Racing for the First IPO: The Credentials, Capabilities, and Ambitions of China's Largest Independent AI Model Company

TechFlow Selected TechFlow Selected

Racing for the First IPO: The Credentials, Capabilities, and Ambitions of China's Largest Independent AI Model Company

Zhipu AI is aiming for a Hong Kong IPO with a valuation of 24.377 billion yuan. As China's largest independent large model company, it boasts globally leading technological capabilities. However, heavy investment in R&D has led to substantial losses, testing capital markets' confidence in the long-term value of AI.

24.377 billion yuan — on the 17th, Zhipu, which passed the Hong Kong Stock Exchange hearing, confirmed its latest valuation in its publicly released prospectus. For the first time, people now have a clear understanding of the valuation amount of a Chinese large model company.

This is a timely moment. Three years after ChatGPT sent shockwaves through the industry and following the frenzy of the "hundred-model war," the remaining Chinese large model players at the table, having proven their innovation and technical capabilities are on par with anyone else, are now making a push into the capital markets.

During this critical transition period—akin to a "youth moving into adulthood"—the market expects large model companies to demonstrate how "novelty-oriented, showcase-style" model technologies can evolve into practical, adaptable end-to-end applications.

As the first company from the "hundred startups battle" to successfully reach shore, Zhipu’s answer is less than satisfying. The disclosed losses in the prospectus far exceed revenue growth, while R&D expenses continue to rise sharply, showing no sign of stopping the "burning cash" trend.

If this were a mature company, such a balance sheet would be deeply unsatisfactory—but large models are special.

Zhipu is one of the earliest independent large model companies established in China, but it has only been around for less than six years. What excites countless people about the AI industry is its revolutionary potential in the future—an evolution that cannot be directly extrapolated from past history, as transformation often occurs suddenly and exponentially at a certain point.

This is Zhipu’s bet—or call it its vision. Before the widely anticipated AGI future arrives, Zhipu aims to prepare as thoroughly as possible, involving a series of complex trade-offs and convincing the market to believe.

To make people believe—this is a gamble filled with hope.

Core Data Summary

Zhipu's core commercial revenue primarily consists of on-premises deployment and cloud-based deployment. The former refers to providing private deployment of large models for B2B clients, while the latter delivers model API access and token usage services via its MaaS platform.

The prospectus shows that based on 2024 revenue, in the enterprise LLM sector, Zhipu is already China’s largest independent large model vendor and ranks second overall among all large model vendors, surpassing Alibaba and SenseTime, with a market share of 6.6%.

From 2022 to 2024, Zhipu’s revenues were 0.6 billion yuan, 1.2 billion yuan, and 3.1 billion yuan respectively, achieving a CAGR of 130%. In 2024H1 and 2025H1, revenues were 0.4 billion yuan and 1.9 billion yuan respectively, representing over 300% year-on-year growth.

Nearly 85% of Zhipu’s revenue comes from on-premises deployment, mainly serving verticals including internet technology, public services, telecommunications, traditional enterprises, consumer electronics, retail, media, and consulting industries.

In 2025H1, overseas revenue surged to nearly 12%, primarily driven by Malaysia and Singapore markets. Under the "Belt and Road" initiative, Zhipu has helped overseas countries deploy sovereign large models, marking a breakthrough in China’s large model technology going global.

From 2022 to 2024 and 2025H1, Zhipu’s gross margins were 54.6%, 64.6%, 56.3%, and 50.0% respectively. By comparison, domestic software outsourcing firms like China Software typically operate around 30%, indicating that Zhipu’s on-premises large model deployment business enjoys relatively high margins.

Notably, the decline in gross margin is mainly due to price fluctuations in the MaaS platform business. Affected by market price wars, Zhipu intensified its discounting strategy to acquire more customers and application scenarios.

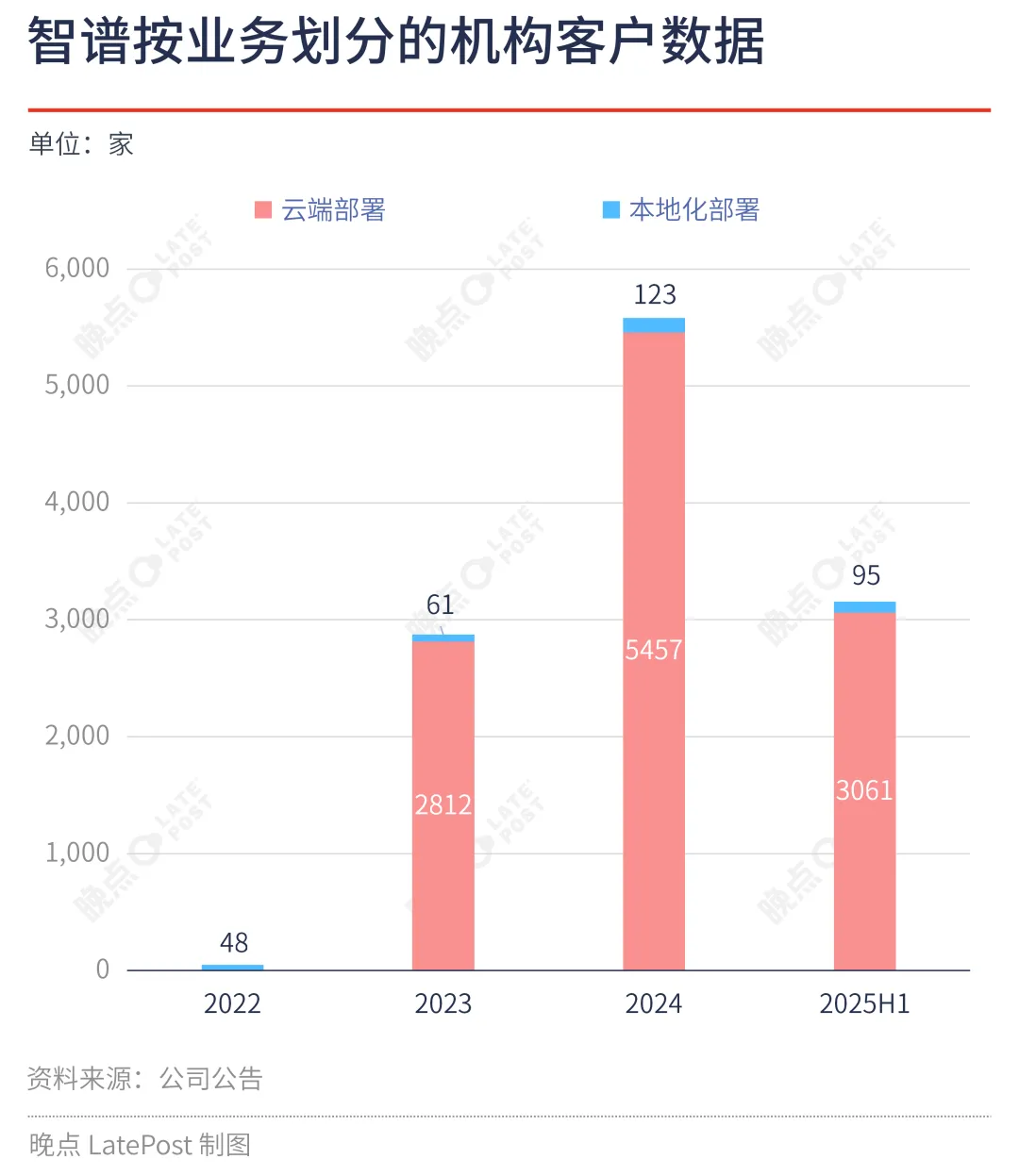

The result: in 2025H1, the number of institutional clients for Zhipu’s on-premises and cloud deployments reached 95 and 3,061 respectively, compared to full-year 2024 figures of 123 and 5,457. The MaaS platform’s price cuts not only increased the number of cloud-based institutional clients but also significantly drove traffic to the on-premises deployment business.

As of 2025Q3, Zhipu’s models have empowered over 80 million end-user devices and more than 45 million developers, serving over 12,000 institutional clients—a significant increase from the 8,000 clients reported in 2025H1.

In addition, in November 2025, Zhipu’s daily token consumption reached 42 trillion, up from 500 million in 2022—a direct reflection of user growth and usage spikes following the release of its new generation GLM 4.5/4.6 open-source base models.

Revenue matters more than anything, but revenue requires patience

In its prospectus, Zhipu introduced a commercialization growth narrative called the “vertical and horizontal strategy.”

Vertically, lowering prices and expanding capacity in the MaaS platform business has attracted broad user adoption and application scenarios. More users mean traffic funneling into on-premises deployment, forming an initial customer and commercial loop—the so-called “MaaS drives traffic, on-premises monetizes” model.

Horizontally, similar to OpenAI and Anthropic, Zhipu’s MaaS platform features high flexibility and scalability. Unlike traditional heavy-customization delivery projects, Zhipu emphasizes that its enterprise-grade MaaS offerings deliver more general-purpose model capabilities, enabling faster scaling of token usage volume.

The combination of vertical customer-loop dynamics and horizontal expansion of generalizable solutions reinforces Zhipu’s identity as China’s largest independent model company by revenue scale. This is the compounding effect Zhipu envisions: MaaS platform revenue is highly likely to grow disproportionately. According to Zhipu’s forecast, future revenue from on-premises and cloud businesses will eventually reach a 50-50 split. To achieve this, Zhipu is willing to sacrifice gross margin: unlike high-margin on-premises projects, cloud business carries lower margins due to substantial spending on compute procurement—this is the inevitable outcome of its strategic pricing in MaaS, a necessary compromise to capture market share in the short term.

Model is product, product is growth

A popular saying in the large model industry is “model as product,” reflecting a simple first-principle insight: users pay for the strongest models, and the process of building the model itself is crafting a highly competitive product.

This forms the core growth logic of MaaS. In the second half of this year, Zhipu’s newly launched GLM 4.5/4.6 base models became the first to natively integrate reasoning, coding, and agent capabilities within a single model. Notably in coding, GLM ranked top alongside Anthropic and OpenAI models on Code Arena, leading to exponential growth in MaaS platform usage after launch.

Like the earlier “vertical and horizontal strategy,” powerful model products have the potential to trigger a data flywheel effect—the most ideal moat in large model competition. Zhipu’s commercial goals will be realized within a complete platform encompassing the latest models, APIs, and development tools. MaaS becomes infrastructure-level “operating system” for the AI era, serving organizations of all sizes—from individuals and small dev teams to large enterprises—and within this full platform, there are no delivery engineers, only product managers.

According to Zhipu’s prospectus data, its MaaS platform serves over 2.9 million enterprise and application developers, making it one of China’s most active large model API platforms. Nine out of China’s top 10 internet companies currently use Zhipu’s GLM large models. Among them, the GLM Coding package (a standardized monthly subscription product for developers) surpassed 150,000 paying developers within two months of launch, achieving annual recurring revenue exceeding 100 million yuan.

The cost of the strongest model

Users pay for the strongest models, and the price Zhipu has paid for this belief is clearly laid bare in its prospectus.

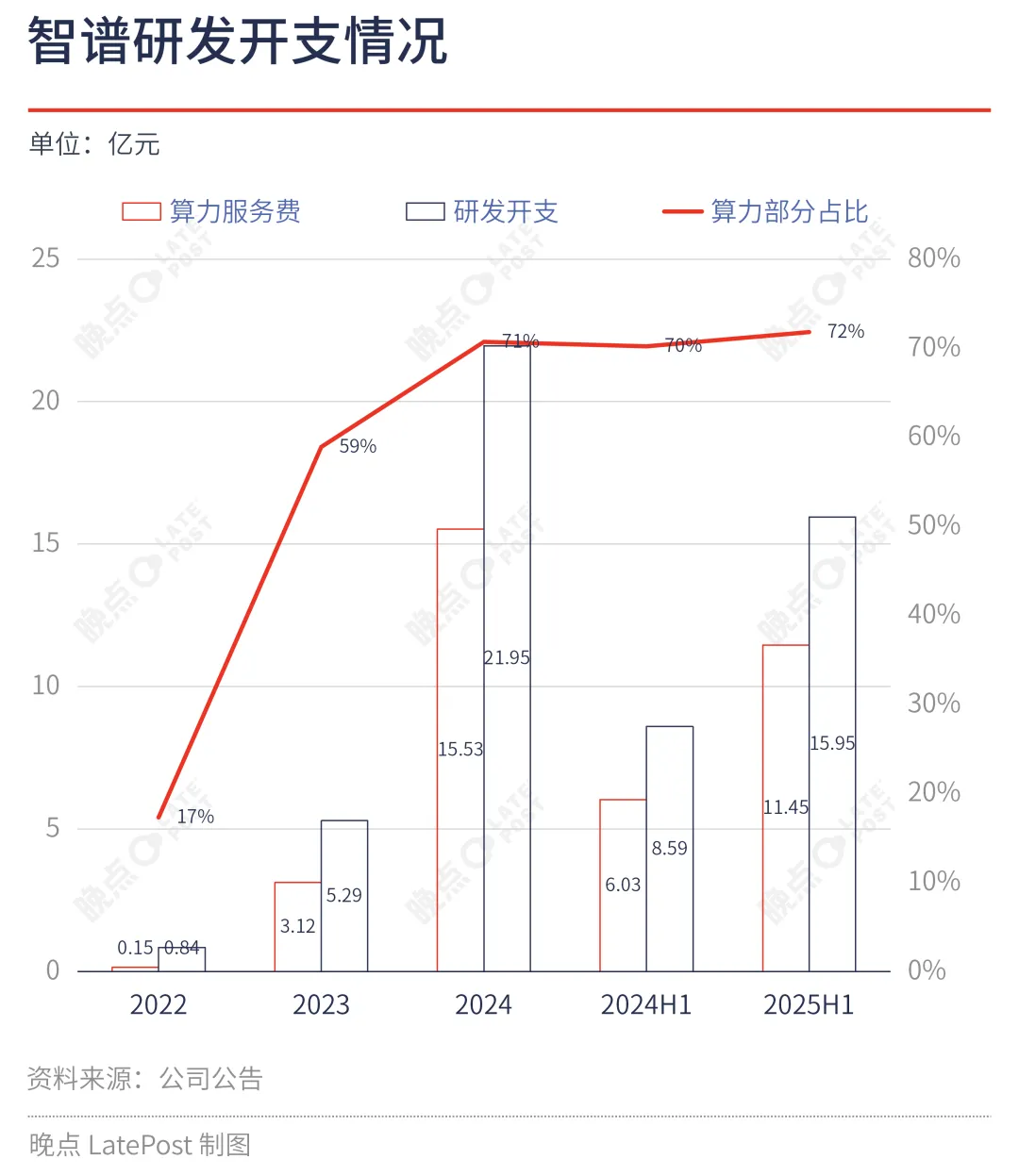

From 2022 to 2024 and in the first half of this year, Zhipu’s adjusted net losses were 0.97 billion yuan, 6.21 billion yuan, 24.66 billion yuan, and 17.52 billion yuan respectively, with R&D expenses reaching 0.8 billion yuan, 5.3 billion yuan, 22.0 billion yuan, and 15.9 billion yuan—accounting for the vast majority of losses.

Zhipu notes that computing service costs’ share of R&D spending has rapidly increased from an initial 17% to over 70%, meaning much of the R&D budget goes toward purchasing compute power—consistent with the rapid growth in MaaS platform usage.

On one hand, the extremely high R&D investment reflects Zhipu’s deliberate strategic choice. Pre-training base model capabilities inherently consume massive compute resources. As progress continues along the AGI development path, additional application models must be developed to enhance agents’ comprehensive performance, reinforcing comparative advantages in foundational model capabilities and thereby attracting more developers and customers.

On the other hand, in the foreseeable mid-to-long term, competition among major tech firms around large models will not cool down. This is a race without a finish line in the near term, where rankings are tightly contested. Only those consistently maintaining top-tier positioning will earn market recognition and attract capital.

Therefore, “running while refueling” is the only viable option.

Unlike the internet bubble before 2000, participants in the large model race understand that while sustained loss-making is not an ideal commercial narrative, it remains a widespread market consensus. When both model capability and market size are undergoing intense and rapid change, staying in the game is paramount. As people envision AI-driven systemic transformation and the creation of trillion-dollar market opportunities, Zhipu is betting that larger market spaces will generate greater revenue growth and stronger economies of scale. Both powerful base models and the MaaS business model imply higher monetary multipliers—this is arithmetic every player in the AI game understands.

Burning cash is how Zhipu ensures a place in an AI-dominated future.

The implicit cost of professionalism, focus, and perseverance

AGI is a long marathon. As Zhipu CEO Zhang Peng puts it, it’s like “running a marathon at sprint speed.” This contradictory metaphor captures both sides of Zhipu: it explains both its technical persistence and its decision to go public.

Spun off from the Knowledge Engineering Lab of Tsinghua University’s Department of Computer Science, Zhipu was formally founded in 2019. Starting from the underlying architecture of base large models, Zhipu has continuously pioneered multiple “first-of-their-kind” models in China, accumulating a suite of domestically developed original models.

Take the July 2025 release of the GLM-4.5 base model. According to Frost & Sullivan, GLM-4.5 achieved the following global leadership positions:

Based on evaluations from 12 industry-standard benchmark tests conducted in July 2025, GLM-4.5 ranked third globally, first in China, and first among all open-source models worldwide.

In September 2025, according to the hallucination leaderboard in the retrieval-augmented generation (RAG) domain, GLM-4.5 had the second-lowest hallucination rate globally and the lowest in China.

Since the launch of GLM-4.5 until now, Zhipu has consistently ranked among the global top ten and China’s top three in token consumption on OpenRouter.

During the same period, Zhipu’s paid API revenue on OpenRouter exceeded the combined total of all other Chinese models.

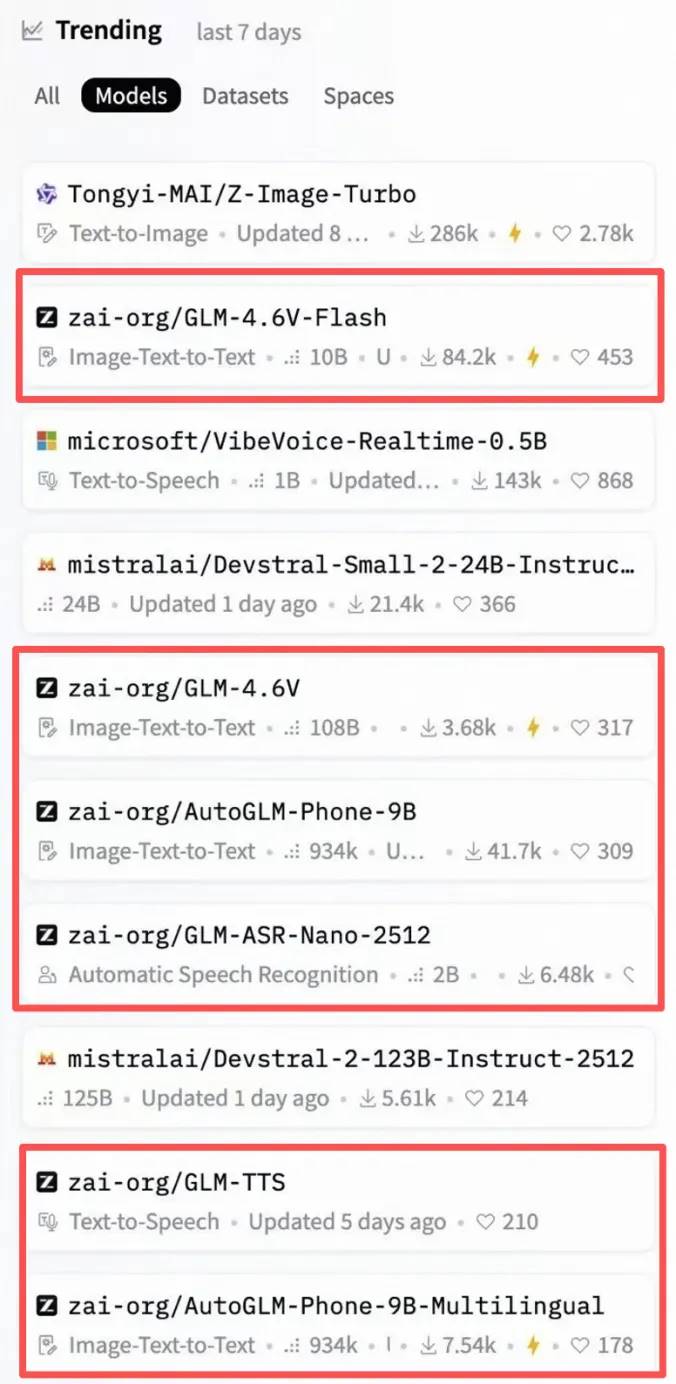

In the second week of December, Zhipu open-sourced a series of multimodal and agent models for five consecutive days, occupying five of the top ten spots on Hugging Face Trending.

These include AutoGLM, capable of operating smartphones on behalf of users, the GLM-4.6V multimodal large model, the GLM-ASR series speech recognition models, the GLMTTS industrial-grade speech synthesis system, and core achievements in video generation. At first glance, this approach seems almost contrary to the logic of emphasizing commercialization and profitability. Yet, at this sensitive pre-IPO juncture, Zhipu’s open-source strategy reveals the strong vision of a technology-centric AI company: advancing the entire AI tech stack and open-source community knows no timing constraints—even during the critical phase when AI companies shift from technical competition to capital operations.

This ethos is precisely why Zhipu was initially dubbed China’s “most OpenAI-like company.”

Recently, as OpenAI paused several non-core initiatives—including the Sora video generation model—and redirected all resources over eight weeks toward enhancing ChatGPT’s performance and user experience, both companies have converged once again on the same product roadmap: model capability itself is decisive, and everything else must yield to it.

The only major difference may lie in the huge valuation gap between Chinese and U.S. AI firms. OpenAI’s sky-high valuations and continuous funding ensure a steady stream of ammunition for model R&D even without going public. In contrast, Chinese large model companies lag by more than an order of magnitude in valuation—even though Zhipu is among the best performers. Over its six years of existence, Zhipu has raised over eight rounds of financing, totaling more than 8.3 billion yuan.

Now, Zhipu needs broader markets to secure even greater resources. The capital market’s response will determine the true worth of independent large model companies like Zhipu, effectively setting the valuation benchmark for China’s entire large model industry.

The War Ahead

China’s capital markets still lack a referenceable independent large model company. Uncertainties surrounding the intense competition in large models continue to linger. During the growth phase of technology companies, financial profitability metrics are largely ineffective in assessing fundamentals and growth potential. Instead, the commercial value or growth logic of such companies is measured across multiple complex dimensions—revenue performance, product capability, market size, business model—and above all, expectations for the future.

Technological optimists firmly believe in the future drawn by artificial intelligence. Two days after Zhipu made its prospectus public, another large model company, MiniMax, also filed its IPO documents. Whichever ultimately goes public first will undoubtedly leave a lasting mark in the history of AI development.

AI is an infinite battle over productivity and social transformation. The war has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News