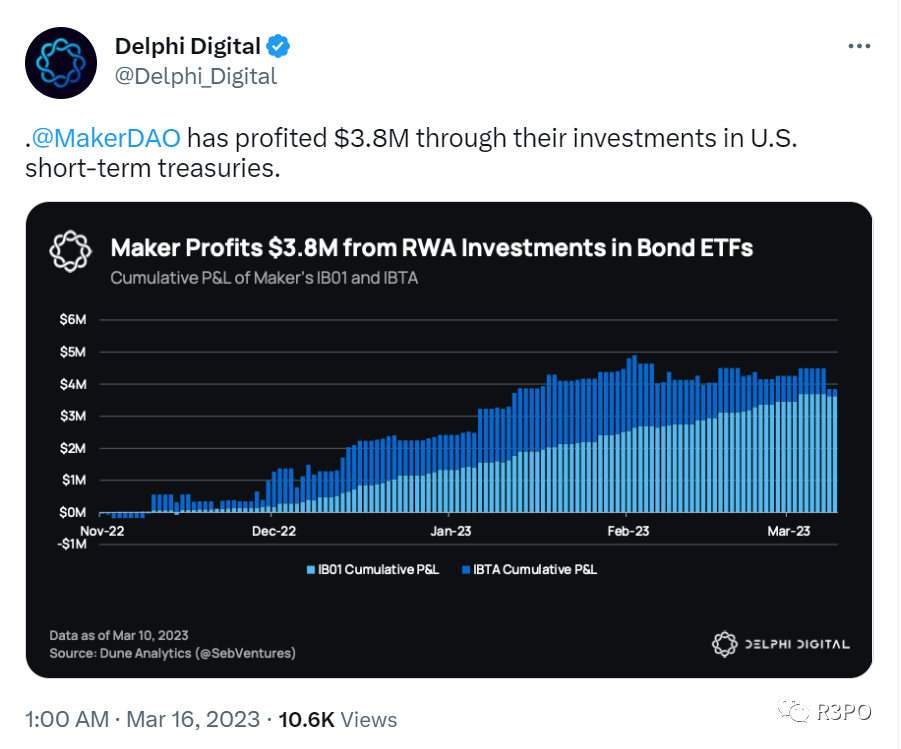

According to data provided by Delphi Digital, MakerDAO earned $3.8 million in profit from its RWA holdings. These positions made a significant contribution to overall earnings, accounting for 11.6% of total holdings. Investments in real-world assets (RWA) significantly boosted profitability, with RWA contributing 58% of its total revenue.

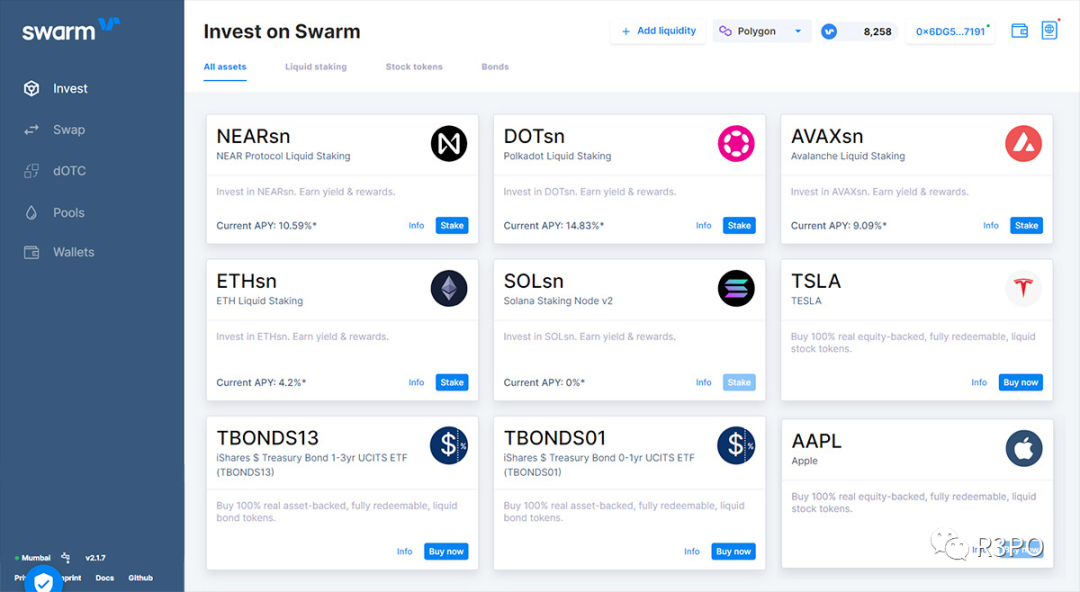

3. Swarm ($SMT) – Equities

Swarm brands itself as “the first tradable stocks and bonds on DeFi,” launching in October 2021 with the aim of becoming central to transparent financial culture and creating value for many. In February 2023, Swarm became the first organization to offer digitized U.S. Treasury bills and Apple stock through a regulated decentralized platform. Within the first month of listing securities, Swarm saw a 11% increase in platform users and sold out its offerings three times—iShares 1-3 Year Treasury Bond ETF sold out on its first trading day (February 24), Tesla shares were fully allocated on February 28, and Apple stock sold out on March 13. Interestingly, Apple’s current market capitalization alone exceeds that of the entire cryptocurrency market.

In April this year, Swarm announced it would add seven additional public stocks available for retail and institutional investors to trade on its regulated DeFi platform. Newly listed companies include BlackRock (BLK), Coinbase (COIN), Coupang (CPNG), Intel (INTC), Microsoft (MSFT), MicroStrategy (MSTR), and NVIDIA (NVDA).

These tokens are 100% backed by real stocks, bonds, and ETFs purchased in traditional financial markets. Underlying assets are held by institutional custodians. Token holders can redeem the value of underlying assets at any time, and monthly reserve disclosures are publicly available.

4. Propy ($PRO) – Real Estate

Propy is a real estate transaction platform enabling buyers, sellers, agents, and escrow officers to complete traditional real estate deals entirely online. Purchase offers, payments, and deeds are uploaded onto an immutable blockchain.

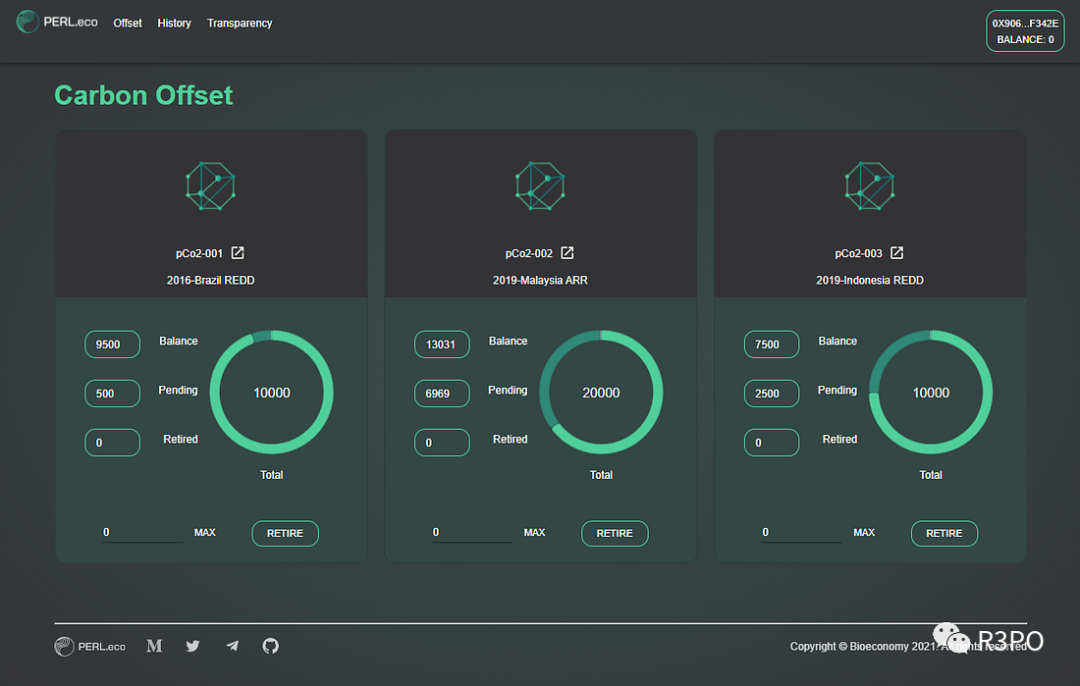

5. PERL.eco ($PERL) – Carbon Credit Certificates

PERL.eco focuses on tokenizing eco-related assets and promoting their wider adoption, starting with carbon assets. Other environmentally relevant assets may include genomic biodiversity. By tokenizing carbon credits, PERL holders can offset emissions and contribute to achieving net-zero greenhouse gas targets. Meanwhile, PERL.eco is collaborating with AirCarbon Group—the operator of fully regulated carbon exchange ACX—to build the PERL.eco Carbon Exchange (PCX), a free-standing, independent, regulated ecosystem for trading PFCs and other environmental financial instruments.

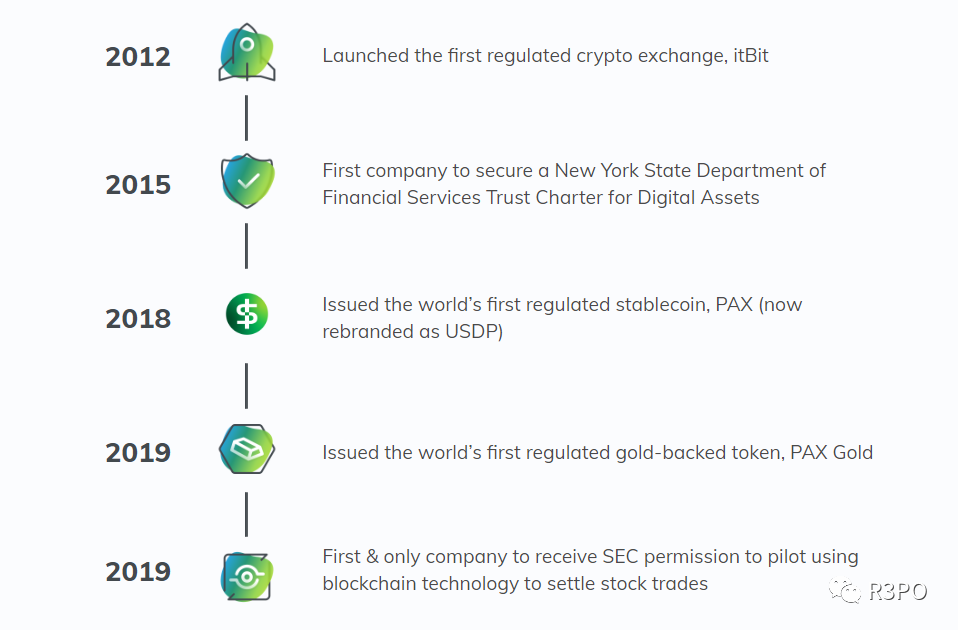

6. Paxos ($PAXG) – Metals

Founded in 2012, Paxos provides tokenization, custody, trading, and settlement services for enterprise clients, enabling trusted and instant movement of any asset at any time. In 2019, it launched PAXG, the world’s first regulated gold-backed token. Paxos’ PAXG offers a lower cost structure compared to other gold tokens, gold ETFs, and LBMA 400-ounce gold bars, with low minimum purchase amounts and no storage fees. Paxos is one of the most well-funded blockchain companies, having raised over $500 million in total financing from major investors including OakHC/FT, Declaration Partners, Mithril Capital, and PayPal Ventures.

Conclusion

The disruptive potential of RWA tokenization and decentralized finance models on traditional markets cannot be overlooked, and exponential growth is expected in the coming years. The diversification of tokenized asset types offers investors opportunities for portfolio diversification and risk mitigation.

However, the legal and regulatory environment for RWA remains uncertain and constantly evolving, creating ambiguity for investors and issuers alike. Additionally, liquidity poses a major challenge: the DeFi market lacks sufficient depth and breadth to support large-scale transactions, potentially limiting RWA adoption—especially for high-value assets. Furthermore, the technological infrastructure supporting RWA still requires improvement in areas such as security, scalability, and interoperability.

Despite these challenges and uncertainties, RWA remains a highly promising investment avenue, offering diversified and stable returns. With continued technological advancements and clearer regulatory frameworks, the RWA market is poised for further maturation and expansion. We believe RWA will become a key component of blockchain finance and exert broad influence worldwide.

Disclaimer: Markets involve risk; investing requires caution. Readers should strictly comply with local laws and regulations when considering any opinions, viewpoints, or conclusions presented herein. The above content does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News