PancakeSwap Deep Dive: Becoming the Binance on BSC

TechFlow Selected TechFlow Selected

PancakeSwap Deep Dive: Becoming the Binance on BSC

PancakeSwap's first battle was SushiSwap, which has been completed. The second battle is the UniSwap campaign. I believe PancakeSwap's ambition is Binance, aiming to claim the crown of the world's leading exchange.

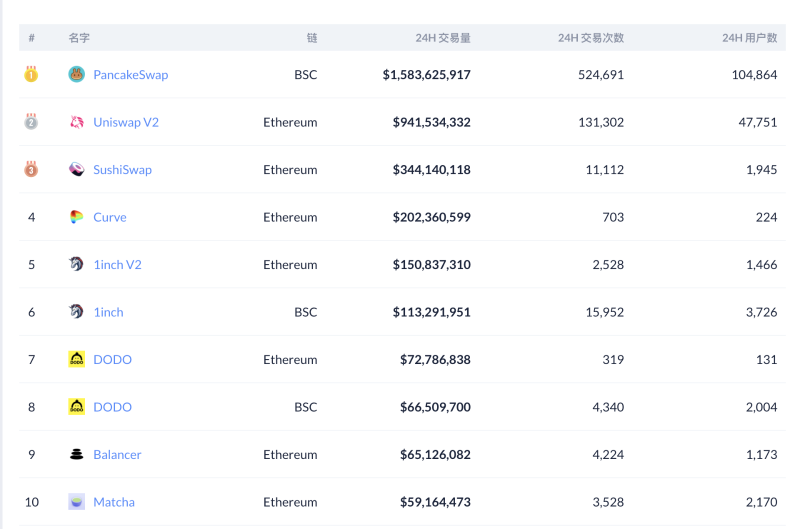

On March 25, a landmark event shocked the market—PancakeSwap’s 24-hour trading volume exceeded the combined volumes of UniSwap, SushiSwap, and Curve, the three major DEXs.

As early as February 20, PancakeSwap's trading volume had nearly caught up with Uniswap, showing signs of overtaking it.

Why does PancakeSwap, the leading DEX on BSC, possess such astonishing momentum? Is this a fleeting phenomenon or the shape of things to come?

Let’s dive deep into PancakeSwap.

1. Core Data Comparison: BSC vs Ethereum

First, we need to examine the current state of PancakeSwap and UniSwap’s respective ecosystems—the flow of money and users.

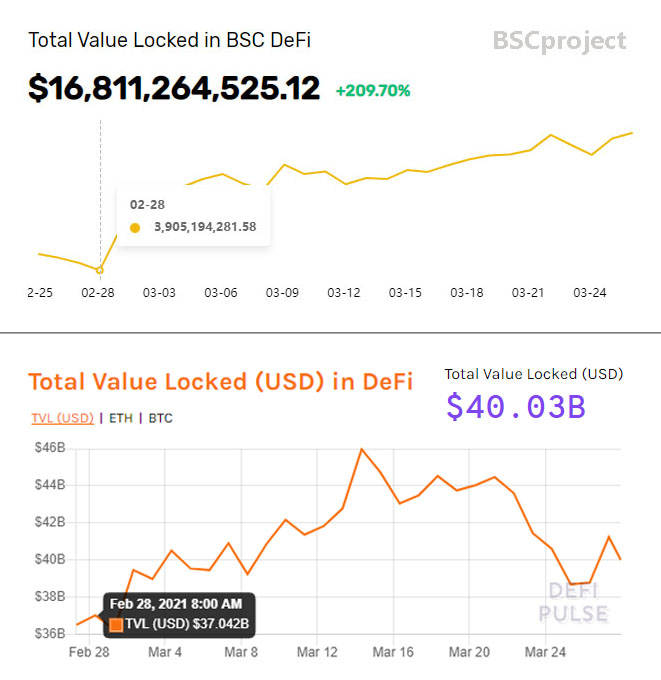

DeFi-TVL comparison (flow of money)

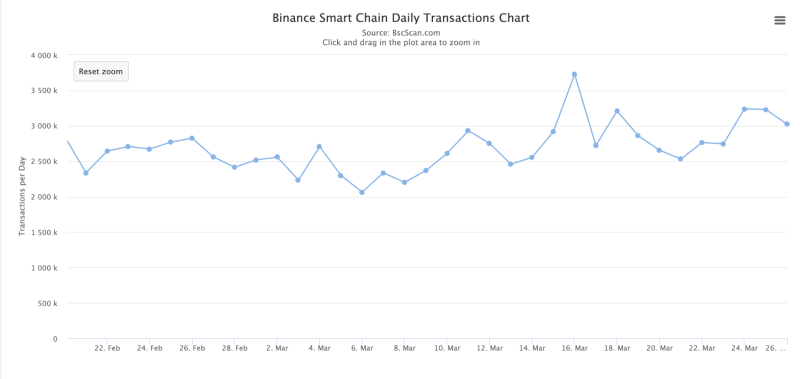

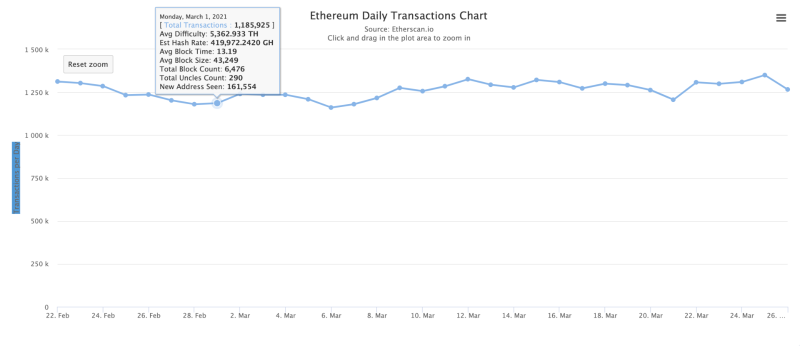

Transaction data comparison (flow of users)

We can see that BSC has shown explosive growth in DeFi-TVL. From February 28 to March 27, BSC’s TVL surged by 430%, while Ethereum grew only 8% during the same period. BSC’s daily transactions are now steadily above 3,000,000, compared to Ethereum’s average of around 1,300,000—making BSC’s transaction volume approximately 2.23 times that of Ethereum. BSC has attracted numerous users thanks to its low gas fees.

BSC provides an ideal environment for PancakeSwap, whereas UniSwap struggles under Ethereum’s high transaction fees.

It is fair to say that BSC offers PancakeSwap a wider and faster track to surpass its peers.

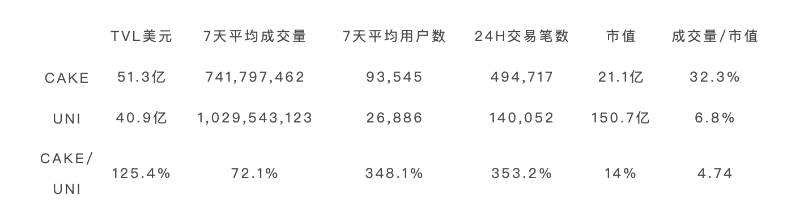

2. Core Data Comparison: PancakeSwap vs UniSwap

3. PancakeSwap: The Key to Unlocking BSC’s Ecosystem

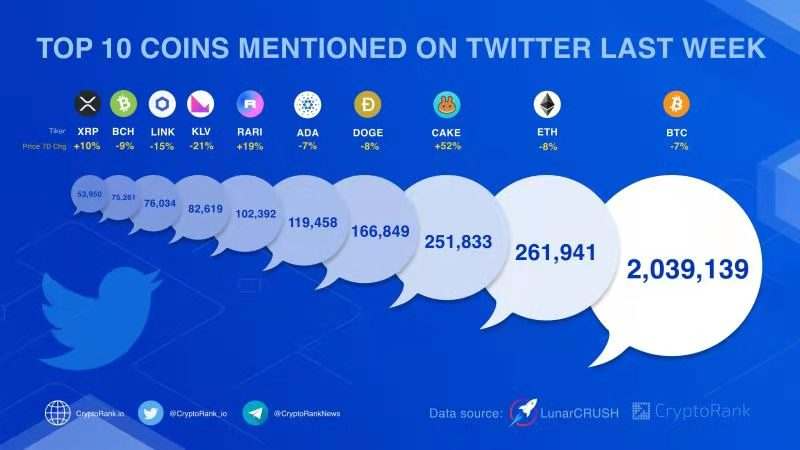

Currently, PancakeSwap’s 7-day average user count is 3.48 times that of UniSwap, its 24-hour transaction count is 3.53 times higher, and its TVL is 1.25 times greater, while its 7-day average trading volume stands at 72.1% of UniSwap’s.

While PancakeSwap still lags behind UniSwap in the most critical metric—trading volume—it has already surpassed UniSwap in user count, number of transactions, and TVL. PancakeSwap is comprehensively outperforming UniSwap across multiple dimensions.

Excluding growth potential and focusing strictly on trading volume—the core metric for DEXs—PancakeSwap is undervalued by 4.74 times compared to UniSwap.

UniSwap is dominated by large traders and IUO games, where transaction fees of $30+ have driven retail investors to PancakeSwap.

The significantly higher number of transactions, larger user base, and lower average trade size make the outcome clear: user dispersion and higher TVL make PancakeSwap’s lead over UniSwap inevitable.

PancakeSwap is the heart of BSC. Yield aggregation projects rely on mining CAKE liquidity rewards and incentivizing LPs on PancakeSwap to feed back into this central hub. New projects launching on BSC require trading pairs on PancakeSwap for liquidity. Syrup Pools offer projects better promotion and distribution mechanisms, while IFOs have become the ideal launchpad for high-quality projects.

For BSC to reverse the dominance of ETH, it must surpass Ethereum in the DEX battleground, proving its strength to both users and the broader ecosystem, thereby creating a powerful suction effect.

To surpass Ethereum, PancakeSwap is BSC’s ecological flagbearer!

4. PancakeSwap Redefines IFO

PancakeSwap’s IFO protects retail investors and validates project teams. Unlike UniSwap’s permissionless IUO model, where anyone can launch a token by providing LP, IFO has entry barriers. Upon closer inspection, it resembles Binance’s approach—PancakeSwap helps users filter high-quality projects, using CAKE and BNB liquidity tokens as participation stakes in fundraising.

Project teams receive only BNB, while CAKE is directly burned, contributing to deflation.

This mechanism not only helps users identify trustworthy projects but also gives project teams significant exposure and traffic through PancakeSwap—an efficient win-win.

In contrast, IUO poses high barriers and risks for retail users due to lack of curation. In this sense, PancakeSwap effectively assumes the role of CoinList.

5. PancakeSwap’s Internal Challenge: Managing Inflation and Deflation

Currently, CAKE has no supply cap (requiring emissions to sustain liquidity incentives). Every block mints 40 new CAKE tokens: 15 are permanently burned, and 25 are allocated to liquidity providers and stakers.

A governance vote to reduce emissions has passed successfully. Starting March 29, 18 CAKE per block will be fixedly burned, helping accelerate the balance between inflation and deflation. Beyond fixed block burns, major burn sources include 50% of funds raised via IFOs and 20% of lottery revenues.

In the upcoming V2 release, the protocol will intensify burning mechanisms and introduce additional channels such as transaction fee buybacks and borrowing fee burns. PancakeSwap’s greatest challenge lies in achieving equilibrium between inflation and deflation.

6. PancakeSwap Roadmap

V2 launches in Q2 this year

1. Introduce a referral rewards program, allowing users to earn a share of transaction fees

2. Add automatic buyback and burn mechanism funded by transaction fees

3. Add auto-compounding functionality to Syrup Pools

4. Enable access to minting logic, with governance votes determining token release speed

5. New smart contracts offering enhanced flexibility and more possibilities

Additional features on the roadmap:

1. Prediction Market

Launching binary options, known as the "Pancake Prediction Market," enabling users to speculate on price movements.

2. Lending and Borrowing

Develop a minimum viable product (MVP) lending platform leveraging PancakeSwap’s existing user base and capital. Fees generated from lending will fund CAKE buybacks and burns. This feature will launch after the prediction market.

3. Collectibles and Gamification

Recently, the team added NFT avatars, team collaboration features, and corresponding point systems alongside the existing loyalty system. These additions have been well-received, increasing user engagement. So far, 27,500 users have created profiles in the system.

4. Lottery

Lower the lottery purchase threshold from $10 to $1. The prize distribution rules will change—users can win with just one correct number.

To save gas fees, lottery tickets will switch from ERC-721 to ERC-1155 tokens.

Add a feature allowing users to pick their own lucky numbers.

Bulk purchases will offer discounts.

5. Token Burning

Possibly allocate 0.1% of transaction fees to token burns. Based on a daily trading volume of $700,000,000, this could result in $700,000 worth of CAKE burned each day.

7. PancakeSwap’s Three Major Battles

PancakeSwap has already won its first battle against SushiSwap. The second battle is against UniSwap. But I believe PancakeSwap’s ultimate ambition is Binance—to inherit the crown of the world’s leading exchange.

It's time for pancakes

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News